Global Camera Tripods Market By Product Type (Travel Tripods, Studio Tripods, Mini or Tabletop Tripods, Compact Tripods, Full-Sized Tripods, Traditional Tripods, Monopods, Others), By Material Type (Aluminum, Carbon Fiber, Plastic, Wood, Others), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134542

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Environment Analysis

- Product Type Analysis

- Material Type Analysis

- Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Major Challenges

- Emerging Trends

- Regional Analysis

- Competitive Landscape Analysis

- Recent Developments

- Report Scope

Report Overview

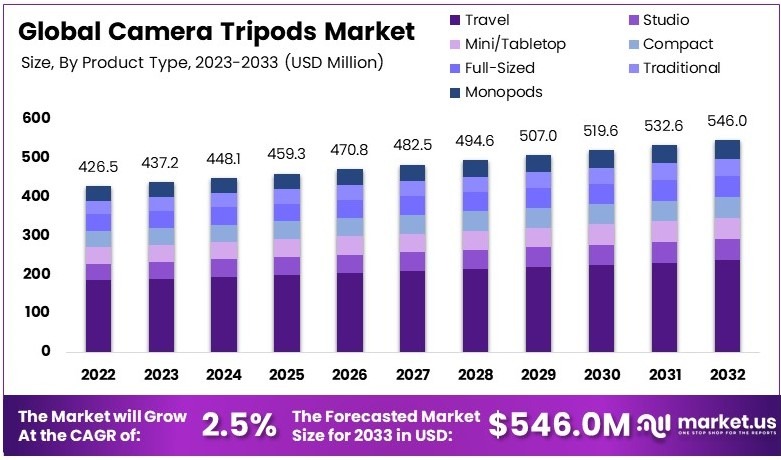

The Global Camera Tripods Market size is expected to be worth around USD 546.0 Million by 2033, from USD 426.5 Million in 2023, growing at a CAGR of 2.5% during the forecast period from 2024 to 2033.

Camera tripods are tools used to stabilize cameras for photography and videography. They consist of three legs and a mounting head that holds the camera securely. Tripods help reduce camera shake, enabling clearer shots and smoother videos, especially in low-light conditions or during long exposures.

The camera tripod market refers to the global industry focused on the production and sale of tripods for cameras. This market includes products for professionals and hobbyists, offering various designs and materials. Manufacturers, suppliers, and retailers cater to photographers seeking stability and precision in capturing images and videos.

The camera tripod market is growing steadily, supported by 3.6 million photographers globally, according to Eksposure. In the U.S., 47,380 professional photographers were reported in 2022 by the Bureau of Labor Statistics, with 68% self-employed. This growth is driven by increased content creation and demand for professional-quality photography accessories.

Advancements in lightweight materials and portable tripod designs create new opportunities. As self-employed photographers make up a significant share of users, they seek versatile and durable options. Additionally, social media trends and rising vlogging activities globally fuel demand for compact and flexible tripods tailored for digital content creators.

Locally, demand is influenced by regional photography trends and accessibility to high-quality equipment. Globally, emerging markets offer growth potential due to increasing adoption of digital photography. In mature markets, innovation in materials, such as carbon fiber, and multifunctional designs help maintain competitiveness and appeal to professional photographers.

Key Takeaways

- The Camera Tripods Market was valued at USD 426.5 million in 2023 and is expected to reach USD 546.0 million by 2033, with a CAGR of 2.5%.

- In 2023, Travel Tripods led with 43.2%, catering to lightweight and portable photography needs.

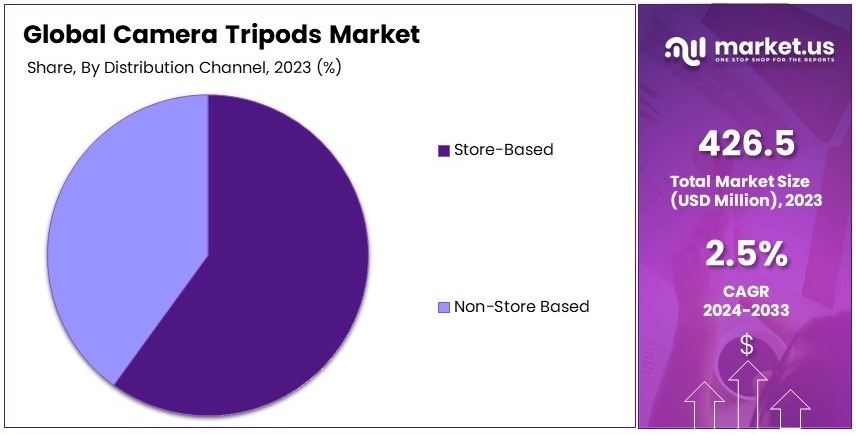

- In 2023, Store-Based Distribution dominated due to hands-on product testing.

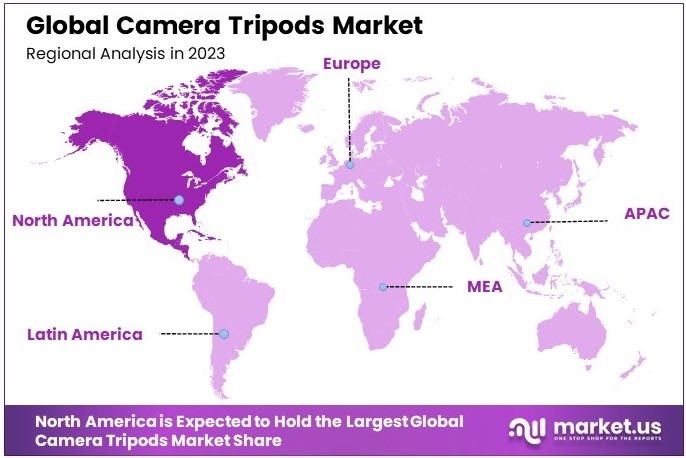

- In 2023, North America was dominant, driven by a high concentration of professional photographers and content creators.

Business Environment Analysis

The camera tripod market is approaching saturation, evidenced by the proliferation of brands and features. Despite this, innovations like SmallRig’s introduction of hydraulic technology in 2024 demonstrate that differentiation is still possible within this competitive field.

The target demographic for camera tripods includes the estimated 3.6 million photographers globally. This diverse group prioritizes features like rapid setup and ease of use, trends that are shaping the current market offerings.

Investment opportunities are growing in areas such as material science and mechanical design to further enhance tripod functionality. With 1.94 trillion photos taken annually as of 2024, the demand for reliable and advanced digital camera supports like tripods is expected to rise.

Export-import dynamics are a critical aspect of the tripod market, shaped by the concentration of manufacturing activities in Asia and the widespread global demand. Navigating these dynamics effectively is crucial for maintaining market presence and optimizing cost-efficiency.

Product Type Analysis

Travel Tripods dominate with 43.2% due to their compactness, portability, and growing demand from mobile photographers and travelers.

The camera tripod market can be segmented by product type into travel tripods, studio tripods, mini/tabletop tripods, compact tripods, full-sized tripods, traditional tripods, monopods, and others. Among these, travel tripods represent the dominant sub-segment, with a market share of 43.2%.

Travel tripods have gained significant popularity due to their compact size, portability, and suitability for photographers who need a lightweight and easy-to-carry tripod during their travels.

Studio tripods, on the other hand, cater to a different set of users, mainly professionals in controlled environments. They are designed for heavy-duty use and are usually more stable and rigid, which is essential for studio photography where precise shots are necessary.

Mini/tabletop tripods are another popular sub-segment, especially among casual photographers and content creators. These smaller tripods are used for tabletop setups or close-up photography. They are not intended for full-length shots but are useful for capturing still objects or small vlogging setups.

Full-sized and traditional tripods are generally preferred by more experienced photographers who need maximum stability and support for their cameras. Full-sized tripods are often used in landscape photography or for long-exposure shots.

Material Type Analysis

Aluminum dominates with 38.5% due to its balanced combination of durability, weight, and cost-effectiveness.

The camera tripod market is also segmented by material type, which includes aluminum, carbon fiber, plastic, wood, and others. Aluminum is the leading material type in the market, with a share of 38.5%. Aluminum tripods are highly favored for their balance of durability, lightweight nature, and affordability.

Aluminum tripods are often used in travel and compact models, where weight is a key consideration, while still offering sufficient strength to support most consumer-grade cameras. Furthermore, aluminum is widely available, which contributes to its cost-effectiveness and broad adoption in various product ranges.

Carbon fiber, while representing a smaller segment compared to aluminum, is growing in popularity, especially among professional photographers. Carbon fiber tripods are known for being even lighter than aluminum while offering excellent durability and vibration reduction.

Plastic tripods, which are typically lighter but less durable, cater to a different market segment, especially for entry-level consumers or those who use lightweight digital cameras or smartphones.

Wooden tripods, though rare, are still found in niche markets, particularly among vintage or traditional photography enthusiasts. Wooden tripods are prized for their aesthetic appeal and the natural, organic feel they provide, but they lack the same stability and durability as metal or carbon fiber alternatives.

Distribution Channel Analysis

Store-based retail dominates with 65% due to customer preference for hands-on evaluation and immediate purchase.

The camera tripod market can be segmented by distribution channel into store-based and non-store-based sales. Store-based retail dominates this segment, accounting for 65% of the market share. Store-based retail encompasses supermarkets, hypermarkets, specialty stores, and other physical retail locations.

Consumers prefer purchasing camera tripods in-store for several reasons. The most significant is the ability to physically inspect the product before buying. Many customers want to touch and feel the tripod, check its stability, weight, and features, and see how well it holds a camera before making a purchasing decision.

Specialty stores that focus on photography and outdoor equipment are particularly important in the camera tripod market. These stores cater specifically to consumers who are seeking professional-quality tripods and have knowledgeable staff who can assist with product selection.

Non-store-based retail, particularly online sales, is growing rapidly, driven by the increasing preference for the convenience of shopping from home. Online platforms such as Amazon, B&H Photo Video, and specialized photography equipment websites have made it easier for consumers to access a wide range of camera tripods, read reviews, compare prices, and find promotions.

Key Market Segments

By Product Type

- Travel Tripods

- Studio Tripods

- Mini/Tabletop Tripods

- Compact Tripods

- Full-Sized Tripods

- Traditional Tripods

- Monopods

- Others

By Material Type

- Aluminum

- Carbon Fiber

- Plastic

- Wood

- Others

By Distribution Channel

- Store-Based

- Supermarkets & Hypermarkets

- Specialty Stores

- Others

- Non-Store Based

- Online Retailers

- Others

Driving Factors

Demand for Stable and Precise Photography Drives Market Growth

The Camera Tripod Market is expanding due to the increasing demand for stable, high-quality photography, which is crucial for both professional photographers and hobbyists. With the rise of social media platforms like Instagram and YouTube, there is a growing need for stable images and videos, leading to an increase in the adoption of camera tripods.

These devices provide the required stability, eliminating blur from camera shake and ensuring sharp images in low-light environments. Additionally, as the quality of digital cameras continues to improve, photographers are seeking accessories that can support and enhance their equipment.

With increasing interest in photography and videography, whether for personal, professional, or content creation purposes, the demand for camera tripods is expected to continue its upward trend. Moreover, technological advancements in tripod designs, such as lightweight materials, improved portability, and more robust features, have further fueled the growth of the market.

Restraining Factors

High Prices and Limited Portability Restrain Market Growth

Despite the growing demand for camera tripods, several factors limit their widespread adoption. High prices for premium models, especially those with advanced features or made from high-quality materials, can discourage price-sensitive consumers. For many, the initial investment in a tripod may not seem justified, especially for casual photographers who do not require professional-grade equipment.

Additionally, some tripods remain bulky and difficult to transport, which limits their appeal to travelers and casual users. While professional photographers may value stability and sturdiness, these features often result in heavier and less portable models, making it inconvenient for users who need portability for fieldwork.

Furthermore, competition from alternative stabilizing devices, such as handheld gimbals, adds additional pressure on tripod sales. These factors, combined with price sensitivity and design limitations, pose significant challenges to the growth of the camera tripod market.

Growth Opportunities

Smart Integration and Compact Designs Provide Opportunities

The camera tripod market is witnessing new growth opportunities, particularly in the areas of smart technology and compact design. As the demand for multifunctional photography tools increases, there is a growing market for tripods that integrate smart features, such as remote control, app connectivity, or automated movement for time-lapse photography.

Additionally, compact and foldable tripod designs are becoming increasingly popular, driven by the growing trend of travel and outdoor photography. Consumers are seeking lightweight, space-saving options that do not compromise on stability.

Manufacturers that can provide smart, portable, and user-friendly tripods will find significant opportunities for growth in this evolving market. As new materials and design innovations emerge, such as carbon fiber and advanced lightweight metals, manufacturers are better equipped to meet the rising demand for portable yet sturdy tripods that cater to diverse photography needs.

Major Challenges

Competition from Alternative Stabilizing Devices Challenges Market Growth

The camera tripod market faces significant challenges due to the increasing popularity of alternative stabilizing devices. Technologies such as handheld gimbals and other electronic stabilization systems provide an alternative to traditional tripods, offering smoother and more flexible shooting options.

Additionally, the growing capabilities of smartphones, which now come equipped with advanced image stabilization technologies, have led to a decline in demand for traditional tripods, especially among casual photographers. The rise of drone photography also presents a challenge to the traditional tripod market, as drones offer stable, aerial shots without the need for ground-based stabilization.

These competing technologies, along with the increasing versatility of smartphones, continue to challenge the camera tripod market by offering more flexible, innovative solutions for both professional and amateur users.

Emerging Trends

Lightweight Materials and Versatile Features Are Latest Trending Factor

The camera tripod market is increasingly influenced by the trend towards lightweight materials and versatile features. With photographers and videographers constantly on the move, portability has become a key factor in the purchasing decision.

Lightweight materials, such as carbon fiber and aluminum, allow for greater ease of transport without compromising on the tripod’s stability and durability. At the same time, the demand for versatile features, such as adjustable height, multi-angle legs, and enhanced adjustability, has become prominent.

The growing trend toward versatile, portable tripods aligns with the needs of travelers, content creators, and professionals who require equipment that can perform across multiple settings and conditions. This shift towards convenience and functionality in camera tripod design is driving the market’s expansion.

Regional Analysis

North America Dominates with the Largest Market Share in Camera Tripods

North America leads the Camera Tripods Market, supported by a high demand from professional photographers, content creators, and hobbyists. The region benefits from widespread use of advanced cameras for commercial and recreational purposes. The rising popularity of vlogging and social media content creation has further boosted tripod sales.

The market in North America is characterized by the presence of leading manufacturers offering lightweight, durable, and feature-rich tripods. High disposable incomes and access to premium camera accessories drive growth. Additionally, the availability of innovative products, such as compact and travel-friendly tripods, contributes to the region’s market dominance.

North America is expected to maintain its leading position as photography and videography trends grow. Advancements in tripod technology, including smartphone compatibility and automation features, are likely to strengthen the region’s influence in the global market.

Regional Mentions:

- Europe: Europe sees steady growth in the Camera Tripods Market, driven by demand from professional photographers and increasing interest in travel photography. Lightweight and foldable tripods are particularly popular.

- Asia Pacific: Asia Pacific is rapidly growing due to rising camera ownership and a surge in social media content creation. Countries like China and India lead in adopting affordable and versatile tripods.

- Middle East & Africa: The market in the Middle East & Africa is emerging, supported by growing interest in photography and videography. Premium tripods are gaining popularity in urban areas.

- Latin America: Latin America experiences growth as photography gains traction as a hobby and profession. Demand is rising for durable and cost-effective tripods, with Brazil and Mexico leading the region.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape Analysis

The Camera Tripods Market is driven by innovation and user-centric designs, with a few companies dominating the segment.

Manfrotto (Vitec Group) leads the market with its high-quality, versatile tripods, suitable for both professionals and hobbyists. Known for durability and stability, Manfrotto’s tripods cater to various photography needs. Their wide product range and constant innovation ensure a strong presence globally.

Gitzo (Vitec Group) stands out with its premium tripods designed for high-end users. Renowned for their lightweight yet robust construction, Gitzo products are ideal for professional photographers and videographers. Their use of advanced materials like carbon fiber ensures superior performance and positions them as a leader in the premium segment.

Benro is a key player focusing on affordability without compromising on quality. Its range includes tripods for entry-level users and professionals. The company’s emphasis on innovation, such as adjustable legs and compact designs, appeals to a broad customer base.

Joby (A Joby Inc.) revolutionized the market with its flexible and portable GorillaPod line. Designed for on-the-go photographers and content creators, Joby’s innovative approach combines versatility with ease of use. Its products are highly popular among vloggers and social media influencers.

These companies—Manfrotto, Gitzo, Benro, and Joby—drive the Camera Tripods Market by addressing diverse consumer needs through innovation, quality, and competitive pricing. Their ability to adapt to changing consumer preferences and advancements in photography technology ensures sustained market growth and leadership.

Top Key Players in the Market

- Manfrotto (Vitec Group)

- Gitzo (Vitec Group)

- Benro

- Velbon

- Joby (A Joby Inc.)

- Slik

- MeFOTO (Benro)

- Peak Design

- Neewer

- Sirui

- K&F Concept

- Feisol

- Photopro

- Zomei

- AmazonBasics

Recent Developments

- Benro: In June 2024, Benro introduced the KH25PC and KH26PC video tripod kits. The KH26PC supports up to 6.8 kg, featuring smooth panning, bubble levels, and interchangeable pan arms for professional results.

- Benro: In June 2024, Benro launched the Theta, a modular, self-leveling travel tripod with enhanced stability. Powered by a rechargeable battery, its intelligent auto-leveling system offers quick, precise adjustments for professional photographers and videographers.

- Edelkrone: In January 2024, Edelkrone unveiled the Tripod X, the first fully motorized video tripod, supporting up to 30 kg. With a height range of 34 cm to 148 cm, it offers automatic height adjustment and self-leveling.

Report Scope

Report Features Description Market Value (2023) USD 426.5 Million Forecast Revenue (2033) USD 546.0 Million CAGR (2024-2033) 2.50% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Travel Tripods, Studio Tripods, Mini/Tabletop Tripods, Compact Tripods, Full-Sized Tripods, Traditional Tripods, Monopods, Others), By Material Type (Aluminum, Carbon Fiber, Plastic, Wood, Others), By Distribution Channel (Store-Based [Supermarkets & Hypermarkets, Specialty Stores, Others], Non-Store Based [Online Retailers, Others]) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Manfrotto (Vitec Group), Gitzo (Vitec Group), Benro, Velbon, Joby (A Joby Inc.), Slik, MeFOTO (Benro), Peak Design, Neewer, Sirui, K&F Concept, Feisol, Photopro, Zomei, AmazonBasics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Manfrotto (Vitec Group)

- Gitzo (Vitec Group)

- Benro

- Velbon

- Joby (A Joby Inc.)

- Slik

- MeFOTO (Benro)

- Peak Design

- Neewer

- Sirui

- K&F Concept

- Feisol

- Photopro

- Zomei

- AmazonBasics