Global Cardiovascular Enterprise Viewer Market By Product Type (Diagnostic & Monitoring Devices, and Imaging Devices), By Application (Coronary Artery Diseases, Structural Heart Diseases, Heart Failure, and Others), By End-user (Hospitals, Research & Academic Institutes, and Diagnostic Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159372

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

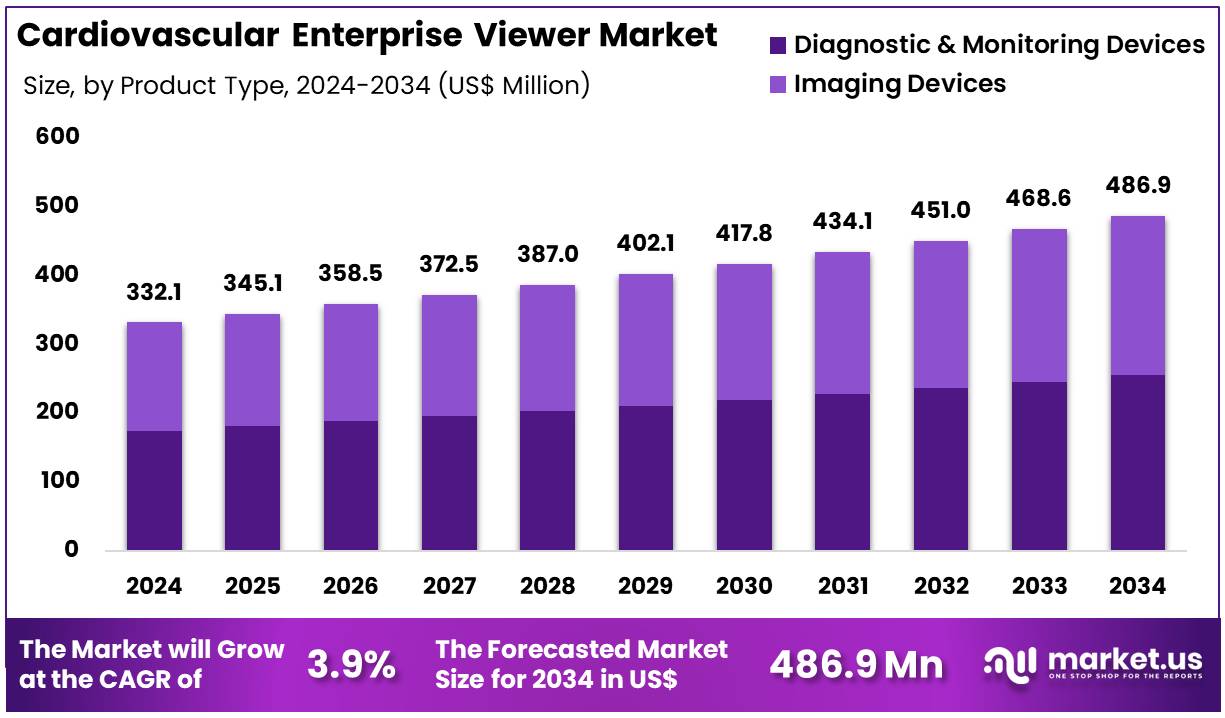

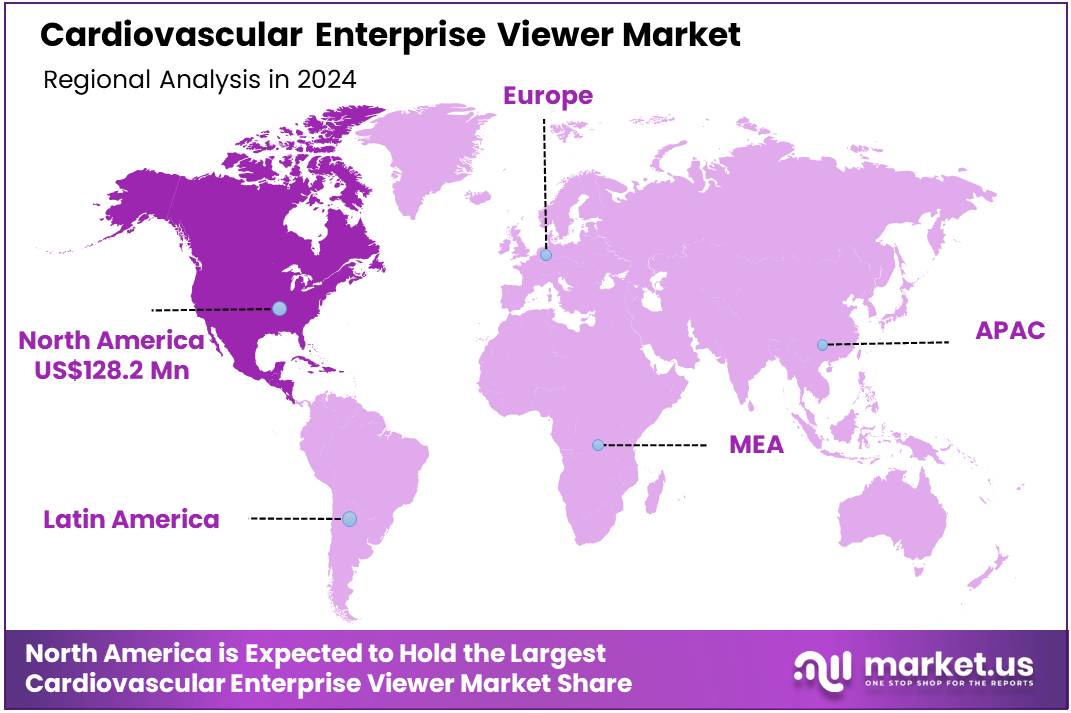

Global Cardiovascular Enterprise Viewer Market size is expected to be worth around US$ 486.9 Million by 2034 from US$ 332.1 Million in 2024, growing at a CAGR of 3.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.6% share with a revenue of US$ 128.2 Billion.

Rising prevalence of cardiovascular diseases drives the cardiovascular enterprise viewer market as cardiologists demand integrated platforms for accurate diagnostics and treatment planning. These systems enable echocardiography analysis, providing detailed heart function visualization to guide precise valve repair procedures. The increasing burden of heart conditions, such as coronary artery disease, intensifies this need, as viewers streamline coronary angiogram assessments for optimal stent placement.

Hospitals adopt these solutions for real-time data integration in electrophysiology labs, enhancing procedural outcomes. According to the CDC, approximately 14.3 million US adults have heart disease based on 2022 data, highlighting the urgent need for efficient imaging solutions. These drivers establish cardiovascular enterprise viewers as critical for advancing clinical precision across cardiology applications.

Growing advancements in artificial intelligence and cloud-based platforms unlock significant opportunities in the cardiovascular enterprise viewer market. Developers create AI-driven tools that automate myocardial strain analysis, supporting early heart failure detection in outpatient clinics. Research institutions leverage these systems for longitudinal studies, aggregating imaging data to study heart valve dysfunction and inform treatment strategies.

Telemedicine applications expand access to expert consultations for complex arrhythmias, improving patient care efficiency. Pharmaceutical firms utilize these platforms in clinical trials to visualize cardiac biomarker responses, accelerating drug development. The FDA reports 903 AI-enabled medical devices cleared by August 2024, underscoring the transformative potential of these solutions in cardiology.

Recent trends in the cardiovascular enterprise viewer market highlight seamless interoperability and enhanced platform integrations to optimize clinical workflows. Developers prioritize electronic health record connectivity, enabling rapid stress test analysis for acute care diagnostics. In May 2023, GE Healthcare showcased its Centricity Cardio Enterprise in a webinar, emphasizing digitized cardiology through streamlined imaging access.

Similarly, in July 2023, Agfa HealthCare launched its Enterprise Imaging for Cardiology platform, unifying image acquisition and retrieval for greater efficiency. Mobile-compatible interfaces support emergency cardiac interventions, with industry reports noting a 25% rise in demand for integrated cardiology solutions in 2023. These advancements drive a cohesive, patient-centric evolution in cardiovascular care delivery.

Key Takeaways

- In 2024, the market generated a revenue of US$ 332.1 Million, with a CAGR of 3.9%, and is expected to reach US$ 486.9 Million by the year 2034.

- The product type segment is divided into diagnostic & monitoring devices and imaging devices, with diagnostic & monitoring devices taking the lead in 2023 with a market share of 52.5%.

- Considering application, the market is divided into coronary artery diseases, structural heart diseases, heart failure, and others. Among these, coronary artery diseases held a significant share of 45.2%.

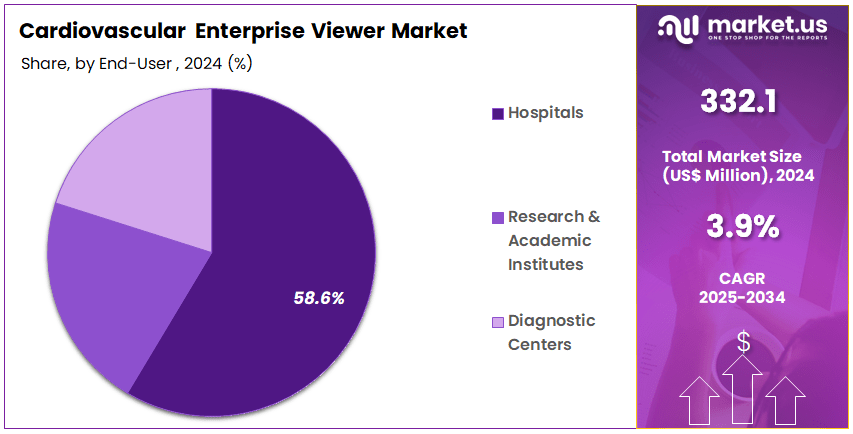

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, research & academic institutes, and diagnostic centers. The hospitals sector stands out as the dominant player, holding the largest revenue share of 58.6% in the market.

- North America led the market by securing a market share of 38.6% in 2023.

Product Type Analysis

Diagnostic & monitoring devices lead the product type segment with 52.5% share. The growth of this segment is fueled by the increasing prevalence of cardiovascular diseases globally, particularly coronary artery diseases and heart failure, which require continuous monitoring. These devices provide crucial real-time data to clinicians, allowing for more accurate and timely diagnoses. The growing adoption of advanced diagnostic and monitoring devices, such as electrocardiogram (ECG) machines and blood pressure monitors, is expected to continue due to their ability to reduce hospital readmission rates and improve patient outcomes.

Additionally, the integration of AI and digital health technologies into these devices enhances their predictive capabilities, making them even more indispensable in managing cardiovascular health. The increasing demand for home-based monitoring solutions also supports the growth of diagnostic & monitoring devices, enabling patients to manage their conditions outside of the hospital setting.

Application Analysis

Coronary artery diseases (CAD) dominate the application segment with 45.2% share. This segment’s growth is attributed to the rising global burden of cardiovascular diseases, particularly CAD, which remains one of the leading causes of death worldwide. Advances in diagnostic and imaging technologies, such as cardiac CT and MRI, are expected to further improve the detection and management of CAD, driving market growth.

The adoption of minimally invasive diagnostic tools, which provide faster and more accurate results, is expected to contribute to the growth of this segment. Additionally, the increasing awareness about heart disease risk factors and the importance of early detection is likely to boost demand for advanced diagnostic solutions for CAD. As the healthcare industry increasingly focuses on prevention and early intervention, the coronary artery diseases application segment will continue to expand.

End-User Analysis

Hospitals represent the largest share of 58.6% in the end-user segment. The growth of this segment is driven by the rising demand for advanced cardiovascular diagnostic tools in hospital settings, where quick and accurate diagnoses are critical for patient survival. Hospitals are increasingly adopting advanced diagnostic and monitoring systems to improve patient outcomes and streamline workflows. These technologies, including ECG systems, blood pressure monitoring devices, and imaging solutions, allow hospitals to better manage cardiovascular patients, particularly those with coronary artery diseases and heart failure.

Furthermore, the integration of hospital information systems (HIS) with diagnostic equipment is anticipated to enhance the efficiency of patient care, contributing to the growth of this segment. The increasing number of specialized cardiovascular units in hospitals further supports the demand for advanced diagnostic and imaging devices, making hospitals a key end-user segment in the cardiovascular enterprise viewer market.

Key Market Segments

By Product Type

- Diagnostic & Monitoring Devices

- Imaging Devices

By Application

- Coronary Artery Diseases

- Structural Heart Diseases

- Heart Failure

- Others

By End-user

- Hospitals

- Research & Academic Institutes

- Diagnostic Centers

Drivers

The rising prevalence of cardiovascular diseases is driving the market.

The market for cardiovascular enterprise viewers is being driven by the increasing global prevalence of cardiovascular diseases (CVDs). These conditions, which include heart disease and stroke, require complex diagnostics and continuous monitoring. Cardiovascular enterprise viewers provide a centralized platform for clinicians to access, view, and analyze a wide range of cardiac images, such as echocardiograms, cardiac CTs, and MRIs, regardless of the originating modality or location. This capability streamlines the diagnostic workflow, facilitates remote consultations, and improves communication among specialists.

As the number of patients with these conditions grows, so does the demand for sophisticated software solutions that can manage the resulting data volume and complexity. According to data from the US Centers for Disease Control and Prevention (CDC), heart disease was the leading cause of death in the United States, with a total of 919,032 deaths in 2023. This overwhelming statistic underscores the critical and ongoing need for technologies that can assist in the diagnosis and management of a disease affecting a vast portion of the population.

Restraints

The high cost of implementation and integration is restraining the market.

A significant restraint on the cardiovascular enterprise viewer market is the high cost and complexity of implementing and integrating these solutions into existing hospital IT infrastructure. These systems are not simple plug-and-play software; they require a substantial financial investment for licensing, customization, and integration with a variety of other systems, including electronic health records (EHRs) and Picture Archiving and Communication Systems (PACS).

The cost is a major hurdle for many healthcare systems, particularly smaller hospitals and clinics with limited budgets. Additionally, the process of migrating data, training staff, and ensuring interoperability can be a lengthy and disruptive undertaking, further adding to the total cost of ownership. The financial pressure on hospitals is a major factor.

According to an American Hospital Association (AHA) analysis of hospital data from 2023, Medicare reimbursement only covered 83 cents for every dollar hospitals spent on care, resulting in over US$100 billion in underpayments. This financial strain makes it difficult for hospitals to justify the immense capital expenditure required for a new enterprise-wide software solution.

Opportunities

The shift to value-based care models is creating growth opportunities.

A significant growth opportunity for the cardiovascular enterprise viewer market is tied to the healthcare industry’s ongoing shift toward value-based care models. Unlike the traditional fee-for-service approach, value-based care incentivizes providers to deliver high-quality, cost-effective services and improve patient outcomes. Enterprise viewers play a crucial role in this transition, enhancing efficiency, minimizing diagnostic errors, and facilitating improved care coordination.

By offering a unified, comprehensive view of a patient’s cardiovascular history, these systems enable clinicians to make more informed decisions, leading to better patient outcomes and reducing unnecessary tests or hospital readmissions. The US Centers for Medicare & Medicaid Services (CMS) is actively supporting this shift, having expanded its value-based care programs in 2023 to include over 20 models.

CMS has set a goal for all Medicare beneficiaries to be part of an accountable care relationship by 2030. This government-driven push toward value-based care provides a strong incentive for healthcare providers to invest in interoperable and efficient technologies, such as cardiovascular enterprise viewers, to streamline patient care and reduce costs.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly shape the cardiovascular enterprise viewer market, presenting challenges alongside opportunities for growth. Global inflation pressures healthcare budgets, prompting hospitals to delay upgrades to AI-powered viewer platforms for cardiac diagnostics. Economic slowdowns in North America and Europe limit funding for cloud-based systems enabling multi-site echocardiography access.

US-China trade tensions and Middle East conflicts drive up costs for critical hardware like GPUs, disrupting supply chains. Data privacy regulations, such as GDPR variations, complicate global viewer deployments for cardiology networks.

Despite these hurdles, rising cardiovascular disease rates—projected to affect 600 million globally by 2030 fuel demand for efficient diagnostics, expanding the market to US$ 4.2 billion by 2028. Companies diversify sourcing to Southeast Asia and invest in edge-computing to bypass disruptions. These strategies enhance resilience, driving innovation in interoperable viewers for superior patient outcomes.

Current US tariffs reshape the cardiovascular enterprise viewer market, escalating costs while fostering domestic innovation. The 10% universal tariff and 30% levies on Chinese imports, effective April 2025, increase prices for servers and displays critical to viewer systems, pressuring margins for firms like Philips. Healthcare providers delay platform integrations, hindering telecardiology advancements and data unification.

Tariff-related supply chain delays from countries like Mexico disrupt custom deployments for enterprise PACS. However, tariffs spur US manufacturing, with companies expanding facilities in tech hubs to localize production and avoid duties. These efforts create jobs and strengthen supply chains, leveraging federal incentives. Strategic partnerships with domestic tech firms accelerate tariff-neutral, scalable viewer solutions. By embracing modularity and proactive procurement, the industry ensures robust growth and cutting-edge diagnostics.

Latest Trends

The integration of artificial intelligence is a recent trend.

A defining trend in the cardiovascular enterprise viewer market in 2024 is the integration of artificial intelligence (AI) for automated image analysis and enhanced diagnostics. AI is being embedded into these platforms to automate time-consuming tasks like image segmentation and measurement, which previously required manual manipulation. This technology can analyze a large volume of images to detect subtle signs of disease, quantify cardiac function, and even predict a patient’s risk for future cardiac events. This capability transforms the viewer from a static viewing tool into a dynamic diagnostic aid. This trend is demonstrated by the strategic focus of key players in the market.

Agfa HealthCare, a leading provider of enterprise imaging solutions, has been recognized for its focus on integrating AI into its platforms. Its financial reports and public statements in 2023 and 2024 highlight a strong commitment to developing AI-powered tools that enhance its cardiovascular solutions, with the company noting in its 2024 annual report that it has successfully grown its HealthCare IT revenue by leveraging innovative digital and AI-driven offerings.

Regional Analysis

North America is leading the Cardiovascular Enterprise Viewer Market

In 2024, North America maintained a 38.6% share of the global cardiovascular enterprise viewer market, bolstered by escalating demands for integrated imaging platforms amid surging cardiovascular disease burdens and an aging populace. Healthcare networks accelerated deployment of unified viewer systems to consolidate echocardiograms, angiograms, and CT scans, facilitating seamless multidisciplinary reviews and expedited interventional planning.

AI enhancements within these viewers enabled automated lesion quantification and risk stratification, empowering cardiologists to refine therapeutic decisions with heightened precision. The FDA’s rigorous yet supportive clearance processes instilled clinician confidence, spurring adoption in ambulatory surgery centers for real-time procedural guidance. Collaborative initiatives between hospitals and software vendors optimized interoperability with electronic health records, mitigating data silos and enhancing longitudinal patient monitoring.

Venture investments in scalable cloud-based viewers addressed bandwidth challenges in rural facilities, democratizing access to specialist consultations. Economic imperatives under value-based care models underscored the cost efficiencies of digital consolidation, reducing redundant scans and administrative overheads. These factors collectively amplified market penetration across the region. The FDA approved seven cardiovascular devices in 2024, several incorporating advanced enterprise viewing capabilities for diagnostic and therapeutic applications.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific cardiovascular enterprise viewer sector to expand vigorously during the 2024-2030 forecast period, as proliferating lifestyle-related heart conditions necessitate robust digital infrastructures. Regional ministries allocate resources to equip tertiary centers with multimodal imaging hubs, enabling physicians to orchestrate comprehensive cardiac evaluations without fragmented workflows.

Technology conglomerates collaborate with local developers to embed predictive analytics into viewing platforms, anticipating reductions in diagnostic delays for acute coronary events. Urban conglomerates in India and Indonesia prioritize mobile-integrated solutions, positioning frontline providers to deliver remote assessments in underserved peripheries. Singapore’s innovation precincts cultivate federated learning networks, empowering institutions to aggregate anonymized datasets for refined algorithmic performance.

China accelerates viewer deployments in national screening campaigns, integrating them with wearable telemetry for proactive arrhythmia detection. Japan anticipates synergies between robotic cath labs and enhanced visualization tools, guiding minimally invasive repairs with sub-millimeter fidelity. These strategies fortify the region’s resilience against epidemiological shifts. The Australian government established a US$220 million Cardiovascular Health Mission in 2024 to advance research and digital innovations in heart disease prevention and management.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading executives in the cardiac imaging software sector, including Philips Healthcare, Siemens Healthineers, and GE HealthCare, propel market expansion through calculated acquisitions and strategic alliances that accelerate innovation and broaden global footprints. These organizations allocate significant capital to research and development, embedding artificial intelligence and cloud-native architectures into diagnostic platforms to elevate precision and operational agility.

They aggressively penetrate emerging economies in Asia-Pacific and Latin America by forging local partnerships and adapting solutions to regional healthcare infrastructures. Furthermore, firms prioritize interoperability protocols and eco-efficient technologies to ensure seamless data integration and compliance with evolving regulations.

GE HealthCare exemplifies this dynamic; as an autonomous entity carved out from General Electric in 2023, it engineers end-to-end healthcare technologies from sophisticated imaging suites to ultrasound and monitoring systems serving over 1,000 institutions worldwide. In 2025, GE HealthCare achieved US$5.0 billion in second-quarter revenues, marking a 3% year-over-year rise, while refining its annual adjusted earnings per share outlook to US $4.43–$4.63 through its Precision Care framework that harnesses analytics for optimized clinical decisions.

Top Key Players

- Zebra Medical Vision

- Siemens Healthineers

- Samsung Medison

- Philips Healthcare

- Medtronic

- IBM Watson Health

- GE Healthcare

- Fujifilm Holdings Corporation

- Canon Medical Systems Corporation

- Agfa HealthCare

Recent Developments

- In August 2024, Philips unveiled AI-powered integrated solutions at the European Society of Cardiology Congress, aimed at improving cardiac care through advanced imaging and informatics. These innovations are designed to enhance diagnostic accuracy and optimize workflows, providing healthcare professionals with efficient tools to better manage cardiovascular conditions.

- In November 2024, during its Investor Day, GE Healthcare emphasized its commitment to AI and digital technologies, particularly in the field of cardiovascular imaging. These advancements are focused on improving patient care by offering more precise and accessible diagnostic tools for cardiovascular diseases.

Report Scope

Report Features Description Market Value (2024) US$ 332.1 Million Forecast Revenue (2034) US$ 486.9 Million CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Diagnostic & Monitoring Devices, and Imaging Devices), By Application (Coronary Artery Diseases, Structural Heart Diseases, Heart Failure, and Others), By End-user (Hospitals, Research & Academic Institutes, and Diagnostic Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zebra Medical Vision, Siemens Healthineers, Samsung Medison, Philips Healthcare, Medtronic, IBM Watson Health, GE Healthcare, Fujifilm Holdings Corporation, Canon Medical Systems Corporation, Agfa HealthCare. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cardiovascular Enterprise Viewer MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Cardiovascular Enterprise Viewer MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zebra Medical Vision

- Siemens Healthineers

- Samsung Medison

- Philips Healthcare

- Medtronic

- IBM Watson Health

- GE Healthcare

- Fujifilm Holdings Corporation

- Canon Medical Systems Corporation

- Agfa HealthCare