Global Automotive Interior Leather Market Size, Share, Growth Analysis By Material (Genuine, Synthetic), By Car Class (Luxury Car, Economic Car), By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), By Application (Seats and Centre Stack, Carpets, Headlines, Upholstery, Seat Belt, Door Panels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 15207

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

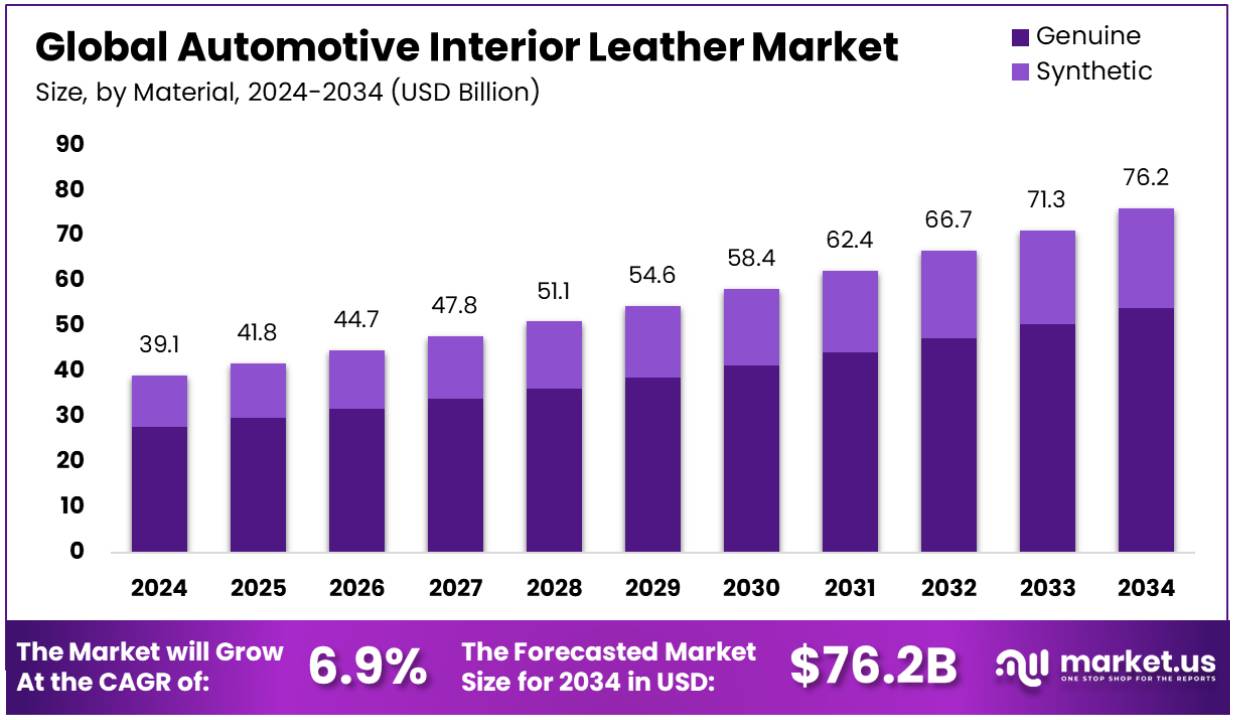

The Global Automotive Interior Leather Market size is expected to be worth around USD 76.2 Billion by 2034, from USD 39.1 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

Automotive interior leather is high-quality material used for car interiors. It offers a luxurious look and enhanced comfort. This leather is durable, easy to clean, and resistant to wear. Manufacturers use it in seats, dashboards, and trim. It adds value and improves the aesthetic appeal of vehicles across global markets.

The automotive interior leather market is centered around the trade of leather products designed for vehicle interiors, involving manufacturers, suppliers, and designers. Market growth is primarily driven by consumer demand for luxury and comfort in their vehicles.

Current trends are focused on innovations in materials and design, which enhance the aesthetic and functional aspects of automotive interiors. Additionally, economic factors and sustainability concerns play significant roles in shaping market dynamics and guiding the development of new and improved products.

The automotive interior leather market is closely tied to vehicle ownership trends. In 2022, a staggering 91.7% of U.S. households had at least one vehicle, and 22.1% had three or more. This high level of vehicle ownership creates a strong demand for automotive interiors, particularly for luxury finishes such as leather, which enhances the aesthetic appeal and comfort of vehicles.

Furthermore, the average annual cost of owning a car in the United States has risen to over $12,000, a figure that underscores the significance of the interior quality in maintaining and enhancing vehicle value. As costs rise, so does the expectation for high-quality, durable interior materials like leather, which can withstand wear and tear while offering comfort and style.

Moreover, the automotive interior leather market is influenced by broader economic factors and consumer preferences, which shift towards more luxurious and personalized vehicle interiors. This trend is supported by rising disposable incomes and a growing preference for premium automotive aesthetics, positioning leather as a preferred choice for buyers looking to invest in vehicle comfort and interior quality.

In this context, the future of the automotive interior leather market looks promising, with opportunities for growth driven by high vehicle ownership rates and the increasing importance of vehicle aesthetics. As households continue to prioritize automotive quality and comfort, the demand for luxury interior materials like leather is expected to remain robust, supporting sustained growth in this niche market.

Key Takeaways

- Automotive Interior Leather Market was valued at USD 39.1 Billion in 2024 and is expected to reach USD 76.2 Billion by 2034, growing at a 6.9% CAGR.

- In 2024, Genuine Leather dominated the material segment with 71.5%, reflecting consumer preference for premium interiors.

- In 2024, Luxury Cars accounted for 60.2%, driven by increased demand for high-end automotive interiors.

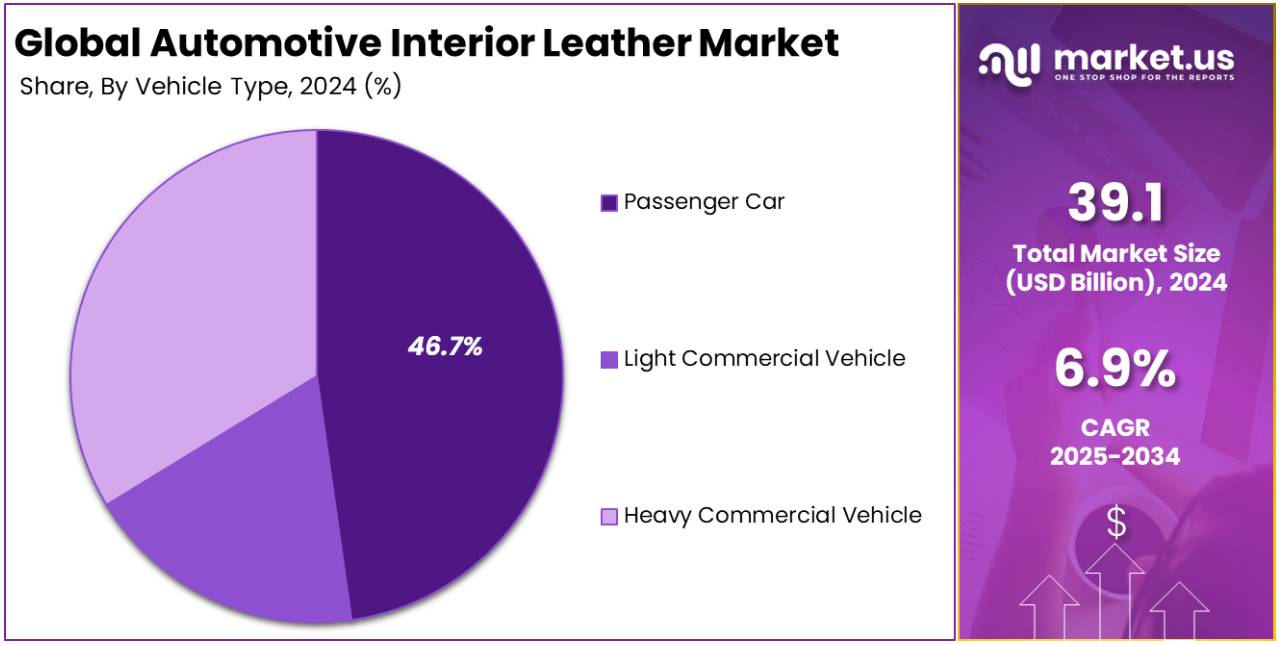

- In 2024, Passenger Cars led with 46.7%, fueled by growing consumer spending on vehicle aesthetics.

- In 2024, Seats & Centre Stack held 32% of the application segment, as seats remain a key focus area for interior comfort.

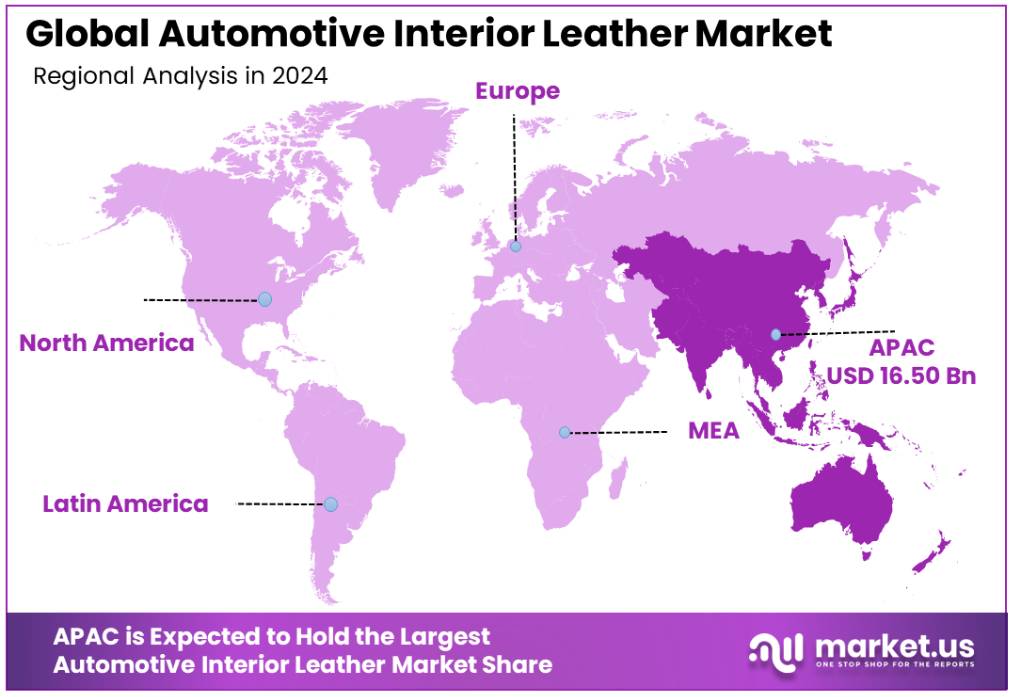

- In 2024, Asia Pacific dominated with 42.2%, valued at USD 16.50 Billion, supported by rising vehicle production.

Material Analysis

Genuine Leather dominates with 71.5% due to its premium quality and durability.

In the Automotive Interior Leather Market, Genuine Leather is the leading sub-segment, holding a significant 71.5% share in 2024. This preference is largely due to its perceived higher quality and longer lifespan, which are highly valued in automotive interiors. Genuine leather is favored for its luxury appeal, which significantly enhances the vehicle’s interior aesthetics and comfort, making it a top choice for consumers who prioritize quality and style.

On the other hand, Synthetic Leather offers a cost-effective and more sustainable alternative, appealing to a different segment of consumers focused on value and environmental considerations. Although less dominant, synthetic leather is important for its role in offering diversity in material choices and catering to the growing demand for eco-friendly automotive solutions.

Car Class Analysis

Luxury Cars lead with 60.2% as they frequently feature high-end interior finishes.

Luxury Cars form the dominant sub-segment within the Car Class category of the Automotive Interior Leather Market, with a 60.2% market share in 2024. This dominance is primarily due to the standard inclusion of high-quality interior materials such as leather in luxury models, which aligns with the expectations of affluent consumers looking for comfort and prestige. The association of genuine leather with luxury and premium feel significantly contributes to this sub-segment’s market share.

In contrast, Economic Cars, which utilize leather less frequently and often opt for more cost-effective materials, cater to price-sensitive consumers. This sub-segment, while smaller, plays a crucial role in providing affordable vehicle options without compromising on quality and comfort, thus maintaining a steady growth in the market.

Vehicle Type Analysis

Passenger Cars dominate with 46.7% due to their high volume and widespread use.

Passenger Cars hold the largest share in the Vehicle Type category of the Automotive Interior Leather Market at 46.7% in 2024. This is because passenger cars are the most commonly owned type of vehicle, and the demand for leather interiors is strongly correlated with the consumer preference for comfort and luxury in personal vehicles.

Light and Heavy Commercial Vehicles, though essential, represent smaller segments. Light Commercial Vehicles are geared towards business needs that require durability and functionality, whereas Heavy Commercial Vehicles are focused on utility and often prioritize cost efficiency over luxury, thus utilizing leather less extensively.

Application Analysis

Seats and Centre Stack lead with 32% due to their critical impact on driver and passenger comfort.

The Seats and Centre Stack sub-segment commands a 32% share in the Application category of the Automotive Interior Leather Market in 2024. This sub-segment’s prominence is due to the significant impact of seating and central control panels on both aesthetics and user experience, making them key areas for the application of leather in automotive interiors.

Other areas such as Carpets, Headliners, Upholstery, Seat Belts, and Door Panels also incorporate leather but are less dominant. Carpets and Upholstery contribute to the vehicle’s overall comfort and aesthetic, while Seat Belts and Door Panels play supporting roles in enhancing interior quality and safety, each adding value to the automotive interior market but not leading in market share.

Key Market Segments

By Material

- Genuine

- Synthetic

By Car Class

- Luxury Car

- Economic Car

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Application

- Seats and Centre Stack

- Carpets

- Headlines

- Upholstery

- Seat Belt

- Door Panels

Driving Factors

Luxury Preferences and EV Design Drives Market Growth

The automotive interior leather market is witnessing strong growth as consumers increasingly seek premium, comfortable, and visually appealing cabin experiences. Modern car buyers, especially in urban areas, are showing a clear preference for vehicles with upscale interiors, where leather remains a symbol of luxury and quality. This demand is particularly notable in mid-range and luxury vehicles, where interior finish significantly influences purchase decisions.

Original Equipment Manufacturers (OEMs) are responding to these preferences by enhancing the tactile comfort and visual appeal of their interiors. Leather, known for its durability and refined texture, continues to be a favored material for seats, dashboards, and door panels. With advancements in design and finishing, manufacturers are able to offer a broader range of leather styles and colors to match evolving customer tastes.

Rising disposable incomes, especially in emerging markets like China, India, and Southeast Asia, are further supporting this trend. As more consumers upgrade to higher-end vehicle trims, the demand for leather interiors grows steadily.

Moreover, the expansion of the electric vehicle (EV) segment is playing a key role. Many EV models emphasize futuristic and minimalist cabin designs, where high-quality leather and sustainable finishes are used to enhance perceived value and comfort, reinforcing the market’s upward trajectory.

Restraining Factors

Cost, Sustainability, and Regulation Restraints Market Growth

Although the demand for leather interiors is on the rise, the automotive interior leather market faces several challenges that can limit its overall growth. One of the most pressing issues is the high cost of genuine leather, which is significantly more expensive than synthetic alternatives such as PU or PVC. This cost barrier makes real leather less viable for mass-market or budget-friendly vehicles, where price sensitivity is higher.

Another growing concern is the ethical and environmental implications of animal-based leather. As consumer awareness around animal welfare and sustainability increases, automakers are facing pressure to reduce reliance on traditional leather and adopt more responsible sourcing practices. This shift is further encouraged by new brand values emphasizing environmental responsibility.

Fluctuations in the prices of raw materials and chemicals used in leather tanning also create challenges. These price swings can disrupt production planning and strain supplier margins, particularly when operating at scale.

In addition, many regions are introducing stricter environmental regulations concerning chemical usage in leather processing. Complying with these standards often requires costly upgrades to manufacturing facilities and processes, adding complexity for leather producers and OEMs alike. These combined factors are encouraging the search for cost-effective, sustainable alternatives in interior design.

Growth Opportunities

Sustainable Materials and Tech Features Provide Opportunities

One of the most significant developments is the rise in demand for plant-based and eco-friendly leather alternatives. Materials derived from pineapple leaves, mushrooms, and recycled content are gaining traction among both luxury and mass-market automakers aiming to reduce their environmental footprint.

Another promising area is digitally printed leather, which allows for customized design themes, textures, and color patterns. This technology enables automakers to offer tailored interior aesthetics while maintaining production efficiency and material quality, adding value for consumers seeking personalization.

The integration of temperature-controlled and ventilated leather seating systems is also creating new demand in both premium and electric vehicles. These features provide superior comfort in extreme climates and are increasingly seen as essential in high-end models, enhancing the overall driving experience.

Additionally, the rise of shared mobility and autonomous vehicle platforms is expected to boost the use of durable, easy-to-maintain leather materials. These vehicles often experience higher passenger turnover, making long-lasting, stain-resistant leather a practical and desirable choice. Collectively, these innovations are setting the stage for a more versatile and future-ready market landscape.

Emerging Trends

Smart Features and Ethical Materials Are Latest Trending Factor

Emerging trends in the automotive interior leather market are being driven by the fusion of advanced technology, hygiene, and ethical considerations. One of the most notable developments is the growing use of antimicrobial and stain-resistant leather coatings, which are helping to enhance cabin hygiene and prolong the life of interior components. This is especially relevant in shared or commercial vehicles where cleanliness is a key concern.

Automakers are also forming deeper partnerships with premium leather suppliers to deliver distinctive and luxurious interior experiences. These collaborations often result in exclusive stitching patterns, rare finishes, or the use of heritage techniques that appeal to high-end customers seeking craftsmanship and brand prestige.

Another important trend is the incorporation of smart fabrics and embedded sensors into leather surfaces. These smart materials can monitor seat occupancy, track temperature, and even detect driver fatigue, all while maintaining the premium feel of traditional leather. This technological integration reflects a broader shift toward connected and responsive vehicle interiors.

Lastly, the emergence of vegan-certified leather alternatives is gaining attention, particularly in the luxury electric vehicle segment. These materials provide a cruelty-free, eco-conscious option that aligns with the sustainability goals of both automakers and modern consumers.

Regional Analysis

Asia Pacific Dominates with 42.2% Market Share

Asia Pacific leads the Automotive Interior Leather Market with a 42.2% share, totaling USD 16.50 billion. This significant market presence is driven by the region’s expansive automotive manufacturing sector and increasing consumer demand for premium vehicle interiors.

Key factors contributing to Asia Pacific’s dominance include rapid economic growth, increasing disposable incomes, and a shift towards luxury automotive brands in countries like China, Japan, and South Korea. The region’s capacity for high-volume manufacturing and a strong supply chain network specializing in high-quality leather products also play crucial roles.

Looking forward, the influence of Asia Pacific in the global Automotive Interior Leather Market is expected to grow even further. As the middle class expands and consumer preferences continue to shift towards more luxurious and customized vehicle interiors, the demand for high-quality automotive leather in the region will likely increase, potentially boosting Asia Pacific’s market share.

Regional Mentions:

- North America: North America maintains a robust position in the Automotive Interior Leather Market, supported by a preference for luxury vehicles and high consumer spending power. The region’s focus on quality and sustainability in automotive materials continues to drive its market growth.

- Europe: Europe is a significant player in the Automotive Interior Leather Market, with a well-established automotive industry and high demand for premium car interiors. The region’s stringent environmental and quality standards ensure a strong market for high-end leather interiors.

- Middle East & Africa: The Middle East and Africa are seeing an uptick in the Automotive Interior Leather Market, fueled by luxury vehicle sales and an affluent consumer base. The market is growing particularly in the Gulf countries, where there is high demand for luxury and custom interiors.

- Latin America: Latin America is gradually increasing its presence in the Automotive Interior Leather Market. Economic improvements and a growing automotive sector contribute to rising demand for quality automotive interiors, with Brazil and Argentina leading the way.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The automotive interior leather market is driven by rising demand for comfort, luxury, and premium vehicle features. The top four players in this market are Lear Corporation, GST Autoleather Inc., Bader GmbH & Co. KG, and Boxmark Leather GmbH & Co KG. These companies are leaders due to their high-quality materials, strong OEM relationships, and global production capabilities.

Lear Corporation is a global supplier of automotive seating and interiors. It offers advanced leather solutions that combine durability, design, and comfort. The company focuses on sustainable practices and innovation, which strengthens its position in the market.

GST Autoleather Inc. is known for its expertise in leather processing for car interiors. It supplies to major global automakers and offers a wide range of styles and finishes. The company invests in new textures and eco-friendly production methods to meet changing customer preferences.

Bader GmbH & Co. KG specializes in premium leather used in high-end vehicles. It is recognized for strict quality control and craftsmanship. The company works closely with luxury car brands and focuses on natural, sustainable leather solutions.

Boxmark Leather GmbH & Co KG provides leather for automotive seating and trim. The company has a global footprint and focuses on innovation in finishing techniques. Boxmark’s products are known for durability, comfort, and elegant design.

These top players shape the automotive interior leather market through product innovation, sustainability efforts, and strong partnerships with automakers. They focus on meeting consumer demand for luxury, while also addressing environmental concerns. Their global presence, design capabilities, and quality control standards position them as key contributors to market growth.

Major Companies in the Market

- Lear Corporation

- Seiren Co., Ltd.

- GST Autoleather Inc.

- Boxmark Leather GmbH & Co. KG

- Bader GmbH & Co. KG

- Katzhin Leather, Inc.

- Leather Resource of America

- Wousdorf Leder Schmidt & Co.

- DK Leather Corporation

- Scottish Leather Group Limited

- Alfatex Italia

- Classic Soft Trim

Recent Developments

- Jaguar Land Rover and Uncaged Innovations: On December 2023, Jaguar Land Rover invested in Uncaged Innovations, a New York-based vegan leather startup, contributing to a pre-seed funding round that raised $2 million.

- Asahi Kasei and NFW: On October 2023, Asahi Kasei made a strategic investment in U.S.-based startup NFW, a producer of non-petroleum-based leather alternatives for car interiors. NFW, headquartered in Peoria, Illinois, has developed a unique platform capable of producing precision-engineered natural leather, foam, and textiles to replace animal and petrochemical-based materials.

Report Scope

Report Features Description Market Value (2024) USD 39.1 Billion Forecast Revenue (2034) USD 76.2 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Genuine, Synthetic), By Car Class (Luxury Car, Economic Car), By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), By Application (Seats and Centre Stack, Carpets, Headlines, Upholstery, Seat Belt, Door Panels) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lear Corporation, Seiren Co., Ltd., GST Autoleather Inc., Boxmark Leather GmbH & Co. KG, Bader GmbH & Co. KG, Katzhin Leather, Inc., Leather Resource of America, Wousdorf Leder Schmidt & Co., DK Leather Corporation, Scottish Leather Group Limited, Alfatex Italia, Classic Soft Trim Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Interior Leather MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Interior Leather MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lear Corporation

- Seiren Co, ltd

- GST autoleather Inc

- Boxmark leather Gmbh and Co kg

- Bader Gmbh and Co kg

- Katzhin Leather, Inc

- Leather resource of America

- Wousdorf Leder Schmidt and Co

- DK leather Corporation

- Scottish Leather Group Limited

- Alfatex Italia

- Classic Soft trim