Global Workwear Market By Product(Work Apparel, Work Footwear), By Demography(Men, Women), By Application(Construction, Chemical, Power, Food and Beverage, Biological and Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139125

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

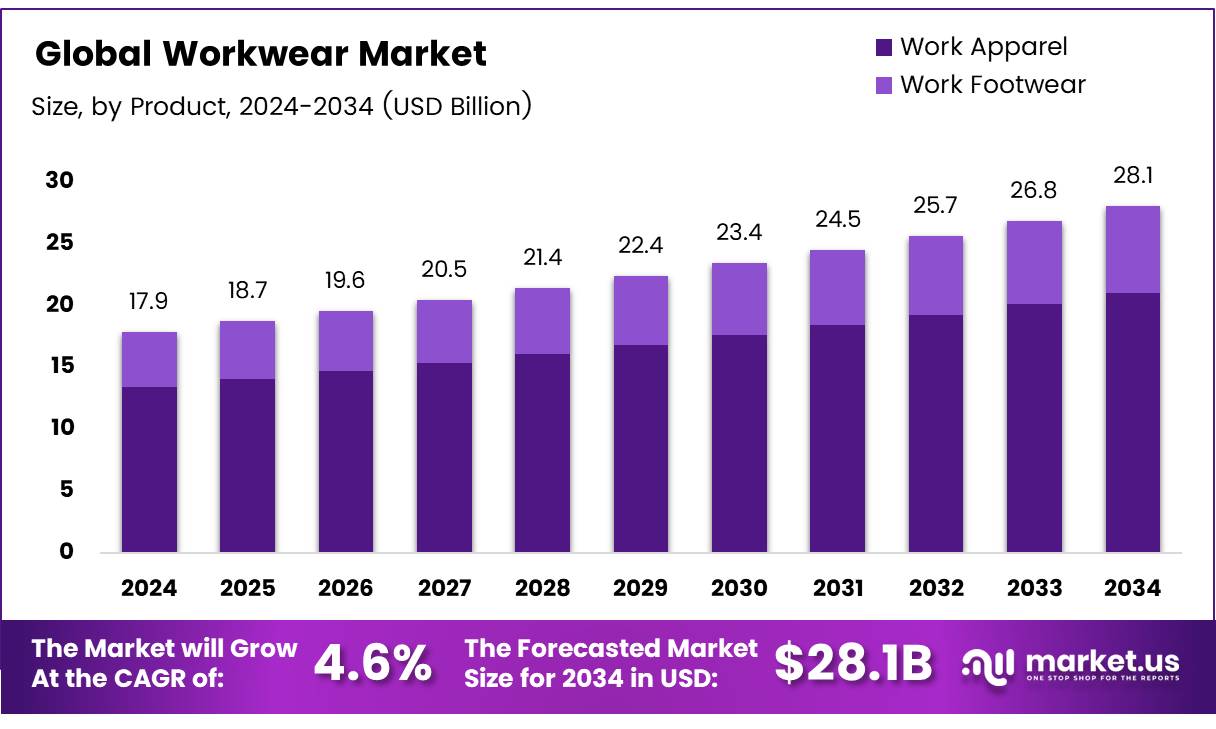

The Global Workwear Market size is expected to be worth around USD 28.1 Billion by 2034, from USD 17.9 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

Workwear refers to specialized clothing designed to meet the functional and safety needs of individuals in various professions. It includes items such as uniforms, protective gear, and apparel that is intended to withstand the demands of specific work environments, from construction sites to hospitals. The primary function of workwear is to ensure worker safety, comfort, and durability while also often reflecting the professional image of an organization.

The workwear market encompasses the production, distribution, and sale of such clothing across different industries. This market serves both individual workers and businesses, with products ranging from basic uniforms to advanced protective gear. As industries expand globally and safety regulations become more stringent, the workwear market has seen steady growth.

Factors such as increasing awareness around employee safety, technological advancements in fabric production, and changing consumer preferences are driving the market’s evolution. Additionally, the rising trend of online shopping and the growing demand for sustainable products are reshaping the market landscape.

The global workwear market is expected to witness significant growth in the coming years, driven by an increase in workplace safety regulations and technological innovations in fabric design. With rising emphasis on comfort, durability, and safety, there are growing opportunities for brands to innovate and cater to the evolving needs of workers.

According to a 2023 survey by Workwear Guru, 72% of workers consider comfort the most important factor when selecting workwear, followed by durability (68%) and safety features (61%). This indicates a substantial opportunity for manufacturers to focus on these key aspects to meet consumer demands.

Additionally, the demand for sustainable workwear is rising, with 67% of consumers indicating sustainability as an important factor in their purchasing decisions, according to the Sustainable Apparel Coalition as per Avenuez. Governments around the world are also contributing to market growth through the implementation of stricter workplace safety regulations.

Many countries are enforcing regulations that require businesses to provide high-quality, protective, and functional workwear for their employees, which further drives the demand for these products.

A major shift in purchasing habits is also influencing market dynamics. According to Workwear Guru, 55% of workers now prefer buying their workwear online, signaling the growing importance of e-commerce platforms in the sector. This digital shift, combined with the rise of eco-conscious consumers and government investments in safety standards, offers significant opportunities for growth, especially for businesses that can innovate while adhering to environmental and regulatory standards.

Key Takeaways

- The global Workwear Market is expected to reach USD 28.1 billion by 2034, growing at a CAGR of 4.6%.

- Work Apparel dominated the product segment in 2024, holding 75.1% of the market share.

- Men accounted for 87.8% of the global Workwear Market share in 2024, leading the By Demography Analysis segment.

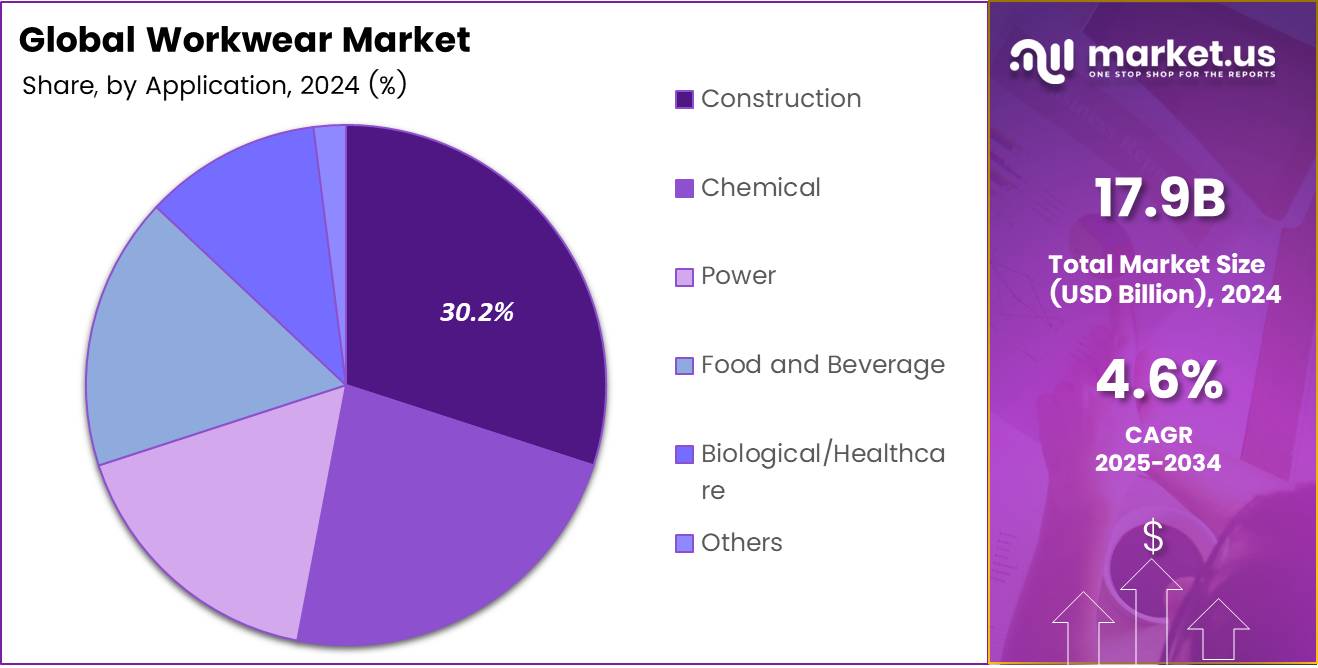

- The Construction sector held the largest share (30.2%) in the By Application Analysis segment in 2024.

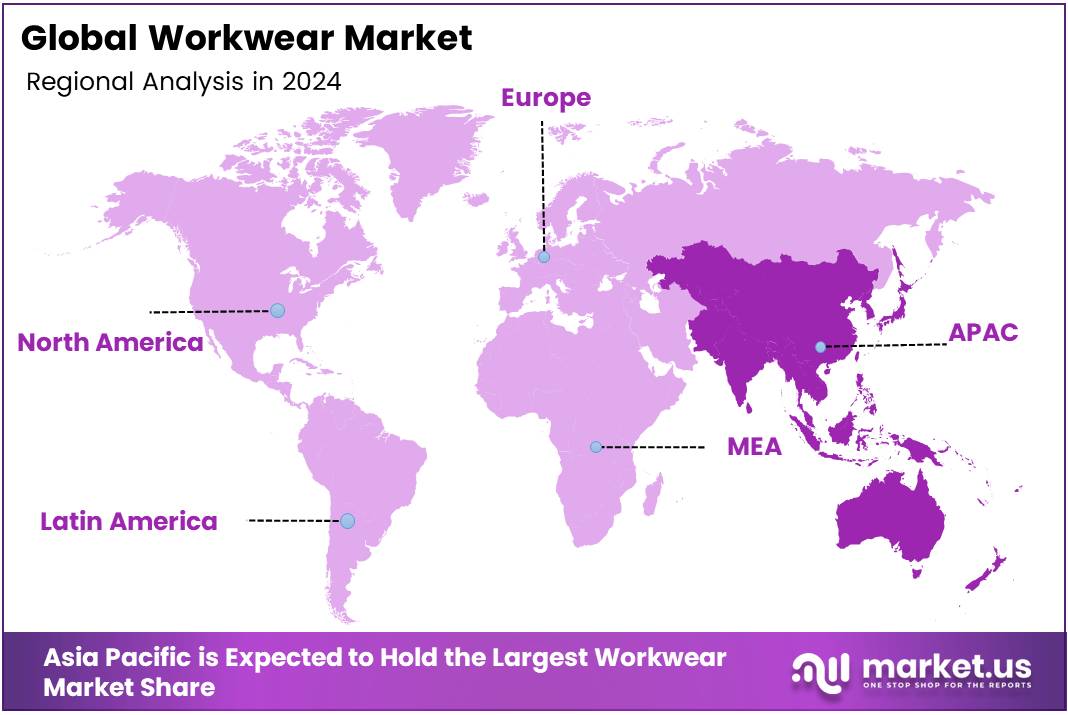

- Asia Pacific leads the global market with a 44.1% share, valued at USD 7.8 billion, driven by industrialization in China and India.

Product Analysis

Work Apparel Leads the Workwear Market with 75.1% Share in 2024, Driven by Versatility and Demand for Safety

In 2024, Work Apparel captured a dominant share of 75.1% in the By Product Analysis segment of the global Workwear Market. This growth is attributed to the high demand for both general and protective apparel, as industries prioritize safety and compliance with workplace regulations. Protective apparel, in particular, continues to lead, driven by stringent safety standards in sectors like construction, manufacturing, and healthcare, where durability, visibility, and hazard protection are non-negotiable.

General work apparel, including uniforms and everyday wear, also maintains significant traction due to its versatility and comfort, especially in sectors like retail and services. As industries evolve, there is an increasing focus on advanced fabrics that offer both functionality and comfort, alongside protection against various environmental risks.

Alongside Work Apparel, Work Footwear is an essential component, with both general and protective footwear contributing to a steady market presence. Footwear innovations focused on comfort, slip resistance, and impact protection continue to cater to the specific needs of workers in high-risk environments.

The combined strength of these segments underscores the growing prioritization of safety and functionality in the global workwear industry.

Demography Analysis

Men Dominate the Workwear Market with 87.8% Share in 2024, Driven by Industry-Centric Demand

In 2024, Men held a dominant position in the By Demography Analysis segment of the global Workwear Market, capturing 87.8% of the market share.

This significant share is largely driven by the higher representation of men in industries such as construction, manufacturing, and logistics, where durable and protective workwear is essential. These sectors have seen a sustained demand for a wide range of work apparel, including heavy-duty clothing and safety gear, where men are the predominant workforce.

While men’s workwear continues to lead in both volume and variety, there is an increasing recognition of the growing demand for women’s workwear. As industries become more inclusive and gender-balanced, the demand for women’s specific work apparel, designed to meet both functionality and comfort, has started to increase. This includes workwear tailored to women’s body shapes and specialized footwear, which cater to the expanding female workforce in traditionally male-dominated industries.

Though women’s workwear currently holds a smaller portion of the market, it is experiencing gradual growth, spurred by workplace diversification and the demand for equality in protective gear and apparel. The future of the Workwear Market will likely see more tailored innovations, as the focus shifts toward meeting the needs of both men and women in the workforce.

Application Analysis

Construction Sector Leads Workwear Market with 30.2% Share in 2024, Fueled by Safety and Durability Demands

In 2024, the Construction sector held a dominant position in the By Application Analysis segment of the Workwear Market, commanding a 30.2% share. This is primarily driven by the high demand for durable, safety-oriented apparel designed to withstand the rigors of construction environments.

The sector’s strict safety regulations and the need for personal protective equipment (PPE) in high-risk conditions, such as fall protection, high visibility, and weather-resistant clothing, have positioned it as the largest application for workwear globally.

The Chemical and Power industries also play a significant role in the market, accounting for a notable portion of demand. Protective apparel for chemical and power sectors is designed to offer specialized protection against hazardous materials, extreme temperatures, and potentially life-threatening accidents. This trend reflects ongoing efforts to ensure worker safety in these high-stakes industries.

The Food and Beverage and Biological/Healthcare sectors have seen a steady increase in demand for workwear tailored to meet hygiene, safety, and comfort requirements. Workers in these industries require protective clothing that not only safeguards them from physical hazards but also maintains cleanliness and compliance with health standards.

The Others category includes a range of industries, but their contribution remains smaller compared to the dominant sectors of Construction, Chemical, and Healthcare. However, as work environments diversify, the need for specialized workwear in these segments is expected to grow.

Key Market Segments

By Product

- Work Apparel

- General Apparel

- Protective Apparel

- Work Footwear

- General Footwear

- Protective Footwear

By Demography

- Men

- Women

By Application

- Construction

- Chemical

- Power

- Food and Beverage

- Biological/Healthcare

- Others

Drivers

Industrial Growth Drives Increased Demand for Workwear

The continued expansion of industrial sectors like manufacturing, construction, and mining is significantly driving the demand for workwear. As these industries grow, workers face greater exposure to risks, which requires more protective clothing. This trend is amplified by stricter workplace safety regulations imposed by governments and regulatory bodies.

These regulations, which mandate the use of protective gear, are pushing companies to invest in high-quality workwear to ensure worker safety and compliance with the law. Additionally, the rapid development of the construction and infrastructure sectors, particularly in emerging economies, is fueling the demand for durable, specialized workwear designed to withstand harsh working conditions.

Companies are also placing increasing emphasis on the overall health and well-being of their workforce. As a result, the demand for comfortable yet protective workwear is rising, as organizations recognize that worker comfort can directly impact productivity and morale. These factors combined industrial growth, safety regulations, booming construction activities, and a stronger focus on worker health are all contributing to a vibrant and expanding market for workwear.

Restraints

High Costs and Regulatory Gaps Pose Challenges for the Workwear Market

One of the key restraints facing the workwear market is the high cost of advanced and high-quality materials used in premium workwear. While these technologically advanced solutions offer improved durability, comfort, and safety, their higher price tags can make them unaffordable for some businesses, especially small and medium-sized enterprises.

As a result, many companies may opt for lower-cost alternatives that may not provide the same level of protection or performance, limiting the overall market growth for top-tier workwear.

Another challenge is the lack of standardization in workwear regulations across various regions. In some countries or industries, there are no clear, uniform standards for the safety and quality of workwear. This inconsistency can lead to regulatory challenges, as businesses may face difficulties in meeting different regional requirements or risk falling short of essential safety benchmarks.

Additionally, the absence of standardized workwear guidelines can hinder the development of a cohesive global market, as manufacturers may need to produce different products for different regions, increasing costs and complexity. These two factors—the high cost of advanced workwear and the regulatory gaps—pose significant hurdles to market expansion and could slow the adoption of higher-quality protective clothing in certain sectors.

Growth Factors

Emerging Markets and Customization Open New Growth Avenues for Workwear

The workwear market is poised for significant growth, especially in emerging regions like Asia-Pacific and Latin America, where industrialization is rapidly increasing. As manufacturing and construction sectors expand in these developing areas, there is a rising need for protective and functional workwear, presenting a prime opportunity for market players to tap into new customer bases.

Additionally, customization of workwear is becoming a key trend, as businesses seek personalized solutions that reflect their brand identity or offer specific functional features. Offering tailored designs, such as adding company logos or creating workwear with unique materials, can help attract businesses looking for specialized solutions.

Another growth opportunity lies in catering to niche sectors such as healthcare, food processing, and hazardous environments, where specialized workwear is essential for worker safety and efficiency. Companies that focus on developing high-quality, industry-specific gear for these sectors can tap into previously underserved markets.

Furthermore, the integration of wearable technology into workwear is a growing trend. Workwear with embedded sensors to monitor worker health, safety, and productivity can offer additional value to employers by enhancing workplace safety and operational efficiency.

This innovation presents a unique opportunity for manufacturers to develop smart workwear, which could become a key differentiator in a competitive market. Together, these factors—expansion into emerging markets, customization, niche sector focus, and wearable technology integration—offer substantial growth potential for the workwear industry.

Emerging Trends

Smart Technology and Comfort Are Shaping the Future of Workwear

The workwear market is undergoing significant transformation, with several key trends influencing its development. One of the most exciting trends is the incorporation of smart technology into workwear. Wearable tech, such as sensors embedded in clothing to monitor health, fatigue levels, or environmental conditions, is gaining popularity in industries where safety and performance are critical.

This allows employers to track worker health and productivity in real-time, offering a new level of protection and efficiency. Alongside this, there is a growing demand for comfort-oriented designs.

Workers, especially in physically demanding jobs, are increasingly seeking lightweight, breathable, and ergonomic workwear that ensures ease of movement and minimizes fatigue. This trend is driving manufacturers to focus on creating garments that don’t just protect but also prioritize worker comfort.

Another emerging trend is the innovation in personal protective equipment (PPE). Modern PPE now includes advanced features like antimicrobial materials, integration with wearable devices, and added comfort elements, providing extra safety and convenience.

Lastly, a trend of blending fashion with functionality is taking hold, particularly in industries like retail and hospitality. Urban and fashion-inspired workwear that combines practical features with stylish designs is becoming more common. This evolution in workwear is driven by the desire for clothing that is both protective and trendy, allowing workers to feel comfortable and confident while maintaining a professional appearance.

Regional Analysis

Asia Pacific leads the workwear market with 44.1% share and USD 7.8 billion

Asia Pacific holds the largest market share, dominating the workwear market with a substantial 44.1% share, translating to a market value of USD 7.8 billion. This dominance is driven by the rapid industrialization in countries like China and India, where demand for durable, high-performance workwear is increasing across sectors like manufacturing, construction, and automotive.

The growing adoption of workplace safety regulations, coupled with a rising number of industrial workers, is contributing to the robust demand in this region.

Regional Mentions:

North America is another key region, accounting for a significant portion of the global workwear market. The United States, in particular, is the leading market due to a mature economy and stringent workplace safety norms. The demand for workwear is primarily driven by industries such as oil and gas, construction, and utilities, where protective clothing is a critical requirement. In addition, the region’s increasing focus on sustainable and eco-friendly workwear solutions is propelling market growth.

Europe follows closely, supported by strong industrial sectors such as automotive, chemicals, and construction. Countries like Germany, France, and the UK exhibit steady demand for specialized workwear, driven by regulations mandating protective apparel and uniforms for workers in hazardous environments. Europe is also witnessing a rise in the use of high-tech, smart textiles in workwear, further boosting market growth.

The Middle East & Africa market is experiencing growth, particularly in sectors like oil & gas and construction. However, the market remains relatively smaller due to lower levels of industrial activity compared to other regions.

Lastly, Latin America is showing potential growth, especially in countries like Brazil and Mexico, where the demand for workwear is growing in sectors such as agriculture and mining.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global workwear market remains competitive, with several key players shaping its dynamics. Companies like Carhartt, Inc. continue to dominate with their reputation for durable, high-performance workwear tailored to industries such as construction, oil and gas, and manufacturing. Their focus on quality and innovation ensures a steady market presence.

Aramark, through its subsidiary Vestis, is also a significant player, capitalizing on its comprehensive workwear rental and laundry services for large organizations, particularly in the hospitality and healthcare sectors. Aramark’s ability to provide customized solutions that ensure uniform compliance and enhance employee safety positions it well in the growing demand for sustainable and functional work apparel.

Honeywell International, Inc. has strengthened its position with smart wearable technology integrated into its workwear. This innovation caters to sectors such as industrial manufacturing and energy, where real-time data collection on health, safety, and performance is crucial.

Kimberly-Clark Corporation continues to leverage its global reach, offering workwear solutions that cater to a variety of industries, while maintaining a focus on hygiene, safety, and comfort. Their strong brand recognition and sustainability efforts make them a leading choice for many businesses.

3M and Ansell Ltd., with their expertise in safety and protective equipment, are prominent in high-risk industries, including chemicals and pharmaceuticals. Both companies are focused on creating workwear that prioritizes safety and ergonomic design, addressing the rising demand for protective clothing.

Top Key Players in the Market

- Carhartt, Inc.

- Aramark (Vestis)

- Honeywell International, Inc.

- Kimberly-Clark Corporation

- A. Lafont SAS

- Hard Yakka

- Alsico Group

- Alexandra

- 3M

- Ansell Ltd.

Recent Developments

- In March 2024, safety helmet startup STUDSON secured $2.48 million in funding to accelerate product development, alongside a strategic partnership with Blaklader to enhance distribution and market reach.

- In January 2025, Lyreco announced its acquisition of Groenendijk Workwear in the Netherlands, aiming to expand its portfolio and deepen expertise in workwear and footwear solutions for professional markets.

- In November 2024, Lindström Group strengthened its presence in the UK by acquiring Micronclean’s industrial workwear business, reinforcing its position as a leading provider of workwear rental and laundry services in the region.

Report Scope

Report Features Description Market Value (2024) USD 17.9 Billion Forecast Revenue (2034) USD 28.1 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Work Apparel, Work Footwear), By Demography(Men, Women), By Application(Construction, Chemical, Power, Food and Beverage, Biological and Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Carhartt, Inc., Aramark (Vestis), Honeywell International, Inc., Kimberly-Clark Corporation, A. Lafont SAS, Hard Yakka, Alsico Group, Alexandra, 3M, Ansell Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Carhartt, Inc.

- Aramark (Vestis)

- Honeywell International, Inc.

- Kimberly-Clark Corporation

- A. Lafont SAS

- Hard Yakka

- Alsico Group

- Alexandra

- 3M

- Ansell Ltd.