Global Baby Products Market By Product (Baby Cosmetics & Toiletries, Baby Food, Baby Safety & Convenience, Baby Clothing, Baby Nursery & Furniture, Baby Feeding & Nursing), By Type (Mass, Premium), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Pharmacies & Drugstores, Online, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 64834

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

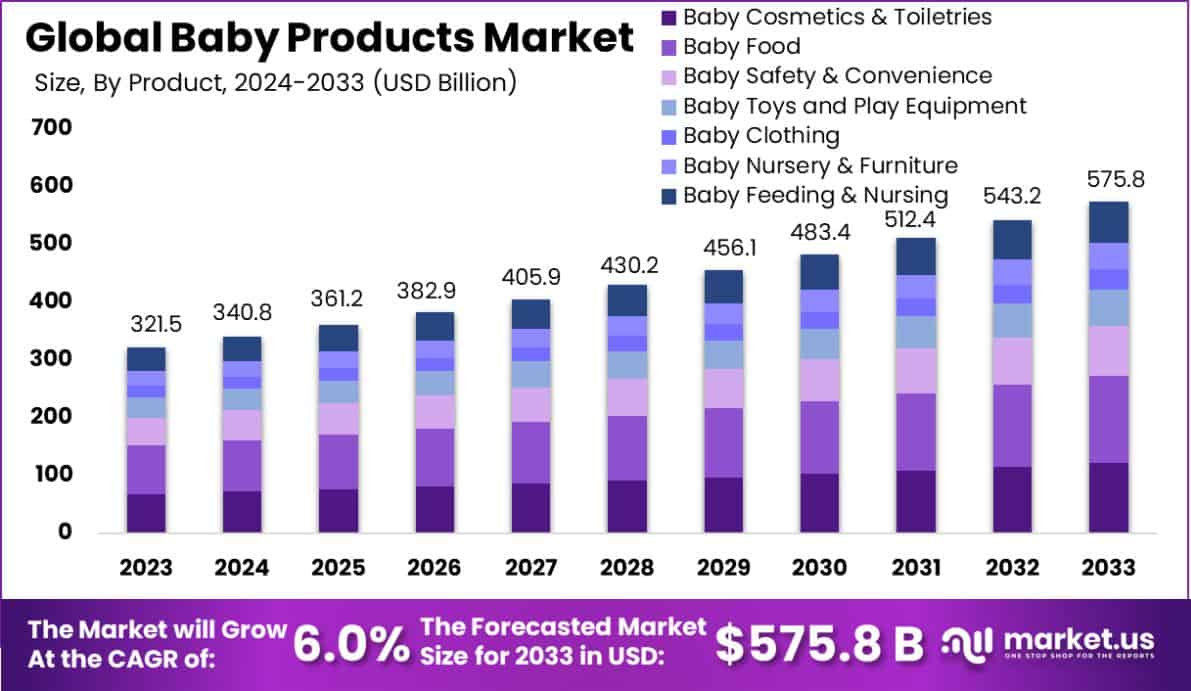

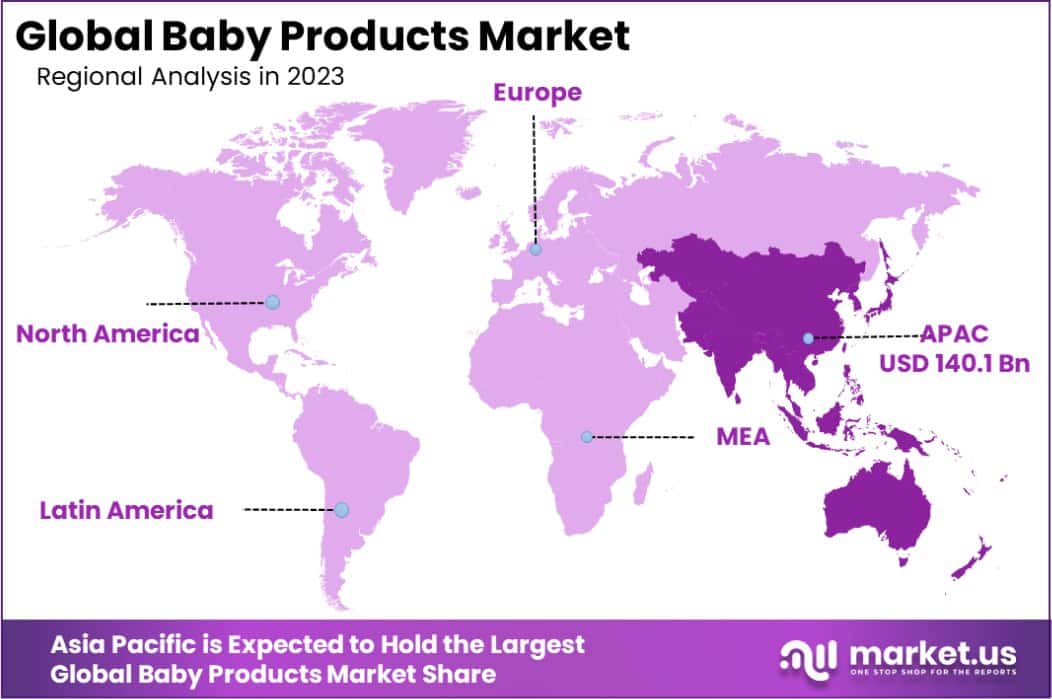

The Global Baby Products Market size is expected to be worth around USD 575.8 Billion by 2033, from USD 321.5 Billion in 2023, growing at a CAGR of 6.0% during the forecast period from 2024 to 2033. Asia Pacific dominated a 43.6% market share in 2023 and held USD 140.1 Billion in revenue from the Baby Products Market.

Baby Products are items specifically designed for infants and toddlers. These products cater to the various needs of babies and include a wide range of items such as feeding bottles, diapers, baby wipes, strollers, baby food, toys, and clothing. They are developed with special attention to safety, comfort, and ease of use, ensuring they meet the stringent regulations governing products intended for children.

The Baby Products Market refers to the commercial sector focused on the manufacture, distribution, and sale of items for infants and toddlers. This market is driven by factors such as rising global birth rates, increased awareness of child safety and well-being, and the growing demand for organic and non-toxic baby products. Additionally, technological advancements and innovations in product features have also fueled market growth.

The baby products market is primarily propelled by increasing global birth rates, which naturally boost the demand for baby care essentials. Furthermore, rising disposable incomes allow parents to spend more on premium baby products, enhancing overall market growth.

There is a strong demand for baby products that are safe, convenient, and innovative. Parents are increasingly looking for products that offer additional benefits such as enhanced safety features, organic materials, and multifunctionality, which cater to a modern, safety-conscious parenting approach.

The baby products market offers significant opportunities for product innovation and eco-friendly solutions. As parents become more environmentally conscious, the demand for sustainable and organic baby products is rapidly increasing, creating new avenues for growth within the industry.

The Baby Products Market continues to exhibit robust growth driven by several key factors, including rising parental awareness and an increase in investments directed toward child wellness.

A notable insight from urban.org underscores the potential of early financial investments in newborns, highlighting that an initial investment of $1,000 can catalyze significant non-financial advantages. These benefits range from elevated parental expectations to alleviations in maternal depression, factors that indirectly stimulate market growth by increasing consumer spending on health-enhancing baby products.

Further energizing the market is the surge in funding for niche players like BabyOrgano. As reported by Hindustantimes, BabyOrgano recently secured ₹6 crore from Sauce Consumer Fund III, bolstered by contributions from existing stakeholders. The brand’s commitment to 100% natural, Ayurvedic, chemical-free products resonates with current consumer preferences towards organic and safe baby care solutions, leveraging ancient Ayurvedic practices.

According to economists. indiatimes, a significant portion of this funding is allocated to strategic areas: 60% for expansion, 20% for operational enhancements, 10% for new product development, and the remainder for team expansion, underscoring a strategic roadmap poised for growth and innovation.

Moreover, the startup lab. reports a $2.5 million funding acquisition by Herby Angel, aimed at broadening their product line. Such financial influxes not only empower brand positioning but also stimulate market competition, driving continual advancements in product offerings. This investment and innovation cycle propels the market forward, making it an attractive sector for further capital injection and development.

Key Takeaways

- The Global Baby Products Market size is expected to be worth around USD 575.8 Billion by 2033, from USD 321.5 Billion in 2023, growing at a CAGR of 6.0% during the forecast period from 2024 to 2033.

- In 2023, Baby Food held a dominant market position in the By Product segment of the Baby Products Market, with a 26.2% share.

- In 2023, Mass held a dominant market position in the By Type segment of the Baby Products Market, with a 77.2% share.

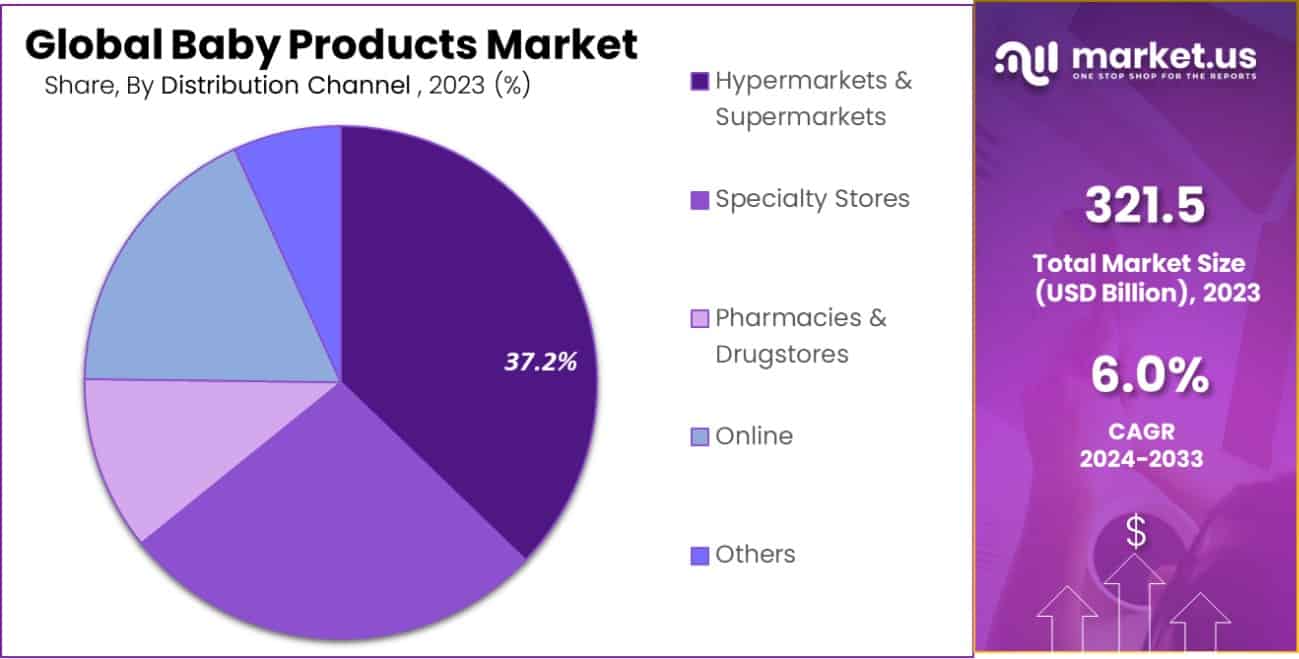

- In 2023, Hypermarkets & Supermarkets held a dominant market position in the By Distribution Channel segment of the Baby Products Market, with a 37.2% share.

- Asia Pacific dominated a 43.6% market share in 2023 and held USD 140.1 Billion in revenue from the Baby Products Market.

By Product Analysis

In 2023, Baby Food held a dominant market position in the “By Product” segment of the Baby Products Market, commanding a 26.2% share. This segment is diverse, encompassing a range of subcategories such as Baby Milk Products, Frozen Baby Food, Baby Juice, Baby Food Snacks, and Baby Food Cereals.

The robust performance of the Baby Food segment is indicative of evolving parental preferences towards nutritious and convenient meal options for infants and toddlers, aligning with global health recommendations.

Beyond Baby Food, the market is segmented into various other categories, each addressing distinct aspects of infant care and development. These include Baby Cosmetics & Toiletries, which feature Baby Skin Care Products, Bath Products, Baby Hair Care Products, Baby Diapers & Wipes, and Other Cosmetics & Toiletries.

Safety and convenience products like Baby Strollers, Baby Car Seats, Baby Monitors, and Baby Proofing Products also represent significant shares, reflecting the growing consumer emphasis on safety and mobility.

The segment further extends to Baby Toys and Play Equipment, including Rattles & Teethers, Stuffed Animals & Plush Toys, and Baby Walkers. Baby Clothing categories such as Bodysuits, Tops, Bottoms, and others also contribute to the market landscape, alongside Baby Nursery & Furniture, featuring Cribs & Coats, Bassinets, and High Chairs, among others.

Lastly, the Baby Feeding & Nursing segment includes essential items such as Bottles & Nipples, Breast Pumps, and Bottle Warmers & Sterilizers, and breastfeeding accessories which are vital for the daily care routines of newborns and young infants. Each segment’s performance is crucial for understanding consumer behavior and emerging market trends in the holistic development of the Baby Products Market.

By Type Analysis

In 2023, Mass products held a dominant market position in the “By Type” segment of the Baby Products Market, with a commanding 77.2% share. This segment’s substantial market share reflects a broader consumer preference for affordable, accessible, and reliable baby products that are readily available across various retail channels.

Mass-market baby products typically encompass a wide range of items including diapers, feeding accessories, baby care essentials, and everyday baby apparel, appealing to a large demographic of price-sensitive consumers.

Contrastingly, the Premium segment, though smaller in size, caters to a niche market segment that prioritizes specialized, high-quality materials and advanced product features. This segment includes higher-end versions of everyday products such as organic baby foods, designer baby wear, and advanced technological products like smart monitors and ergonomic baby carriers.

Premium products often boast enhancements in safety standards, product design, and ecological sustainability, aligning with the values of environmentally conscious parents willing to invest in premium price points for added benefits.

The stark contrast in market share between these two segments underscores the significant influence of economic factors on consumer choices in the baby products industry. It highlights the ongoing demand for cost-efficiency paired with quality and safety in daily-use items, which Mass products effectively deliver.

By Distribution Channel Analysis

In 2023, Hypermarkets & Supermarkets held a dominant market position in the “By Distribution Channel” segment of the Baby Products Market, commanding a 37.2% share. This channel’s prominence is anchored in its ability to offer a wide assortment of baby products under one roof, coupled with the convenience of immediate purchase.

Hypermarkets & Supermarkets are preferred by consumers for their accessibility, competitive pricing, and the ability to physically assess product quality and suitability, factors that are especially pertinent to the purchasing decisions of new or expectant parents.

Other significant channels include Specialty Stores, which specialize in baby products offering expert advice and a curated product range; these stores account for a substantial market share, appealing to consumers seeking specialized products and a higher level of customer service. Pharmacies & Drugstores also play a critical role, particularly for health-related baby products like vitamins, medicines, and hypoallergenic formulas.

The Online segment, though smaller, is rapidly growing due to the convenience of home shopping and the increasing availability of online reviews which help parents make informed decisions.

This channel is particularly favored for repeat purchases, where brand and product loyalty have been established. Lastly, the “Others” category includes various minor outlets such as department stores and baby boutiques, which cater to specific consumer segments looking for unique or luxury baby products.

Key Market Segments

By Product

-

- Baby Cosmetics & Toiletries

- Baby Skin Care Products

- Bath Product

- Baby Hair Care Products

- Baby Diapers & Wipes

- Other Cosmetics & Toiletries

- Baby Food

- Baby Milk Products

- Frozen Baby Food

- Baby Juice

- Baby Food Snacks

- Baby Food Cereals

- Other Baby Food

- Baby Safety & Convenience

- Baby Strollers

- Baby Car Seats

- Baby Monitors

- Baby Proofing Products

- Others

- Baby Toys and Play Equipment

- Rattles & Teethers

- Stuffed Animals & Plush Toys

- Baby Walkers

- Others

- Baby Clothing

- Bodysuits

- Tops

- Bottoms

- Others

- Baby Nursery & Furniture

- Cribs & Coats

- Bassinets

- High Chairs

- Others

- Baby Feeding & Nursing

- Bottles & Nipples

- Breast Pumps

- Bottle Warmers & Sterilizers

- Others

- Baby Cosmetics & Toiletries

By Type

- Mass

- Premium

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- Pharmacies & Drugstores

- Online

- Others

Drivers

Growth Drivers in the Baby Products Market

The Baby Products Market is experiencing significant growth, primarily driven by increasing awareness among parents about child health and safety. This awareness is leading to higher demand for quality and safe baby products, such as organic baby foods, hypoallergenic fabrics, and non-toxic toys.

Additionally, the rise in the number of working parents, particularly mothers, contributes to greater spending on baby care products to ensure comfort and safety for their children. The market is also benefiting from the growing online retailing, which offers parents convenience through easy access to a wide range of products and customer reviews.

Furthermore, advancements in product technology, such as smart baby monitors and ergonomic strollers, are enhancing consumer interest and trust in these products. As such, the combination of health-focused parenting, increased household income, and innovative product offerings is driving robust growth in the Baby Products Market.

Restraint

Challenges in the Baby Products Market

Despite robust growth, the Baby Products Market faces several challenges that could restrain its expansion. One of the primary challenges is the high cost associated with quality baby products, which can be prohibitive for price-sensitive consumers, particularly in developing regions.

The market is also affected by strict regulatory standards governing baby products, which can hinder the speed of product innovation and increase manufacturing costs. Additionally, intense competition in the market can lead to price wars and reduced profit margins for manufacturers.

Moreover, there is a rising concern among consumers about the safety of baby products, fueled by occasional product recalls that can damage brand reputations and consumer trust. These factors combined create significant hurdles for new and existing players in the market, impacting their growth and profitability.

Opportunities

Expanding Opportunities in the Baby Market

The Baby Products Market is ripe with opportunities, particularly from emerging markets where increasing urbanization and rising middle-class populations are boosting consumer spending on baby care products. The trend towards nuclear families, where both parents are employed, is increasing the demand for convenient and advanced baby products that aid in efficient child-rearing.

Technological advancements such as smart baby monitors and GPS-equipped strollers are opening new avenues for innovation, appealing to tech-savvy parents looking for the best tools to enhance their child’s safety and well-being. Additionally, there’s a growing trend towards organic and eco-friendly products, driven by parents’ increasing environmental awareness and concern for their children’s health.

These shifts in consumer preferences provide a fertile ground for companies to introduce differentiated products and capture a larger market share, thereby expanding their footprint in the global market.

Challenges

Challenges Facing the Baby Products Market

The Baby Products Market is navigating several challenges that could impact its growth trajectory. One of the main obstacles is the intense competition among brands, which often leads to price wars and thinner profit margins. Additionally, the safety of baby products remains a critical concern, with frequent recalls due to quality issues undermining consumer trust and loyalty.

Compliance with diverse and stringent regulatory standards across different markets also poses a significant challenge, adding complexity and cost to the production process. The market is further complicated by the economic disparities between different regions, which can limit access to premium baby products in less affluent areas.

These challenges necessitate strategic approaches from companies, such as innovation in product safety, adherence to global standards, and effective communication of brand value to maintain and grow their market presence.

Growth Factors

Key Growth Drivers: Baby Products Market

The Baby Products Market is experiencing substantial growth due to several pivotal factors. Rising global birth rates and increasing parental awareness about childcare products are primary growth drivers.

Modern parents, who are more informed and have access to digital resources, are increasingly opting for products that promote safety, convenience, and healthy development, fueling demand across various product segments.

Economic growth in emerging markets is another significant factor, as it increases disposable income and consumer spending on quality baby care items. Furthermore, innovations in product design and technology, such as biodegradable packaging diapers and smart monitoring devices, cater to current consumer trends toward sustainability and connectivity, broadening the market’s reach.

These dynamics are creating ample opportunities for both established players and new entrants to expand and innovate within the baby products sector.

Emerging Trends

Emerging Trends: Baby Products Sector

The Baby Products Market is witnessing several emerging trends that are reshaping consumer preferences and industry standards. A notable trend is the increasing demand for organic and natural products, as parents become more health-conscious and seek safer options for their children.

This shift is driving growth in organic baby foods, eco-friendly diapers, and natural skincare products. Additionally, technological integration in baby products, such as smart baby monitors and app-controlled devices, is gaining traction among tech-savvy parents who prioritize convenience and enhanced functionality.

The rise of online retail platforms is also a significant trend, offering wider product selections and competitive pricing, which makes shopping more accessible and convenient for busy parents. These trends reflect a market that is becoming increasingly responsive to the needs of modern families, focusing on health, safety, and technological advancements.

Regional Analysis

The Baby Products Market exhibits dynamic growth patterns across various regions, reflecting a blend of mature and emerging market characteristics. North America and Europe, as mature markets, maintain steady growth due to high consumer spending power and awareness about child health and safety products. These regions emphasize advanced, technology-driven products, such as smart monitors and organic consumables.

Conversely, Asia Pacific stands out as the dominating region with a substantial market share of 43.6%, translating to a market value of approximately USD 140.1 billion. This dominance is fueled by rising birth rates, increasing urbanization, and growing middle-class populations in countries like China and India, which collectively drive demand for a wide range of baby products. The region’s rapid embrace of online retailing further supports market expansion, making it easier for parents to access and purchase a variety of baby care items.

Meanwhile, the Middle East & Africa, and Latin America are emerging as potential growth areas. These regions are witnessing gradual increases in consumer awareness and spending on baby products, coupled with urban growth and digital penetration, setting the stage for future market expansion. Each region’s unique demographic and economic developments contribute to the global landscape of the baby products market, highlighting diverse opportunities for market players.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Baby Products Market is significantly influenced by major players such as Johnson & Johnson Services, Inc., Procter & Gamble (P&G) Co., and Kimberly-Clark (KCWW), each holding pivotal roles in shaping industry dynamics.

Johnson & Johnson Services, Inc. remains a stalwart in the market, primarily due to its longstanding reputation and trust among consumers. The company’s focus on safety and innovation, especially in baby skincare products and wellness products, continues to set industry standards.

Johnson & Johnson’s strategic initiatives to enhance organic product lines and commitment to removing controversial chemicals have fortified its market position, appealing to increasingly health-conscious consumers.

Procter & Gamble (P&G) Co. leverages its vast distribution networks and strong brand portfolio, including Pampers and Luvs, to dominate the baby care segment. P&G’s focus on consumer-centric innovation, such as the introduction of eco-friendly diapers and advanced fabric softeners for baby clothing, ensures it remains competitive and relevant.

The company’s aggressive marketing strategies and deep market penetration across diverse regions contribute substantially to its robust market presence.

Kimberly-Clark (KCWW), known for its Huggies brand, excels in the baby diaper and wipes segments. The company’s dedication to product safety and sustainability, combined with strategic global expansions, particularly in emerging markets, supports its competitive edge. Kimberly-Clark’s investment in technology to improve product absorption and comfort has enhanced its brand loyalty among parents seeking premium and reliable baby care solutions.

Together, these companies not only drive competitive strategies but also influence market trends through their innovative product offerings and global reach, making significant impacts on the overall dynamics of the Baby Products Market in 2023.

Top Key Players in the Market

- Johnson & Johnson Services, Inc.

- Procter & Gamble (P&G) Co.

- Kimberly-Clark (KCWW)

- Honasa Consumer Pvt. Ltd.

- The Himalaya Drug Company

- Citta World

- Sebapharma GmbH & Co. KG

- Beiersdorf

- California Baby

- Unilever PLC

- Nestle S.A.

- Other Key Players

Recent Developments

- In August 2023, Citta World partnered with a European design firm in August 2023 to introduce a premium range of eco-friendly baby furniture in their catalog.

- In June 2023, The Himalaya Drug Company launched a new line of organic baby lotions and shampoos, aiming to meet the rising demand for natural baby care products.

- In February 2023, Honasa Consumer Pvt. Ltd., the parent company of Mamaearth, raised $52 million in funding to expand its product range and market presence.

Report Scope

Report Features Description Market Value (2023) USD 321.5 Billion Forecast Revenue (2033) USD 575.8 Billion CAGR (2024-2033) 6.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Baby Cosmetics & Toiletries(Baby Skin Care Products, Bath Product, Baby Hair Care Products, Baby Diapers & Wipes, Other Cosmetics & Toiletries), Baby Food(Baby Milk Products, Frozen Baby Food, Baby Juice, Baby Food Snacks, Baby Food Cereals, Other Baby Food), Baby Safety & Convenience(Baby Strollers, Baby Car Seats, Baby Monitors, Baby Proofing Products, Others), Baby Toys and Play Equipment(Rattles & Teethers, Stuffed Animals & Plush Toys, Baby Walkers, Others), Baby Clothing(Bodysuits, Tops, Bottoms, Others), Baby Nursery & Furniture(Cribs & Coats, Bassinets, High Chairs, Others), Baby Feeding & Nursing(Bottles & Nipples, Breast Pumps, Bottle Warmers & Sterilizers, Others))By Type(Mass, Premium), By Distribution Channel(Hypermarkets & Supermarkets, Specialty Stores, Pharmacies & Drugstores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Johnson & Johnson Services, Inc., Procter & Gamble (P&G) Co., Kimberly-Clark (KCWW), Honasa Consumer Pvt. Ltd., The Himalaya Drug Company, Citta World, Sebapharma GmbH & Co. KG, Beiersdorf, California Baby, Unilever PLC, Nestle S.A., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Johnson & Johnson Services, Inc.

- Procter & Gamble (P&G) Co.

- Kimberly-Clark (KCWW)

- Honasa Consumer Pvt. Ltd.

- The Himalaya Drug Company

- Citta World

- Sebapharma GmbH & Co. KG

- Beiersdorf

- California Baby

- Unilever PLC

- Nestle S.A.

- Other Key Players