Multiple Sclerosis Therapeutics Market Analysis By Drug Class (Immunosuppressants, Immunostimulants, Interferons and Others), By Route of Administration (Oral, Injectable and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies and E-Commerce), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135902

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Multiple Sclerosis Therapeutics Market size is expected to be worth around US$ 43.9 Billion by 2033, from US$ 25.9 Billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

This growth is driven by the increasing global prevalence of the disease and advancements in treatment options, particularly the development of disease-modifying therapies (DMTs) that effectively manage symptoms and slow disease progression.

- The MS International Federation reports that the global number of people living with multiple sclerosis has risen from 2.3 million in 2013 to 2.8 million in 2020 and further to 2.9 million in 2023.

- According to the National Multiple Sclerosis Society, nearly one million individuals in the United States have been diagnosed with multiple sclerosis.

The market is segmented based on drug class, route of administration, and distribution channel. Key drug classes include immunosuppressants, immunostimulants, interferons, and others. Immunosuppressants and disease-modifying therapies (DMTs) have become the cornerstone of MS treatment, effectively slowing disease progression and managing symptoms. Routes of administration such as oral, injectable, subcutaneous, and intravenous options cater to diverse patient preferences, enhancing treatment accessibility and adherence.

Hospital pharmacies dominate the distribution landscape, followed by retail pharmacies and the rapidly growing e-commerce segment. Increasing adoption of digital platforms for prescription refills and medication delivery further boosts market growth.

Technological advancements play a pivotal role in the market’s expansion. Innovative treatments, such as transcranial direct current stimulation (tDCS) and assistive technologies like robotic arms and voice-controlled devices, have significantly improved patient outcomes. These innovations, coupled with the development of novel drugs, address unmet medical needs and provide opportunities for market players.

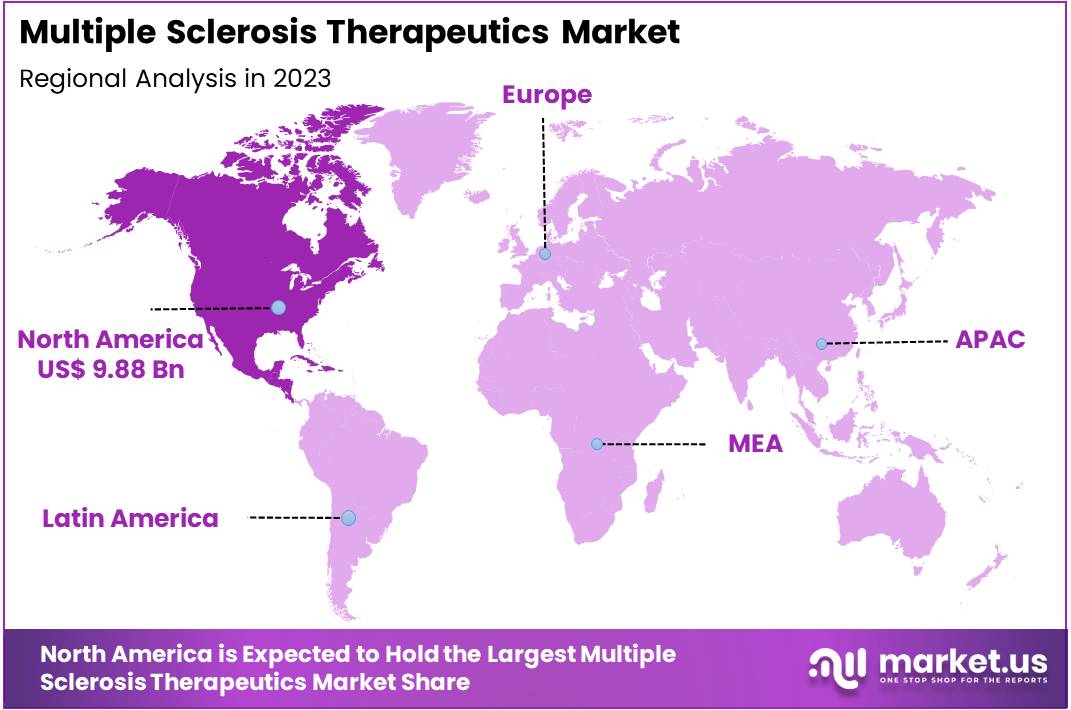

Additionally, government initiatives and support for research and development, alongside rising healthcare spending, are fostering a favorable environment for growth. North America remains the largest market, driven by high disease prevalence, advanced healthcare infrastructure, and significant investment in research. Europe and Asia-Pacific are also experiencing steady growth, with increasing healthcare access and awareness.

Overall, the global MS therapeutics market is poised for significant expansion, driven by technological progress, increased diagnosis rates, and a strong pipeline of innovative treatments. This ensures improved care for patients and sustained opportunities for stakeholders in the forecast period.

Key Takeaways

- The Multiple Sclerosis Therapeutics market generated a revenue of US$ 25.9 billion in 2023, and is predicted to reach US$ 43.94 billion, with a CAGR of 5.5% by 2033.

- Based on the Drug Class, the Immunosuppressants segment generated the most revenue for the market with a market share of 37.6%.

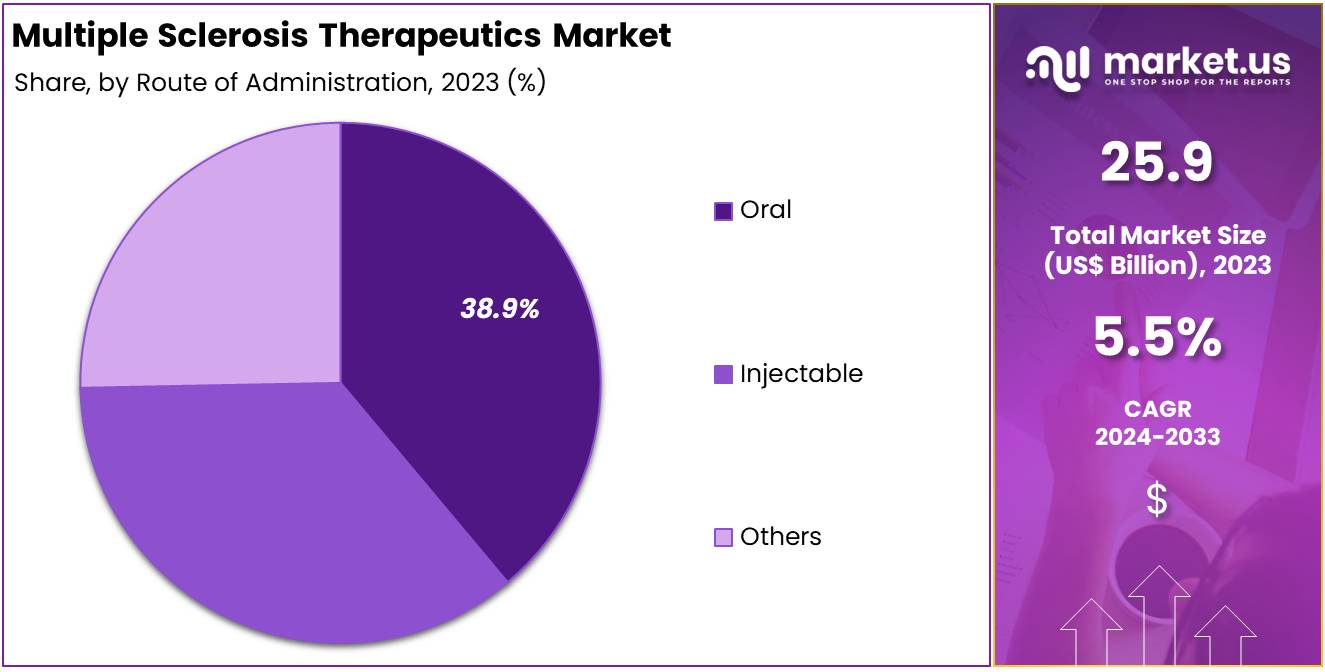

- By route of administration, the Oral segment contributed the most to the market and secured a market share of 38.9%.

- In terms of distribution channel, the hospitals led the market in 2023, with a market share of 48.6%.

- Region-wise, North America remained the lead contributor to the market, by claiming the highest market share, amounting to 38.20%.

Drug Class Analysis

Based on the drug class, the market is further segmented into Immunosuppressants, Immunostimulants, Interferons and Others. In 2023, the immunosuppressants segment led the market with a 37.6% share, reflecting its critical role in managing multiple sclerosis by suppressing abnormal immune responses. The segment’s growth is supported by increasing approvals of new products for MS treatment. These medications offer several advantages, including lower dosage requirements, reduced adverse effects, and high efficacy, which are key drivers of market expansion.

Meanwhile, the immunostimulants segment is anticipated to grow at a robust CAGR of 6.6% during the forecast period. Immunostimulants enhance the immune system’s activity, which can be beneficial in managing multiple sclerosis by slowing disease progression. Advances in research and technology are driving the development of new immunostimulant therapies that target specific pathways involved in MS pathogenesis, presenting promising treatment options for patients. These innovations are expected to contribute significantly to the segment’s growth and the broader expansion of the MS therapeutics market.

Route of Administration Analysis

In 2023, the injectable segment emerged as the largest contributor to the market, accounting for a significant share of 52.9%. This dominance is attributed to the growing preference for injectable drugs, driven by their superior efficacy and rapid onset of action compared to other modes of drug administration. Injectable are particularly effective in managing disease symptoms with precision, ensuring better patient outcomes. Additionally, healthcare professionals often favor injectable drugs in cases where immediate therapeutic impact is required, further supporting their widespread adoption.

Meanwhile, the oral segment is anticipated to witness steady growth, projected to expand at fastest compound annual growth rate during the forecast period. This growth is fueled by the increasing demand for oral medications, which are highly regarded for their convenience and non-invasive nature. Oral drugs offer patients the advantage of ease in self-administration, eliminating the need for frequent visits to healthcare facilities or the discomfort associated with injections.

This makes them particularly appealing for individuals requiring long-term treatment regimens. The ability to integrate oral medications into daily routines seamlessly further enhances their popularity, particularly among patients with chronic conditions. As a result, the oral segment is poised to capture a growing share of the market in the coming years.

End-User Analysis

In 2023, the hospital pharmacies segment led the market, capturing a substantial share of 48.6%. This dominance can be attributed to the increasing prevalence of chronic diseases and the rising number of inpatient admissions. Hospitals are well-equipped with advanced diagnostic and treatment facilities, making them essential centers for managing complex conditions such as multiple sclerosis.

The growing demand for medications to manage symptoms and slow disease progression has further strengthened the role of hospital pharmacies in therapeutic distribution. Their ability to provide specialized medications and ensure proper administration contributes to their market leadership.

On the other hand, the retail pharmacies segment is expected to grow at a compound annual growth rate (CAGR) of 6.4% during the forecast period. This growth is primarily driven by the convenience and easy accessibility that retail pharmacies offer to patients. They serve as a preferred option for individuals seeking regular medication refills, ensuring continuity in treatment. Additionally, the proliferation of retail pharmacy chains enhances their reach and availability, supporting their steady market expansion.

Key Market Segments

By Drug Class

- Immunosuppressants

- Immunostimulants

- Interferons

- Others

By Route of Administration

- Oral

- Injectable

- Intramuscular

- Subcutaneous

- Intravenous

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- E-Commerce

Drivers

Rising Awareness and Early Detection of Multiple Sclerosis Worldwide is Driving the Market

Rising awareness and early detection of multiple sclerosis (MS) are significant drivers of the global MS therapeutics market. As awareness campaigns and educational initiatives gain momentum worldwide, more individuals are recognizing the symptoms of MS, which often leads to earlier diagnosis and intervention.

In countries like the U.S., MS Awareness Month, supported by organizations like the Multiple Sclerosis Association of America, plays a key role in spreading information about the disease, encouraging people to seek medical help sooner. Early detection allows for timely treatment, which can significantly improve patient outcomes and slow disease progression.

Additionally, healthcare professionals are becoming better equipped to identify MS in its early stages, thanks to improved diagnostic tools and techniques. This increased focus on early detection not only helps manage the disease more effectively but also boosts the demand for MS therapeutics, fueling the market growth as more patients are diagnosed and begin treatment at earlier stages.

- According to statistics, an estimated 200 new cases are diagnosed each week in the United States.

Restrains

High Treatment Costs Associated with Multiple Sclerosis Therapeutics is Restraining the Market

High treatment costs are a major restraint in the Multiple Sclerosis Therapeutics market. These therapies, known for their effectiveness, command high prices due to intricate manufacturing processes and the use of advanced technologies. The expensive nature of these treatments can significantly restrict patient access and increase the financial burden on healthcare systems.

Particularly in low- and middle-income countries, the affordability of Multiple Sclerosis Therapies is a pressing issue. Variability in insurance coverage and high out-of-pocket expenses exacerbate this challenge, limiting the widespread adoption of these treatments.

Despite the clinical benefits that Multiple Sclerosis Therapeutics offer, the high costs associated with them impede market growth and accessibility. This situation underscores the urgent need for more cost-effective solutions and broader financial support mechanisms. Implementing these changes could make these vital treatments more accessible and affordable, benefiting a larger population.

Opportunities

Advances in Neuroprotective Treatments is Presenting Growth Opportunities

Advances in neuroprotective treatments are creating significant growth opportunities in the global Multiple Sclerosis (MS) therapeutics market. Unlike traditional disease-modifying therapies (DMTs) that focus on reducing inflammation and relapses, neuroprotective treatments aim to prevent or minimize damage to nerve cells, thereby addressing disease progression. This is especially critical for progressive forms of MS, which currently lack effective treatments.

Emerging therapies targeting mechanisms like oxidative stress, mitochondrial dysfunction, and demyelination are showing promise in preclinical and clinical trials. For example, experimental drugs like Bruton’s Tyrosine Kinase (BTK) inhibitors and remyelination therapies could potentially slow or reverse neurodegeneration.

With an increasing focus on preserving long-term neurological function and improving cognitive health, neuroprotective therapies address a significant unmet need. Additionally, the rising prevalence of MS, coupled with funding for research and development, is accelerating innovation in this area, offering immense potential for market expansion and patient outcomes improvement.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the global Multiple Sclerosis (MS) therapeutics market. Economic instability in developing regions can limit healthcare budgets and patient access to costly MS treatments, such as disease-modifying therapies (DMTs). High drug prices and limited insurance coverage in some countries further exacerbate affordability issues, hindering market growth.

Geopolitical tensions and trade restrictions can disrupt global supply chains for pharmaceuticals, delaying access to MS medications. For instance, the reliance on specific regions for raw materials or drug manufacturing can lead to vulnerabilities during international conflicts or sanctions. Additionally, healthcare policies and regulatory frameworks vary widely across regions.

Developed nations with robust healthcare systems, like the U.S. and Europe, support market growth through reimbursement programs, while underdeveloped healthcare infrastructure in emerging markets limits market penetration. Fluctuating currency exchange rates and inflation also influence drug pricing and profitability, making macroeconomic and geopolitical stability critical for sustained growth in the MS therapeutics market.

Trends

The global Multiple Sclerosis (MS) therapeutics market is witnessing several key trends that are driving innovation and growth. One prominent trend is the shift toward oral disease-modifying therapies (DMTs), such as Fingolimod and Dimethyl Fumarate, offering greater convenience compared to injectable treatments, thereby improving patient adherence.

Another trend is the development of Bruton’s Tyrosine Kinase (BTK) inhibitors, which target B-cell activity to reduce neuroinflammation and slow disease progression, particularly for progressive MS. Monoclonal antibodies, like Ocrelizumab and Ofatumumab, are gaining traction for their efficacy in reducing relapses and disability progression.

Personalized medicine is also emerging, with advances in biomarker research enabling tailored therapies based on individual patient profiles. Additionally, there’s growing interest in remyelination and neuroprotection therapies, aiming to repair damaged myelin and protect neurons, addressing unmet needs in progressive MS. Expanding healthcare access in emerging markets and the integration of digital health solutions, such as AI-driven diagnostics and remote monitoring, further highlight the evolving landscape of the MS therapeutics market.

Regional Analysis

North America Dominates the Global Multiple Sclerosis Therapeutics Market

North America commands a leading position in the global Multiple Sclerosis (MS) therapeutics market. This dominance is attributed to a high disease prevalence, with nearly 1 million people affected in the U.S. alone, as reported by the National Multiple Sclerosis Society. The region’s advanced healthcare infrastructure and substantial investments in research and development also contribute to its significant market share. These factors create a strong demand for advanced MS treatments.

Key pharmaceutical companies like Biogen and Novartis are pivotal in driving innovation within the region. They focus on developing disease-modifying therapies (DMTs) and monoclonal antibodies, leading to advancements in treatment options. North America also benefits from favorable healthcare policies and extensive insurance coverage, which help make expensive MS treatments more accessible to a broader patient population.

The market is further supported by ongoing clinical trials, particularly those exploring neuroprotection and remyelination therapies. There is a notable high adoption rate of novel oral DMTs and injectable biologics in North America. This trend is supported by better patient awareness and adherence to prescribed treatments. Together, these elements ensure that North America continues to lead the MS therapeutics market, fostering a climate of continuous innovation and improvement.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the global Multiple Sclerosis (MS) therapeutics market is highly dynamic, driven by key players focusing on innovation, strategic collaborations, and expanding product portfolios. Major companies like Biogen, Novartis, Roche, Merck KGaA, and Sanofi dominate the market with established therapies such as Tecfidera, Gilenya, Ocrevus, and Aubagio.

Competition is intensifying with the launch of novel oral therapies and monoclonal antibodies that offer improved efficacy and convenience. Emerging players are contributing to innovation, particularly in neuroprotective and remyelination treatments, addressing unmet needs in progressive MS. Strategic mergers and acquisitions, such as Novartis’s acquisition of The Medicines Company, are enabling companies to strengthen their pipelines.

Additionally, companies are leveraging biosimilars to offer cost-effective alternatives to branded drugs, especially in price-sensitive markets. R&D investments, along with advancements in biomarkers and personalized medicine, are shaping the future of the MS therapeutics market, fostering both competition and innovation.

Top Key Players in the Multiple Sclerosis Therapeutics Market

- Acorda Therapeutics Inc.

- Bayer AG

- Biogen

- Bristol-Myers Squibb Company

- Hoffmann-La Roche Ltd

- Horizon Therapeutics plc

- Johnson & Johnson Services Inc. (Janssen Global Services LLC)

- Merck & Co., Inc.

- Merck KGaA

- Novartis AG

- Pfizer Inc.

- Sanofi SA

- Takeda Pharmaceutical Company Limited.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc. (Mylan NV)

Recent Developments

- In February 2024: Roche Pharma India introduced Ocrevus for the treatment of Multiple Sclerosis (MS), aiming to meet the needs of Indian patients. Ocrevus, one of Roche’s flagship products, is now available in over 100 countries and has received approval in India for treating primary progressive and relapsing forms of MS.

- In February 2024: Neuraxpharm Group launched BRIUMVI in Europe, targeting adult patients with relapsing MS.

- In August 2023: The U.S. Food and Drug Administration (USFDA) approved Tyruko, the first biosimilar to Tysabri injection. Tyruko is authorized to treat adults with relapsing forms of MS, including relapsing-remitting disease, active secondary progressive disease, and clinically isolated syndrome.

Report Scope

Report Features Description Market Value (2023) US$ 25.87 billion Forecast Revenue (2033) US$ 43.94 billion CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Drug Class- Immunosuppressants, Immunostimulants, Interferons and Others, Route of Administration- Oral, Injectable and Others, Distribution Channel- Hospital Pharmacies, Retail Pharmacies and E-Commerce. Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Acorda Therapeutics Inc., Bayer AG, Biogen, Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd, Horizon Therapeutics plc, Johnson & Johnson Services Inc. (Janssen Global Services LLC), Merck & Co., Inc., Merck KGaA, Novartis AG, Pfizer Inc., Sanofi SA, Takeda Pharmaceutical Company Limited., Teva Pharmaceutical Industries Ltd. and Viatris Inc. (Mylan NV) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Multiple Sclerosis Therapeutics MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Multiple Sclerosis Therapeutics MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Acorda Therapeutics Inc.

- Bayer AG

- Biogen

- Bristol-Myers Squibb Company

- Hoffmann-La Roche Ltd

- Horizon Therapeutics plc

- Johnson & Johnson Services Inc. (Janssen Global Services LLC)

- Merck & Co., Inc.

- Merck KGaA

- Novartis AG

- Pfizer Inc.

- Sanofi SA

- Takeda Pharmaceutical Company Limited.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc. (Mylan NV)