Global Artificial Food Color Market Size, Share, And Industry Analysis Report By Product Type (Dyes, Pigments), By Color (Red, Blue, Yellow, Green, Others), By Application (Beverages, Bakery, Confectionery, Dairy, Meat Products, Processed Foods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 177400

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

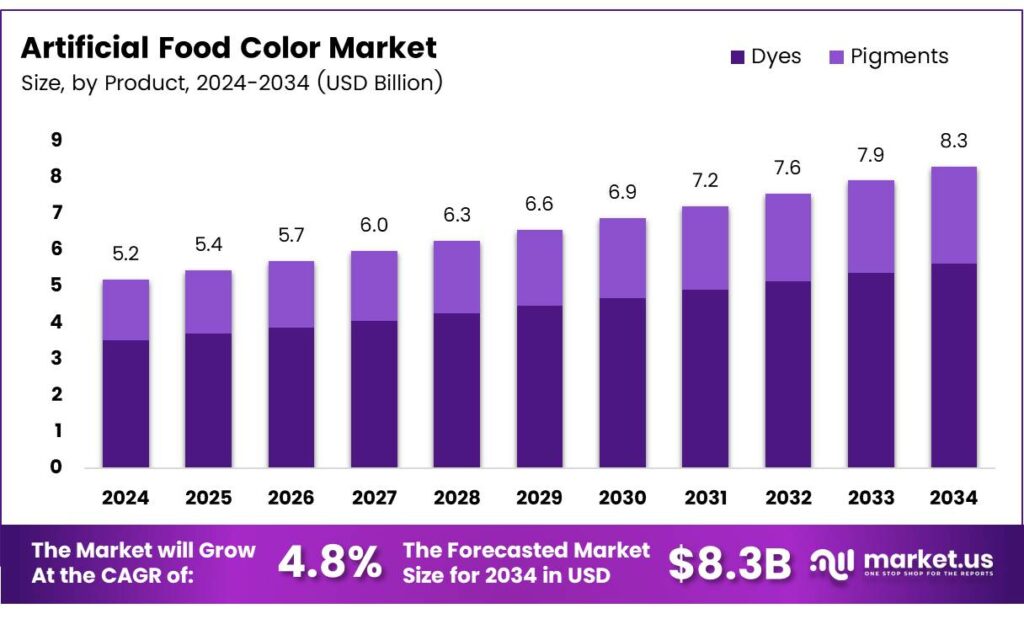

The Global Artificial Food Color Market size is expected to be worth around USD 8.3 billion by 2034 from USD 5.2 billion in 2024, growing at a CAGR of 4.8% during the forecast period 2025 to 2034.

Artificial food colors comprise synthetic dyes and pigments that manufacturers use to enhance product visual appeal. These chemical compounds provide consistent, vibrant hues across processed foods, beverages, and confectionery items. Moreover, food producers rely on these colorants to maintain brand identity and consumer recognition.

The market delivers cost-effective coloring solutions for large-scale food production operations. Synthetic dyes offer superior stability compared to natural alternatives during processing and storage. Additionally, these compounds withstand extreme temperatures, light exposure, and extended shelf life requirements in commercial food manufacturing.

- Regulatory bodies are tightening rules around synthetic dye safety and acceptable daily intake limits as non-compliance remains widespread, with 60% of beverages failing to list correct color ingredients, exposing gaps in transparency and consumer protection.

- At the same time, rising health concerns are reshaping market behavior, as studies show 52% of individuals with chronic hives react negatively to artificial dyes, reinforcing public awareness about risks such as allergic responses, potential mutations, and reduced hemoglobin levels in sensitive groups.

Food processors adopt artificial colors to standardize product appearance across global markets. Quick-service restaurants utilize these additives to ensure menu items maintain identical visual characteristics worldwide. Consequently, synthetic colorants support brand consistency and quality control in competitive food sectors.

The beverage sector drives significant demand for stable color additives in carbonated drinks and fruit beverages. Confectionery manufacturers increasingly use bold, vibrant synthetic shades to attract consumer attention. Furthermore, bakery and dairy producers incorporate these colorants to achieve long-lasting visual appeal in packaged goods.

Key Takeaways

- The Global Artificial Food Color Market is valued at USD 5.2 billion in 2024, projected to reach USD 8.3 billion by 2034, at a CAGR of 4.8% during the forecast period 2025-2034

- The Dyes segment dominates the product type category with 68.2% market share in 2025

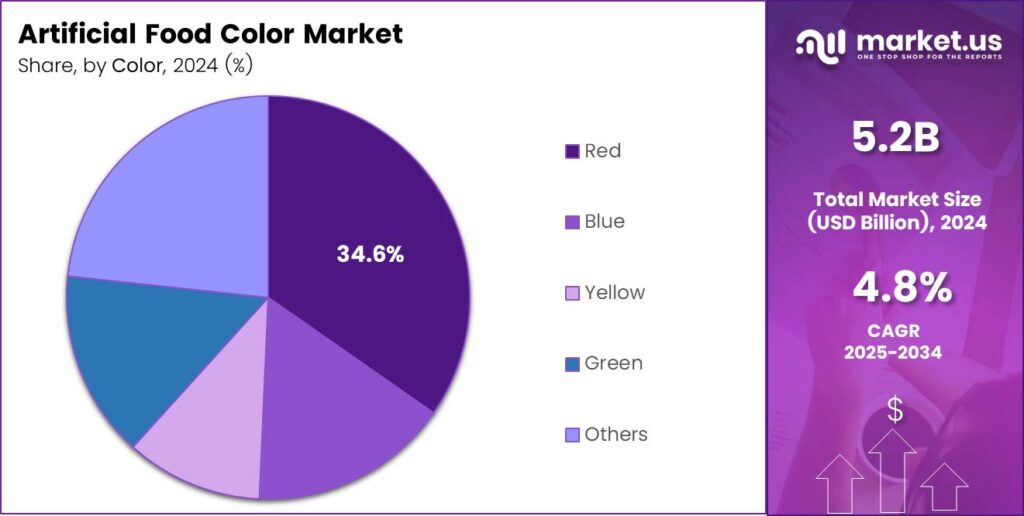

- The Red color segment leads with 34.6% share among color categories

- The Beverages application holds the largest segment with 29.5% market share

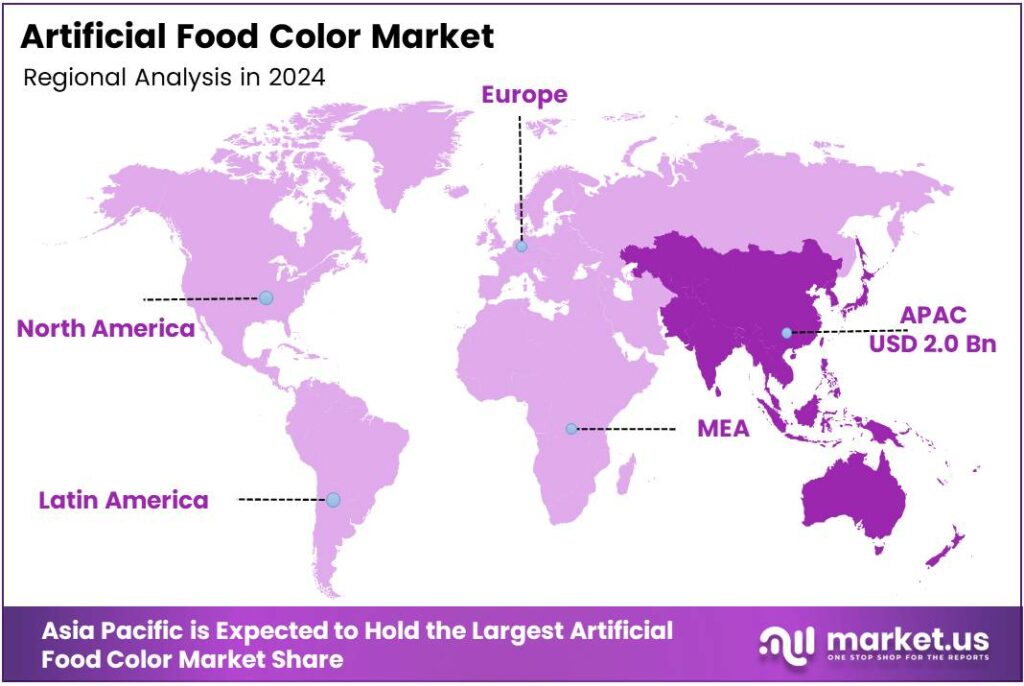

- The Asia-Pacific region dominates with 38.9% share, valued at USD 2.0 billion

Product Type Analysis

Dyes dominate with 68.2% due to superior solubility and widespread application versatility.

In 2025, Dyes held a dominant market position in the By Product Type segment of the Artificial Food Color Market, with a 68.2% share. Synthetic dyes provide excellent water solubility, enabling seamless integration into beverages, dairy products, and liquid food formulations. Food manufacturers prefer dyes for uniform color distribution and cost-effective production processes across high-volume operations.

Pigments serve specialized applications requiring opacity and light stability in food manufacturing. These insoluble particles provide vibrant surface coloring for confectionery coatings, bakery glazes, and meat product casings. Additionally, pigments offer superior heat resistance during baking and cooking processes, making them essential for specific product categories.

Color Analysis

Red dominates with 34.6% due to widespread use in beverages and confectionery applications.

In 2025, Red held a dominant market position in the By Color segment of the Artificial Food Color Market, with a 34.6% share. Red synthetic dyes enhance visual appeal in carbonated beverages, fruit drinks, and cherry-flavored confections. Moreover, food processors utilize red colorants to create appetizing presentations in meat products and bakery items.

Blue synthetic colors provide essential hues for sports drinks, candy coatings, and frozen dessert applications. Manufacturers combine blue dyes with yellow variants to create green shades for diverse product formulations. Consequently, blue colorants support extensive color palette development in processed food manufacturing.

Yellow artificial dyes deliver bright, sunny appearances in lemon-flavored beverages, cheese products, and baked goods. These colorants withstand acidic conditions in fruit drinks while maintaining vibrant intensity throughout shelf life. Additionally, yellow dyes serve as foundational components for creating orange and green color combinations.

Green synthetic colorants find applications in mint-flavored confections, lime beverages, and vegetable-based processed foods. Food manufacturers blend green dyes to achieve specific shade requirements matching natural vegetable colors. Furthermore, green artificial colors provide stability in products exposed to light and temperature variations.

Application Analysis

Beverages dominate with 29.5% due to extensive use in carbonated drinks and fruit-based products.

In 2025, Beverages held a dominant market position in the By Application segment of the Artificial Food Color Market, with a 29.5% share. Soft drink manufacturers rely on synthetic dyes to deliver consistent brand colors across global production facilities. Moreover, fruit juice producers utilize artificial colorants to enhance visual appeal and consumer perception of flavor intensity.

Bakery applications incorporate synthetic colors into cake mixes, frosting formulations, and decorative icings. These colorants provide heat-stable pigmentation that survives high-temperature baking processes without fading or discoloration. Additionally, bakery manufacturers use artificial dyes to create visually appealing products that attract consumer attention.

Confectionery producers utilize vibrant synthetic shades to differentiate candy varieties and create eye-catching product displays. Hard candies, gummies, and chocolate coatings benefit from stable colorants that maintain intensity during storage. Consequently, confectionery applications demand bold, neon hues that appeal to younger consumer demographics.

Dairy products, including flavored yogurts, ice creams, and cheese spreads, incorporate artificial colors for appetizing presentations. Manufacturers use synthetic dyes to indicate flavor variants and create visual consistency across product lines. Furthermore, dairy applications require colorants compatible with protein-based formulations and refrigerated storage conditions.

Meat Products employ artificial colorants to enhance visual appeal in processed meats, sausages, and cured items. These dyes help maintain attractive red or pink hues that signal freshness to consumers. Therefore, meat processors utilize synthetic colors to extend product shelf appeal in retail environments.

The processed foods category encompasses snacks, ready meals, and convenience items utilizing artificial colorants for visual enhancement. Manufacturers incorporate synthetic dyes into sauces, seasonings, and coating systems for standardized appearance. Additionally, processed food applications benefit from colorants offering stability across diverse processing conditions.

Key Market Segments

By Product Type

- Dyes

- Pigments

By Color

- Red

- Blue

- Yellow

- Green

- Others

By Application

- Beverages

- Bakery

- Confectionery

- Dairy

- Meat Products

- Processed Foods

- Others

Drivers

Cost-Efficient Synthetic Solutions Drive Large-Scale Food Manufacturing Adoption

Food processors prioritize artificial colors for economical, large-scale production operations requiring consistent visual outcomes. Synthetic dyes deliver predictable results at significantly lower costs compared to natural alternatives. Moreover, manufacturers achieve economies of scale when purchasing bulk quantities of standardized artificial colorants for high-volume processing lines.

- The European Food Safety Authority updated its scientific review, noting that average children’s exposure reached 7.5 mg/kg body weight per day, close to the acceptable daily intake of 7 mg/kg. These numbers created a wave of public discussions across Europe and pushed food manufacturers to review their long-used coloring systems.

Confectionery producers rely on vibrant synthetic shades to capture consumer attention in crowded retail environments. Bold, eye-catching colors differentiate candy products on store shelves and influence impulse purchasing decisions. Additionally, artificial dyes enable creative product launches featuring neon, metallic, and hyper-vibrant color combinations that natural alternatives cannot achieve cost-effectively.

Restraints

Regulatory Scrutiny and Consumer Health Concerns Limit Market Growth

Government agencies worldwide implement stricter regulations on synthetic dye toxicity levels and acceptable daily intake limits. Regulatory bodies require extensive safety testing and documentation before approving new artificial colorants for food use. Moreover, compliance costs and lengthy approval processes discourage innovation and market entry for smaller manufacturers.

Consumer awareness about potential health risks associated with synthetic food dyes drives purchasing behavior toward natural alternatives. Parents increasingly avoid artificial colors when selecting products for children due to concerns about hyperactivity and allergic reactions. Consequently, mainstream food brands reformulate recipes to eliminate synthetic dyes and appeal to health-conscious consumer segments.

According to health surveys, 30% of tested dried and pickled food products contain excessive benzoic acid levels, affecting liver and kidney function. This preservative often accompanies artificial colors in processed foods, raising additional safety concerns. Therefore, combined scrutiny of synthetic additives creates headwinds for artificial color market expansion in developed regions.

Growth Factors

Innovation and Emerging Market Expansion Accelerate Industry Development

Researchers develop next-generation synthetic dyes featuring improved safety profiles and reduced allergenic properties for sensitive consumer populations. Chemical manufacturers invest in molecular modifications that maintain color vibrancy while minimizing potential adverse health effects. Additionally, advanced formulations address regulatory concerns and position artificial colors for renewed market acceptance.

- Emerging economies present substantial growth opportunities where cost-effective artificial colors remain preferred by local food manufacturers. In the U.S., reformulation gained new urgency after the U.S. Food and Drug Administration reported that Americans consume more than 5,000 tons of certified color additives annually, a figure shared in its certified color batch reports.

Bakery, dairy, and beverage sectors seek long-lasting color vibrancy that withstands processing, distribution, and extended shelf life requirements. Manufacturers develop multifunctional artificial pigments offering enhanced solubility, stability, and compatibility across diverse production processes. Consequently, technical improvements expand application possibilities and strengthen competitive positioning against natural color alternatives.

Emerging Trends

Advanced Technologies Transform Synthetic Color Development and Application

Food manufacturers increasingly adopt microencapsulated artificial colors, providing extended shelf life and controlled release during processing. Encapsulation technologies protect synthetic dyes from degradation while enabling targeted color delivery at specific production stages. Moreover, this innovation enhances stability in challenging formulation environments, including high-acid beverages and protein-rich dairy products.

Confectionery companies launch products featuring bold, neon, and hyper-vibrant synthetic shades appealing to younger demographics globally. These eye-catching colors create social media-worthy visual experiences that drive consumer engagement and brand awareness. Additionally, limited-edition launches featuring unconventional color combinations generate excitement and support premium pricing strategies.

Artificial intelligence systems optimize color formulation processes to ensure consistent hue accuracy across manufacturing batches and production facilities. AI-driven technologies analyze spectral data and adjust dye concentrations automatically to maintain brand color specifications. Furthermore, plant-based and alternative protein manufacturers utilize synthetic color blends tailored to achieve meat-like appearances in innovative food products.

Regional Analysis

Asia Pacific Dominates the Artificial Food Color Market with a Market Share of 38.9%, Valued at USD 2.0 Billion

Asia Pacific commands the largest market position, driven by extensive food processing industries in China, India, and Southeast Asian nations. The region’s growing middle class fuels demand for packaged foods, beverages, and confectionery products requiring synthetic colorants. Cost-competitive manufacturing and favorable regulatory environments support artificial color production and consumption, accounting for 38.9% of the global market, valued at USD 2.0 billion.

North America experiences steady demand despite growing consumer preference for natural alternatives in premium product segments. Food manufacturers continue to use artificial colors in value-oriented brands and products, where cost efficiency remains paramount. However, regulatory scrutiny and clean-label movements influence reformulation strategies among major food processing companies.

Europe maintains stringent regulatory frameworks governing synthetic dye approval and usage limits in food applications. The region witnesses a gradual market decline as manufacturers shift toward natural colorants, responding to consumer health concerns. Nevertheless, certain product categories, including confectionery and beverages, sustain artificial color usage for specific applications.

Middle East and Africa regions show moderate growth supported by developing food processing sectors and increasing consumer spending. Artificial colors gain traction in beverages, confectionery, and bakery applications across urban centers. Moreover, infrastructure investments and economic diversification efforts create opportunities for synthetic colorant suppliers in these markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB Ltd. maintains a significant presence in industrial automation and technology solutions serving food processing industries globally. The company provides advanced control systems and automation equipment that food manufacturers utilize for precise colorant dosing and mixing operations. Their technologies enable consistent quality control and efficient production processes across large-scale food manufacturing facilities worldwide.

Siemens AG delivers comprehensive automation and digitalization solutions supporting modern food processing operations requiring precision color management. The company’s industrial software and hardware systems optimize manufacturing efficiency while ensuring accurate colorant application and quality monitoring. Siemens technologies help food producers maintain stringent color specifications and regulatory compliance throughout production cycles.

Eaton Corporation supplies electrical power management and industrial automation components essential for food processing equipment operations. Their solutions support the reliable performance of mixing, blending, and dosing systems used in artificial color integration processes. Moreover, Eaton’s energy-efficient technologies reduce operational costs while maintaining consistent production output in food manufacturing facilities.

Schneider Electric SE provides energy management and automation solutions, optimizing food processing operations involving artificial colorant applications. The company’s intelligent systems enable precise ingredient control, real-time monitoring, and data analytics for quality assurance. Additionally, Schneider Electric supports sustainability initiatives by improving energy efficiency in food manufacturing processes, utilizing synthetic color additives.

Top Key Players in the Market

- ABB Ltd.

- Siemens AG

- Eaton Corporation

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Parker Hannifin Corporation

- Nozomi Networks, Inc.

- Ericsson

Recent Developments

- In 2025, Siemens AG will provide digital solutions for food & beverage efficiency and sustainability. Focus on energy use and emissions in food processing. The FDA relaxed labeling rules for companies to now claim “no artificial colors” on products free of petroleum-based dyes, even if they use natural/plant-derived colors.

- In 2025, ABB Ltd. will be active in food & beverage automation (e.g., process control, robotics for brewing/beverage at drinktec, robotic burger-making concepts, and collaborations like with Pulmuone for lab-grown foods). These support efficient, hygienic food processing but not colorants.

Report Scope

Report Features Description Market Value (2024) USD 5.2 Billion Forecast Revenue (2034) USD 8.3 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dyes, Pigments), By Color (Red, Blue, Yellow, Green, Others), By Application (Beverages, Bakery, Confectionery, Dairy, Meat Products, Processed Foods, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABB Ltd., Siemens AG, Eaton Corporation, Schneider Electric SE, Mitsubishi Electric Corporation, Parker Hannifin Corporation, Nozomi Networks, Inc., Ericsson Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Artificial Food Color MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Artificial Food Color MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Siemens AG

- Eaton Corporation

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Parker Hannifin Corporation

- Nozomi Networks, Inc.

- Ericsson