Global Biologics Contract Manufacturing Market By Product Type (Monoclonal Antibodies, Vaccines, Gene Therapy, Cell Therapy and Others), By Indication (Oncology, Autoimmune Diseases, Cardiovascular Diseases, Infectious Diseases and Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178437

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

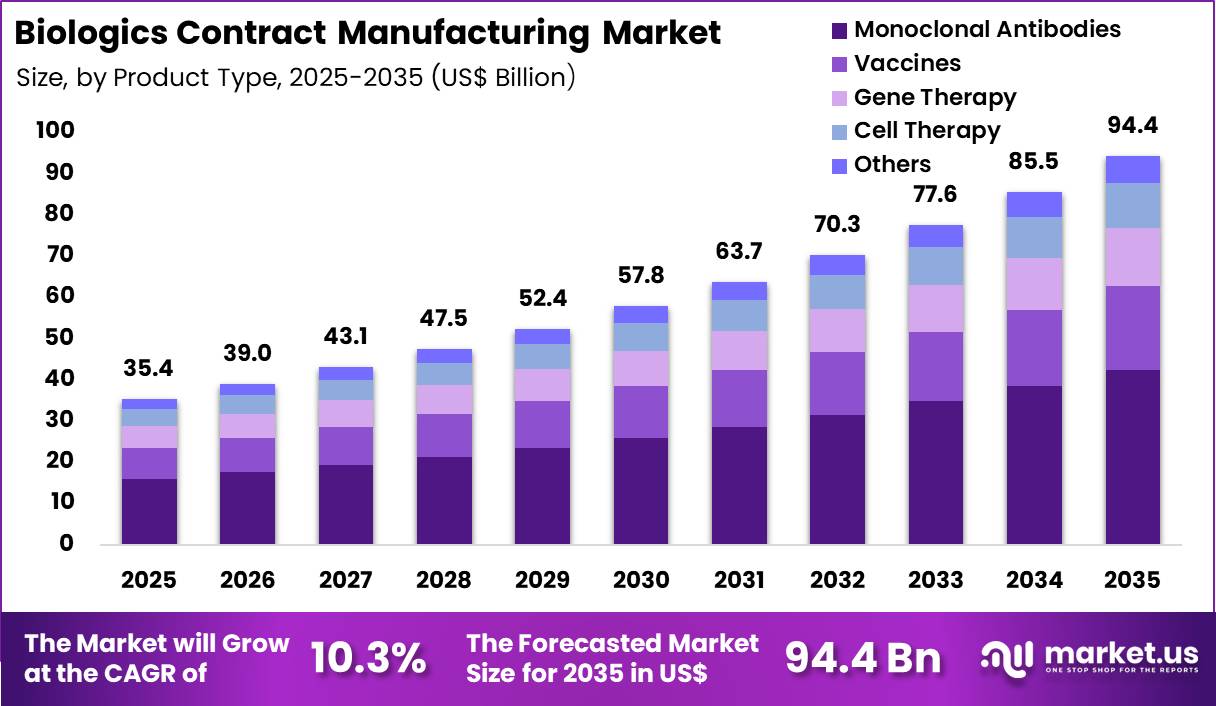

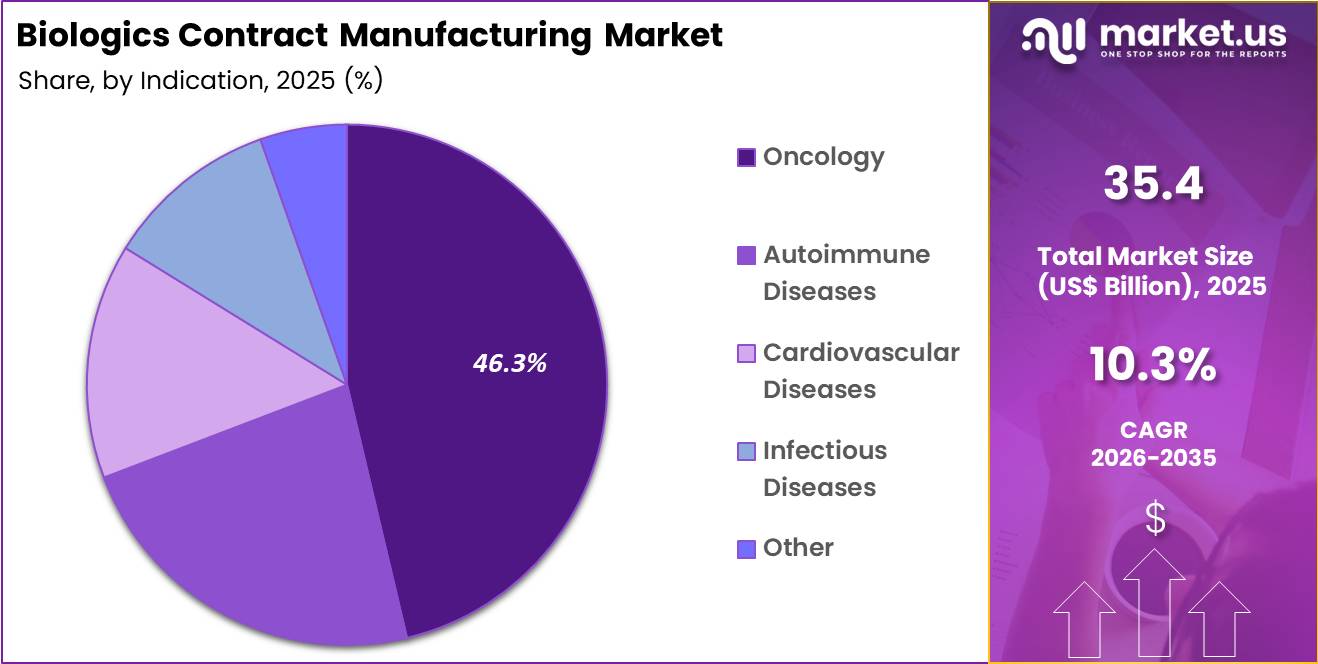

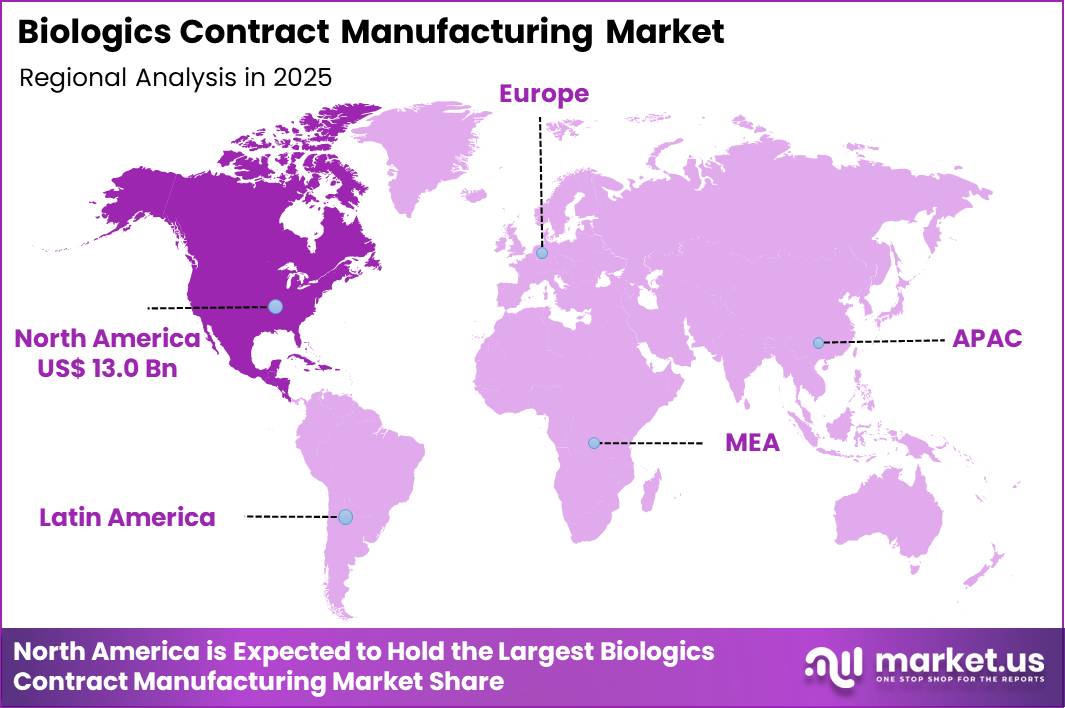

The Global Biologics Contract Manufacturing Market size is expected to be worth around US$ 94.4 Billion by 2035 from US$ 35.4 Billion in 2025, growing at a CAGR of 10.3% during the forecast period 2026-2035. In 2025, North America led the market, achieving over 36.7% share with a revenue of US$ 13.0 Billion.

Increasing complexity of biologic molecules and the need for specialized manufacturing expertise drive biopharmaceutical companies to outsource production to contract manufacturing organizations that deliver scalable, regulatory-compliant solutions.

These partners produce monoclonal antibodies for oncology and autoimmune therapies, ensuring consistent glycosylation and high purity through advanced cell line development and downstream processing. Contract manufacturers also support viral vector production for gene therapies, optimizing transient and stable expression systems to meet stringent quality requirements for rare disease treatments.

They enable large-scale cell therapy manufacturing, including autologous CAR-T processes that demand closed-system automation and rigorous sterility controls. These services further extend to recombinant protein production for vaccines and enzyme replacement therapies, providing flexible capacity that accelerates clinical timelines and commercial supply.

Contract development and manufacturing organizations seize opportunities to integrate end-to-end services that combine drug substance and drug product manufacturing, reducing technology transfer risks and shortening time-to-market for novel biologics.

Developers advance single-use and continuous manufacturing platforms that enhance flexibility for personalized cell and gene therapies while lowering capital investment for emerging biotech firms. These innovations facilitate rapid scale-up of bispecific antibodies and antibody-drug conjugates, supporting oncology pipelines that require precise conjugation and purification.

Opportunities also arise in process analytical technology and digital twins that enable real-time monitoring and predictive modeling, improving yield consistency across complex modalities. Recent trends emphasize sustainable manufacturing practices and modular facilities that accommodate multi-product campaigns, positioning biologics contract manufacturing as a strategic enabler for innovation in advanced therapies and precision medicine.

Key Takeaways

- In 2025, the market generated a revenue of US$ 35.4 Billion, with a CAGR of 10.3%, and is expected to reach US$ 94.4 Billion by the year 2035.

- The product type segment is divided into monoclonal antibodies, vaccines, gene therapy, cell therapy and others, with monoclonal antibodies taking the lead with a market share of 44.9%.

- Considering indication, the market is divided into oncology, autoimmune diseases, cardiovascular diseases, infectious diseases and other. Among these, oncology held a significant share of 46.3%.

- North America led the market by securing a market share of 36.7%.

Product Type Analysis

Monoclonal antibodies contributed 44.9% of growth within product type and led the biologics contract manufacturing market due to their dominant position in global biologics pipelines. Pharmaceutical sponsors increasingly outsource monoclonal antibody production to contract manufacturers to access specialized bioreactor capacity and regulatory expertise.

High development complexity and strict quality requirements drive reliance on experienced manufacturing partners. Expanding biosimilar development programs further increase outsourcing demand for scalable antibody production.

Growth strengthens as therapeutic antibodies expand into multiple disease areas beyond oncology. Contract manufacturers invest in high-yield cell line technologies and single-use systems to improve efficiency. Sponsors seek flexible manufacturing capacity to manage pipeline variability.

Regulatory compliance and global supply chain requirements reinforce long-term partnerships. The segment is expected to remain dominant as monoclonal antibodies continue to anchor biologics innovation and commercial revenue generation.

Indication Analysis

Oncology generated 46.3% of growth within indication and emerged as the leading segment due to the strong focus on targeted biologic therapies in cancer treatment. Pharmaceutical companies prioritize oncology programs because of high unmet clinical needs and accelerated approval pathways.

Monoclonal antibodies, antibody-drug conjugates, and immune-based biologics drive significant manufacturing demand. Increasing cancer incidence and expanding immunotherapy indications elevate production requirements.

Growth accelerates as precision oncology advances require complex biologic formulations and combination regimens. Clinical trial activity in oncology continues to expand, which increases contract manufacturing volumes. Regulatory incentives for breakthrough therapies further stimulate development.

Global investment in cancer research sustains pipeline expansion. The segment is anticipated to maintain leadership as oncology remains the most active and innovation-driven area within biologics development.

Key Market Segments

By Product Type

- Monoclonal Antibodies

- Vaccines

- Gene Therapy

- Cell Therapy

- Others

By Indication

- Oncology

- Autoimmune Diseases

- Cardiovascular Diseases

- Infectious Diseases

- Other

Drivers

Strong revenue growth from leading CDMOs is driving the market.

The robust revenue increases reported by major biologics contract manufacturers reflect surging global demand for outsourced production of complex biologic drugs. Biopharmaceutical companies continue to outsource manufacturing to focus internal resources on research and clinical development. This outsourcing model allows CDMOs to achieve economies of scale and maintain specialized expertise in mammalian cell culture and purification.

The growth in revenue is supported by the expanding pipeline of monoclonal antibodies, antibody-drug conjugates, and other advanced biologics. Contract manufacturers are actively investing in new facilities to accommodate larger commercial batches.

The shift toward biologics in pharmaceutical pipelines has accelerated the need for reliable external manufacturing partners. Leading CDMOs have demonstrated consistent year-over-year growth despite broader industry challenges. This driver encourages further capacity expansions and adoption of advanced manufacturing technologies.

Samsung Biologics reported revenue of KRW 4.55 trillion in 2024, a 23% increase from KRW 3.69 trillion in 2023. This performance underscores the strong underlying demand for biologics contract manufacturing services worldwide.

Restraints

Substantial capital investments for capacity expansion are restraining the market.

The high upfront costs of constructing and validating new biologics manufacturing facilities create significant financial barriers for both established and emerging CDMOs. Many companies must secure large loans or equity financing to fund multi-year expansion projects. Regulatory requirements for GMP compliance and process validation extend timelines and increase total project expenses.

Smaller CDMOs often lack the balance sheet strength to compete in large-scale capacity additions. Economic uncertainty can make investors hesitant to fund new plants amid fluctuating interest rates. This restraint slows the overall pace of global capacity growth relative to demand.

Providers must carefully balance capital allocation between current operations and future projects. The long payback period for new facilities can strain cash flows during construction phases. Lonza invested CHF 1.4 billion in capital expenditures in 2024, equivalent to 22% of its sales. This level of investment illustrates the substantial financial commitment required to remain competitive in the biologics contract manufacturing sector.

Opportunities

Expansion of manufacturing capacity in Asia is creating growth opportunities.

The rapid addition of new production facilities across Asia provides substantial potential for the biologics contract manufacturing market to serve both regional and global clients. Governments in key Asian countries are offering incentives to attract foreign investment in biotechnology infrastructure.

Local CDMOs are building large-scale plants equipped with advanced single-use technologies to meet international standards. This expansion reduces reliance on Western manufacturing hubs and shortens supply chain lead times for many sponsors.

Strategic partnerships between Asian CDMOs and global pharmaceutical companies facilitate technology transfer and regulatory alignment. The growing talent pool of skilled bioprocessing professionals in the region supports efficient facility operations. This opportunity enables cost-competitive manufacturing while maintaining high quality standards.

International sponsors are increasingly diversifying their manufacturing footprints to mitigate geopolitical risks. WuXi Biologics reported revenue of RMB 18,675.4 million in 2024, a 9.6% increase from the previous year. This growth demonstrates the rising contribution of Asian CDMOs to the global biologics supply chain.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the biologics contract manufacturing market through pharma R&D budgets, capital access, and long term outsourcing strategies. Inflation and higher interest rates raise borrowing costs for capacity expansion, which slows facility builds and equipment investments.

Geopolitical tensions disrupt supplies of single use systems, cell culture media, resins, and specialized equipment, increasing operational risk and cost volatility. Current US tariffs on imported bioprocess equipment and critical inputs elevate project expenses, which compresses margins and complicates client pricing negotiations.

These pressures affect emerging biotech sponsors and smaller CMOs more directly. On the positive side, trade exposure accelerates domestic manufacturing investment, regional capacity expansion, and multi sourcing of raw materials.

Strong pipeline growth in monoclonal antibodies, cell therapies, and novel biologics sustains outsourcing demand. With operational excellence, automation, and strategic partnerships, the market remains positioned for resilient and confident growth.

Latest Trends

Signing of large long-term manufacturing contracts is a recent trend in the market.

In 2024, several leading CDMOs secured multi-year, high-value manufacturing agreements with pharmaceutical sponsors. These contracts provide revenue visibility and justify large-scale capacity investments. Manufacturers are focusing on strategic partnerships that include dedicated production suites and exclusive rights for specific molecules.

The trend reflects sponsor confidence in long-term demand for approved biologics. Contracts frequently incorporate technology transfer, process optimization, and regulatory support services. This approach reduces risk for both parties in an increasingly competitive environment. Regulatory pathways support efficient scale-up and validation under these long-term agreements.

Industry leaders are leveraging such contracts to strengthen client relationships and expand their portfolios. Samsung Biologics signed a contract worth approximately USD 1.2 billion in 2024 with an Asia-based pharmaceutical company. This agreement contributed to the company’s total contract value exceeding USD 3.3 billion for the year.

Regional Analysis

North America is leading the Biologics Contract Manufacturing Market

North America accounted for a 36.7% share of the Biologics Contract Manufacturing market in 2024, driven by strong outsourcing activity from biotech and pharmaceutical innovators. Emerging biotech firms increasingly relied on specialized manufacturing partners to access advanced cell culture, fill finish, and quality control capabilities without heavy capital investment.

Growth in monoclonal antibodies, cell and gene therapies, and complex recombinant proteins strengthened demand for flexible and high containment production suites. Established regulatory pathways and skilled bioprocess talent supported efficient scale up from clinical to commercial volumes.

Investments in single use systems and continuous processing enhanced operational agility across manufacturing sites. Strategic collaborations between sponsors and contract manufacturers shortened development timelines and improved supply reliability.

A key supporting indicator comes from the US Food and Drug Administration, which reported 55 novel drug approvals through its CDER program in 2023, reflecting sustained biologics innovation that fuels outsourcing demand.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Biologics Contract Manufacturing market in Asia Pacific is expected to expand steadily during the forecast period as governments strengthen domestic biopharmaceutical production and export capabilities. Countries such as China, South Korea, India, and Singapore actively invest in large scale biologics facilities and advanced bioprocess technologies.

Regional firms pursue global partnerships to support late stage clinical manufacturing and commercial supply. Competitive production costs and expanding skilled workforces attract international sponsors seeking diversified supply chains. Regulatory harmonization and improved quality standards increase global confidence in regional output.

Growing biosimilar pipelines further stimulate demand for large scale production services. A verifiable signal of commitment appears in 2023 data from Singapore’s Economic Development Board, which highlighted continued multibillion dollar investments into biopharmaceutical manufacturing infrastructure, underscoring sustained regional capacity expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the biologics contract manufacturing market grow by expanding high-complexity capabilities such as monoclonal antibody production, cell-culture scale-up, and viral vector processing that support the advanced needs of biopharma developers. They also strengthen customer value by embedding quality systems, regulatory support services, and digital process controls that reduce compliance risk and accelerate submission timelines for global markets.

Firms pursue strategic alliances with emerging biotech innovators and large pharmaceutical partners to secure multi-year production commitments and share development risk on complex programs. Geographic expansion into Asia Pacific and Europe complements strong positions in North America, capturing rising investments in biologic therapeutics and diversified manufacturing capacity.

Catalent, Inc. exemplifies a leading contract development and manufacturing organization with a broad biologics services portfolio, global facility footprint, and coordinated commercial strategy that connects technical excellence with client operational goals.

The company advances performance through disciplined R&D investment, targeted acquisitions that broaden service breadth, and a customer-centric model that translates specialized capabilities into scalable solutions for complex biologic pipelines.

Top Key Players

- Thermo Fisher Scientific

- Samsung Biologics

- Lonza Group

- Catalent

- Samsung Bioepis

- Fujifilm Diosynth Biotechnologies

- Wuxi Biologics

- BioVectra

- Boehringer Ingelheim BioXcellence

- AGC Biologics

Recent Developments

- In November 2024, FUJIFILM Diosynth Biotechnologies formalized a multi-year manufacturing partnership with TG Therapeutics, Inc. to produce BRIUMVI (ublitiximab-xiiy), a therapy cleared by the FDA for patients with relapsing multiple sclerosis. The agreement supports ongoing commercial supply of the monoclonal antibody and strengthens large-scale production capacity for the treatment.

- In November 2024, Lonza outlined an expansion project at its Ibex biopark campus in Visp, Switzerland. The development plan includes constructing two additional 1,200-liter biologics production suites, increasing the site’s operational footprint by roughly 2,000 square meters and reinforcing its flexible manufacturing capabilities for biopharmaceutical clients.

Report Scope

Report Features Description Market Value (2025) US$ 35.4 Billion Forecast Revenue (2035) US$ 94.4 Billion CAGR (2026-2035) 10.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Monoclonal Antibodies, Vaccines, Gene Therapy, Cell Therapy and Others), By Indication (Oncology, Autoimmune Diseases, Cardiovascular Diseases, Infectious Diseases and Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Samsung Biologics, Lonza Group, Catalent, Samsung Bioepis, Fujifilm Diosynth Biotechnologies, Wuxi Biologics, BioVectra, Boehringer Ingelheim BioXcellence, AGC Biologics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Biologics Contract Manufacturing MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Biologics Contract Manufacturing MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Samsung Biologics

- Lonza Group

- Catalent

- Samsung Bioepis

- Fujifilm Diosynth Biotechnologies

- Wuxi Biologics

- BioVectra

- Boehringer Ingelheim BioXcellence

- AGC Biologics