Global Biolubricants Market Size, Share, And Business Benefits By Source (Vegetable Oil, Animal Oil), By Application (Transportation, Industrial), By End-use (Industrial, Commercial Transportation, Consumer Automotive), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167067

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

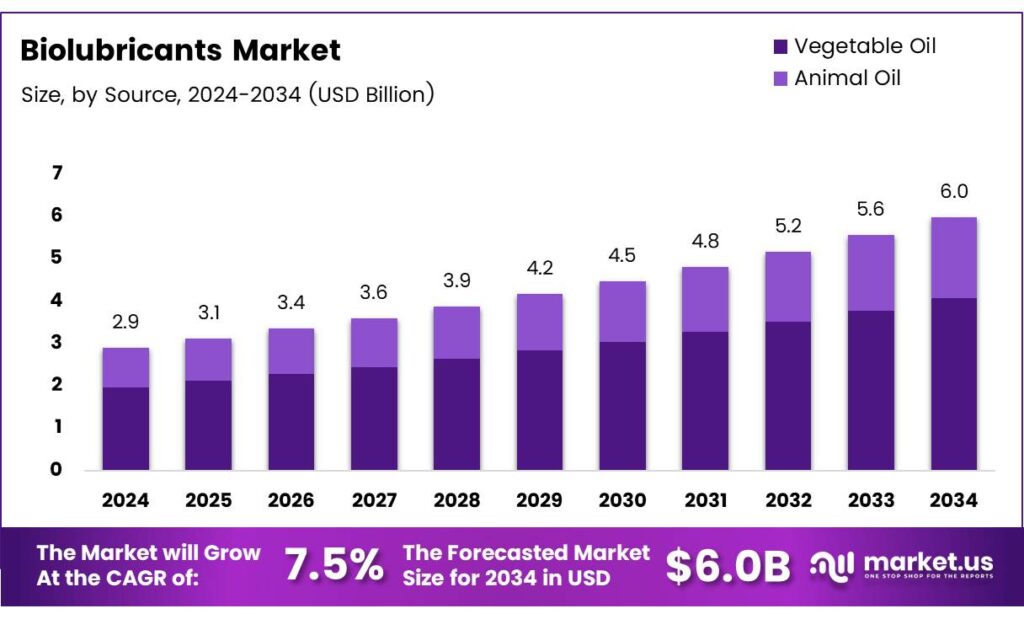

The Global Biolubricants Market size is expected to be worth around USD 6.0 billion by 2034, from USD 2.9 billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

Biolubricants are renewable lubricating oils derived from vegetable oils, animal fats, and microbial sources, offering cleaner performance for automotive, industrial machinery, and metalworking systems. They support reduced emissions and better biodegradability, making them increasingly relevant in sustainability-driven lubrication technologies across mobility, industrial operations, hydraulic systems, and eco-friendly maintenance applications.

Regulatory support drives adoption as governments encourage biodegradable hydraulic oils in forest machinery, marine vessels, and public-sector fleets. Tax rebates, procurement guidelines, and emission-cutting mandates gradually increase bio-lubricant penetration. Though their current market share remains modest, increasing user awareness and cost reductions accelerate long-term substitution of mineral oils.

In European renewable lubricant programmes, bio-based lubricant usage is expected to reach 18% of total lubricant consumption, although biolubricants currently represent only 2% of global demand. Nanoparticles reduce wear rate by 36.4% and friction coefficient by 35%, while chemically modified bio-oils show stronger oxidation stability and load-carrying capacity. These improvements position biolubricants as reliable alternatives for high-demand equipment and emerging clean-mobility systems.

- Recent scientific advances further strengthen commercial potential. An oscillator-flow reactor converts 94% of palm oil into biolubricant oil. Waste-to-oil processes using Rhodosporidium toruloides and Cryptococcus curvatus yield 88% and 82.7%, respectively, while chicken fat also undergoes transesterification for lubricant production, supporting circular-economy feedstocks.

The Biolubricants Market reflects a transition phase as manufacturers shift from petroleum-based lubricants toward renewable formulations with lower toxicity. Demand grows steadily as end-users prioritise carbon-neutral solutions, long equipment life, and reduced disposal impact. Industries such as agriculture, construction, marine, and transportation adopt bio-based hydraulic fluids, compressor oils, and gear oils due to their performance reliability.

Key Takeaways

- The Global Biolubricants Market is forecast to reach USD 6.0 billion by 2034, rising from USD 2.9 billion in 2024, at a CAGR of 7.5% between 2025–2034.

- Vegetable Oil dominates the By Source segment with a strong 84.9% share in 2024.

- Transportation leads the Application segment, accounting for 59.2% of total market demand in 2024.

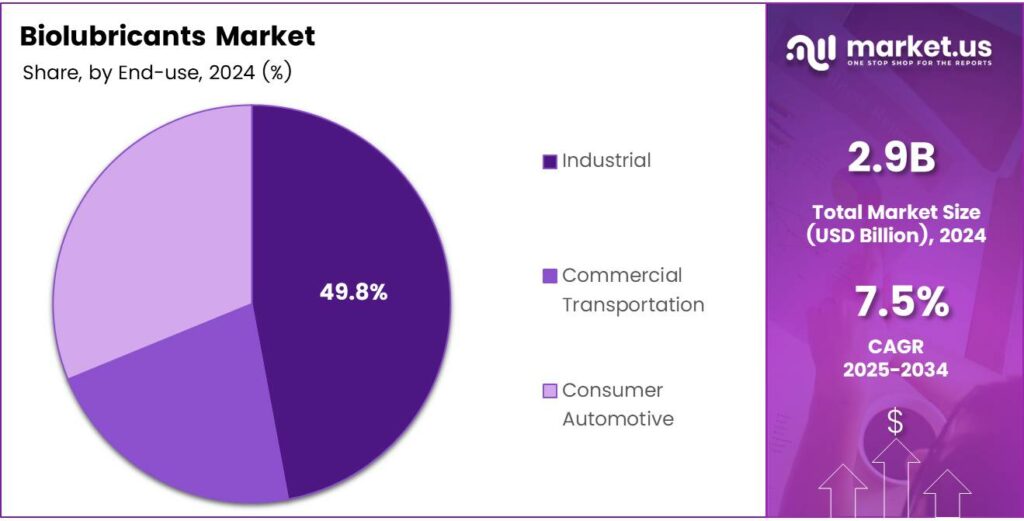

- Industrial is the top End-use segment, holding 49.8% share in 2024.

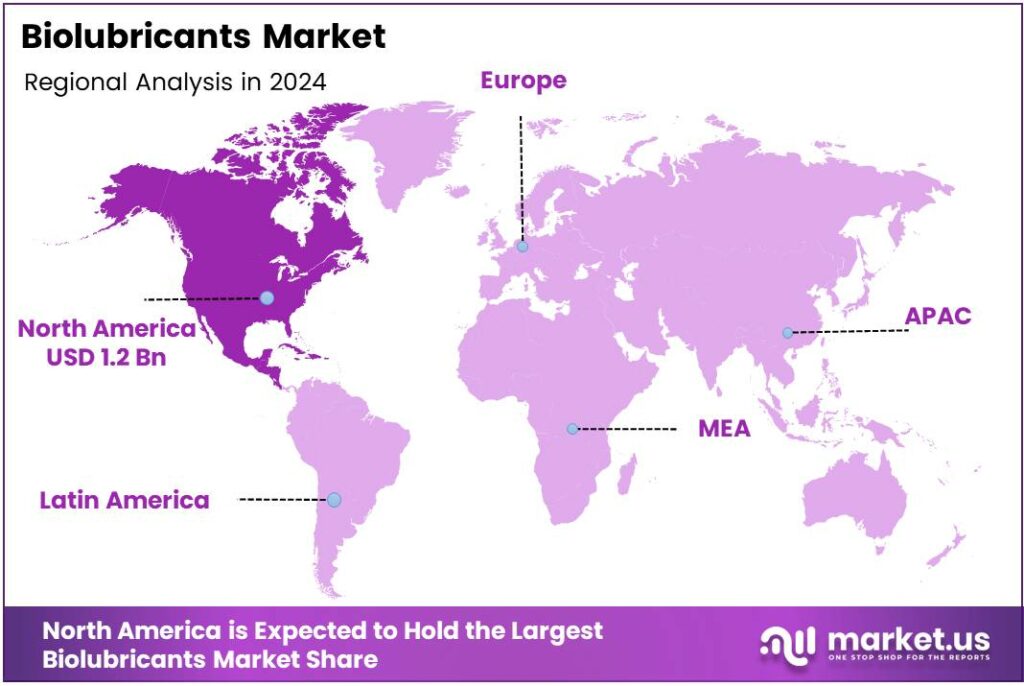

- North America remains the leading region with a 42.8% market share valued at USD 1.2 billion.

Biolubricants Market Segmentation Analysis

Vegetable Oil leads the market with an 84.9% share, driven by strong bio-based adoption and regulatory support.

By Source Analysis

In 2024, Vegetable Oil held a dominant market position in the By Source segment of the Biolubricants Market, with an impressive 84.9% share. This segment benefits from wide availability, renewable feedstock, and strong environmental acceptance. Moreover, rising interest in sustainable materials continues to push manufacturers toward vegetable-based formulations across industrial and transportation lubricants.

Animal Oil remains a smaller yet relevant segment under the By Source category. Although it lacks the dominance of vegetable-based alternatives, it still offers performance reliability in specific niche applications. Additionally, limited supply and higher processing requirements slightly restrict its wider adoption, but ongoing innovations aim to improve its viability in selected lubricant uses.

By Application Analysis

Transportation dominates with 59.2% due to rising eco-friendly mobility needs.

In 2024, Transportation held a dominant market position in the By Application segment of the Biolubricants Market, with a strong 59.2% share. Growing demand for greener engine oils, hydraulic fluids, and gear oils supports its leadership. Furthermore, regulatory moves promoting low-toxicity lubricants in vehicles amplify the need for transportation-grade biolubricants.

Industrial applications continue expanding steadily, supported by increasing use in machinery, metalworking fluids, and process oils. Though not the leading segment, industrial demand grows as companies adopt cleaner lubrication solutions. In addition, sustainability commitments across manufacturing sectors encourage the gradual replacement of mineral-based oils with bio-based alternatives.

By End-Use Analysis

Industrial dominates with 49.8% driven by rising sustainable manufacturing needs.

In 2024, Industrial held a dominant market position in the by-end-use segment of the Biolubricants Market, with a share of 49.8%. This segment benefits from strong industrial sustainability mandates and increasing equipment maintenance requirements. Additionally, factories prefer bio-based lubricants to reduce environmental impact, workplace toxicity, and waste generation.

Commercial Transportation forms a significant secondary segment, supported by higher adoption of bio-based engine oils and greases in fleets. As businesses target emission-reduction goals, demand rises for lubricants offering cleaner disposal, lower VOC emissions, and improved biodegradability. This trend gradually strengthens commercial transportation’s contribution to the market.

Consumer Automotive represents another important segment in the Biolubricants Market. Although smaller in scale, it continues to gain traction as individuals prefer environmentally responsible vehicle maintenance products. Moreover, growing awareness of sustainable mobility encourages consumers to explore bio-based engine and transmission oils as alternatives to conventional mineral lubricants.

Key Market Segments

By Source

- Vegetable Oil

- Animal Oil

By Application

- Transportation

- Automotive Engine Oils

- Gear Oils

- Hydraulic Oil

- Transmission Fluids

- Greases

- Chainsaw Oils

- Others

- Industrial

- Process Oil

- Demolding Oil

- Industrial Gear Oil

- Industrial Greases

- Metal Working Fluid

- Others

By End-Use

- Industrial

- Commercial Transportation

- Consumer Automotive

Emerging Trends

Growing Preference for Eco-Safe Industrial Fluids Drives Market Growth

The Biolubricants Market is experiencing strong momentum as industries increasingly shift toward safer, eco-friendly fluids. Companies in manufacturing, transportation, and construction now prefer lubricants made from vegetable and animal oils because they reduce emissions and lower workplace hazards. This trend is becoming more common as firms seek clean solutions that match tightening environmental rules.

- The EAL definition includes that ≥ 90% by weight of lubricant constituents must biodegrade ≥ 60% within 28 days under OECD test methods. This regulatory trend is propelling foundational demand for biolubricants: companies such as TotalEnergies Lubrifiants reference having over 865 vessels using our EALs, consuming a combined 2 million litres in marine applications.

The demand for high-performance, biodegradable lubricants is expanding due to the need for safer disposal options. Industries dealing with frequent lubricant leaks, such as marine, forestry, and agriculture, prefer biolubricants because they break down naturally and reduce soil and water contamination. This practical benefit makes them a reliable choice for long-term operations.

Drivers

Rising Shift Toward Eco-Friendly Lubrication Solutions Drives Market Growth

Growing environmental awareness is one of the biggest forces pushing the biolubricants market forward. Industries are steadily moving toward cleaner, safer, and biodegradable solutions as regulations tighten. Companies now prefer lubricants made from vegetable oils because they reduce emissions and improve workplace safety. This shift supports long-term sustainability goals across manufacturing, transportation, and energy sectors.

- TotalEnergies states that a single litre of oil can pollute as much as 1,000,000 litres of water in the context of biodegradable lubricant messaging. TotalEnergies Lubrifiants announced that in Europe, their premium lubricant bottles now incorporate 50% post-consumer recycled (PCR) high-density polyethene, and they aim to reach 50% recycled packaging by 2030.

Another strong driver is the improved performance of biolubricants. New processing technologies help bio-based oils deliver better lubricity, higher viscosity stability, and lower volatility compared to conventional options. This leads to longer equipment life and reduced maintenance, making biolubricants appealing for heavy machinery, automotive systems, and industrial equipment.

Restraints

High Production Costs Limit Faster Biolubricants Market Expansion

One major restraint in the biolubricants market comes from the higher production costs compared to mineral-based alternatives. Many bio-based oils require expensive feedstocks and additional refining steps, which raise overall pricing. As a result, industries that depend on large lubricant volumes often hesitate to shift quickly toward bio-based options.

Another challenge is the limited availability of consistent-quality raw materials. Factors such as fluctuating crop yields, weather uncertainties, and competition with food production affect supply stability. When feedstock availability becomes unpredictable, manufacturers face delays and cost pressures, reducing market confidence among end users.

Performance limitations also restrict adoption in heavy-duty applications. While biolubricants offer strong biodegradability and lower toxicity, some formulations struggle with extreme temperatures and oxidation stability. This creates hesitation in sectors like transportation and industrial machinery, where equipment reliability is critical.

Additionally, a lack of awareness and inadequate regulatory enforcement slow acceptance in developing markets. Many small and mid-size industries remain unaware of long-term cost benefits and environmental advantages. Without strong policy support, subsidies, or mandatory sustainability targets, companies tend to continue using cheaper conventional lubricants.

Growth Factors

Rising Shift Toward Eco-Friendly Industrial Oils Creates New Opportunities

Growing awareness about environmental safety is opening strong opportunities for biolubricants. Many industries are now replacing traditional petroleum-based oils with cleaner and safer options. This shift allows producers to offer biodegradable, low-toxicity lubricants that fit new sustainability policies. As companies aim to reduce emissions and workplace hazards, demand for bio-based alternatives is expected to rise steadily.

Another major opportunity comes from government-led green programs. Several countries are encouraging industries to use renewable and bio-based oils in public infrastructure, transportation fleets, and agriculture. These policies push buyers to adopt biolubricants, creating long-term supply contracts for manufacturers. Supportive rules and tax incentives further improve the business case for expanding production capacities.

Growth in high-performance machinery is also boosting opportunities. Modern equipment requires premium-quality lubricants that offer better stability, longer life, and cleaner operation. Biolubricants made from vegetable oils and esters match these needs well. Their natural lubricity and thermal resistance attract users in metalworking, hydraulics, and marine operations, opening new application areas.

Regional Analysis

North America Dominates the Biolubricants Market with a Market Share of 42.8%, Valued at USD 1.2 Billion

North America leads the global biolubricants market, supported by strong environmental policies and early adoption of bio-based formulations. The region’s dominance, holding 42.8% of total demand and reaching USD 1.2 billion, reflects stringent sustainability standards in automotive, industrial, and marine sectors. Ongoing regulations promoting biodegradability continue to strengthen market penetration across manufacturing and transportation segments.

Europe remains a mature market driven by strict eco-label requirements and long-standing bio-lubricant development programs. The region benefits from governmental incentives encouraging reduced carbon emissions and wider use of plant-based oils. Rising industrial machinery upgrades and focus on circular-economy practices support steady growth across Western and Northern Europe.

Asia Pacific shows increasing interest in bio-based lubricants as industrialisation accelerates and nations push cleaner manufacturing strategies. Growing demand in the automotive and construction sectors is complemented by government initiatives promoting renewable raw materials. Expanding manufacturing clusters in China, India, and Southeast Asia create new opportunities for product substitution from mineral oils to biolubricants.

The Middle East & Africa market is gradually adopting biolubricants as sustainability goals become more prominent in energy and industrial operations. Demand is supported by efforts to reduce environmental impact in mining, construction, and transportation fleets. Investment in green technologies and diversification strategies contributes to a slow but steady rise in adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Biolubricants Market continued to mature as leading energy and lubricant manufacturers accelerated investments in bio-based formulations. Companies focused on improving oxidative stability, ensuring OEM compatibility, and expanding supply chains for vegetable-oil-derived base stocks. This shift reflects stronger sustainability mandates across transportation, industrial machinery, and metalworking fluids, supported by cleaner-emission goals in major economies.

Total Energies strengthened its position by scaling bio-based lubricant solutions across industrial and marine applications. The company strategically aligned its low-carbon product portfolio with global decarbonization policies, enhancing demand for ester-based lubricants in environmentally sensitive operations.

Exxon Mobil Corporation advanced its bio-lubricant initiatives through enhanced R&D programs aimed at boosting performance under high-temperature and heavy-load conditions. Its efforts to integrate renewable feedstocks with high-performance additive technologies positioned the company to capture rising demand from automotive and industrial end users.

Shell plc maintained a strong foothold by expanding its eco-engine oils and hydraulic fluid offerings, leveraging its global distribution network. The company’s investments in circularity and renewable feedstock sourcing supported broader adoption of biodegradable lubricants in equipment maintenance and large-scale logistics.

CASTROL Limited accelerated its transition toward bio-derived products, focusing on high-performance formulations for transport and manufacturing. Its emphasis on reducing carbon intensity while maintaining equipment protection helped strengthen its competitive market profile amid growing sustainability commitments.

Top Key Players in the Market

- Total Energies

- Exxon Mobil Corporation

- Shell plc

- CASTROL Limited

- PETRONAS Lubricants International

- Kluber Lubrication

- Emery Oleochemicals

- CASTROL Limited

- FUCHS

Recent Developments

- In 2025, ExxonMobil focuses on high-performance bio-based lubricants that meet Vessel General Permit (VGP) requirements for environmentally acceptable lubricants (EALs), particularly in marine and industrial settings. Innovations include synthetic hydraulic oils with improved lubricity and cold-weather performance.

- In 2025, TotalEnergies has emphasised biodegradable lubricants derived from synthetic esters and vegetable oils, designed to meet OECD standards for biodegradability while maintaining high performance in applications like agriculture, marine, and construction.

Report Scope

Report Features Description Market Value (2024) USD 2.9 billion Forecast Revenue (2034) USD 6.0 billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Vegetable Oil, Animal Oil), By Application – Transportation (Automotive Engine Oils, Gear Oils, Hydraulic Oil, Transmission Fluids, Greases, Chainsaw Oils, Others), By Application – Industrial (Process Oil, Demolding Oil, Industrial Gear Oil, Industrial Greases, Metal Working Fluid, Others), By End-use (Industrial, Commercial Transportation, Consumer Automotive) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Total Energies, Exxon Mobil Corporation, Shell plc, CASTROL Limited, PETRONAS Lubricants International, Kluber Lubrication, Emery Oleochemicals, CASTROL Limited, FUCHS Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Total Energies

- Exxon Mobil Corporation

- Shell plc

- CASTROL Limited

- PETRONAS Lubricants International

- Kluber Lubrication

- Emery Oleochemicals

- CASTROL Limited

- FUCHS