Global Rolling Stock Market By Product (Locomotive: Diesel Locomotive, Electric Locomotive, Electro-Diesel Locomotive; Rapid Transit Vehicle: DMU, EMU, Light Rails and Trams, Subways and Metros, Monorails; Coaches, Wagons, Other Products), By Type (Diesel, Electric), By Train Type (Rail Freight, Rail Passenger), By Locomotive Technology (Conventional Locomotive, Turbocharged Locomotive, Maglev), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 15144

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Rolling Stock Market size is expected to be worth around USD 95.5 Billion by 2033, from USD 59.2 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2024 to 2033.

Rolling stock refers to vehicles used on a railway, including trains, locomotives, and railcars. These vehicles are essential for transporting passengers and goods across rail networks. Rolling stock can vary from freight wagons to high-speed passenger trains, supporting efficient and large-scale transportation.

The rolling stock market involves the production, sale, and servicing of railway vehicles. This market serves rail operators, transportation companies, and governments. It covers different vehicle types, from freight wagons to passenger coaches, catering to the needs of efficient and sustainable transportation infrastructure.

The rolling stock market remains essential for global transportation, supported by extensive railway networks and growing demand for both passenger and freight services. According to the International Union of Railways (UIC), the global railway network spanned 1.3 million kilometers in 2022, enabling the transport of over 9 billion passengers and 10 billion tonnes of freight each year.

The industry benefits from stable demand in regions with established networks, while emerging markets are increasingly adopting modern rolling stock to enhance connectivity. Key players are focusing on electric and bullet train high-speed rail solutions, aligning with sustainability goals and government initiatives aimed at reducing carbon emissions.

Growth in the rolling stock market is driven by the need for efficient and sustainable transport solutions. The European Union’s rail network spans approximately 220,000 kilometers, including over 9,000 kilometers of high-speed lines, catering to significant passenger and freight volumes.

In the United States, the freight rail network covers 140,000 route miles and transports around 1.7 billion tons of freight annually. Meanwhile, China’s high-speed rail network, the largest worldwide, surpassed 40,000 kilometers in 2022 and served 2.3 billion passengers, illustrating the demand for modern rail infrastructure. Market competitiveness is high, with manufacturers innovating in electric vehicle and autonomous technologies to improve efficiency and reduce emissions.

Government investments are critical to the industry’s growth; the European Union’s Connecting Europe Facility (CEF) allocated €24 billion for transport infrastructure projects, with a substantial focus on rail. Such investments encourage the development of high-speed and sustainable rail networks. Regulations promoting clean energy and low-emission transport also shape the market.

Key Takeaways

- The Rolling Stock Market was valued at USD 59.2 Billion in 2023 and is expected to reach USD 95.5 Billion by 2033, with a CAGR of 4.9%.

- In 2023, Rapid Transit Vehicle leads the product segment with 32%, driven by urban transit needs.

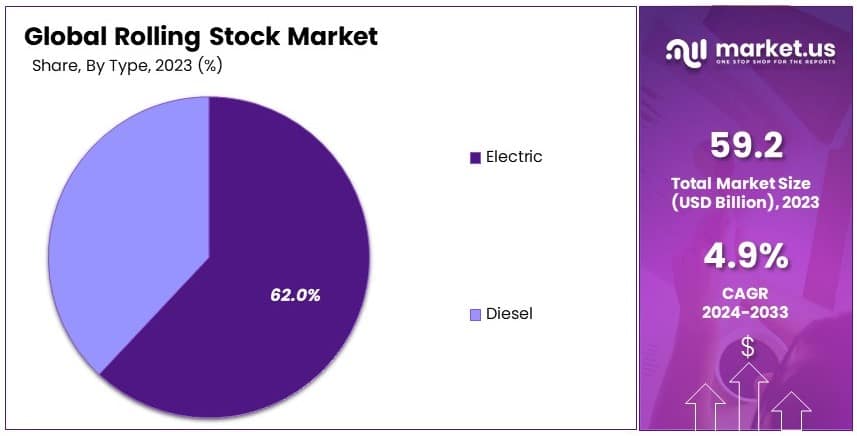

- In 2023, Electric is the dominant type at 62%, reflecting the shift towards cleaner energy.

- In 2023, Rail Passenger is the leading train type, driven by increasing public transportation demand.

- In 2023, the Asia Pacific region dominates with 43.0% market share, supported by significant rail infrastructure investment.

Product Analysis

Rapid Transit Vehicle dominates with 32% due to urbanization and increased demand for efficient public transportation.

The Rapid Transit Vehicle sub-segment leads the Rolling Stock Market, holding a significant 32% market share. This dominance is primarily driven by the rapid urbanization witnessed globally, which has escalated the demand for efficient and high-capacity public transportation solutions. Cities are increasingly investing in rapid transit systems to alleviate traffic congestion, reduce carbon emissions, and enhance the overall quality of urban life.

For instance, recent projects in major metropolitan areas like New York, London, and Shanghai have seen substantial investments in expanding their metro and subway networks, thereby boosting the demand for rapid transit vehicles.

Additionally, the push towards green transportation has favored electric and hybrid rapid transit vehicles, aligning with global sustainability goals and reducing the environmental footprint of urban transit systems.

In contrast, the Locomotive sub-segment, including Diesel, Electric, and Electro-Diesel Locomotives, plays a crucial role in freight and long-distance passenger transport. Diesel locomotives are essential for regions with less electrified rail networks, while electric locomotives are gaining traction in areas prioritizing sustainability and efficiency. Electro-Diesel Locomotives offer versatility by operating on both electrified and non-electrified tracks, catering to diverse operational needs.

Type Analysis

Electric dominates the type segment with 62% due to its efficiency and environmental benefits.

The Electric sub-segment stands out as the leader in the Rolling Stock Market, capturing 62% of the market share. This dominance is fueled by the growing emphasis on sustainability and the need to reduce greenhouse gas emissions in the transportation sector. Electric trains offer significant advantages over their diesel counterparts, including lower operating costs, reduced environmental impact, and higher energy efficiency.

Governments and railway operators worldwide are increasingly prioritizing electrification of rail networks to meet stringent environmental regulations and sustainability targets.

For example, the European Union has set ambitious goals to decarbonize its transportation infrastructure, driving substantial investments in electric rolling stock and electrified rail lines. Technological advancements in electric train systems, such as improved battery storage, regenerative braking, and smart grid integration, have further enhanced the appeal of electric locomotives.

These innovations not only improve the performance and reliability of electric trains but also contribute to cost savings and operational efficiencies. Additionally, the scalability of electric train systems makes them suitable for a wide range of applications, from high-speed intercity services to local commuter lines, thereby broadening their market reach.

On the other hand, the Diesel sub-segment remains vital, particularly in regions where rail electrification is still in progress or economically unfeasible. Diesel locomotives provide the necessary flexibility and independence from fixed infrastructure, making them indispensable for freight operations and long-distance routes.

Electro-Diesel Locomotives, which combine the benefits of both electric and diesel power, offer versatile solutions for areas with partial electrification, ensuring seamless operations across diverse rail networks.

Train Type Analysis

Rail Passenger dominates the train type segment due to increasing demand for efficient and comfortable travel options.

The Rail Passenger sub-segment is the leading force in the Rolling Stock Market, driven by the escalating demand for efficient, reliable, and comfortable travel options. As populations grow and urbanize, the need for effective mass transit systems becomes more pronounced, propelling the expansion of rail passenger services.

Countries like Japan, France, and China have made significant investments in high-speed rail networks, setting benchmarks for speed, safety, and passenger comfort, thereby fueling the demand for advanced rail passenger rolling stock.

Moreover, the resurgence of interest in rail travel as a sustainable alternative to air and road transportation has further bolstered the Rail Passenger segment. Environmental concerns and the push for greener transportation solutions have led to increased patronage of rail services, as trains are more energy-efficient and produce fewer emissions per passenger kilometer compared to cars and airplanes.

Additionally, the development of smart and connected train technologies, such as real-time passenger information systems, automated ticketing, and enhanced onboard amenities, has improved the overall travel experience, attracting more passengers to rail services.

The Rail Freight sub-segment, while not the dominant player, remains crucial for the logistics and supply chain industries. Rail freight offers cost-effective and reliable transportation of goods over long distances, supporting global trade and commerce.

Locomotive Technology Analysis

Conventional Locomotive dominates the locomotive technology segment due to established infrastructure and reliability.

The Conventional Locomotive sub-segment holds the top position in the Locomotive Technology segment of the Rolling Stock Market, primarily due to its established infrastructure and proven reliability. Conventional locomotives, which typically use diesel or electric power, benefit from a long history of development and widespread adoption, making them a trusted choice for railway operators worldwide.

Furthermore, the reliability and durability of conventional locomotives make them suitable for a wide range of applications, from heavy freight hauling to high-speed passenger services, thereby sustaining their dominant market position.

The robust performance and versatility of conventional locomotives are complemented by ongoing advancements in technology, such as improved fuel efficiency, enhanced safety features, and better emission controls. These improvements align with the global push towards more sustainable and eco-friendly transportation solutions.

In contrast, the Turbocharged Locomotive sub-segment is gaining traction due to its enhanced power output and fuel efficiency, which are critical for heavy-duty and long-distance rail operations.

Turbocharged locomotives offer superior performance, especially in challenging terrains and high-demand routes, thereby supporting the growth of freight and passenger services. Maglev locomotives, while still in the nascent stages of development and deployment, represent the future of high-speed rail technology.

Maglev trains utilize magnetic levitation to achieve unprecedented speeds and smoothness, offering a glimpse into the next generation of rail transport. However, the high costs and infrastructural requirements associated with maglev technology currently limit its widespread adoption.

Key Market Segments

By Product

- Locomotive

- Diesel Locomotive

- Electric Locomotive

- Electro-Diesel Locomotive

- Rapid Transit Vehicle

- DMU

- EMU

- Light Rails/Trams

- Subways/Metros

- Monorails

- Coaches

- Wagons

- Other Products

By Type

- Diesel

- Electric

By Train Type

- Rail Freight

- Rail Passenger

By Locomotive Technology

- Conventional Locomotive

- Turbocharged Locomotive

- Maglev

Drivers

Increasing Demand for Urban Rail Transit Drives Market Growth

The growing demand for urban rail transit plays a significant role in driving the Rolling Stock Market. Expanding urban populations require efficient public transportation, making rail systems a preferred choice.

Rising investments in railway infrastructure further support this growth. Governments and private entities are funding new rail projects to improve connectivity and reduce traffic congestion.

Government support for green transportation initiatives also boosts the market. Efforts to reduce carbon emissions have led to increased funding for electric and hybrid rolling stock.

Technological advancements enhance the appeal of modern rail systems. Innovations such as driverless trains, energy-efficient engines, and improved signaling systems attract both passengers and operators, further propelling the market.

Restraints

High Initial Costs of Development Restraints Market Growth

High initial costs of rolling stock development pose a challenge. Manufacturing trains involves significant investments in research, technology, and materials, limiting new market entrants.

Stringent safety and regulatory standards also restrain market growth. Compliance with safety protocols increases costs and can delay project timelines, affecting market expansion.

Long manufacturing and delivery cycles hinder timely project completion. These extended cycles can result in missed deadlines and increased expenses, affecting profitability.

Limited funding in developing regions further restricts growth. Many developing countries lack sufficient funds to support large-scale rail infrastructure projects, slowing down rolling stock adoption.

Opportunity

Expansion of High-Speed Rail Networks Provides Opportunities

The expansion of high-speed rail networks presents major growth opportunities. Many countries are developing high-speed lines to enhance intercity connectivity, driving demand for advanced rolling stock.

Integration with IoT and smart transportation offers further opportunities. Smart trains equipped with IoT solutions improve maintenance, safety, and passenger experience, attracting investment.

Growing demand in emerging markets supports market growth. Rapid urbanization in regions like Asia-Pacific and Latin America drives the need for efficient transportation solutions.

Development of autonomous trains also provides growth avenues. Autonomous rolling stock reduces operational costs and enhances safety, making it a promising segment for manufacturers.

Challenges

Economic Instability in Key Regions Challenges Market Growth

Economic instability in key regions affects the Rolling Stock Market. Fluctuating economies can reduce government spending on infrastructure, impacting rail projects.

Supply chain disruptions also present challenges. Delays in obtaining parts and materials affect manufacturing timelines and increase costs, hindering market stability.

Competition from other transport modes poses additional challenges. High-speed buses, ride-sharing, and domestic air travel compete with rail systems, affecting market share.

Environmental concerns related to emissions create further hurdles. While rolling stock aims to be eco-friendly, diesel-powered trains still contribute to emissions, requiring regulatory adjustments and modernization efforts.

Growth Factors

Increasing Electrification of Railways Are Growth Factors

The increasing electrification of railways drives the Rolling Stock Market. Electric trains are more energy-efficient and environmentally friendly, aligning with global sustainability initiatives.

Rising urbanization and population growth support market growth. Expanding cities require efficient public transport, increasing demand for rolling stock.

Government funding for rail modernization also fuels the market. Investments in upgrading rail infrastructure and purchasing new rolling stock enhance operational efficiency and service quality.

The expansion of freight rail transport is a key growth factor. Freight trains are vital for logistics, and the growing demand for goods transport increases the need for new, efficient rolling stock.

Emerging Trends

Adoption of Hydrogen-Powered Trains Is Latest Trending Factor

The adoption of hydrogen-powered trains is a notable trend in the Rolling Stock Market. These trains offer zero emissions, aligning with global sustainability goals.

The use of AI and predictive maintenance is also trending. AI enhances train performance, safety, and efficiency by predicting maintenance needs, reducing downtime.

The shift towards lightweight materials supports market growth. Lightweight trains consume less energy and have higher speed potential, making them more efficient.

A focus on passenger safety enhancements is evident. Technologies like automatic braking systems, improved surveillance, and passenger information systems increase safety, boosting consumer confidence.

Regional Analysis

Asia Pacific (APAC) leads the Rolling Stock Market with a 43.0% share, totaling USD 25.46 billion. The region’s dominance is driven by rapid infrastructure development, strong government investments in rail networks, and rising demand for urban transit. Key contributors include China, India, and Japan, with expanding metro and high-speed rail projects.

The region benefits from cost-effective manufacturing, a large workforce, and significant raw material availability. Additionally, APAC’s focus on sustainable transport solutions, like electric and hybrid trains, enhances market performance. High population density and increasing urbanization further boost demand for efficient and reliable rail systems.

Asia Pacific’s influence in the global rolling stock market is expected to grow. Ongoing rail modernization and sustainable transit projects will strengthen the region’s position, ensuring steady market growth.

Regional Mentions:

- North America: North America sees growth through modernization of freight rail systems and investments in passenger rail networks. Focus on sustainable transit and technological upgrades drives the market.

- Europe: Europe maintains a significant presence, supported by strict environmental regulations and investments in high-speed rail networks. The push for green transport solutions enhances growth.

- Middle East & Africa: The region shows potential due to increasing infrastructure development and plans for metro systems in urban areas. Investments in sustainable rail solutions drive market expansion.

- Latin America: Latin America experiences steady growth, supported by infrastructure investments and urban rail developments. Focus on improving connectivity and public transport boosts the market.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The rolling stock market is highly competitive, driven by the demand for efficient rail transportation and modernized rail networks. The top four companies in this sector are CRRC Corporation Limited, Alstom Transport, Siemens Mobility, and GE Transportation. These companies dominate the market through innovative designs, sustainable technologies, and strong global presence.

Alstom Transport is a global leader in rail mobility solutions, focusing on electric trains, metro systems, and automated solutions. Its commitment to sustainable transport solutions, such as hydrogen-powered trains, strengthens its market position.

Siemens Mobility emphasizes digitalization and smart mobility solutions, integrating AI and IoT to enhance safety and efficiency in trains. Its strong presence in Europe and expanding footprint in Asia supports its market share growth.

GE Transportation, now part of Wabtec Corporation, is renowned for its heavy-duty locomotives, focusing on freight transport. It prioritizes fuel efficiency and reliability, which are critical for long-distance cargo transportation.

These companies leverage advanced technology, strategic partnerships, and global expansion to maintain leadership in the rolling stock market.

Top Key Players in the Market

- CRRC Corporation Limited

- Trinity Rail

- Alstom Transport

- GE Transportation

- Siemens Mobility

- The Greenbrier Co.

- Hyundai Rotem

- Stadler Rail AG

- Hitachi Rail System

- Other Market Players

Recent Developments

- Eurostar Group: In June 2024, Eurostar announced plans to expand its fleet by up to 50 trains and add new routes from London to address the rising demand for European rail travel. Following its merger with Thalys in 2022, Eurostar aims to grow its fleet to 67 trains, replacing older models and exploring additional routes by the end of 2024 or early 2025.

- Go-Ahead Group: In September 2024, the Go-Ahead Group, a prominent UK rail operator, resumed dividend payments, distributing over £80 million to international shareholders, including £58 million to Spain and Australia and £26 million to Keolis, a subsidiary of SNCF.

- Paris Olympic Transport Preparations: In July 2024, Paris implemented extensive transport improvements to facilitate efficient travel for spectators during the 2024 Olympics. Emphasis was placed on public transit, cycling, and walking as primary modes of transport for attendees.

- Paris-Milan High-Speed Rail: In October 2024, plans were confirmed for a new high-speed rail line set to open by 2032, reducing travel time between Paris and Milan from seven hours to approximately four and a half hours. The 167-mile Turin-Lyon line, featuring the world’s longest Alpine tunnel, aims to boost passenger and freight capacity while reducing road congestion and air pollution.

Report Scope

Report Features Description Market Value (2023) USD 59.2 Billion Forecast Revenue (2033) USD 95.5 Billion CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Locomotive: Diesel Locomotive, Electric Locomotive, Electro-Diesel Locomotive; Rapid Transit Vehicle: DMU, EMU, Light Rails and Trams, Subways and Metros, Monorails; Coaches, Wagons, Other Products), By Type (Diesel, Electric), By Train Type (Rail Freight, Rail Passenger), By Locomotive Technology (Conventional Locomotive, Turbocharged Locomotive, Maglev) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CRRC Corporation Limited, Trinity Rail, Alstom Transport, GE Transportation, Siemens Mobility, The Greenbrier Co., Hyundai Rotem, Stadler Rail AG, Hitachi Rail System, Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CRRC

- Bombardier

- Alstom

- Siemens

- GE Transportation

- Hyundai Rotem

- Transmashholding

- Stadler Rail AG

- Hitachi

- Kawasaki Heavy Industries

- CAF

- EMD (Caterpillar)