Global Chemical Injection Skids Market By Type (Conventional Injection Skids, Multi Point Injection Skids, Multi Compartmental, Others), By Function (Antifoaming, Corrosion Inhibition, Demulsifying Scale Inhibition, Others), By End-use (Oil and Gas, Water and Wastewater Treatment, Chemical and Petrochemical, Energy and Power, Fertilizer, Pharmaceutical, Other) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 100007

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

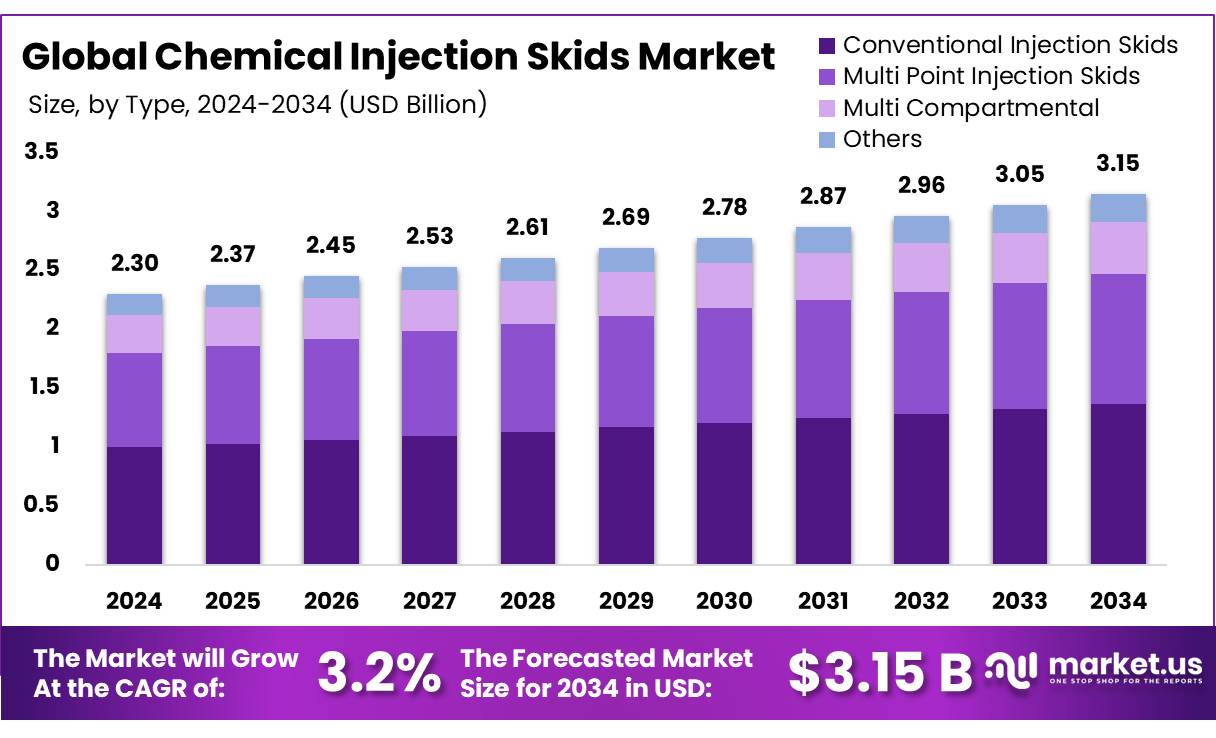

In 2024, the Global Chemical Injection Skids Market size is expected to be worth around USD 94.7 Billion by 2034, from USD 2.3 Billion in 2024, growing at a CAGR of 3.2% during the forecast period from 2025 to 2034.

Chemical injection skids are integrated systems designed to deliver precise amounts of chemicals into various industrial processes. These systems consist of components such as chemical injection pumps, chemical storage tanks, safety valves, isolation valves, instruments, piping, and structural frames.

Chemical injection skids are employed to inject substances such as corrosion inhibitors, scale inhibitors, biocides, demulsifiers, and scavengers into oil and gas pipelines, petrochemical plants, and water treatment facilities. The applications of chemical injection skids span multiple industries, including consumer goods, healthcare, automotive, industrial manufacturing, and food and beverage.

The global chemical injection skids market is growing due to rising demand for precise and efficient dosing systems across industries. These systems are essential in sectors such as oil & gas, water treatment, healthcare, and food & beverage for process optimization and quality control. They enhance operational efficiency, safety, and product performance. As automation and resource demands increase, the market continues to expand globally.

Key Takeaways

- The global chemical injection skids market was valued at USD 2.3 billion in 2024.

- The global chemical injection skids market is projected to grow at a CAGR of 3.2% and is estimated to reach USD 3.15 billion by 2034.

- Among types, conventional injection skids accounted for the largest market share of 4 %.

- By function, corrosion inhibition accounted for the largest market share of 5 %.

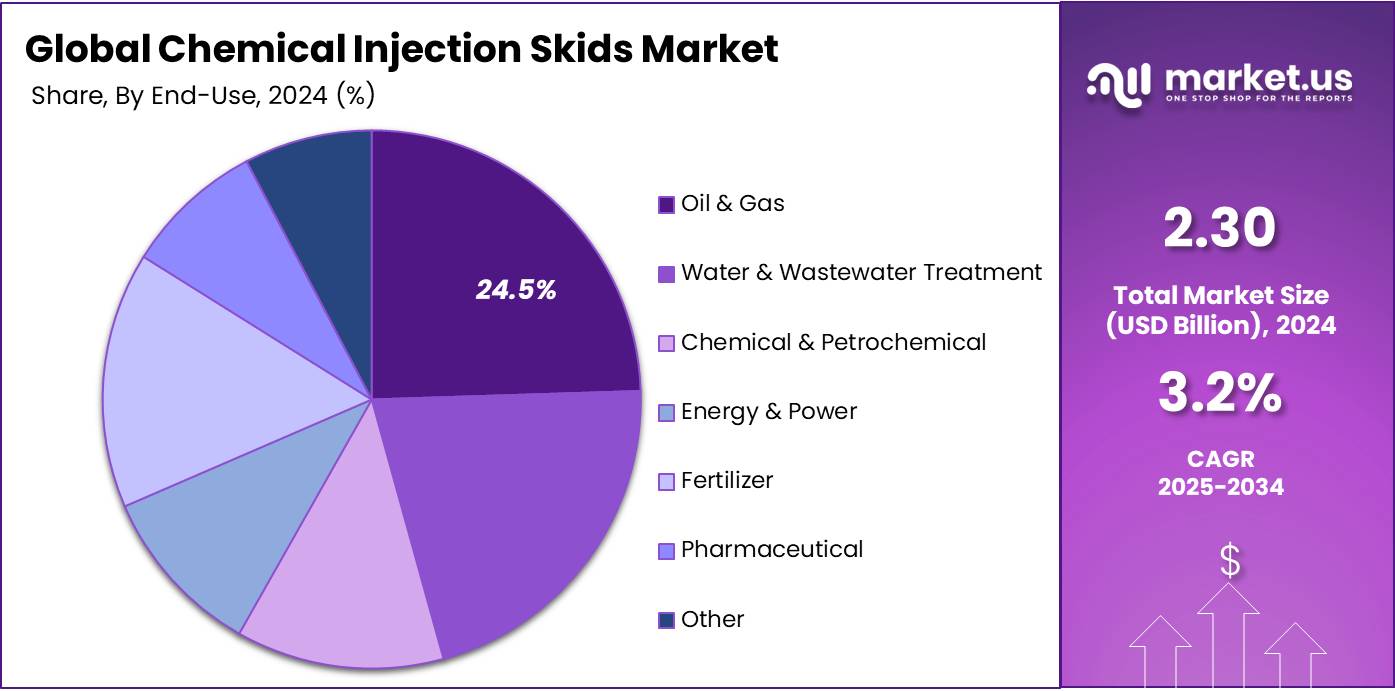

- By end-use, oil & gas accounted for the majority of the market share at 5 %.

- North America is estimated as the largest market for chemical injection skids with a share of 5% of the market share.

Type Analysis

Conventional Injection Skids Lead the Market Due to Versatility and Reliability Across Industries

The chemical injection skids market is segmented based on type into conventional injection skids, multi point injection skids, multi compartmental, and others. In 2024, the conventional injection skids segment held a significant revenue share of 43.4%. Due to their wide-ranging applications across multiple industries and proven reliability in critical operations, conventional injection skids continue to lead the market. These skids are extensively used in oil and gas, petrochemical, water and wastewater treatment, power generation, and chemical processing industries.

In the oil and gas sector, they are essential for injecting corrosion and scale inhibitors to maintain pipeline integrity. In water treatment and chemical plants, they ensure accurate chemical dosing, enhancing safety and reducing waste. Their modular design, ease of integration, and adaptability to various industrial settings make them a preferred choice for both new installations and retrofitting existing infrastructure.

Function Analysis

Corrosion Inhibition Dominates the Chemical Injection Skid Market for Enhancing Process Efficiency

Among functions, the chemical injection skids market is classified into antifoaming, corrosion inhibition, demulsifying scale inhibition, and others. In 2024, corrosion inhibition held a dominant position with a 32.5% share. Due to their critical role in enhancing process efficiency and preventing operational disruptions across multiple industries. Antifoaming agents are essential in sectors such as oil & gas, petrochemicals, water treatment, and food processing, where foam formation can hinder equipment performance, reduce throughput, and compromise product quality.

Chemical injection skids designed for antifoaming functions ensure the precise and continuous dosing of defoaming agents, helping to maintain smooth operations in pipelines, separators, and reactors. Their ability to improve productivity, reduce maintenance, and support compliance with industry standards makes antifoaming injection systems highly valuable driving their significant share in the global market.

End-Use Analysis

Oil & Gas Sector Holds the Largest Share in Chemical Injection Skid Market Driven by Production and Asset Integrity Needs.

In terms of end-use, the chemical injection skid market comprises oil & gas, water & wastewater treatment, chemical & petrochemical, energy & power, fertilizer, pharmaceutical, and others. In 2024, oil & gas lead the market, accounting for a dominant 24.5% share. This dominance is driven by the industry’s continuous need for chemical dosing solutions to ensure efficient production, asset integrity, and environmental compliance.

Chemical injection skids are critical in upstream, midstream, and downstream operations for injecting corrosion inhibitors, scale inhibitors, demulsifiers, biocides, and anti-foaming agents. The growing energy demand, and expansion of drilling activities particularly in regions such as North America and the Middle East. The need to extend the lifespan of pipelines and equipment has significantly boosted the adoption of chemical injection systems in the oil and gas sector. Additionally, stricter regulatory policies and the rising focus on automation and process optimization further support the market’s growth in this segment.

Key Market Segments

By Type

- Conventional Injection Skids

- Multi Point Injection Skids

- Multi Compartmental

- Others

By Function

- Antifoaming

- Corrosion Inhibition

- Demulsifying

- Scale Inhibition

- Others

By End-use

- Oil & Gas

- Water & Wastewater Treatment

- Chemical & Petrochemical

- Energy & Power

- Fertilizer

- Pharmaceutical

- Other

Drivers

Growing Demand In Petrochemical Industries

The growing demand in petrochemical industries is emerging as a key driver for the growth of the global chemical injection skids market. Driven by growing global population, and rapidly expanding economies have significantly boosted the demand for petrochemical products. Industries in these sectors are seeking various technologies to enhance production, and chemical injection skids have emerged as a promising option. These systems enable the precise delivery of chemicals into process streams to prevent corrosion, improve operational efficiency, and regulate reaction conditions. They ensure accurate chemical dosing, minimize side reactions, and contribute to enhanced product quality and process reliability.

- According to a report by the International Energy Agency, petrochemicals are expected to be a major consumer of global oil demand, contributing to around 7 million barrels of oil per day by 2050. Additionally, they are projected to consume an extra 56 billion cubic meters of natural gas by 2030, and 83 bcm by 2050. These projected growth in petrochemical demand drives the need for advanced chemical injection skids to ensure efficient production processes and precise chemical dosing.

Additionally, government initiatives and rising public-private sector investments continue to accelerate the development of petrochemical and refining industries, further increasing the need for advanced chemical injection solutions. Their use is particularly vital in applications such as ethylene cracking and the production of resins and plastics, where precision in dosing catalysts, stabilizers, and other additives is essential. With rising demand for petrochemical products in sectors such as packaging, automotive, and construction, the need for reliable and accurate injection systems is growing. Furthermore, the increasing focus on industrial regulations and sustainability programs is boosting the adoption of chemical injection skids.

As industries shift toward eco-friendly practices, these systems help manufacturers meet environmental standards by reducing chemical waste, ensuring accurate dosing, and minimizing the environmental impact of chemical processes. This alignment with sustainability goals makes chemical injection skids a vital component in the evolving landscape of the petrochemical and refining sectors, positioning them as a key enabler of market growth globally.

- For instance, Indian governments promoting the Chemical Promotion Development Scheme (CPDS) for accelerating the growth and development of the chemicals and petrochemicals industry, which includes supporting the adoption of technologies such as chemical injection skids.

Restraints

Slow Adoption In Developing Regions

The slow adoption of chemical injection skids in developing regions is driven by its limited industrial infrastructure and financial challenges. Many of these regions face challenges in developing advanced manufacturing systems due to insufficient capital investment and a lack of advanced technologies. In addition, industries in these areas companies implementing traditional methods due to chemical skids required high investment, limiting the overall market growth for chemical injection skids. Additionally, a lack of technical expertise and awareness is another factor limiting its market growth in many developing countries, which further reduces the adoption of advanced systems.

In addition, chemical injection skids require skilled professionals for installation, maintenance, and operation, but the shortage of trained personnel in these regions creates a barrier. Moreover, many companies in developing areas prioritize more immediate, low-cost solutions over investing in high-tech equipment such as chemical injection skids, leading to restraining chemical injection skids’ market penetration.

Opportunity

High-Pressure Skids Of Deep Sea Operation

The use of high-pressure skids in deep-sea regions presents a significant opportunity for the global chemical skids market. As offshore and deep-sea exploration and oil activities expand, particularly in ultra-deep regions, the demand for specialized advanced chemical injection systems increases. These systems are crucial due to their ability to withstand extreme weather conditions. This system is essential in the oil and gas industry for delivering chemicals into process systems to enhance production and ensure the proper functioning of equipment, further boosting their demand in deep-sea exploration activities.

- According to reports from petroleum exploration and development, in 2023, 1,372 deepwater/ultra-deepwater fields were discovered globally, with recoverable reserves totaling 408.01 × 10^8 tons of oil equivalent (toe). This growth in reserves has spurred increased demand for specialized, high-performance chemical skids to ensure the efficient and reliable operation of these fields.

Furthermore, deep-sea levels contain vast amounts of untapped oil and gas resources, with the Arctic alone estimated to hold 90 billion barrels of oil and over 1,600 trillion cubic feet of natural gas. In these high-depth environments, standard chemical injection skids are unsuitable. High-pressure skids, specifically designed with pressure-rated components, offer a solution.

The integration of these systems, built for high performance in deep-sea conditions, ensures superior corrosion resistance, durability, and long-term reliability, even in environments characterized by high salinity and low temperatures.

Trends

Emergence of Solar-Powered Chemical Injection Skids

The global chemical injection skids market has witnessed significant growth, with a notable trend towards the adoption of solar-powered chemical injection skids. These systems offer energy efficiency, sustainability, and low maintenance, which align with the increasing demand for environmentally friendly and cost-effective solutions in industries such as oil and gas, water treatment, agriculture, and various industrial processes.

The integration of solar energy into chemical injection skids has gained importance in remote locations, where conventional power sources are scarce or unavailable. This trend reflects the broader shift towards renewable energy solutions and automation in industrial operations, contributing to both operational efficiency and environmental sustainability.

Geopolitical Impact Analysis

Recent geopolitical events, such as former President Donald Trump’s trade impositions on multiple countries, have sparked new tensions in the global market, with several nations engaging in trade wars. These developments have disrupted supply chains and the availability of raw materials across various sectors.

- For instance, Trump recently announced steep U.S. tariffs up to 25% on goods from Canada, Mexico, and China, exposing vulnerabilities in the chemical, plastics, and pharmaceutical industries. In addition, he declared a 25% tariff on countries purchasing oil and gas from Venezuela.

These tariff impositions have significantly impacted the global chemical injection skids market, largely due to the heavy use of these systems in the oil & gas and chemical industries. The 25% tariffs on imports from key trade partners have disrupted supply chains and increased the cost of raw materials used in skid manufacturing. This has led to reduced industrial investment and project delays particularly in oil and gas operations, where chemical injection skids are essential for dosing chemicals during drilling and production.

Moreover, the 25% tariff on countries buying oil and gas from Venezuela has further strained the global energy market, slowing down operations in affected regions and decreasing demand for injection systems. In the chemical sector, these tariffs have increased operational costs and discouraged cross-border trade. This negatively impacts manufacturers that depend on chemical dosing systems like injection skids, ultimately limiting market growth.

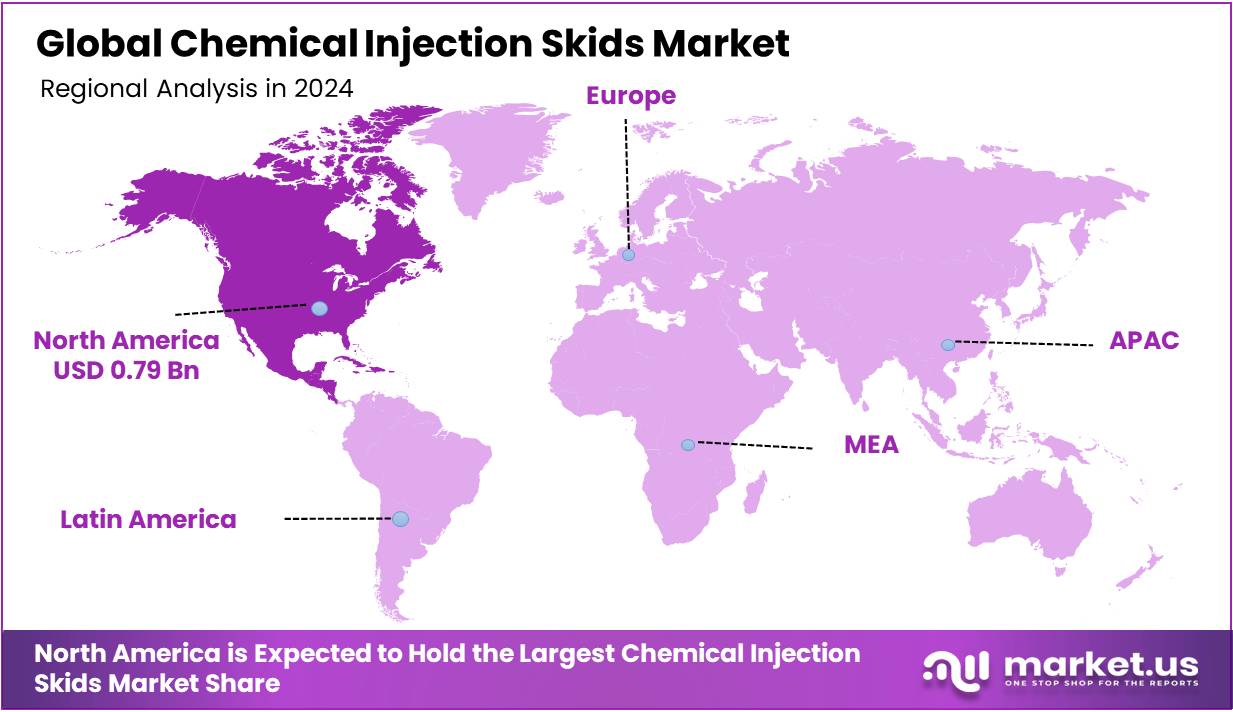

Regional Analysis

North America Held the Largest Share of the Global Chemical Injection Skids Market

In 2024, North America dominated the global chemical injection skids market, accounting for 34.5% of the total market share, Driven by the region’s well-established industrial infrastructure, robust research and development activities, strong government support, and significant investments in the chemical and energy sectors, North America is experiencing a substantial demand for advanced industrial solutions like chemical injection skids. This market serves a wide range of industries, including oil and gas, petrochemical, and water and wastewater treatment. The demand for chemical injection skids in North America is largely driven by the need for advanced industrial solutions that reflect the region’s emphasis on innovation.

Environmental regulations and technological advancements are crucial drivers for the growth of the petrochemical and oil production sectors. The expansion of petrochemical and refining activities has increased the need for precise and controlled dosing solutions, particularly in the United States and Canada, contributing significantly to the demand for chemical injection skids.

Major manufacturers are continually innovating and investing in research and development to maintain their dominant position in the market. Furthermore, water and wastewater treatment sector also represents a significant portion of the demand, as chemical injection skids are used for removing water impurities and harmful chemicals.

The adoption of advanced technologies, such as high-pressure skids and solar-powered skids, has further contributed to the market’s expansion by offering solutions that help reduce operational costs. The United States and Canada possess highly developed industries in oil and gas, petrochemical, and manufacturing sectors that rely heavily on chemical injection skids for precise process control and operational efficiency, creating a consistent demand for these systems in these critical sectors.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the Chemical Injection Skids market dominate the market through strategic innovation and global reach.

The global chemical injection skids market is highly competitive, with several key players operating within it. These firms prioritize product innovation, strategic partnerships, and mergers and acquisitions to expand their market share. Other key players in the sector include Proserv Group Inc., Petronash, AES Arabia Ltd., LEWA GmbH, and others; with demand for chemical injection skids expected to keep growing at an increasing rate, these firms must continue investing in cutting-edge technologies and solutions that satisfy customers’ evolving needs.

Major Players in the Industry

- Ingersoll Rand

- Petronash

- AES Arabia Ltd.

- LEWA GmbH

- SPX FLOW

- INTECH

- Integrated Flow Solutions, Inc.

- PetroServe International

- Carotek, Inc

- IDEX Corporation

- GSW

- Inrada O.G.R.S. B.V.

- Mowe Marine & Offshore.

- Dencil Fluidtek Systems Pvt Ltd

- SMARTCORR

- ALIPU

- Euro Mechanical

- Other Key Players

Recent Development

- In June 2024 – AILIPU has successfully mass-produced its advanced chemical injection skid system, enhancing production capacity in a Middle Eastern oilfield. The system ensures precise, high-pressure chemical dosing compliant with API 675 standards and supports a wide range of applications, including hydrate prevention and corrosion control.

- In June 2023 – Euro Mechanical has launched a modular chemical injection skid package tailored for both fixed and mobile applications, supported by advanced 3D modelling and compliance with global industry standards. The company is set to deliver eight custom-engineered skid packages to a major offshore energy client, reinforcing its position as a leading solutions provider in the UAE.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Bn Forecast Revenue (2034) USD 3.1 Bn CAGR (2025-2034) 3.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Conventional Injection Skids, Multi Point Injection Skids, Multi Compartmental, Others), By Function (Antifoaming, Corrosion Inhibition, Demulsifying Scale Inhibition, Others), By End-use (Oil & Gas, Water & Wastewater Treatment, Chemical & Petrochemical, Energy & Power, Fertilizer, Pharmaceutical, Other) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Ingersoll Rand, Petronash, AES Arabia Ltd., LEWA GmbH , SPX FLOW, INTECH, Integrated Flow Solutions, Inc, Petro Serve International, Carotek, Inc, IDEX Corporation ,GSW Inrada O.G.R.S. B.V., Mowe Marine & Offshore., Dencil Fluidtek Systems Pvt Ltd, SMARTCORR , ALIPU, Euro Mechanical, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chemical Injection Skids MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Chemical Injection Skids MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ingersoll Rand

- Petronash

- AES Arabia Ltd.

- LEWA GmbH

- SPX FLOW

- INTECH

- Integrated Flow Solutions, Inc.

- PetroServe International

- Carotek, Inc

- IDEX Corporation

- GSW

- Inrada O.G.R.S. B.V.

- Mowe Marine & Offshore.

- Dencil Fluidtek Systems Pvt Ltd

- SMARTCORR

- ALIPU

- Euro Mechanical

- Other Key Players