Global Laminated Labels Market By Material Type (Polyester, Vinyl, Polycarbonate, Polypropylene and Others) By Type of Ink (Water Based, Solvent Based, Hot Melt Based and UV Curable) By Printing Technology (Digital, Flexography, Lithography and Others) By End Use Industry (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Consumer Durables, Retail Labels and Others) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 63086

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

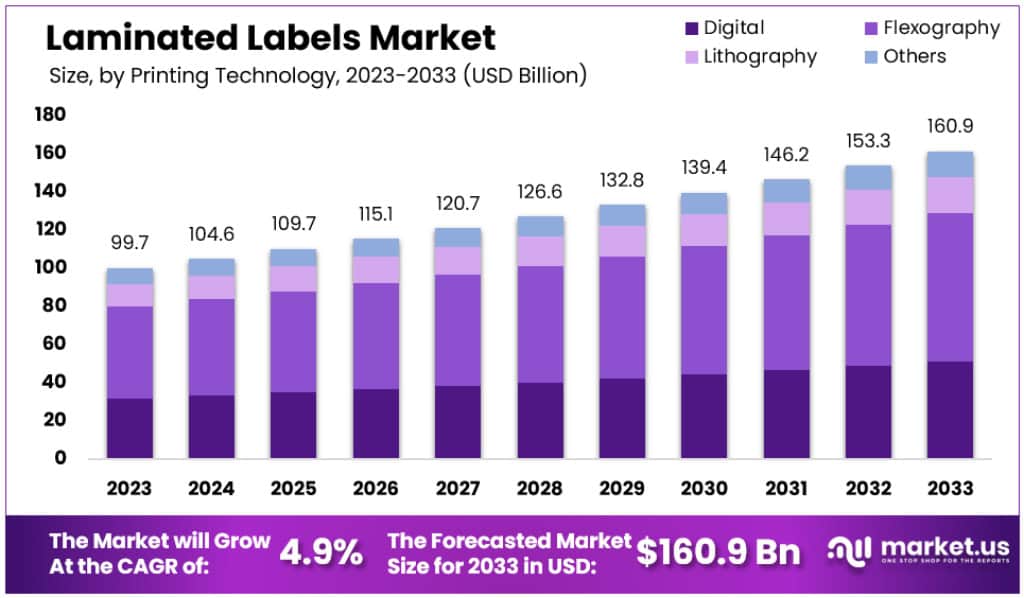

The Global Laminated Labels Market size is expected to be worth around USD 160.9 Billion by 2033, from USD 99.7 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2024 to 2033.

Laminated labels are specialized labels that undergo a lamination process, which involves the complete encasement of either printed or non-printed labels with a protective coating. This coating is crucial for providing resistance against various detrimental elements such as chemicals, dampness, solvents, friction, scuffing, and harsh environmental conditions, including extreme temperatures and ultraviolet radiation. Constructed typically with a polyester release liner made of polyester film material, these labels are designed to ensure the durability and longevity of the imprint, maintaining its readability over extended periods.

Primarily used in challenging environments like outdoor settings and areas exposed to chemicals or moisture, laminated labels are preferred over non-laminated labels due to their enhanced resilience to weathering and high friction.

The labels contain essential product information like names, addresses, market data, ingredients, QR codes, and barcodes. This combination of durability and information retention makes laminated labels a versatile solution, widely employed across various end-use industries. Their ability to protect printed images from damage more effectively than other coatings further underscores their utility in industrial and consumer applications.

The laminated labels market is witnessing significant growth, driven by diverse factors. The increased demand in the food and beverage industry, along with a rising need in the medical and healthcare sector, is propelling market growth. The durability and long-term readability of these labels make them an ideal choice for outdoor products, items exposed to chemicals, and environments that are wet or humid. Furthermore, the shift towards semi-gloss or matte finishes in laminates, primarily due to the ease of scanning barcodes, is influencing market trends. This preference is bolstered by the evolving pressure-sensitive technologies, enhancing both the aesthetic appeal and performance of laminated labels.

The market dynamics are also influenced by the high bargaining power of buyers, attributed to the availability of alternative options like direct printing on containers and a low switching cost among suppliers. This scenario is further compounded by the presence of numerous suppliers, intensifying competition and enabling buyers to negotiate more effectively on pricing.

Moreover, the competition in the laminated labels market is intensifying due to advancements in labeling technologies, such as 3D printing and thermoforming. Converters in the laminated label market are focusing on developing innovative solutions that can withstand extreme weather conditions and abrasion, further driving market growth.

Key Takeaways

- The Global Laminated Labels Market is expected to reach approximately USD 160.9 billion by the year 2033, up from USD 99.7 billion in 2023.

- This growth represents a CAGR of 4.9% from 2024 to 2033.

- Polyester is the most preferred material for laminated labels, holding a significant market share of 35.2% in 2023.

- Flexography is the dominant printing technology for laminated labels, with a share of 46.2% in 2023.

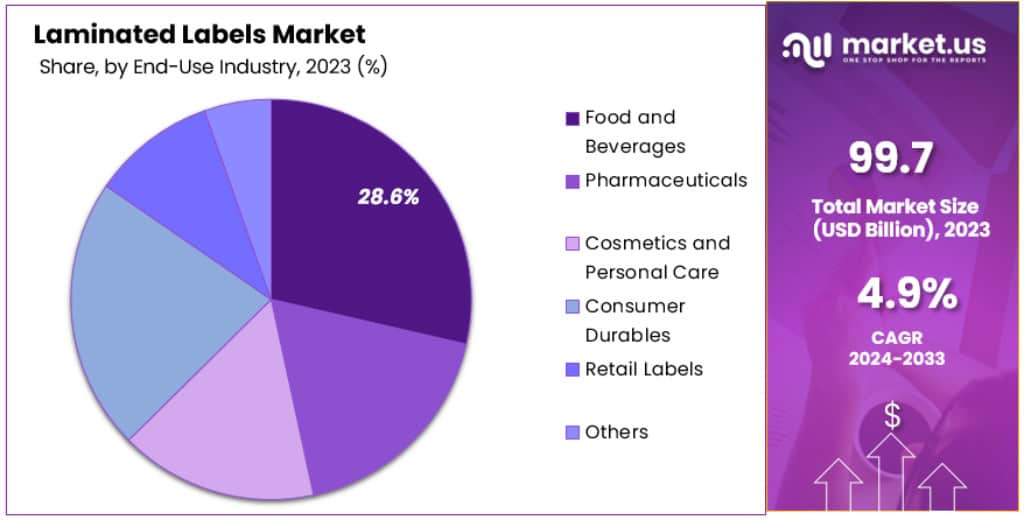

- The food and beverage industry is the leading end-use industry for laminated labels, holding a share of 28.9% in 2023.

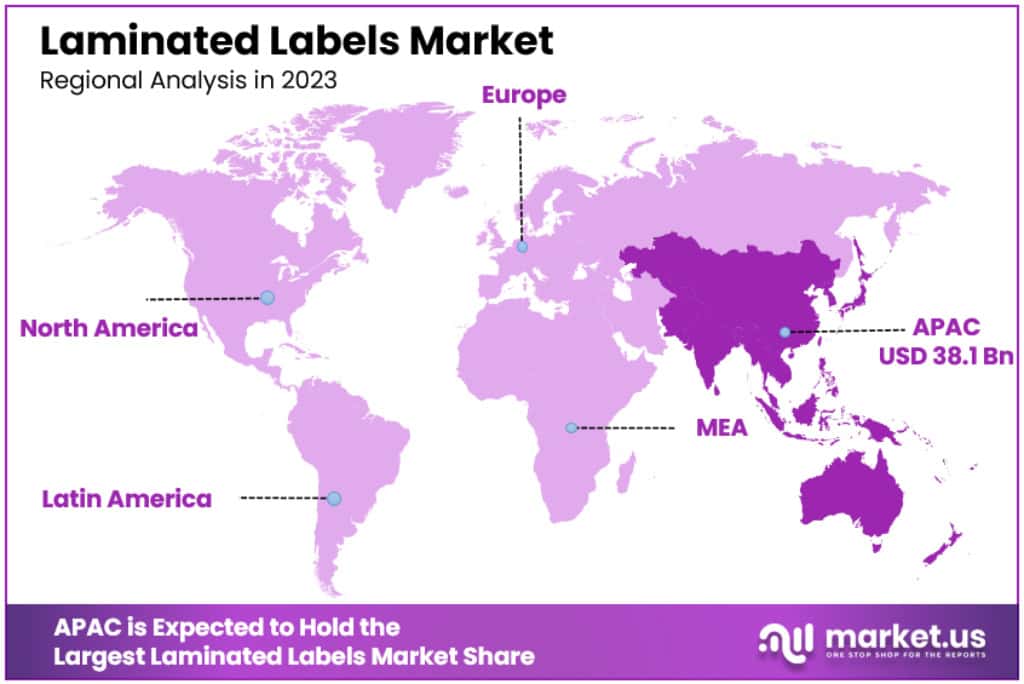

- The Asia-Pacific region is the largest market for laminated labels, with a commanding 46.2% share.

Material Type Analysis

In 2023, Polyester held a dominant market position, capturing more than a significant 35.2% share in the laminated labels market. Polyester’s growing preference stems from its durable nature and excellent resistance to chemicals and heat. These attributes make it an ideal choice for various labeling applications, supporting its sustained growth over the projected period.

The another preference for polyester film in laminated labels is primarily due to its superior flexibility and durability, offering tear-resistant adhesive properties. With higher tensile strength and dimensional stability than other materials, polyester-release liners used in laminated labels further enhance their appeal. These labels offer resistance against chemicals, temperature variations, UV exposure, and weather conditions, extending their lifespan on products. The multipurpose application of polyester, ranging from products and containers to chemicals, coupled with its cost-effectiveness, drives its widespread use and market growth.

Printing Technology Analysis

In 2023, the laminated labels market has seen Flexography hold a dominant position, capturing a significant 46.2% share. This dominance is underpinned by the flexographic printing technology’s versatility, allowing it to be used on a variety of surfaces including porous, non-porous, flat, and rough. Flexography is compatible with numerous ink types such as UV-curable, water-soluble, and solvent-based, which enhances its adaptability. Its quick-drying inks and automation contribute to high performance, while also offering benefits of eco-sustainability, high-quality image reproduction, and lower production costs. These factors collectively drive the growth of flexographic printing in the laminated labels market.

Furthermore, the laminated labels market is experiencing growth driven by various segments. The food and beverage industry, logistics applications, and the rising use of laminated labels in consumer durables are key contributors to this expansion. The Asia-Pacific region holds a significant share of the global market revenue and is predicted to maintain its dominance. This growth is fueled by rapid industrialization and the expansion of various sectors like food and beverage, pharmaceutical, and others in the region. Countries like China and India are estimated to account for a considerable portion of the market revenue, supporting the global market expansion in this region.

Additionally, the use of laminated labels in reel form has dominated the market, with volumes exceeding 36 billion square meters. This trend is expected to continue due to the widespread use of reel-shaped labels in large-scale labeling processes.

End-Use Industry Analysis

In 2023, the Food and Beverages sector holds a dominant position in the laminated labels market, capturing a significant 28.9% share. The Food and beverage industry’s dominance in the laminated labels market can be attributed to several key factors driving its growth. Firstly, there’s a growing demand from the fresh food and beverage packaging industry, primarily driven by the need to display critical product information such as barcodes, unit costs, manufacturing dates, and expiration dates on labels. These factors are crucial in the food and beverage industry due to stringent regulatory requirements and consumer preferences for product information transparency.

Another significant driver is the expansion of product innovations and the integration of advanced technology in retail operations, which enhances the efficiency and appeal of various products, including those in the food and beverage sector. The cost-effective nature of laminated labels, coupled with their durability and resistance to moisture and vapor, makes them particularly suitable for this industry.

Additionally, the sector’s growth is also influenced by the overall expansion of the e-commerce industry and increasing consumer awareness. The COVID-19 pandemic further accelerated the demand for laminated labels in the food and beverage industry due to a surge in online shopping and food delivery services. This increase in e-commerce activities necessitated more extensive use of laminated labels for packaging and shipping.

The Asia-Pacific region, especially countries like China and India, are significant contributors to this market’s growth, driven by rapid industrialization and the expansion of the food and beverage sector. The implementation of regulations governing labeling and packaging requirements, along with favorable government policies in these regions, also supports the expansion of the laminated labels market.

Key Market Segments

By Material Type

- Polyester

- Vinyl

- Polycarbonate

- Polypropylene

- Others

By Type of Ink

- Water Based

- Solvent Based

- Hot Melt Based

- UV Curable

By Printing Technology

- Digital

- Flexography

- Lithography

- Others

By End Use Industry

- Food and Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Consumer Durables

- Retail Labels

- Others

Drivers

- Growth in E-commerce and Industrial Label Demand: The expansion of the e-commerce sector, one of the fastest-growing retail segments, is driving the laminated labels market. Online retail requires effective branding and product identification, which is fulfilled by laminated labels. The industrial label market is projected to grow at a CAGR of about ~5% over the forecast period.

- Development in the Medical and Healthcare Sector: The medical and healthcare sector’s rapid development is boosting the demand for laminated labels, which are essential for displaying critical product information on pharmaceuticals and medical devices. The European Federation of Pharmaceutical Industries and Association reported a 5.7% increase in pharmaceutical production in Europe from 2019 to 2020, reaching €310 billion (approximately US$354.08 billion).

- Consumer Goods Sector Growth: Increasing demand in consumer goods, especially smartphones and consumer electronics, is propelling the market. The Global System for Mobile Communication predicts 700 million new mobile subscribers by 2025, further fueling demand for laminated labels.

Restraints

- Substitutes and High Competition: The availability of substitutes like flexible packaging and high gloss varnish-coated labels are challenging the market. Additionally, intense competition is pressuring profit margins for label manufacturers, impeding market growth.

- Environmental Regulations: Government regulations on plastic use in labels and disposal issues pose significant challenges. For instance, the UK and Devolved Administrations are focusing on extended producer responsibility for packaging, requiring manufacturers to manage waste more effectively.

Opportunities

- Technological Innovations: Advancements such as nanotechnology, spy dust, or Nano taggants for invisible brand protection coding, and temperature-indicator labels are creating new opportunities. The advent of technologies like thermoforming and 3D printing in labeling is anticipated to drive market growth.

Challenges

- Government Regulations for Environmental Protection: The usage of plastics in labels and the associated disposal problems are major obstacles. According to UN Environment, only 9% of plastic is recycled, with the rest contributing to growing landfill issues.

Trends

- Adoption by FMCG Industry: The FMCG sector’s growing adoption of laminated labels, driven by the need for comprehensive product information and authenticity, is a key trend. The beverage industry, in particular, is increasingly using laminated labeling for personalization.

Regional Analysis

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

This industry is competitive, with large companies constantly innovating and researching to increase their product offerings. This industry has a competitive edge by producing and printing labels that comply with the US FDA Labeling Rules as well other food and product marking guidelines.

Avery Dennison Corporation is one of the key companies in this industry. CCL Industries Inc. and 3M Company are Constantia Flexibles Group GmbH and Coveris Holdings S.A. Donnelley & Sons Company, Torraspapel Adestor, Bemis Company, Inc., Flexcon Company, Inc., & Stickythings Limited.

Маrkеt Кеу Рlауеrѕ

- Avery Dennison Corporation

- CCL Industries Inc.

- Constantia Flexibles

- Coveris Holdings

- R.R. Donnelley

- Torraspapel Adestor

- 3M Company

- Bemis Company, Inc.

- Flexcon Company, Inc.

- Sticky things Limited

- Amtico

- The Armstrong Flooring, Inc.

- Congoleum

- Flowcrete (RPM)

- Forbo International SA

- Gerflor

- Interface, Inc.

- IVC Group

- James Halstead Plc.

- Mannington Mills, Inc.

- NOX Corp.

- Tkflor

- Nora

- Toli Flooring

- Other Companies

Recent Developments

- November 2022: Multi-Color Corporation, a major player in the printed labels sector in the US, finalized the acquisition of Flexcoat Autoadesivos S.A., a Brazil-based manufacturer specializing in labels and lamination. This strategic move expands MCC’s offerings in South America, enhancing their product range and introducing advanced label technologies to Flexcoat’s clients.

- June 2022: Selic Corp Public Co. Ltd., known for its expertise in bonding innovation, acquired the rights to Neoplast™ & Neobun™ brands and related assets in Thailand and other Southeast Asian countries from 3M. This deal also included the acquisition of manufacturing assets in 3M’s Ladlumkaew facility in Thailand, signaling Selic’s expansion in the region.

- May 2021: CCL Industries Inc., a global leader in the specialty label and packaging solutions sector, acquired Lux Global Label Asia Pte. Ltd. in Singapore. This acquisition marks an expansion of CCL Industries’ capabilities in the Asian market, further solidifying its position as a global provider.

- September 2021: Constantia Flexibles, headquartered in Austria, launched an innovative PE film with 80% recycled content, derived from production waste from its EcoLam laminates. This development represents a significant stride in sustainability within the packaging industry, contributing to reduced environmental impact.

- July 2019: Coveris acquired Amberley Adhesive Labels Ltd, a UK-based company. This acquisition underlines Coveris’s commitment to expanding its label capabilities and developing the potential of the newly acquired facility, indicating a strategic move to enhance its market presence in the UK.

Report Scope

Report Features Description Market Value (2023) USD 99.7 Billion Forecast Revenue (2033) USD 160.9 Billion CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Polyester, Vinyl, Polycarbonate, Polypropylene and Others) By Type of Ink (Water Based, Solvent Based, Hot Melt Based and UV Curable) By Printing Technology (Digital, Flexography, Lithography and Others) By End Use Industry (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Consumer Durables, Retail Labels and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Avery Dennison Corporation, CCL Industries Inc., Constantia Flexibles, Coveris Holdings, R.R. Donnelley, Torraspapel Adestor, 3M Company, Bemis Company, Inc., Flexcon Company, Inc., Sticky things Limited, Amtico, The Armstrong Flooring, Inc., Congoleum, Flowcrete (RPM), Forbo International SA, Gerflor, Interface, Inc., IVC Group, James Halstead Plc., Mannington Mills, Inc., NOX Corp., Tkflor, Nora, Toli Flooring and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the laminated labels market size in 2023?A: The laminated labels market size was USD 99.7 Billion in 2023.

Q: What is the CAGR for the laminated labels market?A: The laminated labels market is expected to grow at a CAGR of 4.9% during 2024-2033.

Q: Who are the key players in the laminated labels market?A: The key vendors in the global laminated labels market Avery Dennison Corporation, CCL Industries Inc., Constantia Flexibles, Coveris Holdings, R.R. Donnelley, Torraspapel Adestor, 3M Company, Bemis Company, Inc., Flexcon Company, Inc., Sticky things Limited, Amtico, The Armstrong Flooring, Inc., Congoleum, Flowcrete (RPM), Forbo International SA, Gerflor, Interface, Inc., IVC Group, James Halstead Plc., Mannington Mills, Inc., NOX Corp., Tkflor, Nora, Toli Flooring and Other Key Players.

-

-

- Avery Dennison Corporation

- CCL Industries Inc.

- Constantia Flexibles

- Coveris Holdings

- R.R. Donnelley

- Torraspapel Adestor

- 3M Company

- Bemis Company, Inc.

- Flexcon Company, Inc.

- Sticky things Limited

- Amtico

- The Armstrong Flooring, Inc.

- Congoleum

- Flowcrete (RPM)

- Forbo International SA

- Gerflor

- Interface, Inc.

- IVC Group

- James Halstead Plc.

- Mannington Mills, Inc.

- NOX Corp.

- Tkflor

- Nora

- Toli Flooring

- Other Companies