Global Base Oil Market Size, Share, And Business Benefits By Product (Group I, Group II, Group III, Group IV, Group V), By Application (Automotive Oils, Process Oils, Hydraulic Oils, Metalworking Fluids, Industrial Oils), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166747

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

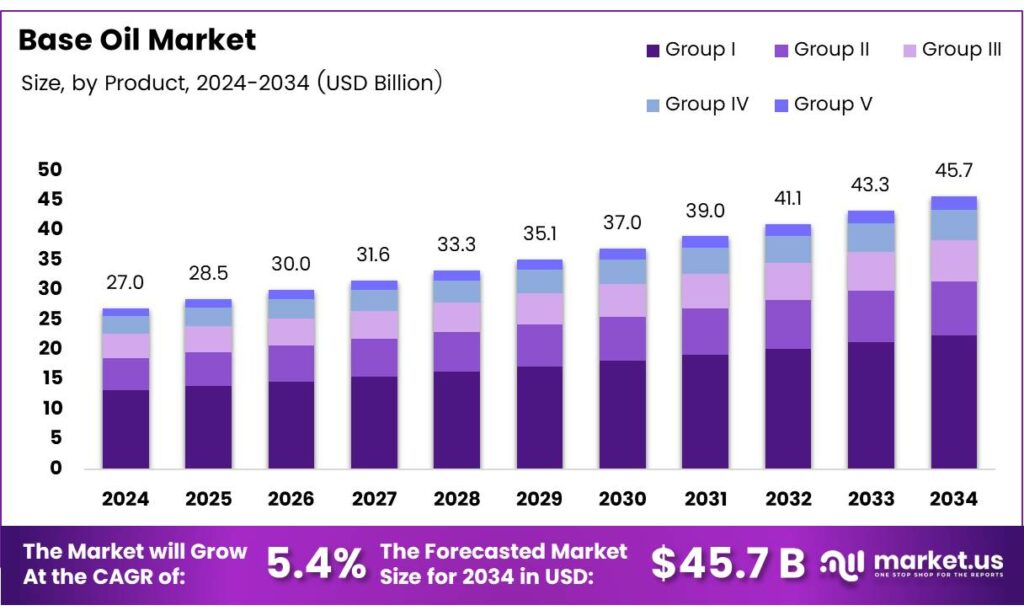

The Global Base Oil Market size is expected to be worth around USD 45.7 billion by 2034, from USD 27.0 billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

Base oil makes up 70–99% of finished lubricants (engine oils, hydraulic fluids, gear oils, etc.), with additives comprising the rest; it primarily determines viscosity, oxidation stability, thermal resistance, and load-carrying ability. It is produced either by refining crude oil (removing sulfur, aromatics, and wax via hydrotreating and dewaxing) or through synthetic processes that create highly uniform, stable molecules for superior extreme-temperature performance.

Energy-transition policies open new market potential for environmentally compliant lubricants. Emerging sectors—such as electric mobility, wind turbine maintenance, and high-performance industrial equipment—need specialty lubricants made from purer and more stable base oils. This trend supports long-term upgrades from Group I to Group II and Group III categories.

- ASTM classifications, Group I oils contain less than 90% saturates, more than 0.03% sulfur, and a viscosity index of 80–120, processed through solvent refining. Meanwhile, Group III oils exceed 90% saturates, contain less than 0.03% sulfur, and hold viscosity indexes above 120, achieved through severe hydrocracking at higher pressure and heat, producing much purer base stocks that align with modern efficiency regulations.

The application structure of the market reinforces demand stability. The American Petroleum Institute (API), lubricants remain the primary use of base oils, with base stocks comprising 70–95% of finished lubricants. API also reports that engine oils require the highest additive levels, where 10–20% of engine oil consists of corrosion inhibitors, viscosity modifiers, detergents, and other critical components.

Key Takeaways

- The Global Base Oil Market is projected to grow from USD 27.0 billion in 2024 to USD 45.7 billion by 2034, registering a 5.4% CAGR.

- Group II dominated the product segment in 2024 with a 37.2% share due to wider OEM acceptance.

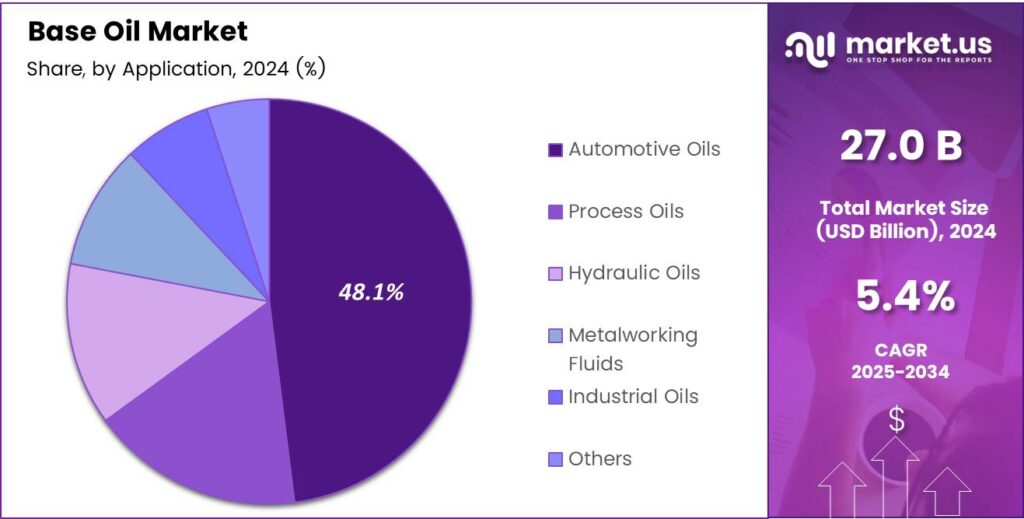

- Automotive Oils led the application segment in 2024 with a strong 48.1% market share globally.

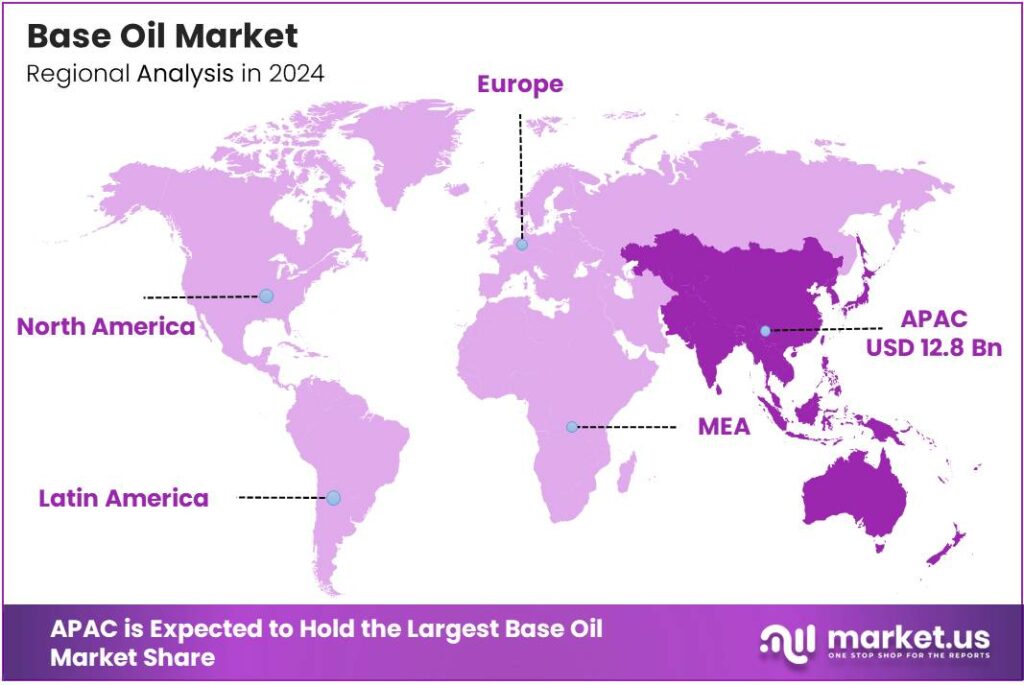

- Asia Pacific remained the leading region in 2024, capturing 47.6% of the market valued at USD 12.8 billion.

By Product Analysis

Group II dominates the Base Oil Market with a 37.2% share in 2024 due to wider OEM acceptance and cleaner performance.

In 2024, Group II held a dominant market position in the By Product Analysis segment of the Base Oil Market, with a 37.2% share. This segment benefits from high oxidation stability and low sulfur content, supporting demand in automotive and industrial lubricants where cleaner formulations are preferred.

Group I remained relevant in 2024 as a cost-effective option for applications requiring moderate performance. This segment serves grease, marine oils, and older engine formulations. It continues to attract buyers in developing regions where affordability and compatibility with legacy machinery drive its consistent market use.

Group III expanded gradually in 2024 because of its higher viscosity index and premium quality. This category supports synthetic and semi-synthetic lubricants, enabling better fuel efficiency. Its demand rises as manufacturers shift toward high-performance formulations in modern automotive engines and demanding industrial systems.

Group IV gained steady traction in 2024 through its use in advanced synthetic lubricants. Known for superior stability and temperature performance, it supports applications in high-stress machinery. Growing interest in long-drain engine oils and extended maintenance cycles continues to strengthen their adoption.

Group V contributed to niche applications in 2024, including ester-based lubricants and specialty fluids. Its chemical versatility allows blending flexibility, helping formulators achieve specific lubrication characteristics. This segment grows gradually as industries adopt tailored solutions for unique operational requirements.

By Application Analysis

Automotive Oils dominate the Base Oil Market with a 48.1% share in 2024 due to high global vehicle servicing needs.

In 2024, Automotive Oils held a dominant market position in the By Application Analysis segment of the Base Oil Market, with a 48.1% share. Strong demand comes from engine oils, transmission fluids, and gear oils, supported by rising vehicle parc growth and frequent maintenance cycles worldwide.

Process Oils maintained steady usage in 2024 across the plastics, rubber, and textile industries. These oils act as carriers, plasticizers, and softening agents. Their diverse industrial applications ensure stable demand as manufacturing expands and producers seek consistent formulation performance.

Hydraulic Oils advanced in 2024 as industries modernize equipment requiring efficient fluid power systems. These oils support energy transfer and component protection in machinery. Their demand increases with automation growth and expanding infrastructure development in emerging regions.

Metalworking Fluids continued to see consistent adoption in 2024 due to machining, cutting, and forming operations. Base oils enable cooling and lubrication during metal processing. Rising manufacturing of automotive components and heavy machinery supports long-term consumption.

Key Market Segments

By Product

- Group I

- Group II

- Group III

- Group IV

- Group V

By Application

- Automotive Oils

- Process Oils

- Hydraulic Oils

- Metalworking Fluids

- Industrial Oils

- Others

Emerging Trends

Growing Use of High-Performance Lubricants Drives Market Momentum

The Base Oil Market is witnessing strong momentum as industries increasingly prefer high-performance lubricants. Modern engines and machinery require cleaner, more efficient, and thermally stable oils, encouraging manufacturers to shift toward premium base oils. This trend is especially visible in automotive and industrial sectors that aim to reduce wear and improve fuel efficiency.

- Base oil production in the EU is estimated at 8 million tonnes, with only 0.68 million tonnes coming from re-refining waste oils. Companies are upgrading their equipment, and these new systems demand high-quality base oils to ensure smooth operations and longer equipment life. This shift is pushing producers to focus more on Group II and Group III base oil production.

Environmental regulations are also shaping market trends. Many regions now encourage the use of low-sulfur and low-emission lubricants. As a result, refiners are investing in cleaner processing technologies to meet these expectations. This regulatory push is accelerating the transition from traditional Group I oils to more refined and eco-friendly base oils.

Drivers

Growing Use of High-Performance Lubricants Drives Base Oil Market Growth

The Base Oil Market is expanding steadily because industries now need high-performance lubricants for smoother and more reliable operations. Manufacturers in automotive, machinery, and heavy equipment are shifting toward cleaner and more stable base oils, which improve engine protection and reduce wear and tear. This rising preference directly supports long-term market growth.

Industrial users are also creating strong growth momentum. Sectors like manufacturing, power generation, and metal processing depend on lubricants made from high-quality base oils to enhance equipment life and maintain efficiency. This ongoing dependence on reliability boosts consumption across multiple industries.

Stricter environmental rules further accelerate the shift toward cleaner and low-sulfur base oils. Companies are investing in hydrocracked and synthetic grades because they help reduce emissions and improve overall fuel efficiency. As sustainability becomes a priority worldwide, high-quality base oils are gaining even more importance.

Restraints

Environmental Pressures Limit Base Oil Market Expansion

Stricter environmental norms act as a major restraint for the base oil market. As governments enforce tighter emission rules, lubricant manufacturers must shift toward cleaner and low-sulfur formulations. This transition increases production complexity and forces refiners to invest more in upgrading units, adding financial pressure.

- One major restraint for the base-oil market is the accelerating closure of conventional refinery plants, particularly those producing Group I base stocks, driven by regulatory and environmental pressures. Globally, about 2.395 million tonnes of Group I base-oil capacity have been lost.

Additionally, the rising push toward bio-based and synthetic alternatives slows the growth of conventional mineral-based oils. Many end-use industries are adopting eco-friendly lubricants to meet sustainability goals, reducing long-term dependence on traditional base oil grades. This shift challenges refiners that rely heavily on Group I and Group II products.

The market also faces headwinds from the transition toward electric vehicles. EVs require fewer lubricants compared to internal combustion engines, which reduces the future demand for automotive oils—a major application of base oil. As EV adoption grows across Asia, Europe, and North America, long-term consumption patterns are expected to change.

Growth Factors

Growing Adoption of High-Performance Lubricants Creates New Market Paths

The Base Oil Market is seeing strong growth opportunities as industries shift toward high-performance lubricants. Modern engines, advanced machinery, and heavy-duty systems require cleaner, more stable base oils. This need pushes manufacturers to develop better-quality Group II and Group III oils, opening space for premium, value-added products.

Opportunities are also rising due to rapid industrial expansion in emerging economies. Countries in Asia, Africa, and Latin America continue to increase manufacturing output, transportation activity, and infrastructure development. These sectors heavily rely on lubricants, which directly lifts long-term demand for base oils across automotive, power generation, and general engineering.

Sustainability trends also create new openings. Many governments are encouraging cleaner refining technologies and better waste management practices. This increases interest in re-refined base oils, which help reduce environmental impact. Suppliers investing in circular-economy solutions can access new customer segments and meet tightening regulatory standards effectively.

Regional Analysis

Asia Pacific Dominates the Base Oil Market with a Market Share of 47.6%, Valued at USD 12.8 Billion

The Asia Pacific region leads the global Base Oil Market due to its fast-growing automotive, industrial, and manufacturing sectors. With a dominant 47.6% share valued at USD 12.8 billion, the region benefits from large-scale lubricant consumption and rapid infrastructure growth. Expanding transportation fleets and strong refining capacities further support continuous demand across key economies.

North America shows steady growth driven by advanced automotive maintenance practices, strict quality standards, and rising adoption of synthetic and semi-synthetic lubricants. The region also benefits from well-established refining networks and increasing industrial automation. Continuous technological upgrades in lubricant formulations further enhance market demand.

Europe’s Base Oil Market is shaped by stringent environmental rules and a strong shift toward cleaner, high-performance Group II and Group III base oils. Demand remains stable due to mature automotive fleets, industrial modernization, and growing interest in energy-efficient lubricants. Sustainability-focused production practices continue to influence the region’s consumption patterns.

The Middle East & Africa region benefits from abundant crude supply, expanding refining capacities, and rising investments in downstream industries. The market is supported by growing automotive needs in key Gulf countries and increasing industrial diversification efforts. Infrastructure development and export-oriented production also strengthen regional growth prospects.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Base Oil Market in 2024 reflects steady expansion as major producers strengthen refining efficiency and broaden high-quality base stock portfolios. Companies are focusing on cleaner formulations, better viscosity performance, and upgraded hydrocracking capacity to meet rising demand from automotive, industrial machinery, and marine lubricants.

CNOOC Limited continues to play an influential role through its integrated refining operations, supporting the market with stable Group I and Group II supplies. Its focus on optimizing offshore crude processing helps maintain a consistent flow of base stocks for domestic lubricant manufacturers.

PetroCanada Lubricants Inc. remains recognized for producing some of the purest base oils through its advanced hydrocracking technology. The company’s emphasis on high-performance Group II and Group III products strengthens its relevance in automotive and industrial lubricant applications worldwide.

SINOPEC supports the market with extensive refining capacity and a strong domestic distribution network. Its growing investments in modern base oil plants enable the production of higher-quality formulations that cater to cleaner engine technologies and evolving environmental norms.

PETRONAS Lubricants International maintains a strong global presence with a focus on premium base stocks designed for fuel-efficient engines. Its efforts in technology partnerships and lubricant innovation support the demand for enhanced thermal stability and improved oxidation resistance.

Top Key Players in the Market

- CNOOC Limited

- PetroCanada Lubricants Inc.

- SINOPEC

- PETRONAS Lubricants International

- PetroChina Co., Ltd

- Exxon Mobil Corporation

- Abu Dhabi National Oil Company

- Chevron Corporation

- Shell plc

- Indian Oil Corporation Ltd

Recent Developments

- In 2024, PLI and Indonesian state refinery PT Kilang Pertamina Internasional (KPI) signed a joint study agreement (JSA) to explore a new lube/base-oil plant in RU-IV Cilacap. PLI and Stellantis N.V. launched a co-branded lubricant product range sourced from recycled base oils, emphasising a lower carbon footprint.

- In 2024, Petro-Canada has focused on operational efficiencies and sustainability in lubricants derived from Group III+ base oils. The company marked its PURITY FG food-grade lubricant brand, emphasizing NSF H1-certified products for industrial applications.

Report Scope

Report Features Description Market Value (2024) USD 27.0 Billion Forecast Revenue (2034) USD 45.7 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Group I, Group II, Group III, Group IV, Group V), By Application (Automotive Oils, Process Oils, Hydraulic Oils, Metalworking Fluids, Industrial Oils, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape CNOOC Limited, PetroCanada Lubricants Inc., SINOPEC, PETRONAS Lubricants International, PetroChina Co., Ltd, Exxon Mobil Corporation, Abu Dhabi National Oil Company, Chevron Corporation, Shell plc, Indian Oil Corporation Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- CNOOC Limited

- PetroCanada Lubricants Inc.

- SINOPEC

- PETRONAS Lubricants International

- PetroChina Co., Ltd

- Exxon Mobil Corporation

- Abu Dhabi National Oil Company

- Chevron Corporation

- Shell plc

- Indian Oil Corporation Ltd