Global Dementia Treatment Market By Indication (Alzheimer’s Disease Dementia, Vascular Dementia, Lewy Body Dementia, Frontotemporal Dementia, Parkinson Disease Dementia, and Others), By Drug Class (Cholinesterase Inhibitors, NMDA Receptor Antagonist, MAO Inhibitors, Combination Drug, and Others), By Route of Administration (Oral, Transdermal Patch, and Injectable), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135745

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Indication Analysis

- Drug Class Analysis

- Route of Administration Analysis

- Distribution Channel Analysis

- Key Segments Analysis

- Drivers

- Restraints

- Opportunities

- Impact of macroeconomic factors / Geopolitical factors

- Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

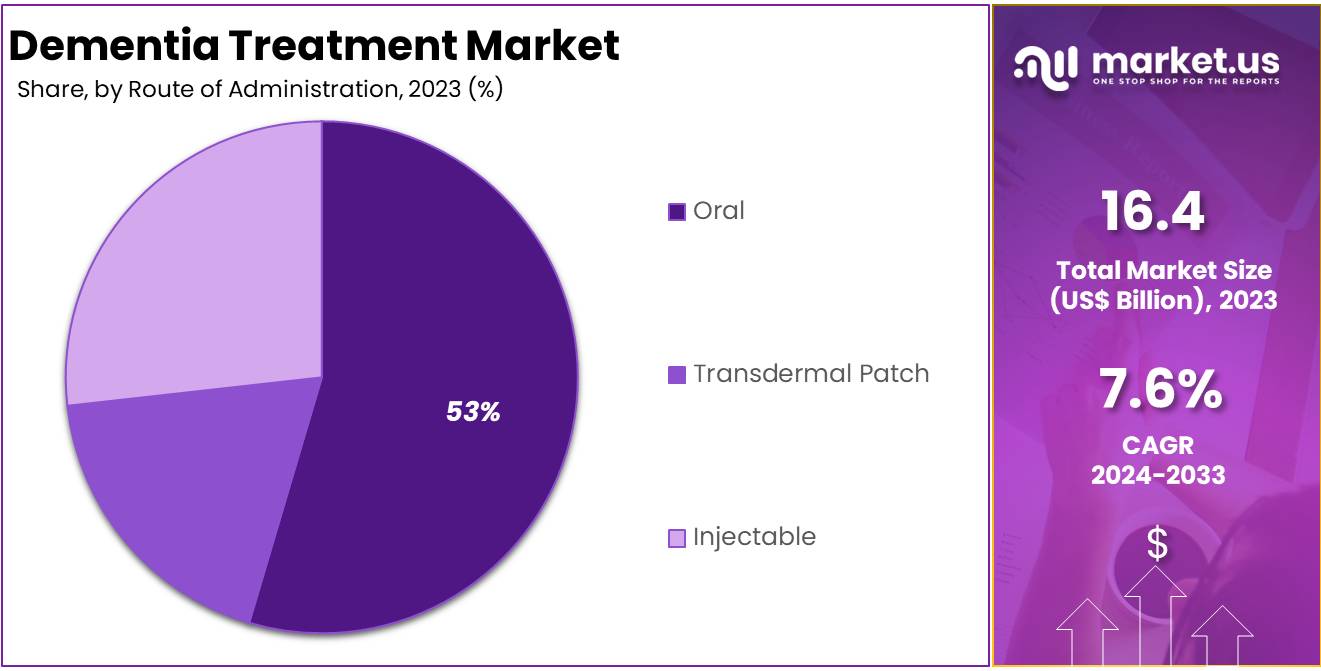

The Global Dementia Treatment Market Size is expected to be worth around US$ 34.1 Billion by 2033, from US$ 16.4 Billion in 2023, growing at a CAGR of 7.6% during the forecast period from 2024 to 2033.

The global dementia treatment market is driven by the rising prevalence of dementia-related disorders, such as Alzheimer’s disease, due to the aging global population. Advancements in drug development, including cholinesterase inhibitors and NMDA receptor antagonists, are contributing to market growth.

Additionally, increased research funding, collaborations between pharmaceutical companies, and growing awareness programs are propelling innovation in dementia care. However, the market faces challenges such as high treatment costs, limited therapeutic options, and complex clinical trial processes. Opportunities lie in the development of disease-modifying therapies, biomarker-based diagnostics, and personalized treatment solutions.

Furthermore, government initiatives and policies supporting dementia care, along with technological advancements like AI-based cognitive training, are expected to further shape the market’s dynamics, driving sustained growth in the coming years. As reported by the World Health Organization (WHO), there are more than 55 million individuals globally affected by dementia, with almost 10 million new cases emerging each year. This situation highlights a critical need for effective treatments to address this growing health concern.

Key Takeaways

- The global dementia treatment market was valued at US$ 16.4 billion in 2023 and is anticipated to register substantial growth of USD 34.1 billion by 2033, with a 7.6% CAGR.

- In 2023, the Alzheimer disease segment took the lead in the global market, securing 60% of the total revenue share.

- Among drug class segments, cholinesterase inhibitors emerged as the dominant segment, capturing 44% of the total revenue.

- The oral segment took the lead in the global market, securing 53% of the total revenue share.

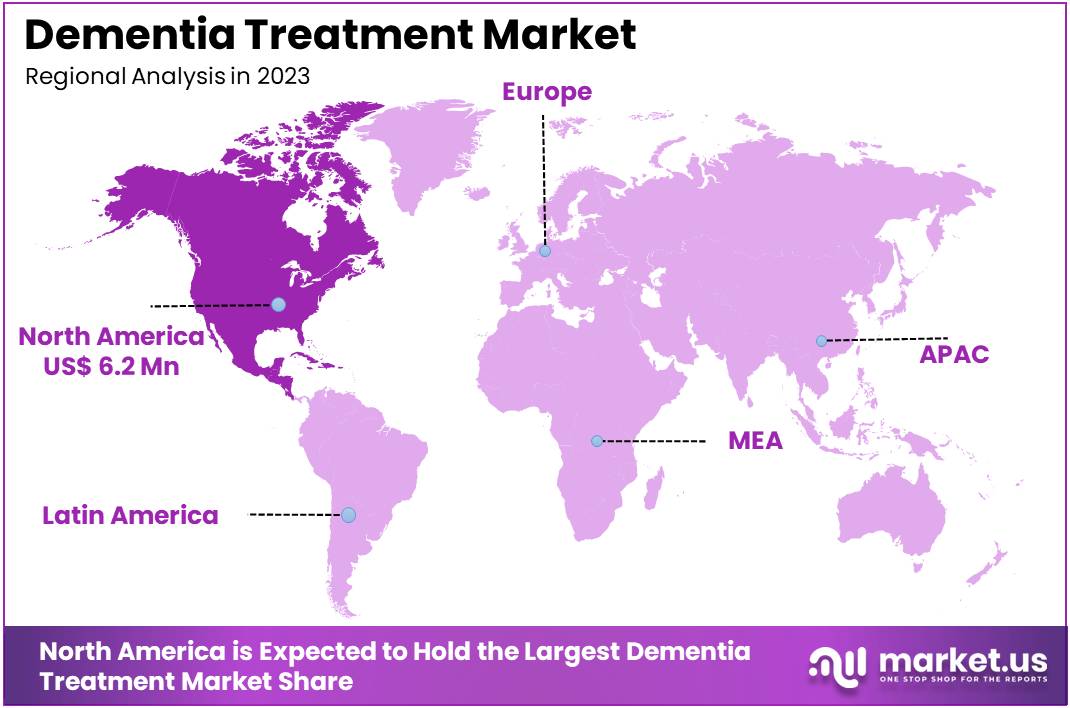

- North America maintained its leading position in the global market with a share of over 38% of the total revenue.

Indication Analysis

Based on indication the market is fragmented into alzheimer’s disease dementia, vascular dementia, lewy body dementia, frontotemporal dementia, parkinson disease dementia, and others. Amongst these, alzheimer’s disease dominated the global dementia treatment market capturing a significant market share of 60% in 2023 due to its high prevalence among dementia-related disorders.

Pharmaceutical companies and research institutions are heavily investing in clinical trials to develop innovative solutions targeting the disease’s underlying pathology. Additionally, government initiatives, rising healthcare expenditures, and awareness programs are further boosting advancements in Alzheimer’s treatment. This substantial disease burden positions Alzheimer’s as the leading segment in the global dementia treatment market.

- According to the World Health Organization (WHO), Alzheimer’s accounts for approximately 60-70% of all dementia cases globally, making it the most common form of the condition.

Drug Class Analysis

The market is fragmented by drug class into cholinesterase inhibitors, NMDA receptor antagonist, MAO inhibitors, combination drug, and others. Cholinesterase inhibitors dominated the global dementia treatment market capturing a significant market share of 44% in 2023. Cholinesterase inhibitors dominated the global dementia treatment market due to their widespread use in managing symptoms of mild to moderate dementia, particularly Alzheimer’s disease.

These drugs, including Donepezil, Rivastigmine, and Galantamine, work by increasing acetylcholine levels in the brain, which helps improve communication between nerve cells and temporarily alleviates cognitive decline. The high prevalence of Alzheimer’s disease, which accounts for 60-70% of dementia cases globally, drives the demand for these medications. Their proven efficacy in improving memory, thinking, and behavioral symptoms has made them the standard first-line treatment.

Route of Administration Analysis

The market is fragmented by route of administration into oral, transdermal patch, and injectable. Oral dominated the global dementia treatment market capturing a significant market share of 53% in 2023. Oral medications, including cholinesterase inhibitors such as Donepezil, Rivastigmine, and NMDA receptor antagonists like Memantine, are the most commonly prescribed therapies for managing dementia symptoms, particularly in Alzheimer’s disease.

These drugs are easy to administer, reducing the need for specialized healthcare professionals or hospital visits, making them a preferred option for both patients and caregivers. Additionally, the availability of numerous pharmaceutical companies offering oral drugs, along with the rising approvals for these treatments, are key factors driving the segment’s expansion.

In May 2023, the U.S. Food and Drug Administration (FDA) provided additional approval for the oral tablets Rexulti (brexpiprazole), which are now also indicated for treating agitation related to dementia.

Distribution Channel Analysis

The market is fragmented by distribution channels into hospital pharmacy, retail pharmacy, and online pharmacy. Hospital pharmacy dominated the global dementia treatment market capturing a significant market share of 47% in 2023 due to their role in providing specialized care and ensuring access to essential medications for dementia patients.

Hospitals serve as primary points of diagnosis, treatment, and management for dementia-related conditions of all dementia cases globally. Additionally, the hospital setting allows for comprehensive care, including medication monitoring, adjustments, and the management of comorbidities, which are common among elderly dementia patients. Hospitals also play a crucial role in clinical trials and the introduction of new therapies, further reinforcing their importance in the treatment landscape.

Key Segments Analysis

By Indication

- Alzheimer’s Disease Dementia

- Vascular Dementia

- Lewy Body Dementia

- Frontotemporal Dementia (FTD)

- Parkinson Disease Dementia

- Others

By Drug Class

- Cholinesterase Inhibitors

- NMDA Receptor Antagonist

- MAO Inhibitors

- Combination Drug

- Others

By Route of Administration

- Oral

- Transdermal Patch

- Injectable

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Drivers

Increasing Prevalence of Dementia

The increasing prevalence of dementia is a significant driver of growth in the dementia treatment market. As the global population ages, the number of individuals affected by dementia is rising rapidly. Healthcare systems and governments are prioritizing dementia care, leading to increased funding for research and development. Pharmaceutical companies are responding by accelerating innovation in disease-modifying therapies targeting the underlying causes of Alzheimer’s disease and related disorders. Additionally, rising awareness about early diagnosis and treatment options is encouraging market adoption.

- For example, as reported by the NCBI in 2023, approximately 6.7 million individuals aged 65 and older in the U.S. were living with Alzheimer’s disease dementia, a number projected to rise to around 13.8 million by 2060.

Restraints

Limited Insurance Coverage and Reimbursement Policies

Limited insurance coverage and restrictive reimbursement policies are significant restraints hindering the growth of the dementia treatment market. Advanced dementia therapies, including disease-modifying drugs, are often priced at premium levels due to high research, development, and production costs. However, inadequate insurance coverage leaves many patients unable to afford these treatments, particularly in low- and middle-income countries.

Reimbursement policies often lag behind innovation, with delays in including newly approved drugs in healthcare coverage plans. This issue is further compounded by varying regional policies, where some healthcare systems prioritize cost-effectiveness over access to cutting-edge therapies. Consequently, patients face significant out-of-pocket expenses, limiting market penetration of advanced treatments.

Opportunities

Introduction and Development of Novel Therapeutic

The introduction and development of novel therapeutics are creating significant growth opportunities in the dementia treatment market. With traditional treatments focusing primarily on symptom management, there is a growing emphasis on disease-modifying therapies targeting the underlying causes of dementia, such as amyloid-beta plaques and tau protein tangles. Advances in biotechnology and drug discovery are enabling the development of innovative therapeutics, including monoclonal antibodies, gene therapies, and neuroprotective agents.

- In September 2022, Corium, Inc. announced the availability of Adlarity (donepezil transdermal system) for prescription in the U.S., intended for the treatment of mild, moderate, or severe dementia associated with Alzheimer’s disease.

- In March 2022, the U.S. FDA approved Adlarity for the treatment of Alzheimer’s disease dementia. Additionally, favorable initiatives by government and non-government organizations are being implemented to enhance overall healthcare services for patients and raise awareness among the public.

Impact of macroeconomic factors / Geopolitical factors

The dementia treatment market is significantly influenced by macroeconomic and geopolitical factors. Economic stability and healthcare funding directly impact the affordability and accessibility of dementia treatments. In developed nations, rising healthcare budgets and aging populations drive market growth. Conversely, in low-income countries, limited funding restricts access to advanced treatments.

Geopolitical factors, such as international trade policies and global conflicts, affect the supply chain of pharmaceuticals, delaying treatment availability. Additionally, regulatory differences between countries influence market dynamics, often slowing innovation and approval processes. For instance, stricter regulations in regions like Europe can delay new drug launches.

Trends

Growing Prevalence Of Neurodegenerative Disorders

The dementia treatment market is witnessing transformative trends aimed at addressing the growing prevalence of neurodegenerative disorders. A significant focus is on disease-modifying therapies, particularly those targeting amyloid-beta plaques and tau protein aggregates, which are key pathological hallmarks of Alzheimer’s disease.

Recent approvals and advancements in monoclonal antibody therapies, such as lecanemab, are setting new benchmarks in treatment efficacy. The integration of digital health technologies is another notable trend. AI and machine learning are being utilized for early diagnosis, patient monitoring, and optimizing clinical trials. Digital biomarkers and wearable devices are aiding in real-time data collection, improving patient outcomes. The dementia treatment market is experiencing a surge in clinical trials, driven by advancements in biotechnology.

- In August 2022, Lilly initiated a large Phase-3 clinical study of remternetug to assess the drug’s safety and efficacy in individuals with mild Alzheimer’s disease (AD). The study is anticipated to conclude in 2025.

Regional Analysis

North America accounted for a significant 38% share of the global dementia treatment market, driven by high disease prevalence, the presence of leading pharmaceutical companies, and supportive government initiatives. The region’s strong focus on the development and commercialization of novel dementia drugs has further accelerated market growth.

The robust healthcare infrastructure, combined with increasing investments in research and development, enhances access to advanced therapies. Government efforts to raise awareness, provide funding, and facilitate drug approvals have created a favorable environment for market expansion. These factors collectively position North America as a dominant player in the global dementia treatment market.

- For instance, in June 2023, Health Canada initiated the approval process for lecanemab, a promising treatment for dementia. Additionally, according to the Alzheimer’s Society of Canada, approximately 747,000 people in the country are living with dementia, highlighting the substantial demand for effective treatments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The dementia treatment market is dominated by key pharmaceutical companies focused on developing innovative therapies for Alzheimer’s disease and other forms of dementia. Major players include Eli Lilly and Company, Biogen Inc., and Eisai Co., Ltd., which lead the market with advanced research and breakthrough therapies targeting disease-modifying mechanisms. Leading companies are employing various strategies, including new product development, collaborations, and partnerships, to expand their presence in the industry.

- For example, Eisai and Biogen joined forces to develop and commercialize treatments for Alzheimer’s disease (AD), resulting in the introduction of aducanumab and lecanemab to address dementia management.

- In January 2024, Eisai Co., Ltd. and Biogen obtained approval for Leqembi as a treatment for mild cognitive impairment caused by Alzheimer’s disease (AD) and mild AD dementia.

Top Key Players in the Dementia Treatment Market

- Eisai Co. Ltd.

- Eli Lilly and Co

- Novartis AG

- Daiichi Sankyo Company Ltd.

- AbbVie Inc.

- Lundbeck A/S

- Biogen

- Cipla Inc.

- Sun Pharmaceutical Industries Ltd.

- Viatris Inc.

Recent Developments

- In May 2023: Lilly announced positive results from a Phase-3 clinical study, indicating that donanemab significantly slowed cognitive and functional decline in patients with early-stage Alzheimer’s disease.

- In May 2023: Eisai Co., Ltd. submitted an application for market approval of lecanemab in the UK, with a regulatory decision anticipated in 2024.

- In April 2022: Sage Therapeutics, Inc. reported Phase-2 clinical trial results for SAGE-718, demonstrating that the drug is well-tolerated and associated with improvements in multiple memory-related tests for patients with mild dementia due to Alzheimer’s disease.

Report Scope

Report Features Description Market Value (2023) US$ 16.4 billion Forecast Revenue (2033) US$ 34.1 billion CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2019-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Indication (Alzheimer’s Disease Dementia, Vascular Dementia, Lewy Body Dementia, Frontotemporal Dementia (FTD), Parkinson Disease Dementia, and Others), By Drug Class (Cholinesterase Inhibitors, NMDA Receptor Antagonist, MAO Inhibitors, Combination Drug, and Others), By Route of Administration (Oral, Transdermal Patch, and Injectable), By By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Eisai Co., Ltd., Eli Lilly and Co, Novartis AG, Daiichi Sankyo Company, Ltd., AbbVie Inc., H. Lundbeck A/S, Biogen, Cipla Inc., Sun Pharmaceutical Industries Ltd., Viatris Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Eisai Co. Ltd.

- Eli Lilly and Co

- Novartis AG

- Daiichi Sankyo Company Ltd.

- AbbVie Inc.

- Lundbeck A/S

- Biogen

- Cipla Inc.

- Sun Pharmaceutical Industries Ltd.

- Viatris Inc.