Global Bulk Food Dispensers Market Size, Share Analysis Report By Material Type (Plastics, Acrylic, Polycarbonate (PC), Acrylonitrile Butadiene Styrene (ABS), Copolyester, Others, Metal, Glass), By Type (Gravity-fed, Scoop bins, Pre-Packaged Bulk Food Dispenser), By Installation Type (Countertop, Wall-Mounted, Floor-Standing), By Capacity (Up to 3 Gallon, 3 to 6 Gallon, Above 6 Gallon), By End-user (Hypermarkets And Supermarkets, Retail Stores, Food Service, Residential) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145856

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

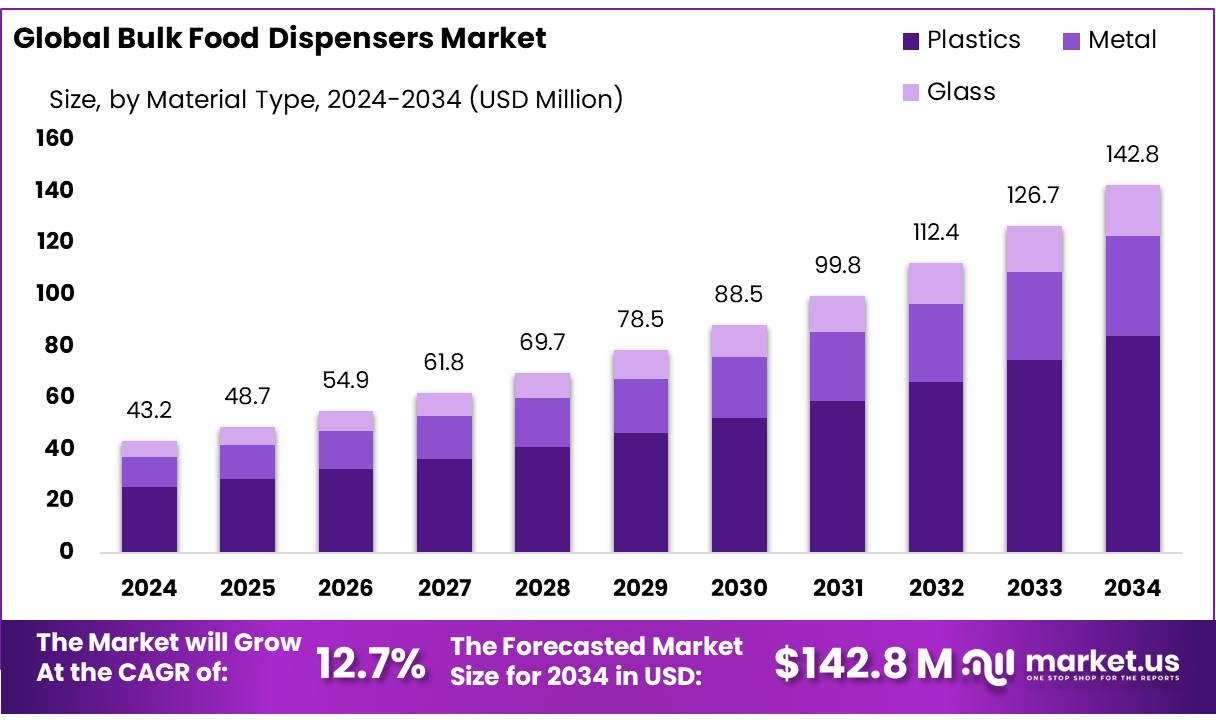

The Global Bulk Food Dispensers Market size is expected to be worth around USD 142.8 Mn by 2034, from USD 43.2 Mn in 2024, growing at a CAGR of 12.7% during the forecast period from 2025 to 2034.

The bulk food dispensers industry is emerging as a significant component within India’s evolving food processing and retail sectors. These dispensers, designed to store and dispense dry food items like grains, cereals, and pulses, align with the country’s increasing emphasis on sustainability, waste reduction, and efficient food distribution systems.

India’s food processing sector is experiencing robust growth, contributing 1.69% to the nation’s Gross Value Added (GVA). The Ministry of Food Processing Industries (MoFPI) has been instrumental in this expansion, with a budget allocation of ₹3,290 crore for 2024–25, marking a 30.19% increase from the previous year. This financial commitment underscores the government’s dedication to enhancing food processing infrastructure, which directly benefits the bulk food dispensers market.

Several government initiatives are propelling this growth. The Production Linked Incentive Scheme for Food Processing Industries (PLISFPI) offers financial incentives to promote Indian food brands globally, reimbursing up to 50% of their expenditure on branding and marketing abroad, capped at ₹50 crore per year.

Additionally, the Pradhan Mantri Kisan Sampada Yojana (PMKSY) aims to leverage investments of ₹31,400 crore for handling agro-produce, benefiting 20 lakh farmers and generating over 5 lakh employment opportunities . These schemes enhance the overall food supply chain, creating a conducive environment for the adoption of bulk food dispensers.

The government’s focus on agricultural productivity and food security is evident in its recent policies. For instance, the wheat procurement for the new season has commenced strongly, with 2.08 million metric tons acquired since March 15, 2025, marking a 44.4% increase over the same period last year. Such measures ensure a steady supply of food grains, which can be efficiently distributed using bulk food dispensers.

Key Takeaways

- Bulk Food Dispensers Market size is expected to be worth around USD 142.8 Mn by 2034, from USD 43.2 Mn in 2024, growing at a CAGR of 12.7%.

- Plastics in the bulk food dispensers market played a pivotal role, commanding a significant majority with over 58.30% of the market share.

- Gravity-fed bulk food dispensers emerged as the market leaders, securing a commanding 57.30% market share.

- Countertop bulk food dispensers solidified their prominence in the market by securing a substantial 46.30% share.

- Up to 3 gallons proved to be the most popular choice in the market, claiming over 46.30% of the market share.

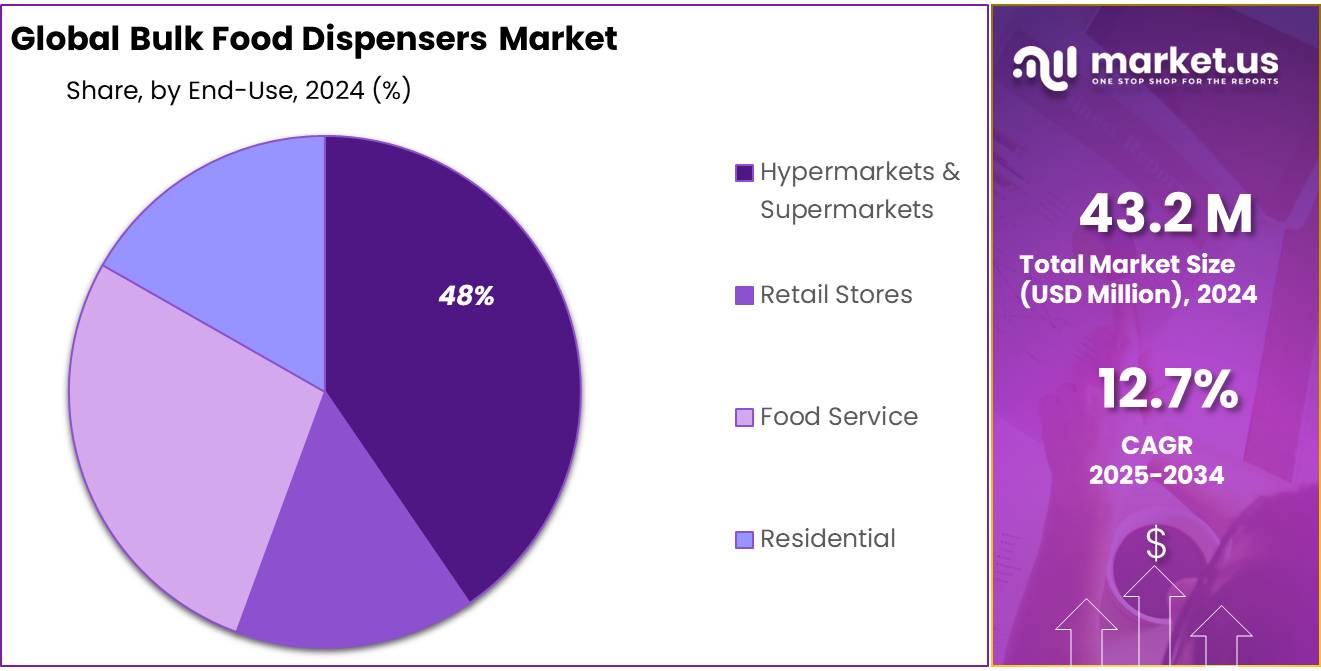

- Hypermarkets and supermarkets emerged as the leading end-users of bulk food dispensers, securing a dominant 48.30% of the market share.

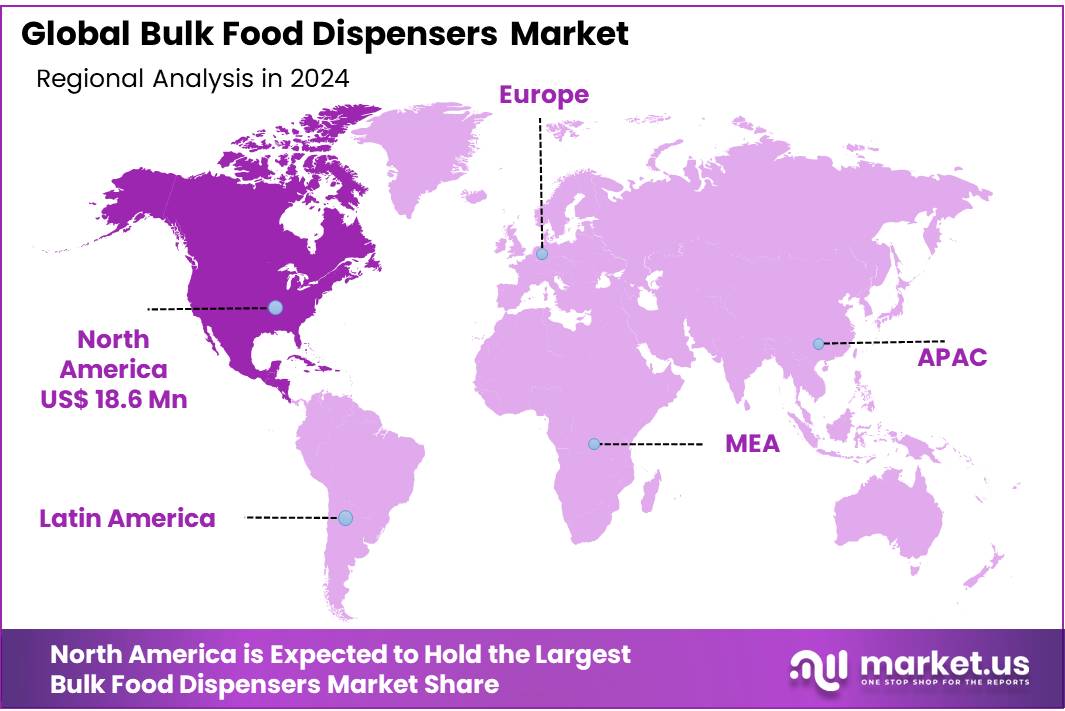

- North America demonstrated a robust presence in the bulk food dispensers market, securing a substantial 43.20% share, which translates to a market value of approximately USD 18.6 million.

By Material Type

Plastic dispensers lead with 58.3% due to affordability and versatility.

In 2024, plastics in the bulk food dispensers market played a pivotal role, commanding a significant majority with over 58.30% of the market share. This material’s popularity can largely be attributed to its versatility and cost-effectiveness, which make it a preferred choice for manufacturers and retailers alike. Plastics are highly valued for their durability, lightweight nature, and the ability to preserve the quality of food products by providing an airtight environment.

Additionally, the ease of customization and the relatively lower production costs associated with plastic dispensers further solidify their dominant status in the market. This preference ensures that plastic dispensers continue to be an integral part of bulk food sales, catering to a wide range of bulk items from grains and cereals to candies and nuts.

By Type

Gravity-fed dispensers dominate with 57.3% for their efficiency and hygiene.

In 2024, gravity-fed bulk food dispensers emerged as the market leaders, securing a commanding 57.30% market share. This type of dispenser is favored for its straightforward and efficient mechanism, which allows food items to flow out smoothly under the force of gravity without the need for mechanical aids.

Ideal for a variety of dry foods such as grains, nuts, coffee beans, and candies, gravity-fed dispensers offer both functionality and hygiene. They minimize food handling and maximize freshness, which is crucial in retail settings. The simplicity of use and reduced maintenance contribute significantly to their popularity, making them a top choice for both retailers and consumers aiming to reduce waste and enhance shopping efficiency.

By Installation Type

Countertop dispensers lead with 46.3% for their space efficiency and accessibility.

In 2024, countertop bulk food dispensers solidified their prominence in the market by securing a substantial 46.30% share. These dispensers are highly valued for their convenience and space-saving design, making them an ideal choice for establishments with limited space.

Typically placed on counters, these dispensers allow easy access and efficient use of vertical space, facilitating customer self-service and enhancing the shopping experience. Their accessibility and ease of use not only streamline the purchasing process but also play a vital role in attracting more customers who appreciate the ability to visually assess and select the quantity of the product they wish to purchase.

By Capacity

Up to 3-gallon dispensers dominate with 46.3% due to their compact efficiency and convenience.

In 2024, bulk food dispensers with a capacity of up to 3 gallons proved to be the most popular choice in the market, claiming over 46.30% of the market share. These compact dispensers are especially favored in settings where space is at a premium and a smaller quantity of product turnover is expected. Ideal for a variety of environments, including small retail spaces, cafes, and personal use in home kitchens, these smaller dispensers meet the needs of users who prefer fresher, more frequent refills of products. Their size makes them not only space-efficient but also easier to handle and maintain, ensuring that they remain a practical choice for many businesses focusing on customer convenience and efficiency.

By End-user

Hypermarkets and supermarkets lead with 48.3% for enhanced shopping convenience and waste reduction.

In 2024, hypermarkets and supermarkets emerged as the leading end-users of bulk food dispensers, securing a dominant 48.30% of the market share. This prevalence is attributed to the growing consumer preference for shopping in larger stores where they can access a wide variety of products, including bulk food items, under one roof.

Hypermarkets and supermarkets use these dispensers extensively to offer customers the flexibility to purchase exact quantities, thereby reducing food waste and providing cost savings. The strategic placement of these dispensers in such retail environments not only enhances the shopping experience by offering convenience but also promotes an eco-friendly approach to food retailing by minimizing packaging waste.

Key Market Segments

By Material Type

- Plastics

- Acrylic

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Copolyester

- Others

- Metal

- Glass

By Type

- Gravity-fed

- Scoop bins

- Pre-Packaged Bulk Food Dispenser

By Installation Type

- Countertop

- Wall-Mounted

- Floor-Standing

By Capacity

- Up to 3 Gallon

- 3 to 6 Gallon

- Above 6 Gallon

By End-user

- Hypermarkets & Supermarkets

- Retail Stores

- Food Service

- Residential

Drivers

Increasing Consumer Demand for Sustainable Shopping Options Drives Market Growth

One of the primary driving factors for the growth of the bulk food dispensers market is the increasing consumer demand for sustainable shopping options. As awareness of environmental issues grows, more consumers are seeking ways to reduce their carbon footprint, leading to a rise in preference for zero-waste shopping. According to the Environmental Protection Agency (EPA), packaging materials make up a significant portion of municipal solid waste, amounting to nearly 82.2 million tons of generation in 2018. Bulk food dispensers offer a viable solution by minimizing the reliance on single-use packaging.

Supermarkets and hypermarkets are responding to this demand by integrating more bulk food dispensers into their layouts. This shift not only aligns with corporate sustainability goals but also caters to the environmentally conscious shopper. For instance, several leading grocery chains have reported a noticeable reduction in plastic waste after adopting bulk dispensers, with some stores observing up to a 35% decrease in packaging waste, according to internal sustainability reports.

Government initiatives also support this trend. For example, the European Union’s Circular Economy Action Plan encourages reduction in packaging waste and the adoption of reusable solutions. This policy has prompted retailers across the EU to consider bulk dispensers as a way to comply with regulatory requirements while meeting customer expectations.

Furthermore, the versatility and efficiency of bulk food dispensers make them attractive to retailers. These dispensers allow easy access to a variety of products such as grains, nuts, and spices, and enable consumers to purchase the exact quantities they need, thus reducing food waste—a concern for 77% of consumers, as reported by the Food Industry Association.

Restraints

Initial Cost and Maintenance Concerns Limit Market Expansion

A significant restraining factor for the adoption of bulk food dispensers is the initial investment and ongoing maintenance costs associated with these systems. For many small to medium-sized retailers, the upfront cost of acquiring high-quality, durable dispensers can be prohibitive. Additionally, the need for regular maintenance to ensure hygiene and operational efficiency adds to the operational expenses.

Reports from several independent grocery store associations highlight that the cost of installing bulk dispensers can be substantially higher than traditional shelving or packaged goods displays. For instance, a basic setup for a medium-sized store can range from $5,000 to $10,000, which is a considerable investment for small businesses. Moreover, the maintenance involves regular cleaning and occasional repairs due to mechanical failures, which can further increase the total cost of ownership.

Hygiene concerns also play a significant role in hindering the market growth of bulk food dispensers. In the wake of health crises like the COVID-19 pandemic, consumers have become increasingly conscious of food safety. The open nature of bulk dispensers can sometimes deter customers who prefer the safety of sealed, tamper-evident packages. A survey conducted by a national food safety council found that 62% of consumers expressed concerns about the cleanliness of bulk dispensing units, fearing contamination from repeated handling by other shoppers.

Government regulations can also impact the deployment of bulk dispensers. Health and safety guidelines require that food dispensing equipment meets stringent standards to avoid contamination. Compliance with these regulations requires regular inspections and could lead to additional modifications, further escalating costs for retailers.

Opportunity

Technological Advancements Enhance Consumer Experience and Drive Market Growth

One of the most promising growth opportunities for the bulk food dispensers market lies in the integration of technology to enhance the consumer shopping experience. Innovations such as automated dispensing systems, smart dispensers with touchless sensors, and integrated scales for precise measurement are making bulk food purchasing more appealing and convenient for consumers.

A notable example of this technological integration is the development of “smart” bulk dispensers that utilize IoT technology to provide real-time data on inventory levels, product freshness, and consumer usage patterns. These systems help retailers manage stock more efficiently and reduce waste, aligning with the growing consumer demand for sustainable practices. According to a study by a consortium of food retail associations, stores that implemented smart dispensers saw a 20% increase in bulk product sales, indicating a strong consumer preference for these advanced systems.

Government initiatives aimed at reducing packaging waste further bolster the market for advanced bulk dispensers. For instance, the U.S. Environmental Protection Agency (EPA) has launched programs to support zero-waste solutions in grocery stores, offering incentives for businesses that reduce their reliance on single-use packaging. This governmental support not only motivates retailers to invest in bulk dispensers but also reassures consumers about the environmental and health benefits of using these systems.

Moreover, with the increasing emphasis on hygiene post-pandemic, the market for touchless bulk dispensers is rapidly expanding. These dispensers minimize physical contact with the dispensing mechanism, thus addressing consumer concerns about contamination and safety. The introduction of such technology is expected to draw in a broader demographic of health-conscious consumers, further driving market growth.

Trends

Customization and Personalization Trend Reshapes the Bulk Food Dispensers Market

A significant trend in the bulk food dispensers market is the increasing consumer interest in customized and personalized shopping experiences. Retailers are now offering more tailored options through their bulk dispensing systems, allowing consumers to mix and match different products according to their preferences. This trend caters to the growing desire for individualized diets and lifestyles, such as gluten-free, organic, or vegan options, providing a more engaging and personalized shopping experience.

The trend towards customization extends to the design of the dispensers themselves. Modern dispensers now feature modular designs that can be easily adjusted in layout and size according to the store’s needs and the types of foods being offered. This flexibility not only enhances the aesthetic appeal of retail spaces but also improves the functionality, making it easier for consumers to access and interact with the products.

Industry reports from leading retail design associations show that stores with customized bulk dispenser systems see an increase in customer engagement. For instance, a survey highlighted that stores with highly personalized dispenser setups experienced a 25% higher repeat customer rate compared to those with standard configurations.

Furthermore, government initiatives that promote sustainability in retail are supporting this trend. Programs that encourage the reduction of packaging waste are driving retailers to adopt bulk systems as a way to meet regulatory requirements while offering consumers the eco-friendly options they demand.

Regional Analysis

In 2024, North America demonstrated a robust presence in the bulk food dispensers market, securing a substantial 43.20% share, which translates to a market value of approximately USD 18.6 million. This significant market penetration is largely driven by a growing consumer preference for sustainable and zero-waste shopping options, a trend that is particularly pronounced in the United States and Canada.

North American consumers are increasingly aware of the environmental impact of packaging waste, leading to heightened demand for bulk purchase options that reduce plastic and disposable packaging. Retail giants and local grocers alike are responding by expanding their bulk food offerings, which range from cereals and grains to nuts and spices. This shift is supported by environmental policies and initiatives at both the federal and state levels that encourage waste reduction and sustainable practices in retail operations.

The region’s advanced retail infrastructure also plays a crucial role in the adoption and integration of sophisticated bulk dispensing systems. These systems are being enhanced with technological innovations such as IoT connectivity for inventory management and touchless dispensing mechanisms, aligning with the region’s high tech adoption rates and hygiene standards post-pandemic.

Moreover, the presence of key market players who are continuously innovating in the design and functionality of bulk dispensers further stimulates market growth. Companies are investing in research and development to create more user-friendly and efficient dispensing solutions, which not only attract more retailers but also offer consumers a more satisfactory shopping experience.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Danone has strategically positioned itself in the bulk food dispensers market by emphasizing sustainability in its product offerings. Recognized for its commitment to health and environmental stewardship, Danone utilizes bulk dispensers in various settings to reduce packaging waste and encourage healthier consumption patterns. Their involvement in this market complements their broader corporate goals of promoting global health and sustainability.

Nestlé S.A. leverages bulk food dispensers as part of its commitment to reducing environmental impact. Nestlé’s use of these dispensers in retail settings helps minimize packaging waste and supports its sustainability objectives. The company continually innovates in dispenser technology to enhance customer convenience and operational efficiency.

Lipton, a renowned tea brand under Unilever, incorporates bulk dispensers to offer consumers a fresh and customized tea experience. Their bulk dispensers allow customers to blend various tea flavors according to their preferences, which aligns with the growing trend of personalized nutrition. Lipton’s approach not only attracts eco-conscious consumers but also enhances the brand’s reputation for innovation and sustainability.

Rosseto Serving Solutions specializes in providing high-quality bulk food dispensers with a focus on aesthetic appeal and durability. Their products are designed to offer ease of use and efficient storage solutions, making them popular in both commercial and hospitality settings. Rosseto’s commitment to innovative design and functionality makes them a key player in enhancing the consumer experience in bulk food purchasing.

Top Key Players

- Danone

- Nestlé S.A.

- Lipton

- Rosseto Serving Solutions

- Hubert Company, LLC

- IDM LTD

- Jiangxi Eco Technology Group Co., Ltd.

- Cal-Mil

- Server Products Inc

- Akriform Plast AB

- BestBins

- Hangzhou Fulinde Display Manufacturer

- Purcell

- Food Dispense

- Joalpe International UK

- Other Key Players

Recent Developments

In 2024, Lipton has actively expanded its presence in the bulk food dispensers market, capitalizing on the growing trend towards sustainable consumption. The company has innovatively utilized bulk dispensers to offer a variety of its tea products, allowing consumers to mix different flavors and create customized blends.

In 2024, Nestlé S.A. has significantly enhanced its role in the bulk food dispensers market, focusing on eco-friendly solutions and operational efficiency. The company has deployed bulk dispensers across a variety of retail settings, offering products such as coffee, cereals, and other dry goods. This move is part of Nestlé’s broader environmental strategy to reduce packaging waste and promote sustainable consumer habits.

Report Scope

Report Features Description Market Value (2024) USD 43.2 Mn Forecast Revenue (2034) USD 142.8 Mn CAGR (2025-2034) 12.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Plastics, Acrylic, Polycarbonate (PC), Acrylonitrile Butadiene Styrene (ABS), Copolyester, Others, Metal, Glass), By Type (Gravity-fed, Scoop bins, Pre-Packaged Bulk Food Dispenser), By Installation Type (Countertop, Wall-Mounted, Floor-Standing), By Capacity (Up to 3 Gallon, 3 to 6 Gallon, Above 6 Gallon), By End-user (Hypermarkets And Supermarkets, Retail Stores, Food Service, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Danone, Nestlé S.A., Lipton, Rosseto Serving Solutions, Hubert Company, LLC, IDM LTD, Jiangxi Eco Technology Group Co., Ltd., Cal-Mil, Server Products Inc, Akriform Plast AB, BestBins, Hangzhou Fulinde Display Manufacturer, Purcell, Food Dispense, Joalpe International UK, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bulk Food Dispensers MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Bulk Food Dispensers MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Danone

- Nestlé S.A.

- Lipton

- Rosseto Serving Solutions

- Hubert Company, LLC

- IDM LTD

- Jiangxi Eco Technology Group Co., Ltd.

- Cal-Mil

- Server Products Inc

- Akriform Plast AB

- BestBins

- Hangzhou Fulinde Display Manufacturer

- Purcell

- Food Dispense

- Joalpe International UK

- Other Key Players