Tinea Pedis Treatment Market By Treatment Type (OTC medication, Alternative Therapies, Prescription Medication, and Others), Route of Administration (Oral, Topical, and Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133779

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

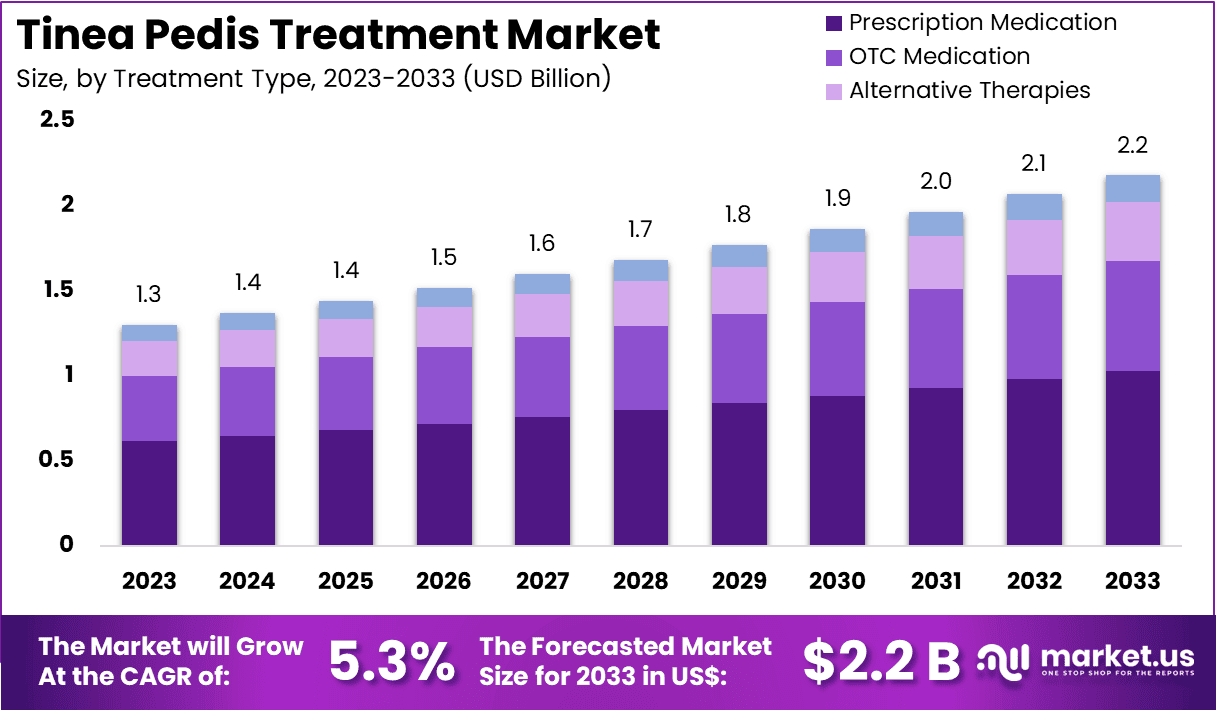

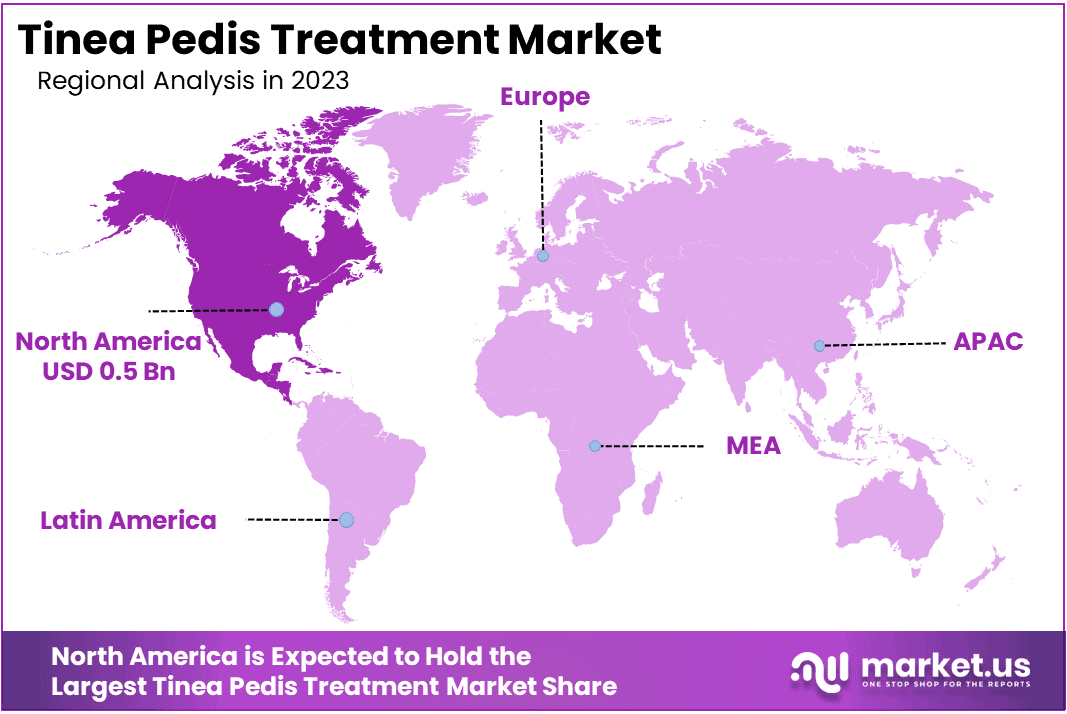

The Global Tinea Pedis Treatment Market Size is expected to be worth around US$ 2.2 Billion by 2033, from US$ 1.3 Billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033. North America dominated the market, securing a 39.1% share and reaching a market value of US$ 0.5 billion for the year.

Growing awareness of fungal infections and increasing concerns about foot health are driving the expansion of the tinea pedis treatment market. Tinea pedis, commonly known as athlete’s foot, affects millions of individuals worldwide, causing symptoms such as itching, redness, and peeling skin. The market benefits from the rising demand for effective and accessible treatments, particularly as consumers seek over-the-counter solutions for this common condition.

In June 2022, Kerasal launched a new product line specifically targeting athlete’s foot, featuring a unique 5-in-1 formula designed to treat tinea pedis, improve skin appearance, and promote overall foot health. This launch reflects the growing trend toward comprehensive treatment options that not only address fungal infection but also enhance the health and appearance of the affected skin.

The market is also driven by increasing health-consciousness and the rise of wellness trends, which have led to more individuals investing in preventive foot care solutions. Furthermore, the availability of new treatment formulations, including topical antifungal creams, sprays, and powders, is expanding the array of options available to consumers. Recent trends emphasize convenience and user-friendly applications, with innovations in formulations designed for faster relief and better absorption.

The ongoing research into the efficacy of combination therapies and natural-based ingredients also presents new opportunities for growth, as consumers look for products that offer both effectiveness and minimal side effects. As awareness of fungal infections grows, the tinea pedis treatment market is poised for continued development with innovative products that meet the evolving needs of consumers.

Key Takeaways

- In 2023, the market for tinea pedis treatment generated a revenue of US$ 1.3 billion, with a CAGR of 5.3%, and is expected to reach US$ 2.2 billion by the year 2033.

- The treatment type segment is divided into OTC medication, alternative therapies, prescription medication, and others, with prescription medicationtaking the lead in 2023 with a market share of 47.3%.

- Considering route of administration, the market is divided into oral, topical, and others. Among these, oralheld a significant share of 48.1%.

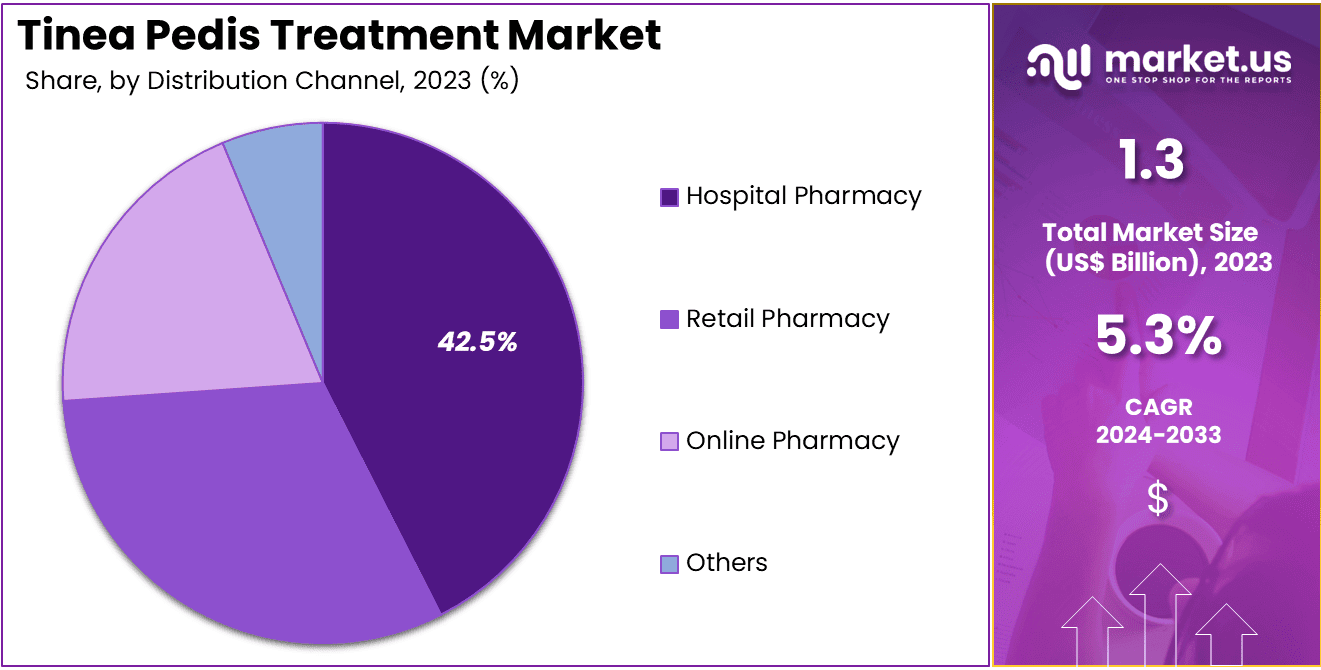

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacysector stands out as the dominant player, holding the largest revenue share of 5% in the tinea pedis treatment market.

- North America led the market by securing a market share of 39.1% in 2023.

Treatment Type Analysis

The prescription medication segment led in 2023, claiming a market share of 47.3% owing to the increasing prevalence of fungal infections and the demand for effective and targeted treatments. Prescription medications, such as antifungal creams, oral therapies, and prescription-strength treatments, are anticipated to dominate the market, particularly for more severe or recurrent cases of tinea pedis.

The rise in healthcare awareness and the growing trend toward professional consultations for chronic or persistent fungal infections are likely to drive patients toward prescription treatments. Additionally, the development of new, more effective antifungal agents with fewer side effects is projected to further propel growth in this segment. The increasing availability of combination therapies and more specialized treatments is expected to make prescription medications the preferred option for many patients.

Route of Administration Analysis

The oral held a significant share of 48.1% due to the convenience and effectiveness of oral antifungal medications. Oral treatments, such as terbinafine and itraconazole, are likely to become more popular, particularly for patients with extensive or resistant infections. The rising number of severe tinea pedis cases and the shift toward more comprehensive treatment regimens are expected to drive growth in this route of administration.

Oral antifungal treatments offer the advantage of targeting the infection systemically, which is beneficial for patients who may not respond to topical treatments alone. As patient preference shifts toward faster and more effective solutions, the oral segment is expected to witness increased demand, especially for individuals with recurring or difficult-to-treat fungal infections.

Distribution Channel Analysis

The hospital pharmacy segment had a tremendous growth rate, with a revenue share of 42.5% owing to the increasing number of patients seeking treatment for fungal infections in hospital settings. Hospitals are expected to remain a critical point of care for patients with severe or complicated tinea pedis cases, particularly those requiring prescription-strength antifungal medications.

The rising prevalence of tinea pedis, especially in immunocompromised individuals and patients with comorbidities, is likely to drive hospital pharmacies to provide more targeted and effective treatments.

Furthermore, hospitals’ ability to offer specialized care and monitor patients’ progress is expected to encourage the use of hospital pharmacies for tinea pedis treatment. The increasing focus on healthcare access and the development of inpatient care options for fungal infections are likely to drive the continued expansion of the hospital pharmacy segment.

Key Market Segments

By Treatment Type

- OTC medication

- Alternative Therapies

- Prescription Medication

- Others

By Route of Administration

- Oral

- Topical

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Drivers

Rising Prevalence of Tinea Pedis

The increasing prevalence of tinea pedis, commonly known as athlete’s foot, is driving the demand for effective treatments. According to the National Institute of Health, it is estimated that around 3% of the global population is affected by tinea pedis, with higher prevalence rates observed in adolescents and adults compared to children. This underscores the widespread nature of the condition, leading to a greater need for accessible and effective treatment options.

The study’s findings highlight the significant burden of tinea pedis on public health, emphasizing the importance of developing and distributing effective antifungal treatments. As the incidence of tinea pedis continues to rise, healthcare providers are increasingly focusing on preventive measures and treatment strategies to address this common fungal infection.

The growing awareness of the condition’s prevalence is expected to further stimulate market growth for tinea pedis treatments. Efforts to educate the public about prevention and early treatment are anticipated to reduce the incidence and impact of tinea pedis. The development of new antifungal agents and treatment modalities is likely to enhance patient outcomes and quality of life. Overall, the rising prevalence of tinea pedis is a significant driver in the market for its treatment.

Restraints

High Treatment Costs

The high costs associated with advanced treatments for tinea pedis are expected to restrain market growth. While effective treatments are available, their prices may be prohibitive for some patients, particularly in low-income regions. The affordability of antifungal medications is a critical factor influencing patient adherence to treatment regimens. In some cases, the cost of prescription medications may lead patients to seek over-the-counter alternatives, which may be less effective.

Additionally, the need for prolonged treatment durations can increase the overall financial burden on patients. Healthcare systems with limited resources may struggle to provide access to the most effective treatments, potentially leading to suboptimal patient outcomes. Insurance coverage and reimbursement policies play a significant role in determining patient access to necessary medications.

The economic impact of high treatment costs may also influence healthcare providers’ prescribing practices. Addressing the financial aspects of treatment is crucial to ensure equitable access to effective therapies. Efforts to negotiate pricing and improve insurance coverage are essential to mitigate this restraint.

Opportunities

Increased Research and Clinical Trials

The surge in research activities and clinical trials presents significant opportunities for the tinea pedis treatment market. Ongoing clinical trials are exploring various therapeutic agents and combinations, aiming to improve patient outcomes. This research is expected to lead to the discovery of novel treatments and biomarkers, enhancing diagnostic precision and personalized medicine approaches.

Collaborations between pharmaceutical companies, academic institutions, and healthcare providers are fostering innovation in this field. The expansion of clinical trial networks is likely to accelerate the development and approval of new therapies. Patient participation in these trials is crucial for advancing treatment options and understanding disease mechanisms.

The focus on research and development is anticipated to drive market growth by introducing more effective and targeted therapies. This momentum reflects a broader commitment to improving patient care in dermatological disorders. The integration of new technologies and methodologies in research is expected to yield more efficient and effective treatments. Overall, the increased emphasis on research and clinical trials is a promising opportunity for the tinea pedis treatment market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly affect the tinea pedis treatment market, influencing both supply and demand. Economic downturns often lead to reduced consumer spending, which can result in lower demand for non-essential healthcare products, including antifungal treatments. Conversely, periods of economic growth typically boost healthcare spending, driving greater demand for treatments for common conditions like athlete’s foot.

Geopolitical factors, such as trade disputes or regulatory changes, may disrupt the availability of active ingredients or delay the approval of new treatment options. On the positive side, rising awareness of skin conditions and the increasing focus on personal hygiene globally contribute to greater adoption of treatments for fungal infections.

Furthermore, the expansion of over-the-counter products and advances in drug formulations provide patients with more accessible and effective treatment options. As the awareness and accessibility of these treatments continue to improve, the market for tinea pedis treatment is expected to experience steady growth in the coming years.

Trends

Standardized Diagnostic Approaches

A recent trend in the tinea pedis treatment market is the implementation of standardized diagnostic approaches. In August 2023, a study published in Blood highlighted the importance of standardized evaluations across healthcare systems to improve diagnostic accuracy and patient outcomes in tinea pedis. The research emphasized the need for consistent diagnostic criteria and protocols to ensure timely and accurate identification of the condition.

Standardization is expected to enhance the effectiveness of treatment strategies and facilitate better patient management. By adopting uniform diagnostic methods, healthcare providers can more effectively monitor disease progression and response to therapy. This trend is likely to lead to improved patient outcomes and more efficient use of healthcare resources.

The adoption of standardized diagnostic approaches is anticipated to become a cornerstone of clinical practice in tinea pedis. This development reflects a broader movement towards evidence-based and consistent medical practices. The focus on standardization is expected to drive improvements in patient care and treatment efficacy.

Regional Analysis

North America is leading the Tinea Pedis Treatment Market

North America dominated the market with the highest revenue share of 39.1% owing to the increasing prevalence of fungal infections and the growing availability of effective treatment options. The market expansion is attributed to the widespread awareness of the benefits of timely treatment, particularly the use of topical antifungal medications.

A report by The College of Family Physicians in Canada in January 2021 noted that topical antifungal treatments cure tinea pedis in 70%-75% of patients, significantly outperforming a placebo, which only provides results in 20%-30% of cases. This efficacy has led to a growing preference for over-the-counter antifungal creams and sprays, further boosting market growth.

Additionally, the rise in sports participation, especially among younger adults, has increased the incidence of tinea pedis, fueling demand for treatments. The increasing availability of these products through retail pharmacies and online platforms has made treatment more accessible, contributing to market growth. Moreover, rising healthcare awareness and better education about fungal infections have driven early diagnosis and treatment, further supporting market expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing urbanization, rising disposable incomes, and an improved healthcare infrastructure. As countries like India and China continue to experience rapid population growth and urbanization, the incidence of tinea pedis is likely to rise. In June 2024, Glenmark, a pharmaceutical company based in India, received final approval from the U.S. Food and Drug Administration (USFDA) for its antifungal ointment, marking an important development in the region’s treatment options.

This approval is expected to enhance market penetration and introduce more effective treatments to a wider audience. Additionally, the growing awareness of foot care and the rising preference for preventive healthcare are projected to drive demand for tinea pedis treatments. As healthcare access improves and disposable incomes increase, the demand for antifungal treatments in both urban and rural areas is expected to grow, significantly expanding the market in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the tinea pedis treatment market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the tinea pedis treatment market adopt strategies such as expanding their product portfolios, focusing on targeted therapies, and leveraging digital platforms for enhanced patient engagement.

Companies prioritize the development of antifungal treatments with higher efficacy, faster action, and improved safety profiles to meet patient needs. Strategic partnerships with healthcare providers and pharmaceutical distributors help increase market reach. Investments in clinical trials and regulatory approvals facilitate the introduction of innovative treatment options. Additionally, market players explore opportunities in emerging regions where the prevalence of fungal infections is rising.

One of the key players in the market is Johnson & Johnson, a leading global healthcare company known for its broad range of consumer health products. The company offers various topical antifungal treatments for managing skin infections, including tinea pedis.

Johnson & Johnson’s growth strategy centers on continuous product innovation, strategic collaborations with healthcare providers, and expanding its market footprint through both online and retail channels. The company also invests heavily in R&D to enhance the effectiveness of its treatments and to address evolving patient needs in dermatology.

Top Key Players in the Tinea Pedis Treatment Market

- Teva Pharmaceutical Industries Ltd.

- Taro Pharmaceutical Industries Ltd.

- Perrigo Company plc

- Novartis AG

- Glaxosmithkline Plc

- Bayer AG

- Aurobindo Pharma

Recent Developments

- In December 2023: Aurobindo Pharma Ltd., a major Indian multinational pharmaceutical company, secured final approval from the USFDA to produce and market a generic version of Posaconazole injection. This medication is aimed at preventing severe fungal infections, particularly in patients dealing with invasive Candida and Aspergillus infections.

- In July 2023: Teva Pharmaceuticals, the U.S. subsidiary of Teva Pharmaceutical Industries, and Alvotech, a biotech company from Iceland specializing in biosimilars, announced an expansion of their existing strategic collaboration. The agreement will focus on the development and commercialization of several biosimilar drugs, marking a continued commitment to advancing healthcare solutions.

- In June 2023: a research team of Kelvin Yeung from the Department of Traumatology and Orthopaedics, School of Clinical Medicine, LKS Faculty of Medicine, University of Hong Kong has developed a microneedle patch designed to treat skin infections, including tinea pedis, offering a promising non-antibiotic treatment alternative.

Report Scope

Report Features Description Market Value (2023) US$ 1.3 billion Forecast Revenue (2033) US$ 2.2 billion CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Treatment Type (OTC medication, Alternative Therapies, Prescription Medication, and Others), Route of Administration (Oral, Topical, and Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teva Pharmaceutical Industries Ltd., Taro Pharmaceutical Industries Ltd., Perrigo Company plc, Novartis AG, Glaxosmithkline Plc, Bayer AG, and Aurobindo Pharma. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Tinea Pedis Treatment MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Tinea Pedis Treatment MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Teva Pharmaceutical Industries Ltd.

- Taro Pharmaceutical Industries Ltd.

- Perrigo Company plc

- Novartis AG

- Glaxosmithkline Plc

- Bayer AG

- Aurobindo Pharma