Automotive Tire Market Report By Season Tire Type (Summer, Winter, All-season), By Rim Size, By Vehicle Type (Commercial Vehicle, Light Commercial, Heavy Commercial, Passenger Car), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 22409

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

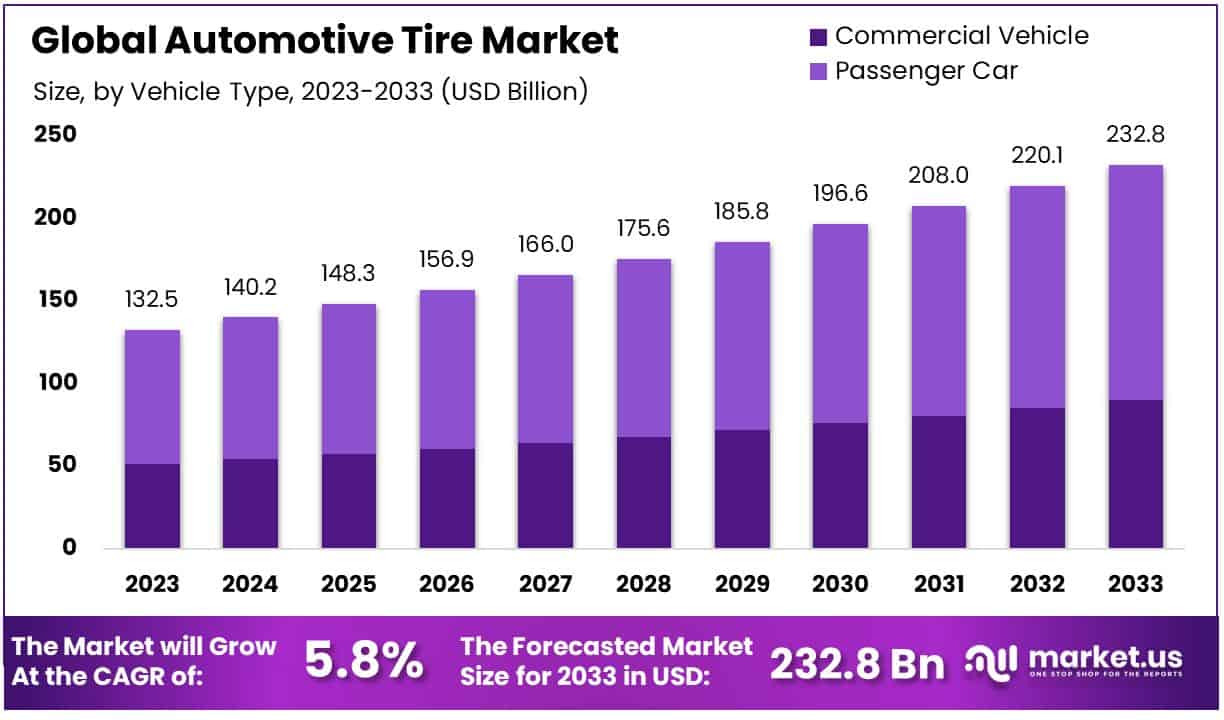

The Global Automotive Tire Market size is expected to be worth around USD 232.8 Billion by 2033, from USD 132.5 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

An automotive tire is a circular component made of rubber and other materials that fits around a wheel’s rim to offer traction and cushion the ride of a vehicle. It is engineered to withstand various weather conditions, road surfaces, and weights.

The automotive tire market encompasses the manufacturing, distribution, and sale of tires for various types of vehicles. This market includes tires for passenger cars, trucks, buses, and other commercial and private vehicles, focusing on innovation, safety, and performance.

In the Automotive Tire Market, significant growth factors include the rising vehicle ownership rates and demand for new tires and car parts. According to Forbes Advisor, 91.7% of U.S. households had at least one vehicle in 2022, showing a vast market for tire manufacturers. This widespread vehicle ownership presents continuous opportunities for tire sales, both as OEM parts and in the aftermarket.

The Automotive Tire Industry reflects a high level of market saturation with a competitive landscape. Most U.S. households (91.7%) owning at least one vehicle signifies a mature market. However, the rising costs of car ownership and car accessories, which now average over $12,000 annually according to AAA, might influence consumer spending on maintenance and upgrades like tires.

Government regulations and investments also shape the tire market. New safety standards and environmental regulations drive innovation in tire production, pushing manufacturers to develop more sustainable and safer products. Such initiatives not only protect consumers but also spur market growth by requiring periodic tire updates and replacements.

Key Takeaways

- Automotive Tire Market was valued at USD 132.5 billion in 2023 and is expected to reach USD 232.8 billion by 2033, with a CAGR of 5.8%.

- In 2023, All-season tires dominate the tire type segment with 55.4% due to their year-round utility.

- In 2023, 16 to 18 inches rims lead the rim size segment with 31.6% because they balance performance and aesthetics.

- In 2023, Passenger cars are the predominant vehicle type with 61.3%, reflecting their massive global usage.

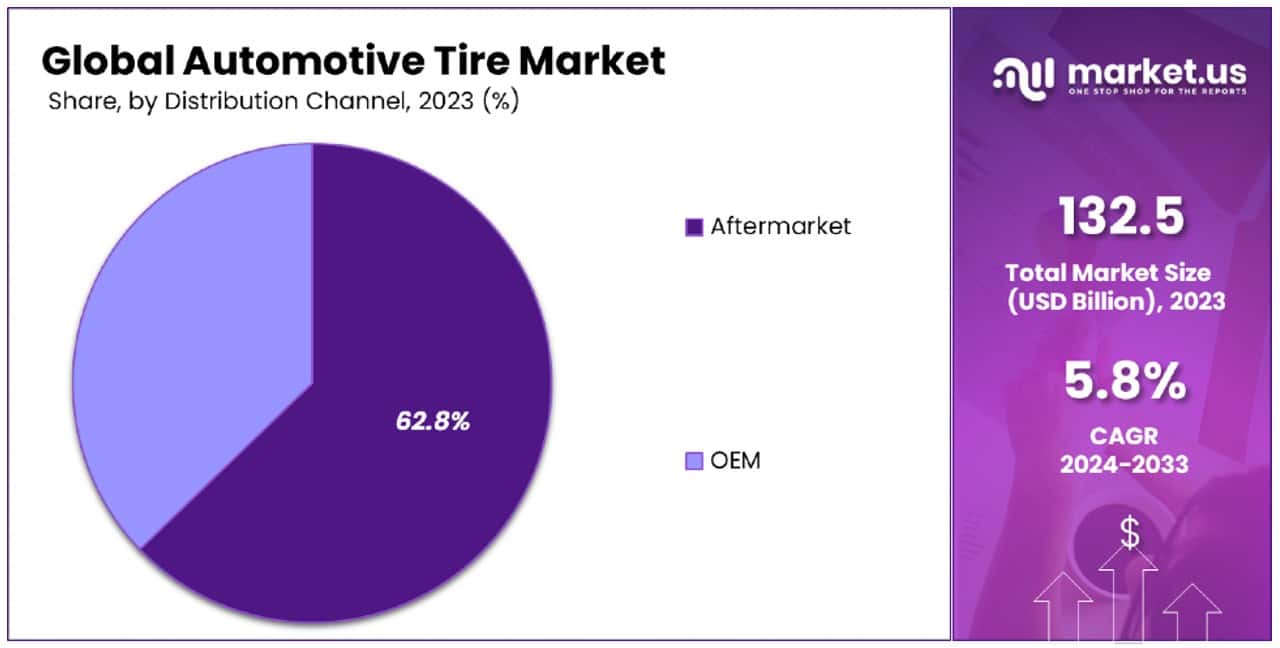

- In 2023, Aftermarket distribution holds the majority with 62.8%, driven by the demand for replacements and upgrades.

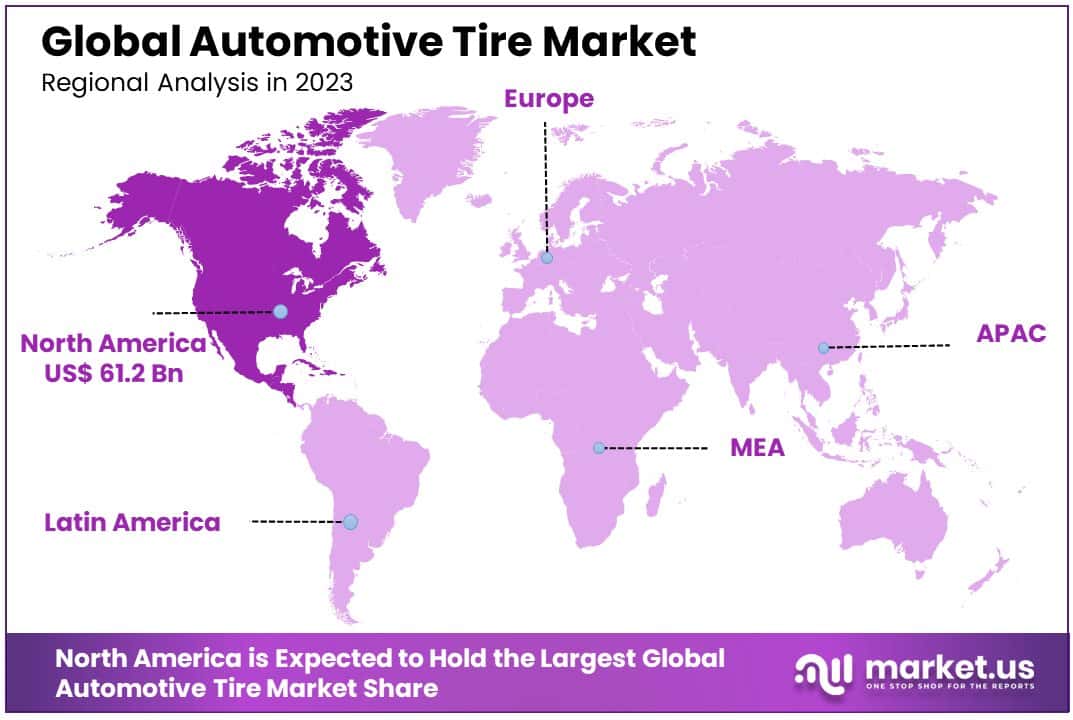

- In 2023, North America dominates with 46.2%, equivalent to USD 61.2 billion, highlighting its strong market presence.

Business Environment Analysis

The automotive tire market exhibits high market saturation, highlighted by rubber tires being the 34th most traded product globally with a trade value of $95.4 billion in 2022. This growth reflects intense competition and numerous established players within the industry.

The primary target demographic for automotive tires includes elderly drivers, with 62% of new cars in the US bought by those aged 55 to 75. Additionally, marketing strategies focus more on men, as 20.5% own personal vehicles compared to 14.6% of women.

Product differentiation in the tire market focuses on safety and compliance, as 78% of Canadian drivers now use winter tires. Manufacturers like LD Carbon invest $28 million to develop recovered carbon black, enhancing tire performance and sustainability.

The value chain in the automotive tire market is strengthened through strategic acquisitions and investments. For instance, Straightaway Tire & Auto acquired Maple Grove Auto Service and Warzecha Auto Works, enhancing service capabilities and distribution networks within the industry.

Investment opportunities in the automotive tire sector are robust, evidenced by BizzyCar securing $15 million in growth funding and LD Carbon raising $28 million. These investments highlight confidence in technological advancements and market expansion potential.

Export-import dynamics in the tire market reveal China’s dominance as a leading exporter with $19.6 billion in 2022. The US faces a trade deficit, exporting $12.5 million and importing $34.2 million of used rubber tires, emphasizing import reliance.

Tire Type Analysis

All-season tires dominate with 55.4% due to their versatility across various weather conditions.

All-season tires hold a dominant position in the tire market, capturing 55.4% of the segment due to their ability to perform in a variety of weather conditions without the need for replacement. This versatility makes them highly appealing to consumers seeking cost-effective solutions without compromising on safety.

Manufacturers have optimized the tread patterns and materials in all-season tires to provide adequate performance in mild winter conditions as well as wet and dry environments. This multi-condition suitability is crucial for drivers who prefer not to change tires seasonally.

In contrast, summer tires are specifically engineered for warm weather and provide exceptional grip and precision on both dry and wet roads but fall short in colder climates. While they are essential for high-performance vehicles in temperate regions, their seasonal limitation restricts their market share.

Winter tires, designed for ice and snow, offer critical safety features in cold climates but are unnecessary in milder regions, thus limiting their market scope compared to the more universally applicable all-season tires. Both types are essential for specific conditions, yet their specialized nature confines their usage to respective climates.

Rim Size Analysis

Rims sized 16″-18″ dominate the market with 31.6% due to their common application across a variety of popular vehicle models.

Rims of 16″-18″ size represent the largest market segment at 31.6%, primarily because they strike a balance between aesthetics and functionality, fitting a broad range of vehicles from sedans to SUVs. This size range is popular among manufacturers and consumers alike due to its adaptability and aesthetic appeal, which complements the modern vehicle design while not compromising on performance or safety.

The <15″ rim size, typically used in smaller, more economical vehicles, offers advantages in terms of cost and fuel efficiency but often lacks the appeal of larger rims. On the other end, 19″-21″ and >21″ rims cater to high-end sports and luxury vehicles, enhancing the vehicle’s appearance and driving experience.

These larger rims support wider and often lower-profile tires, improving handling at higher speeds but at a higher cost and reduced ride comfort. Despite their significant roles, their specialized applications and higher costs limit their market penetration compared to the more universally popular 16″-18″ rims.

Vehicle Type Analysis

Passenger cars are the largest market for tires, with 61.3% due to their vast global prevalence and production volumes.

The dominance of passenger cars in the tire market is evident with a market share of 61.3%. This segment’s vast scale can be attributed to the global prevalence of passenger vehicles, which are the primary mode of transport for millions worldwide. The frequency of tire replacement due to wear and tear and the desire for upgraded tire technology fuels continual demand within this segment.

In commercial vehicles segment, Light commercial vehicles (LCVs), such as vans and small trucks, are crucial for urban logistics and transport. They require durable tires that can handle frequent starts, stops, and varying loads.

Heavy commercial vehicles (HCVs), including large trucks and buses, need highly robust tires that offer high mileage and load-carrying capacity. Both segments are integral to commercial transportation and logistics, underpinning essential economic activities, though their specific tire requirements differ significantly from those of passenger cars.

Distribution Channel Analysis

The aftermarket leads tire sales with 62.8% due to the continuous need for tire replacement and maintenance.

The aftermarket’s dominance in tire distribution at 62.8% underscores the ongoing demand for tire replacement and upgrades throughout a vehicle’s lifespan. Vehicle owners frequently seek aftermarket products to find better value or performance than what is available through OEMs, driving this segment’s substantial share.

The OEM channel serves as the initial touchpoint for tire installation on new vehicles. While it commands a smaller portion of the market, its impact is foundational, ensuring that new vehicles meet rigorous safety and performance standards.

However, as vehicles age, owners turn to the aftermarket for replacements and upgrades, driven by a broader selection of products and often more competitive pricing. This dynamic ensures a robust and continually evolving marketplace in both sectors.

Key Market Segments

By Season Tire Type

- Summer

- Winter

- All-season

By Rim Size

- <15″

- 16″-18″

- 19″-21″

- >21″

By Vehicle Type

- Commercial Vehicle

- Light Commercial

- Heavy Commercial

- Passenger Car

By Distribution Channel

- Aftermarket

- OEM

Drivers

Increasing Vehicle Production Drives Market Growth

The surge in global vehicle production significantly propels the Automotive Tire Market. As manufacturers produce more cars, the demand for new tires naturally increases. Additionally, the rise in vehicle ownership in emerging economies further amplifies this growth. Moreover, advancements in manufacturing technologies have enabled tire producers to meet the higher demand efficiently.

Consequently, economies of scale are achieved, reducing costs and making tires more affordable for consumers. Furthermore, the expansion of automotive industries into developing regions opens new markets for tire manufacturers. This growth is supported by the increasing penetration of automotive sales channels, both traditional and online.

Additionally, partnerships between tire companies and vehicle manufacturers ensure a steady supply of tires tailored to specific vehicle models. Therefore, the combined effect of increased vehicle production and strategic collaborations fosters robust growth in the Automotive Tire Market.

Restraints

High Raw Material Costs Restraints Market Growth

The Automotive Tire Market faces significant challenges due to high raw material costs. Raw materials like rubber compounds, synthetic rubber, and steel are essential for tire manufacturing, and their prices have been volatile. Consequently, increased costs can squeeze profit margins for tire manufacturers.

Additionally, the reliance on imported materials exposes companies to exchange rate fluctuations, further complicating cost management. Moreover, stringent regulatory standards for material quality add to the production expenses. Intense competition in the market forces companies to keep prices competitive, making it difficult to pass on the increased costs to consumers.

Furthermore, the scarcity of certain raw materials can lead to supply chain disruptions, affecting production schedules and delivery times. Therefore, high raw material costs act as a significant restraint, limiting the overall growth potential of the Automotive Tire Market.

Opportunity

Expansion in Emerging Markets Provides Opportunities

Expansion in emerging markets offers substantial growth opportunities for the Automotive Tire Market. As countries like India and Brazil continue to develop, the demand for vehicles—and consequently tires—increases. Additionally, rising disposable incomes in these regions enable more consumers to afford personal transportation. Furthermore, urbanization trends lead to greater vehicle usage, boosting tire sales.

Moreover, the establishment of manufacturing plants in these markets reduces production and logistics costs, enhancing profitability for tire companies. Partnerships with local distributors and retailers also facilitate market penetration and brand recognition.

Additionally, government incentives and infrastructure improvements in emerging economies support the growth of the automotive sector. Therefore, the strategic expansion into emerging markets positions tire manufacturers to capitalize on the increasing demand and drive significant market growth.

Challenges

Supply Chain Disruptions Challenge Market Growth

Supply chain disruptions pose a considerable challenge to the Automotive Tire Market. Events such as natural disasters, geopolitical tensions, and pandemics can interrupt the steady flow of raw materials and finished products. Consequently, delays in production schedules occur, leading to shortages and unmet demand.

Additionally, increased transportation costs due to logistical inefficiencies further strain profit margins. Moreover, the reliance on global suppliers makes the market vulnerable to international trade policies and tariffs. Rapid technological changes require adaptable supply chains, which can be difficult to implement swiftly.

Furthermore, fluctuations in demand can lead to either excess inventory or stockouts, complicating inventory management. Therefore, supply chain disruptions significantly hinder the consistent growth of the Automotive Tire Market by introducing unpredictability and increased operational costs.

Emerging Trends

Adoption of Run-flat Tires Is the Latest Trending Factor

The adoption of run-flat tires is a prominent trending factor in the Automotive Tire Market. Run-flat tires offer enhanced safety by allowing drivers to continue driving even after a puncture, reducing the risk of accidents due to sudden tire failure. Consequently, their popularity has surged among both consumers and automotive manufacturers.

Additionally, advancements in tire technology have made run-flat tires more reliable and cost-effective, increasing their market appeal. Furthermore, the integration of run-flat tires in luxury and performance vehicles has set a new standard for safety and convenience.

Moreover, consumer awareness about the benefits of run-flat tires continues to grow, driving higher adoption rates. Therefore, the increasing preference for run-flat tires reflects a significant trend that is shaping the future dynamics of the Automotive Tire Market.

Regional Analysis

North America Dominates with 46.2% Market Share

North America leads the Automotive Tire Market with a 46.2% share, valued at USD 61.2 Bn. This dominance is driven by high vehicle production, strong consumer demand for premium and high-performance tires, and significant technological advancements in tire manufacturing. Additionally, the presence of major tire manufacturers and a robust automotive industry further bolster the region’s leading position.

The region benefits from a mature automotive sector and extensive distribution networks that ensure wide availability of tire products. Moreover, high disposable incomes and a preference for quality and safety in vehicles boost tire sales. Government regulations promoting road safety and environmental sustainability also support market growth in North America. Advanced infrastructure and widespread adoption of innovative tire technologies contribute to the region’s competitive edge.

Regional Mentions:

- Europe: Europe holds a strong position in the Automotive Tire Market, driven by stringent safety and environmental regulations. The region’s focus on sustainable and eco-friendly tires supports steady market growth.

- Asia Pacific: Asia Pacific is rapidly expanding its share in the Automotive Tire Market, fueled by increasing vehicle production and rising consumer demand. Countries like China and India are key contributors to this growth.

- Middle East & Africa: The Middle East and Africa are emerging markets in the Automotive Tire sector, with growing vehicle ownership and investments in automotive infrastructure driving market expansion.

- Latin America: Latin America is gradually increasing its presence in the Automotive Tire Market, supported by economic growth and expanding automotive industries in countries like Brazil and Mexico.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Automotive Tire Market is led by four major companies: Bridgestone Corporation, Continental AG, Cooper Tire & Rubber Company, and Goodyear Tire & Rubber Company. These top players hold significant market shares and drive industry innovations through their extensive product portfolios and strategic initiatives.

Bridgestone Corporation stands out as the largest player, known for its wide range of high-quality tires catering to various vehicle types. The company invests heavily in research and development, focusing on sustainable and smart tire technologies. Bridgestone’s global presence and strong distribution network enable it to effectively reach diverse markets, enhancing its competitive edge.

Continental AG is another key player, renowned for its advanced tire technologies and commitment to safety and performance. Continental leverages its expertise in automotive systems to integrate smart features into its tires, such as sensors for real-time monitoring. This integration not only improves vehicle safety but also aligns with the growing demand for connected and autonomous vehicles.

Cooper Tire & Rubber Company excels in the aftermarket segment, providing a vast selection of replacement tires. Cooper focuses on delivering value through durable and cost-effective tire solutions, appealing to a broad customer base. The company’s strong emphasis on customer service and extensive retail partnerships further strengthen its market position.

Goodyear Tire & Rubber Company remains a dominant force with its innovative tire designs and strong brand reputation. Goodyear invests in cutting-edge technologies, including run-flat and eco-friendly tires, to meet evolving consumer preferences. Additionally, the company’s strategic alliances and sponsorships in motorsports enhance its brand visibility and credibility.

Together, these top four companies shape the Automotive Tire Market by setting industry standards, driving technological advancements, and expanding their global footprints. Their continuous focus on innovation, quality, and customer satisfaction ensures they remain at the forefront of the market.

Top Key Players in the Market

- B.V.Bridgestone Corporation

- Continental AG

- Cooper Tire & Rubber Company

- Goodyear Tire & Rubber Company

- Hankook Tire Group

- Michelin

- MRF (Madras Rubber Factory Limited)

- Pirelli & C SpA

- Apollo Tires

- Yokohama Rubber Co. Ltd

- Sumitomo Rubber Industries Ltd

- Toyo Tire Corporation

Recent Developments

- Feb 2024, AutoNation, a national car retailer, has announced plans to expand its mobile service and parts business following its acquisition of RepairSmith Inc. for $190 million. This acquisition, which was completed last year, aims to align RepairSmith with AutoNation’s standalone used-vehicle-only AutoNation business.

- Feb 2024, Sentury Tire USA has recently launched the Bandit light truck tire line under its Delinte brand. This new tire line is designed for SUVs, CUVs, and light trucks, and it includes five products that cover a range of applications.

- June 2023, Continental, a leading tire manufacturer, is actively working to increase the sustainability of its products. The UltraContact NXT tire, for example, contains up to 65% renewable, recycled, and mass balance certified materials, with renewable materials accounting for up to 32% and recycled materials up to 5%

Report Scope

Report Features Description Market Value (2023) USD 132.5 Billion Forecast Revenue (2033) USD 232.8 Billion CAGR (2024-2033) 5.80% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Season Tire Type (Summer, Winter, All-season), By Rim Size (<15″, 16″-18″, 19″-21″, >21″), By Vehicle Type (Commercial Vehicle, Light Commercial, Heavy Commercial, Passenger Car), By Distribution Channel (Aftermarket, OEM) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bridgestone Corporation, Continental AG, Cooper Tire & Rubber Company, Goodyear Tire & Rubber Company, Hankook Tire Group, Michelin, MRF (Madras Rubber Factory Limited), Pirelli & C SpA, Apollo Tires, Yokohama Rubber Co. Ltd, Sumitomo Rubber Industries Ltd, Toyo Tire Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hankook Co. Ltd.

- Continental Group

- Michelin Group

- Cooper & Rubber Company

- Goodyear & Rubber Company

- Sumitomo Rubber Industries Ltd.

- The Bridgestone Corp.

- Yokohama Rubber Co. Ltd.

- Apollo Tires

- Other Key Players