Global Nephroblastoma Treatment Market By Type (Favorable histology and Anaplastic histology), By Route of Administration (Intravenous (IV), Oral and Others), By Drug type (Dactinomycin, Doxorubicin, Vincristine, Cyclophosphamide, and Etoposide and Irinotecan), By Distribution channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136285

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Route of Administration Analysis

- By Drug Type Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

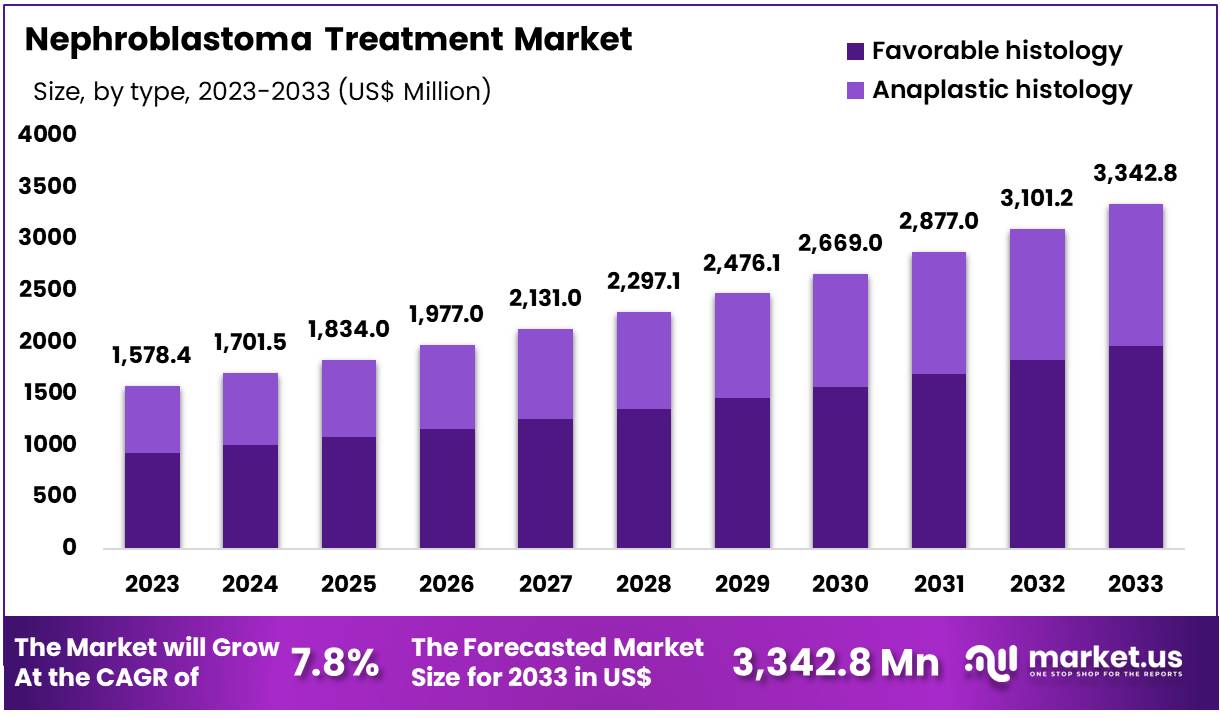

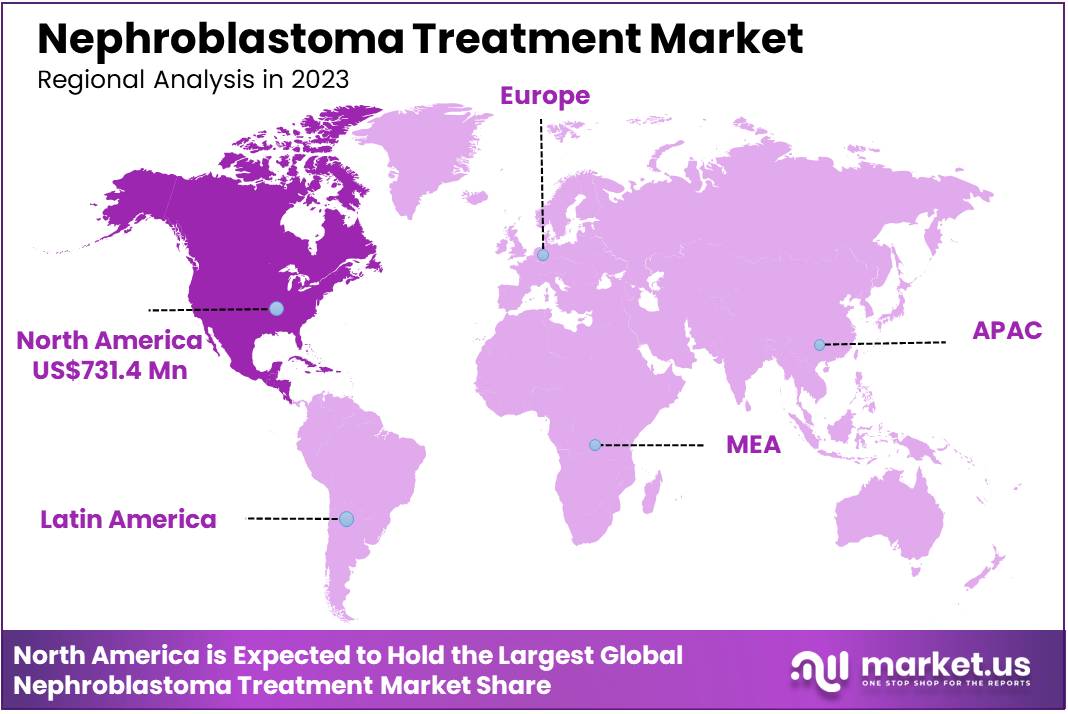

Global Nephroblastoma Treatment Market size is expected to be worth around US$ 3,342.8 Million by 2033 from US$ 1,578.4 Million in 2023, growing at a CAGR of 7.8% during the forecast period 2024 to 2033. In 2023, North America led the market, achieving over 43.8% share with a revenue of US$ 731.4 Million.

The nephroblastoma treatment market is expected to grow positively due to the increasing global incidence of nephroblastoma, which drives the demand for effective treatments. This condition is primarily managed with a combination of surgery, chemotherapy, and radiation therapy.

Additionally, the development of new drugs and therapies currently in clinical trials offers significant potential for market expansion once approved. However, the high cost of treatment and limited awareness about nephroblastoma in developing regions could pose challenges to market growth.

Nephroblastoma, also known as Wilms tumor, is a rare form of kidney cancer that primarily affects children, typically under the age of 5. It arises from immature kidney cells and is the most common pediatric kidney cancer. The tumor is often discovered when a child presents with an abdominal mass, abdominal pain, blood in the urine, or high blood pressure.

Nephroblastoma can be unilateral (affecting one kidney) or bilateral (involving both kidneys). The exact cause is often unknown, though genetic mutations and certain congenital syndromes, such as Beckwith-Wiedemann syndrome or WAGR syndrome, can increase the risk.

Treatment usually involves a combination of surgery (to remove the tumor or affected kidney), chemotherapy, and sometimes radiation therapy. With early detection and appropriate treatment, the prognosis for children with nephroblastoma is generally favorable, with survival rates exceeding 90% for localized cases.

Key Takeaways

- In 2023, the market for Nephroblastoma Treatment generated a revenue of US$ 1,578.4 million, with a CAGR of 7.8%, and is expected to reach US$ 3,342.8 million by the year 2033.

- The type segment is divided into Favorable histology and Anaplastic histology, with Favorable histology taking the lead in 2023 with a market share of 58.9%.

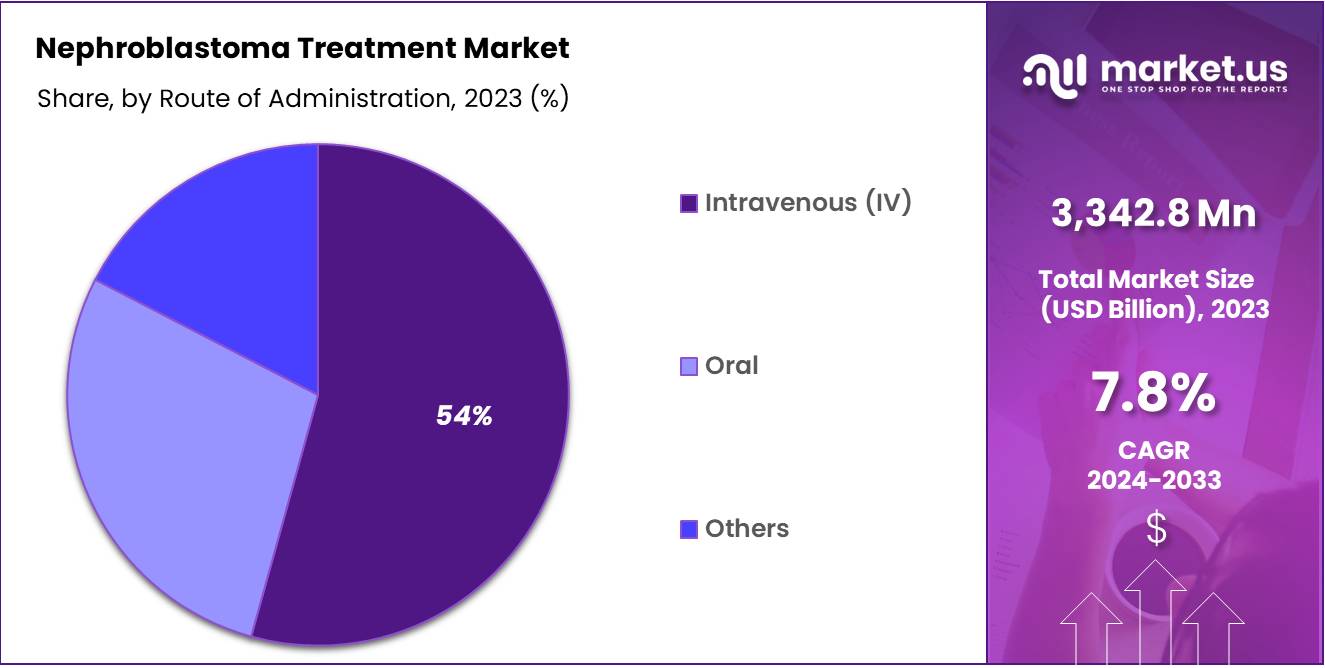

- Considering active Route of Administration, the market is divided into Intravenous (IV), Oral, and Others. Among these, Intravenous (IV) agents held a significant share of 54.3%.

- Furthermore, concerning the Drug type, the market is segregated into Dactinomycin, Doxorubicin, Vincristine, Cyclophosphamide, Etoposide and Irinotecan. The Dactinomycin stands out as the dominant segment, holding the largest revenue share of 25.0% in the Nephroblastoma Treatment market.

- By Distribution channel, the market is classified into Hospital Pharmacies, Retail Pharmacies and Online Pharmacies. Hospital Pharmacies held a major share of 55.5%.

- North America led the market by securing a market share of 43.8% in 2023.

By Type Analysis

Favorable Histology held the largest market share with 58.9% as it is the most common and less aggressive form of nephroblastoma, characterized by well-differentiated tumor cells. Treatment for favorable histology typically involves surgery to remove the tumor, followed by chemotherapy (often involving drugs like vincristine, dactinomycin, and cyclophosphamide).

The prognosis is generally very good, with survival rates exceeding 90% in localized cases. This segment dominates the market due to the higher incidence of favorable histology in pediatric patients and the generally favorable outcomes associated with it.

By Route of Administration Analysis

Intravenous (IV) is the most common route of administration for nephroblastoma treatments, especially for chemotherapy drugs like vincristine, dactinomycin, cyclophosphamide, and doxorubicin. IV administration ensures rapid drug delivery directly into the bloodstream, which is crucial for treating pediatric cancers like nephroblastoma.

IV chemotherapy is typically preferred in hospital settings for its controlled and immediate therapeutic effects. This segment dominates the market due to its widespread use in aggressive treatment protocols, particularly for advanced or recurrent cases. Intravenous (IV) held 54.3% market share in 2023.

By Drug Type Analysis

Dactinomycin is the dominant segment with 25.0% market share. This segment dominated the market due to their widespread use in standard treatment protocols for nephroblastoma, especially in favorable histology cases, which are more common and less aggressive.

These drugs form the cornerstone of chemotherapy regimens for most nephroblastoma patients. Dactinomycin is widely used and contributes significantly to the treatment outcomes of nephroblastoma. Its segment holds a strong position in the market due to its proven efficacy in pediatric oncology.

By Distribution Channel Analysis

Hospital pharmacies are the primary distribution channel for nephroblastoma treatment drugs. Since nephroblastoma is primarily treated in a hospital setting, where chemotherapy drugs like vincristine, dactinomycin, doxorubicin, and cyclophosphamide are administered intravenously, hospital pharmacies are the dominant suppliers of these treatments.

They manage the storage, dispensing, and administration of chemotherapy agents in an environment with the necessary medical supervision and support. This segment holds the largest share of the market, driven by the need for controlled administration of potent chemotherapy agents, the higher prevalence of hospital-based treatment, and the significant costs associated with nephroblastoma treatment.

Key Market Segments

By Type

- Favorable histology

- Anaplastic histology

By Route of Administration

- Intravenous (IV)

- Oral

- Others

By Drug type

- Dactinomycin

- Doxorubicin

- Vincristine

- Cyclophosphamide

- Etoposide

- Irinotecan

By Distribution channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Rising Incidence of Nephroblastoma (Wilms Tumor) in Children

The increasing number of pediatric cancer cases, especially Wilms tumor, has contributed significantly to the growth of the nephroblastoma treatment market. Although nephroblastoma is rare, it is the most common type of kidney cancer in children.

Advances in diagnostic techniques, such as imaging and genetic testing, have also improved early detection rates, leading to increased awareness and treatment demand. With early detection, survival rates have improved, but ongoing treatments such as surgery, chemotherapy, and novel therapies are still in demand.

Additionally, early detection and diagnosis allow for more effective interventions, creating opportunities for pharmaceutical companies to develop targeted therapies that improve patient outcomes and reduce treatment toxicity. According to American Cancer Society, each year in the United States, approximately 500 to 600 new cases of Wilms tumor are diagnosed, a figure that has remained steady for many years.

Wilms tumors account for about 5% of all childhood cancers. These tumors primarily affect young children, with the average age at diagnosis being around 3 to 4 years. They become less common as children age and are very rare in adults, though some cases have been reported.

Restraints

High Cost of Treatment and Healthcare Infrastructure Constraints

The treatment of nephroblastoma, especially in advanced stages, often involves long-term chemotherapy, surgery, radiation, and sometimes stem cell transplantation, all of which contribute to high healthcare costs. Additionally, emerging therapies such as targeted treatments and immunotherapies are costly and not always covered by insurance, further limiting access for patients, particularly in low- and middle-income countries.These high costs can create a financial burden on families and healthcare systems, which may hinder market growth. Healthcare infrastructure in some regions may not be equipped to provide these advanced treatments, reducing patient access to life-saving therapies.

Opportunities

Growing Focus on Personalized and Precision Medicine

The shift towards personalized medicine presents a significant opportunity for the nephroblastoma treatment market. For instance, in February 2024, Personalized Medicine Coalition (PMC) published a report showing that personalized medicines topped one third of new U.S. Food and Drug Administration (FDA) drug approvals for the fourth year in a row in 2023. In 2023, FDA approved 16 new personalized treatments for rare disease patients, up from six in 2022.Advances in genomics and molecular diagnostics are enabling a deeper understanding of the genetic and molecular basis of nephroblastoma. This knowledge can lead to the development of targeted therapies that are tailored to individual genetic profiles, improving efficacy and reducing side effects.

As genetic testing becomes more widespread, physicians can better predict which treatments are most likely to be effective for each patient, opening the door for more precise, individualized therapies. Personalized treatments are also expected to improve survival rates, especially for patients with high-risk or recurrent cases of nephroblastoma.

Impact of Macroeconomic / Geopolitical Factors

Economic downturns can strain national healthcare budgets, leading to reduced government funding for cancer treatment programs. In low- and middle-income countries, this can result in limited access to essential cancer therapies, including those used in nephroblastoma treatment. A reduction in healthcare funding may delay the introduction of innovative therapies or limit access to critical drugs like vincristine and dactinomycin, which are necessary for treating nephroblastoma in children.

In wealthier regions, the rising cost of treatments, especially with the introduction of targeted therapies and immunotherapies, may place financial burdens on families and healthcare systems, potentially restricting access.

Geopolitical factors, such as trade wars or international sanctions, can disrupt the supply chains for critical medications. For example, chemotherapy drugs like doxorubicin or cyclophosphamide may face production delays or price increases due to tariffs or supply chain disruptions. This can delay treatment availability in certain regions, particularly in developing countries with fewer domestic drug manufacturers.

Moreover, political instability in certain regions can hinder the establishment of necessary healthcare infrastructure and treatment protocols, reducing the accessibility of essential nephroblastoma treatments.

Latest Trends

Use of Minimal Invasive Surgical Techniques

Another trend shaping the nephroblastoma treatment market is the shift toward less invasive surgical techniques, such as laparoscopic or robotic-assisted surgery, which offer quicker recovery times and reduced complication rates compared to traditional open surgery. In addition, precision diagnostics are improving, allowing for earlier and more accurate detection of nephroblastoma.

Advanced imaging techniques and genetic profiling enable clinicians to identify tumors at an earlier stage, improving prognosis and guiding treatment decisions. This trend is expected to increase the number of cases that can be treated successfully, contributing to improved patient outcomes and lower healthcare costs over the long term.

Regional Analysis

North America is leading the Nephroblastoma Treatment Market

The Nephroblastoma Treatment Market in North America is driven by advanced healthcare infrastructure, high healthcare spending, and strong research and development in pediatric oncology.

As per the satstistics by Yale Medicine, Neuroblastoma is the third most common type of childhood cancer, behind leukemia and brain tumors. However, only 600 to 1,000 cases are diagnosed in the U.S. every year. Hence, there is a strong need for treatment which is a factor driving the market. North America held 43.8% of market share.

The U.S. and Canada are major players in this market, with pediatric oncology centers and specialized hospitals providing comprehensive care for nephroblastoma patients. Treatment primarily involves chemotherapy, surgery, and radiation therapy, with drugs like vincristine, dactinomycin, and cyclophosphamide being standard in treatment regimens. The increasing prevalence of Wilms tumor (nephroblastoma) in children, along with improved early detection and diagnostic techniques, contributes to the demand for these treatments.

Additionally, clinical trials and the introduction of targeted therapies and immunotherapies are boosting innovation in the market, offering hope for more effective and less toxic treatments. The high costs of treatment and potential barriers in accessing cutting-edge therapies in underserved regions remain challenges.

The Europe region is expected to experience the steady growth during the forecast period

Europe is the second-largest region in the Nephroblastoma Treatment market. The Nephroblastoma Treatment Market in Europe is influenced by the region’s well-established healthcare systems, comprehensive pediatric cancer care, and ongoing research into innovative treatment options. Countries like the UK, Germany, and France have advanced oncology networks and treatment protocols, including the use of chemotherapy, surgery, and radiation therapy for nephroblastoma (Wilms tumor).

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Nephroblastoma Treatment Market is highly competitive, with a variety of companies focusing on innovation, regulatory approvals, and consumer trust to capture market share. Key players include Merck & Co., Inc., Bristol-Myers Squibb, Recordati Rare Diseases, Pfizer Inc., Sun Pharmaceutical Industries Ltd., Cipla Inc., Actiza Pharmaceutical Private Limited, Teva Pharmaceutical Industries Ltd., Alvogen, Accord Healthcare Ireland Ltd., Amneal Pharmaceuticals LLC., Cadila, Xediton, Eli Lilly and Co., Sanofi, and Novartis.

Bristol-Myers Squibb (BMS) is a leading global biopharmaceutical company with a strong portfolio in oncology, particularly in immuno-oncology and targeted therapies. While BMS does not currently have drugs specifically approved for nephroblastoma (Wilms tumor), its portfolio includes treatments that may potentially play a role in pediatric cancers like nephroblastoma, especially in high-risk or recurrent cases.

BMS’s ongoing research in immuno-oncology may lead to promising future options for nephroblastoma patients, particularly those with more aggressive or resistant forms of the disease.

Top Key Players

- Merck & Co., Inc.

- Bristol-Myers Squibb

- Recordati Rare Diseases

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd.

- Cipla Inc.

- Actiza Pharmaceutical Private Limited

- Teva Pharmaceutical Industries Ltd.

- Alvogen

- Accord Healthcare Ireland Ltd.

- Amneal Pharmaceuticals LLC.

- Cadila

- Xediton

- Eli Lilly and Co.

- Sanofi

- Novartis

- Other players

Recent Developments

- Merck & Co., Inc.: In November 2024, Merck & Co., Inc. announced the expansion of its oncology portfolio to include pediatric cancers, with a focus on nephroblastoma. This strategic move aims to address the unmet medical needs in pediatric oncology and underscores the company’s commitment to advancing cancer treatment across all age groups.

- Pfizer Inc.: In October 2024, Pfizer Inc. launched a new clinical trial to evaluate the efficacy of a novel targeted therapy for nephroblastoma. This initiative reflects Pfizer’s dedication to developing innovative treatments for rare pediatric cancers and improving patient outcomes through advanced therapeutic options.

- Sun Pharmaceutical Industries Ltd.: In September 2024, Sun Pharmaceutical Industries Ltd. announced a collaboration with a leading research institute to develop generic formulations for nephroblastoma treatment. This partnership aims to enhance the accessibility and affordability of essential medications for pediatric cancer patients, particularly in emerging markets.

- Cipla Inc.: In August 2024, Cipla Inc. introduced a new generic version of a key nephroblastoma chemotherapy drug. This product launch is expected to increase the availability of cost-effective treatment options for patients, reinforcing Cipla’s commitment to affordable healthcare solutions.

Report Scope

Report Features Description Market Value (2023) US$ 1,578.4 million Forecast Revenue (2033) US$ 3,342.8 million CAGR (2024-2033) 7.8% Base Year for Estimation 2023 Historic Period 2019-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Favorable histology and Anaplastic histology), By Route of Administration (Intravenous (IV), Oral and Others), By Drug type (Dactinomycin, Doxorubicin, Vincristine, Cyclophosphamide, and Etoposide and Irinotecan), By Distribution channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Merck & Co., Inc., Bristol-Myers Squibb, Recordati Rare Diseases, Pfizer Inc., Sun Pharmaceutical Industries Ltd., Cipla Inc., Actiza Pharmaceutical Private Limited, Teva Pharmaceutical Industries Ltd., Alvogen, Accord Healthcare Ireland Ltd., Amneal Pharmaceuticals LLC., Cadila, Xediton, Eli Lilly and Co., Sanofi, and Novartis Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Nephroblastoma Treatment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Nephroblastoma Treatment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Merck & Co., Inc.

- Bristol-Myers Squibb

- Recordati Rare Diseases

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd.

- Cipla Inc.

- Actiza Pharmaceutical Private Limited

- Teva Pharmaceutical Industries Ltd.

- Alvogen

- Accord Healthcare Ireland Ltd.

- Amneal Pharmaceuticals LLC.

- Cadila

- Xediton

- Eli Lilly and Co.

- Sanofi

- Novartis

- Other players