Global Brewing Supplies Market Size, Share, Growth Analysis By Product Type (Fermentation Unit, Brew House Unit, Filtration System, Maturation Unit, Others), By Application (Commercial Purpose, Industrial Purpose), By Category (Nano/Microbrewery, Macro/Industrial Brewery), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171213

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

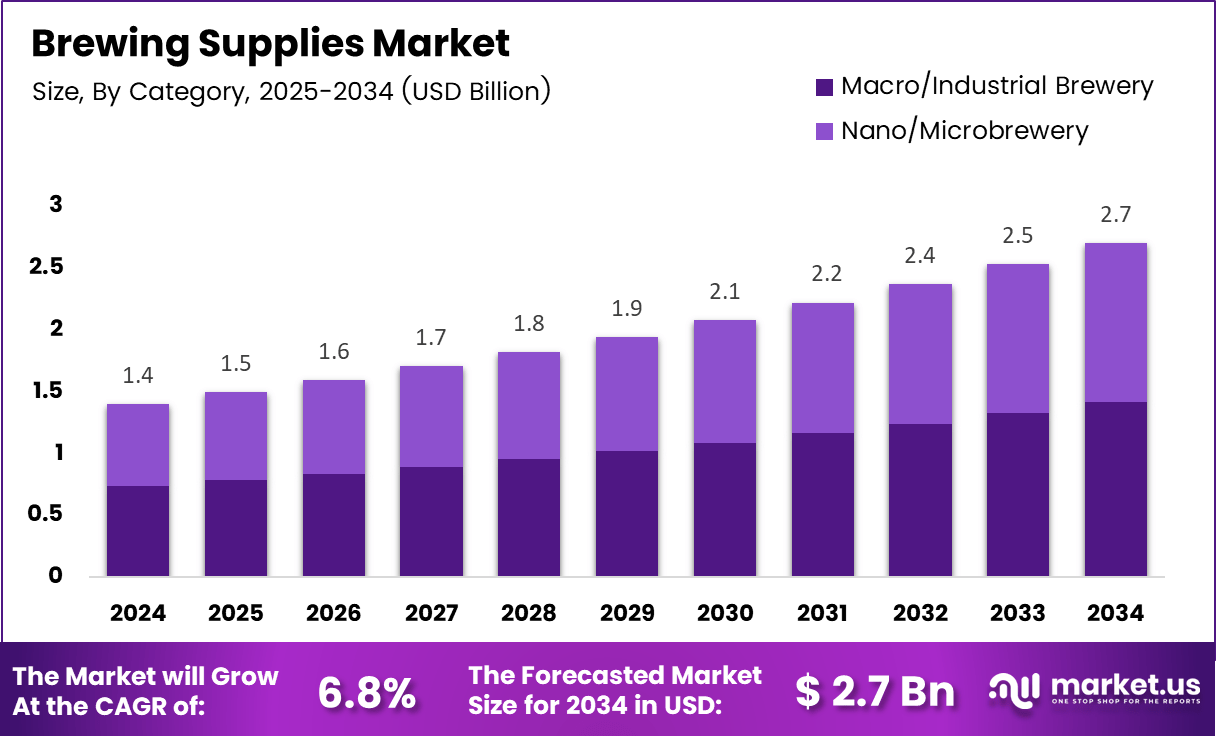

The Global Brewing Supplies Market size is expected to be worth around USD 2.7 billion by 2034, from USD 1.4 billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

The Brewing Supplies Market represents the commercial ecosystem supporting beer production through ingredients, equipment, and processing inputs. Broadly, it covers malt, hops, yeast, beer adjuncts, brewing vessels, fermentation systems, and packaging tools. From an analyst viewpoint, the market reflects steady demand driven by beverage consumption patterns and continuous innovation across brewing workflows and production scales.

From a growth perspective, expanding craft brewing culture and premium beverage consumption continue strengthening baseline demand for brewing supplies. Additionally, rising experimentation with flavors, formulations, and batch sizes supports repeat procurement of ingredients and equipment. As a result, suppliers increasingly focus on quality consistency, supply reliability, and technical support for diverse brewing operations.

At the same time, homebrewing and small commercial setups contribute incremental volume growth across entry level brewing kits and modular systems. Consequently, brewing supplies increasingly address both hobbyist and professional needs within one ecosystem. This dual demand structure enhances market resilience while creating opportunities for bundled offerings, training oriented products, and scalable brewing solutions.

Government investment and regulatory clarity further influence market momentum, particularly in structured alcohol markets. In many regions, authorities support small breweries through simplified licensing frameworks and local manufacturing incentives. Moreover, food safety, labeling, and quality compliance regulations encourage standardized brewing inputs, indirectly driving demand for certified ingredients and compliant brewing equipment.

From a formulation standpoint, water quality and treatment supplies play a central role in brewing operations. According to the Brewers Association, water accounts for approximately 90% of finished beer volume, highlighting its functional importance. Consequently, demand remains strong for filtration systems, mineral adjustment solutions, and water efficiency technologies across breweries.

Operational definitions within regulatory frameworks also shape brewing supply demand. According to the Health and wellness Survey, a small brewery produces fewer than 15,000 barrels annually and sells 75% or more off site. Additionally, a restaurant brewery sells at least 25% on site while operating substantial food services, influencing equipment and ingredient procurement patterns.

Overall, the Brewing Supplies Market continues evolving through balanced growth, regulatory alignment, and product specialization. As consumer preferences shift toward differentiated beer experiences, brewing supply vendors remain positioned to benefit from sustained investment cycles. Therefore, the market presents a stable opportunity landscape for buyers seeking reliable inputs, scalable systems, and compliant brewing solutions.

Key Takeaways

- The global Brewing Supplies Market is projected to grow from USD 1.4 billion in 2024 to USD 2.7 billion by 2034, registering a CAGR of 6.8%.

- By product type, Fermentation Units represent the leading segment with a market share of 37.9%, reflecting their critical role in brewing operations.

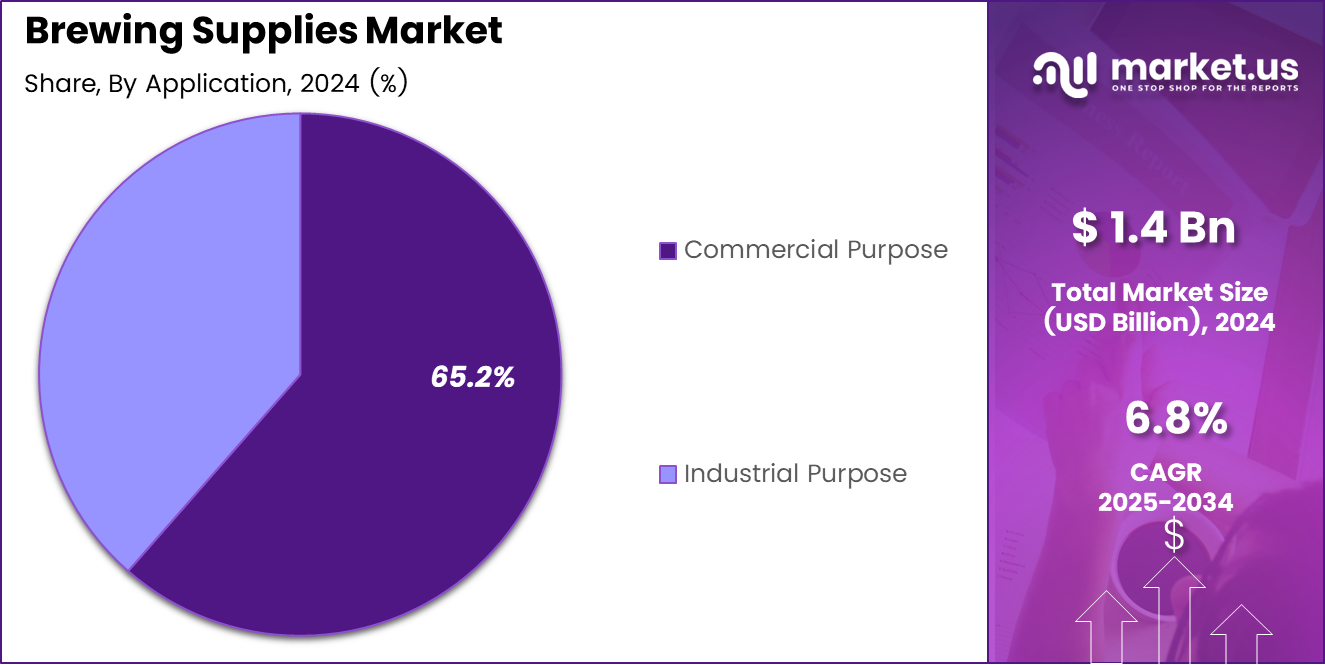

- By application, Commercial Purpose dominates the market, accounting for a share of 65.2% due to expanding craft and on premise brewing activities.

- By category, Nano and Microbreweries hold a leading position with 52.4% share, supported by local consumption and entrepreneurial adoption.

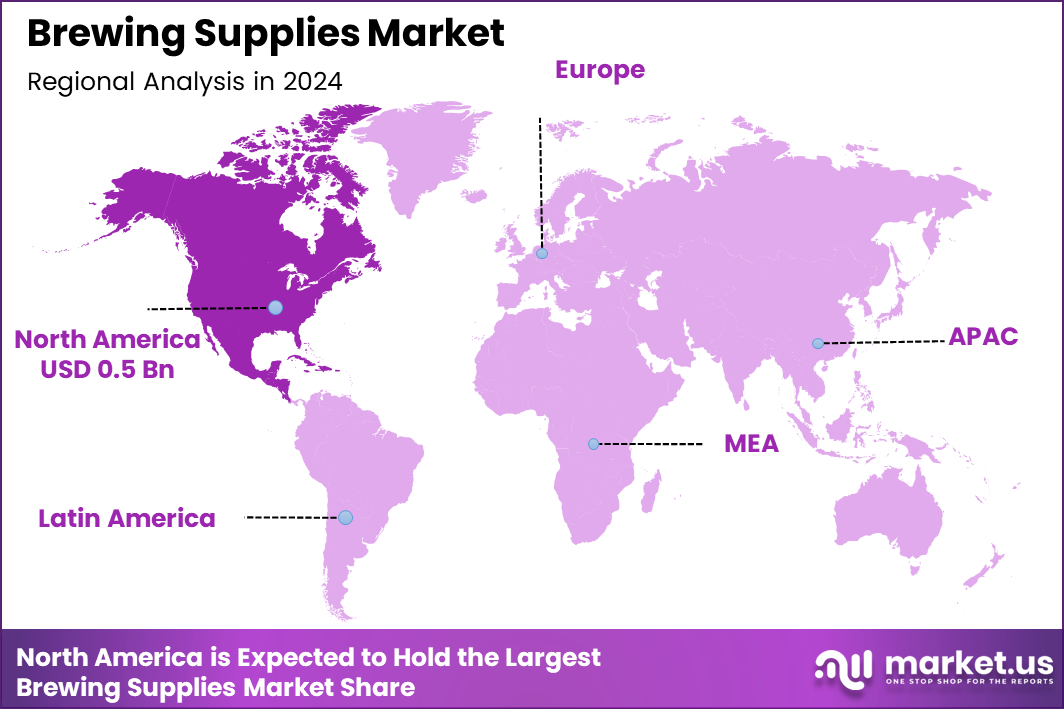

- Regionally, North America leads the global market with a share of 37.2%, valued at approximately USD 0.5 billion in 2024.

By Product Type Analysis

Fermentation Unit dominates with 37.9% due to its central role in beer production consistency and quality control.

In 2024, Fermentation Unit held a dominant market position in the By Product Type Analysis segment of Brewing Supplies Market, with a 37.9% share. This dominance is driven by its essential function in yeast activity management, alcohol formation, and flavor development. Moreover, rising craft beer volumes continue to strengthen demand for advanced fermentation solutions.

Brew House Unit represents a critical upstream component supporting mashing, boiling, and wort preparation processes. Consequently, breweries increasingly invest in modular and automated brew house systems to enhance operational efficiency. As production scales, these units support consistent batch output while aligning with evolving quality standards.

Filtration System adoption is gradually expanding as breweries emphasize clarity, shelf stability, and taste uniformity. Furthermore, filtration technologies help reduce microbial risks while improving visual appeal. This segment benefits from breweries seeking extended distribution reach and longer product shelf life across domestic and export channels.

Maturation Unit demand grows steadily as breweries focus on aging precision and flavor refinement. Additionally, controlled maturation enhances carbonation balance and aroma complexity. Others include auxiliary equipment such as cleaning systems and storage vessels, which support overall brewing efficiency and regulatory hygiene compliance.

By Application Analysis

Commercial Purpose dominates with 65.2% as on-premise and craft-focused brewing expands globally.

In 2024, Commercial Purpose held a dominant market position in the By Application Analysis segment of Brewing Supplies Market, with a 65.2% share. This leadership reflects the rapid expansion of brewpubs, taprooms, and regional craft brands. Moreover, consumer preference for fresh, localized beer strengthens commercial brewing investments.

Industrial Purpose applications focus on large-scale, standardized beer production for mass distribution. Accordingly, this segment emphasizes high-capacity equipment, automation, and process optimization. While fewer in number, industrial breweries maintain stable demand for durable brewing supplies that support volume consistency and cost efficiency.

By Category Analysis

Nano/Microbrewery dominates with 52.4% driven by entrepreneurial entry and local beer consumption trends.

In 2024, Nano/Microbrewery held a dominant market position in the By Category Analysis segment of Brewing Supplies Market, with a 52.4% share. This growth is supported by low entry barriers, flexible batch sizes, and strong community-driven demand. Additionally, experimentation with flavors sustains frequent equipment upgrades.

Macro/Industrial Brewery operations emphasize scale, consistency, and supply chain efficiency. Consequently, this category prioritizes robust systems capable of continuous production cycles. Although fewer facilities operate at this level, their long-term investments sustain steady demand for high-capacity brewing infrastructure.

Key Market Segments

By Product Type

- Fermentation Unit

- Brew House Unit

- Filtration System

- Maturation Unit

- Others

By Application

- Commercial Purpose

- Industrial Purpose

By Category

- Nano/Microbrewery

- Macro/Industrial Brewery

Drivers

Rising Homebrewing Adoption Supported by DIY Culture and Personalization Preferences Drives Market Growth

Rising interest in homebrewing is a major driver for the brewing supplies market. Many consumers now prefer making beer at home as a hobby, supported by strong DIY culture and the desire for personalized flavors. Easy access to online tutorials, recipes, and communities has lowered the learning curve, encouraging beginners to invest in basic brewing equipment and ingredients.

At the same time, personalization plays a key role in demand growth. Homebrewers experiment with different grains, hops, and yeast to create unique taste profiles not easily available in mass produced beers. This behavior increases repeat purchases of brewing supplies such as fermenters, sanitizers, and small batch ingredients. As a result, suppliers benefit from steady demand across entry level and intermediate product categories.

The expansion of craft beer culture also influences homebrewing adoption. Consumers who develop an appreciation for craft beverages often transition into brewing at home, further strengthening market growth. Overall, homebrewing continues to act as a stable and long term demand driver for brewing supplies.

Restraints

High Upfront Investment Required for Professional Grade Brewing Equipment Limits Market Expansion

High initial costs remain a key restraint in the brewing supplies market, especially for commercial users. Professional grade brewing systems, including brewhouse units, fermentation tanks, and temperature control systems, require significant capital investment. This creates financial pressure for startups, microbreweries, and small restaurants.

Regulatory complexity further adds to market challenges. Alcohol production and distribution require multiple licenses, approvals, and compliance with local laws. These requirements vary by region and often increase operational costs and setup time. For new entrants, regulatory uncertainty can delay equipment purchases and reduce short term demand for brewing supplies.

Raw material price volatility also affects the market. Prices of hops, barley, and specialty yeast fluctuate due to climate conditions and supply chain disruptions. These changes increase production costs for brewers, leading to cautious spending on equipment upgrades and consumables. Together, high costs and regulatory hurdles act as notable restraints on market growth.

Growth Factors

Growing Demand for Non Alcoholic and Low Alcohol Craft Beverages Creates New Growth Opportunities

The rising popularity of non alcoholic and low alcohol craft beverages presents strong growth opportunities for the brewing supplies market. Health conscious consumers increasingly seek flavorful alternatives with reduced alcohol content. This trend encourages breweries to invest in specialized brewery equipment and processes designed for low alcohol production.

E commerce expansion also supports market growth. Online platforms allow direct to consumer sales of brewing supplies, improving accessibility for homebrewers and small businesses. Customers can compare products, access detailed instructions, and order complete kits easily, which boosts overall market penetration.

Brewing kits and starter packs are gaining popularity among beginners. These kits simplify the brewing process by combining equipment, ingredients, and instructions in one package. Their convenience attracts hobbyists and first time users, helping suppliers expand their customer base. Together, these factors create long term opportunities for market players.

Emerging Trends

Integration of Smart Brewing Systems with Digital Monitoring and Automation Shapes Market Trends

Smart brewing systems are emerging as a key trend in the brewing supplies market. Digital monitoring tools help brewers control temperature, fermentation timing, and ingredient ratios with higher accuracy. Automation improves consistency, reduces errors, and saves time for both homebrewers and commercial producers.

Flavor innovation is another major trend. Brewers increasingly use specialty hops and experimental yeast strains to develop unique taste profiles. This drives demand for diverse ingredients and flexible brewing equipment capable of handling small batch experimentation.

Sustainability is gaining importance across the industry. Brewers prefer eco friendly supplies, water efficient systems, and reusable materials to reduce environmental impact. Additionally, collaborations with local ingredient suppliers are increasing, supporting fresh sourcing and regional identity. These trends collectively shape the evolving landscape of the brewing supplies market.

Regional Analysis

North America Dominates the Brewing Supplies Market with a Market Share of 37.2%, Valued at USD 0.5 billion

North America holds the leading position in the brewing supplies market, driven by a mature craft beer ecosystem and strong homebrewing culture. In 2024, the region accounted for a dominant 37.2% share, with market value reaching USD 0.5 billion, supported by high consumption of craft and specialty beverages. Widespread availability of brewing equipment, ingredients, and educational resources continues to support sustained demand across commercial and hobbyist segments.

Europe Brewing Supplies Market Trends

Europe represents a well established brewing market with deep rooted beer traditions and strong demand for specialty and artisanal products. Growth is supported by rising interest in small batch production, premium ingredients, and traditional brewing methods blended with modern technology. Regulatory clarity and strong regional sourcing of raw materials further support stable adoption of brewing supplies across Western and Central Europe.

Asia Pacific Brewing Supplies Market Trends

Asia Pacific is witnessing steady growth due to the expanding craft beer scene in urban centers and changing consumer preferences toward premium beverages. Increasing disposable income and exposure to global brewing trends are encouraging microbreweries and homebrewers to invest in modern brewing supplies. The region also benefits from growing e commerce penetration, improving access to equipment and ingredients.

Middle East and Africa Brewing Supplies Market Trends

The Middle East and Africa market remains relatively niche but shows gradual expansion in select countries with supportive regulatory environments. Demand is primarily driven by tourism led hospitality sectors and growing interest in non alcoholic beverage and specialty brews. Limited local manufacturing encourages reliance on imported brewing supplies, shaping cautious but consistent market development.

Latin America Brewing Supplies Market Trends

Latin America is experiencing rising demand for brewing supplies due to the growth of craft breweries and regional flavor experimentation. Local entrepreneurs are increasingly investing in small scale brewing setups to cater to evolving consumer tastes. Economic diversification and cultural acceptance of craft beverages continue to support moderate market growth.

US Brewing Supplies Market Trends

The US market benefits from a large base of homebrewers and a dense network of micro and nano breweries. Innovation in brewing techniques, strong DIY adoption, and demand for advanced fermentation equipment support ongoing market activity. Consumer preference for unique and locally produced beverages remains a key factor sustaining demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Brewing Supplies Company Insights

From an analyst viewpoint, the global Brewing Supplies market in 2024 reflects a balance between large scale industrial capability and growing demand for flexible, quality focused brewing solutions. Leading suppliers are positioning themselves around efficiency, hygiene, energy optimization, and scalable systems to support both established breweries and fast growing craft producers. The first four companies play a critical role in shaping technology standards, operational reliability, and long term investment confidence across the brewing ecosystem.

GEA Group maintains a strong position through its broad portfolio of process technology and brewing systems designed for high efficiency and consistency. The company focuses on automation, energy optimization, and hygienic design, which aligns well with breweries seeking cost control and sustainable operations. Its solutions support both large scale production and modular expansion strategies.

Paul Mueller is widely recognized for its expertise in stainless steel fermentation and processing equipment. The company’s strength lies in customized tank solutions that address precise temperature control and sanitation needs. This approach supports breweries aiming for product consistency while scaling production without compromising quality.

Alfa Laval plays a key role in separation, heat transfer, and fluid handling technologies used across brewing operations. Its equipment supports process efficiency, reduced water usage, and improved yield management. These capabilities are increasingly important as breweries focus on sustainability and operational optimization.

Della Toffola brings strong engineering capabilities in beverage processing equipment, supporting both traditional and modern brewing methods. The company emphasizes integrated systems that improve process control and flexibility. This positions it well for breweries expanding into specialty, low alcohol, and experimental beverage categories.

Overall, these players collectively influence technology adoption, efficiency benchmarks, and long term capacity planning within the Brewing Supplies market.

Top Key Players in the Market

- GEA Group

- Paul Mueller

- Alfa Laval

- Della Toffola

- Kaspar Schulz

- Criveller Group

- Hypro Group

- Micet Group

- Brewtech Tiantai

- Meura SA

Recent Developments

- In Jul 2024, Athletic Brewing Company announced a $50 million equity financing round led by General Atlantic, supporting its continued growth in the non alcoholic beer segment. The funding enables Athletic Brewing to expand production capacity, strengthen brand presence, and accelerate product innovation across key global markets.

- In May 2024, Anchor Brewing’s future was confirmed following its acquisition by Hamdi Ulukaya, the founder and CEO of Chobani, including the brewery’s 2.17 acre property in San Francisco’s Potrero Hill neighborhood. The acquisition positions Anchor Brewing for revival through renewed investment, operational stability, and long term stewardship under experienced consumer brand leadership.

Report Scope

Report Features Description Market Value (2024) USD 1.4 billion Forecast Revenue (2034) USD 2.7 billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fermentation Unit, Brew House Unit, Filtration System, Maturation Unit, Others), By Application (Commercial Purpose, Industrial Purpose), By Category (Nano/Microbrewery, Macro/Industrial Brewery) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape GEA Group, Paul Mueller, Alfa Laval, Della Toffola, Kaspar Schulz, Criveller Group, Hypro Group, Micet Group, Brewtech Tiantai, Meura SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GEA Group

- Paul Mueller

- Alfa Laval

- Della Toffola

- Kaspar Schulz

- Criveller Group

- Hypro Group

- Micet Group

- Brewtech Tiantai

- Meura SA