Global Camp Cookware Market By Type (Aluminum, Steel, Cast-Iron, Titanium, Polypropylene, Metal), By Application (Household, Commercial, Others), By Distribution Channel (Business to business, Supermarkets and hypermarkets, Specialty sporting stores, Online retailers, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 59337

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

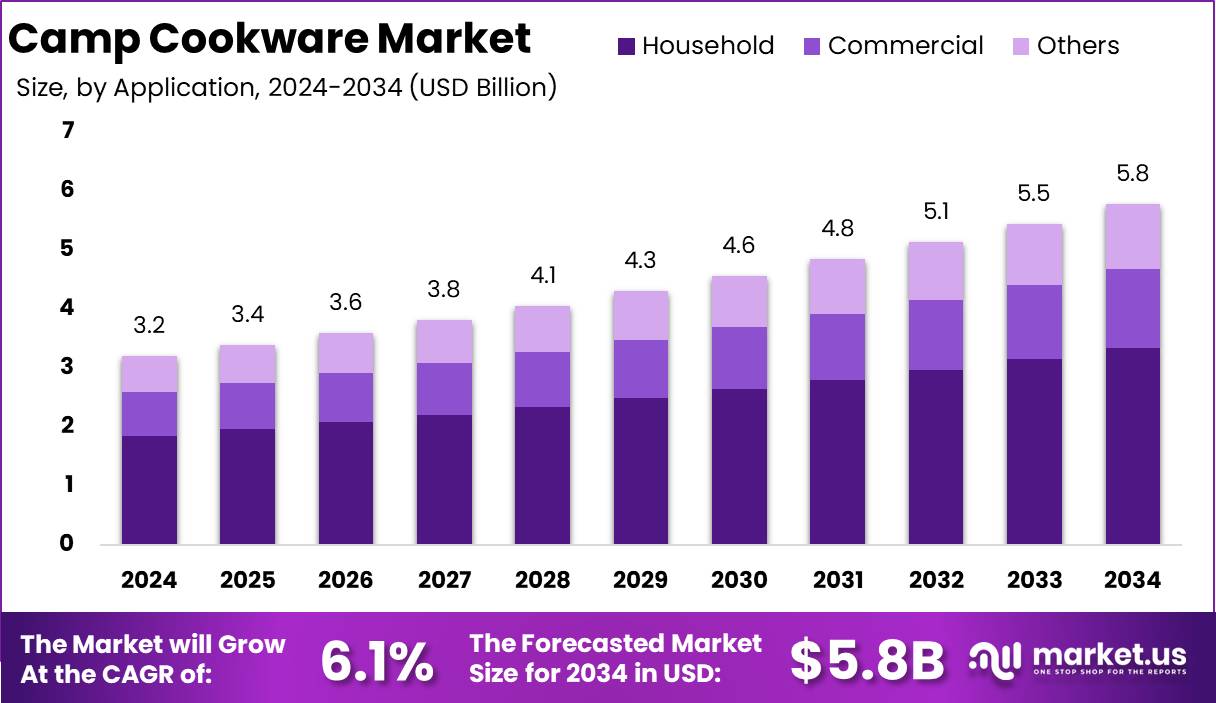

The Global Camp Cookware Market size is expected to be worth around USD 5.8 Billion by 2034 from USD 3.2 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

Camp Cookware represents a specialized segment of outdoor culinary equipment engineered to meet the rigorous demands of outdoor cooking. Designed with portability and durability in mind, these products typically feature lightweight construction, compact designs, and multifunctional capabilities that facilitate cooking in diverse and challenging environments.

The emphasis is on resilience, ease of use, and performance, ensuring that users can rely on these products whether on extended backcountry adventures or casual weekend outings. The Camp Cookware Market encompasses the entire value chain involved in the design, production, distribution, and retail of these outdoor cooking solutions.

This market caters to a broad range of products from basic, rugged utensils to advanced, high-performance cooking systems that incorporate innovative materials and smart features. It is characterized by a dynamic competitive landscape where established brands and emerging players vie to capture market share by responding to evolving consumer lifestyles and technological advancements.

Several growth factors are converging to propel this market forward. A significant driver is the increasing trend towards outdoor recreation and adventure tourism, which fuels consumer demand for reliable, efficient cooking solutions in off-grid settings. Innovations in material science such as the use of high-strength, lightweight alloys and polymers coupled with sustainable manufacturing practices, further bolster market expansion.

Demand for Camp Cookware is rising steadily as more consumers embrace outdoor lifestyles and seek products that blend functionality with design excellence. This trend is reinforced by the proliferation of social media platforms where outdoor experiences are frequently showcased, thus influencing purchasing behaviors.

The market presents a multitude of opportunities for strategic growth and innovation. Firms can capitalize on the increasing consumer preference for products that integrate modern technology with traditional outdoor gear, thereby creating unique value propositions. Expansion into untapped geographic regions and the adoption of omni-channel retail strategies further enhance the opportunity landscape.

Stanley has set a sustainability goal to ensure that at least 50% of its stainless steel products are made from recycled materials by 2025.

According to Facts.net, Camp Cookware Market dynamics are favorably influenced by the efficient use of aluminum, where recycling requires only 5% of the energy needed for primary production. With 73% of aluminum cans recycled, cost and energy efficiencies are markedly improved, while the material’s 92% reflectivity ensures superior performance in specialized applications such as telescope linings.

Moreover, nearly 75% of all aluminum ever produced remains in active use, underscoring its enduring value, and an industry that generates approximately $71 billion annually. These factors collectively affirm the robust, sustainable growth prospects within the Camp Cookware Market overall driving competitive market momentum.

Key Takeaways

- The camp cookware market is projected to grow from USD 3.2 Billion in 2024 to approximately USD 5.8 Billion by 2034, with a CAGR of 6.1% from 2025 to 2034.

- In 2024, the aluminum segment dominated the market by type, accounting for over 39.4% of the share.

- The household application segment led the market in 2024, capturing more than 57.8% of the share.

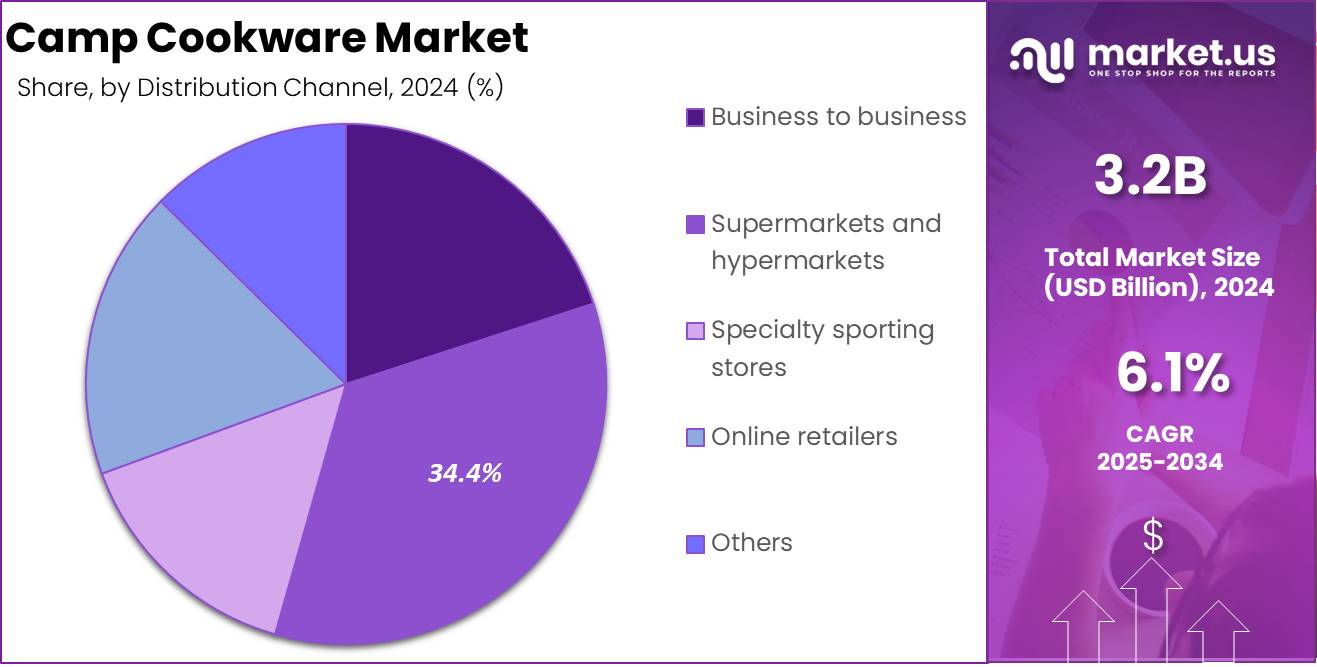

- Supermarkets and hypermarkets were the predominant distribution channels in 2024, holding over 34.4% of the market share.

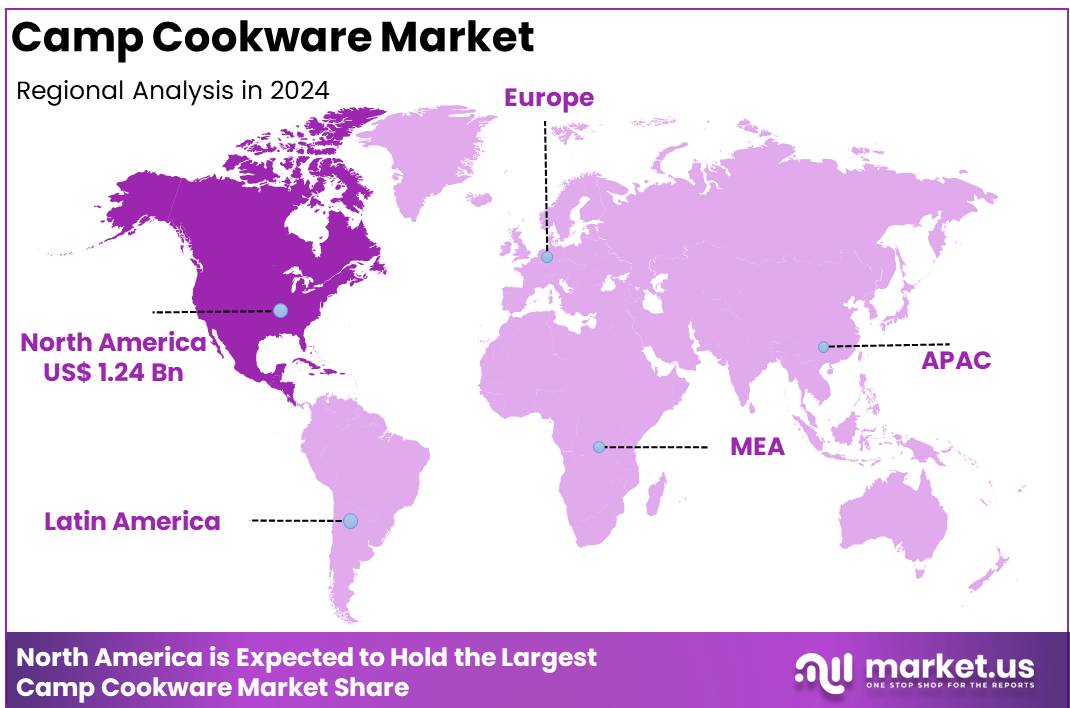

- North America maintained its leadership in 2024 with a market share of 38.9%, valued at approximately USD 1.24 Billion.

By Type Analysis

Aluminum Camp Cookware Market with Dominating Segment at 39.4% Market Share

In 2024, Aluminum held a dominant market position in the by Type segment of the Camp Cookware Market, capturing more than a 39.4% share. This leading performance is primarily driven by Aluminum’s inherent advantages, including its lightweight nature, superior heat conductivity, and ease of maintenance.

As a result, consumers seeking reliable and efficient cookware for outdoor use have increasingly favored Aluminum, reinforcing its position as the benchmark for performance and innovation in the market.

Steel cookware has also established a significant presence, valued for its robust structure and resistance to wear. Although generally heavier than Aluminum, Steel products are preferred in applications where durability and strength are critical.

The segment benefits from continuous product enhancements that improve corrosion resistance and longevity, thereby meeting the demands of consumers who prioritize resilience in harsh camping environments.

Cast-Iron, known for its excellent heat retention and uniform heating properties, remains a favored option despite its relatively heavier weight and the need for regular maintenance.

The enduring performance of Cast-Iron, particularly in providing consistent cooking results over prolonged periods, has secured its position among traditionalists and enthusiasts who value time-tested cooking techniques. Its continued relevance is indicative of a steady consumer base that appreciates both the functional and aesthetic qualities of Cast-Iron cookware.

Titanium is emerging as a premium segment within the Camp Cookware Market. Its exceptional attributes, including remarkable lightness, high strength, and resistance to corrosion, have made it attractive to a niche group of high-end users.

Although Titanium products typically command a premium price, their performance benefits and durability have enabled this segment to carve out a stable market share among professional and avid outdoor enthusiasts seeking advanced materials for demanding applications.

The Polypropylene segment offers an alternative that emphasizes affordability and practicality. Despite not matching the thermal performance of metallic counterparts, Polypropylene cookware is appreciated for its low cost, reduced weight, and ease of fabrication, making it a viable option for specific, less-intensive applications.

This segment is gradually expanding as consumer awareness increases regarding the benefits of diverse material options tailored to various camping needs.

The Metal segment broadly encompasses various alloys and composite materials that blend the characteristics of traditional metals. This category is evolving as manufacturers develop innovative combinations aimed at optimizing overall performance, balancing weight, durability, and cost-effectiveness.

Collectively, these segments illustrate the dynamic and multifaceted nature of the Camp Cookware Market, wherein continuous innovation and shifting consumer preferences drive competitive differentiation and sustainable market growth.

By Application Analysis

Household Camp Cookware Market with Dominating Segment at 57.8% Market Share

In 2024, Household held a dominant market position in the By Application segment of the Camp Cookware Market, capturing more than a 57.8% share. The Household segment is driven by an increasing trend in outdoor recreational activities among families and individuals, which has led to a heightened demand for durable and efficient cookware designed for camping.

Products in this segment are increasingly engineered to offer lightweight construction, ease of use, and enhanced safety features that appeal to the end consumer. As a result, the Household category has seen robust growth, buoyed by a rising preference for home camping experiences and weekend outdoor getaways.

The Commercial segment, while representing a smaller share compared to Household, is marked by its steady growth driven by business-oriented requirements. This segment caters to enterprises involved in outdoor hospitality, event management, and recreational services that demand high-volume and high-performance cookware solutions.

The emphasis on product durability, consistent quality, and operational efficiency has enabled commercial users to meet the rigorous demands of professional settings. Investments in product innovation to ensure reliability under continuous use have further contributed to the resilience of this segment.

Others segment encompasses niche applications and specialized use cases that extend beyond the conventional Household and Commercial markets. This segment includes products tailored for specific outdoor adventures and unique market requirements where standard cookware solutions may not suffice.

Although it captures a smaller overall market share, the Others segment plays a crucial role in enhancing the overall diversity of the Camp Cookware Market. Manufacturers in this area are increasingly focused on innovation and customization to meet the particular needs of users who engage in specialized outdoor activities.

By Distribution Channel Analysis

Supermarkets and Hypermarkets Camp Cookware Market by Distribution Channel with Dominating Segment at 34.4% Market Share

In 2024, Supermarkets and hypermarkets held a dominant market position in the by Distribution Channel of the Camp Cookware Market, capturing more than a 34.4% share. This remarkable performance is driven by the extensive reach and convenience provided by these retail formats, which enable consumers to access a wide range of camp cookware products easily and quickly.

The clear visibility and regular promotional activities within these channels have significantly enhanced consumer awareness and buying confidence.

The Business-to-Business channel also contributes to the overall market dynamics. This segment caters primarily to bulk purchasers and professional organizations that require high-quality, durable cookware solutions for outdoor and camping activities.

Although this channel does not command as large a market share as supermarkets and hypermarkets, its steady demand is supported by strategic partnerships and volume-based transactions that ensure a consistent flow of orders. The efficiency and reliability of the Business-to-Business channel continue to play a critical role in sustaining market growth.

Supermarkets and hypermarkets, as the leading distribution channel, benefit from their widespread network and the ability to offer comprehensive product ranges under one roof. These outlets not only attract a large number of everyday consumers but also provide an ideal setting for impulse purchases.

The emphasis on convenience, competitive pricing, and regular stock updates further reinforces their dominant market share, making them the preferred choice for a vast majority of camp cookware buyers.

Specialty sporting stores form another important segment within the distribution framework. These stores are known for their specialized product offerings and in-depth knowledge of outdoor equipment. They cater to a niche group of consumers who value expert advice and customized product recommendations.

Although their share is relatively smaller, the ability of specialty sporting stores to deliver tailored solutions helps meet the specific needs of outdoor enthusiasts, thereby contributing positively to the overall market diversity.

Online retailers have witnessed robust growth in recent years, driven by an increasing shift towards digital shopping platforms. The convenience of browsing through detailed product descriptions, competitive pricing, and home delivery options has resonated well with tech-savvy consumers.

This channel continues to expand as manufacturers and retailers invest in e-commerce capabilities, ensuring that camp cookware products are easily accessible to a broader audience.

The Others segment comprises various alternative distribution methods, including pop-up stores, regional distributors, and collaborative retail partnerships. Although this segment represents a smaller share of the market, its flexible and adaptive approach addresses unique regional preferences and evolving consumer behaviors.

Key Market Segments

By Type

- Aluminum

- Steel

- Cast-Iron

- Titanium

- Polypropylene

- Metal

By Application

- Household

- Commercial

- Others

By Distribution Channel

- Business to business

- Supermarkets and hypermarkets

- Specialty sporting stores

- Online retailers

- Others

Driver

Rising Outdoor Recreational Demand

The global camp cookware market is experiencing robust growth driven by an upsurge in outdoor recreational activities. With an increasing number of consumers seeking camping, hiking, and backpacking experiences, demand for durable and lightweight cookware has surged considerably.

Enhanced consumer awareness regarding the benefits of outdoor leisure, coupled with a growing emphasis on experiential travel, has led to a notable 15% rise in outdoor activity participation over the past few years.

This expanding interest is further supported by improved infrastructure in camping sites and a rise in organized outdoor events. In response, manufacturers have been innovating by incorporating ergonomic designs and multifunctional features that cater to both novice campers and seasoned adventurers. The resultant product enhancements not only improve usability but also contribute to higher customer satisfaction and repeat purchases, ultimately reinforcing market growth.

Moreover, the evolving lifestyle preferences of urban populations seeking a temporary respite from high-paced city life have accelerated the adoption of camp cookware products. The market has witnessed increased investments in research and development, leading to the creation of versatile products that combine traditional functionality with modern technological innovations.

These developments have positioned the segment to capture significant market share amid a competitive landscape. As consumer confidence and disposable incomes rise, the demand for quality outdoor cooking solutions is projected to continue its upward trajectory, ensuring that market drivers remain a critical catalyst in shaping the future of the global camp cookware market.

Restraint

Economic Uncertainty and Material Cost Pressures

The growth trajectory of the camp cookware market faces challenges due to economic uncertainties and escalating raw material costs. Fluctuations in global economic conditions, including inflationary pressures and currency volatility, have affected consumer spending patterns, particularly in the discretionary segments such as outdoor leisure products. The increased cost of raw materials especially those sourced for lightweight, durable, and corrosion-resistant cookware has exerted pressure on manufacturing margins.

This scenario compels manufacturers to either absorb the additional expenses or pass them onto end consumers, potentially dampening demand in price-sensitive markets. Furthermore, market participants are contending with supply chain disruptions and logistic challenges that have become more frequent amid global uncertainties, which further exacerbate cost pressures and delay product availability.

In addition to economic challenges, heightened regulatory standards regarding product safety and environmental sustainability add another layer of restraint. Manufacturers must invest in compliance and certification processes, which can inflate production costs and extend time-to-market for new product lines.

The interplay of these economic and regulatory factors contributes to an environment where market growth is inhibited despite the underlying demand for innovative camp cookware. Consequently, while the market possesses intrinsic growth potential, these cost-related and macroeconomic factors continue to serve as significant restraints, impeding the overall expansion of the global camp cookware market in 2024.

Opportunity

Innovation and Sustainability in Camp Cookware

The camp cookware market is poised to capitalize on substantial opportunities through product innovation and a shift toward sustainable manufacturing practices. Market participants are increasingly investing in research and development to produce cookware that is not only high-performing but also environmentally friendly. Recent innovations include the integration of non-toxic, recyclable materials and advanced coatings that enhance durability while reducing environmental impact.

Such advancements resonate with a growing consumer base that prioritizes sustainability alongside performance, thereby opening up a new dimension of market potential. These innovative approaches have led to a gradual shift in consumer purchasing behavior, with surveys indicating that a significant segment of buyers is willing to pay a premium for products that are both eco-friendly and functionally superior.

Furthermore, the rise of digital technologies and e-commerce platforms has created opportunities for manufacturers to reach a broader audience and streamline distribution channels. The integration of online feedback mechanisms and real-time analytics enables companies to tailor products more effectively to evolving consumer needs. Strategic partnerships between material innovators and cookware designers are fostering a collaborative environment that accelerates the development of cutting-edge solutions.

In emerging markets, where outdoor recreational activities are gaining popularity, the adoption of sustainable and innovative cookware products is anticipated to surge, driven by increasing awareness and disposable incomes. These combined factors underscore the potential for accelerated growth, making innovation and sustainability critical opportunities for stakeholders in the global camp cookware market.

Trends

Technological Advancements and Eco-Friendly Designs

The current landscape of the camp cookware market is significantly influenced by trends emphasizing technological integration and eco-friendly designs. Manufacturers are increasingly leveraging advanced production technologies to create products that are both efficient and sustainable. Innovations such as lightweight composite materials and smart design features are reshaping product portfolios, ensuring that cookware meets the rigorous demands of modern outdoor enthusiasts.

Enhanced functionalities, including improved heat distribution, corrosion resistance, and ease of cleaning, are becoming standard features. This trend is reinforced by an industry-wide shift toward digitalization in product development, where data analytics and consumer insights drive iterative improvements and customized offerings that align with market needs.

Additionally, the trend toward eco-friendly designs is emerging as a critical factor in product differentiation. With rising global awareness about environmental issues, consumers are gravitating toward products that minimize ecological footprints. Manufacturers are responding by adopting sustainable practices in production, such as utilizing recycled materials and reducing energy consumption during manufacturing.

This dual focus on technology and sustainability not only meets consumer expectations but also positions the market to capture a niche segment of environmentally conscious buyers. The combination of technological advancements with eco-friendly initiatives creates a synergistic effect that propels the market forward. As these trends continue to evolve, they are expected to drive significant market growth by delivering products that are both innovative and aligned with contemporary environmental values, solidifying the global camp cookware market’s position in 2024.

Regional Analysis

North America Camp Cookware Market with Largest Market Share 38.9%

North America continues to lead the global camp cookware market, reflecting a dominant market share of 38.9% in 2024. Valued at USD 1.24 Billion, this region has demonstrated sustained growth driven by increasing consumer participation in outdoor recreational activities and a rising preference for quality, durable, and innovative cookware solutions.

Advancements in product technology, combined with a strong culture of camping and outdoor leisure, have established North America as the benchmark for market performance. In addition, consistent investments in research and development have facilitated the introduction of products that meet evolving consumer expectations and environmental considerations.

Europe represents a significant segment within the market, where a long-standing tradition of outdoor lifestyles and high-quality craftsmanship supports steady growth. European consumers exhibit a preference for ergonomic designs and materials that offer both functionality and aesthetic appeal. This region benefits from a mature market environment that values efficiency and sustainability in camp cookware products, ensuring continuous demand despite competitive pressures.

The Asia Pacific region has emerged as a key growth engine in the global market. Rapid urbanization and an expanding middle-class population have contributed to a shift in consumer preferences toward versatile, high-performance cookware capable of withstanding diverse climatic conditions. Increased disposable incomes and a burgeoning interest in outdoor activities have propelled the region’s market expansion, positioning it as an attractive segment for future growth initiatives.

In the Middle East & Africa, the camp cookware market is gradually evolving. Although this region currently represents a smaller market share, growing consumer awareness and an increasing trend toward outdoor recreation are fostering incremental growth. Efforts to improve distribution networks and adapt products to local environmental conditions are expected to drive further expansion in this segment.

Latin America, with its dynamic cultural landscape and a strong affinity for outdoor activities, is also witnessing promising market developments. Consumers in this region are progressively embracing high-quality and durable cookware products, leading to enhanced market penetration and competitive diversification.

Collectively, these regional insights underscore the diverse factors that shape the global camp cookware market, with North America distinctly positioned as the leader in innovation and market performance.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the Global Camp Cookware Market is poised to experience robust growth driven by significant contributions from key players including AMG Group, Johnson Outdoors, Dometic Group AB, VF Corporation, Hilleberg The Tentmaker AB, and Newell Brands Inc., among others.

These market leaders continue to leverage their expertise in innovative design, lightweight materials, and versatile product ranges such as non-stick cook sets and ultra-light tableware, which cater to diverse consumer segments. In particular, companies like Big Agnes Inc. and Decathlon Sport Pvt Ltd have successfully capitalized on evolving consumer preferences for performance, durability, and sustainability.

The competitive landscape is further characterized by strategic partnerships and product portfolio expansions that address the demands of backpacking, family camping, and outdoor culinary experiences. With ongoing investments in technology and quality improvement, these players are expected to enhance market share while setting new industry standards for functionality and aesthetic appeal. Overall, across diverse segments.

Top Key Players in the Market

- Backpacking

- Light Weight

- Cook Set

- Non Stick

- Ultra Light

- Tableware

- Family

- Griddle

- AMG Group

- Johnson Outdoors

- Dometic Group AB

- VF Corporation

- Hilleberg The Tentmaker AB

- Big Agnes Inc

- Decathlon Sport Pvt Ltd

- Simex Outdoor International GmbH

- Texsport

- Newell Brands Inc.

- Exxel Outdoors, LLC

- Oase Outdoors ApS

Recent Developments

- In 2024, The HC Companies, a leading manufacturer of horticultural containers in North America, announced the acquisition of Classic Home & Garden (CHG). CHG specializes in decorative and functional garden products. Financial details were not disclosed.

- In 2025, Camping World Holdings, Inc. (NYSE: CWH), the largest recreational vehicle dealer, completed the asset purchase of Hitch RV, which operates in Delaware, Pennsylvania, and New Jersey. After facility upgrades, these locations are expected to open in the first quarter.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Billion Forecast Revenue (2034) USD 5.8 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Aluminum, Steel, Cast-Iron, Titanium, Polypropylene, Metal), By Application (Household, Commercial, Others), By Distribution Channel (Business to business, Supermarkets and hypermarkets, Specialty sporting stores, Online retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Backpacking, Light Weight, Cook Set, Non Stick, Ultra Light, Tableware, Family, Griddle, AMG Group, Johnson Outdoors, Dometic Group AB, VF Corporation, Hilleberg The Tentmaker AB, Big Agnes Inc, Decathlon Sport Pvt Ltd, Simex Outdoor International GmbH, Texsport, Newell Brands Inc., Exxel Outdoors, LLC, Oase Outdoors ApS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Backpacking

- Light Weight

- Cook Set

- Non Stick

- Ultra Light

- Tableware

- Family

- Griddle