Apoptosis Market By Modality (Apoptosis Assays, Apoptosis Antibodies and Apoptosis Inhibitors and Inducers), By Application (Oncology, Neurodegenerative Diseases, Autoimmune Disorders, Cardiovascular Diseases and Others), By End User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Contract Research Organizations and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137651

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

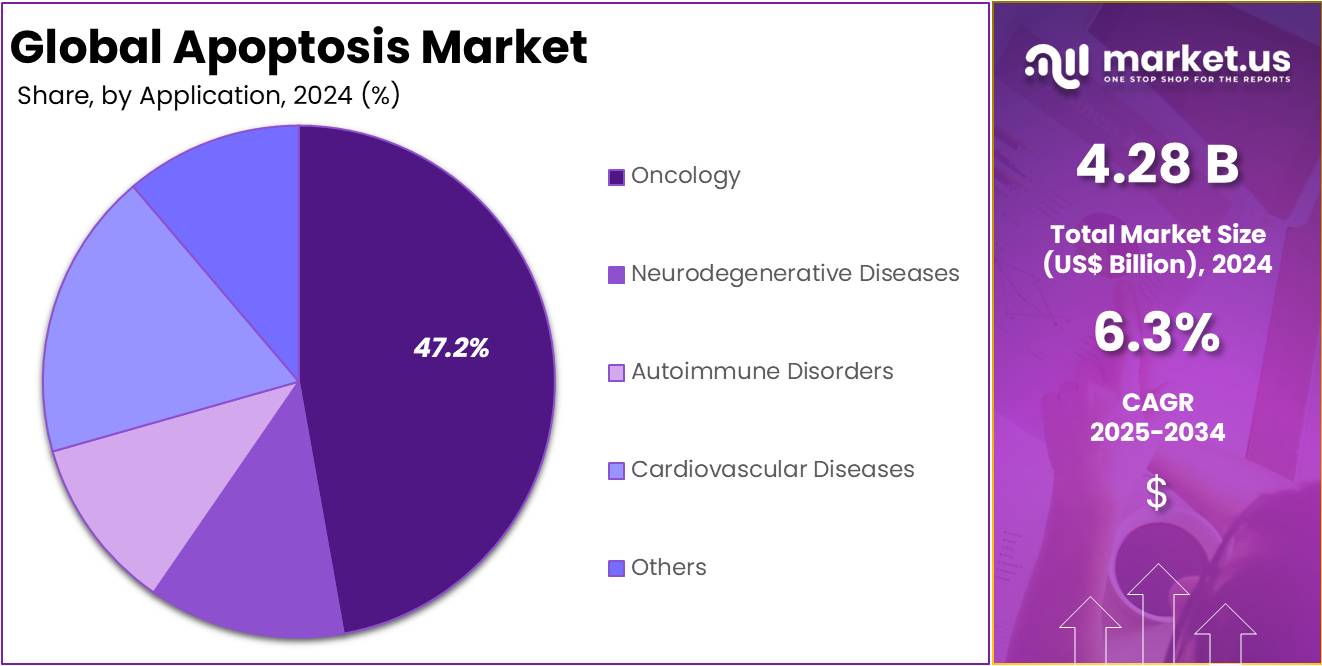

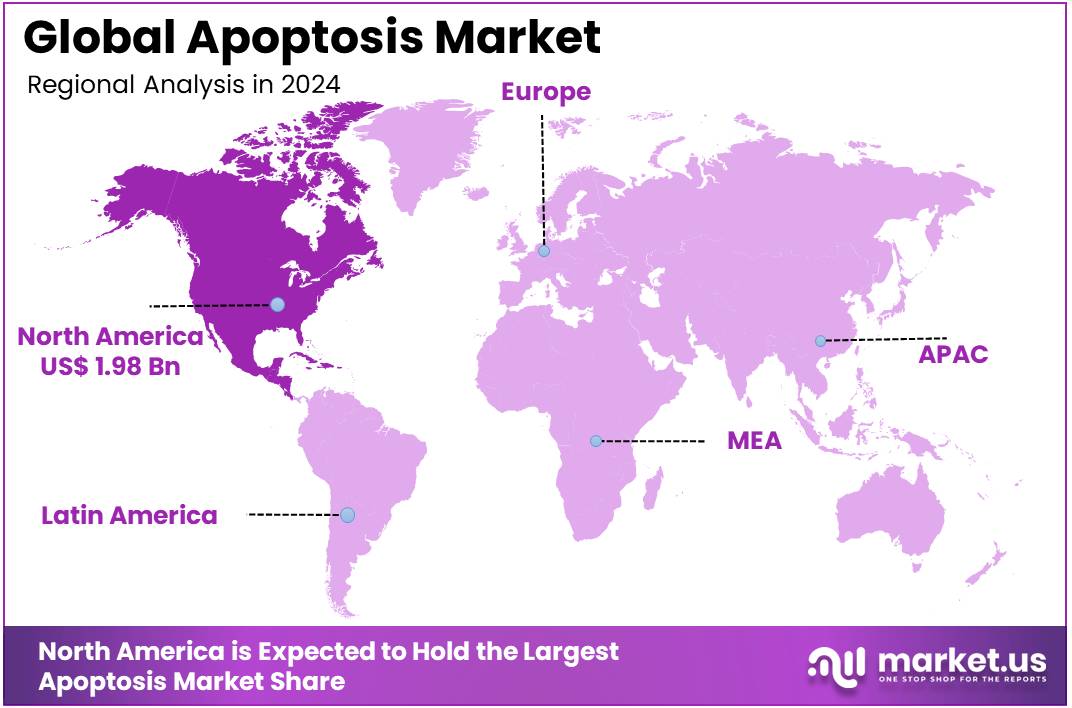

The Global Apoptosis Market size is expected to be worth around US$ 7.42 Billion by 2034, from US$ 4.28 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 46.2% share and holds US$ 1.98 Billion market value for the year.

The apoptosis market is a rapidly growing sector within the broader field of cell biology and biotechnology, driven by the increasing recognition of apoptosis (programmed cell death) as a critical process in various diseases, including cancer, neurodegenerative disorders, and autoimmune diseases. The market is primarily fueled by advancements in cancer research, where manipulating apoptosis pathways offers potential therapeutic benefits.

Apoptosis modulators, including small molecules, biologics, and gene therapies, are being explored to induce cell death in cancer cells or protect healthy cells from premature apoptosis in neurodegenerative diseases like Alzheimer’s. Key drivers of the market include rising cancer incidences, an aging global population, and growing investments in drug development targeting apoptosis pathways.

Pharmaceutical companies, biotech firms, and academic institutions are focusing on understanding the molecular mechanisms behind apoptosis to design more effective, targeted therapies. Major challenges remain in ensuring specificity and minimizing off-target effects in apoptosis modulation. However, ongoing research into novel apoptosis regulators, such as inhibitors of anti-apoptotic proteins (Bcl-2 family) and activators of pro-apoptotic proteins, is expected to drive future growth.

The apoptosis market is expected to expand significantly over the next decade, with the development of new therapies and technologies, including apoptosis-targeted cancer drugs, gene editing, and cell-based therapies. For instance, In May 2024, BeiGene’s sonrotoclax was granted Fast Track designation by the U.S. FDA for the treatment of mantle-cell lymphoma as a monotherapy or in second-line therapy and beyond.

Key Takeaways

- In 2024, the market for Apoptosis generated a revenue of US$ 4.28 billion, with a CAGR of 6.3%, and is expected to reach US$ 7.42 billion by the year 2034.

- The type segment is divided into Apoptosis Assays, Apoptosis Antibodies, Apoptosis Inhibitors and Inducers with Apoptosis Inhibitors and Inducers taking the lead in 2024 with a market share of 52.7%.

- Considering Application, the market is divided into Oncology, Neurodegenerative Diseases, Autoimmune Disorders, Cardiovascular Diseases and Others. Among these, Oncology held a significant share of 47.2%.

- By End User, the market is classified into Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Contract Research Organizations and Others. Pharmaceutical and Biotechnology Companies held a major share of 44%.

- North America led the market by securing a market share of 46.2% in 2024.

Modality Analysis

Apoptosis inhibitors and inducers hold a dominant market share of 52.7%, primarily driven by their growing role in drug development. These agents are crucial in the treatment of cancer and neurodegenerative diseases. Apoptosis inhibitors are primarily utilized in neurodegenerative diseases, whereas apoptosis inducers are being actively developed for cancer therapies. The increasing use of these drugs in various therapeutic areas has led to notable market growth. This trend is expected to continue as research and development in these areas intensify.

The potential for significant market growth in the apoptosis inhibitor and inducer segment remains high due to their therapeutic applications. Leading pharmaceutical companies, such as BeiGene, Zentalis Pharmaceuticals, and Ascentage Pharma, are focusing on developing novel BCL-2 inhibitors. These inhibitors are expected to have a notable impact on the BCL-2 inhibitor market in the coming years. The development of these drugs is expected to offer new treatment options, further boosting the market’s expansion.

Application Analysis

The oncology segment dominates the apoptosis market, holding a 47.2% share. This is due to significant research investment and ongoing advancements in cancer therapies that focus on apoptosis modulation. Apoptosis plays a crucial role in cancer treatments, where inducing cell death in tumor cells helps combat various cancers. The increasing prevalence of cancer has further fueled the growth of this segment. Additionally, the continuous development of apoptosis-targeted therapies is driving market expansion, making oncology the largest and fastest-growing segment in this field.

The demand for apoptosis-based therapies is rising, driven by the need for better cancer treatments. Researchers are focusing on developing drugs that can target apoptosis pathways to treat cancers more effectively. These therapies aim to selectively trigger cell death in cancer cells, leading to improved patient outcomes. The focus on apoptosis modulation is critical for advancing treatment options for several cancer types. As a result, this approach has gained momentum and is expected to continue shaping the oncology market for years to come.

One notable development is the Fast Track designation granted by the U.S. FDA to BeiGene’s sonrotoclax in May 2024. This designation is for the treatment of mantle-cell lymphoma, either as a monotherapy or in second-line therapy. The Fast Track status highlights the potential of sonrotoclax in addressing unmet medical needs for patients with this aggressive lymphoma. This expedited development pathway aims to accelerate the drug’s availability and improve treatment outcomes, further emphasizing the role of apoptosis modulation in cancer therapy.

End User Analysis

Based on end user, Pharmaceutical and Biotechnology Companies dominated the apoptosis market with 44.0% of market share, due to their central role in the development of new therapies and the significant investment in apoptosis-targeted drug discovery and development.

They utilize apoptosis modulators, assays, and antibodies in drug discovery, development, and clinical trials, particularly for cancer, neurodegenerative diseases, and autoimmune disorders. This segment is the primary driver of market growth, given the strong focus on developing apoptosis-targeted therapies.

Key Market Segments

By Modality

- Apoptosis Assays

- Apoptosis Antibodies

- Apoptosis Inhibitors and Inducers

By Application

- Oncology

- Neurodegenerative Diseases

- Autoimmune Disorders

- Cardiovascular Diseases

- Others

By End User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations

- Others

Drivers

Rising Cancer Incidence

The increasing global prevalence of cancer is a major driver for the apoptosis market. According to WHO data, in 2022, there were approximately 20 billion new cancer cases globally, with 9.7 billion deaths attributed to the disease. At the same time, an estimated 53.5 billion people were living within five years of a cancer diagnosis.

Cancer remains a significant public health challenge, with roughly 1 in 5 people expected to develop the disease in their lifetime. The mortality rate varies by gender, with about 1 in 9 men and 1 in 12 women dying from cancer. Apoptosis plays a crucial role in regulating tumor growth and metastasis, making it a critical target in cancer therapy.

Cancer cells often evade apoptosis, which contributes to uncontrolled cell proliferation. Targeting apoptosis pathways can therefore offer potential therapeutic benefits. As cancer rates rise worldwide, there is a growing need for innovative treatments that can induce apoptosis specifically in cancerous cells. For instance, drugs like Venetoclax, which target the anti-apoptotic protein Bcl-2, are already approved for treating certain types of leukemia.

The growing incidence of cancers, such as breast, lung, and colorectal cancers, has spurred investments in apoptosis-based therapies, including both apoptosis inducers and inhibitors. This trend is expected to continue, driving market growth and research efforts focused on developing novel apoptosis-targeted cancer drugs.

Restraints

High Cost of Apoptosis-based Therapies

Despite the promising potential of apoptosis-based therapies, the high cost of development and treatment remains a significant restraint. Apoptosis-targeted therapies, such as small molecule inhibitors and biologics, often involve complex development processes, lengthy clinical trials, and specialized manufacturing techniques, all of which contribute to high costs.

For instance, drugs like Obinutuzumab and Venetoclax are highly effective but come with hefty price tags, making them inaccessible for a large portion of the population, especially in low- and middle-income countries. Additionally, the lack of cost-effective production methods for some apoptosis modulators increases the financial burden on both healthcare providers and patients.

The high cost of these therapies limits their widespread adoption, posing a challenge to market growth. To overcome this challenge, companies and research institutions are exploring ways to streamline production processes and improve cost-effectiveness without compromising efficacy.

Opportunities

Growing Focus on Personalized Medicine

The increasing emphasis on personalized medicine worldwide presents a significant opportunity for the apoptosis market. Personalized medicine aims to tailor treatments based on an individual’s genetic profile and molecular characteristics, allowing for more targeted and effective therapies. Apoptosis, the process of programmed cell death, plays a critical role in how patients respond to drugs, develop resistance to therapies, and experience disease progression. As such, understanding a patient’s apoptotic pathway is essential for developing customized treatment plans.

This growing need for precision in treatment is expected to drive demand for advanced apoptosis detection tools and assays, particularly from pharmaceutical and biotechnology companies focused on personalized medicine development. Furthermore, contract research organizations (CROs) and clinical laboratories supporting drug development are likely to increase their focus on acquiring advanced apoptosis analysis systems. As the shift toward precision medicine continues to accelerate, the apoptosis market is poised for substantial growth, potentially boosting revenues for key players in this space in the coming years.

Impact of Macroeconomic / Geopolitical Factors

Economic downturns or recessions can strain healthcare budgets and limit spending on new, expensive therapies. High-cost apoptosis-based treatments, such as biologics or targeted cancer therapies, may see slower adoption during economic slowdowns. Conversely, in periods of economic growth, healthcare systems may invest more in advanced therapies, fueling market expansion.

Additionally, inflation and fluctuating currency exchange rates can affect the cost of raw materials and manufacturing processes, potentially raising the prices of apoptosis-based drugs and diagnostic tools. However, economic growth in emerging markets may drive increased demand for advanced cancer treatments and personalized medicine, thus benefiting the apoptosis market.

Political instability, trade conflicts, and regulatory changes can impact the global supply chain for apoptosis-related products. Trade disputes, such as those between the U.S. and China, could delay the delivery of essential raw materials or affect the availability of innovative drugs. Additionally, changes in healthcare policies, such as reimbursement rates for biologics or drugs, can influence market dynamics.

For instance, a shift toward nationalized healthcare systems in some countries might lead to more stringent cost controls, limiting the accessibility of advanced therapies, while private-sector growth in other regions could accelerate market demand.

Trends

Advancements in High-Throughput Screening

High-throughput screening (HTS) is revolutionizing the discovery of apoptosis modulators, enabling the rapid identification of potential drug candidates. HTS allows researchers to test thousands of compounds simultaneously for their ability to induce or inhibit apoptosis, significantly speeding up the drug discovery process. This method has been instrumental in identifying new apoptosis-targeting molecules that could lead to novel cancer therapies.

For example, HTS platforms have helped identify compounds that target anti-apoptotic proteins like Bcl-2 or Mcl-1, which are frequently overexpressed in cancer cells. The increasing use of automated systems, AI, and machine learning algorithms to analyze HTS data is further accelerating drug development. As technologies improve, HTS will continue to play a pivotal role in advancing apoptosis research, offering new therapeutic possibilities and driving growth in the apoptosis market.

This trend is particularly beneficial in oncology, where HTS can help identify compounds that selectively target cancer cells while sparing healthy tissue. In December 2023, as per a study published on AIChE, High-throughput systems enable the empirical testing of a wide range of conditions and factors to assess their impact on cell behavior. With recent advancements in microscale manufacturing and analytical techniques, traditional two-dimensional high-throughput systems have evolved into three-dimensional models.

This shift allows for more in vivo-relevant analyses of cellular behavior, providing deeper insights into how cells interact within a more physiologically accurate environment. As this field progresses, one can expect to see faster and more cost-effective drug development pipelines, along with improved yields in directed cell differentiation protocols. These advancements are likely to contribute to the advancement of personalized medicine, leading to more tailored treatments and, ultimately, better therapeutic outcomes for patients.

Regional Analysis

North America is leading the Apoptosis Market

The North America apoptosis market is the largest growing regions which held 46.2% of the total market share in 2024, driven primarily by advanced healthcare infrastructure, strong research capabilities, and high investments in biotechnology and pharmaceutical industries. The United States, in particular, dominates the market due to its leading position in cancer research, drug development, and personalized medicine.

The presence of major pharmaceutical companies and biotech firms, such as Genentech, Amgen, and Bristol-Myers Squibb, which are heavily involved in apoptosis-targeted therapies, further strengthens the market. Additionally, North America benefits from high healthcare spending, robust reimbursement systems, and strong government support for medical research, including initiatives like the National Cancer Institute (NCI).

In January 2024, InnoCare announced that the U.S. FDA had cleared its Investigational New Drug (IND) application for ICP-248, a novel BCL-2 inhibitor. ICP-248 is an orally bioavailable, selective inhibitor of BCL-2, currently being investigated for the treatment of hematologic malignancies. The drug is being studied both as a monotherapy and in combination with other therapies, with the aim of improving treatment outcomes for patients with blood cancers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The apoptosis market is highly competitive, with various companies striving to capture market share through innovation, regulatory approvals, and consumer trust. Leading players include Merck KGaA, Thermo Fisher Scientific, Bio-Rad Laboratories, GE Healthcare, and Becton, Dickinson and Company (BD). These companies focus on providing apoptosis assays, reagents, and antibodies, aiming to advance cancer research and diagnostics. Their products are crucial for understanding cell death mechanisms, which is vital in developing targeted therapies, particularly in oncology and neurodegenerative diseases.

Merck KGaA is a key player, offering products like the MilliporeSigma apoptosis kits. These kits are widely used in drug discovery, cancer research, and diagnostics. Merck KGaA’s strong focus on precision medicine aligns with the increasing demand for apoptosis-targeted therapies. Their contributions to cancer and neurodegenerative disease research make them a leading force in the apoptosis market. This focus on innovative solutions helps them stay ahead of competitors and strengthens their position in the market.

Another prominent company, Bio-Techne, plays a significant role in the life sciences sector. Bio-Techne specializes in providing research tools and reagents, particularly for apoptosis studies. Their offerings support researchers in various domains, including drug discovery and cancer research. Their products help explore apoptotic mechanisms, aiding the development of therapies. This position within the apoptosis market allows Bio-Techne to cater to the growing need for effective, targeted treatments in the healthcare industry.

Thermo Fisher Scientific is also a major player, offering a wide range of apoptosis research tools. Their Invitrogen brand provides assays, kits, antibodies, and reagents, crucial for exploring apoptotic mechanisms. Thermo Fisher’s emphasis on high-throughput screening and advanced technologies accelerates the development of apoptosis-based therapies. These innovations are particularly important for oncology and neurodegenerative disease research. Their robust portfolio helps researchers make significant strides in understanding apoptosis and developing treatments for related diseases.

Top Key Players in the Apoptosis Market

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories

- GE Healthcare

- Becton, Dickinson and Company (BD)

- Promega Corporation

- Sartorius AG

- Abcam plc.

- Biotium

- Geno Technology

- BioTek Instruments

- Canvax

- Abnova

- Creative Bioarray

- PerkinElmer

- Danaher Corporation

- Bio-Techne

- GeneCopoeia, Inc.

- Takara Bio Inc.

- Bioss Antibodies

- Other Prominent Players

Recent Developments

- In November 2024, it was announced by Ascentage Pharma, a biopharmaceutical firm with a global presence specializing in the discovery, development, and commercialization of novel treatments for critical health needs, especially in oncology, that the New Drug Application (NDA) for its Bcl-2 selective inhibitor, lisaftoclax (APG-2575), has been accepted by the Center for Drug Evaluation (CDE) of China’s National Medical Products Administration (NMPA). This application, which is focused on treating patients with relapsed or refractory chronic lymphocytic leukemia/small lymphocytic lymphoma (CLL/SLL), has also been granted Priority Review status.

- In October 2023, a clinical collaboration was formed between Ascentage Pharma and AstraZeneca to explore the potential of combining Ascentage Pharma’s BCL-2 inhibitor, lisaftoclax, with AstraZeneca’s BTK inhibitor, acalabrutinib. This partnership is aimed at assessing the efficacy of this combination therapy in treatment-naïve patients diagnosed with first-line chronic lymphocytic leukemia (CLL) and small lymphocytic lymphoma (SLL).

Report Scope

Report Features Description Market Value (2024) US$ 4.28 billion Forecast Revenue (2034) US$ 7.89 billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Modality (Apoptosis Assays, Apoptosis Antibodies and Apoptosis Inhibitors and Inducers), By Application (Oncology, Neurodegenerative Diseases, Autoimmune Disorders, Cardiovascular Diseases and Others), By End User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Contract Research Organizations and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Merck KGaA, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, GE Healthcare, Becton, Dickinson and Company (BD), Promega Corporation, Sartorius AG, Abcam plc., Biotium, Geno Technology, BioTek Instruments, Canvax, Abnova, Creative Bioarray, PerkinElmer, Danaher Corporation, Bio-Techne, GeneCopoeia, Inc., Takara Bio Inc., Bioss Antibodies, and Other Prominent Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories

- GE Healthcare

- Becton, Dickinson and Company (BD)

- Promega Corporation

- Sartorius AG

- Abcam plc.

- Biotium

- Geno Technology

- BioTek Instruments

- Canvax

- Abnova

- Creative Bioarray

- PerkinElmer

- Danaher Corporation

- Bio-Techne

- GeneCopoeia, Inc.

- Takara Bio Inc.

- Bioss Antibodies

- Other Prominent Players