Global Carpet and Rug Market Size, Share, Growth Analysis By Product Type (Tufted, Woven, Needle-Punched, Knotted, Others), By Application (Residential, Commercial), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144504

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

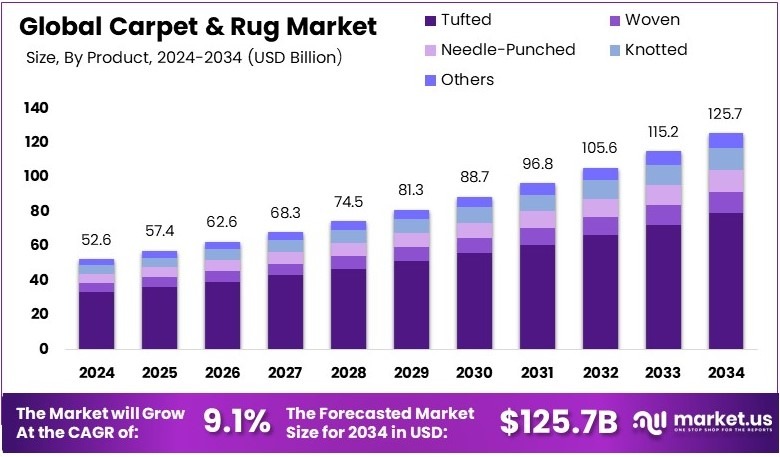

The Global Carpet & Rug Market size is expected to be worth around USD 125.7 Billion by 2034, from USD 52.6 Billion in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034.

Carpets and rugs are textile floor coverings used for comfort, warmth, and decoration. Carpets usually cover entire floors, while rugs are smaller and movable. They come in various materials like wool, nylon, and polyester. These products are common in homes, offices, hotels, and public spaces.

The carpet and rug market includes the global trade, production, and sales of floor coverings. It tracks trends in design, material use, and demand from housing and commercial sectors. Growth is influenced by construction activity, renovation trends, and consumer preference for comfort and interior design.

Carpets and rugs continue to play a key role in home décor. They offer warmth, style, and noise control. In 2023, the U.S. Census Bureau reported about 1.4 million new housing units completed. This steady rise supports demand for flooring products, especially in newly built homes and renovated spaces.

Meanwhile, the global trade flow also shapes the market. According to the OEC, the U.S. imported about $2.5 billion in carpets and textile floor coverings in 2023. At the same time, exports reached just $1.2 billion. This shows a trade gap, with the U.S. relying heavily on foreign-made products.

In this context, international producers from India, China, and Turkey dominate U.S. imports. Their strong manufacturing capacity and cost-effective output increase market competition. However, local brands are responding with better design, custom options, and faster delivery. These factors help maintain domestic relevance despite foreign pressure.

Corporate strategies are also shaping the future. In 2023, Mohawk Industries acquired a major European carpet company. This move expanded its footprint across Europe and added new product lines. Such acquisitions reflect how companies are scaling up to stay competitive and enter new regional markets.

Still, the market remains fragmented. While large players grow through deals, smaller firms compete on design, material innovation, and niche offerings. This keeps the market diverse. Although saturation is visible in mature regions, emerging markets offer new opportunities through urban development and rising disposable income.

On a broader scale, carpets and rugs influence indoor air and comfort. In colder climates, they reduce heating needs. Locally, they support home improvement businesses, from installers to retailers. Their role in real estate staging and office décor also adds value in both residential and commercial segments.

Key Takeaways

- The Carpet & Rug Market was valued at USD 52.6 billion in 2024 and is expected to reach USD 125.7 billion by 2034, with a CAGR of 9.1%.

- In 2024, Tufted Carpets and Rugs dominated with 63.7%, due to cost-effectiveness and durability.

- In 2024, Residential Use led with 72.4%, driven by home renovations and décor trends.

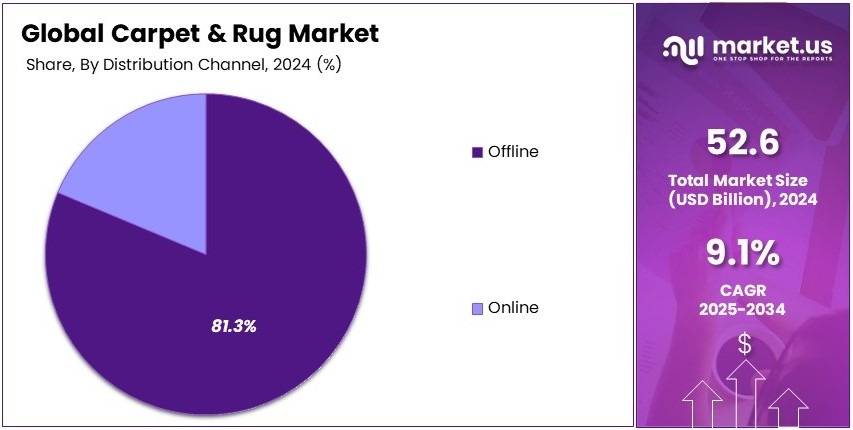

- In 2024, Offline distribution accounted for 81.3%, as consumers prefer to assess texture and quality in-store.

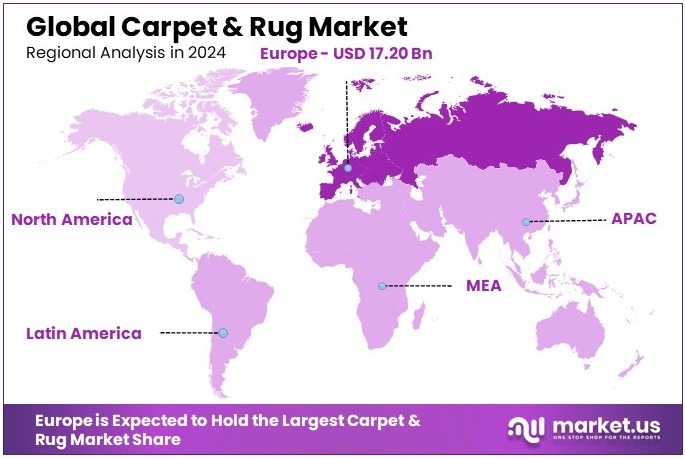

- In 2024, Europe led with 32.7%, valued at USD 17.20 billion, due to high consumer spending on home furnishings.

Product Type Analysis

Tufted carpets and rugs dominate with 63.7% due to their versatility and cost-effectiveness.

Tufted carpets and rugs are the most prevalent sub-segment within the market, accounting for 63.7% of sales. This dominance is primarily because tufting technology allows for diverse designs and quick production times, making it a popular choice for both residential and commercial applications. Tufted carpets are favored for their affordability and adaptability in various decorative styles, supporting their continued market leadership.

Woven carpets, though less dominant, hold a critical place in the market, known for their high quality and durability. These are often considered premium products and are preferred in settings where luxury and longevity are priorities.

Needle-punched carpets are essential for industrial and commercial applications where durability under heavy foot traffic is required. Their role in the market is significant, especially in sectors like commercial real estate and automotive.

Knotted carpets represent a niche market focused on artisanal quality and traditional craftsmanship. While they command higher prices, their appeal lies in their unique aesthetics and cultural heritage.

Other types of carpets, including hand-loomed and machine-made varieties, cater to specific consumer needs and preferences, contributing to the overall diversity and richness of the market.

Application Analysis

Residential use dominates with 72.4% due to the wide range of aesthetic and functional needs in home environments.

Residential applications hold the largest share in the carpet and rug market at 72.4%. This segment’s dominance is driven by the extensive use of carpets and rugs in homes for comfort, warmth, and interior aesthetics. The wide variety of designs, materials, and sizes available makes carpets and rugs highly adaptable to different living spaces and decor styles, ensuring their continued popularity among homeowners.

Commercial use, while smaller in comparison, is crucial to the market, especially in business environments, hotels, and public buildings. Carpets in these settings are selected for durability, style, and the ability to withstand high foot traffic, highlighting their functional and aesthetic contributions to business settings.

Distribution Channel Analysis

Offline sales dominate with 81.3% due to consumers’ preference for seeing and feeling the products before purchasing.

Offline channels are the most significant in the distribution of carpets and rugs, with an 81.3% market share. This substantial share is largely attributed to consumer preferences for touching and seeing the products in person before making a purchase decision. Physical stores offer the advantage of immediate tactile experience, which is particularly important for products like carpets and rugs where texture, color, and quality are better assessed in person.

Online channels, though growing, cater primarily to a consumer segment that values convenience. With advancements in e-commerce technology, such as high-resolution images and augmented reality apps, online retailers are increasingly able to mimic the in-store experience, gradually increasing their market share.

Key Market Segments

By Product Type

- Tufted

- Woven

- Needle-Punched

- Knotted

- Others

By Application

- Residential

- Commercial

By Distribution Channel

- Online

- Offline

Driving Factors

Sustainability, Convenience, and Design Trends Drive Market Growth

The carpet and rug market is growing due to rising interest in easy-care and eco-conscious products. Many homeowners now prefer stain-resistant and low-maintenance carpets that fit into busy lifestyles. These products help reduce cleaning time and improve long-term durability, making them especially attractive for families and pet owners.

At the same time, environmental awareness is influencing purchasing decisions. Carpets made from recycled or sustainable materials are gaining popularity. Consumers are looking for options that are both stylish and responsible, which pushes manufacturers to innovate with green solutions.

Smart carpets are also emerging as a new growth area. These advanced products can include embedded sensors that connect to home automation systems for functions like lighting control or security alerts. This appeals to tech-savvy homeowners seeking smarter living spaces.

In addition, handwoven and artisanal rugs are becoming key design elements in homes. These rugs offer unique patterns and craftsmanship, supporting local artisans and reflecting global interior trends. With this mix of functionality, sustainability, and style, the market continues to expand. These factors are shaping a modern carpet industry focused on comfort, innovation, and eco-friendly living.

Restraining Factors

Affordability, Competition, and Health Concerns Restrain Market Growth

Several challenges are limiting the growth of the carpet and rug market. One of the key concerns is affordability. Premium rugs made from wool or natural fibers can be expensive, which reduces accessibility for average buyers. As a result, many households turn to more budget-friendly flooring options.

In addition, hard flooring alternatives such as tiles, laminate, and hardwood are gaining popularity. These options are easier to clean and often preferred in modern minimalist designs. This shift in consumer preference is gradually reducing demand for traditional carpets.

Health concerns also play a role. Carpets can trap dust, pollen, and pet dander, which may trigger allergies or respiratory issues. For this reason, some consumers prefer bare flooring, especially in homes with children or allergy sufferers.

Another limiting factor is fluctuating raw material prices. When input costs rise, manufacturers face pressure on pricing and margins. This makes it harder to maintain affordability and consistent supply. Taken together, these factors—high costs, strong alternatives, health concerns, and volatile material pricing—are slowing market expansion and prompting brands to rethink product strategies.

Growth Opportunities

Customization and Eco-Friendly Materials Provide Opportunities

New opportunities are emerging in the carpet and rug market, particularly through personalization and sustainability. One growing trend is modular carpet tiles. These allow consumers to create custom layouts and replace individual sections as needed, offering greater flexibility in design and maintenance.

Another area of growth is smart and heated carpets. In colder regions, these carpets offer added comfort and warmth, making them highly desirable for bedrooms or living spaces. Smart versions may also include temperature controls or energy-saving features, aligning with trends in home automation.

Direct-to-consumer carpet brands are gaining traction online. These companies offer personalized sizing, colors, and textures, allowing buyers to match rugs to their unique home décor. This shift gives customers more control over style and supports easier shopping from home.

Eco-conscious consumers are also looking for plant-based or biodegradable carpet options. Rugs made from natural fibers like jute, sisal, or corn-based materials are becoming more popular. These sustainable choices reduce environmental impact and appeal to modern buyers who prioritize green living. In this context, companies that embrace innovation and eco-friendly materials can capitalize on evolving market needs.

Emerging Trends

Digital Tools and Functional Design Are Latest Trending Factor

Current trends are transforming the carpet and rug market through technology and functionality. One popular style is vintage and distressed rugs. These pieces offer a worn-in look that fits well with modern and bohemian interiors, bringing character to living spaces.

There is also rising demand for washable rugs. Families, pet owners, and busy professionals favor machine-friendly rugs that are easy to clean and maintain. These products offer both style and convenience, making them suitable for high-traffic areas like kitchens and playrooms.

Online shopping is being enhanced with virtual try-on tools. AI-powered platforms let users visualize how a carpet will look in their room before buying. This technology reduces uncertainty and increases buyer confidence, especially for higher-priced items.

Multifunctional rugs are also trending. These carpets may offer thermal insulation, soundproofing, or dual use in both indoor and outdoor settings. As an example, apartments in noisy urban areas benefit from rugs that reduce echo and maintain warmth. Overall, the market is shifting toward smart design, convenience, and high-tech experiences that match today’s lifestyle preferences.

Regional Analysis

Europe Dominates with 32.7% Market Share

Europe leads the Carpet & Rug Market with a 32.7% share, totaling USD 17.20 billion. This dominance is driven by high consumer demand for luxury and designer floor coverings, deeply rooted in the region’s strong traditions in textile craftsmanship.

Key factors contributing to this substantial market share include the prevalence of renowned carpet manufacturers, a focus on sustainable and eco-friendly production practices, and high consumer purchasing power. Europe is also home to some of the world’s leading design fairs, where trends that influence global carpet and rug styles are set.

The future of Europe in the Carpet & Rug Market looks promising. With an increasing emphasis on sustainable living, European consumers are likely to continue favoring eco-friendly materials and production methods. This trend, coupled with the region’s capacity for high-end design and innovation, is expected to keep Europe at the forefront of the market.

Regional Mentions:

- North America: North America remains a significant player in the Carpet & Rug Market, driven by innovations in eco-friendly materials and smart home integration. The region’s focus on sustainability and modern design continues to influence market dynamics positively.

- Asia Pacific: Asia Pacific is rapidly growing in the Carpet & Rug Market, spurred by economic growth and an expanding middle class. The region’s increasing demand for modern and traditional designs supports its rising market share.

- Middle East & Africa: The Middle East and Africa are noted for their rich history in carpet weaving, contributing uniquely to the global market. Recent economic developments and luxury hotel projects have stimulated demand for high-end carpets and rugs.

- Latin America: Latin America is witnessing gradual growth in the Carpet & Rug Market, with an increasing number of local manufacturers and rising consumer interest in home decor. This growth is supported by improving economic conditions and a growing appreciation for interior aesthetics.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The global carpet and rug market is led by Mohawk Industries, Shaw Industries, Interface, Inc., and Tarkett S.A. These four companies dominate due to their wide product lines, strong global networks, and innovation.

Mohawk Industries is one of the largest players in the flooring industry. It offers carpets for residential, commercial, and hospitality use. The company focuses on both synthetic and natural fibers and invests heavily in sustainable practices.

Shaw Industries, a Berkshire Hathaway company, provides high-quality carpets with strong focus on design and performance. Its broad range includes stain-resistant and eco-friendly options. Shaw also leads in recycling efforts and green manufacturing.

Interface, Inc. is well-known for modular carpet tiles. It focuses on corporate and commercial spaces. Interface is also a global leader in sustainable flooring. The company’s “Climate Take Back” initiative has made it a favorite among environmentally conscious buyers.

Tarkett S.A. offers a wide variety of carpets and rugs, including custom solutions. It operates in over 100 countries and serves various sectors, from healthcare to education. Tarkett emphasizes innovation, durability, and design flexibility.

These companies lead the market by offering sustainable, stylish, and durable carpet solutions. Their global reach, investment in green technology, and customer-focused product development keep them at the forefront of the industry.

Major Companies in the Market

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.

- Interface, Inc.

- Tarkett S.A.

- Milliken & Company

- Beaulieu International Group

- Dixie Group, Inc.

- Oriental Weavers

- Mannington Mills, Inc.

- Tai Ping Carpets International Ltd.

- Victoria PLC

- Balta Group

- Brintons Carpets Limited

Recent Developments

- FNA Group Acquires Kent Investment Corporation: On January 2025, The FNA Group announced the acquisition of Kent Investment Corporation, a leader in the professional carpet cleaning industry. This strategic move enables FNA Group to expand its product portfolio and enter the indoor cleaning segment.

- Ruggable and Architectural Digest Launch New Rug Collection: On January 2025, Ruggable, known for its stain-proof and machine-washable rugs, collaborated with Architectural Digest to release a new collection inspired by 2025 interior design trends. The collection features three distinct styles—Archaic, Industrial, and Art Deco—each reinterpreting historical aesthetics for modern interiors.

Report Scope

Report Features Description Market Value (2024) USD 52.6 Billion Forecast Revenue (2034) USD 125.7 Billion CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tufted, Woven, Needle-Punched, Knotted, Others), By Application (Residential, Commercial), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mohawk Industries, Inc., Shaw Industries Group, Inc., Interface, Inc., Tarkett S.A., Milliken & Company, Beaulieu International Group, Dixie Group, Inc., Oriental Weavers, Mannington Mills, Inc., Tai Ping Carpets International Ltd., Victoria PLC, Balta Group, Brintons Carpets Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.

- Interface, Inc.

- Tarkett S.A.

- Milliken & Company

- Beaulieu International Group

- Dixie Group, Inc.

- Oriental Weavers

- Mannington Mills, Inc.

- Tai Ping Carpets International Ltd.

- Victoria PLC

- Balta Group

- Brintons Carpets Limited