Global Car Covers Market By Product Type (Conventional, Automatic, Semi-Automatic), By Type (Custom car cover, Universal car covers), By Application (Individual and Vehicle Manufacturers, 4S store), By Sales Channel (Online Shopping Portals, Automotive OEM Centers, Independent Aftermarket Vendors, Textile), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2025-2034

- Published date: March 2025

- Report ID: 12459

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

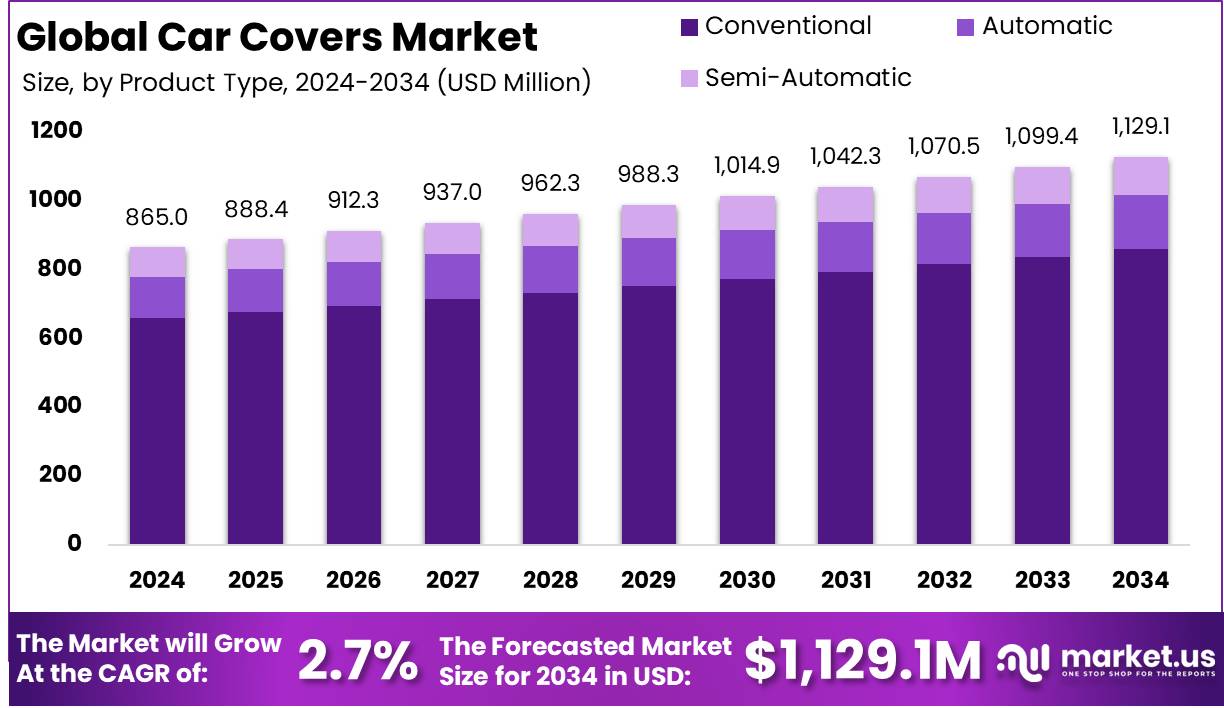

The Global Car Covers Market size is expected to be worth around USD 1,129.1 Million by 2034 from USD 865.0 Million in 2024, growing at a CAGR of 2.7% during the forecast period from 2025 to 2034.

Car covers are protective materials specifically designed to shield vehicles from environmental elements such as dust, UV radiation, rain, snow, bird droppings, and scratches. These covers are manufactured using various materials including polyester, polypropylene, and microfiber, tailored to provide protection in both indoor and outdoor conditions.

Car covers play a critical role in maintaining the exterior quality of vehicles, extending their lifespan, and preserving resale value. They are available in different types such as custom-fit, semi-custom, and universal-fit, catering to diverse consumer needs across passenger and commercial vehicle segments.

The car covers market encompasses the production, distribution, and sale of vehicle protective covers globally. It includes a wide spectrum of products segmented by material type, fit type, end-use, sales channel, and geographic region.

The market is characterized by the presence of both organized and unorganized players offering a range of solutions from basic dust covers to advanced multi-layered, weather-resistant variants. Rising vehicle ownership, increasing awareness regarding vehicle maintenance, and growth in the aftermarket automotive accessories sector are contributing to the expansion of the global car covers market.

The growth of the car covers market can be attributed to multiple converging factors. The increasing demand for vehicle protection solutions driven by harsh climatic conditions and urban pollution has significantly influenced market dynamics.

Demand for car covers is witnessing a steady upward trajectory due to heightened consumer focus on vehicle longevity and maintenance. As vehicle prices continue to rise, consumers are increasingly inclined toward safeguarding their investments through cost-effective protective solutions.

The rise in urban vehicle parking in open spaces further necessitates the use of covers to prevent damage from pollutants and weather conditions. E-commerce platforms have also played a pivotal role in amplifying demand by offering product variety, ease of purchase, and price competitiveness, especially in price-sensitive markets.

Significant opportunities exist in the customization and smart car cover segments. Increasing consumer preference for tailored solutions aligned with specific vehicle models is creating demand for custom-fit car covers.

The global car covers market is witnessing steady demand, driven by products offering 5–10+ year durability, which, according to Car Covers Factory, may vary depending on UV exposure and weather conditions.

The car covers industry is undergoing a transformation influenced by strategic investments and value chain consolidation. According to CNBC TV18, Samvardhana Motherson International Ltd. has announced the acquisition of a 51% stake in Saddles International Automotive and Aviation Interiors Pvt. Ltd. for Rs 207 crore.

Key Takeaways

- The global car covers market is projected to reach approximately USD 1,129.1 Million by 2034, up from USD 865.0 Million in 2024, expanding at a Compound Annual Growth Rate (CAGR) of 2.7% during the forecast period from 2025 to 2034.

- Conventional car covers accounted for the largest product segment, capturing over 76.2% of the total market share in 2024, indicating a strong preference for traditional protection solutions due to their affordability and wide availability.

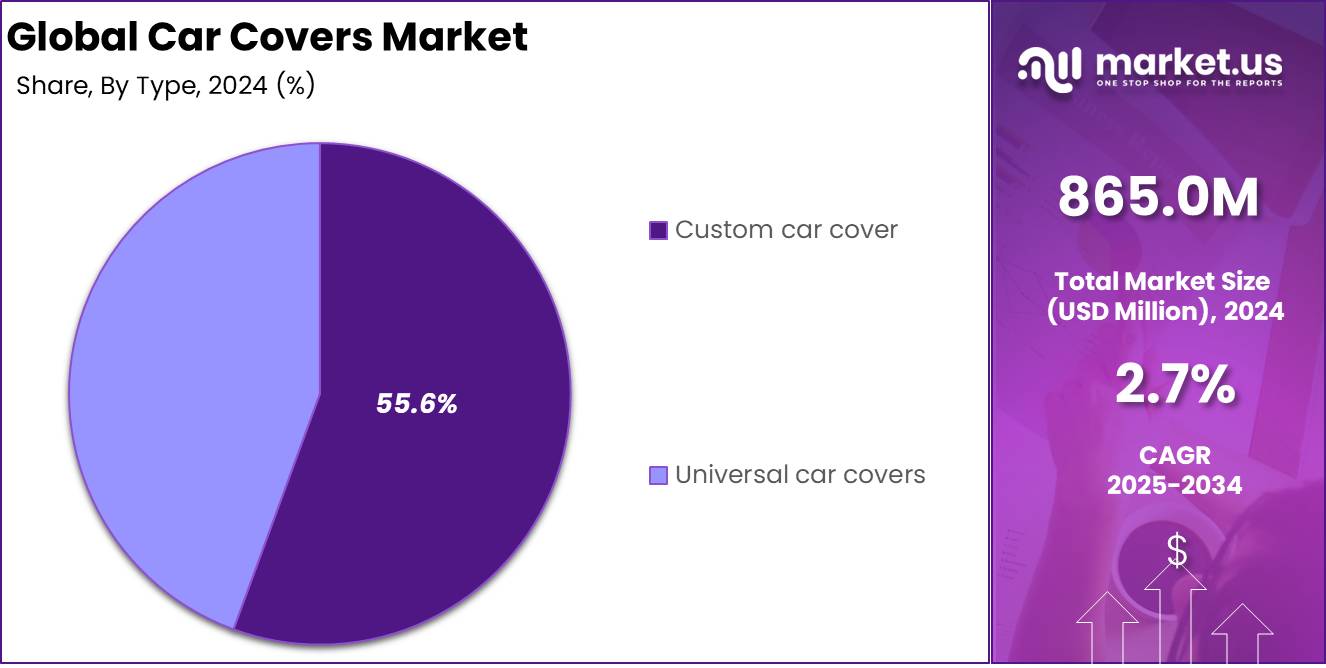

- Within the product type segmentation, custom car covers emerged as the leading segment with over 55.6% market share in 2024, driven by increasing consumer demand for vehicle-specific fit and enhanced protection features.

- The application segment was led by individual consumers and vehicle manufacturers, collectively holding over 54% market share in 2024, reflecting the dual demand from private owners seeking to preserve vehicle condition and OEMs aiming to deliver enhanced vehicle care.

- Automotive OEM centers were the dominant sales channel, accounting for over 45.6% share in 2024, suggesting a strong alignment between manufacturers and product distribution channels that enhance customer access to high-quality car covers.

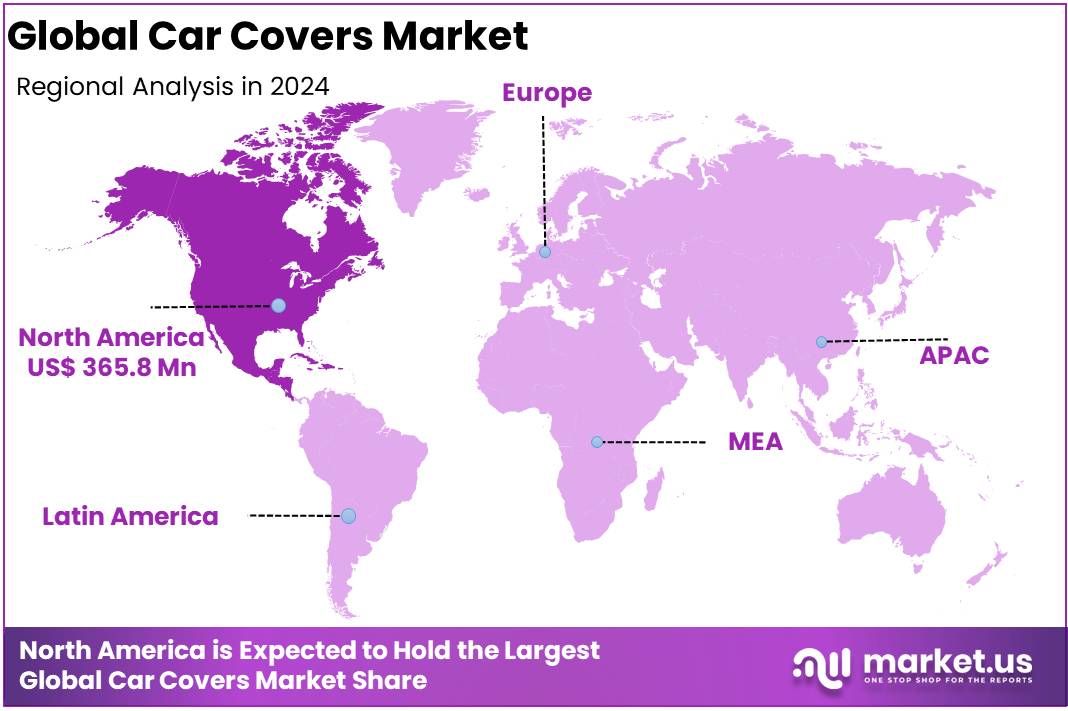

- North America emerged as the leading regional market, securing the largest share of 42.3% in 2024, attributed to higher vehicle ownership rates, strong aftermarket sales, and growing consumer awareness regarding vehicle protection.

By Product Type Analysis

Conventional Car Covers Dominating Product Type in Car Covers Market with Over 76.2% Share in 2024

In 2024, Conventional Car Covers dominated the global Car Covers Market by product type, accounting for over 76.2% of total revenue. Their widespread availability, affordability, and ease of use especially in cost-sensitive regions have positioned them as the most preferred option among both individual and commercial vehicle owners.

These covers do not require mechanical or electrical components, making them accessible and practical. Growing vehicle ownership in emerging economies and rising concerns about environmental protection (e.g., UV rays, dust, rain) have further fueled demand. Additionally, their customization options and strong aftermarket presence continue to support segment growth.

The Automatic Car Covers segment is witnessing steady growth, driven by rising interest in smart vehicle accessories. These covers offer convenience through remote or app-based deployment and often include sensor-based features and compact, foldable designs.

High adoption is noted among premium vehicle owners seeking user-friendly, high-tech solutions. However, elevated product costs, complex installations, and low awareness in some markets have limited broader adoption. Despite these barriers, continued technological advancements and declining hardware costs are expected to enhance accessibility and drive future growth.

Semi-Automatic Car Covers represent a transitional category, offering partial automation at a lower cost compared to fully automated systems. These products appeal to mid-range vehicle owners looking for improved ease of use without premium pricing.

Though currently experiencing moderate adoption, this segment is expected to grow steadily due to increasing consumer awareness, demand for affordable innovation, and rising online visibility through e-commerce and digital demonstrations.

By Type Analysis

Custom Car Covers Leading Segment in Car Covers Market by Type with Over 55.6% Share in 2024

In 2024, custom car covers led the By Type of Car Covers segment, capturing over 55.6% of the global market revenue. This dominance is attributed to their tailored fit, which ensures superior protection by conforming closely to specific vehicle models. These covers offer effective defense against dust, moisture, UV rays, and physical damage, aligning with the rising demand for high-performance, vehicle-specific solutions.

Growing consumer awareness regarding vehicle maintenance, especially among premium car owners, has driven adoption. The use of advanced materials such as water-resistant and breathable fabrics has further enhanced their appeal. Additionally, the rise of e-commerce and direct-to-consumer platforms has improved accessibility and boosted market penetration, particularly in North America and Europe. The ongoing trend of automotive personalization continues to support this segment’s growth trajectory.

In 2024, universal car covers represented a notable share of the By Type of Car Covers segment, offering a budget-friendly option for general vehicle protection. Designed to fit a wide range of car types, these covers remain popular in cost-sensitive and rural markets due to their low price, easy availability, and simple installation.

Although they do not provide the precise fit of custom covers, their practicality makes them suitable for temporary or seasonal use. Widespread offline and online retail presence supports continued demand. As affordability remains a key purchasing factor in many regions, universal covers are expected to maintain steady sales in the near term

By Application Analysis

Individual and Vehicle Manufacturers Leading Application Segment in Car Covers Market with Over 54% Share in 2024

In 2024, Individual and Vehicle Manufacturers held a dominant position in the By Application segment of the Car Covers Market, capturing more than 54% of the global revenue share. This strong performance is primarily driven by the increasing number of personal vehicle owners seeking to protect their automobiles from environmental damage such as UV exposure, dust, rain, and pollutants.

The growth of this segment is supported by rising global vehicle ownership, especially in urban and suburban areas, where concerns about long-term vehicle preservation are high. Consumers are increasingly aware of the benefits of car covers in maintaining vehicle appearance and resale value, prompting a steady demand across various income groups.

In addition, automobile manufacturers have incorporated car covers as part of aftersales accessory offerings to enhance customer value and promote vehicle care. The availability of both standard and custom-fit covers through OEM channels has further strengthened segment growth. Digital retailing, particularly via e-commerce platforms, has improved product reach and purchasing convenience for individual buyers worldwide.

In 2024, 4S stores (Sales, Spare parts, Service, and Survey) accounted for a smaller yet significant share in the By Application segment of the Car Covers Market. These authorized dealerships and service centers are increasingly offering car covers as part of their aftermarket services or bundled accessory packages during new vehicle purchases.

The segment benefits from customer trust in brand-authorized stores and the opportunity for bundled promotions. While their market share remains lower than that of individual and manufacturer-driven sales, 4S stores play a key role in providing high-quality, branded car covers. As the demand for vehicle care accessories continues to grow, this segment is expected to see gradual expansion, particularly in urban centers and premium vehicle markets.

By Sales Channel Analysis

Automotive OEM Centers Dominating Sales Channel in Car Covers Market with Over 45.6% Share in 2024

In 2024, Automotive OEM Centers held a dominant market position in the By Sales Channel segment of the Car Covers Market, capturing more than 45.6% of global revenue. This strong share is primarily attributed to the increasing integration of car covers within OEM accessory packages during new vehicle purchases. Consumers prefer OEM-supplied covers due to their assured quality, precise fit, and compatibility with specific vehicle models.

OEM centers benefit from strong brand trust and provide high-quality, customized car covers aligned with manufacturer specifications. The convenience of purchasing protective accessories directly from authorized centers, along with extended warranty services, further supports consumer preference.

The segment is also driven by growing vehicle sales across emerging economies and rising awareness regarding proactive vehicle maintenance. This structured, brand-led distribution channel is expected to maintain a leading position over the forecast period.

In 2024, Online Shopping Portals represented a rapidly growing share in the By Sales Channel segment. The convenience of doorstep delivery, access to a wide range of brands and price points, and user-friendly platforms have made online channels highly attractive for consumers globally. The availability of custom filters, size guides, and detailed specifications has helped consumers make informed decisions, further accelerating sales.

Key Market Segments

By Product Type

- Conventional

- Automatic

- Semi-Automatic

By Type

- Custom car cover

- Universal car covers

By Application

- Individual and Vehicle Manufacturers

- 4S store

By Sales Channel

- Online Shopping Portals

- Automotive OEM Centers

- Independent Aftermarket Vendors

- Textile

Driver

Rising Vehicle Ownership Across Emerging Economies

The growth of the global car covers market in 2024 can be strongly attributed to the significant rise in vehicle ownership across emerging economies. Increasing disposable income, urbanization, and improved access to automobile financing options have collectively led to a surge in car sales, particularly in countries across Asia-Pacific, Latin America, and parts of Africa.

As car ownership grows, so does the need for protective accessories like car covers. In environments where secure parking infrastructure is limited or outdoor vehicle storage is common, car covers become a cost-effective and practical solution to protect vehicles from environmental damage, dust, bird droppings, and UV radiation.

Additionally, consumers in these regions are becoming increasingly conscious of maintaining vehicle aesthetics and resale value. This growing awareness has elevated the importance of protective accessories.

Furthermore, harsh weather conditions such as heavy rains, extreme heat, and rising pollution levels in urban centers are accelerating the adoption of car covers as a preventive measure. With the number of registered passenger cars increasing by over 6% year-on-year in some emerging markets, the correlation between vehicle growth and car cover sales is becoming more pronounced.

The expanding middle class, particularly in India, Brazil, and Southeast Asia, is expected to continue fueling the growth of this segment. As this demographic segment becomes more brand-conscious and quality-oriented, demand for customized and premium-grade car covers is also expected to increase.

The rising vehicle-to-household ratio serves as a reliable indicator of the market’s long-term potential. As more first-time buyers enter the market, the penetration of car covers is poised to deepen, thereby acting as a primary driver of growth in 2024.

Restraint

Low Penetration in Apartment-Based Urban Living

A major restraint facing the global car covers market in 2024 is the limited utility and lower adoption rate of car covers in urban areas dominated by apartment-style living with underground or covered parking spaces. In many developed urban markets, cars are increasingly parked in multi-story buildings or basements where environmental exposure is minimal.

As a result, the perceived need for external protective covers is significantly diminished. This structural and infrastructural change in urban planning is particularly evident in cities across North America, Western Europe, and parts of East Asia, where secure and sheltered parking facilities are often included in residential developments.

Moreover, in densely populated cities, where parking space is limited and often managed by residential or municipal authorities, the use of car covers can be impractical. Removing and refitting covers in tight, congested parking environments is often viewed as cumbersome and time-consuming. In such cases, consumer preference tends to shift towards other forms of vehicle protection, such as ceramic coatings or garage-based storage, reducing the demand for physical covers.

In addition, the availability of automated car wash services and periodic maintenance packages in urban areas further reduces the reliance on traditional protective solutions like covers. Consequently, these urban dynamics create a structural hindrance to market growth in high-income cities, where car ownership levels may be high, but the practicality of car covers remains low. This creates an uneven adoption pattern globally, limiting the market’s expansion in developed economies and posing a significant restraint to overall market penetration.

Opportunity

Advancements in Smart Fabric Technology Enabling Product Innovation

One of the most promising opportunities in the global car covers market in 2024 lies in the rapid advancements in smart fabric and material technologies. Innovations in thermoplastic polyurethane, high-grade polyester blends, and nanotechnology-infused materials are redefining product performance and functionality.

These technological improvements have allowed manufacturers to develop car covers that offer superior durability, waterproofing, breathability, and resistance to extreme weather conditions. Moreover, the incorporation of UV-reflective coatings, anti-theft locking mechanisms, and custom-fit designs has significantly elevated the perceived value of car covers among consumers, transforming them from basic accessories to essential vehicle maintenance tools.

This evolution in product quality has also opened doors to high-margin opportunities, especially in premium and luxury car segments, where buyers are willing to invest in advanced protective solutions. Customization capabilities, including branding, precise vehicle model fittings, and all-weather performance, are further enhancing consumer appeal.

The integration of digital features, such as smart covers equipped with sensors that alert users of tampering or environmental changes, represents a frontier for next-generation innovation. As consumers become more environmentally conscious, the demand for eco-friendly, recyclable materials in car covers is also rising, opening up a new segment within the sustainable automotive accessories market.

In 2024, the convergence of these technological and behavioral shifts is expected to unlock significant growth avenues for manufacturers and retailers. The ability to cater to specific customer preferences through innovation-driven differentiation positions companies to capture unmet demand and expand their consumer base. With R&D investment increasing and smart textile production costs gradually decreasing, the industry is well-positioned to leverage this opportunity and transition toward a more value-added, technology-enabled product offering that aligns with evolving consumer expectations.

Trends

Growing Popularity of Outdoor Car Covers Due to Climate Variability

A key trend shaping the global car covers market in 2024 is the growing consumer preference for outdoor car covers in response to increasing climate variability and extreme weather events. Global weather patterns have become increasingly unpredictable, with rising instances of heatwaves, acid rain, hailstorms, and heavy snowfall.

These changing conditions have elevated the risk of damage to vehicles parked outdoors, making protective measures more important than ever. Consumers, particularly in regions without garage access or with frequent exposure to harsh environmental conditions, are increasingly turning to heavy-duty outdoor car covers as a proactive safeguard.

Furthermore, climate awareness is influencing purchasing behavior. Car owners now seek protection against UV rays that can cause paint fading, as well as moisture and snow that can accelerate corrosion and rust. Multi-layered, weatherproof covers that offer thermal insulation, water resistance, and windproof properties are gaining traction.

The market is also witnessing a surge in demand for seasonal car covers such as snow covers for winter or reflective sun covers for summer indicating a shift toward specialized use cases rather than one-size-fits-all solutions.

This climate-driven demand is also leading to greater innovation in fabric technology, such as breathable membranes that prevent mold build-up while still providing weather protection. Manufacturers are responding by diversifying their offerings to include climate-specific SKUs, which further segment and expand the market.

The heightened awareness of weather-induced vehicle degradation is expected to persist, positioning outdoor car covers as not just a protective tool, but a necessity for long-term vehicle maintenance. This trend is expected to reinforce the market’s upward trajectory throughout 2024 and beyond, especially in areas most impacted by climate volatility.

Regional Analysis

North America Leads Car Covers Market with Largest Market Share of 42.3% in 2024

The global car covers market exhibits varied growth trends across regional segments, with North America emerging as the dominant region. In 2024, North America accounted for the largest market share of 42.3%, translating to a market value of USD 365.8 Million.

This dominance can be attributed to the high vehicle ownership rate, increased awareness regarding vehicle maintenance, and adverse climatic conditions such as snowfall and UV exposure, which drive demand for protective car covers. The United States, in particular, remains the primary contributor due to its extensive automotive fleet and consumer preference for vehicle longevity.

In Europe, the market is driven by rising environmental concerns and the increasing adoption of eco-friendly, sustainable car cover materials. Countries such as Germany, the United Kingdom, and France are at the forefront, supported by strong automotive aftermarket activities and consumer awareness regarding paint protection and insulation against weather extremes.

The Asia Pacific region is witnessing the fastest growth, fueled by the expanding middle-class population, growing automotive production, and increasing disposable incomes, especially in emerging economies such as China and India. Additionally, the surge in urbanization and limited parking infrastructure in urban centers supports the adoption of car covers for dust and scratch protection.

In the Middle East & Africa, market growth is primarily driven by harsh climatic conditions, particularly high temperatures and dust storms, which create substantial demand for UV-resistant and durable car covers. The UAE and Saudi Arabia are notable markets within this region, benefiting from high-end car ownership and the presence of luxury vehicles that require enhanced protection.

Latin America also presents steady growth potential, with Brazil and Mexico leading the regional demand. The market is supported by increasing vehicle sales, growing consumer focus on vehicle care, and a gradual rise in aftermarket services.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global car covers market has remained moderately fragmented, characterized by the presence of several prominent players operating across regional and international levels. Among these, Covercraft Industries, LLC continues to dominate due to its expansive product portfolio, advanced material innovation, and strong distribution channels across North America and Europe.

The company’s focus on custom-fit covers and high-performance fabrics has strengthened its competitive positioning. California Car Cover Co., known for its premium, handcrafted car covers, maintains a niche yet influential presence in the luxury and enthusiast segments, benefiting from a loyal customer base and high-quality product offerings.

Polco Creations Pvt Ltd, an emerging Indian manufacturer, has demonstrated consistent growth in South Asia and the Middle East markets. Its value-driven pricing and expanding OEM partnerships have enabled it to compete effectively with global players. Similarly, Coverwell, also based in India, has focused on leveraging domestic demand through e-commerce expansion and dealer networks, gradually increasing its footprint in Southeast Asia and African markets.

In the UK, Classic Additions Ltd has established itself as a reputable supplier of custom indoor and outdoor car covers, particularly in the European luxury automotive aftermarket. The company benefits from long-standing relationships with car clubs and heritage brands. Rampage Products, primarily active in North America, offers robust, all-weather vehicle protection accessories, targeting off-road and SUV segments. The brand’s alignment with automotive accessories has positioned it well in utility-focused consumer segments.

Xuantai, a China-based player, has gained traction through competitive pricing, mass production capabilities, and increasing exports to North America and Europe. Its cost-efficient operations and OEM tie-ups are likely to fuel further expansion. Overall, competitive dynamics in 2024 are shaped by a blend of product customization, regional manufacturing advantages, and innovation in weather-resistant materials, with top players seeking differentiation through quality, distribution efficiency, and brand value.

Top Key Players in the Market

- Covercraft

- California Car Cover Co.

- Polco Creations Pvt Ltd

- Coverwell

- Classic Additions Ltd

- Rampage Products

- Xuantai

Recent Developments

- In 2023, Schaeffler India Limited, part of Germany-based Schaeffler AG, agreed to acquire 100% ownership of KRSV Innovative Auto Solutions Private Limited. Based in Bengaluru, KRSV operates the digital B2B platform Koovers, which connects spare parts and repair services to independent workshops across India. This strategic move is expected to enhance Schaeffler’s reach in India’s aftermarket sector, aligning with the company’s long-term digital growth vision. Koovers brings digital strength to Schaeffler’s existing automotive aftermarket operations and strengthens partnerships across distribution networks.

- On March 20, 2025, Karma Automotive organized Create Karma 2025, an event focused on the future of vehicle technology and its role in shaping Southern California’s mobility landscape. Industry experts, educators, and business leaders attended the event to discuss innovation in the automotive sector and its influence on community development. The gathering highlighted Karma’s ongoing commitment to sustainability and advanced electric vehicle technologies.

- In 2023, Samvardhana Motherson International Ltd. announced the acquisition of a 51% stake in Saddles International Automotive and Aviation Interiors Pvt. Ltd. for Rs 207 crore. This investment supports Motherson’s expansion in premium interior solutions for both automotive and aviation sectors. Saddles International, known for its high-end upholstery products, will help Motherson strengthen its product offerings and serve a wider range of customers with advanced design and manufacturing capabilities.

Report Scope

Report Features Description Market Value (2024) USD 865.0 Million Forecast Revenue (2034) USD 1,129.1 Million CAGR (2025-2034) 2.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Conventional, Automatic, Semi-Automatic), By Type (Custom car cover, Universal car covers), By Application (Individual and Vehicle Manufacturers, 4S store), By Sales Channel (Online Shopping Portals, Automotive OEM Centers, Independent Aftermarket Vendors, Textile) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Covercraft, California Car Cover Co., Polco Creations Pvt Ltd, Coverwell, Classic Additions Ltd, Rampage Products, Xuantai Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Covercraft

- California Car Cover Co.

- Polco Creations Pvt Ltd

- Coverwell

- Classic Additions Ltd

- Rampage Products

- Xuantai