Global Infection Control Market, By Type (Equipment, Services), By End-Use (Hospitals, Medical Device Companies), As well as by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 44350

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

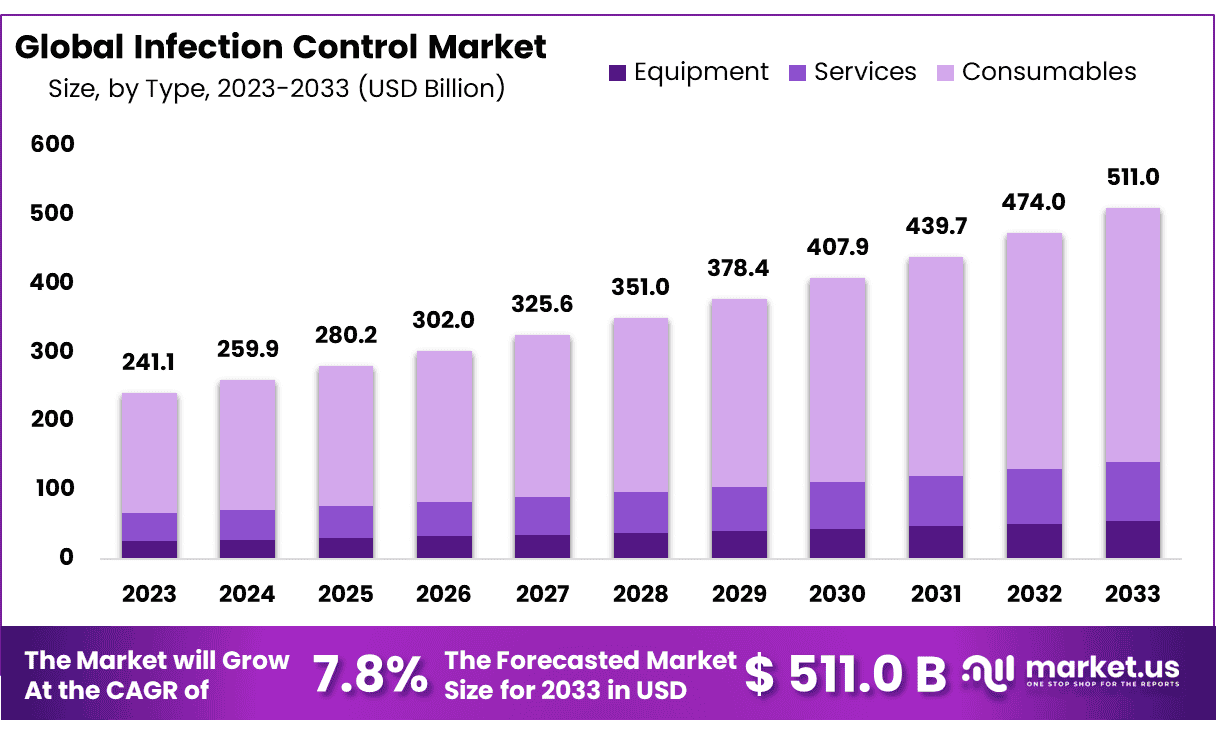

Global Infection Control Market size is expected to be worth around USD 511 Billion by 2033 from USD 241.41 Billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2024 to 2033.

This market is being driven by the increasing number of surgical procedures that prevent high-intensity infections.

Infections are usually caused by microorganisms such as bacteria, viruses, parasites or fungi and can range in type from digestive and stomach infections, lung and respiratory infections, eye and ear infections to hospital-acquired infections (HAIs) as well as skin infections or sexually transmitted diseases transmitted via cross contamination between patient skin/surface area/equipment and healthcare personnel

Positive clinical outcomes are thought to explain the high preference for infection control. The COVID-19 pandemic has had a positive impact on market growth. This has led to an increase in sterilization services at hospitals, clinics, and pharmaceutical companies as well as medical device firms. This market report gives a detailed analysis of the Infection Control market size, share, growth opportunities, major factors, key trends, and other key factors.

Key Takeaways

- Market Size: Infection Control Market size is expected to be worth around USD 511 Billion by 2033 from USD 241.41 Billion in 2023.

- Market Growth: The market growing at a CAGR of 7.8% during the forecast period from 2024 to 2033.

- Type Analysis: Consumables’ segment accounted for 72.5 % of the infection control market’s revenue share in 2023.

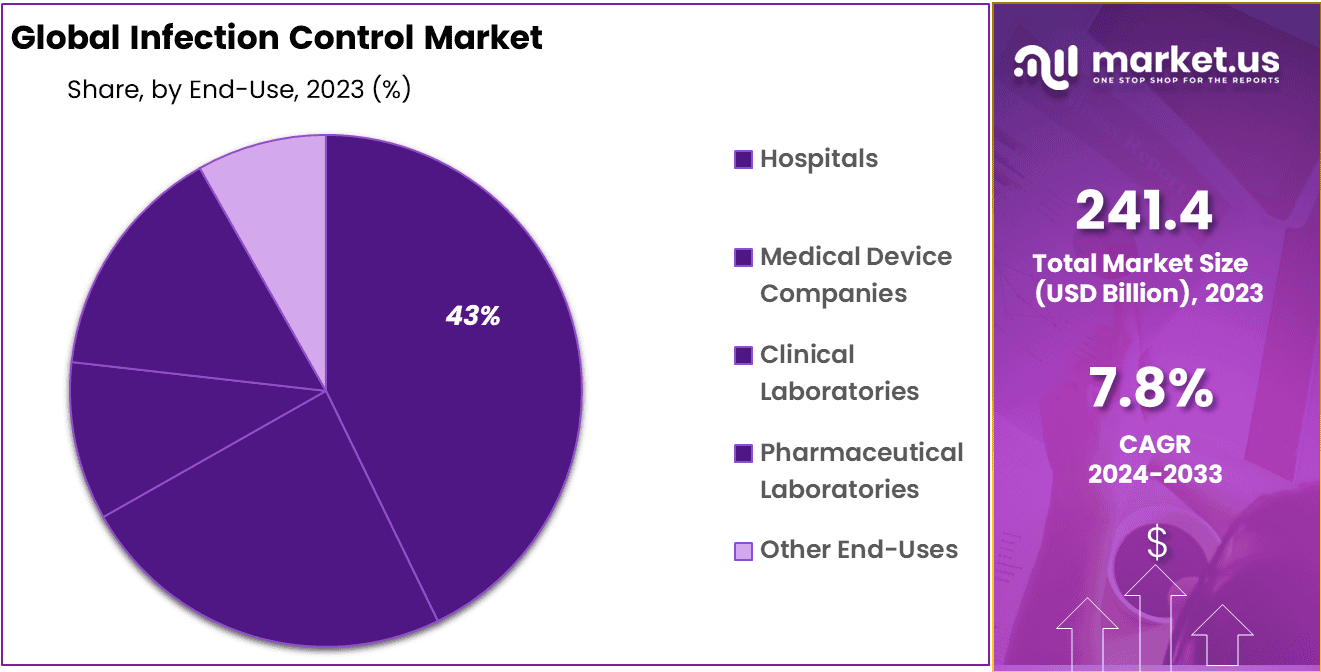

- End-Use Analysis: Hospitals’ segment dominated the infection control market and globally accounted for the major revenue share of 42.8% in 2023.

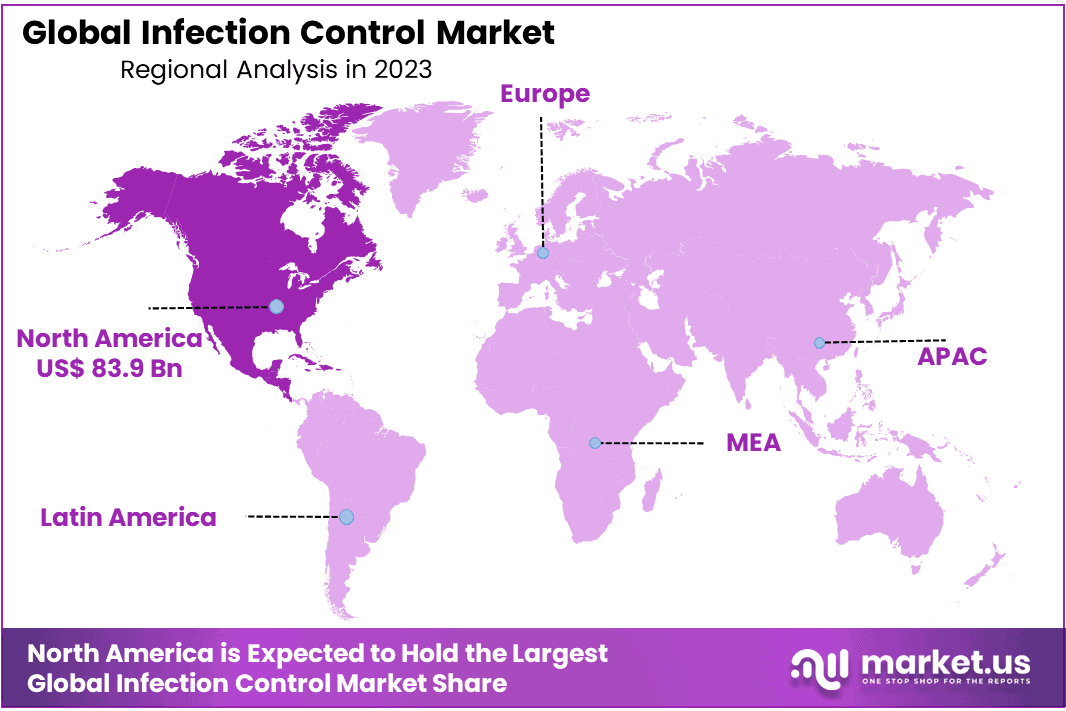

- Regional Analysis: North America was the most important market for infection control, accounting for 34.8% of total revenues in 2023.

- Technological Advancements: Innovations in sterilization and disinfection technologies, such as UV-C light and hydrogen peroxide vapor, are driving market growth by enhancing the efficacy and efficiency of infection control measures.

- Regulatory Compliance: Stringent regulations and guidelines from health organizations, such as the CDC and WHO, are propelling the adoption of advanced infection control practices in healthcare settings, contributing to market expansion.

- Challenges: Challenges in the market include high costs of advanced infection control products and the need for continuous training and compliance among healthcare staff.

Type Analysis

In terms of ‘Type’, the ‘Consumables’ segment accounted for 72.5 % of the infection control market’s revenue share in 2023. Because of their constant use and short life spans, consumers are expected to account for the majority market share. More consumables are being used in sterilization, disinfection, and other control procedures.

Consumables are now an integral part of these procedures. As of 2023, personal protective equipment was a large percentage of all consumables. Many healthcare organizations support the use of personal protective equipment and promote its benefits.

Over the forecast period, the ‘Services’ segment is expected to grow at a rapid pace. They encourage adoption by recommending guidelines and suggesting ways to select, assess risk and use rationally. The infection control market players want to reduce healthcare costs and maximize benefits.

This segment is expected to grow the fastest. This includes cost savings, better efficiency of services, and a greater focus on core areas that are vital to a company’s overall profit growth and development.

End-Use Analysis

With respect to ‘End-Use’, the ‘Hospitals’ segment dominated the infection control market and globally accounted for the major revenue share of 42.8% in 2023. This segment is expected to grow at the fastest rate over the forecast period.

The Infection Control Market involves ways of preventing the spread of infectious organisms in places like hospitals, labs and medical device companies. People working at these establishments need to take measures to avoid getting sick or spreading germs to others – infections control products and methods can keep everyone safer by lowering infection risks – hospitals, labs and pharmaceutical labs use infection control measures as do other institutions to keep people healthy and prevent diseases from spreading further.

This large share is mainly due to the high likelihood spread of infection in hospitals through blood-borne or respiratory pathogens. HAIs pose a major challenge and require strict control. One of the main concerns is the high risk of infections by blood-borne pathogens and drug-resistant pathogens.

UTIs can be caused by the frequent use of urinary catheters. According to NCBI research, 25% of all bacterial infection cases are caused by UTIs. These factors will increase this segment’s future growth potential.

Маrkеt Ѕеgmеntation

Type

Equipment

- Disinfectors

- Endoscope Reprocessors

- Others

Services

- Contract Sterilization

- Infectious Waste Disposal

Consumables

- Infectious Waste Disposal

- Disinfectants

- Sterilization Consumables

- Personal Protective Equipment

- Others

End-use

- Hospitals

- Medical Device Companies

- Clinical Laboratories

- Pharmaceutical Laboratories

- Other End-Uses

Driver

Healthcare Awareness Campaign

- Rising Health Concerns: Raising awareness about healthcare-associated risks has become one of the main drivers for infection control market growth. Both patients and healthcare providers understand the significance of maintaining safe and hygienic environments.

- Global Health Crises: Recent global pandemics like COVID-19 have made us acutely aware of the devastating impact infectious diseases can have on society, prompting an unprecedented demand for infection control products and services.

- Government Regulation and Healthcare Guidelines that Emphasize Infection Control Practices: Government regulations and guidelines which emphasize infection control practices not only encourage compliance but also drive adoption of related products and services in healthcare institutions.

Restraints

Healthcare Facilities

- Financial Constraints: Many healthcare facilities face budgetary restrictions that limit their ability to invest in advanced infection control solutions, limiting them from investing in cutting-edge technology or comprehensive infection control measures.

- Cost of Compliance: Meeting infection control regulatory standards often requires substantial financial investments from healthcare organizations, which may put strain on their resources – this can be especially challenging for smaller or underfunded facilities.

- Competing Priorities: Healthcare organizations must allocate their resources across competing priorities such as patient care, equipment acquisition and staffing needs. Due to these competing demands on funding allocation, infections control may face restrictions due to funding requirements being spread too thinly across departments.

Opportunity

Technological Advances provide us with a great advantage

- Innovative Solutions: Rapid advances in technology have produced innovative infection control solutions, such as automated disinfection systems, IoT-connected devices and telemedicine services that significantly increase effectiveness and efficiency of infection control efforts. These innovations significantly improve their efficacy.

- Data Analytics: Utilizing data analytics and artificial intelligence for monitoring and prevention offers great potential to create proactive, data-driven approaches for controlling infections. Real-time analysis can assist in quickly detecting outbreaks and mitigating risks.

- Market Expansion: Rising awareness of infection control has broadened its market, creating opportunities for both established and newcomer companies alike to offer comprehensive infection control products and services, catering to various needs.

Challenge

Rising Pathogens and Antimicrobial-Resistant Infections

- Emerging Pathogens: New infectious agents present a unique challenge for infection control. Rapid adaptation to new pathogens requires quick action to create effective infection prevention measures.

- Antibiotic Resistance: The growing prevalence of drug-resistant infections, including antibiotic-resistant bacteria, intensifies the complexity of infection control efforts. Strategies must be devised to confront this increasingly formidable situation effectively.

- Adaptation Imperative: Given the dynamic nature of infectious diseases and the constant evolution of threats, infection control measures must undergo continuous updates to respond to emerging pathogens and novel challenges. Maintaining pace with these changes is an ongoing and demanding task for infection control professionals, essential for their effectiveness in combatting new pathogens.

Regional Analysis

North America was the most important market for infection control, accounting for 34.8% of total revenues in 2023. This region accounts for a higher share of the infection control market due to its strong collaborations with key market players. This has allowed these players to grow their product portfolios and improve their infection control capabilities. The US is the dominant market due to its greater presence in the region.

Infection control in the Asia Pacific is anticipated to index the highest CAGR over the forecast period. This is due to higher healthcare spending, increased outsourcing, and the unprecedented development of healthcare infrastructures and standards throughout the region.

The Asia Pacific’s growth has also been influenced by the existence of several voluntary and state-funded organizations that strive to improve infection control standards. Market leaders from developed countries are increasingly outsourcing to Asia Pacific companies making it a key growth driver.

The Asia Pacific Society of Infection Control (a Non-Profit Organization) works to create partnerships to improve quality and promote cost efficiency in the region.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Major companies like Advanced Sterilization Products and STERUS Corporation have extensive collaboration strategies that are driving competition. These companies are focused on implementing competitive strategies, such as mergers & acquisitions, as well as the development of new products to expand their geographical reach.

Market Key Рlауеrѕ

- 3M Company

- Belimed AG

- Halyard Health, Inc.

- Getinge Group

- Advanced Sterilization Products

- Matchana Group

- Sterigenics International

- MMM Group

- Cantel Medical Corporation

- STERIS Corporation

Recent Developments

- January 2023: 3M launched its antimicrobial personal protective equipment (PPE), offering healthcare workers enhanced protection from infectious agents. Cantel Medical announced the debut of their automated endoscope reprocessing system which streamlines cleaning and disinfection procedures to lower cross-contamination risks.

- March 2023: The Association of Professionals in Infection Control and Epidemiology (APIC) released a new guideline regarding ultraviolet (UV) lighting for disinfection purposes in healthcare environments. A study published in Infection Control and Hospital Epidemiology demonstrated how using hydrogen peroxide vaporization could significantly decrease healthcare-associated infections (HAIs).

- June 2023: Food and Drug Administration (FDA) approved in June a new surgical mask designed to offer healthcare workers more effective protection from airborne pathogens. A study published by PLOS One shows how using this new hand hygiene product significantly reduced HAIs.

- August 2023: American Hospital Association (AHA) released a new report detailing the financial ramifications of HAIs this August, while research published in Clinical Microbiology and Infection shows how an antimicrobial coating could significantly lower catheter-associated bloodstream infections (CLABS).

Report Scope

Report Features Description Market Value (2023) USD 241.1 Billion Forecast Revenue (2033) USD 511 Billion CAGR (2024-2033) 7.8 % Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Type, Equipment(Disinfectors, Endoscope Reprocessors, Others),Services(Contract Sterilization, Infectious Waste Disposal),Consumables(Infectious Waste Disposal, Disinfectants, Sterilization Consumables, Personal Protective Equipment, Others), End-use, (Hospitals, Medical Device Companies, Clinical Laboratories, Pharmaceutical Laboratories, Other End-Uses) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape 3M Company, Belimed AG, Halyard Health, Inc., Getinge Group, Advanced Sterilization Products, Matchana Group, Sterigenics International, MMM Group, Cantel Medical Corporation, STERIS Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M Company

- Belimed AG

- Halyard Health, Inc.

- Getinge Group

- Advanced Sterilization Products

- Matchana Group

- Sterigenics International

- MMM Group

- Cantel Medical Corporation

- STERIS Corporation