Global E-Commerce Automotive Aftermarket Size, Share, Growth Analysis By Replacement Parts (Engine Parts (Piston and Piston Rings, Engine Valves and Parts, Fuel Injection Systems, Power Train Components), Transmission and Steering (Clutch Assembly Systems, Gearbox, Axles, Wheels, Tires), Braking System (Brake Calipers, Brake Pads, Rotor and Drums, Brake Disk), Lighting (Headlamps, Tail Lamps, Others), Electrical Parts (Starter Motor, Spark Plugs, Battery, Others), Suspension Systems, Wipers, Others), By End-Use (Business to Business, Business to Customer), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142907

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

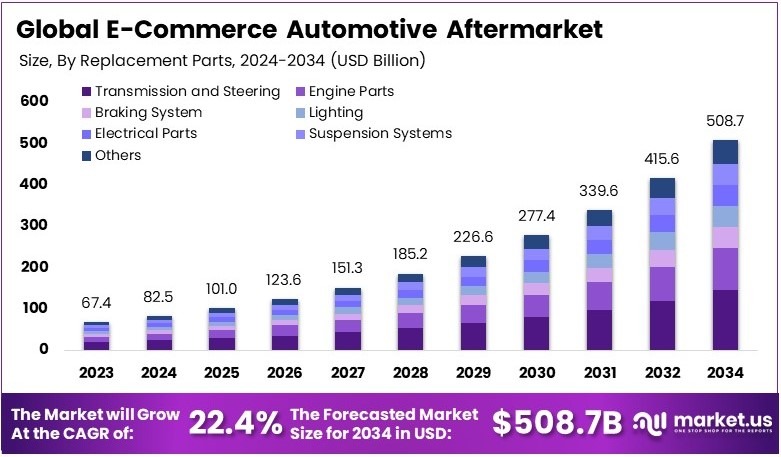

The Global E-Commerce Automotive Aftermarket size is expected to be worth around USD 508.7 Billion by 2034, from USD 67.4 Billion in 2024, growing at a CAGR of 22.4% during the forecast period from 2025 to 2034.

E-Commerce Automotive Aftermarket refers to online sales of car parts, accessories, and services. Customers buy replacement parts, tires, and maintenance tools through digital platforms. This market offers convenience, competitive pricing, and a wide range of products. It benefits both businesses and consumers by providing easy access to automotive products.

The E-Commerce Automotive Aftermarket Market includes companies selling auto parts and accessories online. Growth is driven by digital transformation, rising vehicle ownership, and increasing consumer preference for online shopping. Key players focus on faster delivery and better customer service. Trends include AI-powered recommendations and mobile-friendly shopping platforms.

E-commerce automotive aftermarket sales are growing rapidly as more consumers choose to buy car parts online. According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle ownership has surpassed 1.4 billion, driving consistent demand for replacement parts. In the U.S. alone, there are 289 million registered vehicles, creating a strong market for auto components.

Online platforms offer competitive prices, ease of comparison, and access to rare parts, making them increasingly popular among consumers. Moreover, digital advancements simplify the buying process, encouraging more people to shop for automotive parts online. Consequently, businesses are investing in better logistics and faster delivery services to meet growing expectations.

The market is highly competitive, with both established brands and new entrants offering similar products. As a result, price, service quality, and delivery speed have become key factors influencing consumer choices. Trust and quality assurance remain major concerns, as customers prefer reliable sellers with strong warranties.

Companies that focus on seamless shopping experiences, efficient shipping, and hassle-free returns gain a significant advantage. Additionally, small businesses benefit from digital platforms by reaching wider audiences and expanding their customer base beyond local markets.

Despite rising competition, the market still has room for growth, particularly in developing regions where online shopping is gaining traction. Mobile-friendly websites and AI-driven recommendations enhance the buying experience, making it easier for customers to find the right products. Moreover, the increasing adoption of electric vehicles (EVs) presents new opportunities.

According to BloombergNEF, global EV sales are projected to reach 40 million units annually by 2030, driving demand for EV batteries, charging accessories, and eco-friendly components. Consequently, businesses must adapt to these shifts by expanding their product offerings to cater to evolving customer needs.

Key Takeaways

- The E-Commerce Automotive Aftermarket was valued at USD 67.4 billion in 2024 and is projected to reach USD 508.7 billion by 2034, growing at a 22.4% CAGR.

- In 2024, Transmission and Steering Parts led the replacement parts segment with 28.5%, driven by the demand for drivetrain and steering components.

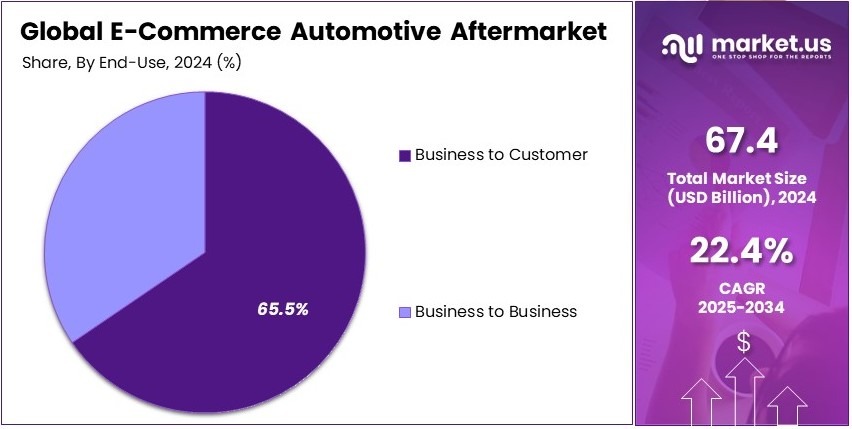

- In 2024, Business to Customer (B2C) dominated the end-use segment with 65.5%, reflecting the growing preference for direct-to-consumer online sales.

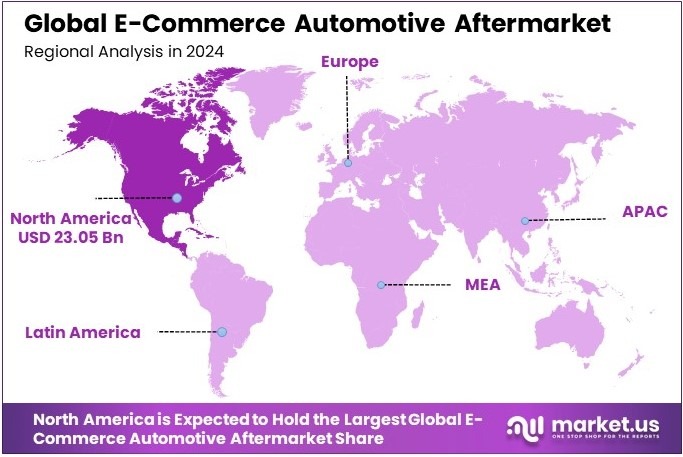

- In 2024, North America accounted for 34.2% (USD 23.05 billion), supported by a strong digital ecosystem and rising online auto part purchases.

Replacement Parts Analysis

Transmission and Steering dominates with 28.5% due to its critical role in vehicle functionality and safety.

In the E-Commerce Automotive Aftermarket, the Replacement Parts segment is significantly led by Transmission and Steering components, which hold a 28.5% share. This sub-segment’s dominance is attributed to the essential nature of these parts in ensuring the operational integrity and safety of vehicles. As vehicles age, the demand for replacement transmission systems and steering components increases, driven by the need to maintain vehicle performance and meet safety standards.

Furthermore, Engine Parts are crucial for maintaining the engine’s performance and efficiency. Items like pistons, valves, and fuel injection systems are in constant demand, reflecting their necessity for engine upkeep and the overall health of the vehicle.

Similarly, the Braking System, encompassing brake calipers, pads, rotors, and disks, plays a pivotal role in vehicle safety. Regular maintenance and replacement of these components are crucial due to the wear and tear they experience, highlighting their importance in the aftermarket sector.

Lighting components, including headlamps and tail lamps, are essential for vehicle safety and compliance with road regulations. Their replacement is often required due to damage or as technology advances, prompting upgrades to more efficient and durable options.

Additionally, Electrical Parts like starter motors, spark plugs, and batteries form the backbone of a vehicle’s electrical system. Their frequent replacement is necessitated by the critical functions they perform, from starting the engine to powering electrical systems.

Lastly, Suspension Systems and Wipers, although smaller in market share, are vital for vehicle comfort and functionality. These parts improve the driving experience and safety, particularly in adverse weather conditions, thus maintaining their steady demand in the market.

End-Use Analysis

Business to Customer leads with 65.5% owing to the convenience and growing consumer preference for online shopping.

In the End-Use category of the E-Commerce Automotive Aftermarket, the Business to Customer (B2C) model prevails with a substantial 65.5% market share. This dominance is driven by the growing consumer preference for the convenience of online shopping, which offers easy access to a wide range of automotive parts and the ability to compare prices and specifications seamlessly.

The B2C model benefits from direct engagement with end consumers, who are increasingly turning to online platforms for both research and purchase of automotive parts.

On the other hand, the Business to Business (B2B) segment, while smaller, plays a crucial role in the supply chain. This model caters to the needs of businesses such as auto repair shops, fleets, and resellers, who require bulk purchases and often seek specialized parts and equipment. The B2B model is essential for supporting the automotive service industry and facilitating the efficient distribution of parts across different market players.

Key Market Segments

By Replacement Parts

- Engine Parts

- Piston and Piston Rings

- Engine Valves and Parts

- Fuel Injection Systems

- Power Train Components

- Transmission and Steering

- Clutch Assembly Systems

- Gearbox

- Axles

- Wheels

- Tires

- Braking System

- Brake Calipers

- Brake Pads

- Rotor and Drums

- Brake Disk

- Lighting

- Headlamps

- Tail Lamps

- Others

- Electrical Parts

- Starter Motor

- Spark Plugs

- Battery

- Others

- Suspension Systems

- Wipers

- Others

By End-Use

- Business to Business

- Business to Customer

Driving Factors

Digitalization and Online Retail Drive Market Growth

The rapid digital transformation of the automotive aftermarket industry is fueling the growth of e-commerce platforms. Consumers increasingly prefer online shopping due to its convenience, wide product selection, and competitive pricing. This shift is driving more automotive retailers to expand their digital presence, making high-quality aftermarket parts more accessible.

Another key factor is the growing interest in DIY vehicle maintenance. Many vehicle owners seek cost-effective solutions to repair and upgrade their cars without relying on service centers. Online platforms offer easy access to instructional content, tutorials, and product recommendations, further supporting this trend.

Subscription-based auto parts delivery services are also gaining traction. These services provide regular shipments of essential components like filters, wipers, and lubricants, ensuring vehicle owners have what they need without frequent store visits. This model enhances customer retention and creates a steady revenue stream for sellers.

Additionally, the availability of certified and high-quality aftermarket parts online has improved consumer confidence. As leading manufacturers and suppliers enter the e-commerce space, buyers can find reliable and well-reviewed components with manufacturer-backed guarantees. With online automotive retail expanding, the market is poised for continued growth, offering a seamless shopping experience for customers.

Restraining Factors

Product Authenticity and High Logistics Costs Restrain Market Growth

One of the biggest challenges in the e-commerce automotive aftermarket is ensuring product authenticity. Counterfeit and low-quality parts are widespread, leading to safety concerns and distrust among consumers. Buyers hesitate to purchase online when the risk of receiving fake components is high. This issue also affects the reputation of legitimate sellers.

High logistics and shipping costs further limit market growth. Large and heavy auto parts, such as engines and transmissions, require specialized packaging and handling, increasing expenses. For smaller businesses, absorbing these costs while maintaining competitive pricing is difficult, affecting profitability.

Additionally, complex return and warranty policies create frustration for customers. Unlike traditional retail, where parts can be inspected before purchase, online buyers rely on descriptions and images. If a product does not fit or perform as expected, returning it can be a complicated process. Many consumers hesitate to buy expensive components online due to these concerns.

Another issue is the lack of awareness about online aftermarket services. Many vehicle owners still rely on physical stores and mechanics for their repair needs. Without proper education and marketing efforts, e-commerce adoption remains slow among traditional customers. Addressing these challenges is essential for sustained market expansion.

Growth Opportunities

Omnichannel Strategies and AI Support Provide Opportunities for Growth

The integration of omnichannel strategies is creating new opportunities in the e-commerce automotive aftermarket. Retailers are blending online and offline experiences, offering in-store pickups, same-day deliveries, and seamless customer support. This approach enhances convenience and builds trust, encouraging more consumers to shift to digital platforms.

AI-powered chatbots and virtual assistants are also transforming customer interactions. These tools provide instant recommendations, troubleshooting assistance, and guided shopping experiences. By improving response times and offering personalized solutions, AI enhances customer satisfaction and boosts sales.

Another growth opportunity lies in eco-friendly and recycled auto parts. As sustainability becomes a priority, more consumers seek green alternatives for their vehicles. E-commerce platforms that offer certified refurbished or environmentally friendly components stand to benefit from this trend.

Cross-border e-commerce is also expanding market reach. Online retailers can now sell auto parts to customers worldwide, bypassing geographical limitations. This trend is particularly strong in regions with limited access to aftermarket products. With increasing global demand, businesses that invest in international logistics and localized platforms can capitalize on new customer segments.

Emerging Trends

Social Media Influence and AR Adoption Are Latest Trending Factors

Social media and influencer marketing are playing a growing role in the automotive aftermarket sector. Platforms like YouTube, Instagram, and TikTok showcase vehicle modifications, repair tutorials, and product reviews, directly influencing buying decisions. Consumers trust recommendations from automotive enthusiasts, leading to increased online purchases.

Augmented reality (AR) is another game-changer in e-commerce. AR-powered applications allow customers to virtually fit auto parts onto their vehicles before purchasing, ensuring compatibility. This technology reduces return rates and enhances the online shopping experience, making it easier for customers to choose the right products.

Blockchain technology is also gaining traction for supply chain transparency. By tracking product origins and authenticity, blockchain helps combat counterfeit parts and builds consumer confidence. More companies are exploring this technology to enhance security in online transactions.

The direct-to-consumer (DTC) business model is another emerging trend. Manufacturers are bypassing traditional distribution channels and selling directly to customers through their websites. This approach reduces costs, improves margins, and strengthens brand-customer relationships. As these trends continue to evolve, the e-commerce automotive aftermarket is set for dynamic growth.

Regional Analysis

North America Dominates with 34.2% Market Share

North America leads the E-Commerce Automotive Aftermarket with a 34.2% share, amounting to USD 23.05 billion. This substantial market presence is driven by high vehicle ownership rates, a trend towards vehicle maintenance and customization, and the widespread adoption of e-commerce platforms.

The region’s established e-commerce infrastructure, combined with a strong digital literacy among consumers, facilitates the online purchase of automotive parts and accessories. The presence of major e-commerce giants and specialized automotive e-retailers also enhances consumer accessibility and variety.

The future influence of North America in the E-Commerce Automotive Aftermarket is expected to grow, driven by advancements in e-commerce technology and increasing consumer confidence in online shopping. The ongoing trends towards digitalization and personal vehicle use are likely to further propel the demand for online automotive services.

Regional Mentions:

- Europe: Europe’s E-Commerce Automotive Aftermarket is thriving, supported by a robust logistics network and high consumer trust in online transactions. The region’s emphasis on high-quality, environmentally friendly automotive parts resonates well with the consumer base, fostering growth.

- Asia Pacific: Asia Pacific is rapidly gaining momentum in the E-Commerce Automotive Aftermarket, driven by increasing internet penetration and the rising middle class. The region is seeing a shift towards online shopping for automotive parts, supported by local e-commerce advancements.

- Middle East & Africa: The Middle East and Africa are witnessing early growth stages in the E-Commerce Automotive Aftermarket. The expansion is supported by improving internet access and a growing automotive sector, with the Gulf countries leading the way in market development.

- Latin America: Latin America shows potential in the E-Commerce Automotive Aftermarket, fueled by increasing internet usage and vehicle ownership. The region is experiencing a gradual shift towards online automotive purchases, which is expanding the market’s reach.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the E-Commerce Automotive Aftermarket, the leading companies include Amazon.com, Inc., Alibaba Group Holding Limited, AutoZone Inc., and Advance Auto Parts. Amazon stands at the forefront, leveraging its massive online platform and distribution network to cater to diverse customer needs rapidly. Its vast inventory and user-friendly interface make it a top choice for consumers seeking automotive parts and accessories.

Alibaba Group enhances market reach through its B2B and B2C platforms, facilitating global trade in the automotive sector. This company’s strong logistics framework and digital payment solutions streamline the purchasing process for both suppliers and buyers.

AutoZone and Advance Auto Parts are integral to the market, with their strong brand presence and extensive product ranges. These companies focus on providing DIY solutions and professional advice, which are highly valued by automotive enthusiasts and professionals alike.

These top players significantly influence the E-Commerce Automotive Aftermarket by innovating in logistics, expanding digital services, and enhancing customer engagement through advanced digital platforms. Their strategies drive not only sales growth but also customer loyalty and market expansion.

Major Companies in the Market

- Advance Auto Parts

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- AutoZone Inc.

- CARiD.com

- eBay Inc.

- Flipkart.com

- National Automotive Parts Association

- O’Reilly Auto Parts

- RockAuto, LLC

- U.S. Auto Parts Network, Inc.

- Others

Recent Developments

- Swap and ICONIQ Growth: In March 2025, Swap, an e-commerce logistics startup, secured $40 million in a Series B funding round led by ICONIQ Growth. Founded in 2022, Swap offers a platform for direct-to-consumer e-commerce brands to consolidate logistics operations, including cross-border shipping, order tracking, return management, and inventory forecasting. The company plans to use the funds to expand its customer base and international presence, including opening a new office in New York.

- Dowlais and American Axle & Manufacturing: In February 2025, Dowlais, a UK-based car parts firm, agreed to a £1.2 billion cash-and-stock merger with American Axle & Manufacturing. The deal values Dowlais shares at 85.2 pence each, offering a 25% premium. Post-merger, Dowlais shareholders will own approximately 49% of the combined group. The merger aims to strengthen the companies’ positions amid the industry’s shift to electric vehicles and is expected to generate $300 million in annual cost savings.

Report Scope

Report Features Description Market Value (2024) USD 67.4 Billion Forecast Revenue (2034) USD 508.7 Billion CAGR (2025-2034) 22.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Replacement Parts (Engine Parts (Piston and Piston Rings, Engine Valves and Parts, Fuel Injection Systems, Power Train Components), Transmission and Steering (Clutch Assembly Systems, Gearbox, Axles, Wheels, Tires), Braking System (Brake Calipers, Brake Pads, Rotor and Drums, Brake Disk), Lighting (Headlamps, Tail Lamps, Others), Electrical Parts (Starter Motor, Spark Plugs, Battery, Others), Suspension Systems, Wipers, Others), By End-Use (Business to Business, Business to Customer) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Advance Auto Parts, Alibaba Group Holding Limited, Amazon.com, Inc., AutoZone Inc., CARiD.com, eBay Inc., Flipkart.com, National Automotive Parts Association, O’Reilly Auto Parts, RockAuto, LLC, U.S. Auto Parts Network, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  E-Commerce Automotive AftermarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

E-Commerce Automotive AftermarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Advance Auto Parts

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- AutoZone Inc.

- CARiD.com

- eBay Inc.

- Flipkart.com

- National Automotive Parts Association

- O’Reilly Auto Parts

- RockAuto, LLC

- U.S. Auto Parts Network, Inc.

- Others