Global Butternut Squash Market Size, Share, And Industry Analysis Report By Form (Fresh, Frozen, Puree), By Application (Food and Beverages, Cosmetics, Baby Food), By Distribution Channel (Supermarkets, Online Retailers, Wholesale Market, Specialty Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176751

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

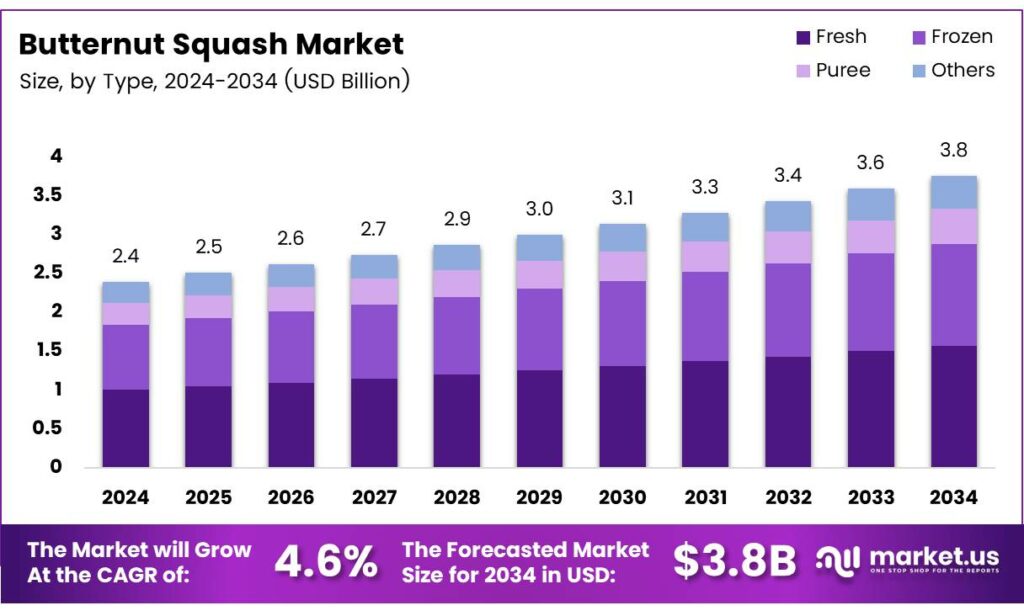

The Global Butternut Squash Market size is expected to be worth around USD 3.8 billion by 2034, from USD 2.4 billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The Butternut Squash Market continues to evolve as consumers seek nutrient-dense produce, clean-label ingredients, and versatile vegetable-based foods. The market reflects strong engagement from both fresh and processed product manufacturers, supported by rising interest in plant-based diets. As demand expands, producers emphasize quality, sustainability, and enhanced nutritional value to strengthen market positioning.

The market benefits from increasing adoption of controlled cultivation practices, enabling farmers to improve consistency in texture, sweetness, and shelf stability. Rapid growth in ready-to-cook meals and puree-based applications further encourages global trade, driving commercial interest across retail, foodservice, and processing industries. These trends collectively enhance the long-term attractiveness of butternut squash as a scalable crop.

- Nutrient composition varies significantly across farming systems and varieties. Findings show that organic squashes contained 1.3-fold higher essential amino acids, alongside increases in potassium by 9%, magnesium by 67%, sodium by 29%, manganese by 3-fold, zinc by 2-fold, and tocopherol by 4-fold. Meanwhile, conventional cultivation achieved 15% higher folic acid and 62% higher β-carotene, supporting functional-food demand.

Varietal performance influences commercial returns. The Pluto variety delivered 24% higher folic acid and 80% higher β-carotene, while Ariel recorded a 3-fold increase in tocopherol. Yields also differed, with conventional farming producing 45.7 t/ha (Ariel) and 42.7 t/ha (Pluto), whereas organic output fell 15%, reaching 38.7 t/ha and 36.7 t/ha, shaping strategic decisions in the Butternut Squash Market.

Additionally, supportive government programs promoting vegetable consumption and farm-level modernization boost market confidence. Investments in drip-irrigation, post-harvest storage, and organic farming certifications continue to unlock new opportunities. Regulations encouraging pesticide reduction and improved soil practices also reshape production systems, offering producers a strong avenue to differentiate premium butternut squash varieties within competitive fresh-produce categories.

Key Takeaways

- The Global Butternut Squash Market is projected to reach USD 3.8 billion by 2034, growing from USD 2.4 billion in 2024 at a 4.6% CAGR.

- Fresh form leads the market with a 61.8% share in 2025, dominating the overall Form segment.

- Food & Beverages is the top Application segment, accounting for 68.3% of total butternut squash consumption.

- Supermarkets dominate the Distribution Channel with a 48.1% contribution in 2025.

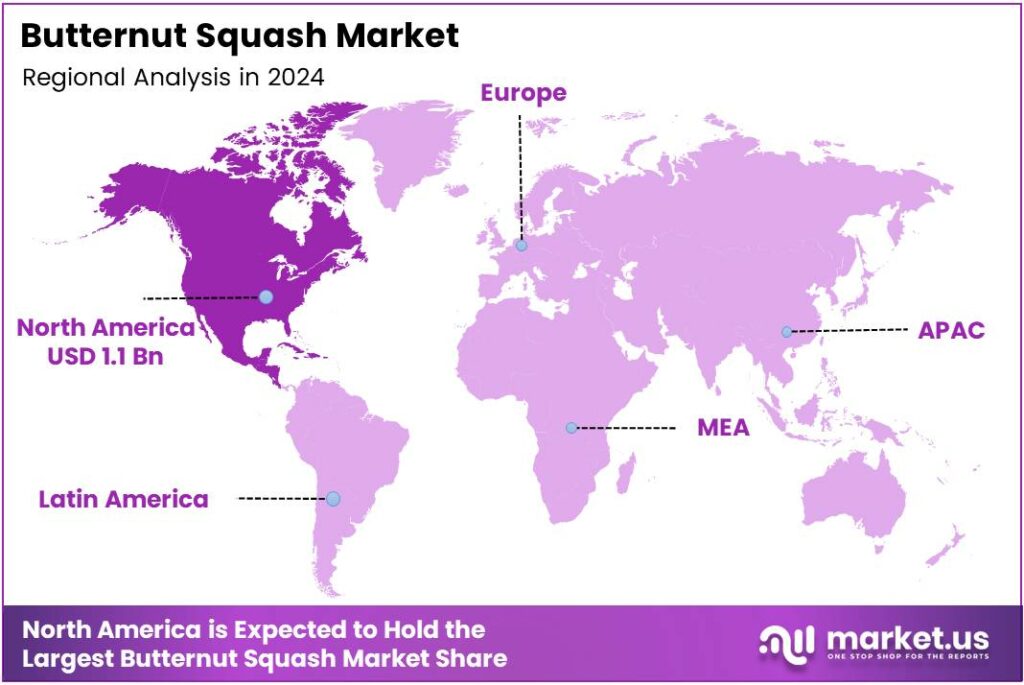

- North America leads regionally with a 44.9% share, valued at USD 1.1 billion in 2025.

By Form Analysis

Fresh dominates with 61.8% due to its natural taste and strong consumer preference.

In 2025, Fresh held a dominant market position in the By Form Analysis segment of the Butternut Squash Market, with a 61.8% share. Fresh butternut squash continues gaining traction as consumers seek minimally processed produce. Its long shelf life, versatility in cooking, and clean-label appeal drive strong retail and culinary demand worldwide.

Frozen butternut squash recorded steady growth as households embrace convenient meal ingredients. Frozen formats reduce preparation time and maintain nutritional quality, appealing to busy consumers. Food processors also adopt frozen squash for year-round supply consistency. Despite lacking the dominance of fresh formats, frozen options remain important for modern retail segments.

The Puree segment expanded gradually due to rising use in soups, sauces, bakery fillings, and ready-to-eat meals. Manufacturers value puree for its smooth texture and standardized flavor, enabling efficient large-scale production. Although not as widely used as fresh or frozen forms, puree consumption continues to increase across foodservice and packaged food applications.

By Application Analysis

Food and Beverages dominate with 68.3% as the primary consumption category.

In 2025, Food and Beverages held a dominant market position in the By Application Analysis segment of the Butternut Squash Market, with a 68.3% share. Its wide use in soups, salads, casseroles, bakery items, and beverages supports strong commercial and household adoption. Rising focus on plant-based diets further strengthens category demand.

The Cosmetics segment experienced moderate growth as beauty brands incorporate squash extracts for moisturization and antioxidant benefits. Butternut squash-based formulations appeal to consumers seeking naturally sourced skincare ingredients. Although comparatively smaller, the segment grows steadily with rising clean-beauty trends and botanical-based product development.

Baby Food applications remain a reliable segment due to the vegetables’ mild flavor and smooth texture. Parents increasingly prefer natural vegetable purees free from additives, supporting butternut squash adoption in infant nutrition. Demand from ready-to-feed baby food lines also encourages consistent procurement from food manufacturers.

By Distribution Channel Analysis

Supermarkets dominate with 48.1% due to strong retail visibility.

In 2025, Supermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Butternut Squash Market, with a 48.1% share. These stores offer high product visibility, diverse form options, and competitive pricing. Supermarkets remain the primary choice for household grocery shopping, ensuring steady butternut squash movement.

Online Retailers experienced rapid adoption as consumers shifted to digital grocery platforms. Home delivery convenience and easy access to multiple brands support this segment’s rise. Online retailers also promote organic and value-added butternut squash formats, appealing to health-conscious and tech-savvy buyers.

The Wholesale Market segment plays a crucial role in supplying restaurants, food processors, and institutional clients. Bulk availability and cost-efficient procurement strengthen its relevance. Despite not leading in share, wholesalers ensure a continuous supply flow across commercial buyers who depend heavily on reliable sourcing.

Specialty Stores and Others cater to organic, gourmet, and premium product seekers. These outlets emphasize quality, niche varieties, and curated selections. Although comparatively smaller, these channels attract consumers willing to pay more for freshness, traceability, or specialty butternut squash products.

Key Market Segments

By Form

- Fresh

- Frozen

- Puree

- Others

By Application

- Food and Beverages

- Cosmetics

- Baby Food

- Others

By Distribution Channel

- Supermarkets

- Online Retailers

- Wholesale Market

- Specialty Stores

- Others

Emerging Trends

Growing Popularity of Plant-Based Recipes Fuels Market Trends

The trend toward plant-based eating is shaping new consumption patterns in the butternut squash market. More consumers are exploring vegetable-centric dishes, leading to higher interest in squash-based soups, purees, and roasted meal options. Social media platforms also contribute by promoting easy, healthy recipes that highlight squash as a versatile ingredient.

- Butternut squash also benefits from credible nutrient data that food developers can point to without hype. One government-linked nutrient table reports that “squash, winter, butternut, frozen, unprepared” provides 2152 µg of beta-carotene per 113 g serving.

Food service chains and fine-dining restaurants are adopting butternut squash for seasonal menus. This trend is driven by customer demand for fresh, colorful, nutrient-rich meals. Seasonal dishes like squash ravioli, salads, and gourmet side dishes remain popular, especially during colder months.

Drivers

Rising Preference for Healthy and Natural Food Boosts Market Demand

Growing consumer interest in healthy eating is strongly supporting the demand for butternut squash. People prefer vegetables rich in vitamins, fiber, and antioxidants, making butternut squash a popular choice for everyday meals. This shift toward natural and nutritious foods continues to push retailers and producers to expand supply.

- Butternut squash is hardy compared with many vegetables, but it is not immune to supply-chain losses, grading rejections, and shrinkage—especially once it is cut or moved long distances. The Food and Agriculture Organization of the United Nations reports that 13.2% of food is lost in the supply chain after harvest and before retail stages.

The market is also benefiting from the increasing popularity of plant-based diets. More households are adding vegetables to their weekly meal plans, which encourages higher consumption of butternut squash in soups, salads, and baked dishes. Restaurants and food brands are including squash-based recipes to meet the rising preference for clean-label ingredients.

Restraints

Seasonal Production Challenges Limit Continuous Market Supply

Seasonal dependency remains one of the biggest challenges for the butternut squash market. Since the crop can only be grown in specific climatic conditions, the supply often fluctuates throughout the year. This causes price instability, making it harder for producers and retailers to maintain consistent sales.

- The market also faces limitations due to high storage and handling costs. Butternut squash needs proper temperature control during transportation to prevent spoilage. In the United States, total squash utilized production reached 6,146.7 (1,000 cwt) in 2024, reflecting the scale moving through commercial channels.

Unpredictable weather patterns, including droughts and heavy rains, further affect crop yield. These environmental challenges lead to lower production and impact distribution networks, especially in developing countries where farming technologies are limited.

Growth Factors

Expanding Use in Packaged and Ready-to-Cook Foods Creates New Market Prospects

The rise of ready-to-cook and convenience meals is opening strong opportunities for the butternut squash market. Food processors are incorporating squash into pre-cut vegetable packs, frozen blends, and microwavable meal boxes. This helps busy consumers access nutritious meals quickly without preparation time.

- There is also increasing demand for butternut squash in baby food products. Its soft texture, mild flavor, and nutrient-rich profile make it ideal for infant meals. USDA reporting squash processing utilized production of 87,750 tons in 2024. The World Health Organization states that everyone older than 10 should aim for at least 400 grams of fruits and vegetables per day.

Export opportunities are growing as international consumers show rising interest in exotic and healthy vegetables. Countries with limited local production rely on imports, allowing farmers and exporters to expand distribution networks. The development of value-added products like squash noodles, snacks, bakery fillings, and beverages is creating new revenue streams.

Regional Analysis

North America Dominates the Butternut Squash Market with a Market Share of 44.9%, Valued at USD 1.1 Billion

North America leads the global butternut squash market, accounting for a commanding 44.9% share and generating around USD 1.1 billion in 2025. The region benefits from strong consumer preference for healthy, plant-based foods and widespread retail availability. High adoption in both fresh and processed product formats strengthens regional dominance. Additionally, seasonal demand, expanding organic farming, and rising household consumption patterns continue to support steady regional growth.

Europe represents a mature and steadily expanding market driven by increasing interest in nutrient-rich vegetables and culinary diversification. Consumption is supported by a high awareness of seasonal produce and a strong presence of local farming communities. Growth in ready-to-cook vegetable offerings and rising preference for natural ingredients further enhance the region’s butternut squash demand.

Asia Pacific is emerging as a high-potential market as regional consumers shift toward healthier diets and diversify vegetable consumption. Expanding agricultural output in countries such as China and India supports a year-round supply. Urbanization, rising disposable incomes, and the adoption of Western-style cuisine contribute to increasing demand for butternut squash across foodservice and retail channels.

The Middle East & Africa market is gradually expanding, driven by a growing focus on fresh produce imports and improving distribution networks. Rising interest in nutrient-dense foods and diversification of household diets are contributing factors. Although overall market penetration remains moderate, improving retail infrastructure and culinary globalization are creating new growth opportunities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dole Food Company is well-positioned to influence the butternut squash market in 2025 through its scale in fresh produce sourcing, ripening, and distribution. Dole’s advantage is dependable supply coordination across multiple growing regions, which helps retailers manage seasonal swings. The brand’s strength in retail relationships can support wider squash visibility through ready-to-cook packs and mixed-vegetable assortments.

Fresh Del Monte Produce brings a similar global logistics edge, and its performance in 2025 likely depends on how effectively it balances freshness with freight costs. Butternut squash benefits from a longer shelf life than many vegetables, making it a good fit for Del Monte’s export-oriented model. Analysts would watch its private-label partnerships and value-added formats that reduce prep time for consumers.

Sysco Corporation matters less as a grower and more as a demand-shaping channel for foodservice. In 2025, Sysco can expand butternut squash usage by standardizing cuts (cubes, spirals, purees) that simplify kitchen labor and cut waste. Its broad customer base—restaurants, institutions, and caterers—can stabilize volume even when retail demand softens.

Earthbound Farm is a key signal for premium and organic positioning, especially where shoppers pay for traceability and clean sourcing. In 2025, Earthbound’s opportunity is to connect butternut squash to wellness-led meal solutions, such as roasting kits and salad add-ins. From a competitive view, the brand’s differentiation will rely on consistent quality, packaging innovation, and strong merchandising in natural and specialty retail.

Top Key Players in the Market

- Dole Food Company

- Fresh Del Monte Produce

- Sysco Corporation

- Earthbound Farm

- Green Giant

- Birds Eye Foods

- Cascadian Farm

- Bonduelle Group

- Riverford Organic Farmers

- Driscoll’s

Recent Developments

- In 2025, Dole advanced public-private partnerships to expand access to essential services like healthcare and education for agricultural workers in its operations. The company maintains goals such as donating 2,500 tons of fresh fruits and vegetables to communities and developing digital initiatives to promote healthy eating.

- In 2025, a company executive discussed the future of produce departments at retail, highlighting the impact of new dietary guidelines emphasizing fruits and vegetables, acquisition of Del Monte Foods assets to expand convenient produce offerings.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Billion Forecast Revenue (2034) USD 3.8 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Fresh, Frozen, Puree, Others), By Application (Food and Beverages, Cosmetics, Baby Food, Others), By Distribution Channel (Supermarkets, Online Retailers, Wholesale Market, Specialty Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Dole Food Company, Fresh Del Monte Produce, Sysco Corporation, Earthbound Farm, Green Giant, Birds Eye Foods, Cascadian Farm, Bonduelle Group, Riverford Organic Farmers, Driscoll’s Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Butternut Squash MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Butternut Squash MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Dole Food Company

- Fresh Del Monte Produce

- Sysco Corporation

- Earthbound Farm

- Green Giant

- Birds Eye Foods

- Cascadian Farm

- Bonduelle Group

- Riverford Organic Farmers

- Driscoll's