Global Branded Generics Market By Product Type (Alkylating Agents, Antimetabolites, Hormones, Anti-hypertensive, Lipid Lowering Drugs, Anti-depressants, Others) By Therapeutic Area (ardiovascular, Oncology, Diabetes, Central Nervous System (CNS), Gastrointestinal, Respiratory, Others) Route Of Administration (opical, Oral, Parenteral, Others) By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 163926

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

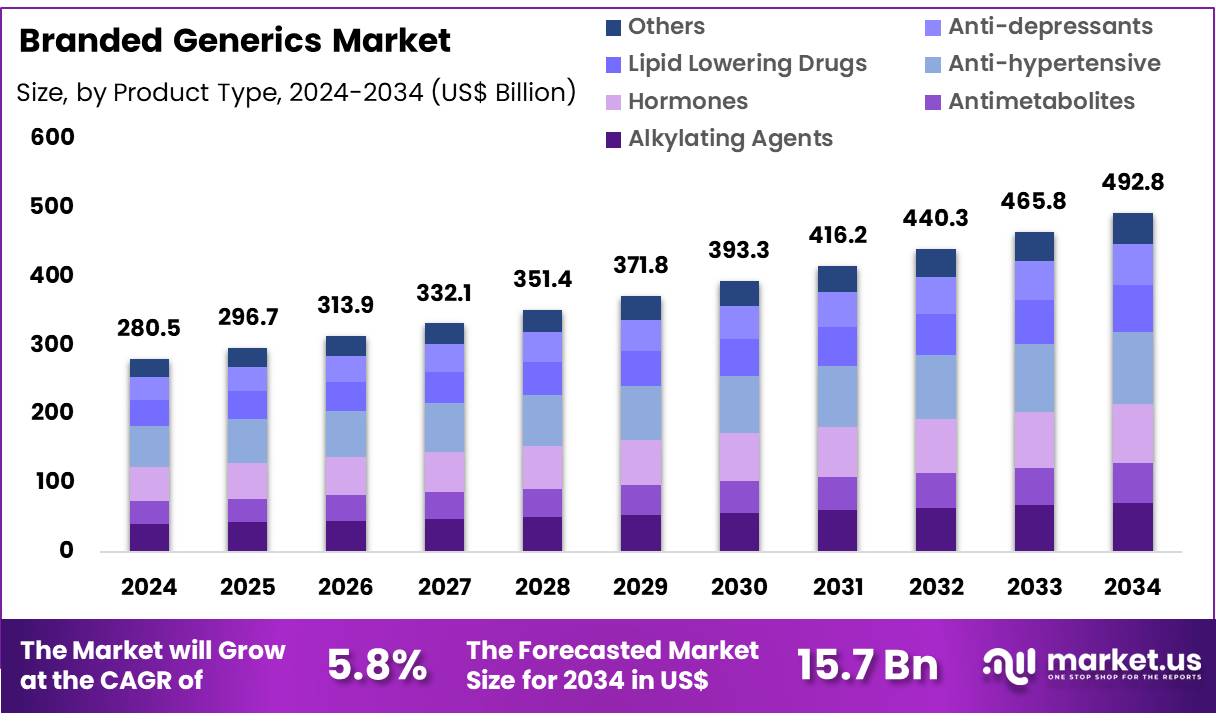

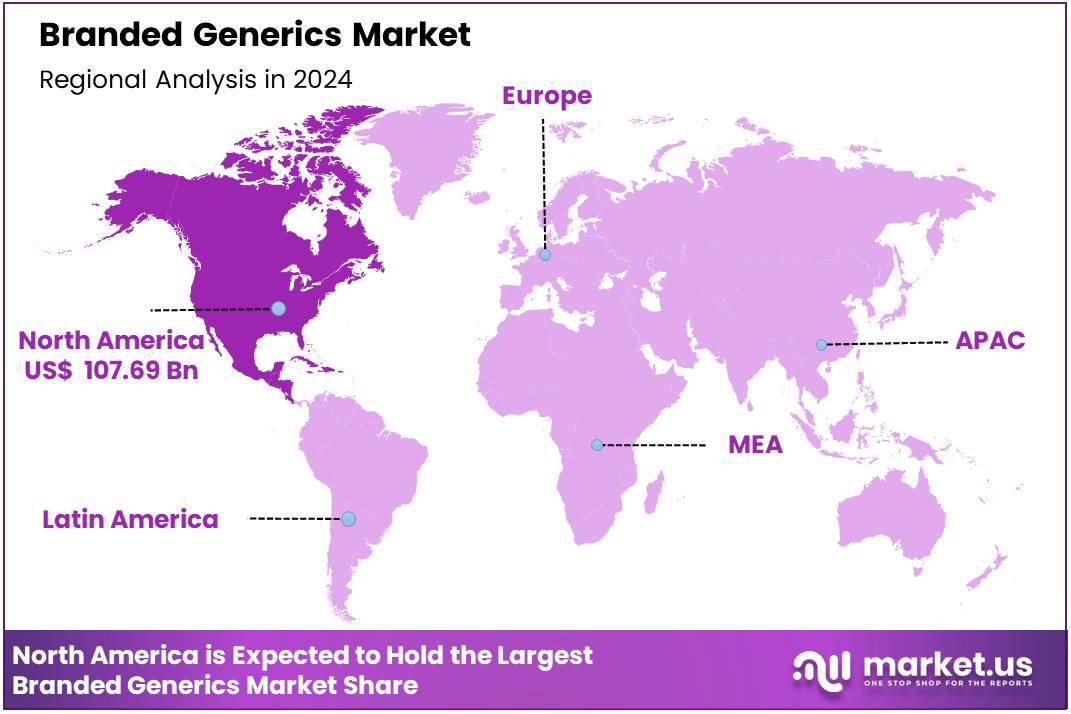

Global Branded Generics Market size is expected to be worth around US$ 492.8 Billion by 2034 from US$ 280.5 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 38.4% share with a revenue of US$ 107.69 Billion.

The expansion of branded generics is driven by growing demand for affordable medicines and sustained pressure on health systems to control pharmaceutical spending. Widespread use of generics demonstrates strong acceptance; in the United States, approximately nine out of ten prescriptions are filled with generic medicines, showing payer and prescriber confidence in lower-cost options. This environment enables branded generics to gain share by combining affordability with added trust, consistent quality, and brand familiarity.

Strict bioequivalence and quality standards enforced by agencies such as the U.S. FDA, the European Medicines Agency, and Health Canada have strengthened market confidence. These regulations ensure that generic medicines match reference drugs in strength, quality, and therapeutic performance. As a result, branded generic manufacturers can invest in product differentiation, packaging, and patient support without compromising regulatory assurance.

Cost containment policies also support growth. Reference pricing, competitive tendering, and substitution mandates in major markets encourage generic uptake and establish predictable price structures. These mechanisms allow branded generics to compete effectively by offering reliability, availability, and compliance-driven advantages.

Significant cost savings have reinforced adoption. Estimated billions in annual savings from generic entry provide fiscal space for healthcare payers. Formulary preferences for off-patent drugs, combined with chronic disease prevalence and aging populations, continue to expand long-term prescription volumes across therapeutic areas such as diabetes, cardiovascular disease, and oncology.

Public access programs in emerging markets further accelerate penetration. Initiatives like India’s nationwide affordable medicine scheme normalize generic purchasing behavior, creating a supportive base for branded generics to thrive within regulated price frameworks.

International prescribing guidance and universal health coverage goals also strengthen the shift toward generics. With policy alignment, regulatory confidence, and rising healthcare demand, branded generics are positioned for steady growth by delivering quality, continuity, and value within cost-sensitive health systems.

Key Takeaways

- Market Size: Global Branded Generics Market size is expected to be worth around US$ 492.8 Billion by 2034 from US$ 280.5 Billion in 2024.

- Market Growth: The market growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

- Product Analysis: In 2024, North America led the market, achieving over 38.4% share with a revenue of US$ 107.69 Billion.

- Application Analysis: The market for branded generics by product type is led by anti-hypertensive medicines, which accounted for approximately 21.3% of the global share in 2024.

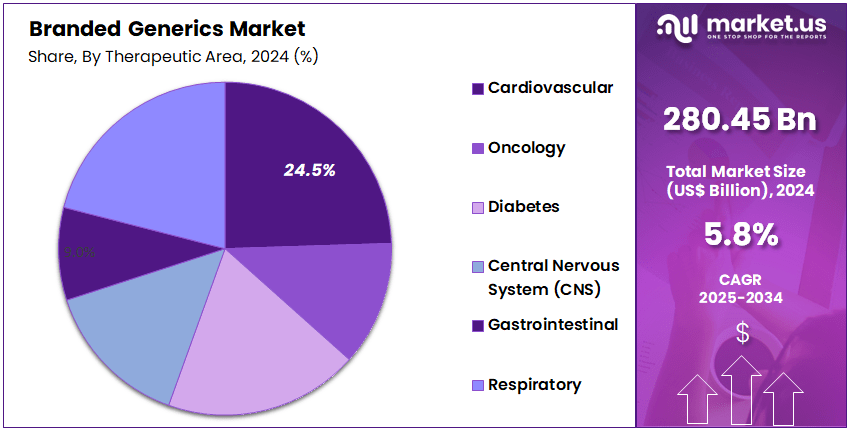

- End-Use Analysis: Cardiovascular disorders represented the largest therapeutic area within the branded generics market, accounting for approximately 24.5% of global share in 2024.

- Regional Analysis: The branded generics market by route of administration is dominated by oral formulations, representing nearly 64.2% of total share in 2024.

Product Type Analysis

The market for branded generics by product type is led by anti-hypertensive medicines, which accounted for approximately 21.3% of the global share in 2024. The dominance of this segment is linked to the high burden of hypertension and growing diagnosis and treatment rates across developed and emerging health systems.

Expanding elderly populations and rising lifestyle-related cardiovascular risk factors have further increased long-term therapy needs, supporting sustained demand for trusted branded alternatives to originator drugs.

Other significant therapy classes include alkylating agents, antimetabolites, and hormones, which serve large oncology and endocrine patient pools where treatment continuity and clinician confidence remain important. Lipid-lowering drugs maintain strong uptake due to growing cardiovascular disease incidence and preventive care programs.

Anti-depressants benefit from rising mental health awareness and improved access to therapy. Additional products grouped under “others” support demand across infectious diseases, respiratory care, and pain management. Collectively, these segments contribute to a broad and stable prescription base for branded generics worldwide.

Therapeutic Area Analysis

Cardiovascular disorders represented the largest therapeutic area within the branded generics market, accounting for approximately 24.5% of global share in 2024. The leading position of this segment is supported by the high prevalence of heart disease, hypertension, and lipid disorders, along with the need for long-term therapy and high treatment adherence.

Increasing diagnosis rates, preventive care focus, and aging populations have continued to drive sustained prescription volumes for cardiovascular medications, strengthening branded generic uptake where affordability and trusted quality are prioritized.

Oncology remains a fast-growing area due to rising cancer incidence and wider adoption of cost-efficient branded generics to support treatment access. Diabetes therapies show robust demand as metabolic disorders expand across both developed and emerging markets.

Central nervous system drugs benefit from growing awareness of mental health and neurological conditions, while gastrointestinal and respiratory segments maintain steady usage linked to lifestyle disorders and chronic pulmonary diseases. Other therapeutic categories collectively contribute to stable market persification and long-term growth prospects.

Route of Administration Analysis

The branded generics market by route of administration is dominated by oral formulations, representing nearly 64.2% of total share in 2024. This leading position is linked to patient preference for easy and convenient dosing, strong adherence levels, and wide availability of oral solid and liquid dosage forms.

Most chronic therapies for cardiovascular, diabetes, and central nervous system disorders are administered orally, which further strengthens the segment. Extensive use of tablets and capsules in primary care settings and cost-efficient manufacturing capabilities also reinforce demand for oral branded generics across global markets.

Topical formulations continue to gain traction in dermatology, pain relief, and ophthalmic therapies, supported by increasing demand for localized treatment with minimal systemic effects. Parenteral branded generics serve critical care, oncology, and infectious disease needs, benefiting from improved hospital access and biosimilar transition trends. The “others” segment includes inhalation, transdermal, and nasal delivery formats, reflecting innovation in drug delivery aimed at improving convenience and treatment continuity.

Distribution Channel Analysis

Hospital pharmacies accounted for the largest share of branded generics distribution, representing approximately 43.4% of the market in 2024. The dominance of this channel can be attributed to the high volume of prescriptions issued within hospital settings, particularly for chronic and acute conditions requiring continuous medication supply.

Strong procurement capabilities, structured formulary systems, and centralized purchasing practices support competitive pricing and reliable supply for branded generics. In addition, increasing hospital admissions for cardiovascular, oncology, and respiratory conditions, along with government initiatives to improve inpatient care access, continue to strengthen the role of hospital pharmacies in branded generic dispensation.

Retail pharmacies maintain a significant share, driven by high accessibility for routine and long-term therapies. Their wide coverage in both urban and semi-urban regions encourages consistent patient reach and medication adherence. Online pharmacies are expanding rapidly due to rising digital health adoption, home-delivery convenience, and e-prescription penetration, particularly in emerging markets, where affordability and availability are key purchasing drivers.

Key Market Segments

By Product Type

- Alkylating Agents

- Antimetabolites

- Hormones

- Anti-hypertensive

- Lipid Lowering Drugs

- Anti-depressants

- Others

By Therapeutic Area

- Cardiovascular

- Oncology

- Diabetes

- Central Nervous System (CNS)

- Gastrointestinal

- Respiratory

- Others

Route Of Administration

- Topical

- Oral

- Parenteral

- Others

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

Driving Factors

The growth of the branded generics market is largely supported by governmental and regulatory initiatives promoting generic medicines. For example, the U.S. Food and Drug Administration (FDA) reports that greater competition among generic drug makers leads to lower drug prices.

Additionally, in India the Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP) aims to provide quality generic medicines at significantly lower prices than branded equivalents, thereby increasing accessibility. The combined effect of cost-containment policies, patent expirations of originator drugs and the need for affordable medicines in emerging economies are thus key drivers of the branded generics segment.

Trending Factors

A notable trend in the branded generics domain is the increasing substitution of branded originator drugs by generics with equivalent efficacy and safety profiles. According to the FDA’s “Generic Drugs: Questions & Answers”, generic medicines are required to meet the same standards as brand-name drugs in terms of dosage, safety, effectiveness, strength and quality.

In parallel, Indian market analysis shows a high proportion of retail medicines are already branded generics, reflecting patient and physician acceptance.These developments indicate a maturing branded generics market where trust and regulation are aligning to support uptake.

Restraining Factors

Despite supportive policy contexts, the branded generics market faces constraints related to competitive pricing and manufacturing cost pressures. The ASPE (U.S. Department of Health & Human Services) study notes that generic drug prices are consistently lower than brand-name prices across all markets and time periods. This intense price competition restricts margin potential for branded generics firms.

Moreover, regulatory compliance, bioequivalence testing and quality assurance impose cost burdens and may delay market entry, acting as a restraint on faster growth.

Opportunity

Substantial opportunity exists for branded generics in markets with high demand for lower-cost medicines and broadening healthcare coverage. The PMBJP in India has demonstrated that generic medicines can be distributed widely at lower cost, thereby reducing out-of-pocket expenses for patients.

Further, the FDA’s focus on increasing generic approvals and thereby expanding competition suggests that there remains room for branded generics to gain share as originator patents expire. The convergence of regulatory support, cost pressures on healthcare systems and rising chronic disease burdens therefore position branded generics favourably.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 38.4% share and holds US$ 107.69 billion market value for the year. The region benefits from strong healthcare spending. High prescription volumes support branded generic adoption. A large ageing population increases chronic disease treatment needs. The United States promotes competition in pharmaceuticals.

The U.S. Food and Drug Administration (FDA) encourages timely generic approvals to enhance affordability and expand patient access. This policy environment strengthens branded generic penetration. Favourable insurance coverage also supports uptake. As a result, branded generics continue to expand across retail and hospital channels in the region.

Europe remains a significant market. Public health systems emphasise cost-effective medicines. Government programs encourage generic substitution. Growing awareness and reimbursement frameworks support branded generics usage. Eastern Europe demonstrates higher reliance on branded generics due to pricing structures and prescribing practices.

Asia-Pacific shows strong growth potential. Expanding healthcare investments and large patient populations fuel demand. India plays a major role as a global manufacturing hub for generics. National schemes in several Asian economies encourage affordability and wider access to essential medicines. Rising chronic disease burden drives sustained demand.

Latin America experiences steady expansion. Government procurement programs and improving insurance coverage increase generic adoption. Pharmaceutical reforms in key markets enhance regulatory clarity.

The Middle East & Africa region grows gradually. Improved healthcare access and rising public-sector investment drive uptake. However, limited reimbursement coverage in some markets slows growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The branded generics landscape is shaped by a mix of established pharmaceutical manufacturers and fast-growing regional producers. Market leadership is supported by strong product portfolios, extensive distribution networks, and advanced manufacturing capabilities. Strategic emphasis has been placed on expanding therapeutic categories, improving product quality, and enhancing supply chain efficiency.

Investment in research for bioequivalence, formulation improvements, and compliance with regulatory standards has been prioritized. Partnerships with healthcare providers and retail pharmacy chains strengthen market reach. Continuous focus on pricing strategies and cost optimization supports competitive positioning.

Expansion strategies include capacity upgrades, acquisitions, and entry into emerging markets with high demand for affordable branded medicines. Ongoing patent expirations in key drug classes offer additional avenues for portfolio expansion and sustained revenue generation across global markets.

Market Key Players

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Cipla Inc.

- Mylan N.V.

- Sandoz (Novartis)

- Dr. Reddy’s Laboratories Ltd.

- Aurobindo Pharma Ltd.

- Lupin Limited

- Amgen Inc.

- Eli Lilly and Co.

- AbbVie Inc.

- Sanofi

- Glenmark Pharmaceuticals Ltd.

- Zydus Cadila

- Others

Recent Developments

- Teva Pharmaceutical Industries Ltd. (August 2025)—Launched the first generic version of liraglutide injection (the branded product was Saxenda®) in the U.S., marking entry into the GLP-1 weight-loss class.

- Sun Pharmaceutical Industries Ltd. (July 2025)—Introduced a new alopecia treatment (LEQSELVI 8 mg tablets) in the U.S. following settlement of a patent dispute, expanding its branded generics and speciality portfolio.

- Mylan N.V. (September 2025)—Announced agreement to acquire a non-sterile topicals-focused specialty & generics business for US$950 million, strengthening its generics portfolio.

- Dr. Reddy’s Laboratories Ltd. (July 2025) Announced plans to launch generic versions of a blockbuster weight-loss drug (semaglutide) across 87 countries, signalling expansion of its branded generics footprint.

Report Scope

Report Features Description Market Value (2024) US$ 280.5 Billion Forecast Revenue (2034) US$ 492.8 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Alkylating Agents, Antimetabolites, Hormones, Anti-hypertensive, Lipid Lowering Drugs, Anti-depressants, Others) By Therapeutic Area (ardiovascular, Oncology, Diabetes, Central Nervous System (CNS), Gastrointestinal, Respiratory, Others) Route Of Administration (opical, Oral, Parenteral, Others) By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Cipla Inc., Mylan N.V., Sandoz (Novartis), Dr. Reddy’s Laboratories Ltd., Aurobindo Pharma Ltd., Lupin Limited, Amgen Inc., Eli Lilly and Co., AbbVie Inc., Sanofi, Glenmark Pharmaceuticals Ltd., Zydus Cadila, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Cipla Inc.

- Mylan N.V.

- Sandoz (Novartis)

- Dr. Reddy’s Laboratories Ltd.

- Aurobindo Pharma Ltd.

- Lupin Limited

- Amgen Inc.

- Eli Lilly and Co.

- AbbVie Inc.

- Sanofi

- Glenmark Pharmaceuticals Ltd.

- Zydus Cadila

- Others