Camylofin Market By Application (Gastrointestinal Disorders, Gynecological Disorders and Others (Urological Disorders, etc.)), By Formulations (Tablets, Injection and Syrup/Suspension), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137181

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

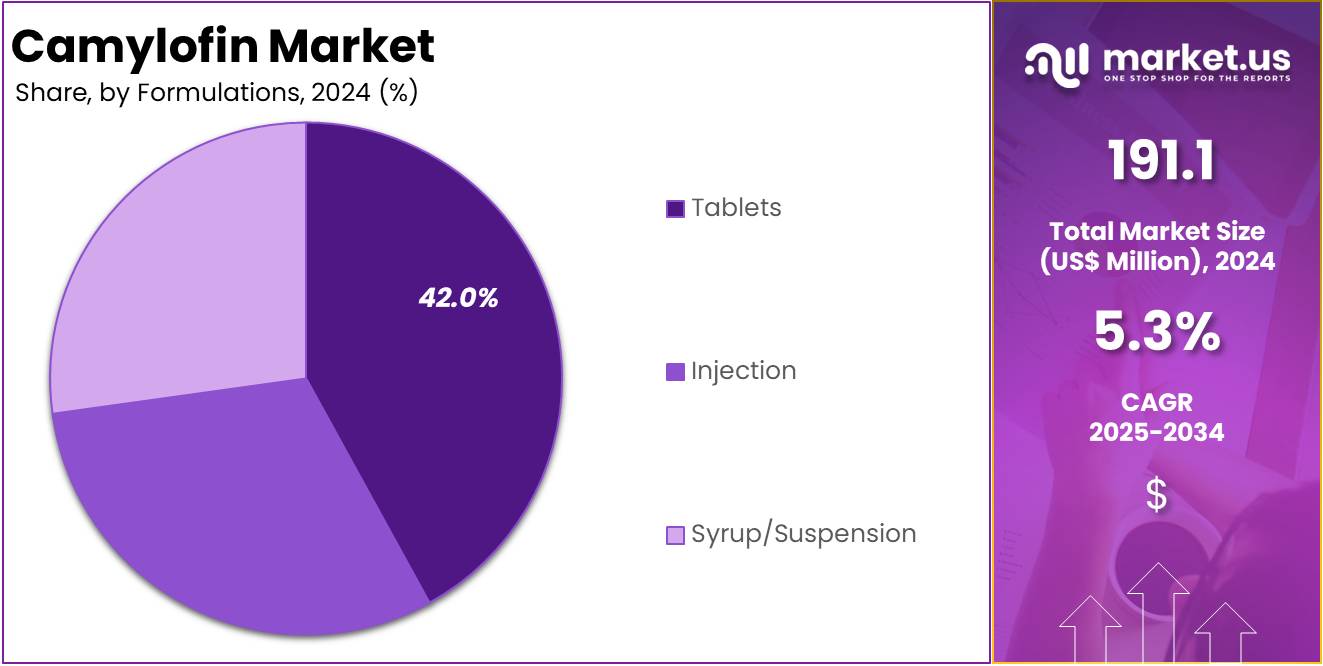

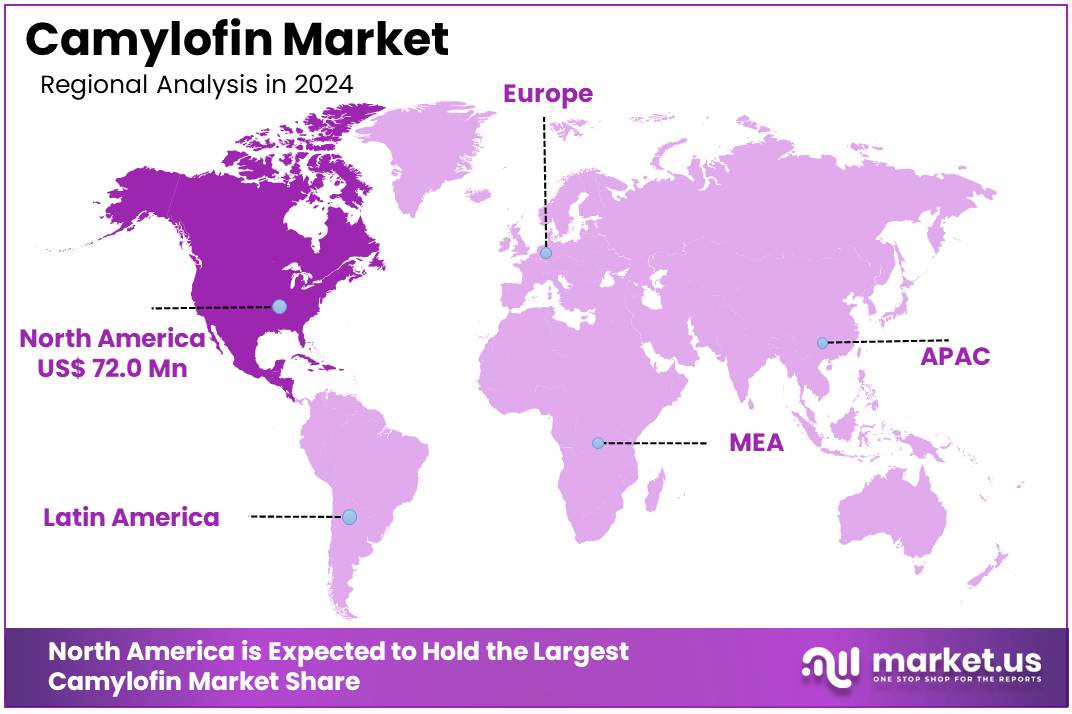

The Global Camylofin Market size is expected to be worth around US$ 320.3 Million by 2034, from US$ 191.1 Million in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 37.7% share and holds US$ 72 Million market value for the year.

Camylofin is a smooth muscle relaxant used primarily for the relief of abdominal pain, spasms, and discomfort associated with gastrointestinal and gynecological disorders. For instance, as per a study published in August 2024 in ScienceDirect, the prevalence of Functional Gastrointestinal disorders (FGIDs), 15.85% (120 individuals) of the adolescent population had functional gastrointestinal disorders (FGIDs).

The most common type was functional abdominal pain disorders, affecting 54.2% (65 individuals) of those with FGIDs, followed by functional defecation disorders at 40.8% (49 individuals), and functional nausea and vomiting disorders at 5% (6 individuals). Adolescents with FGIDs tended to be younger (average age around 13 years) and had a lower average BMI (16.9 kg/m²) compared to those without FGIDs. There was no significant difference in the prevalence of FGIDs between male and females.

It is typically employed to manage conditions such as irritable bowel syndrome (IBS), dyspepsia, dysmenorrhea (menstrual pain), and certain pelvic disorders. Camylofin works by inhibiting smooth muscle contractions in the gastrointestinal tract and other smooth muscles, providing relief from spasms and reducing associated pain. This mechanism of action makes it effective in treating conditions characterized by muscle hyperactivity or spasm.

Camylofin is available in various formulations, including oral tablets, syrups, and in some regions, injections or suppositories for more severe or acute cases. The drug is most commonly prescribed for short-term, on-demand relief, though it may also be used for chronic management depending on the specific condition and patient needs. It is well-tolerated in most patients, although, like any medication, side effects such as nausea or dizziness can occur in some individuals.

The Camylofin market is driven by the increasing prevalence of gastrointestinal disorders (e.g., IBS) and gynecological conditions (e.g., dysmenorrhea). Its smooth muscle relaxant properties make it effective in managing pain and spasms associated with these conditions. The market is primarily segmented by formulation, with oral tablets and syrups being the most common, though injections and suppositories are also available for severe cases.

Key Takeaways

- In 2024, the market for Camylofin generated a revenue of US$ 191.1 million, with a CAGR of 5.3%, and is expected to reach US$ 320.3 million by the year 2034.

- The type segment is divided into Gastrointestinal Disorders, Gynecological Disorders, Others (Urological Disorders, etc.) and Others with Gastrointestinal Disorders taking the lead in 2024 with a market share of 45.9%.

- Considering Formulations, the market is divided into Tablets, Injection, and Syrup/Suspension. Among these, Tablets held a significant share of 42%.

- By Distribution Channel, the market is classified into Hospital Pharmacies, Retail Pharmacies and Online Pharmacies. Retail Pharmacies held a major share of 44.6%.

- North America led the market by securing a market share of 37.7% in 2024.

Application Analysis

Gastrointestinal Disorders is the largest segment holding over 45.9% market share, driven by the high prevalence of conditions like irritable bowel syndrome (IBS), dyspepsia, and functional gastrointestinal disorders. Camylofin is widely used to relieve abdominal pain and spasms, making this the dominating application segment in the market.

Its efficacy in providing rapid relief from spasms and discomfort positions it as a preferred choice in this category. Camylofin is also indicated for conditions like intestinal colic, biliary colic, renal colic, and dysmenorrhea (irregular periods). Muscle spasms, which are involuntary muscle contractions, can cause significant pain.

Formulations Analysis

Based on formulation, tablets are the dominant segment, accounting for the 42% market share. Tablets are the most commonly prescribed form of Camylofin due to their convenience, ease of use, and suitability for chronic treatment of gastrointestinal and gynecological disorders. They are widely used for managing conditions like irritable bowel syndrome (IBS) and dysmenorrhea, where long-term, on-demand relief is often required.

Injections are used for more acute or severe cases, providing rapid relief from spasms and pain. While this formulation is critical in hospital or emergency settings, its market share is smaller compared to tablets due to the preference for oral treatments in outpatient care.

Distribution Channel Analysis

Retail pharmacies dominated the market with 44.6% market share in 2024. Retail pharmacies (including chain pharmacies and local drugstores) are widely available and provide Camylofin to the general population, without the need for a hospital stay. This segment is especially important for patients who need outpatient treatment and are prescribed Camylofin for conditions like gastrointestinal discomfort, colic, or spasm-related conditions.

Hospital pharmacies also play a crucial role in dispensing medications directly to inpatients and outpatients. Doctors or healthcare providers typically prescribe Camylofin in clinical settings, especially for acute conditions where immediate treatment is required.

Key Market Segments

By Application

- Gastrointestinal Disorders

- Gynecological Disorders

- Others (Urological Disorders, etc.)

By Formulations

- Tablets

- Injection

- Syrup/Suspension

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Rising Prevalence of Muscle Spasms

Muscle spasms are becoming more common, driven by factors such as stress, physical strain, poor posture, and chronic conditions like irritable bowel syndrome (IBS) and other gastrointestinal disorders. As these health issues grow in prevalence, there’s a rising demand for muscle relaxants, including Camylofin. This medication provides relief from painful and uncomfortable symptoms, making it a key player in the pharmaceutical market.

According to the World Health Organization (WHO) data from July 2022, around 1.71 million people worldwide suffer from musculoskeletal conditions. These conditions span all age groups and are especially prevalent in high-income countries, where 441 million people are affected. The demand for effective treatment solutions, such as muscle relaxants, is expected to rise with these numbers.

Musculoskeletal disorders are the leading cause of disability globally, contributing to approximately 149 million years lived with disability (YLDs), which accounts for 17% of all YLDs. This significant impact highlights the crucial need for effective medications like Camylofin, which helps alleviate muscle spasms associated with these conditions.

In addition to musculoskeletal issues, IBS also significantly contributes to the demand for Camylofin. Frequent abdominal cramps and spasms characteristic of IBS necessitate effective antispasmodic treatments. Moreover, urinary tract spasms, often caused by infections or other urological conditions, further underscore the growing need for Camylofin in the medical field. As the global population ages, the market for such medications is expected to expand further.

Restraints

Regulatory and Market Access Barriers

Many countries enforce strict regulations on the approval and sale of pharmaceuticals, including antispasmodics like Camylofin. This rigorous process, led by agencies such as the FDA in the United States and the EMA in the European Union, necessitates comprehensive clinical trials and detailed documentation. Such thorough vetting can significantly delay Camylofin’s market entry, adding to the complexity and cost of drug approval.

These regulatory challenges are particularly pronounced in emerging markets, where infrastructure may not be as developed. The lack of a robust regulatory framework can restrict access to essential medicines like Camylofin, hindering patient care and limiting market expansion. In these regions, bureaucracy and underdeveloped healthcare systems further complicate the approval process.

Additionally, in jurisdictions with stringent prescription medication regulations, acquiring market authorization for Camylofin can be a lengthy and intricate process. This is often exacerbated in developing countries, where regulatory delays and limited healthcare facilities prevent patients from accessing effective treatments. Consequently, these barriers reduce the potential market size for Camylofin in these areas, affecting overall accessibility and availability.

Opportunities

Expanding Healthcare Access in Emerging Markets

An important opportunity for the Camylofin market lies in the expanding healthcare access in emerging markets. In many developing regions, healthcare infrastructure is improving rapidly due to increasing investments, better access to healthcare professionals, and expanding insurance coverage.

This trend presents a significant opportunity for the market, as more patients in these regions will gain access to essential medications like Camylofin, which is used to treat muscle spasms, particularly those related to gastrointestinal and urinary disorders.

For example, countries in Asia, Africa, and Latin America are seeing rapid urbanization and improvements in healthcare services. In nations like India, Brazil, and Nigeria, the growing middle class and the expansion of public health programs are increasing the availability of medications through both traditional and online pharmacies.

Impact of Macroeconomic / Geopolitical Factors

Economic conditions, such as inflation, GDP growth, and healthcare spending, play a crucial role. In economically stable regions, consumers and healthcare providers can afford to purchase medications like Camylofin, leading to increased demand. Conversely, in countries facing economic downturns or high inflation, there may be a reduction in spending on non-essential medications, which could hinder Camylofin sales. Additionally, shifts in healthcare budgets and insurance coverage policies may impact the affordability and accessibility of Camylofin, particularly in emerging markets where healthcare spending is still developing.

Geopolitical instability, trade restrictions, and conflicts can disrupt the supply chain for pharmaceutical products, including Camylofin. For instance, political tensions or trade wars could result in delays in production or distribution, increasing costs and reducing the availability of Camylofin in affected regions. In addition, healthcare policies can vary widely across borders—changes in drug approval regulations, tariffs, or import/export restrictions may slow the entry of Camylofin into new markets or raise prices.

Trends

Shift Towards Oral and Non-Invasive Treatments

A notable trend in the Camylofin market is the growing preference for oral and non-invasive treatments over more invasive therapies. This shift is driven by patient demand for convenience, ease of use, and reduced side effects associated with non-invasive options. Oral medications like Camylofin offer a less disruptive way to manage conditions such as muscle spasms, abdominal cramps, and urinary tract issues, which are often treated with more complex interventions like injections or surgeries.

This shift aligns with broader healthcare trends where patients seek more convenient, less painful, and easily administered treatments. Oral medications offer better patient compliance, particularly for chronic conditions, as they can be taken at home without the need for hospital visits or injections. Additionally, non-invasive therapies like oral medications are cost-effective compared to injections, reducing the need for healthcare professionals’ time and resources.

Camylofin’s oral dosage forms are becoming more popular due to their ease of use, improving accessibility and overall patient satisfaction. As patients increasingly prefer non-invasive, at-home treatments, pharmaceutical companies are adapting by developing more oral and user-friendly Camylofin formulations, enhancing both the efficacy and convenience of treatment regimens. This trend is expected to continue as healthcare systems focus on improving patient convenience and reducing the burden on healthcare facilities.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 37.7% share and holding a market value of US$ 72.0 million. The region benefits from advanced healthcare systems and high prescription volumes. Widespread use of antispasmodic drugs for conditions such as irritable bowel syndrome (IBS) and urinary tract disorders boosts growth. Strict FDA regulations, however, affect the speed of drug approvals. These factors collectively enhance the region’s standing in the Camylofin Market.

The leadership of North America in this market is due to well-developed healthcare systems and rising adoption of antispasmodic drugs. The high prevalence of gastrointestinal disorders also drives demand. Improved access to medications supports this growth. The United States leads the market because of advanced healthcare infrastructure and growing awareness about these treatments. Favorable reimbursement policies and investments in research further enhance drug innovation and availability, strengthening the regional market.

Canada plays a key role in expanding the market by addressing growing demand for gastrointestinal treatments. Increased healthcare spending supports this trend. Government initiatives aimed at improving drug accessibility are also significant contributors. Additionally, North America’s strict regulatory frameworks maintain high-quality standards for medications. This fosters consumer trust and drives consistent demand. The combination of these factors cements the region’s dominance in the global Camylofin Market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Camylofin Market is highly competitive, with a variety of companies focusing on innovation, regulatory approvals, and consumer trust to capture market share. Key players include Merck, Incopharma, Bosnalijek, Dynamic Pro Research Insights, Kahira Pharmaceuticals, Winston Pharmaceuticals, Khandelwal Laboratories, Bio Sidus, Astar, Bo-Chem Pvt Ltd, Nishchem International Pvt. Ltd, Piramal Pharma Solutions, SM BIOMED, Ritual Drugs Private Limited, Cormedix, Gedeon Richter, Hetero Labs, Mylan, Teva Pharmaceuticals, and Zydus Cadila.

Merck & Co. (known as MSD outside the United States and Canada) is a global healthcare company that focuses on pharmaceuticals, vaccines, and biologics. While Merck is renowned for its leadership in areas such as oncology, vaccines, and cardiovascular health, its presence in the antispasmodic and gastrointestinal markets, including drugs like Camylofin, plays an important role in treating conditions such as muscle spasms and gastrointestinal disorders.

Incopharma is a pharmaceutical company based in Brazil, specializing in the development, manufacturing, and marketing of a wide range of pharmaceutical products. The company focuses on providing affordable and accessible medications for various therapeutic areas, including gastrointestinal, respiratory, and cardiovascular disorders.

Top Key Players in the Camylofin Market

- Merck

- Incopharma

- Bosnalijek

- Dynamic Pro Research Insights

- Kahira Pharmaceuticals

- Winston Pharmaceuticals

- Khandelwal Laboratories

- Bio Sidus

- Astar

- Bo-Chem Pvt Ltd

- Nishchem International Pvt. Ltd

- Piramal Pharma Solutions

- SM BIOMED

- Ritual Drugs Private Limited

- Cormedix

- Gedeon Richter

- Hetero Labs

- Mylan

- Teva Pharmaceuticals

- Zydus Cadila

- Others

Recent Developments

- In August 2024: the Indian government banned 156 fixed-dose combination (FDC) drugs, including Camylofin Dihydrochloride 25 mg + Paracetamol 300 mg. This decision was driven by concerns over potential health risks and lack of therapeutic justification for these combinations. The ban is part of a wider regulatory initiative to ensure drug safety and efficacy, based on recommendations from an expert committee and the Drugs Technical Advisory Board (DTAB).

Report Scope

Report Features Description Market Value (2024) US$ 191.1 million Forecast Revenue (2034) US$ 320.3 million CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Gastrointestinal Disorders, Gynecological Disorders and Others (Urological Disorders, etc.)), By Formulations (Tablets, Injection and Syrup/Suspension), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Merck, Incopharma, Bosnalijek, Dynamic Pro Research Insights, Kahira Pharmaceuticals, Winston Pharmaceuticals, Khandelwal Laboratories, Bio Sidus, Astar, Bo-Chem Pvt Ltd, Nishchem International Pvt. Ltd, Piramal Pharma Solutions, SM BIOMED, Ritual Drugs Private Limited, Cormedix, Gedeon Richter, Hetero Labs, Mylan, Teva Pharmaceuticals, Zydus Cadila and others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Merck

- Incopharma

- Bosnalijek

- Dynamic Pro Research Insights

- Kahira Pharmaceuticals

- Winston Pharmaceuticals

- Khandelwal Laboratories

- Bio Sidus

- Astar

- Bo-Chem Pvt Ltd

- Nishchem International Pvt. Ltd

- Piramal Pharma Solutions

- SM BIOMED

- Ritual Drugs Private Limited

- Cormedix

- Gedeon Richter

- Hetero Labs

- Mylan

- Teva Pharmaceuticals

- Zydus Cadila

- Others