Global Automotive Webbing Market Size, Share, Growth Analysis By Material Type (Polyester, Nylon, Polypropylene, Aramid), By Application (Seat Belts, Airbags, Child Restraint Systems, Safety Harnesses), By End Use (Passenger Cars, Commercial Vehicles, Two Wheelers), By Distribution Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142269

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

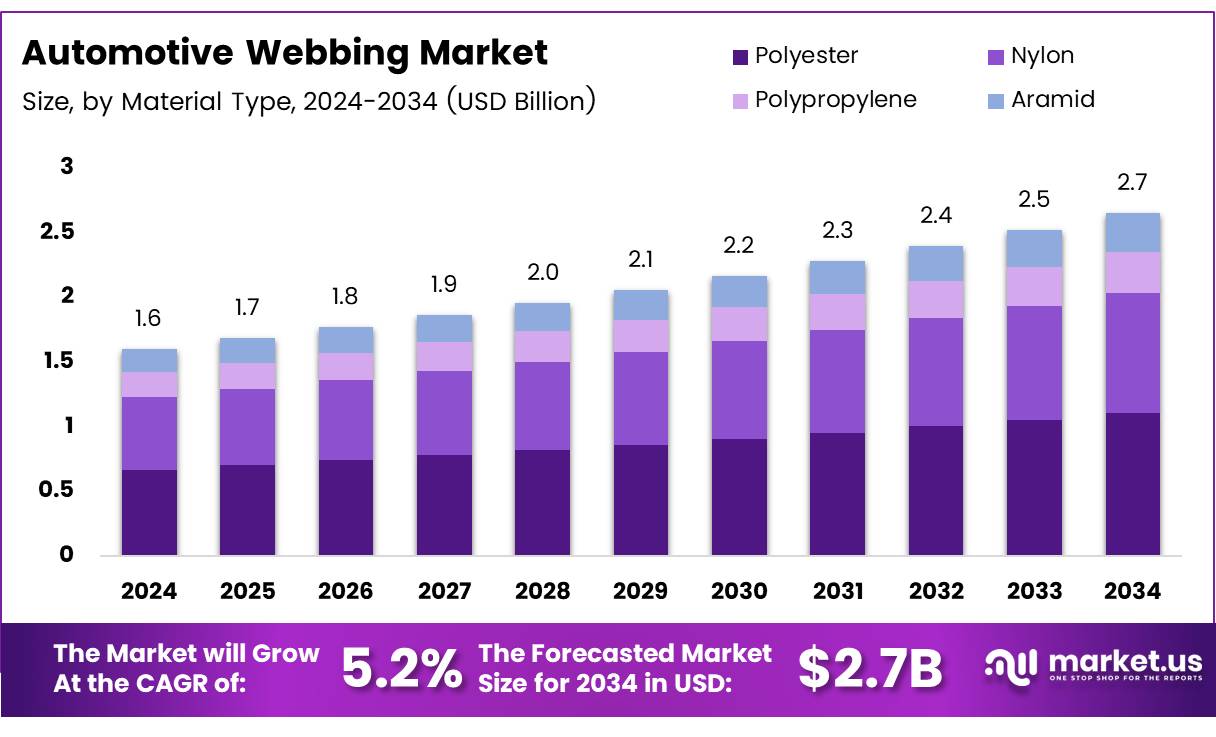

The Global Automotive Webbing Market size is expected to be worth around USD 2.7 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

The Automotive Webbing Market is a crucial segment within the automotive industry, focusing primarily on the production and distribution of webbing materials used in vehicles. These materials are integral components found in seat belts, airbags, harnesses, and other safety mechanisms. The primary function of automotive webbing is to provide strength and flexibility, which are vital for ensuring passenger safety and compliance with vehicle standards.

Automotive webbing plays a pivotal role in enhancing vehicle safety standards. With advancements in material science and manufacturing techniques, the quality and durability of webbing have significantly improved, leading to better safety outcomes in automotive applications.

The integration of high-tensile fibers and the adoption of innovative weaving technologies are key trends driving the evolution of this market. As safety regulations become more stringent, the demand for high-quality automotive webbing is expected to rise, underscoring its importance in modern automotive design.

The Automotive Webbing Market is poised for substantial growth, driven by increasing vehicle production and heightened safety regulations worldwide. Government investments in road safety and regulatory mandates on vehicle safety standards are major catalysts for this growth.

For instance, the National Highway Traffic Safety Administration (NHTSA) estimates that seat belts reduce the risk of death by 45% and serious injury by 50% for front-seat passengers in cars. For occupants in light trucks, the reduction in risk of death is as high as 60%, and for serious injury, 65% according to Consumer Affairs.

Furthermore, wearing a seat belt in the rear seat reduces the risk of death by 55% in passenger vehicles and 74% in light trucks and vans, as per Most Policy Initiative. These statistics highlight the critical role of automotive webbing in enhancing passenger safety.

Opportunities in the market are abundant, particularly in the development of next-generation webbing solutions that combine performance with cost efficiency. The ongoing shift towards more sustainable materials and processes also presents a significant opportunity for innovation in this sector.

Companies that can leverage technology to improve the ecological footprint of their production processes while maintaining or enhancing the safety features of their products are likely to gain a competitive edge.

Key Takeaways

- The global automotive webbing market is projected to grow from USD 1.6 billion in 2024 to USD 2.7 billion by 2034, at a CAGR of 5.2%.

- Polyester dominates the material segment due to its durability and suitability for safety applications like seat belts.

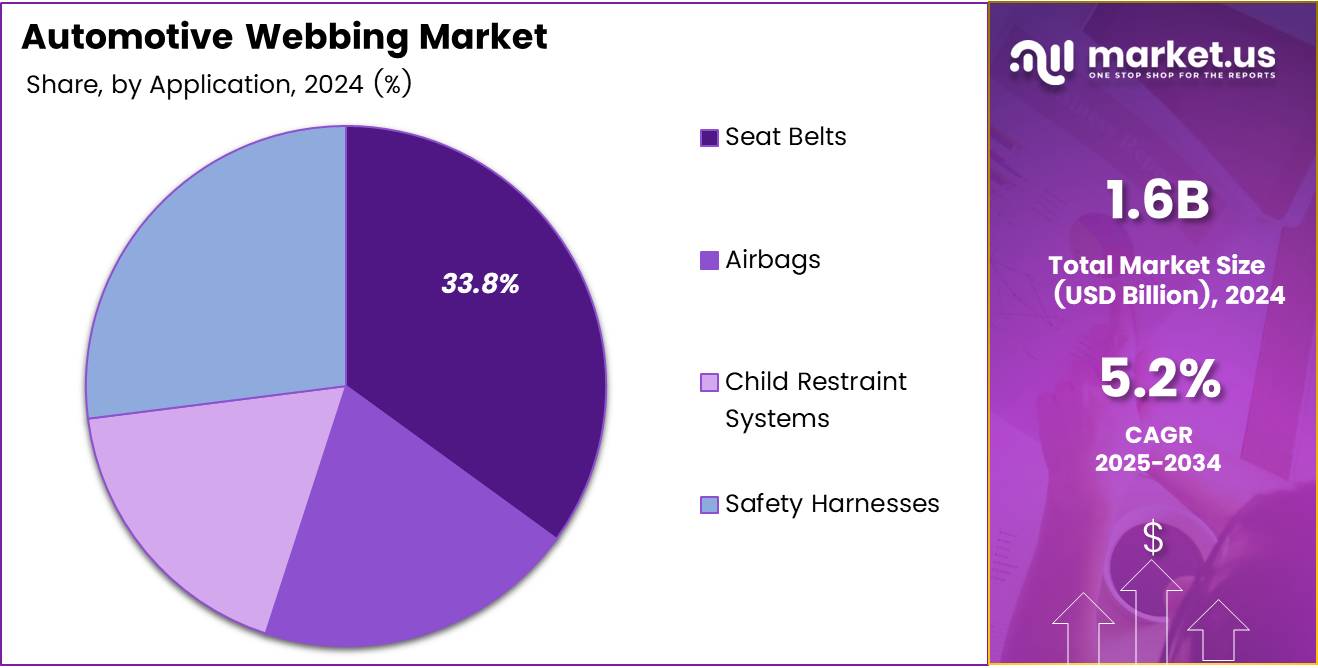

- Seat belts are the leading application of automotive webbing, holding a 33.8% market share, driven by stringent safety regulations.

- Passenger cars are the primary end users in the automotive webbing market, emphasizing the demand for safety and comfort.

- OEMs are the main distribution channel, highlighting their essential role in the automotive industry.

- Asia Pacific is the leading region, with a 40% market share, fueled by high automotive production and strict safety standards in China, India, and Japan.

Material Type Analysis

Polyester Leads with Significant Market Share in Automotive Webbing Material

In 2024, Polyester held a dominant market position in the By Material Type Analysis segment of the Automotive Webbing Market. This material’s prominence is primarily due to its superior strength, durability, and resistance to environmental factors such as UV light and moisture, making it particularly suitable for safety applications such as seat belts and harnesses. Polyester’s resilience against stretching and shrinkage under loads ensures longevity and reliability, attributes highly valued in automotive safety components.

Nylon follows as another key player in this market, appreciated for its elasticity and smooth texture which provide enhanced comfort and user experience.

Polypropylene, though lighter and more cost-effective, offers less durability and strength compared to polyester and nylon, positioning it as a budget-friendly alternative for less critical applications. Aramid, with its exceptional heat and abrasion resistance, caters to niche needs within high-performance applications, though its higher cost limits its widespread adoption.

As automakers continue to focus on passenger safety and regulatory compliance, polyester is expected to maintain its lead due to its balanced properties and cost efficiency, proving to be the material of choice for the majority of automotive webbing applications.

Application Analysis

Seat Belts Lead with 33.8% in the Automotive Webbing Market’s Application Segment

In 2024, the automotive webbing market witnessed significant demand across various applications, with seat belts emerging as the predominant category in the By Application Analysis segment. Capturing a robust market share of 33.8%, seat belts underscored their critical role in vehicle safety and regulatory compliance. This segment’s dominance is largely attributed to heightened global safety regulations and an increased awareness of automotive safety among consumers.

Following seat belts, airbags also held a substantial portion of the market. These are integral to the passive safety systems in vehicles, designed to work in conjunction with seat belts to provide enhanced protection during collisions. Meanwhile, child restraint systems showed a notable increase in uptake, driven by stricter child safety laws and parental concern for child safety in vehicles.

Safety harnesses, although a smaller segment compared to seat belts and airbags, are gaining traction in specific markets, particularly in commercial vehicles and sports cars, where additional safety measures are paramount.

The overall growth trajectory of the automotive webbing market is supported by technological advancements in safety features and the automotive industry’s push towards more stringent safety standards, making each segment crucial to understanding the market dynamics and future opportunities.

End Use Analysis

Passenger Cars Lead with Prominent Share in Automotive Webbing Market

In 2024, Passenger Cars held a dominant market position in the By End Use Analysis segment of the Automotive Webbing Market, reflecting a major trend in consumer preferences and safety innovations. This segment outstripped others such as Commercial Vehicles and Two Wheelers, largely due to the increasing demand for enhanced safety features and comfort in passenger vehicles.

Automotive webbing, essential for seat belts, airbags, and harnesses, has seen substantial integration in passenger cars as manufacturers focus on meeting stringent safety regulations and consumer expectations for security and durability.

Commercial Vehicles also incorporated automotive webbing extensively, driven by global expansion in logistics and increased awareness about driver safety. However, the penetration rate in Commercial Vehicles did not reach the heights seen in Passenger Cars, as the latter’s volume significantly outweighs that of commercial fleets.

Two Wheelers, while a smaller segment of the market, showed promising growth potential. The rise in two-wheeler sales in emerging markets, coupled with evolving safety standards, has begun to spur demand for webbing solutions tailored to this category.

Overall, the leadership of Passenger Cars in the automotive webbing market underscores the sector’s crucial role in shaping market dynamics and driving technological adoption in vehicle safety.

Distribution Channel Analysis

OEM Leads with Commanding Presence in Automotive Webbing Distribution

In 2024, OEM held a dominant market position in the By Distribution Channel Analysis segment of the Automotive Webbing Market, solidifying its pivotal role across multiple vehicular applications.

As primary providers, OEMs ensure the integration of high-quality webbing solutions directly during the vehicle assembly process, which includes seat belts, airbag components, and other safety harnesses. This segment benefits significantly from the stringent safety regulations that compel automotive manufacturers to adhere to robust safety standards, thereby driving OEMs’ continued dominance in the market.

Meanwhile, the aftermarket segment also plays an essential role, though it follows the OEMs in market share. It caters primarily to the replacement needs and upgrades that are not addressed during the initial manufacturing phase. The aftermarket provides diverse options for customization and enhancements, appealing to vehicle owners looking to retrofit older models or enhance new ones with advanced webbing technologies.

Both segments are integral to the automotive webbing landscape, with OEMs leading the charge through direct integration in new vehicles and the aftermarket offering vital support and innovation in vehicle customization and safety enhancements. Together, they create a dynamic market environment ripe for further exploration and growth opportunities.

Key Market Segments

By Material Type

- Polyester

- Nylon

- Polypropylene

- Aramid

By Application

- Seat Belts

- Airbags

- Child Restraint Systems

- Safety Harnesses

By End Use

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

By Distribution Channel

- OEM

- Aftermarket

Drivers

Heightened Safety Regulations Propel Automotive Webbing Market

The automotive webbing market is experiencing substantial growth, driven primarily by the escalating global safety regulations which mandate the use of advanced safety features in vehicles. As governments worldwide tighten safety standards, the demand for automotive webbing, crucial for seat belts, airbags, and harnesses, is surging to enhance passenger security.

This increase is further fueled by the rapid expansion of automobile production, especially in emerging economies such as China and India, where automotive manufacturers are integrating more webbing components to meet both local and international safety norms. Additionally, advancements in material technology are enabling the development of more durable, strong, and lightweight webbing solutions, which are becoming increasingly preferred for their contribution to overall vehicle safety and efficiency.

Consumer awareness about the critical role of high-quality safety components is also rising, leading to greater consumer demand for vehicles equipped with reliable automotive webbing, thereby boosting the market’s growth. This collective push towards improved vehicle safety is shaping the trajectory of the automotive webbing industry, marking it as a crucial component in the evolution of automotive safety standards.

Restraints

High Costs of Advanced Materials Challenge Automotive Webbing Market

The automotive webbing market is experiencing significant restraints due to the high costs of advanced, high-performance materials. These materials are crucial for making products like seat belts and other safety harnesses.

Unfortunately, their high prices push manufacturers towards cheaper alternatives, which might not offer the same quality or safety standards. Furthermore, the market is also impacted by the unpredictable prices of raw materials such as nylon and polyester, which can fluctuate widely. This instability adds to the production costs and complicates pricing strategies, posing challenges for steady market growth.

Growth Factors

Innovations in Webbing Propel Autonomous Vehicle Safety and Design

As the automotive industry rapidly advances towards autonomous vehicles, significant growth opportunities arise for the automotive webbing market. Innovations in webbing technology are crucial for meeting the unique design and safety specifications of self-driving cars.

Integrating advanced webbing solutions allows for enhanced passenger safety and vehicle functionality, adapting to the unconventional seating arrangements and interior setups typical in autonomous vehicles.

Additionally, expanding into emerging markets with growing automotive sectors offers vast prospects for market expansion. Collaborative efforts with vehicle manufacturers to develop tailored webbing solutions can further drive market growth by aligning product offerings with specific OEM requirements.

Moreover, emphasizing recycling and sustainability in production processes not only aligns with global environmental trends but also attracts forward-thinking consumers and manufacturers committed to eco-friendly practices.

Together, these strategies paint a promising picture for the future of the automotive webbing market, positioning it as a key player in the evolution of vehicle safety and design.

Emerging Trends

Lightweight and High-Strength Materials Propel Automotive Webbing Market

In the evolving landscape of the automotive webbing market, several key trends are shaping its growth and development. A prominent trend is the ongoing shift towards lightweight and high-strength materials, which are becoming increasingly essential for improving vehicle efficiency and safety. These materials are not only crucial for reducing overall vehicle weight but also play a significant role in enhancing the structural integrity of safety components like seat belts and airbags.

Additionally, there is a noticeable shift towards incorporating webbing into vehicle interiors that are not only safe but also aesthetically pleasing and comfortable, meeting the rising consumer expectations for luxury and comfort. The integration of smart technologies into safety systems is another significant development, with advancements in smart seat belts and airbags that incorporate sensors to enhance passenger protection dynamically.

Moreover, the surge in popularity of recreational and off-road vehicles has led to an increased demand for more durable and robust webbing solutions, tailored to withstand harsher environments and provide reliable safety. These factors collectively drive innovation and demand in the automotive webbing market, ensuring its continuous adaptation and growth in response to the changing automotive landscape.

Regional Analysis

Asia Pacific Leads Global Automotive Webbing Market with 40% Share, Fueled by High Production and Strict Safety Standards

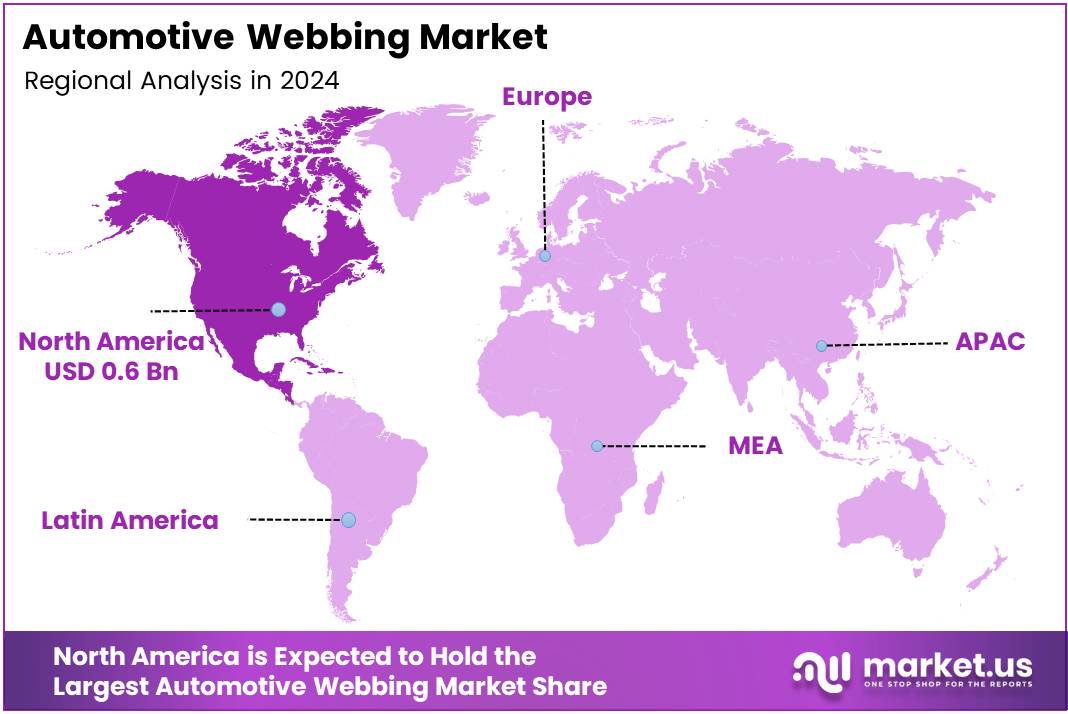

The automotive webbing market showcases significant regional variations and trends across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, reflecting diverse automotive safety standards, manufacturing capabilities, and market penetration rates of vehicles equipped with advanced safety features.

Asia Pacific stands as the dominant region in the global automotive webbing market, commanding an impressive 40% market share, valued at USD 0.64 billion. This dominance is attributed to the substantial automotive production and sales in countries like China, India, and Japan, coupled with stringent vehicle safety regulations that mandate the use of safety belts and airbags, thereby driving the demand for automotive webbing materials.

Regional Mentions:

In North America, the market is driven by robust automotive safety norms and the presence of major automobile manufacturers and webbing suppliers. The U.S. and Canada continue to see growth in the production of vehicles with enhanced safety features, which in turn boosts the automotive webbing market in the region.

Europe remains a critical market, characterized by high safety standards and the widespread adoption of advanced safety technologies in vehicles. The region’s focus on reducing road fatalities has led to an increased demand for automotive webbing used in car safety belts and airbags. Major automotive hubs like Germany, France, and Italy are pivotal in fostering regional market growth.

The Middle East & Africa region, though smaller in comparison, is experiencing gradual growth due to increasing vehicle sales and an emerging focus on vehicle safety regulations, particularly in GCC countries and South Africa. This region shows potential for significant market expansion as awareness and regulatory frameworks continue to develop.

Latin America is also witnessing growth in the automotive webbing market, driven by recovering automotive production and increasing safety regulations in countries like Brazil and Mexico. The market is benefiting from regional economic recovery and the increasing incorporation of safety systems in vehicles.

Collectively, these regional dynamics underline the importance of automotive safety regulations, economic factors, and technological advancements in driving the demand for automotive webbing across the globe. The Asia Pacific region’s dominance is particularly noteworthy, setting a benchmark in market size and growth potential.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global automotive webbing market in 2024 presents a competitive landscape with a diverse array of players, each bringing unique strengths to the forefront. Martin B. H. Gruppe and Schoeller Textil AG are notable for their innovation in textile solutions, which are crucial for developing safer and more durable automotive webbing products. Their focus on sustainability and advanced material science could position them as leaders in high-performance webbing materials.

Webbing Technologies and Stucki AG are pivotal in integrating cutting-edge technologies with traditional webbing applications. Their expertise in crafting specialized webbing solutions for automotive safety and utility translates into potential market growth, driven by trends towards safer and smarter vehicles.

Jakob Rope Systems and Trelleborg AB stand out for their robust product offerings in high-strength materials, catering to both automotive and industrial applications. Their commitment to quality and durability in webbing products is likely to appeal to manufacturers looking for reliable, long-term applications.

Miller Electric and Avery Dennison Corporation are leveraging their extensive experience in material technology to innovate in automotive webbing, particularly in areas such as lightweight and flexible materials, which can contribute significantly to vehicle efficiency and safety.

Groupe PSA and Exel Composites bring a unique perspective with their focus on integrating webbing products into vehicle design and manufacturing processes, emphasizing the importance of webbing in automotive structural integrity and performance.

Owosso Motor Car Company and GURIT Holding AG are smaller, niche players who offer specialized and innovative solutions in the automotive webbing market. Their agile approach to market demands and customization sets them apart in a field dominated by larger corporations.

Lastly, Belttech Marine, Saint-Gobain Performance Plastics, and Intertape Polymer Group are essential for their high-quality, durable products that meet rigorous safety standards, ensuring that automotive manufacturers can rely on their webbing solutions to enhance vehicle safety and functionality.

Top Key Players in the Market

- Martin B. H. Gruppe

- Schoeller Textil AG

- Webbing Technologies

- Stucki AG

- Jakob Rope Systems

- Trelleborg AB

- Miller Electric

- Avery Dennison Corporation

- Groupe PSA

- Exel Composites

- Owosso Motor Car Company

- GURIT Holding AG

- Belttech Marine

- SaintGobain Performance Plastics

- Intertape Polymer Group

Recent Developments

- In March 2024, ZF Rane Automotive India completed the acquisition of TRW Sun Steering Wheels, significantly expanding its manufacturing capabilities and product range in the automotive steering sector.

- In December 2024, the Russian auto components holding company MGC Group successfully purchased a manufacturing plant from Joyson Safety Systems, aiming to enhance its production footprint and technological capabilities in the safety components market.

- In July 2024, the mobility arm of TVS acquired an Italy-based automotive components supplier, which is expected to bolster its international presence and supply chain efficiency in the European market.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 2.7 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Polyester, Nylon, Polypropylene, Aramid), By Application (Seat Belts, Airbags, Child Restraint Systems, Safety Harnesses), By End Use (Passenger Cars, Commercial Vehicles, Two Wheelers), By Distribution Channel (OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Martin B. H. Gruppe, Schoeller Textil AG, Webbing Technologies, Stucki AG, Jakob Rope Systems, Trelleborg AB, Miller Electric, Avery Dennison Corporation, Groupe PSA, Exel Composites, Owosso Motor Car Company, GURIT Holding AG, Belttech Marine, SaintGobain Performance Plastics, Intertape Polymer Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Webbing MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Webbing MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Martin B. H. Gruppe

- Schoeller Textil AG

- Webbing Technologies

- Stucki AG

- Jakob Rope Systems

- Trelleborg AB

- Miller Electric

- Avery Dennison Corporation

- Groupe PSA

- Exel Composites

- Owosso Motor Car Company

- GURIT Holding AG

- Belttech Marine

- SaintGobain Performance Plastics

- Intertape Polymer Group