Plasma Fractionation Market Size, Share, and Trends Analysis Report by Product (Albumin, Immunoglobulins, Coagulation Factors), By Method (Method, Centrifugation, Depth Filtration, Chromatography, Other Methods), By Application (Immunology, Hematology, Neurology), By End-user (Hospitals Segments, Clinical Research Laboratories, Other End Users), By Region, And Segment Forecasts, 2023-2032

- Published date: Sep 2024

- Report ID: 17742

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

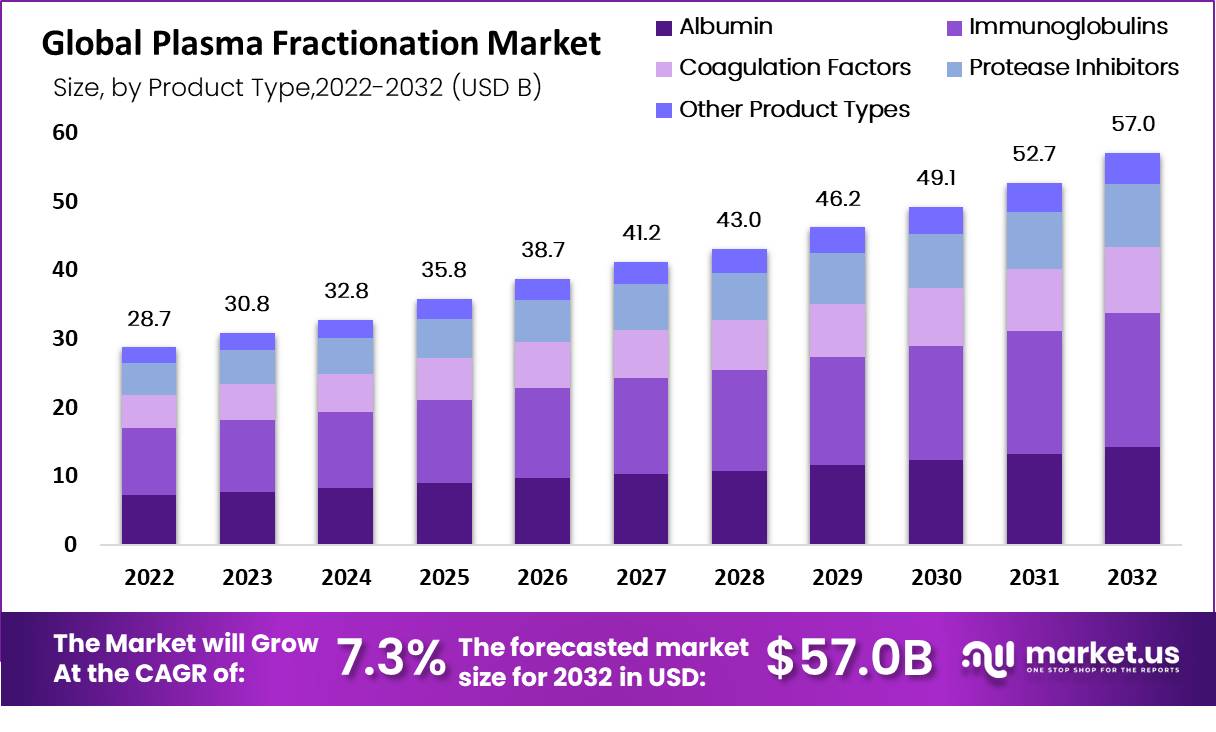

The Global Plasma Fractionation Market Size is expected to be worth around USD 57.0 Billion by 2032 from USD 28.7 Billion in 2022, growing at a CAGR of 7.3% during the forecast period from 2023 to 2032.

A mixture is divided into various parts during fractionation. Albumin and immunoglobulin, which are plasma derivatives, are produced by fractionating the blood’s plasma component. These animals’ plasma products treat a wide range of diseases related to blood plasma and have therapeutic effects.

For instance, hemophilia treatment and prevention rely on the plasma derivative of coagulation factor VIII. Additionally, it stops excessive bleeding during surgery. Immunoglobulins, on the other hand, are used to treat both primary and secondary immune deficiencies.

Key Takeaways- Market size: Expected to reach USD 57.0 Bn by 2032, growing at a CAGR of 7.3%.

- Key products: Immunoglobulins are the largest segment, followed by coagulation factors and albumin.

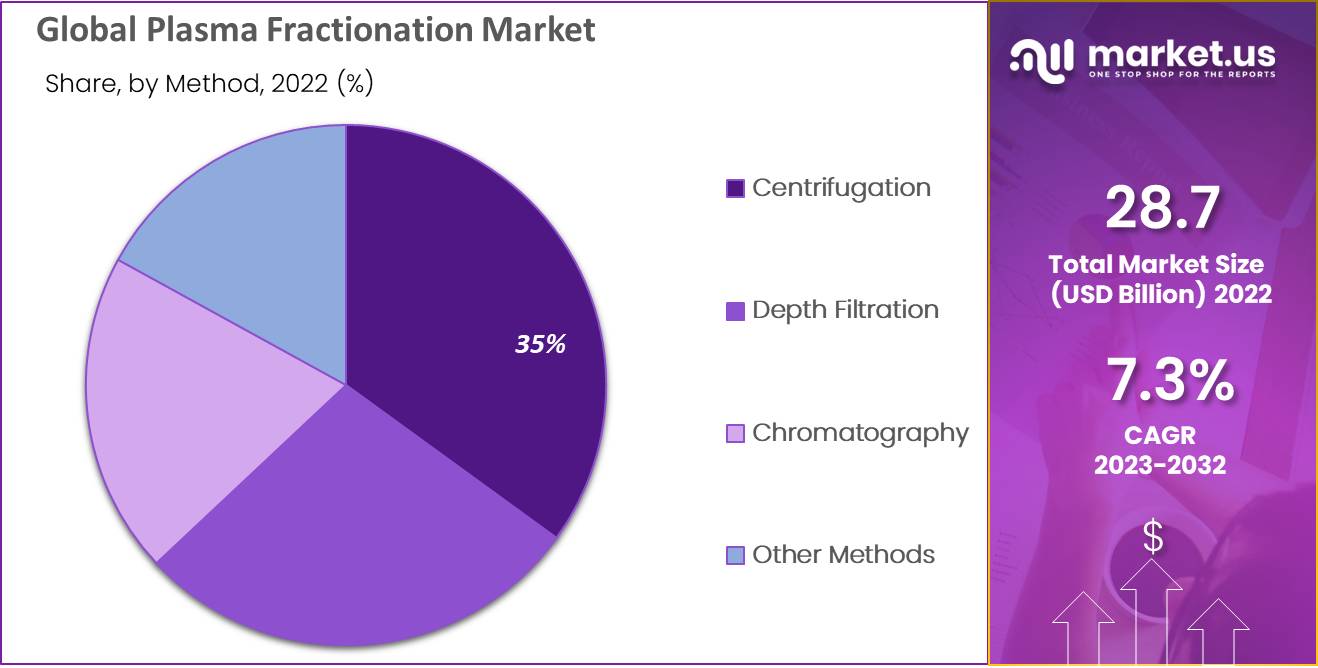

- Key methods: Centrifugation is the most widely used method, followed by chromatography and depth filtration.

- Key applications: Neurology is the largest segment, followed by hematology and oncology.

- Key end-users: Hospitals and clinics are the largest segment, followed by academic institutes and clinical research laboratories.

- Growth drivers: Rising incidences of immunodeficiency disorders, increased use of plasma-derived products in various medical fields, and growing demand for plasma-derived products for the treatment of complex conditions.

- Restraints: Emergence of recombinant therapies as an alternative to plasma-derived medicines.

Product Analysis

The increase in this phase is a consequence of the different use of immunoglobulins in different problems such as primary and secondary immune deficiencies, autoimmune diseases, and inflammatory diseases. In addition, the exponential advancement of research related to immunology

worldwide is another factor contributing to the development of the immunoglobulin market. The growth of this segment has been attributed to the huge plasma-derived immunoglobulins available in the market against various products and the increasing use of immunoglobulins, especially in Immunodeficiency. In 2022, the immunoglobulin phase is expected to account for the largest share of the global plasma fractionation market.

On the premise of the product, the plasma fractionation marketplace is divided into immunoglobulins, coagulation, concentrates, albumins, and protease inhibitors. Immunoglobulins are the largest phase of the plasma fractionation market and likewise is expected that it will show the fastest-growing cargo over the forecast period.

Method Analysis

The centrifugation fragment caught the most elevated portion of 33.32% in 2021 and the quickest development rate throughout the projection period. Centrifugation is a significant stage in getting great blood supernatant. Furthermore, it helps scientists with reliable blood partition and better patient clinical results. Subsequently, the rising interest in centrifugation instruments would enhance the plasma fractionation market development.

The usage of modern scale chromatographic fractionation and filtration methods for plasma fractionation has recently expanded. Another age of restorative plasma has grown, especially coagulation factors, protease inhibitors, and anticoagulants. Accordingly, chromatography has made it conceivable to make new therapeutic things for treating patients who have obtained or inborn hindrances in plasma protein levels. Consequently, it will drive market development.

Application Analysis

The immunoglobulin application type is considered for a huge share in 2022. With the increasing occurrence of infectious diseases, the use of immunoglobulins is expected to increase during the 12-month prognosis. The world market for plasma fractionation is fragmented. The immunoglobulin market segment presented the best percentage increases, in 2022 attributed to the use of immunoglobulin products in the major and secondary immunodeficiency disorders. Immunoglobulin has several advantages in drug packages, including immunosenescence, control, detection of metabolic problems, healing, and completely clear modifications based on immunity.

For immunology, hematology, neurology, vital care, hemato-oncology, rheumatology, and orthopedics as well as specific packages. In addition, the coagulation elements market is also expected to grow with excessive blood donation or transplant, recent drug approvals, and excessive bleeding problems. In 2022, the field of neurology is expected to dominate the global plasma fractionation market. The increasing incidence of neurological problems and the huge use of plasma-derived products to treat them is the key driver of the increase to this degree. clotting elements are usually used for bleeding issues such as hemophilia and Von Willebrand’s ailment.

End-User Analysis

The acquisitions, joint ventures, and the provision of comprehensive services for a variety of medical needs under one roof, particularly in countries such as Germany, The UK, China, and India. Moreover, the increasing use of plasma-based products in multiple therapeutic areas, an increasing number of hospitals, and increasing healthcare spending are some of the main factors driving the growth of this segment. The market is segmented into hospitals and clinics, academic institutes, and clinical research laboratories It is estimated that in 2022, the hospital and clinical segment will dominate the global plasma fractionation market.

Key Market Segments

By Product Type

- Albumin

- Immunoglobulins

- Coagulation Factors

- Protease Inhibitors

- Other Product Types

By Method

- Centrifugation

- Depth Filtration

- Chromatography

- Other Methods

By Application

- Neurology

- Hematology

- Oncology

- Immunology

- Pulmonology

- Other Applications

By End-User

- Hospitals

- Clinical Research Laboratories

- Other End-Users

Drivers

Growing Incidences of Immunodeficiency Disorders

The rising number of older adults worldwide who are more likely to suffer from rare diseases that necessitate plasma fractionation is the primary growth driver for the plasma fractionation market. The number of therapeutic applications for plasma-derived immunoglobulins is rising, including those for autoimmune and inflammatory conditions.

The need for plasma fractionation is also expanding due to the increased use of immunoglobulins and alpha-1-antitrypsin in various medical fields worldwide. The COVID-19 scenario increases respiratory diseases that can infect the lungs. Some patients struggle with diabetes and high blood pressure, and family history frequently has a significant impact. As a result, plasma fractionation is commonly utilized for disease treatment.

Additionally, these products are in high demand due to the complex conditions that can be treated with modern medical methods. The hospitals and clinics industry is expected to grow over the forecast period in 2021, accounting for a significant revenue price. Numerous disorders, improved health services, and infrastructure

Furthermore,plasma-derived Restorative Items (PDMPs) are arranged economically with the assistance of human plasma. These items incorporate egg whites, immunoglobulins, and coagulation factors. The World Wellbeing Association (WHO) had a few PDMP things in the model rundown of fundamental prescriptions. This drive featured these drugs as viable and ok for critical requirements in a well-being framework.

The solid prerequisite for plasma-determined items builds interest in this methodology, prompting positive market development. For example, essential immunodeficiency illnesses can be treated with immunoglobulin by supplanting the missing IgG serotype antibodies. Be that as it may, Von Willebrand’s (VWD) sickness and hemophilia require the substitution of coagulation factors. Plasma treatments likewise assume a significant part in pre-birth and escalated care and, in this manner, are demonstrated fundamental severe inadequacies.

Restraints

Emergence Of Recombinant Therapies

The emergence of Recombinant Therapies as an Alternative to Plasma-Derived Medicines Restraints the Market Growth. The recombinant product performance of plasma-derived products is produced by expressing comparable proteins in genetically engineered cells. It is safer than plasma-derived products because it stops the potential transmission of bloodborne pathogens. The development of recombinant

therapies as a choice to plasma-derived medicines has slowed the growth. Innumerable plasma-driven treatments have invented multiple recombinant options in recent years. Plasma-derived products are more immunogenic than recombinant products used for preventative purposes. Numerous additional longer-acting replacement factors are included in the development series in addition to these.

The products are more effective as a preventative measure and provide significant benefits like a low need for repeat administration. As a result, their property makes them more trustworthy than plasma-derived products, which limits their international market expansion. As a result, plasma product adaptability is hindered by the growing use of recombinant components and their increased service in preventative therapies for diseases that spread.

Growth Opportunity

Numerous factors, including an expanding population, environmental trade, and increased human-animal contact, have contributed to new disease outbreaks. In the initial phase of the COVID-19 pandemic, patients worldwide received treatment with blood plasma therapy to ensure complete healing without specific treatment.

In addition, the plasma procedure’s success in disease management bodes well for expanding the market. As a result, the market grew at a rate of 14.4% in 2020 and is expected to continue expanding significantly in the future. This dramatically impacts the international plasma fractionation market.

Trends

Launch of New Technologies

To increase their market value at the industry level, the important key participants in the plasma fractionation demand are increasingly concentrating on creating highly enhanced and technologically developed outcomes.

For instance, in December 2018, The U.S. Food and Drug Administration (USFDA) authorized Novoeight, a plasma fractionation-based drug developed by Novo Nordisk. The Japan Blood Products Organization, CSL Behring, Green Cross Corp., Octapharma AG, Bio Product Laboratory Ltd., Grifols International S.A., and Kedrion S.p. are additional significant players in the global plasma fractionation market. S.p.A.

Regional Analysis

In 2022, North America held 53.5% of the county share. The presence of significant players also supports the regional market’s expansion, increasing the number of plasma collection facilities, increasing immunoglobulin consumption, and the capacity to supply plasma due to the feasibility of plasma collection and distribution.

The market for plasma fractionation products in the Asia-Pacific region is growing as a result of increased funding for research and development from both public and private sources, favorable government regulations, an increase in the use of immunoglobulins, and an increase in the prevalence of targeted diseases in a geriatric population that has blood-related conditions.

Diseases and the growing use of plasma-based therapies. This results from a rise in breathing problems and respiratory diseases, as well as an increase in plasma fractionation awareness and revenue in North America.

Key Regions

- North America

- The US

- Canada

- Mexico

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Key game enthusiasts in this marketplace are growing numerous traits, which include partnerships thru mergers and acquisitions, geographical growth, and strategic collaborations, to increase their marketplace presence. the simplest 100 and 17,000-rectangular-foot facility will produce unmarried-use collection devices for the cutting-edge FDA-9 Rika Plasma Donation device to provide supply plasma collections to clients.

Inaugurated his most productive work. The company’s purpose is to support society and help more people through medical supplies, which is associated with the manufacturing facility, which costs US$250 million. For example, in Douglas County, Colorado, Terumo Blood, and Cellular Technology may well extend beyond 2022.

Market Key Players

- Bio Products Laboratory Biotest AG

- China Biologic

- Intas Pharmaceuticals Ltd.

- Products Holdings Inc.

- CSL Limited

- Takeda Pharmaceutical Company Limited

- Green Cross Corporation

- Grifols

- Other Key Players

Recent Developments

- In April 2022: Biotest AG was acquired by Grifols, a deal that completed after securing all necessary regulatory approvals. This acquisition has allowed Grifols to control 96.20% of the voting rights and 69.72% of the share capital of Biotest AG. The transaction valued Biotest’s capital at approximately EUR 1,600 million (equity value) and its market value at EUR 2,000 million (enterprise value). This strategic acquisition is set to enhance Grifols’ global plasma capacity, expand its product portfolio, and increase the availability of plasma therapies.

- In August 2022: Taibang Biologic Group, previously known as China Biologic Products Holdings, secured $300 million in equity funding. The investment round was led by Platinum Orchid, a subsidiary of the Abu Dhabi Investment Authority, with additional participation from China Life and Cinda Kunpeng. This funding is intended to support the expansion of plasma stations and the development of new products, strengthening Taibang’s position in the Chinese market.

- In November 2023: Intas Pharmaceuticals announced a significant licensing agreement with Syna Therapeutics to commercialize LB-0702, a biosimilar drug, on a global scale. This agreement grants Intas exclusive rights to market LB-0702 worldwide, marking a strategic enhancement of their biosimilar program. The deal also aligns with Intas’ long-term strategy to increase access to high-quality biosimilar drugs globally, underpinning their commitment to addressing large-scale healthcare needs.

Report Scope

Report Features Description Market Value (2022) USD 28.7 Bn Forecast Revenue (2032) USD 57.0 Bn CAGR (2024-2033) 7.3% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Product Type (Albumin, Immunoglobulins, Coagulation Factors, Protease Inhibitors, Other Product Types), Based on Method (Centrifugation, Depth Filtration, Chromatography, Other Methods), Based on Application (Neurology, Hematology, Oncology, Immunology, Pulmonology, Other Applications), Based on End-User (Hospitals, Clinical Research Laboratories, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bio Products Laboratory, Biotest AG, China Biologic, Intas Pharmaceuticals Ltd., Products Holdings Inc., CSL Limited, Takeda Pharmaceutical Company Limited, Green Cross Corporation, Grifols, Japan Blood Products Organization, Kedrion, LFB group, Octapharma AG, Sanquin Blood Supply Foundation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plasma Fractionation MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample

Plasma Fractionation MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Bio Products Laboratory Biotest AG

- China Biologic

- Intas Pharmaceuticals Ltd.

- Products Holdings Inc.

- CSL Limited

- Takeda Pharmaceutical Company Limited

- Green Cross Corporation

- Grifols

- Other Key Players