Global Antidiabetics Market By Product, Insulin (Rapid-acting analog, Long-acting analog, Premixed insulin, Short-acting analog, Intermediate-acting insulin) Drug class (Alpha-glucosidase inhibitors, Biguanides, Sulphonylureas, GLP-1 (Glucagon-like peptide) agonists, DPP-IV (Dipeptidyl Peptidase) inhibitors, Meglitinides, SGLT-II (Sodium-Glucose Transport Proteins) inhibitors, Thiazolidinedione) By Route of administration (Oral, Subcutaneous, Intravenous) By Distribution Channel (Online Pharmacies, Hospital Pharmacies, Retail Pharmacies) By Diabetes Type (Type 1, Type 2) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 125817

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

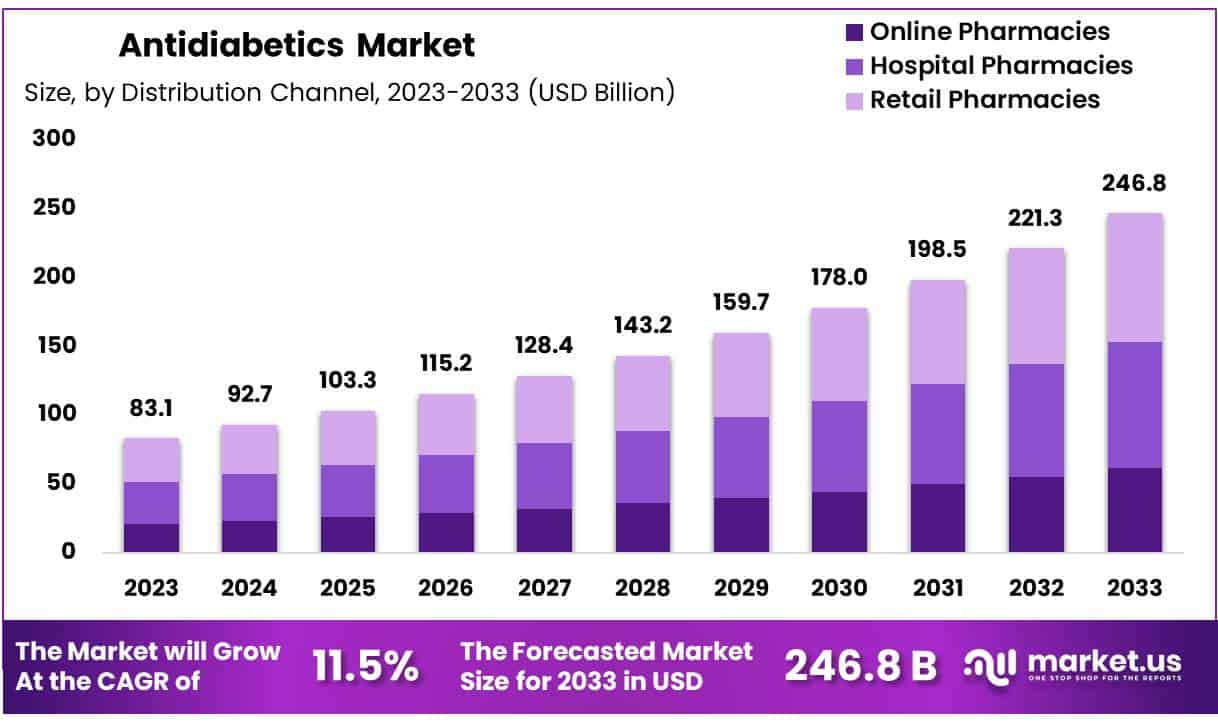

Global Antidiabetics Market size is expected to be worth around USD 246.8 Billion by 2033 from USD 83.1 Billion in 2023, growing at a CAGR of 11.5% during the forecast period from 2024 to 2033.

Antidiabetics, also known as oral hypoglycemic agents, are drugs designed primarily for treating diabetes. According to the International Diabetes Federation, global diabetes prevalence is expected to rise by 550 million by 2030. This increase is anticipated to significantly impact the growth of the antidiabetics market in the coming years.

Additionally, diabetes and obesity are closely linked and represent major public health challenges of the 21st century. Reports indicate that nearly 85% of individuals diagnosed with diabetes also suffer from obesity. Unregulated and irregular dietary habits contribute to the rising incidence of diabetes. In 2010, global obesity affected 1.3 billion adults and over 35 million children under five.

There has been significant progress in developing highly accurate diabetes therapies due to the rising demand for advanced treatment methods to meet the needs of the growing diabetic population worldwide. The COVID-19 pandemic has unexpectedly affected numerous businesses and adversely impacted the market. However, increasing financial recovery support from governments and other organizations is expected to stabilize the market in the coming years.

The antidiabetics market is expected to grow during the forecast period due to lifestyle changes and increased consumption of unhealthy food, which are contributing to the global rise in diabetes. The increasing incidence of diabetes is anticipated to lead to a substantial rise in demand for antidiabetic medications. Additionally, growing research and development activities are likely to have a positive impact on market growth. Increasing awareness of diabetes treatment presents one of the most significant opportunities for the antidiabetics market in emerging nations.

Key Takeaways

- Market Size: Antidiabetics Market size is expected to be worth around USD 246.8 Billion by 2033 from USD 83.1 Billion in 2023.

- Market Growth: The market growing at a CAGR of 11.5% during the forecast period from 2024 to 2033.

- Product Analysis: Insulin remains the dominant segment in 2023, capturing approximately 55% of the market share.

- Route of Administration: Oral is the dominating segment, accounting for approximately 45% of the market share in 2023.

- Distribution Channel Analysis: In 2023, hospital pharmacies emerged as the dominant segment, accounting for 37% of the market share.

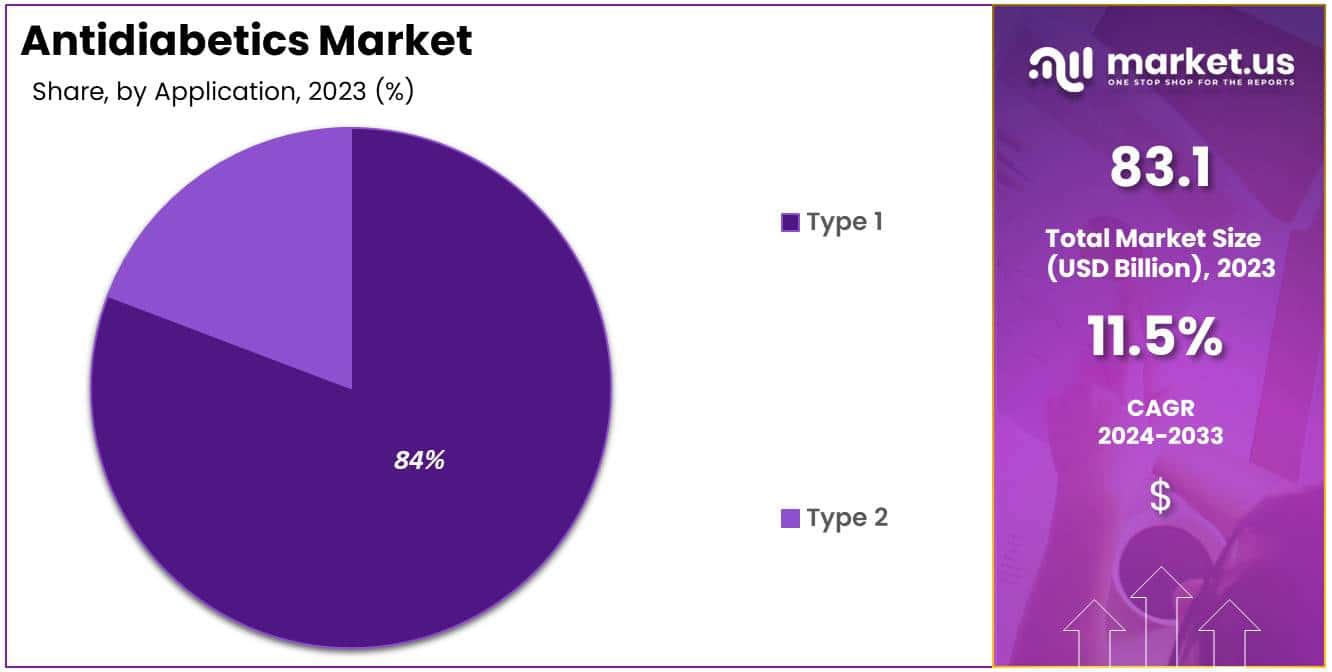

- Diabetes Type Analysis: Type 2 diabetes accounted for a dominant 84% of the market share.

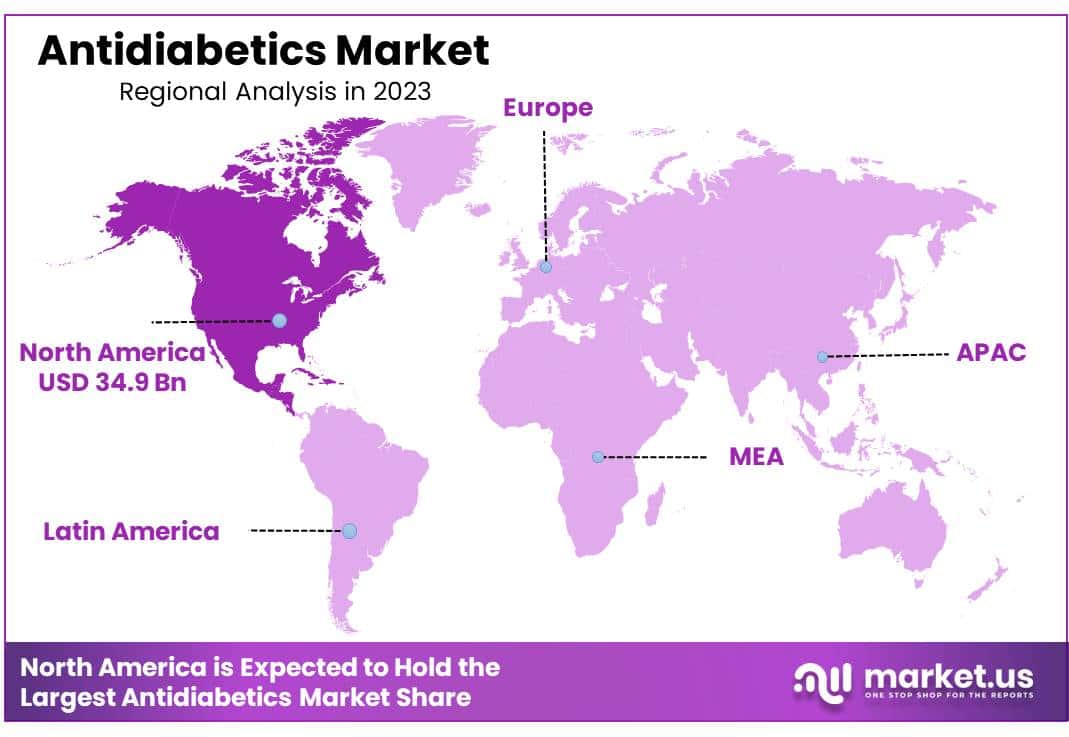

- Regional Analysis: In 2023, North America accounted for the largest share of the antidiabetics market, holding 42% of the total market.

Product Analysis

The antidiabetics market is segmented into several drug classes, including insulin, biguanides, sulfonylureas, DPP-4 inhibitors, GLP-1 receptor agonists, SGLT2 inhibitors, and others. Among these, insulin remains the dominant segment in 2023, capturing approximately 55% of the market share. This dominance can be attributed to the increasing prevalence of type 1 diabetes, where insulin is essential, and the rising incidence of type 2 diabetes, where insulin is often used when oral medications become insufficient.

Insulin’s market leadership is further driven by continuous advancements in insulin delivery methods, such as the development of insulin pumps and pens, which offer improved patient convenience and compliance. Additionally, the introduction of long-acting and ultra-rapid-acting insulin analogs has enhanced glucose control, contributing to their widespread adoption.

Other drug classes, such as DPP-4 inhibitors and SGLT2 inhibitors, are also gaining traction due to their efficacy and favorable side effect profiles. However, insulin’s established role in diabetes management and ongoing innovations ensure its continued prominence in the antidiabetics market.

Route of Administration

The antidiabetics market is segmented by route of administration into oral, subcutaneous, and intravenous categories. The oral route, which includes medications like metformin and sulfonylureas, remains the dominant segment, accounting for approximately 45% of the market share in 2023. This dominance is due to the convenience and non-invasiveness of oral medications, making them highly preferable for patients and healthcare providers alike. The oral route’s efficacy in managing Type 2 diabetes and its widespread availability contribute to its leading position in the market.

Subcutaneous administration, which includes insulin injections and glucagon-like peptide-1 (GLP-1) receptor agonists, holds a significant share in the market. This route is essential for managing Type 1 diabetes and advanced Type 2 diabetes cases. Innovations in insulin delivery systems, like insulin pens and insulin pumps, have enhanced patient compliance, boosting the subcutaneous segment’s growth.

The intravenous route, used primarily in hospital settings for acute glycemic management, represents a smaller portion of the market. It is typically reserved for critical care situations where rapid glucose control is required.

Distribution Channel Analysis

The antidiabetics market is segmented by distribution channel into hospital pharmacies, online pharmacies, and retail pharmacies. In 2023, hospital pharmacies emerged as the dominant segment, accounting for 37% of the market share. This prominence is due to the increasing number of diabetes patients requiring specialized care and hospital-based treatments, where medications are often dispensed directly through hospital pharmacies. Additionally, the presence of healthcare professionals in hospital settings ensures accurate dispensing and patient education, contributing to their significant market share.

Retail pharmacies hold a substantial portion of the market as well, driven by their widespread presence and accessibility, which makes it convenient for patients to obtain their medications. The availability of both prescription and over-the-counter antidiabetic drugs in retail pharmacies further supports their market position.

Online pharmacies are rapidly gaining traction due to the growing trend of digitalization and consumer preference for home delivery services. These platforms offer convenience, privacy, and competitive pricing, attracting a growing number of consumers. As the digital landscape evolves, online pharmacies are expected to capture an increasing share of the antidiabetics market.

Diabetes Type Analysis

The antidiabetics market is segmented by diabetes type into Type 1 and Type 2 diabetes. In 2023, Type 2 diabetes accounted for a dominant 84% of the market share. This substantial market share is primarily due to the higher prevalence of Type 2 diabetes compared to Type 1, largely driven by lifestyle factors such as poor diet, physical inactivity, and obesity. Type 2 diabetes is more common among adults and is increasingly diagnosed in younger populations, contributing to its significant market presence.

Type 2 diabetes management typically involves oral antidiabetic medications, which are widely used and continuously developed, further boosting this segment’s market share. The availability of a variety of treatment options, including newer non-insulin drugs and combination therapies, supports the dominance of the Type 2 diabetes segment.

Type 1 diabetes, though less prevalent, requires insulin therapy for management. While this segment represents a smaller portion of the market, advances in insulin delivery systems and monitoring technologies are driving growth. However, due to the lower incidence of Type 1 diabetes compared to Type 2, its market share remains comparatively smaller.

Key Market Segments

By Product

Insulin

- Rapid-acting analog

- Long-acting analog

- Premixed insulin

- Short-acting analog

- Intermediate-acting insulin

Drug class

- Alpha-glucosidase inhibitors

- Biguanides

- Sulphonylureas

- GLP-1 (Glucagon-like peptide) agonists

- DPP-IV (Dipeptidyl Peptidase) inhibitors

- Meglitinides

- SGLT-II (Sodium-Glucose Transport Proteins) inhibitors

- Thiazolidinedione

By Route of administration

- Oral

- Subcutaneous

- Intravenous

By Distribution Channel

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

By Diabetes Type

- Type 1

- Type 2

Driver

One of the main drivers of the antidiabetics market is the escalating prevalence of diabetes worldwide. Factors such as sedentary lifestyles, unhealthy diets, aging populations, and increasing obesity rates contribute to a higher incidence of Type 2 diabetes, fueling the demand for effective antidiabetic therapies.

Additionally, technological advancements in diabetes management, including continuous glucose monitoring systems and innovative insulin delivery devices, are significantly improving patient outcomes and adherence, further propelling market growth.

Trend

A notable trend in the antidiabetics market is the shift towards novel therapeutic approaches, including the development of non-insulin drugs and personalized medicine strategies. There is a growing focus on combination therapies, where two or more drugs are used synergistically to enhance glycemic control, minimize side effects, and improve patient compliance.

Additionally, the integration of digital health solutions, such as mobile applications and telemedicine, is becoming increasingly prevalent, offering patients more accessible and effective ways to monitor and manage their condition remotely.

Restraint

Despite its positive outlook, the market faces several restraints. High costs associated with advanced diabetes medications and treatments can limit accessibility for many patients, particularly in low- and middle-income countries.

Moreover, stringent regulatory requirements and lengthy approval processes for new drugs pose significant challenges for market participants, potentially delaying the introduction of innovative therapies and impacting market dynamics.

Opportunity

The antidiabetics market holds substantial opportunities for growth, especially in emerging economies where diabetes prevalence is rising rapidly. Increasing healthcare expenditure, improved healthcare infrastructure, and growing awareness of diabetes management are creating favorable conditions for market expansion. Additionally, ongoing investments in research and development aimed at producing more effective and affordable treatments offer further potential for market growth.

Developing targeted therapies and leveraging big data analytics to enhance treatment efficacy can meet the needs of an expanding diabetic population, paving the way for significant advancements in diabetes care.

Regional Analysis

In 2023, North America accounted for the largest share of the antidiabetics market, holding 42% of the total market. This dominance is largely attributed to the region’s high prevalence of diabetes, especially Type 2 diabetes, driven by lifestyle changes and an aging population. The well-developed healthcare infrastructure and significant healthcare expenditure in North America facilitate comprehensive diabetes management and treatment options, further reinforcing the market’s leadership.

Additionally, North America hosts several leading pharmaceutical companies and research institutions that focus on diabetes care and innovation. These organizations are at the forefront of developing and launching new antidiabetic drugs and technologies, contributing to the market’s growth. Continuous advancements in diabetes management, along with a strong focus on research and development, support the region’s prominent position in the global antidiabetics market. This commitment to innovation ensures that North America remains a key player in providing cutting-edge solutions for diabetes care.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The antidiabetics market is experiencing significant growth driven by the global prevalence of diabetes and advancements in drug research and technology, which have led to more effective and targeted treatment options. This growth presents substantial opportunities for major players to capitalize on the expanding demand. Key market participants are actively pursuing strategic initiatives, including mergers, acquisitions, and collaborations, to enhance their market share and address the increasing need for antidiabetic products and services.

For example, in February 2023, Akums Drugs and Pharmaceutical Limited, a leading contract drug manufacturing company in India, launched a new antidiabetic drug called ‘lobeglitazone.’ This novel medication is specifically designed for Type 2 diabetic patients and represents a significant advancement in diabetes care. Lobeglitazone works by improving pancreatic beta-cell function, thereby enhancing glycemic control. Such developments highlight the ongoing innovation in the antidiabetics market and underscore the efforts of industry leaders to provide better treatment options for managing diabetes.

Market Key Players

- AstraZeneca plc

- Bayer AG

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Boehringer Ingelheim

- Bristol-Myers Squibb Company

- Pfizer, Inc.

- Johnson & Johnson Services Inc.

- Merck & Co. Inc

- Novartis AG

Recent Developments

- AstraZeneca plc (February 2023) – AstraZeneca completed its acquisition of CinCor Pharma for $1.1 billion. This strategic move bolsters AstraZeneca’s portfolio with CinCor’s lead candidate, baxdrostat, an aldosterone synthase inhibitor. Baxdrostat is aimed at treating conditions like chronic kidney disease and hypertension, aligning with AstraZeneca’s focus on cardiovascular and metabolic diseases.

- Bayer AG (January 2023) – Bayer announced the launch of Kerendia, a novel treatment for patients with chronic kidney disease and Type 2 diabetes, in the U.S. The drug offers a new therapeutic approach by reducing the risk of cardiovascular events and slowing kidney disease progression, significantly expanding Bayer’s portfolio in the antidiabetics market.

- Takeda Pharmaceutical Company Limited (February 2023) – Takeda completed its acquisition of Nimbus Therapeutics’ TYK2 program subsidiary, strengthening its immunology pipeline. This acquisition includes the potential for developing treatments for multiple autoimmune diseases, such as psoriasis and inflammatory bowel disease, supporting Takeda’s strategic growth in related therapeutic areas.

Report Scope

Report Features Description Market Value (2023) USD 83.1 Billion Forecast Revenue (2033) USD 246.8 Billion CAGR (2024-2033) 11.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product, Insulin (Rapid-acting analog, Long-acting analog, Premixed insulin, Short-acting analog, Intermediate-acting insulin) Drug class (Alpha-glucosidase inhibitors, Biguanides, Sulphonylureas, GLP-1 (Glucagon-like peptide) agonists, DPP-IV (Dipeptidyl Peptidase) inhibitors, Meglitinides, SGLT-II (Sodium-Glucose Transport Proteins) inhibitors, Thiazolidinedione) By Route of administration (Oral, Subcutaneous, Intravenous) By Distribution Channel (Online Pharmacies, Hospital Pharmacies, Retail Pharmacies) By Diabetes Type (Type 1, Type 2) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape AstraZeneca plc, Bayer AG, Takeda Pharmaceutical Company Limited, Eli Lilly and Company, Boehringer Ingelheim, Bristol-Myers Squibb Company, Pfizer, Inc., Johnson & Johnson Services Inc., Merck & Co. Inc, Novartis AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AstraZeneca plc

- Bayer AG

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Boehringer Ingelheim

- Bristol-Myers Squibb Company

- Pfizer, Inc.

- Johnson & Johnson Services Inc.

- Merck & Co. Inc

- Novartis AG