Global Camping Tent Market By Product (Tunnel, Dome, Geodesic), By End-use (Individual, Commercial), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135766

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

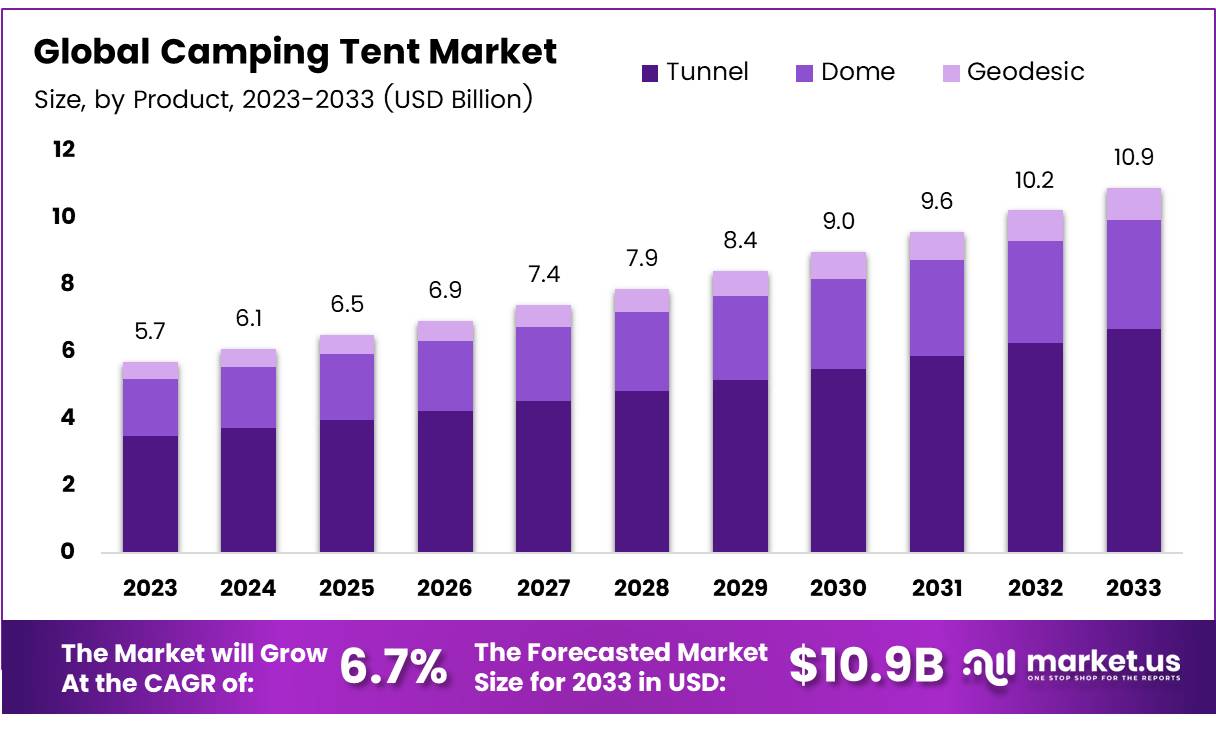

The Global Camping Tent Market size is expected to be worth around USD 10.9 Billion by 2033, from USD 5.7 Billion in 2023, growing at a CAGR of 6.7% during the forecast period from 2024 to 2033.

A camping tent is a portable shelter made of fabric, supported by poles and secured with stakes or guy ropes. Historically derived from nomadic structures, today’s camping tents are engineered for various environments, from lightweight backpacking models to durable shelters for family camping.

The camping tent market encompasses the production, distribution, and sale of camping tents. This market is a segment of the broader outdoor recreational industry and is influenced by trends in outdoor activities, advancements in materials technology, and changes in consumer preferences.

Companies operating within this market are involved in continuous product development and innovation to meet the evolving needs of campers, while also navigating the competitive landscape of outdoor gear manufacturers.

Opportunities within this market are plentiful. Innovations in materials technology have led to the development of lighter, more durable, and environmentally friendly tents, which appeal to both eco-conscious consumers and those venturing into harsher climates.

Furthermore, the expansion of e-commerce platforms has made camping tents more accessible to a global audience, providing growth avenues for manufacturers and retailers alike.

Governments worldwide have also played a crucial role in this market’s development by investing in public camping grounds and national parks, enhancing infrastructure to accommodate more campers safely and comfortably.

Recent data underscores the robust engagement within the camping sector. According to the Camping and Caravanning Club, in 2023, 55% of campers reported camping four or more times a year, highlighting a strong repeat engagement in outdoor activities.

Gender dynamics in camping are also evolving. The proportion of female campers has risen to 43% in 2023 from 38% previously, according to the same source. This shift is crucial for market participants as it indicates a broadening demographic base, necessitating product diversification to cater to different preferences and requirements.

From a product satisfaction standpoint, the Camping and Caravanning Club notes that 80% of tent owners reported no defects with their tents in 2023, a statistic that mirrors the previous year’s results and highlights high product reliability—a key selling point for manufacturers.

Additionally, specific product categories, such as inflatable tents, are seeing notable growth. As reported by Coolest Gadgets, the demand for inflatable tents in the United States has surged, with an expected growth rate of 7.5% from the previous year.

Key Takeaways

- The global Camping Tent Market is projected to grow from USD 5.7 billion in 2023 to USD 10.9 billion by 2033, at a CAGR of 6.7%.

- Tunnel tents dominated the product segment in 2023 with a 54.3% share, favored for their robust design and spacious interiors.

- Individuals were the leading end-users in the Camping Tent Market in 2023, indicating a strong trend in personal outdoor activities.

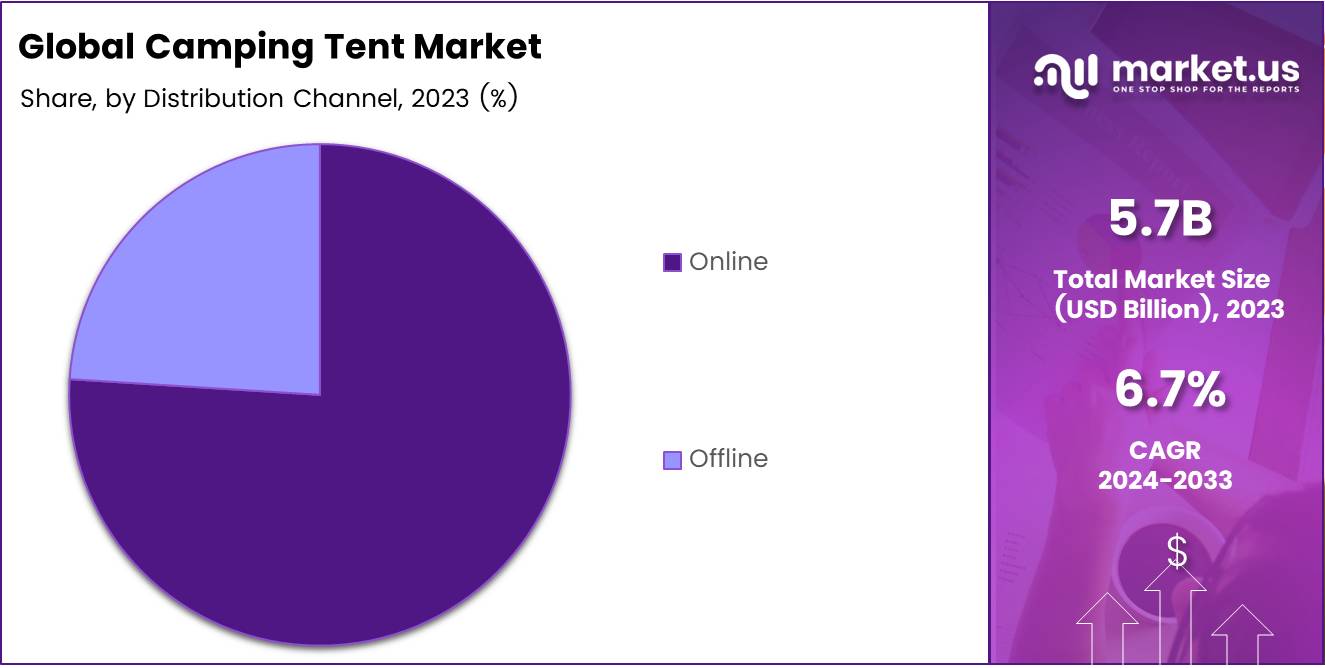

- The offline distribution channel held a dominant position in 2023 due to consumer preference for physically inspecting camping gear.

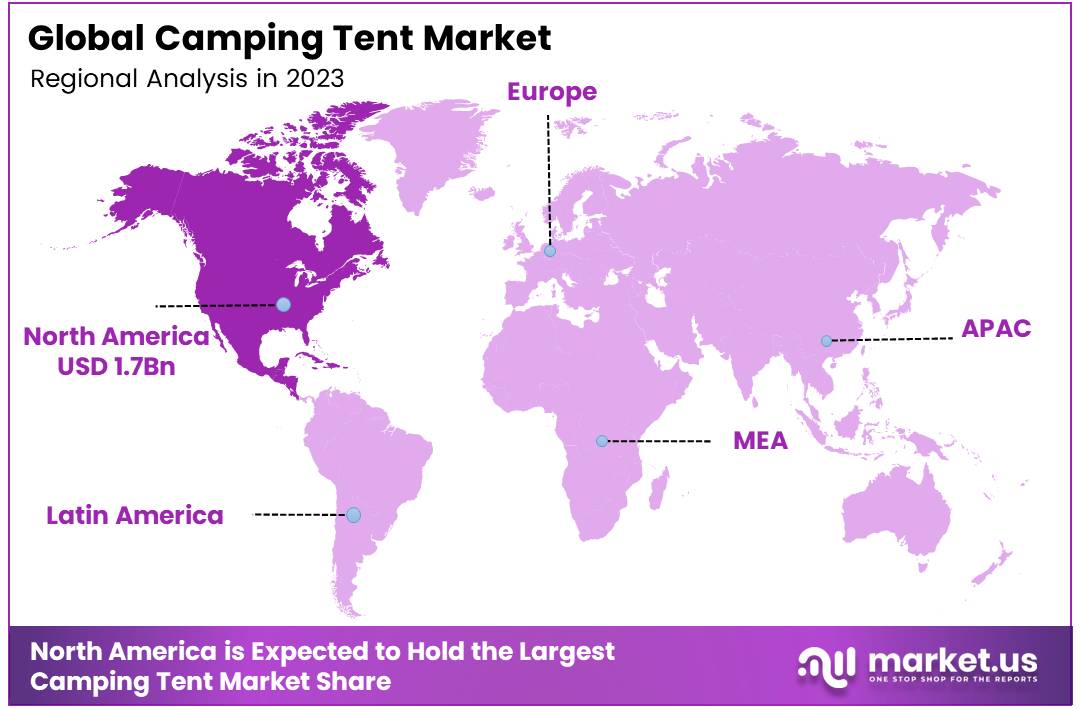

- North America led the market with a 30% share, valued at USD 1.7 billion, driven by a strong outdoor culture and technological innovations in tent design.

Product Analysis

Tunnel Tents Capture 54.3% Market Share Driven by Spacious Design and Weather Resistance

In 2023, Tunnel held a dominant market position in the By Product Analysis segment of the Camping Tent Market, with a 54.3% share. The robust design and spacious interior of Tunnel tents have made them a preferred choice for family camping and extended outdoor stays, contributing significantly to their market dominance.

Moving to the Dome segment, this style captured a substantial market segment due to its versatility and ease of setup. Dome tents are particularly favored for their stability and compact nature, making them ideal for a variety of weather conditions and terrain types.

Lastly, the Geodesic tents, known for their superior stability and resistance to extreme weather, represent a niche but vital segment of the market. These tents are engineered with multiple intersecting poles, creating triangular sections that distribute stress across the structure, which is crucial in harsh environmental conditions.

End-use Analysis

Individual Users Take the Lead in 2023 Camping Tent Market, Bolstering Outdoor Recreation Trends

In 2023, individuals held a dominant market position in the By End-use Analysis segment of the Camping Tent market, reflecting a significant trend in outdoor recreational activities.

The preference among individual users can be attributed to increasing interest in solo and family camping expeditions, which require reliable and versatile camping equipment. This trend is bolstered by a growing emphasis on mental health and wellness, prompting more people to engage in nature-based activities.

Conversely, the commercial segment, which includes outfitters and recreational service providers, also experienced growth, though at a slower pace. This sector’s expansion is driven by the rising popularity of organized outdoor events and the burgeoning eco-tourism industry.

These dynamics underscore a robust demand within the camping tent market, with individual users leading the way due to their specific needs for flexibility and functionality in camping gear, while commercial entities adapt to cater to group-oriented outdoor engagements.

Distribution Channel Analysis

In 2023, Offline Dominated Camping Tent Market with Extensive Distribution Channels

In 2023, the offline segment held a dominant position in the By Distribution Channel Analysis of the camping tent market. This supremacy can be attributed to the consumer preference for physically inspecting products before purchase, which is particularly significant in the selection of camping gear.

Moreover, offline channels benefit from established relationships with consumers, providing personalized service that online platforms often cannot match.

Retail staff contribute to consumer confidence through their expertise and ability to address queries instantaneously, enhancing the shopping experience and potentially increasing consumer loyalty.

On the other hand, the online segment has shown considerable growth, driven by the convenience of home shopping and the increasing penetration of e-commerce. The rise of digital platforms has expanded consumer access to a wider range of camping tent products, complemented by competitive pricing and detailed product information.

Key Market Segments

By Product

- Tunnel

- Dome

- Geodesic

By End-use

- Individual

- Commercial

By Distribution Channel

- Offline

- Online

Drivers

Rising Popularity of Outdoor Activities Boosts Camping Tent Market

The growing enthusiasm for outdoor activities, such as camping, trekking, and hiking, is significantly boosting the demand for camping tents. This trend can be attributed to the increasing popularity of agritourism, especially among the millennial demographic, who are seeking immersive experiences in nature.

Additionally, as disposable incomes rise globally, consumers are more inclined to invest in premium camping tents that offer advanced features and enhanced durability. These factors collectively drive the expansion of the camping tent market, as individuals and families look to enhance their outdoor experiences with reliable and comfortable accommodations.

Restraints

Seasonal Demand Patterns Challenge Camping Tent Market

The camping tent market faces significant challenges due to the seasonality of demand, which tends to peak during specific times of the year such as summer and early fall. This pattern presents difficulties for manufacturers in achieving consistent revenue streams throughout the year.

Additionally, the rise in alternative outdoor accommodations, such as Airbnb, cabins, and recreational vehicles (RVs), has introduced new competition, potentially diminishing the appeal of traditional camping.

These alternatives often offer greater comfort and convenience, appealing to a broader segment of potential customers who might otherwise have considered camping. As a result, tent manufacturers must navigate these fluctuating demand cycles and competition from non-traditional camping options, which can impact market growth and operational stability.

Growth Factors

Expansion into Emerging Markets Fuels Camping Tent Growth

The camping tent market is poised for expansion in emerging markets, particularly in regions like Asia-Pacific and Latin America, where rising disposable incomes and growing interest in outdoor activities are opening new avenues for growth.

Manufacturers have the opportunity to capitalize on these trends by diversifying their product offerings to cater to a variety of camping preferences, ranging from solo and family tents to luxury glamping tents.

Additionally, there is a significant opportunity in embracing eco-friendly and sustainable practices. Increasing consumer awareness and demand for environmentally responsible products are encouraging manufacturers to develop tents using recycled and sustainable materials.

These initiatives not only cater to market demand but also align with global sustainability goals, enhancing brand reputation and consumer loyalty. By addressing these areas, camping tent manufacturers can broaden their market reach and meet the evolving preferences of modern consumers.

Emerging Trends

Multi-Functional Tents Gain Popularity in the Camping Market

In the camping tent market, a notable trend is the increasing demand for multi-functional tents. These innovative designs serve multiple purposes, not only providing shelter but also functioning as recreational spaces, enhancing their appeal among diverse camping enthusiasts. The rise of inflatable tent technology further exemplifies the market’s shift towards convenience and efficiency.

These tents are valued for their easy setup and space-saving features, making them ideal for campers who prioritize ease and comfort.

Additionally, the popularity of portable and modular tents is on the rise, particularly among families and groups who appreciate the flexibility to customize their camping space according to their needs.

Weather-resistant and all-season tents are also seeing increased demand, as they are designed to withstand various climatic conditions, making camping a viable activity year-round. These trends reflect a broader movement towards versatility, comfort, and adaptability in camping equipment, catering to a wide range of consumer needs and preferences.

Regional Analysis

North America Leads the Camping Tent Market with a 30% Share, Valued at USD 1.7 Billion

The global camping tent market exhibits substantial growth potential across various regions, each presenting unique dynamics and opportunities influenced by regional trends and consumer preferences.

North America commands a significant share of the market, representing 30% with a value of USD 1.7 billion. This dominance is primarily driven by a robust outdoor culture and increasing participation in camping activities among American and Canadian populations. Innovations in tent technologies, such as weather-resistant materials and eco-friendly designs, further propel market expansion in this region.

Regional Mentions:

Europe follows closely, with a market driven by a strong inclination towards nature and sustainable tourism. Countries like Germany, France, and the UK exhibit high demand for camping tents, spurred by both domestic and international tourists seeking natural escapades. European manufacturers emphasize durable and environmentally sustainable products, aligning with the region’s stringent environmental regulations.

In the Asia Pacific region, rapid urbanization and growing disposable incomes have led to increased leisure spending, including on outdoor activities such as camping. Countries like China, Japan, and Australia are witnessing a rise in camping popularity, which is boosting demand for high-quality camping tents.

The Middle East & Africa shows promising growth prospects, with the market in its nascent stages but expanding as tourism policies favor adventure and eco-tourism. The unique landscapes and climates in this region offer vast potential for destination camping, which in turn stimulates the camping tent market.

Lastly, Latin America is seeing an upturn in camping activities due to its diverse and scenic nature reserves and parks. Countries like Brazil and Argentina are progressively tapping into their natural resources to promote camping and outdoor activities, which supports the growth of the camping tent market in the region.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Camping Tent Market for 2023, key companies have positioned themselves as leaders through innovative product offerings and strategic market initiatives.

Notably, AMG-Group has demonstrated robust growth potential by expanding its distribution channels and enhancing product functionality to cater to diverse camping environments. Similarly, Hilleberg the Tentmaker continues to capitalize on its reputation for high-quality, durable tents, appealing particularly to the high-end market segment focused on extreme conditions.

JOHNSON OUTDOORS INC., a renowned player in the outdoor equipment sector, has leveraged its R&D capabilities to introduce eco-friendly and technologically advanced camping solutions, aligning with growing consumer demands for sustainability. The North Face, a subsidiary of VF Corporation, remains at the forefront of innovation with its integrated marketing strategies and product lines that emphasize both comfort and performance.

Newell Brands has seen positive traction in the market by broadening its portfolio to include family-oriented tent designs, which cater to a segment looking for reliable and spacious options. Oase Outdoors ApS has similarly focused on the family camping segment but has distinguished itself with modular tent designs that offer flexibility and scalability.

Big Agnes, Inc. and Exxel Outdoors, LLC both emphasize ultralight camping solutions, targeting the increasing number of adventure campers seeking compact and lightweight tents. Simex Outdoor International GmbH focuses on the European market with designs that prioritize both functionality and aesthetic appeal.

The Coleman Company, Inc. remains a dominant force, driven by its competitive pricing strategy and wide product range that appeals to both novice campers and seasoned outdoor enthusiasts. The growth of these companies can be attributed to their proactive adaptation to consumer preferences and the evolving camping landscape, setting them up for continued success in the global market.

Top Key Players in the Market

- AMG-Group

- Oase Outdoors ApS

- Simex Outdoor International GmBH

- Hilleberg the Tentmake

- Big Agnes, Inc.

- Exxel Outdoors, LLC

- JOHNSON OUTDOORS INC.

- The North Face, A VF Company

- Newell Brands

- The Coleman Company, Inc.

Recent Developments

- In September 2024, a Central Pennsylvania-based camping gear company expanded its operations by acquiring a New Jersey business, aiming to enhance its market presence in the northeastern United States.

- In January 2024, Eurocamp, part of the European Camping Group, broadened its portfolio by acquiring the assets of Vacansoleil, increasing its total number of mobile homes to over 45,000 across Europe.

- In September 2024, Montefiore Investment acquired a majority stake in Ciela Village, a prominent French camping group, through its latest fund, “Montefiore Investment VI,” signaling a strategic expansion in the European camping market.

Report Scope

Report Features Description Market Value (2023) USD 5.7 Billion Forecast Revenue (2033) USD 10.9 Billion CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Tunnel, Dome, Geodesic), By End-use (Individual, Commercial), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AMG-Group, Oase Outdoors ApS, Simex Outdoor International GmBH, Hilleberg the Tentmake, Big Agnes, Inc., Exxel Outdoors, LLC, JOHNSON OUTDOORS INC., The North Face, A VF Company, Newell Brands, The Coleman Company, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AMG-Group

- Oase Outdoors ApS

- Simex Outdoor International GmBH

- Hilleberg the Tentmake

- Big Agnes, Inc.

- Exxel Outdoors, LLC

- JOHNSON OUTDOORS INC.

- The North Face, A VF Company

- Newell Brands

- The Coleman Company, Inc.