Antimicrobial Plastics Market Report By Product (Commodity Plastic, Engineering Plastics, High-performance Plastics), By End-Use (Healthcare, Building & Construction, Automotive & Transportation, Packaging, Food & Beverage, Consumer Goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 61652

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

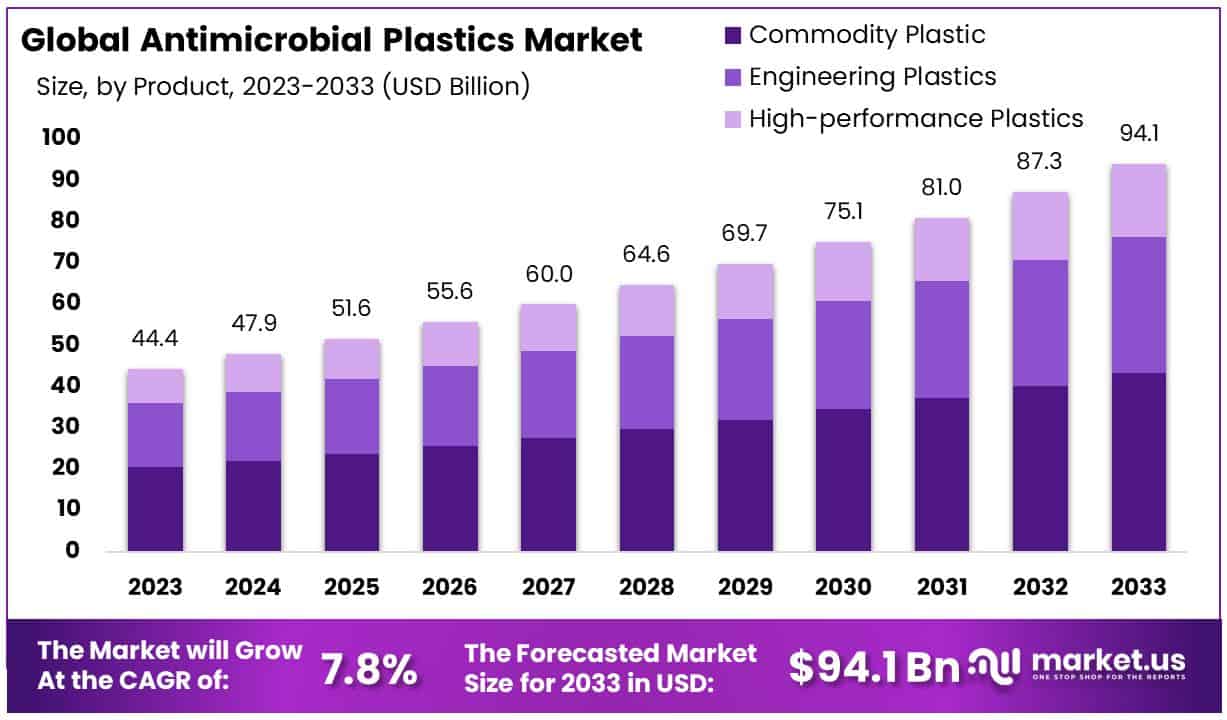

The Global Antimicrobial Plastics Market size is expected to be worth around USD 94.1 Billion by 2033, from USD 44.4 Billion in 2023, growing at a CAGR of 7.80% during the forecast period from 2024 to 2033.

The Antimicrobial Plastics Market encompasses materials designed to inhibit the growth of microorganisms such as bacteria, mold, and fungi. These plastics are integrated with antimicrobial agents, enhancing their hygiene and durability.

Widely utilized across healthcare, packaging, consumer goods, and construction sectors, antimicrobial plastics are crucial for applications demanding high sanitation standards. The market’s growth is propelled by increasing hygiene awareness, regulatory standards for product safety, and the expansion of industries requiring sterile environments.

The antimicrobial plastics market is poised for significant growth, driven by escalating demand across several sectors, notably within the medical technology (MedTech) industry. This surge can be primarily attributed to the rigorous investment in research and development (R&D) by MedTech companies.

On average, these entities allocate 5.1% of their annual revenue to R&D activities, with firms in the US and UK notably increasing their R&D investments by 11.5%. This robust financial commitment underscores the sector’s dedication to innovation, directly contributing to the expansion of antimicrobial plastics applications in healthcare.

Moreover, the pressing issue of healthcare waste, particularly plastics, which constitutes about 30% of the total, highlights a critical area for the application of antimicrobial plastics. The UK National Health Service (NHS), for instance, is estimated to dispose of 133,000 tonnes of plastic annually.

This considerable figure not only stresses the environmental impact of healthcare waste but also underscores the urgent need for sustainable solutions. Antimicrobial plastics, with their ability to inhibit the growth of harmful bacteria and other microorganisms, offer a promising pathway towards addressing these challenges.

By integrating antimicrobial properties into plastics, the medical sector can significantly mitigate the risk of infection, reduce the environmental burden, and advance towards more sustainable practices. Consequently, the antimicrobial plastics market is expected to witness robust growth, fueled by the dual forces of innovation in medical technology and the imperative for sustainable healthcare solutions.

Key Takeaways

- Market Value: The Global Antimicrobial Plastics Market is projected to reach approximately USD 94.1 Billion by 2033, experiencing robust growth from USD 44.4 Billion in 2023, with a notable CAGR of 7.80% during the forecast period from 2024 to 2033.

- Dominant Segments:

- Product Analysis: Commodity plastics hold a dominant share of 62.5%, led by versatile materials like polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC), extensively used in packaging, healthcare, and consumer goods.

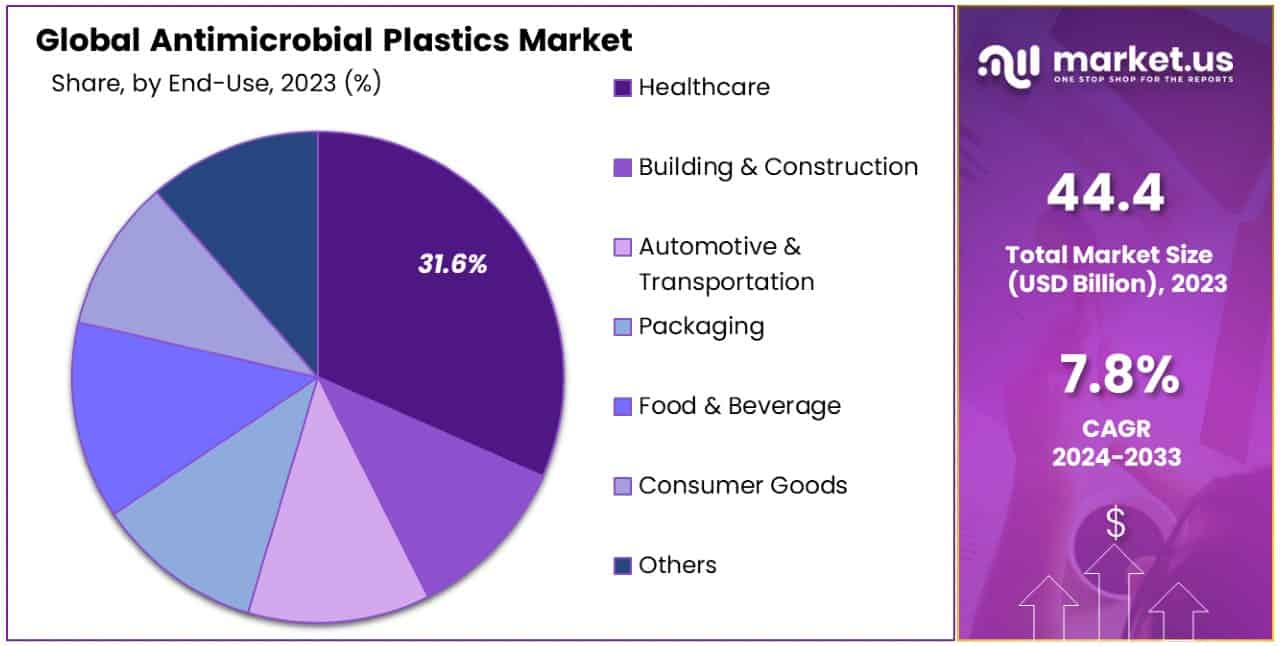

- End-Use Analysis: Healthcare emerges as the leading sector, capturing 31.6% of the market, driven by the critical need for infection control in medical facilities and the rising incidence of healthcare-associated infections (HAIs).

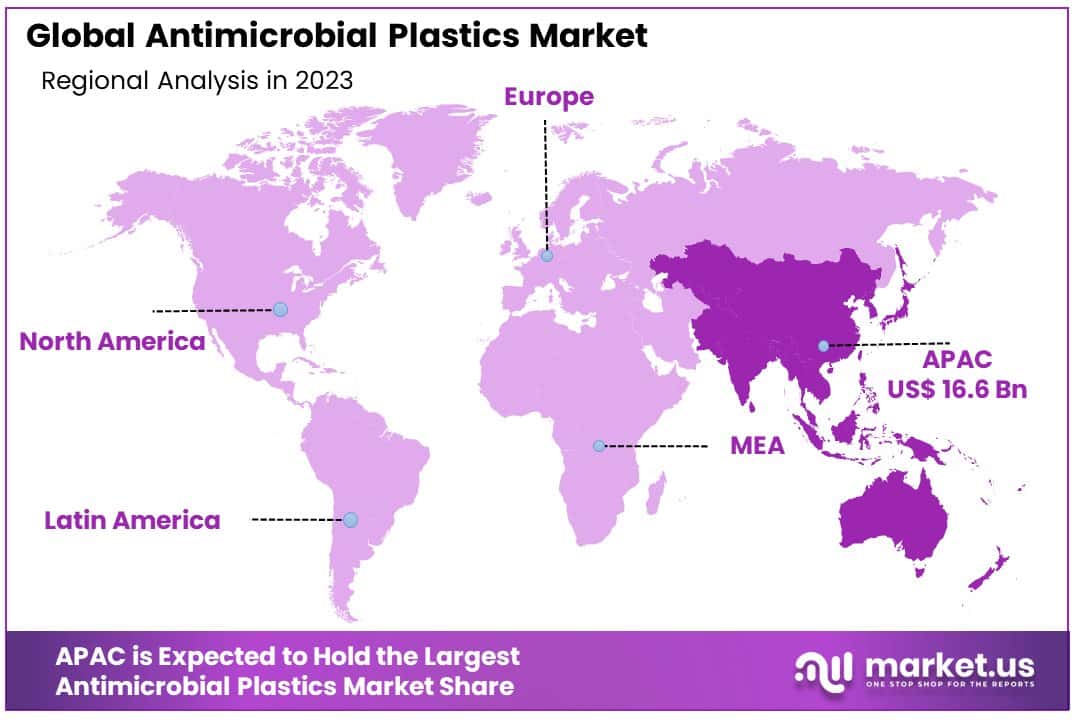

- Regional Analysis: APAC dominates the market with a 37.5% share, reflecting the region’s growing healthcare infrastructure, expanding automotive and construction sectors, and increasing consumer awareness of hygiene and safety.

- Key Players: Major players in the Antimicrobial Plastics Market include BASF SE, Dow Inc., RTP Company, LyondellBasell Industries Holdings B.V., and Mitsubishi Chemical Corporation, among others.

- Analyst Viewpoint: The Antimicrobial Plastics Market’s significant growth is fueled by increasing concerns about infection control, rising healthcare standards, and the growing demand for hygienic and durable materials across various industries.

- Growth opportunity: Growth opportunities lie in developing antimicrobial solutions tailored to specific applications, expanding market reach in emerging regions, and leveraging advancements in material science and technology to enhance product performance and efficacy.

Driving Factors

Rising Demand for Infection Control Drives Market Growth

The increasing incidence of healthcare-associated infections (HAIs) underscores the critical need for effective infection control strategies, making antimicrobial plastics an essential component in medical settings. HAIs represent a significant health concern, with millions of cases reported annually, leading to extended hospital stays, increased healthcare costs, and higher mortality rates.

Antimicrobial plastics, embedded with agents that inhibit microbial growth, play a pivotal role in addressing this issue by reducing the risk of bacterial contamination on high-touch surfaces such as door handles, bed rails, and medical equipment housings. The synergy between the need for effective infection control measures and the push for innovative, sustainable materials drives the expansion of the antimicrobial plastics market.

Growth in Healthcare Infrastructure Fuels Market Expansion

The global expansion of healthcare facilities, including hospitals, clinics, and diagnostic centers, significantly propels the demand for antimicrobial plastics. As healthcare infrastructure grows, so does the need for materials that support a sterile environment, making antimicrobial plastics invaluable in this setting. These materials are increasingly utilized in the construction of healthcare facilities, finding application in wall claddings, flooring, furniture, and more, to ensure a hygienic environment that minimizes the risk of infection spread.

The growth of healthcare infrastructure is not just about increasing the number of facilities but also about enhancing the quality of care through safer environments. This expansion is part of a larger trend towards improving healthcare access and quality worldwide, reflecting a broader commitment to public health and safety. Antimicrobial plastics support this goal by providing durable, effective solutions for maintaining cleanliness and reducing HAIs in healthcare settings.

Increasing Awareness of Hygiene and Safety Accelerates Adoption

The COVID-19 pandemic has dramatically heightened public awareness about the importance of hygiene and safety, leading to a surge in the adoption of antimicrobial plastics across various sectors. This awareness transcends healthcare settings, extending into public spaces such as transportation hubs, shopping centers, and schools, where antimicrobial plastics are now commonly used on high-touch surfaces like handrails, door handles, and tabletops to mitigate the spread of infectious agents.

The pandemic has fundamentally changed attitudes towards cleanliness and infection control, making hygiene a top priority for individuals and institutions alike. This shift has catalyzed the demand for antimicrobial solutions, with plastics playing a key role due to their versatility, durability, and efficacy in preventing microbial growth. The broader application of antimicrobial plastics beyond healthcare, into areas of daily life, underscores the material’s importance in the current health-conscious landscape.

Restraining Factors

Leaching Concerns Restraints Market Growth

Certain antimicrobial agents, such as silver or triclosan, used in plastics have the potential to leach into the environment or food products, triggering significant environmental and safety apprehensions. This potential for leaching raises red flags among consumers, regulatory bodies, and industry stakeholders, limiting the widespread adoption of antimicrobial plastics.

For instance, the U.S. Food and Drug Administration (FDA) banned triclosan in various consumer products, including certain antimicrobial plastics, citing health and environmental risks in 2016. This regulatory action highlights the seriousness of leaching concerns and their impact on market growth. The fear of environmental contamination and potential health hazards associated with leaching restricts the market’s expansion, as consumers and businesses seek safer alternatives. Additionally, negative publicity surrounding leaching incidents further erodes consumer confidence and impedes market penetration.

Stringent Regulatory Hurdles Impede Market Expansion

Antimicrobial plastics intended for healthcare or food-contact applications encounter formidable regulatory challenges and approval processes, imposing substantial barriers to market entry and expansion. Regulatory bodies, such as the U.S. Environmental Protection Agency (EPA), mandate rigorous testing and registration procedures for antimicrobial products, demanding extensive evidence of safety and efficacy.

These regulatory requirements significantly prolong product development timelines and inflate associated costs, deterring manufacturers from investing in antimicrobial plastics. For instance, the EPA’s stringent regulations necessitate comprehensive testing and documentation for antimicrobial plastics, adding layers of complexity to the approval process.

Product Analysis

Commodity plastics dominate the antimicrobial plastics market, accounting for 62.5% of its share. This segment’s prevalence is attributed to the versatile nature and wide application range of these materials, which include polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), acrylonitrile butadiene styrene (ABS), and polyethylene terephthalate (PET). Among these, polyethylene (PE) stands out as the dominant sub-segment due to its extensive use in packaging, agricultural films, and containers, where antimicrobial properties are increasingly sought after to enhance product safety and longevity.

The use of antimicrobial agents in PE not only helps in extending the shelf life of food products by preventing microbial growth but also plays a crucial role in healthcare applications by reducing the risk of infections associated with medical devices and packaging.

Similarly, PP and PVC are significant for their application in healthcare and food packaging, offering benefits similar to PE but with variations in mechanical properties and cost-effectiveness. PS and ABS find their applications majorly in consumer goods and electronics, where antimicrobial features are added for hygiene reasons. PET, though less commonly associated with antimicrobial properties, is gaining traction in beverage and food packaging for its ability to maintain product integrity.

The engineering plastics and high-performance plastics segments, though smaller in market share, contribute significantly to the market’s diversity and innovation. These segments include materials like polyamide (PA), polycarbonate (PC), and thermoplastic polyurethane (TPU), which are used in more demanding applications such as in automotive, aerospace, and medical devices where higher performance is required. These plastics offer enhanced properties like temperature resistance, durability, and strength, making them ideal for applications where commodity plastics might not suffice.

End-Use Analysis

In end-use segments, healthcare emerges as the leading sector, holding 31.6% of the antimicrobial plastics market. This prominence is largely due to the critical need for infection control within medical facilities, driving demand for materials that can effectively reduce microbial presence on surfaces and medical devices. Within healthcare, antimicrobial plastics are utilized across a broad spectrum of applications, including medical devices, hospital bedding, surgical drapes, and containers for medical waste, emphasizing the sector’s reliance on these materials for ensuring patient safety and infection control.

The healthcare segment’s dominance is reinforced by the rising incidence of healthcare-associated infections (HAIs), the expanding global healthcare infrastructure, and the increasing investment in medical research and development. These factors collectively necessitate the use of antimicrobial plastics to mitigate infection risks, streamline hospital operations, and contribute to overall public health safety. The segment’s growth is further facilitated by regulatory support for materials that can demonstrate tangible benefits in infection control, aligning with public health policies and healthcare standards.

Other significant end-use segments include building & construction, automotive & transportation, packaging, food & beverage, and consumer goods, each contributing to the market’s expansion in unique ways. For instance, the building & construction sector utilizes antimicrobial plastics in applications like ventilation systems and water pipes to prevent microbial growth and ensure clean air and water supply.

In the automotive sector, these materials are used for interior surfaces to enhance passenger safety by reducing the potential for microbial contamination. The packaging segment, particularly for food and beverages, leverages antimicrobial plastics to extend product shelf life and maintain food safety. Consumer goods, ranging from electronic devices to children’s toys, incorporate these materials to maintain surface hygiene and product longevity.

Key Market Segments

By Product

- Commodity Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Acrylonitrile Butadiene Systems (ABS)

- Polyethylene Terephthalate (PET)

- Engineering Plastics

- Polyamide (PA)

- Polycarbonate (PC)

- Thermoplastic polyurethane (TPU)

- Others

- High-performance Plastics

By End-Use

- Healthcare

- Building & Construction

- Automotive & Transportation

- Packaging

- Food & Beverage

- Consumer Goods

- Others

Growth Opportunities

Increasing Demand in Healthcare and Food Industries Offers Growth Opportunity

The healthcare and food industries are witnessing a significant upswing in the demand for antimicrobial plastics, primarily driven by the imperative to control infections and ensure food safety. In healthcare, the use of antimicrobial plastics is becoming increasingly critical for medical devices, hospital furniture, and various touchpoints to minimize the risk of healthcare-associated infections (HAIs), which affect millions globally each year.

Concurrently, the food industry seeks antimicrobial solutions to enhance food packaging and processing plants, aiming to extend product shelf life and reduce spoilage. This growing emphasis not only underscores the importance of antimicrobial plastics in maintaining health and safety standards but also highlights the vast potential for market expansion in these sectors. The demand is further bolstered by rising health consciousness among consumers and stringent regulatory standards, pushing manufacturers to innovate and expand their antimicrobial product lines to meet these industries’ specific needs.

Expansion in Consumer Products and Building Materials Offers Growth Opportunity

The proliferation of antimicrobial plastics into the consumer products and building materials sectors marks a substantial growth frontier for the industry. This expansion is fueled by the increasing consumer demand for hygiene and safety in everyday items, including household appliances, furniture, and interior surfaces. As awareness regarding the benefits of antimicrobial properties grows, consumers are more inclined to seek products that offer added health protection. This trend is mirrored in the building sector, where antimicrobial plastics are integrated into materials to create cleaner, safer indoor environments.

Such applications range from ventilation systems to water pipes, and even to flooring and wall claddings, to combat microbial growth effectively. The cross-sectoral demand for antimicrobial plastics in these areas is not just a response to the COVID-19 pandemic but a fundamental shift in consumer preferences towards healthier living spaces. Manufacturers tapping into these sectors are positioned to unlock new revenue streams, driven by the consumer and regulatory push towards enhanced safety and hygiene standards across multiple aspects of daily life.

Trending Factors

Focus on Sustainability and Environmental Concerns Are Trending Factors

The shift towards sustainability and heightened environmental awareness is significantly influencing the antimicrobial plastics market. Consumers and industries alike are increasingly seeking solutions that not only provide antimicrobial protection but also address ecological concerns. This trend is driving innovation in the development of sustainable, eco-friendly antimicrobial plastics that can degrade more naturally without harming the environment.

Manufacturers are responding by exploring alternative, less harmful antimicrobial agents and biodegradable plastic sources, aiming to reduce the ecological footprint of their products. This focus on combining hygiene with sustainability reflects a broader market evolution, where environmental impact is a critical consideration in product development and consumer choice. As a result, sustainable antimicrobial plastics are gaining traction, offering growth opportunities for companies that prioritize eco-conscious product innovations.

Regulatory Changes and Guidelines Are Trending Factors

The antimicrobial plastics market is also being shaped by evolving regulations and guidelines focused on antimicrobial products, food safety, and infection control. Governments and regulatory bodies worldwide are updating their standards to ensure the safe and effective use of antimicrobial materials, particularly in sensitive applications such as healthcare and food packaging. These changes are prompting manufacturers to adapt their product formulations and testing protocols to comply with stricter safety and efficacy requirements.

The trend towards tighter regulation reflects growing concerns over antimicrobial resistance and the potential health risks associated with certain antimicrobial agents. Consequently, these regulatory shifts are not only influencing market dynamics by raising the bar for product approval but also encouraging innovation in the development of new, safer antimicrobial plastic solutions. As companies navigate these regulatory landscapes, those that successfully align their products with the latest guidelines are likely to see increased demand and market share.

Regional Analysis

APAC Dominates with 37.5% Market Share

The Asia Pacific (APAC) region holds a commanding 37.5% share of the antimicrobial plastics market, largely due to its expansive manufacturing capabilities and burgeoning healthcare sector. High population density across countries like China and India escalates the demand for antimicrobial products in healthcare to prevent infections. Additionally, the region’s rapid urbanization fuels the construction and consumer goods sectors, further driving the demand for antimicrobial plastics.

APAC’s dominance is also rooted in its dynamic economic growth, leading to increased investments in healthcare infrastructure and heightened awareness about hygiene and safety. The region’s cost-effective manufacturing environment attracts global companies seeking to leverage lower production costs, thereby expanding the local antimicrobial plastics industry. Furthermore, APAC’s diverse industrial base supports a wide range of applications for antimicrobial plastics, from packaging to automotive, showcasing the region’s integral role in global supply chains.

APAC’s influence on the antimicrobial plastics market is expected to grow, driven by continued industrial expansion, rising healthcare standards, and increasing consumer demand for hygienic products. Investments in research and development within the region are likely to foster innovation, leading to the creation of advanced antimicrobial materials. This trend, coupled with ongoing urbanization and economic development, suggests that APAC will remain a pivotal market, shaping global antimicrobial plastics industry trends.

Regional Market Shares and Dynamics

- North America: North America, with its advanced healthcare system and stringent regulatory environment, holds a significant market share. The emphasis on infection control in medical facilities and food safety contributes to the demand for antimicrobial plastics. The region’s market is expected to grow steadily, supported by technological advancements and increasing consumer awareness about hygiene.

- Europe: Europe’s market share is bolstered by its strong focus on sustainability and regulatory compliance. The region’s commitment to reducing environmental impact influences the development of eco-friendly antimicrobial plastics. Europe’s market is characterized by high demand in healthcare, packaging, and consumer products, driven by safety and environmental concerns.

- Middle East & Africa: The Middle East & Africa region is experiencing growth in the antimicrobial plastics market due to expanding healthcare sectors and urbanization. The demand is particularly pronounced in water treatment and building materials, reflecting the region’s focus on improving public health infrastructure and living standards.

- Latin America: Latin America’s market is growing, with increased adoption of antimicrobial plastics in healthcare and food packaging to enhance hygiene and safety. The region’s growth is fueled by rising consumer awareness and the need for durable, hygienic materials in various applications.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Antimicrobial Plastics Market, key players such as BASF SE, DuPont de Nemours, Inc., and Lonza Group lead the charge in driving innovation and expanding market reach. These companies, along with Sanitized AG, Microban International, and Milliken & Company, are pivotal in integrating antimicrobial technologies into plastics, catering to a wide range of applications from healthcare to consumer goods.

Covestro AG and Clariant contribute by developing advanced materials that offer both performance and antimicrobial protection, marking their strategic positioning towards sustainability and efficiency. BioCote Limited, PolyOne Corporation, and King Plastic Corporation further enrich the market landscape by offering specialized antimicrobial solutions that enhance product value and safety.

Parx Materials NV stands out for its unique approach to incorporating biocompatible antimicrobial properties, indicating a trend towards safer and more natural alternatives. Collectively, these key players not only shape the competitive dynamics of the market but also drive the industry towards innovative solutions that meet the growing demands for hygiene, safety, and environmental sustainability. Their market influence is significant, dictating the pace of technological advancement and adoption across various sectors.

Market Key Players

- BASF SE

- DuPont de Nemours, Inc.

- Lonza Group

- Sanitized AG

- Microban International

- Milliken & Company

- Covestro AG

- Clariant

- BioCote Limited

- PolyOne Corporation

- King Plastic Corporation

- Parx Materials NV

Recent Developments

- On March 2024, AIMPLAS will host its first conference on the use of antimicrobials in the plastics industry, bringing together over 20 specialists to address challenges related to microbes and the opportunities for industry.

- On September 2023, Microban International introduced Ascera, a new antimicrobial technology designed for use in olefinic polymers and solvent-based coatings. Ascera is sustainable, metal-free, less toxic than alternative technologies, and provides lifelong antimicrobial product protection.

- On October 2023, TekniPlex Healthcare introduced PVC and TPE antimicrobial compounds for healthcare applications. These innovative compounds are formulated with silver ion technology, proven to significantly reduce the risk of contamination due to bacterial buildup

Report Scope

Report Features Description Market Value (2023) USD 44.4 Billion Forecast Revenue (2033) USD 94.1 Billion CAGR (2024-2033) 7.80% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Commodity Plastic, Engineering Plastics, High-performance Plastics), By End-Use (Healthcare, Building & Construction, Automotive & Transportation, Packaging, Food & Beverage, Consumer Goods, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, DuPont de Nemours, Inc., Lonza Group, Sanitized AG, Microban International, Milliken & Company, Covestro AG, Clariant, BioCote Limited, PolyOne Corporation, King Plastic Corporation, Parx Materials NV Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the expected worth of the Global Antimicrobial Plastics Market?The Global Antimicrobial Plastics Market is expected to be worth around USD 94.1 Billion by 2033. The projected CAGR of the Antimicrobial Plastics Market from 2024 to 2033 is 7.80%.

What sectors widely utilize antimicrobial plastics?Antimicrobial plastics are widely utilized across healthcare, packaging, consumer goods, and construction sectors.

Which are the dominant segments in the Antimicrobial Plastics Market by product?Commodity plastics, including polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), among others, dominate the Antimicrobial Plastics Market.

Which region dominates the Antimicrobial Plastics Market?The Asia Pacific (APAC) region dominates the Antimicrobial Plastics Market, holding 37.5% of the market share.

Antimicrobial Plastics MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Antimicrobial Plastics MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Parx Materials N.V

- Ray Products Company Inc.

- Covestro AG

- King Plastic Corporation

- Palram Industries Ltd.

- Clariant AG

- Sanitized AG

- Dow Inc.

- Lonza

- Other Key Players