Global Automotive Film Market By Type (Automotive window films, Automotive wrap films, Paint Protection Films), By Application (Interior, Exterior), By Vehicle type (Passenger cars, Commercial cars), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 13893

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

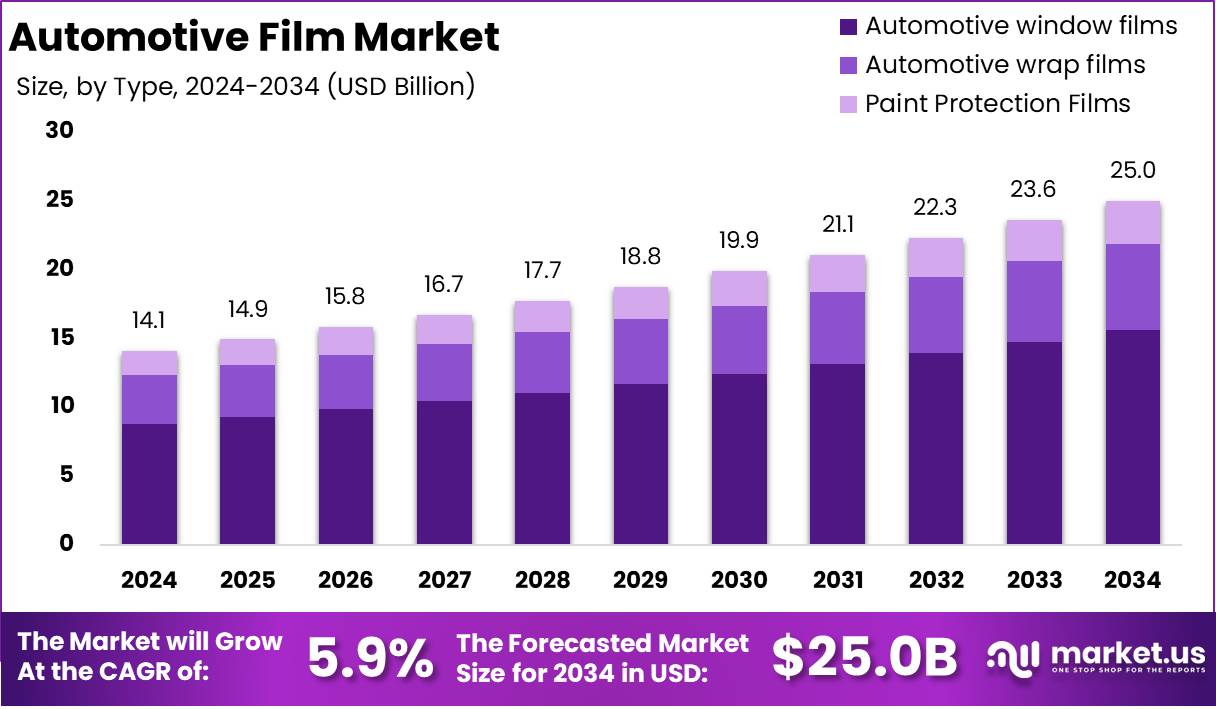

The Global Automotive Film Market size is expected to be worth around USD 25.0 Billion by 2034 from USD 14.1 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

Automotive film refers to a thin, multi-layered material applied to various parts of a vehicle, primarily for protection, aesthetics, and performance enhancement. These films are typically made from polyester or other high-durability polymers and are engineered to meet specific functional requirements such as UV protection, thermal insulation, paint protection, glare reduction, and tinting.

The most common categories include window tint films, paint protection films (PPF), decorative films, and wrap films. Automotive films serve both functional and stylistic purposes, enhancing the longevity of vehicle components while also offering customization options for consumers and fleet operators.

The automotive film market encompasses the global industry involved in the manufacturing, distribution, and application of films designed for use in vehicles. This includes films applied on vehicle exteriors and interiors to provide benefits such as protection against environmental damage, heat and glare control, improved aesthetic appeal, and enhanced vehicle performance.

The market spans a wide range of end-users including OEMs (original equipment manufacturers), aftermarket service providers, and individual vehicle owners. It is characterized by continuous innovation in materials, coatings, and installation technologies, driven by evolving automotive trends and regulatory developments.

The growth of the automotive film market can be attributed to rising consumer demand for vehicle personalization, increasing awareness of vehicle maintenance, and heightened focus on passenger comfort and safety.

Global demand for automotive films is witnessing a steady upward trajectory, driven by both OEM and aftermarket segments. The aftermarket segment, in particular, is gaining momentum due to rising vehicle ownership rates and increased interest in vehicle aesthetics and protection among consumers.

Significant opportunities lie in the development of advanced film technologies that align with the automotive industry’s sustainability and innovation goals. For instance, the growing popularity of electric and autonomous vehicles presents a favorable environment for films offering glare reduction, thermal insulation, and lightweight design.

According to Road Genius, the Automotive Film Market is poised for sustained growth, driven by rising adoption of electric, autonomous, and connected vehicles. Approximately 14 million EVs were sold globally in 2023, a significant increase from 10.5 million in 2022, accounting for 14% of all new car sales.

Advancements in autonomous technologies are evident, with over 1,400 self-driving vehicles tested by 80+ companies across 36 U.S. states since 2018. Furthermore, 8–25% of new U.S. vehicles in 2022 featured ADAS. The surge in connected vehicles from 192 million in 2023 to a projected 367 million by 2027 continues to support demand for protective and functional automotive films.

According to ACEA, the Automotive Film Market is poised for growth, supported by rising global vehicle demand. In 2024, global car sales rose by 2.5% to 74.6 million units, with the EU up 0.8% (10.6 million units) and North America up 3.8%. China led with nearly 23 million units, or 31% of global sales, despite declines in Japan -7% and South Korea -5.1%. Global car production totaled 75.5 million units, while EU output dropped 6.2%. Bus production also grew by 10.3% to 362,005 units. These trends indicate growing opportunities for automotive films across OEM and aftermarket channels.

Key Takeaways

- The Global Automotive Film Market is projected to reach approximately USD 25.0 billion by 2034, increasing from USD 14.1 billion in 2024, at a CAGR of 5.9% during the forecast period (2025–2034).

- Automotive window films accounted for the largest market share by type, representing over 62.4% of the global market in 2024, positioning them as the leading product category.

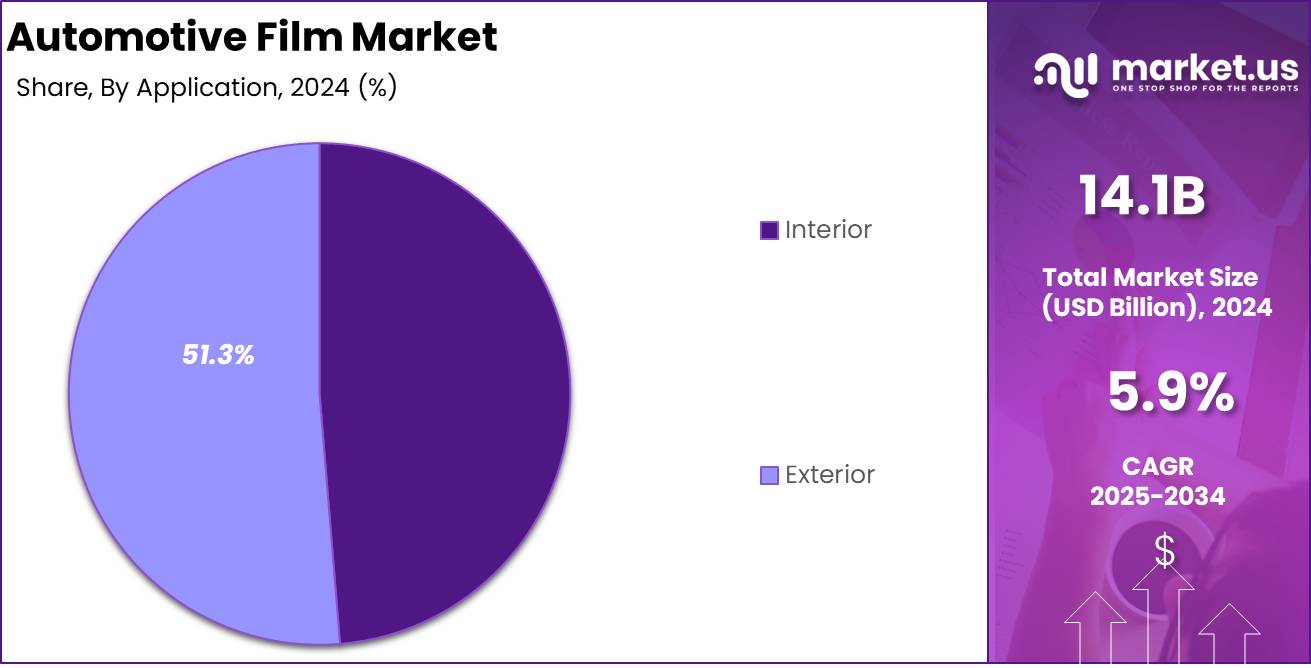

- Exterior applications emerged as the dominant application segment, contributing more than 51.3% to the total market share.

- Passenger cars represented the largest share by vehicle type, accounting for over 73.6% of the overall market in 2024.

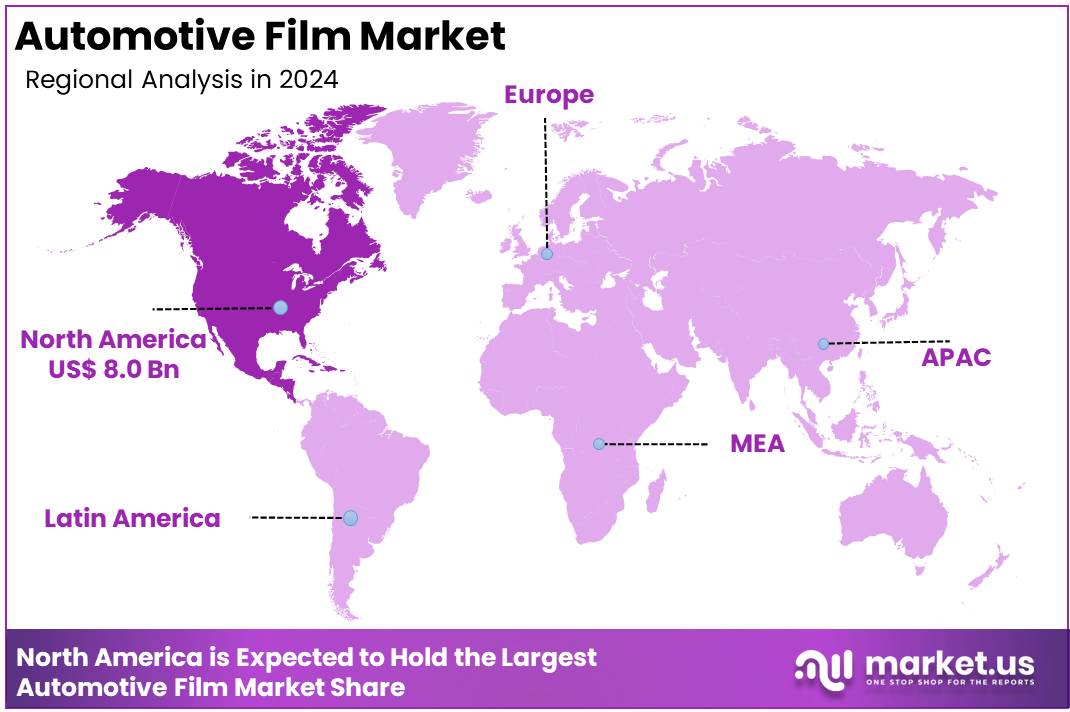

- North America led the global market with a 56.8% share, equivalent to an estimated market value of USD 8.0 billion in 2024, making it the most prominent regional market.

By Type Analysis

Automotive Window Films Leading the Automotive Film Market with 62.4% Share in 2024

In 2024, automotive window films accounted for over 62.4% of the global automotive film market by type, emerging as the leading segment. This dominance is driven by rising consumer preference for privacy, UV protection, and heat insulation. Their growing use across both OEM and aftermarket channels especially in passenger and luxury vehicles has bolstered demand.

The ability of window films to reduce solar heat gain and enhance cabin comfort has further increased adoption, particularly in warmer climates. Regulatory initiatives promoting energy efficiency through window tinting and advancements in nanoceramic and hybrid technologies, which offer high clarity and heat rejection without signal interference, have supported sustained growth.

Automotive wrap films are gaining momentum, driven by increasing demand for vehicle personalization and cost-effective aesthetic modifications. These films offer a removable alternative to traditional paint, allowing for customization in color, finish, and design.

In the commercial sector, wrap films are widely used for fleet branding and advertising. Improved durability, UV resistance, and installation ease have strengthened their appeal. Rising vehicle ownership and aesthetic consciousness, particularly in developing markets, are expected to continue driving growth in this segment.

Paint protection films (PPFs) are seeing increased demand due to heightened consumer awareness about vehicle surface preservation. Designed to protect against chips, scratches, and environmental damage, PPFs are especially popular in luxury vehicle segments.

Technological innovations like self-healing coatings and enhanced application techniques have improved product adoption. As vehicle lifespans extend and long-term protection becomes a priority, the PPF market is expected to register steady growth across various regional markets.

By Application Analysis

Exterior Leading the Automotive Film Market with 51.3% Share in 2024

In 2024, Exterior applications dominated the Automotive Film Market by Application, accounting for over 51.3% of the total market share. This dominance was driven by high demand for window tint films, paint protection films (PPFs), and vehicle wrap films, used widely to enhance aesthetics, provide UV protection, and safeguard vehicle surfaces from environmental damage.

The market benefited from growing consumer interest in vehicle customization and technological innovations such as self-healing and UV-resistant films. Expansion of the vehicle fleet and increased use of wraps for commercial branding further supported the segment’s growth.

Meanwhile, Interior applications held a substantial share, ranking just behind exterior use. Films for dashboard protection, trim enhancement, and glare reduction contributed to increased adoption. The segment is being propelled by rising demand for thermal comfort, visual clarity, and interior aesthetics, supported by developments in smart and nanoceramic film technologies. Steady growth is expected as consumers prioritize comfort and solar control solutions.

By Vehicle Type Analysis

Passenger Cars Leading the Automotive Film Market with 73.6% Share in 2024

In 2024, Passenger Cars dominated the automotive film market’s vehicle type segment, accounting for over 73.6% of the total market share. This leadership was primarily driven by the expanding global vehicle fleet, increasing demand for aesthetic enhancement, and rising consumer inclination toward paint protection solutions in personal vehicles. The adoption of paint protection films, window tint films, and wrap films witnessed significant growth, particularly across North America, Europe, and emerging Asian markets.

The surge in disposable income, coupled with heightened awareness regarding UV protection, fuel efficiency, and vehicle resale value, further supported this segment’s growth. Advancements in self-healing films and nano-ceramic coatings also contributed to increased usage in premium and electric vehicles, solidifying the segment’s dominance.

the Commercial Vehicles segment held a smaller market share but showed steady growth in 2024. The increasing application of films in buses, trucks, and light commercial vehicles was driven by benefits such as heat rejection, glare reduction, and enhanced occupant privacy. Fleet operators adopted films to improve fuel efficiency, driver comfort, and branding through vehicle wraps. This trend is expected to support sustained growth in the commercial segment over the coming years.

Key Market Segments

By Type

- Automotive window films

- Automotive wrap films

- Paint Protection Films

By Application

- Interior

- Exterior

By Vehicle type

- Passenger cars

- Commercial cars

Driver

Rising Demand for Vehicle Aesthetics and Surface Protection

The increasing consumer preference for vehicle customization and surface protection has emerged as a significant driver of growth in the global automotive film market. Modern vehicle owners are increasingly inclined towards enhancing the visual appeal of their vehicles through wraps, tints, and paint protection films. These films offer a cost-effective alternative to repainting, allowing consumers to experiment with textures, colors, and finishes while retaining the original paint underneath.

In particular, the popularity of vinyl wraps and gloss/matte finishes has risen considerably among younger demographics and car enthusiasts, who value aesthetic appeal alongside functional durability. The demand is further supported by a growing aftermarket ecosystem where automotive films are readily accessible and professionally installed, offering consumers a convenient solution for aesthetic customization.

In addition to visual enhancement, automotive films provide surface protection against scratches, stone chips, and environmental elements such as UV rays, bird droppings, and acid rain. This dual function appearance enhancement and protective shielding has made automotive films increasingly indispensable for both personal and commercial vehicles.

As consumers become more aware of vehicle resale value, they are more likely to invest in protective solutions that maintain the exterior condition over time. The shift toward higher vehicle ownership in developing countries and increasing disposable income are also positively influencing the adoption of these films. This sustained interest in combining utility with visual appeal is expected to contribute to the steady expansion of the global automotive film market over the forecast period.

In 2024, the market is experiencing a strong push from regions such as Asia-Pacific and North America, where the aesthetic value of vehicles is becoming a key component of consumer behavior. Consequently, this trend is expected to sustain long-term demand for automotive films, reinforcing its position as a critical driver of growth within the industry.

Restraint

Stringent Regulatory Standards

One of the key restraints affecting the growth of the global automotive film market in 2024 is the presence of stringent regulatory standards, particularly related to the optical visibility and reflectivity of window tints and films. These regulations, which vary significantly across countries and regions, often restrict the level of visible light transmission (VLT) permitted on automotive windows. For instance, many jurisdictions enforce strict VLT percentages to ensure driver visibility and road safety, especially during nighttime driving.

These laws have created challenges for manufacturers attempting to develop darker or more opaque films, which may be desirable for privacy or heat rejection but fall outside legal compliance limits. As a result, product development is frequently hindered by the need to balance performance attributes with regulatory constraints.

The inconsistent legal landscape across different geographies further complicates global expansion strategies for automotive film manufacturers. While a particular film product may be permissible in one market, it may be restricted or banned in another due to local regulations. This limits the ability of companies to standardize offerings, increases compliance costs, and reduces profit margins. Furthermore, regulatory approvals can delay the launch of new and innovative products, affecting time-to-market and competitiveness.

In addition to aesthetic-related films, certain protective coatings must also meet environmental standards concerning volatile organic compound (VOC) emissions, posing additional hurdles for product approval and commercialization. These challenges are particularly relevant in regions with strict environmental or safety policies, such as Europe and parts of North America. Consequently, despite the market’s underlying growth potential, these regulatory constraints remain a significant barrier to broader adoption and innovation.

Manufacturers must invest in research and development to engineer compliant yet high-performance solutions, which can be both time-consuming and capital intensive. This restraint is expected to persist, potentially limiting the full growth trajectory of the automotive film market over the near to medium term.

Opportunity

Surge in Electric Vehicle Production

The rapid global expansion of electric vehicle (EV) production represents a major opportunity for the automotive film market in 2024 and beyond. As the EV market continues to experience exponential growth driven by climate change policies, government incentives, and rising fuel costs—there is a corresponding rise in demand for innovative automotive films tailored to the unique requirements of EVs. These vehicles often feature lightweight designs, aerodynamic shapes, and advanced onboard technology that necessitate protective, functional, and visually cohesive film solutions.

For instance, paint protection films are increasingly being used to maintain the pristine appearance of EV exteriors, which often come in specialty finishes that are more susceptible to damage. Additionally, EV manufacturers are seeking thermal control films to enhance energy efficiency by minimizing interior heat build-up, thereby reducing the burden on battery-powered air conditioning systems.

The growth of the EV sector also opens the door for integrating smart films and solar control coatings that contribute to energy conservation and passenger comfort. As cabin comfort and sustainability become key selling points, there is an increasing emphasis on infrared (IR) rejection films and advanced tinting solutions that improve cabin insulation without compromising visibility. Furthermore, the futuristic design language of EVs supports the adoption of high-performance wraps and films that align with modern styling and branding preferences.

With EVs often showcasing cutting-edge design and technology, automotive films serve not only as a protective layer but also as a key aesthetic component. In this evolving landscape, manufacturers have a substantial opportunity to collaborate with EV producers to develop customized film solutions that align with the vehicles’ design philosophy and environmental goals. As EV adoption continues to accelerate across major automotive markets, the demand for complementary automotive film technologies is projected to witness significant growth, positioning the segment as a strategic opportunity for long-term market expansion.

Trends

Integration of Nanotechnology Enhances Functional Capabilities of Automotive Films

A defining trend shaping the automotive film market in 2024 is the integration of nanotechnology to enhance the performance characteristics of films. Nanotechnology-enabled films offer superior features, including higher UV protection, self-healing surfaces, improved thermal rejection, and anti-glare properties, which are becoming increasingly attractive to both consumers and OEMs.

The incorporation of nano-ceramic particles, for example, has enabled the development of window films that provide excellent heat rejection without compromising visibility—addressing both comfort and regulatory needs. Such films have shown up to 90% infrared heat rejection and over 99% UV blockage, making them ideal for high-performance applications in both luxury and mass-market vehicles.

Furthermore, nanotechnology is facilitating the evolution of smart films with adaptive functionalities, such as electrochromic films that can change tint levels in response to light intensity. These innovations cater to growing consumer preferences for technologically advanced and multifunctional vehicle components. The added value provided by these films, including scratch resistance, hydrophobicity, and enhanced clarity, contributes to their rising demand in both aftermarket and OEM segments.

As R&D in material science continues to progress, manufacturers are focusing on developing cost-effective nanofilm solutions that combine durability, performance, and sustainability. Consequently, the integration of nanotechnology represents a transformative trend, enabling differentiation in an increasingly competitive market while elevating product capabilities to meet evolving consumer and environmental standards.

Regional Analysis

North America Leads the Automotive Film Market with the Largest Market Share of 56.8% in 2024

In 2024, North America emerged as the leading region in the global automotive film market, commanding the largest market share of 56.8%, which is equivalent to a valuation of USD 8.0 billion. The region’s dominance can be attributed to the high rate of vehicle ownership, growing consumer awareness regarding vehicle aesthetics and protection, and the increasing preference for paint protection films and window tints across the United States and Canada.

Moreover, the rising demand for automotive personalization, coupled with stringent regulations promoting energy efficiency and UV protection, continues to drive the regional market growth.

Europe holds a significant position in the global automotive film market due to the well-established automotive industry across countries such as Germany, France, and the United Kingdom. The region is witnessing steady adoption of window films and paint protection films, especially in the luxury and premium vehicle segments.

Environmental concerns, coupled with rising demand for sustainable and energy-efficient solutions, have also supported market growth in this region. Technological advancements in film manufacturing and increasing penetration of electric vehicles further contribute to Europe’s strong market presence.

The Asia Pacific region is characterized by a rapidly expanding automotive sector, particularly in economies such as China, India, Japan, and South Korea. The increasing production and sales of vehicles, along with rising disposable incomes and urbanization, have significantly boosted the adoption of automotive films in this region.

Additionally, the growing aftermarket for automotive accessories and a rise in consumer preference for heat control and glare reduction films are fostering market demand. Asia Pacific is expected to witness notable growth during the forecast period, driven by its large consumer base and evolving automotive trends.

Middle East & Africa is gradually emerging in the automotive film market, supported by rising demand for premium and luxury vehicles, along with climatic conditions that necessitate UV protection and heat-rejection solutions. The growing awareness of automotive aesthetics and vehicle preservation has led to increased utilization of automotive films across urban areas in this region.

Latin America represents a developing market, with Brazil and Mexico being the key contributors. Rising automotive sales, growing middle-class population, and an expanding aftermarket for vehicle customization are supporting the gradual growth of automotive film usage. The demand for window tint films and decorative wraps is expected to rise in the region as consumers seek improved vehicle comfort and appearance.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The competitive landscape of the global automotive film market in 2024 has been shaped by the strategic initiatives, technological capabilities, and regional dominance of key players such as Saint-Gobain, Eastman Chemical Company, Avery Corporation, LINTEC Corporation, Ergis S.A, Toray Industries, Johnson Window Films, Hexis S.A, XPEL Inc, and Nexfil Co., Ltd. These companies are leveraging innovation, sustainability, and strong distribution networks to maintain or expand their market share amid growing demand for vehicle protection, aesthetics, and regulatory compliance.

Saint-Gobain has maintained a strong market presence through its high-performance films that cater to both OEM and aftermarket needs. Its focus on energy-efficient and sustainable solutions has resonated well in markets with strict emission and environmental standards. Eastman Chemical Company, with its well-established LLumar and SunTek brands, continues to dominate the premium segment by offering advanced solar control and paint protection films.

Innovation in multilayer nanoceramic film technology has further strengthened its competitive position. Avery Corporation is recognized for its expertise in wrapping films and custom vehicle graphics, benefitting from rising personalization trends.

LINTEC Corporation and Toray Industries, both Japan-based players, are emphasizing R&D to improve the functional attributes of automotive films, such as UV protection and heat rejection. Their expansion into emerging markets, particularly in Asia-Pacific, supports revenue growth. Ergis S.A and Hexis S.A, although relatively smaller in scale, focus on niche applications and customized solutions in the European market.

Johnson Window Films and Nexfil Co., Ltd. maintain strong aftermarket positions by targeting cost-sensitive segments with high-quality yet affordable offerings. XPEL Inc stands out due to its aggressive growth strategy, particularly in the paint protection film (PPF) segment, supported by dealership networks and direct-to-consumer models. Overall, competition is intensifying as players balance product differentiation, pricing strategies, and technological innovation to capitalize on evolving consumer preferences.

Top Key Players in the Market

- Saint-Gobain

- Eastman Chemical Company

- Avery Corporation

- LINTEC Corporation

- Ergis S.A

- Toray Industries

- Johnson Window Films

- Hexis S.A

- XPEL Inc

- Nexfil Co, ltd.

Recent Developments

- In 2024, The Shyft Group and Aebi Schmidt Group agreed to merge through an all-stock deal, aiming to form a stronger specialty vehicle company. As per the deal, Shyft shareholders will receive 1.04 shares in the new company for every Shyft share held. Once completed, Shyft investors will hold 48% ownership, while Aebi Schmidt stakeholders will hold 52%. The merger is designed to be tax-free for Shyft shareholders and has been approved by both companies’ boards. This move reflects a strategic decision to expand market reach and enhance long-term growth opportunities.

- In 2024 REE Automotive revealed its decision to manufacture P7 electric trucks in the U.S. by working with Roush Industries. Production will take place in Roush’s Michigan facility, allowing faster delivery to North American clients. REE’s unique REEcorner® technology will continue to be built in the UK. A joint team from REE and Motherson will manage quality checks, testing, and logistics on-site. This step brings REE closer to full-scale production while maintaining its focus on quality and innovation.

- In 2023, Zhejiang Geely Holding Group increased its investment in Aston Martin Lagonda to around 17%. This move strengthens Geely’s partnership with the British luxury car brand. The enhanced stake reflects Geely’s long-term interest in the premium automotive segment and marks the start of a deeper collaboration with Aston Martin in future developments and strategies.

- In 2024, Renault Group and Geely Holding completed the formation of HORSE Powertrain Limited, a new company focused on advanced powertrain technologies. The new joint venture will operate from its headquarters in London. With both companies contributing assets and expertise, this partnership is expected to develop low-emission and hybrid solutions for global markets, supporting the transition toward cleaner mobility solutions.

Report Scope

Report Features Description Market Value (2024) USD 14.1 Billion Forecast Revenue (2034) USD 25.0 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Automotive window films, Automotive wrap films, Paint Protection Films), By Application (Interior, Exterior), By Vehicle type (Passenger cars, Commercial cars) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Saint-Gobain, Eastman Chemical Company, Avery Corporation, LINTEC Corporation, Ergis S.A, Toray Industries, Johnson Window Films, Hexis S.A, XPEL Inc, Nexfil Co, ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Saint-Gobain

- Eastman Chemical Company

- Avery Corporation

- LINTEC Corporation

- Ergis S.A

- Toray Industries

- Johnson Window Films

- Hexis S.A

- XPEL Inc

- Nexfil Co, ltd.