Global Agricultural Testing Market Size, Share, And Enhanced Productivity By Sample (Soil, Water, Seed, Compost, Manure, Biosoilds, Plant Tissue), By Application (Safety Testing, Quality Assurance), By Technology (Conventiona, Rapid), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174098

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

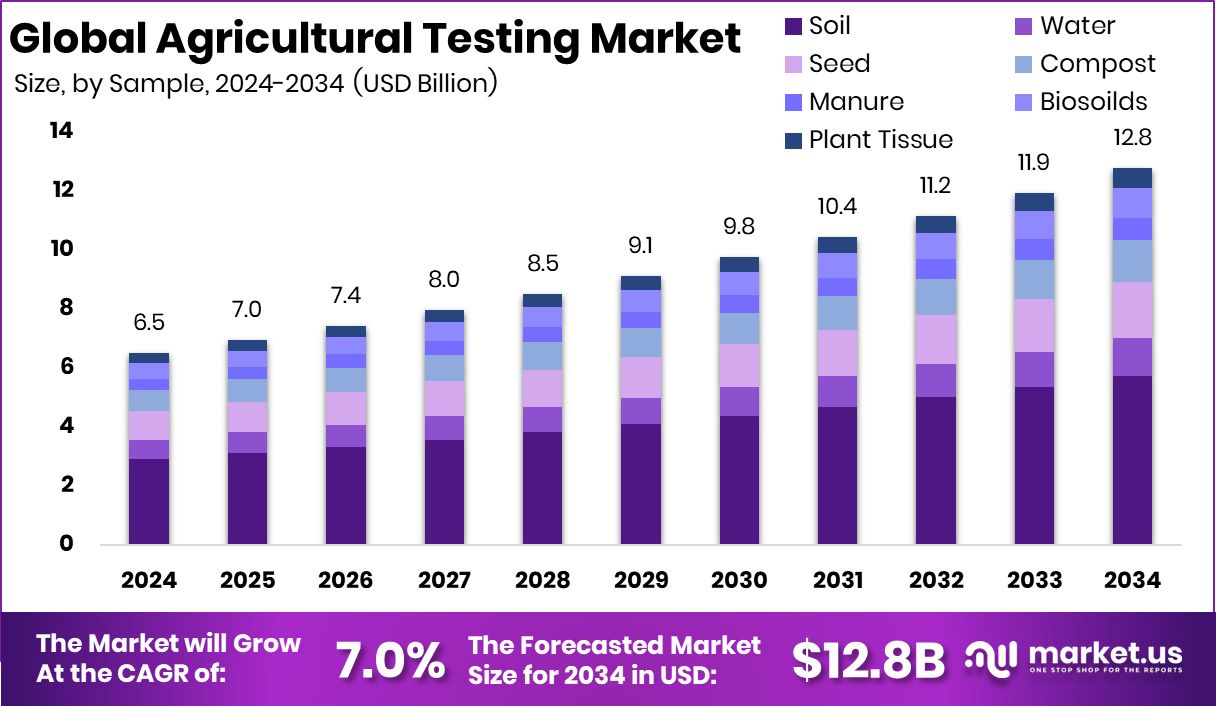

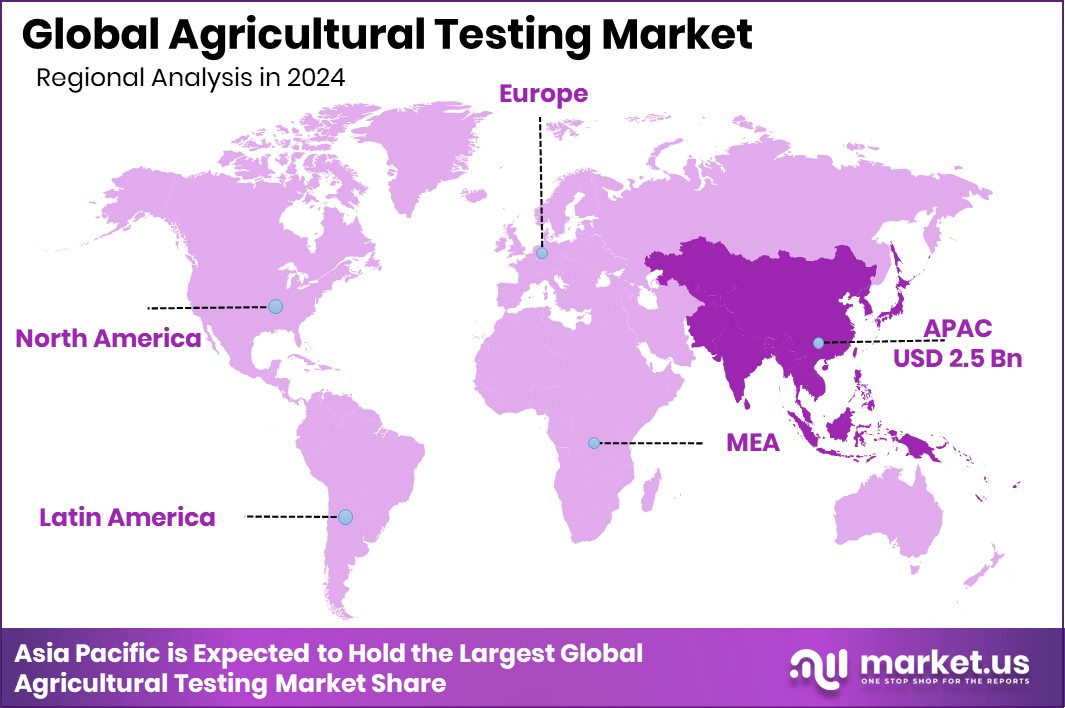

The Global Agricultural Testing Market is expected to be worth around USD 12.8 billion by 2034, up from USD 6.5 billion in 2024, and is projected to grow at a CAGR of 7.0% from 2025 to 2034. Rapid farming expansion positioned Asia Pacific at 38.9%, generating USD 2.5 Bn market value.

Agricultural testing is the process of checking soil, water, crops, seeds, and farm inputs to understand quality, safety, and performance. It helps farmers know nutrient levels, contamination risks, and crop health before and after cultivation. Testing supports better decisions on fertilizer use, irrigation, and crop protection, improving yields while protecting soil and ecosystems.

The Agricultural Testing Market covers services and tools used to analyze agricultural samples for safety, quality, and sustainability. It plays a key role in modern farming systems, food supply chains, and environmental protection. Public and academic support remains strong, shown by College of Agriculture researchers securing $106 million in grant funding, while a €30M ecosystem project is testing regenerative agriculture at landscape level to improve long-term soil outcomes.

Growth factors are closely linked to soil conservation and sustainable land use. Governments and institutions are investing heavily, including nearly $500M requested by Florida agencies for land conservation, and $14.6 million in new funding to help farmers protect soil and water. These initiatives directly increase demand for soil and environmental testing.

Demand is rising as regenerative and data-driven farming expands. Investments such as €30.5M poured into India’s Varaha, €1.5M secured by Elaniti for soil intelligence, and €2.1M raised by Citizens of Soil reflect growing need for accurate testing to support sustainable production.

Opportunities continue to emerge despite funding challenges, including $66 million in federal research funding losses in South Dakota, balanced by grassroots support like a $2K student soil research grant. These shifts highlight long-term opportunities for agricultural testing in education, innovation, and ecosystem protection.

Key Takeaways

- The Global Agricultural Testing Market is expected to be worth around USD 12.8 billion by 2034, up from USD 6.5 billion in 2024, and is projected to grow at a CAGR of 7.0% from 2025 to 2034.

- Soil sampling leads the Agricultural Testing Market with 44.8%, driven by rising soil health monitoring needs.

- Safety Testing dominates the Agricultural Testing Market at 62.7%, supporting food quality, export compliance, and consumer trust.

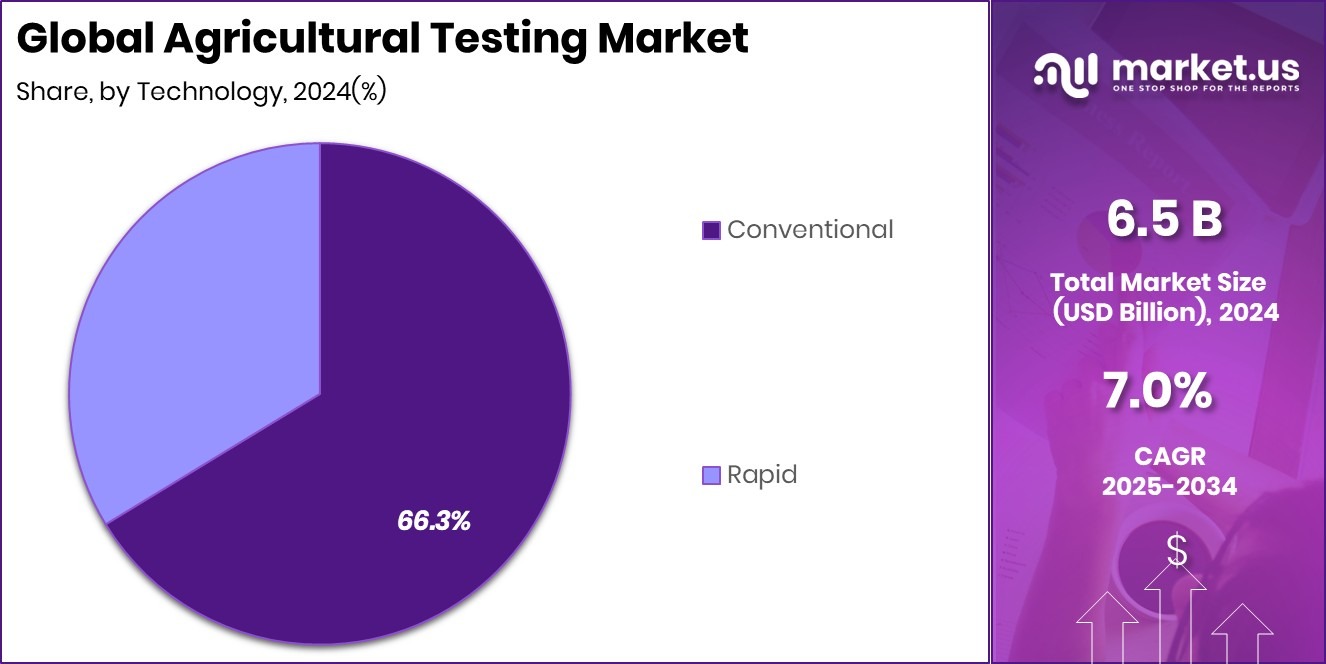

- Conventional technology holds 66.3% share in the Agricultural Testing Market due to affordability, reliability, and wide laboratory adoption.

- The Asia Pacific Agricultural Testing Market reached USD 2.5 Bn, holding a strong 38.9% regional share.

By Sample Analysis

In Agricultural Testing Market, soil samples dominate with 44.8% share globally today.

In 2024, soil samples held a dominant position in the Agricultural Testing Market with a 44.8% share, as soil health remains the foundation of crop productivity and sustainable farming. Farmers increasingly rely on soil testing to understand nutrient balance, pH levels, organic matter, and contamination risks before planting. Rising fertilizer costs and soil degradation concerns are pushing growers to optimize input use through regular soil analysis.

Government-supported soil health card programs and precision agriculture adoption are further strengthening demand. Soil testing also supports long-term land management decisions, helping farmers improve yields while reducing environmental impact. As climate variability affects soil conditions, demand for frequent and accurate soil testing continues to rise across both developed and emerging agricultural economies.

By Application Analysis

Within Agricultural Testing Market, safety testing leads applications holding 62.7% demand worldwide.

In 2024, safety testing dominated the Agricultural Testing Market by application, accounting for a 62.7% share, driven by stricter food safety regulations and growing export requirements. Governments and international trade bodies mandate testing for pesticide residues, heavy metals, pathogens, and mycotoxins to ensure consumer safety. Food processors and exporters increasingly depend on safety testing to meet compliance standards and avoid shipment rejections.

Rising consumer awareness around food quality and traceability is also influencing producers to invest more in testing. Safety testing plays a key role in protecting brand reputation and maintaining access to premium markets, making it a critical service across grains, fruits, vegetables, and processed agricultural products.

By Technology Analysis

In Agricultural Testing Market, conventional technologies remain preferred, capturing 66.3% adoption rates.

In 2024, conventional technologies led the Agricultural Testing Market with a 66.3% share, reflecting their reliability, affordability, and widespread acceptance. Traditional laboratory-based methods such as wet chemistry, chromatography, and culture techniques continue to be trusted for accurate and standardized results. Many regulatory frameworks still recognize conventional testing as the reference method, supporting its continued dominance.

Small and mid-sized laboratories prefer conventional tools due to lower upfront investment and skilled workforce availability. While advanced and rapid testing technologies are gaining interest, conventional methods remain the backbone of agricultural testing, especially in regions with limited access to high-end digital or automated systems, ensuring consistent and dependable analysis outcomes.

Key Market Segments

By Sample

- Soil

- Water

- Seed

- Compost

- Manure

- Biosoilds

- Plant Tissue

By Application

- Safety Testing

- Quality Assurance

By Technology

- Conventional

- Rapid

Driving Factors

Water Quality Investments Drive Agricultural Testing Demand

Water quality protection is a major driving factor for the Agricultural Testing Market, as farming depends heavily on clean and safe water sources. Governments and financial institutions are increasing support for monitoring water used in irrigation and food production. Montana offering $1.5M in grants for water quality projects shows how public funding is encouraging regular testing of soil runoff, groundwater, and surface water near farms.

At the same time, private capital is strengthening this push, with Incofin’s safe drinking water fund raising €61m at final close to support long-term water safety initiatives. These investments increase the need for agricultural testing services to measure contamination, nutrient leakage, and compliance with water standards, making testing an essential tool for sustainable farming systems.

Restraining Factors

Infrastructure Gaps Slow Testing Expansion Across Regions

Limited infrastructure and uneven funding act as a key restraining factor for the Agricultural Testing Market. While innovation is growing, access to testing facilities and advanced tools remains uneven, especially in rural areas. Private investment such as Burnt Island Ventures raising a $50 million fund for water technology and infrastructure highlights the need to modernize systems, but progress takes time.

Public funding also remains fragmented, as seen in $4 million allocated for water projects under an Arizona funding bill, which may not fully meet regional testing needs. These gaps slow the adoption of regular agricultural testing, delay sample analysis, and limit farmer participation, especially where budgets and technical resources remain constrained.

Growth Opportunity

Water Remediation Settlements Open New Testing Opportunities

Environmental remediation and water protection settlements are creating strong growth opportunities for the Agricultural Testing Market. Legal and regulatory actions increasingly require long-term monitoring of soil and water quality in affected farming regions. A clear example is AG Mayes securing an $11M Riverview settlement for Sulphur Springs Valley water, which supports cleanup and ongoing testing efforts.

Such settlements increase demand for agricultural testing services to track contamination levels, assess recovery progress, and ensure safe agricultural use of land and water. These initiatives create steady, long-term testing needs, opening opportunities for expanded laboratory services, field sampling, and continuous environmental monitoring across agricultural landscapes.

Latest Trends

Large Water Funds Shape Modern Testing Practices

A key latest trend in the Agricultural Testing Market is the growing role of large water-focused investment funds and regeneration programs. Institutional capital is moving toward ecosystem protection, directly supporting testing and monitoring activities. Water corporates investing into Emerald’s new $200m water fund signal strong interest in data-backed water management, which relies on accurate agricultural testing.

At the regional level, Anglian Water launching a £11m Catchment Regeneration Fund supports soil and water monitoring at farm level. These initiatives encourage routine testing, digital tracking, and preventive analysis, making agricultural testing a core part of modern water and land management strategies.

Regional Analysis

Asia Pacific leads the Agricultural Testing Market with 38.9% share, valued at USD 2.5 Bn.

Asia Pacific dominates the Agricultural Testing Market, holding a leading 38.9% share and valued at USD 2.5 Bn, making it the largest regional contributor globally. This dominance is supported by extensive agricultural activity, large farming populations, and rising awareness of soil quality, crop safety, and yield optimization across the region. Countries within Asia Pacific rely heavily on testing services to manage soil fertility, monitor residue levels, and support export-oriented agriculture, reinforcing its strong market position.

In contrast, North America represents a mature and well-structured market, driven by established testing practices and strong regulatory oversight, although it trails Asia Pacific in overall market share.

Europe follows with steady demand linked to food safety compliance and standardized agricultural quality norms. The Middle East & Africa region shows developing market characteristics, where testing adoption is gradually improving alongside modernization of farming practices.Latin America reflects growing interest in agricultural testing as commercial farming expands, particularly for export crops.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

SGS continues to play a critical role in the global Agricultural Testing Market through its broad testing portfolio and strong laboratory network. The company’s long-standing expertise in quality, safety, and compliance enables agricultural producers to meet regulatory and trade requirements with confidence. SGS supports soil, crop, and residue testing using standardized procedures, helping farmers and agribusinesses improve productivity while managing risk. Its global reach allows consistent testing practices across regions, which is especially valuable for export-driven agricultural supply chains.

Eurofins stands out for its strong scientific depth and focus on analytical precision in agricultural testing. The company is widely recognized for advanced laboratory capabilities covering soil analysis, food safety, and environmental testing linked to agriculture. Eurofins’ emphasis on data accuracy and method validation supports informed decision-making for growers, processors, and regulators. Its ability to handle complex sample matrices strengthens trust among stakeholders focused on compliance, sustainability, and long-term soil and crop health management.

Intertek maintains a solid position by offering integrated agricultural testing and assurance services. The company supports quality verification across agricultural inputs and outputs, helping clients align with safety standards and market expectations. Intertek’s balanced approach between testing, inspection, and certification adds value for agricultural businesses seeking reliable, end-to-end quality assurance solutions in 2024.

Top Key Players in the Market

- SGS

- Eurofins

- Intertek

- Bureau Veritas

- ALS Limited

- TUV Nord Group

- Merieux

- AsureQuality

- RJ Hill Laboratories Limited

- SCS Global

- Agrifood Technology

Recent Developments

- In July 2025, the food testing operations of Bureau Veritas in Ecuador were acquired by Mérieux NutriSciences, strengthening the buyer’s food safety testing footprint in Latin America. This included laboratories focused on microbiological, chemical, pesticide, and related analyses – areas closely tied to agricultural product testing.

- In June 2024, ALS Limited successfully acquired Wessling Group, a European laboratory testing business strong in environmental, pharmaceutical, and food analysis. This deal expanded ALS’s scientific testing capabilities and strengthened its presence across multiple European countries. Wessling’s expertise supports testing that can include agriculture-related soil and environmental assessments

Report Scope

Report Features Description Market Value (2024) USD 6.5 Billion Forecast Revenue (2034) USD 12.8 Billion CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Sample (Soil, Water, Seed, Compost, Manure, Biosoilds, Plant Tissue), By Application (Safety Testing, Quality Assurance), By Technology (Conventiona, Rapid) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SGS, Eurofins, Intertek, Bureau Veritas, ALS Limited, TUV Nord Group, Merieux, AsureQuality, RJ Hill Laboratories Limited, SCS Global, Agrifood Technology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agricultural Testing MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Agricultural Testing MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- SGS

- Eurofins

- Intertek

- Bureau Veritas

- ALS Limited

- TUV Nord Group

- Merieux

- AsureQuality

- RJ Hill Laboratories Limited

- SCS Global

- Agrifood Technology