Global Agrivoltaics Market Size, Share, And Business Benefits By System Design (Fixed Solar Panels Over Crops, Dynamic Agrivoltaic), By Crop Type (Leafy Greens (Lettuce, Spinach, Others), Root Crops (Potatoes, Radishes, Beets, Carrots, Others), Fruits and Other Crops), By Placement (Standalone, Shading Nets, Greenhouse, Others (Solar Fence, Solar Windows, etc.)), By Material Type (Panels, Paints), By Cell Type (Monocrystalline, Polycrystalline), By Crop Collaboration (Vegetables, Fruits, Crops, Others), By Type of Agrivoltaic Plant (Overhead Tilted, Interspace, Hybrid), By Type of Solar Panel (Opaque, Semi-Transparent, Transparent), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153782

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By System Design Analysis

- By Crop Type Analysis

- By Placement Analysis

- By Material Type Analysis

- By Cell Type Analysis

- By Crop Collaboration Analysis

- By Type of Agrivoltaic Plant Analysis

- By Type of Solar Panel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

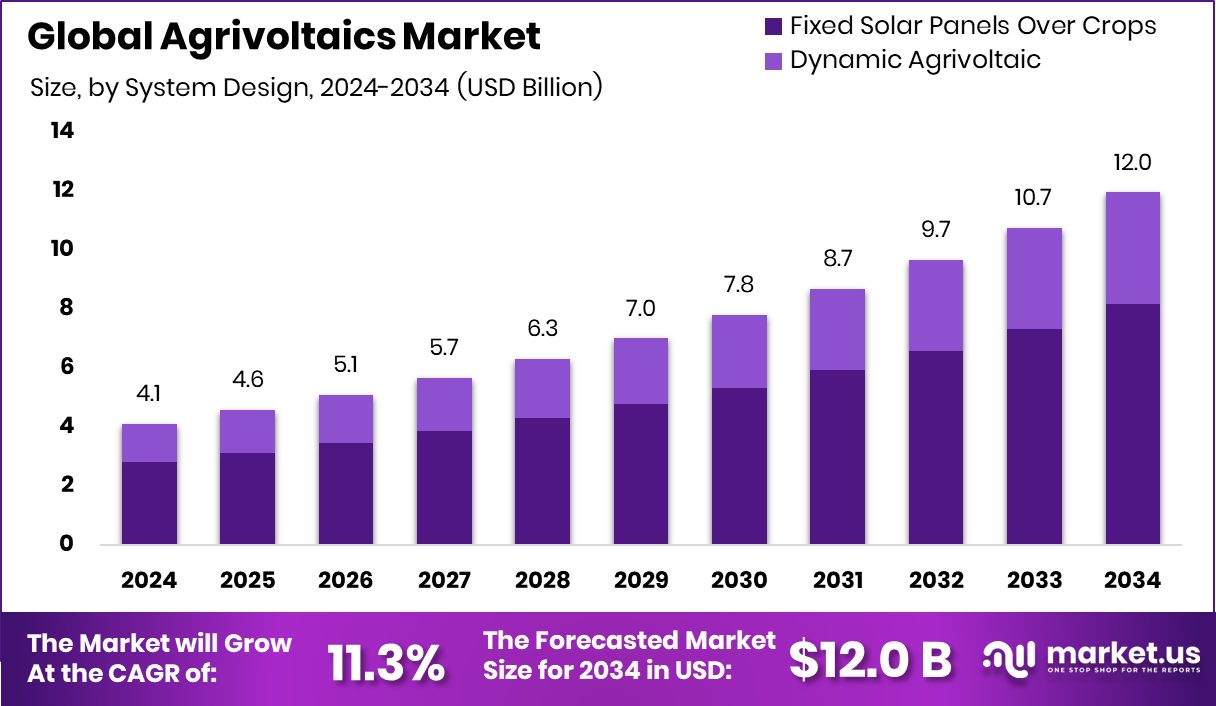

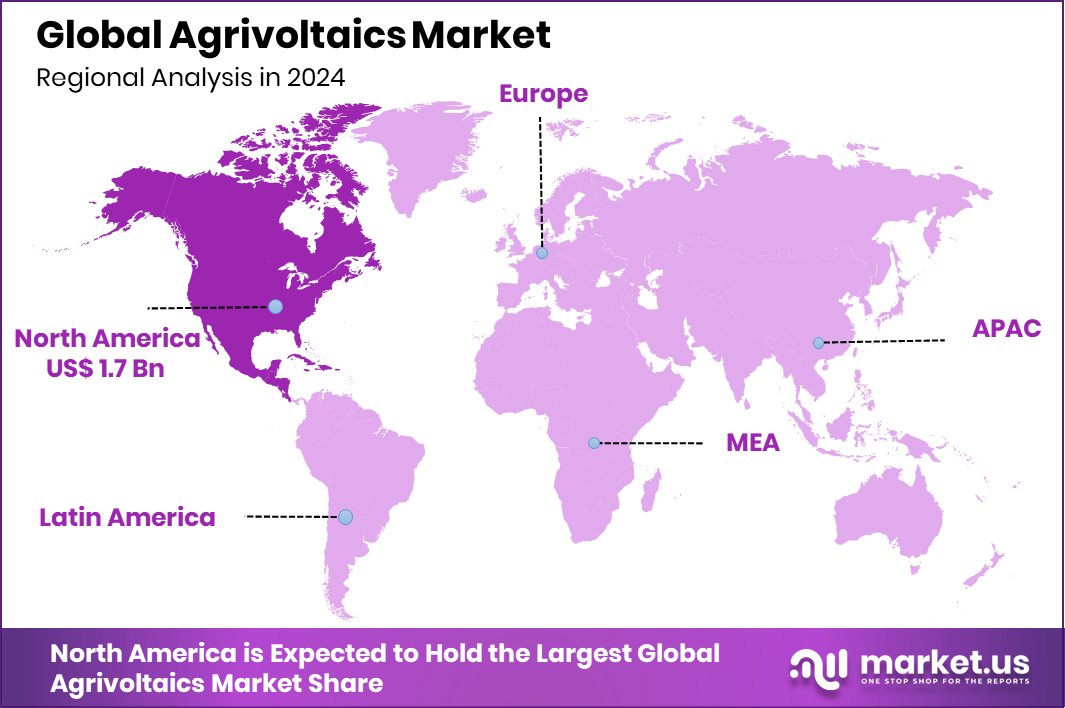

The Global Agrivoltaics Market is expected to be worth around USD 12.0 billion by 2034, up from USD 4.1 billion in 2024, and is projected to grow at a CAGR of 11.3% from 2025 to 2034. North America leads agrivoltaics adoption, capturing 42.8% share and USD 1.7 Bn.

Agrivoltaics is an innovative approach that combines solar energy production with agricultural activities on the same land. In this system, solar panels are installed above or between crop fields, enabling both farming and electricity generation to coexist. This dual-use model allows farmers to optimize land use, reduce water evaporation, protect crops from extreme weather, and generate additional income through solar power. The height, spacing, and angle of the panels are adjusted to ensure sufficient sunlight for plant growth, making the land more productive and sustainable in the long run.

The agrivoltaics market refers to the growing industry surrounding the development, installation, and integration of photovoltaic systems on farmland. It includes technology providers, agricultural stakeholders, and energy producers working together to create systems that support both crop cultivation and solar electricity. The market is gaining attention due to increasing land use pressure, climate change concerns, and the global shift toward renewable energy.

Demand for agrivoltaic systems is also growing due to their role in improving climate resilience. The partial shading from solar panels reduces heat stress on crops and conserves soil moisture, which is crucial in drought-prone areas. These benefits help stabilize food production under changing climate conditions, making agrivoltaics a valuable tool for farmers facing environmental stress.

Governments are increasingly recognizing agrivoltaics as a climate-smart solution. Incentives, subsidies, and policy frameworks are being introduced to promote dual land use. Many countries are funding research and demonstration projects, which help build confidence among farmers and accelerate adoption. This policy momentum presents a major opportunity for expanding agrivoltaic systems at scale.

Key Takeaways

- The Global Agrivoltaics Market is expected to be worth around USD 12.0 billion by 2034, up from USD 4.1 billion in 2024, and is projected to grow at a CAGR of 11.3% from 2025 to 2034.

- In the Agrivoltaics Market, fixed solar panels over crops account for a dominant 68.2% share.

- Fruits and other crops dominate by crop type in agrivoltaics, capturing around 56.4% market share.

- Standalone system placement leads with a 43.7% share in the global agrivoltaics market.

- Panels dominate by material type in the agrivoltaics market, holding a strong 87.1% share.

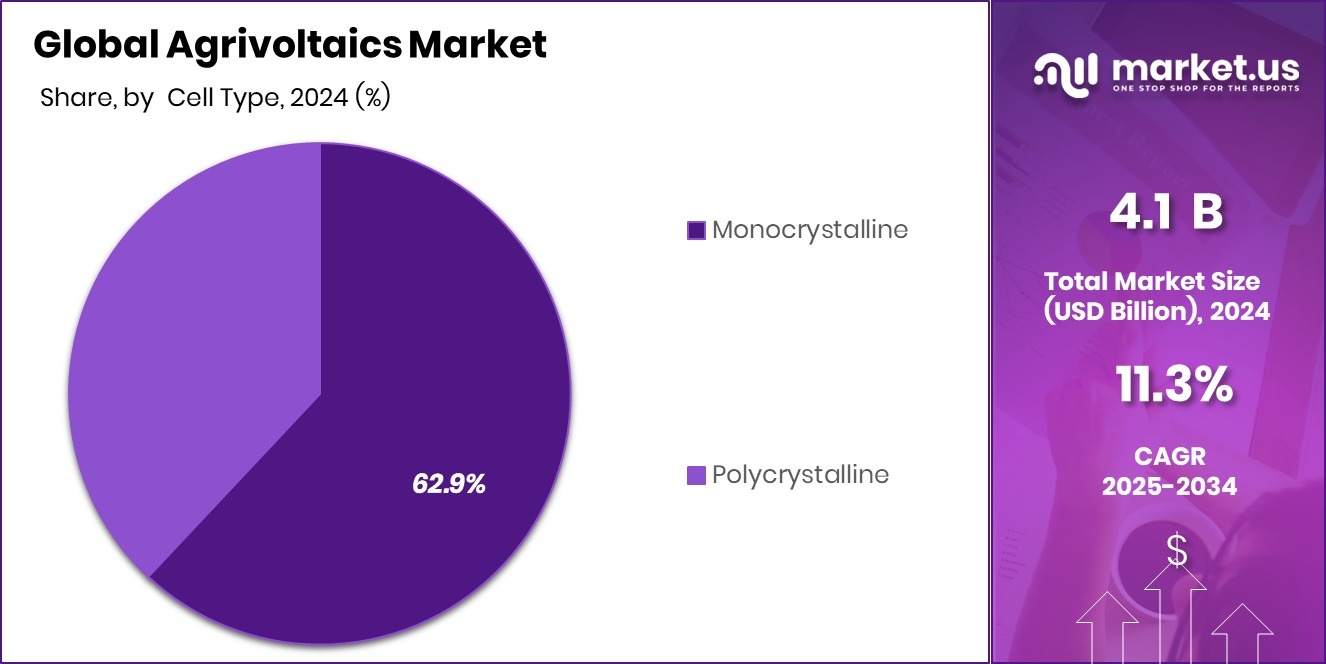

- Monocrystalline cells are preferred in agrivoltaic systems, contributing 62.9% to the overall market share.

- Vegetables are key in crop collaboration setups, accounting for approximately 45.8% in agrivoltaics projects.

- Overhead tilted structures are most widely used in agrivoltaics, securing a 46.1% share globally.

- Opaque solar panels are prominently used in agrivoltaics, holding 48.5% of the market share.

- Strong government support drives agrivoltaics growth in North America’s USD 1.7 Bn market.

By System Design Analysis

Fixed solar panels over crops dominate the agrivoltaics market with 68.2%.

In 2024, Fixed Solar Panels Over Crops held a dominant market position in the By System Design segment of the Agrivoltaics Market, with a 68.2% share. This system design has gained widespread acceptance due to its structural simplicity, lower installation costs, and compatibility with a wide range of crops. Fixed panel installations allow farmers to maintain consistent agricultural practices while generating renewable energy, making the system particularly attractive for rural and semi-urban regions with limited resources.

The stability of fixed panels provides predictable shading patterns, which can help reduce water evaporation from the soil and moderate ground temperatures—two critical factors for crop health in warmer climates.

Moreover, the reliability of these systems in terms of performance and maintenance has further contributed to their popularity among farmers seeking long-term returns. The dominant market share of 68.2% reflects a growing preference for cost-effective, low-maintenance solutions that can be easily integrated into existing farmland layouts.

By Crop Type Analysis

Fruits and other crops lead the crop type segment at 56.4%.

In 2024, Fruits and Other Crops held a dominant market position in the By Crop Type segment of the Agrivoltaics Market, with a 56.4% share. This leading position can be attributed to the compatibility of fruit-bearing plants and specialty crops with partial shading environments created by solar panels. Many fruits, such as berries, grapes, and certain vegetables, thrive under moderate sunlight, benefiting from reduced heat stress and improved soil moisture retention, which agrivoltaic systems naturally support.

The cultivation of these crops under solar panels not only helps in maintaining or even improving yield quality but also ensures better resource efficiency, particularly in regions experiencing rising temperatures and irregular rainfall. Farmers growing high-value fruits and niche crops have shown greater interest in adopting agrivoltaic setups as they offer dual benefits—consistent agricultural output and revenue from solar power generation.

The substantial 56.4% share reflects a clear trend where agrivoltaic installations are increasingly being aligned with crop types that respond well to controlled environmental conditions. As farmers continue to explore resilient farming methods, the integration of solar infrastructure with fruit and specialty crop cultivation is expected to sustain its dominance in this segment of the market.

By Placement Analysis

Standalone placement systems hold a 43.7% share in agrivoltaics adoption.

In 2024, Standalone held a dominant market position in the By Placement segment of the Agrivoltaics Market, with a 43.7% share. This placement model has emerged as the preferred option for many agricultural installations due to its flexibility and ease of integration into existing farm layouts. Standalone systems are typically installed on open agricultural land without requiring significant alterations to crop arrangement or field infrastructure, which helps minimize disruption to farming activities.

The popularity of standalone setups is also supported by their adaptability across various terrains and their potential for optimal sunlight exposure and energy output. These systems provide farmers the ability to manage both solar production and crop cultivation independently, enhancing operational efficiency and system reliability. Moreover, maintenance and inspection activities are generally more straightforward in standalone placements, reducing downtime and labor costs.

The 43.7% market share reflects the growing interest among farmers and landowners in adopting solutions that offer both energy independence and agricultural productivity. As agrivoltaics continues to evolve as a sustainable land-use strategy, the standalone placement model is expected to maintain its lead due to its practicality, scalability, and farmer-friendly design features.

By Material Type Analysis

Solar panel materials dominate with an 87.1% share in installations.

In 2024, panels held a dominant market position in the By Material Type segment of the Agrivoltaics Market, with an 87.1% share. This overwhelming market dominance highlights the widespread reliance on traditional photovoltaic panel structures in agrivoltaic installations. Panels are well-established in terms of technology maturity, energy efficiency, and durability, making them the preferred choice for integrating solar infrastructure within agricultural settings.

Their proven performance in diverse climatic conditions and long operational lifespan contributes significantly to their broad adoption. Panels are also favored for their ease of installation and compatibility with various mounting systems used in farmlands. In addition, the widespread availability of panel-based systems and supporting components further supports their stronghold in the market, allowing for easier deployment at scale.

The 87.1% share indicates a clear preference for established and cost-effective material options that provide both energy output and structural reliability. As the agrivoltaics market expands, panels are expected to remain central to system design choices due to their consistent energy generation capability and alignment with farmer expectations.

By Cell Type Analysis

Monocrystalline cells capture a 62.9% share in the agrivoltaics market demand.

In 2024, Monocrystalline held a dominant market position in the By Cell Type segment of the Agrivoltaics Market, with a 62.9% share. This leadership is primarily due to the high efficiency and long lifespan associated with monocrystalline solar cells, making them highly suitable for agrivoltaic systems where land productivity and energy output must be maximized simultaneously.

Monocrystalline technology is known for delivering superior energy conversion rates, which helps farmers and energy producers achieve higher electricity generation even in smaller installation footprints. Their sleek and compact design further supports seamless integration into fixed structures without interfering with crop growth. The ability to produce consistent output over time with minimal degradation also adds to their appeal in long-term farm planning and investment strategies.

With a 62.9% market share, monocrystalline cells clearly represent the preferred choice for agrivoltaic installations where performance and reliability are essential. Their dominance in this segment underlines the growing preference for high-efficiency cell technologies that can support sustainable farming practices while contributing significantly to renewable energy generation on agricultural land.

By Crop Collaboration Analysis

Vegetables hold a 45.8% share in crop collaboration with solar.

In 2024, Vegetables held a dominant market position in the By Crop Collaboration segment of the Agrivoltaics Market, with a 45.8% share. This significant share reflects the compatibility of vegetable cultivation with agrivoltaic systems, particularly in regions where managing heat stress, soil moisture, and sunlight exposure is essential for maintaining crop yield and quality.

The growth cycle of many vegetables aligns well with the energy production patterns of solar installations, allowing farmers to optimize both agricultural and energy outputs throughout the year. Additionally, vegetables often require intensive land use and frequent monitoring, making the integration of solar systems on such land more viable, especially when the panels are installed at a height that allows ease of access for farming activities.

With a 45.8% market share, vegetable cultivation under agrivoltaic setups has proven to be both economically and environmentally advantageous. The preference for this crop category underlines a broader shift toward efficient land use practices where food production and renewable energy generation can occur side by side without compromising output or quality in either domain.

By Type of Agrivoltaic Plant Analysis

Overhead tilted plants lead design types with a 46.1% share.

In 2024, Overhead Tilted held a dominant market position in the By Type of Agrivoltaic Plant segment of the Agrivoltaics Market, with a 46.1% share. This type of plant configuration has gained widespread adoption due to its structural design, which positions solar panels at an elevated height and at a tilted angle. The overhead placement allows sufficient sunlight to reach the crops below while also providing partial shading that helps reduce soil moisture loss and protect plants from excessive heat.

The tilted orientation of the panels enhances solar energy capture by aligning better with sun angles throughout the day, resulting in improved energy generation efficiency. This system is particularly effective in regions with high solar irradiance, where optimal panel positioning can significantly improve returns. Moreover, the elevated structure ensures that farming activities, including irrigation, machinery movement, and manual crop handling, are not obstructed.

With a 46.1% share, the dominance of the overhead tilted type in agrivoltaic plant setups reflects a practical balance between agricultural productivity and solar power generation. Its adaptable design and operational benefits make it a preferred choice for landowners seeking to maximize land utility while supporting sustainable and climate-resilient farming practices.

By Type of Solar Panel Analysis

Opaque solar panels dominate with a 48.5% share in usage.

In 2024, Opaque held a dominant market position in the By Type of Solar Panel segment of the Agrivoltaics Market, with a 48.5% share. This dominance is largely attributed to the high energy efficiency and cost-effectiveness of opaque solar panels, which have been widely adopted in agrivoltaic installations. These panels are known for capturing maximum sunlight for electricity generation, making them highly suitable for farmers looking to enhance on-site energy output without requiring complex infrastructure.

The solid structure of opaque panels also provides a degree of shade over crops, which can help in reducing soil moisture loss and protecting plants from excessive sunlight exposure—particularly beneficial in regions prone to heatwaves or prolonged sun intensity. While they block direct sunlight, strategic placement and spacing ensure that sufficient light reaches the crops, allowing for a functional balance between power generation and plant growth.

With a market share of 48.5%, the preference for opaque panels underlines the emphasis on performance and energy yield in agrivoltaic systems. Their durability, availability, and efficiency make them a reliable solution for dual land use, supporting both agricultural productivity and clean energy goals. This strong market presence reflects ongoing trust in traditional photovoltaic technologies within the agrivoltaics space.

Key Market Segments

By System Design

- Fixed Solar Panels Over Crops

- Dynamic Agrivoltaic

By Crop Type

- Leafy Greens

- Lettuce

- Spinach

- Others

- Root Crops

- Potatoes

- Radishes

- Beets

- Carrots

- Others

- Fruits and Other Crops

By Placement

- Standalone

- Shading Nets

- Greenhouse

- Others (Solar Fence, Solar Windows, etc.)

By Material Type

- Panels

- Paints

By Cell Type

- Monocrystalline

- Polycrystalline

By Crop Collaboration

- Vegetables

- Fruits

- Crops

- Others

By Type of Agrivoltaic Plant

- Overhead Tilted

- Interspace

- Hybrid

By Type of Solar Panel

- Opaque

- Semi-Transparent

- Transparent

Driving Factors

Rising Land Use Pressure Encourages Dual Utilization

One of the main driving factors for the agrivoltaics market is the increasing pressure on land resources. As populations grow and urban development expands, available agricultural land is becoming limited. At the same time, there is a rising demand for renewable energy and food production. Agrivoltaics offers a smart solution by allowing both solar energy generation and farming on the same land.

This dual use improves land efficiency and helps avoid competition between the energy and agriculture sectors. By producing electricity without removing farmland from cultivation, farmers can secure extra income and contribute to clean energy targets. This land optimization approach is gaining attention from governments, farmers, and developers as a sustainable strategy for future land management.

Restraining Factors

High Initial Installation Costs Limit Adoption

A key restraining factor for the agrivoltaics market is the high upfront cost of installing solar panel systems on farmland. These systems often require customized mounting structures, electrical connections, and adjustments in farm layout, which can be expensive for small and medium-sized farmers. In many cases, farmers may not have easy access to financing or subsidies to cover these costs.

Even though agrivoltaics can offer long-term savings and income, the initial investment can act as a barrier. This financial challenge is especially prominent in developing regions where capital availability is low. Without adequate financial support or incentives, many farmers remain hesitant to adopt this dual-use model despite its long-term environmental and economic benefits.

Growth Opportunity

Government Incentives Promote Solar-Farming Integration

A major growth opportunity in the agrivoltaics market comes from rising government support. Many countries are introducing subsidies, tax benefits, and grant programs to encourage farmers to adopt solar energy systems on agricultural land. These incentives reduce the financial burden of installation and make the technology more accessible to small and medium-sized farmers.

In addition, national renewable energy targets and rural development policies are supporting pilot projects and long-term investments in agrivoltaics. As climate change and land scarcity become pressing issues, policymakers are viewing this dual-use model as a smart solution for sustainable development. With continued policy backing, more farmers are likely to adopt agrivoltaic systems, driving strong market growth in the coming years.

Latest Trends

Transparent Solar Panels Gain Growing Popularity

One of the latest trends in the agrivoltaics market is the increasing use of transparent solar panels. These panels allow more sunlight to pass through, which helps crops grow better under the solar structures. Unlike traditional opaque panels, transparent designs strike a better balance between light for plants and power generation. This technology is being tested and adopted on farms where crops require more direct sunlight.

It helps maintain healthy plant growth while still generating clean energy. As more research supports their benefits, farmers and developers are exploring transparent panels as a smart solution for certain crops. Their growing use reflects a shift toward more crop-friendly solar systems that can support both farming and renewable energy goals.

Regional Analysis

North America held a 42.8% share in the agrivoltaics market, worth USD 1.7 Bn.

In 2024, North America held a dominant position in the global agrivoltaics market, accounting for 42.8% of the total share, valued at approximately USD 1.7 billion. The region’s leadership can be attributed to favorable government policies, growing emphasis on sustainable farming, and the adoption of renewable energy technologies in agriculture. Extensive farmland availability combined with increasing awareness among farmers has further supported the implementation of agrivoltaic systems across the United States and Canada.

Europe is also witnessing the steady adoption of agrivoltaics as part of its broader energy transition and sustainable agriculture initiatives. Support from regional governments and EU-backed pilot programs is fostering interest in dual-use land strategies across several member states.

In Asia Pacific, agrivoltaics adoption is progressing as countries explore ways to maximize limited arable land while addressing growing energy needs. Regions with high population densities are showing increasing interest in combining solar infrastructure with food production to ensure both energy security and agricultural output.

Middle East & Africa and Latin America are in the early stages of adoption, with growing awareness and interest in integrating solar solutions on farmlands. Although these regions currently represent a smaller share, supportive policies and climate advantages may drive gradual expansion in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Agrivoltaic Solution LLC remained a focused contributor in the niche space of dual-use solar-agriculture systems. The company continued delivering tailored agrivoltaic infrastructure for small and medium-scale farms, emphasizing crop-specific shading designs and modular PV structures. Their customized solutions helped address local agricultural needs, enhancing land productivity in regions facing arable land scarcity.

BayWa AG, a major force in renewable energy, significantly advanced its agrivoltaics portfolio in 2024 by integrating large-scale solar farms with agricultural land. With its experience in both agriculture and solar project development, BayWa utilized its dual-sector expertise to deploy agrivoltaic installations across Germany, the Netherlands, and parts of Southern Europe. Their projects focused on combining solar panels with crops like berries and leafy greens, promoting both energy yield and sustainable farming practices.

Boralex, known for renewable energy generation, expanded its strategy into agrivoltaics by exploring feasibility studies and pilot installations in Canada and France during 2024. While not a core focus, the company used agrivoltaics as a diversification approach in underutilized lands and community solar schemes. Boralex’s efforts in aligning agrivoltaic development with rural revitalization plans highlighted its long-term sustainability goals.

Enel Green Power, a global renewable energy leader, continued piloting agrivoltaic projects in Italy and Chile during 2024. These installations aimed at enhancing biodiversity, supporting local farmers, and increasing solar plant social acceptance. The company’s global reach, technological resources, and integration with regenerative agriculture positioned it as a strategic influencer in scaling agrivoltaics globally through public-private partnerships.

Top Key Players in the Market

- Agrivoltaic Solution LLC

- BayWa AG

- Boralex

- Enel Green Power

- Insolight SA

- JA Solar Holdings Co. Ltd.

- Mirai Solar

- Namaste Solar

- Next2Sun Technology GmbH

- Ombrea

- REM TEC

- SunAgri

- SunSeed APV Private Limited

- Suntech Power Holdings

- TotalEnergies SE

Recent Developments

- In February 2025, Insolight organized multiple conferences across Italy to present its agrivoltaic solutions. The events highlighted the agronomic and economic benefits, system design, and business model behind insolagrin. Insolight is also in the authorization phase to build a 2‑hectare pilot facility in Forlì, intended for blueberries, strawberries, and raspberries.

- In August 2024, Enel Green Power develops renewable energy projects worldwide, including solar installations that integrate agricultural activities like crop growing, livestock grazing, or pollinator habitats—a dual‑use approach defined as agrivoltaics or ecovoltaics.

Report Scope

Report Features Description Market Value (2024) USD 4.1 Billion Forecast Revenue (2034) USD 12.0 Billion CAGR (2025-2034) 11.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By System Design (Fixed Solar Panels Over Crops, Dynamic Agrivoltaic), By Crop Type (Leafy Greens (Lettuce, Spinach, Others), Root Crops (Potatoes, Radishes, Beets, Carrots, Others), Fruits and Other Crops), By Placement (Standalone, Shading Nets, Greenhouse, Others (Solar Fence, Solar Windows, etc.)), By Material Type (Panels, Paints), By Cell Type (Monocrystalline, Polycrystalline), By Crop Collaboration (Vegetables, Fruits, Crops, Others), By Type of Agrivoltaic Plant (Overhead Tilted, Interspace, Hybrid), By Type of Solar Panel (Opaque, Semi-Transparent, Transparent) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agrivoltaic Solution LLC, BayWa AG, Boralex, Enel Green Power, Insolight SA, JA Solar Holdings Co. Ltd., Mirai Solar, Namaste Solar, Next2Sun Technology GmbH, Ombrea, REM TEC, SunAgri, SunSeed APV Private Limited, Suntech Power Holdings, TotalEnergies SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agrivoltaic Solution LLC

- BayWa AG

- Boralex

- Enel Green Power

- Insolight SA

- JA Solar Holdings Co. Ltd.

- Mirai Solar

- Namaste Solar

- Next2Sun Technology GmbH

- Ombrea

- REM TEC

- SunAgri

- SunSeed APV Private Limited

- Suntech Power Holdings

- TotalEnergies SE