Global Agricultural Biologicals Market Size, Share Analysis Report By Crop-Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others), By Product (Biopesticides, Biostimulants, Biofertilizers, Others), By Application (Biofertilizers, Seed Treatment, Soil Treatment, Post-Harvest) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155651

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

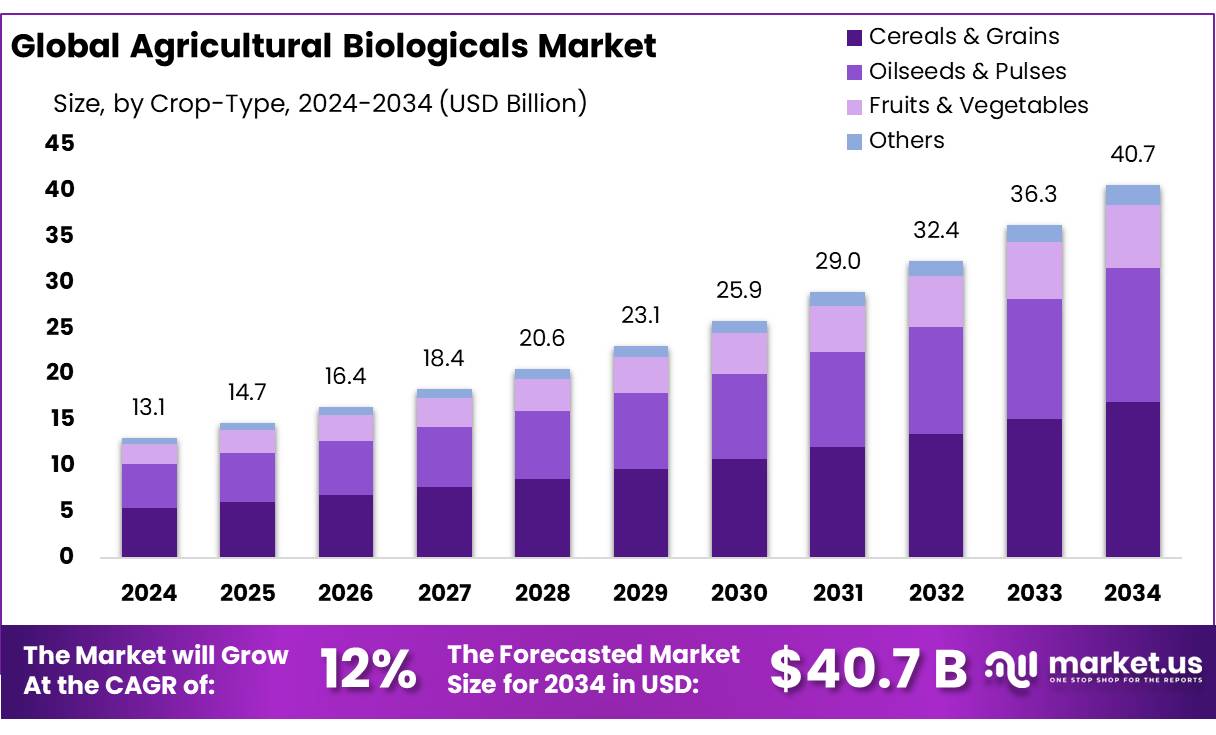

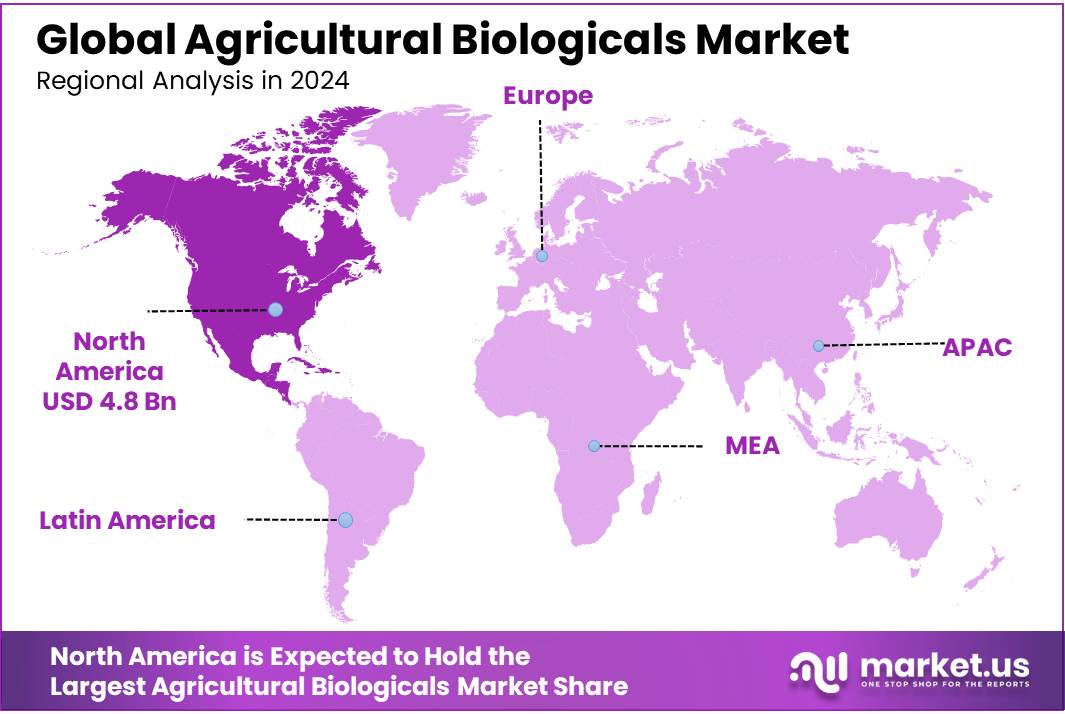

The Global Agricultural Biologicals Market size is expected to be worth around USD 40.7 Billion by 2034, from USD 13.1 Billion in 2024, growing at a CAGR of 12.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.3% share, holding USD 4.8 Billion revenue.

Agricultural Biologicals Concentrates (ABCs) are high-strength formulations of microbials, botanicals, biopesticides and biostimulants designed for efficient dilution at the point of use. By shipping actives in concentrated form, suppliers cut transport, packaging and storage costs while improving tank-mix compatibility for foliar, seed-treatment and fertigation programs.

Their appeal aligns with integrated pest management (IPM) and residue-reduction goals as regulators and growers look for lower-risk tools to complement or replace conventional chemistries. In the U.S., EPA maintains and updates the national list of biopesticide active ingredients (biochemical and microbial), underscoring regulatory visibility and a growing toolbox for registrants.

Europe offers regulatory clarity for plant biostimulants via the EU Fertilising Products Regulation (EU) 2019/1009 (CE-marking since July 2022), which has catalyzed label harmonization and cross-border trade for biological concentrates positioned as fertilizers/biostimulants rather than plant protection products. Within crop protection, the European Commission’s Farm-to-Fork strategy set headline targets to cut both the use and risk of chemical pesticides by 50% by 2030, a policy signal that continues to steer innovation and adoption of biologicals.

Government initiatives are accelerating uptake and manufacturing scale. In India, the National Mission on Natural Farming (NMNF) approved in November 2024 allocates ₹2,481 crore (₹1,584 crore central; ₹897 crore states) to promote chemical-free practices across 7.5 lakh hectares via 15,000 clusters and 10,000 bio-input resource centres—directly stimulating local production and distribution of biological concentrates.

In parallel, the PM-PRANAM scheme rewards states by returning 50% of fertilizer-subsidy savings when they cut chemical fertilizer use, strengthening the economics for bio-inputs. In the U.S., USDA’s $300 million Organic Transition Initiative—plus up to $100 million for the Transition to Organic Partnership Program and $75 million in Organic Market Development Grants—funds training, technical assistance and processing capacity that expand organic and IPM systems where ABCs are a natural fit.

The future of the agricultural biologicals market in India looks promising, with several growth opportunities on the horizon. The increasing export potential of organic fruits and vegetables, with the Agricultural and Processed Food Products Export Development Authority (APEDA) reporting USD 770.70 million in fresh fruit and USD 864.24 million in vegetable exports in 2022-23, is expected to drive the demand for biostimulants that enhance crop quality and shelf life.

Key Takeaways

- The Agricultural Biologicals Market is projected to reach USD 40.7 billion by 2034, rising from USD 13.1 billion in 2024, with a strong CAGR of 12.0%.

- Cereals & Grains dominated crop-type usage, holding 41.7% share of the global market.

- Biopesticides led the product segment, accounting for 47.8% share in 2024.

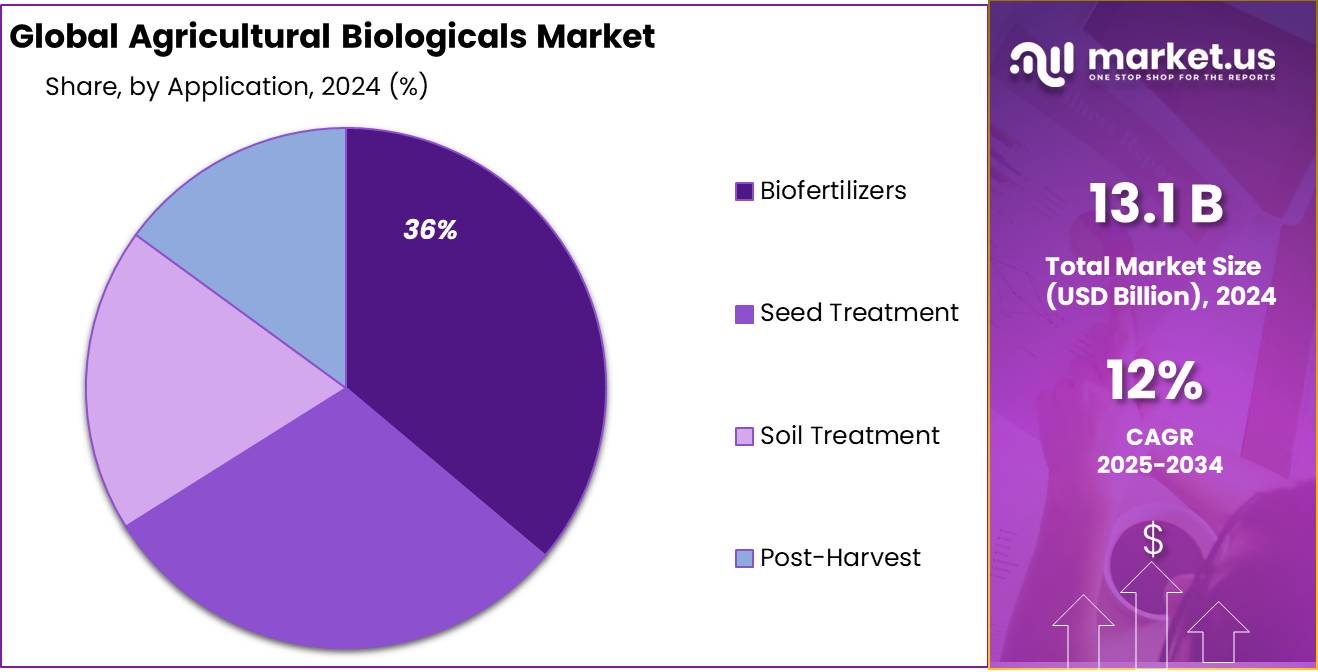

- Biofertilizers captured a solid 36.2% share, reflecting strong adoption in sustainable farming practices.

- North America stood out as the top regional market, representing 37.3% share with a value of around USD 4.8 billion in 2024.

By Crop-Type Analysis

Cereals & Grains lead with 41.7% share in 2024

In 2024, Cereals & Grains held a dominant market position, capturing more than a 41.7% share of the agricultural biologicals market. This strong foothold reflects the vast acreage and global demand for staple crops such as wheat, rice, corn, and barley, which require sustainable inputs to maintain yields under rising environmental pressures.

Farmers across major producing regions—North America, Asia-Pacific, and Europe—are increasingly adopting biological seed treatments, biofertilizers, and biopesticides to enhance soil health and reduce dependence on chemical inputs. The share is expected to remain significant in 2025 as governments and farmer cooperatives continue supporting sustainable practices through incentives and subsidies, particularly in large cereal-producing countries like India, China, and the U.S.

The cereals and grains segment has benefited from both policy and consumer demand. For example, the Indian government’s National Mission on Natural Farming (2024) allocated ₹2,481 crore to promote bio-input use across 7.5 lakh hectares, much of which is cereal farmland. Similarly, in the U.S., USDA’s $300 million Organic Transition Initiative (2024) is pushing growers of corn and wheat toward natural crop protection solutions. These policies directly align with the needs of cereal farmers who face growing resistance issues from chemical pesticides.

By Product Analysis

Biopesticides dominate with 47.8% share in 2024

In 2024, Biopesticides held a dominant market position, capturing more than a 47.8% share of the agricultural biologicals market. This leadership reflects the growing shift of farmers toward safer and more sustainable crop protection methods. Biopesticides, which include microbial agents, botanical extracts, and naturally derived compounds, are increasingly used to manage insect pests, weeds, and plant diseases without leaving harmful residues. Their adoption is driven by rising global concerns about pesticide resistance, soil degradation, and food safety standards.

The dominance of biopesticides is also strongly supported by regulatory frameworks and government programs. In the United States, the Environmental Protection Agency (EPA) continues to fast-track registrations for biopesticide products under its reduced-risk program, which helps growers access new tools more quickly. In Europe, the Farm-to-Fork strategy targets a 50% reduction in chemical pesticide use by 2030, creating a strong push for biopesticides to replace or supplement synthetic chemicals. These initiatives directly fuel the segment’s market expansion in 2024.

Looking into 2025, biopesticides are expected to hold their lead position as more countries enforce residue limits and encourage eco-friendly pest management. With cereals, fruits, and vegetables showing higher adoption rates of microbial solutions, the demand for concentrated and easy-to-apply formulations is set to rise further. Farmers are increasingly recognizing that biopesticides not only reduce chemical dependency but also improve soil biodiversity and long-term crop resilience, ensuring the segment continues to drive the agricultural biologicals market in the coming year.

By Application Analysis

Biofertilizers lead with 36.2% share in 2024

In 2024, Biofertilizers held a dominant market position, capturing more than a 36.2% share of the agricultural biologicals market. Their growth comes from the rising need to improve soil fertility while reducing chemical fertilizer dependency. Biofertilizers, which use living microorganisms such as Rhizobium, Azotobacter, and phosphate-solubilizing bacteria, help plants absorb essential nutrients more effectively. This not only enhances yields but also reduces input costs for farmers who face rising prices of synthetic fertilizers.

Government initiatives have played a crucial role in strengthening this segment. For example, India’s National Mission on Natural Farming launched in 2024 allocated ₹2,481 crore to promote chemical-free cultivation across 7.5 lakh hectares, directly boosting demand for biofertilizers. Similarly, global programs encouraging sustainable farming, such as USDA’s Organic Transition Initiative, are providing grants and technical support that make biofertilizers more accessible to farmers. These efforts highlight the trust governments are placing on biological solutions to achieve long-term soil health and food security.

Looking ahead to 2025, the biofertilizers segment is expected to hold its strong market position as countries expand subsidies and awareness campaigns around sustainable inputs. With the global focus on reducing greenhouse gas emissions from fertilizer production, biofertilizers are emerging as a practical and environmentally friendly alternative. The shift toward precision farming and micro-irrigation also favors liquid and concentrated biofertilizer applications, which will continue to strengthen their role in the agricultural biologicals market in the coming year.

Key Market Segments

By Crop-Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Product

- Biopesticides

- Biochemicals

- Microbials

- Biostimulants

- Acid based

- Seaweed extract

- Microbials

- Others

- Biofertilizers

- Nitrogen Fixation

- Phosphate Solubilizing

- Others

- Others

By Application

- Biofertilizers

- Seed Treatment

- Soil Treatment

- Post-Harvest

Emerging Trends

Government-Driven Transition to Natural Farming

India is witnessing a significant shift towards sustainable agriculture, largely propelled by government-led initiatives aimed at promoting natural farming practices. The National Mission on Natural Farming (NMNF), launched in November 2024, exemplifies this trend. With a substantial budget allocation of ₹2,481 crore, the mission targets the adoption of chemical-free farming methods across 7.5 lakh hectares, benefiting approximately 10 million farmers.

This mission is not just about policy; it’s about tangible support for farmers. It includes the establishment of 10,000 Bio-Input Resource Centres to ensure easy access to natural farming inputs and the creation of a simplified certification system for naturally grown produce. Moreover, the mission emphasizes the importance of on-farm knowledge dissemination, blending traditional practices with scientific approaches to enhance soil health and biodiversity.

To further bolster this transition, the Union Budget for 2025-26 has increased the allocation for the NMNF by ₹516 crore, bringing the total to ₹616.01 crore. This boost underscores the government’s commitment to sustainable agriculture and reflects a broader strategy to enhance rural incomes and curb inflation.

These initiatives are part of a larger movement towards natural farming in India, with states like Andhra Pradesh, Karnataka, Himachal Pradesh, Gujarat, Uttar Pradesh, and Kerala leading the way. The government’s active involvement is crucial in facilitating this transition, providing farmers with the necessary resources, training, and support to adopt sustainable practices.

Drivers

Rising Demand for Sustainable Agricultural Practices

The increasing global focus on sustainability is a major driving factor for the growth of agricultural biologicals. As the world faces challenges such as climate change, soil degradation, and water scarcity, there is a growing need for more sustainable farming practices. Agricultural biologicals, such as biopesticides, biofertilizers, and biostimulants, offer an environmentally friendly alternative to traditional chemical inputs. These products are designed to enhance crop productivity while reducing the negative environmental impacts of conventional agricultural practices.

Governments worldwide are increasingly supporting sustainable agriculture initiatives. For instance, in the European Union, the “Farm to Fork” strategy aims to promote organic farming, reduce the use of pesticides, and encourage sustainable food production. This strategy aligns with the growing consumer demand for organic and sustainably produced food, which, in turn, drives the adoption of agricultural biologicals. According to the European Commission, the organic market in Europe is expected to grow at a rate of 10-15% annually, further boosting the demand for bio-based agricultural products.

In the U.S., the Environmental Protection Agency (EPA) has been promoting the use of biopesticides as part of its Integrated Pest Management (IPM) programs. The EPA estimates that biopesticides account for more than 20% of the pesticide market in the U.S. By 2025, this share is expected to increase significantly due to the growing need for eco-friendly crop protection solutions.

- According to the Food and Agriculture Organization (FAO), sustainable farming practices can help reduce global greenhouse gas emissions from agriculture, which account for around 25% of total emissions. As more countries commit to carbon reduction goals, the use of agricultural biologicals becomes a key part of their climate change mitigation strategies.

Restraints

Limited Awareness and Trust Among Farmers

While agricultural biologicals offer promising benefits for sustainable farming, their widespread adoption faces significant barriers. One of the primary challenges is the limited awareness and trust among farmers regarding these products. Despite the growing interest in sustainable agriculture, many farmers remain skeptical about the efficacy and reliability of biological solutions.

A survey conducted by CropLife in 2024 revealed that nearly half of the respondents cited a lack of trust in product performance as the leading reason for the slow adoption of biologicals. This skepticism is often rooted in the perception that biological products are less effective than traditional chemical inputs. Unlike chemical pesticides, whose effects are often immediate and visible, the benefits of biologicals can be subtle and may take longer to manifest, leading to doubts among farmers about their effectiveness.

Furthermore, many farmers are accustomed to the convenience and familiarity of conventional farming practices. Transitioning to biological solutions often requires changes in application methods, equipment, and timing, which can be daunting and perceived as risky. The lack of comprehensive education and training on the use of biologicals exacerbates this challenge, leaving farmers ill-prepared to make informed decisions.

Addressing these barriers requires a concerted effort from all stakeholders, including government agencies, industry leaders, and agricultural extension services. Implementing comprehensive education and training programs, simplifying regulatory procedures, and providing incentives for early adoption can help build trust and confidence among farmers. By fostering a supportive environment and demonstrating the tangible benefits of agricultural biologicals, it is possible to overcome the current limitations and pave the way for a more sustainable and resilient agricultural future.

Opportunity

Government Support and Policy Initiatives

India’s agricultural biologicals sector is experiencing significant growth, driven by supportive government policies and initiatives aimed at promoting sustainable farming practices. These efforts are creating a conducive environment for the adoption and expansion of biological solutions in agriculture.

- In November 2024, the Government of India launched the National Mission on Natural Farming (NMNF), a standalone Centrally Sponsored Scheme with an outlay of ₹2,481 crore. The mission aims to promote chemical-free, ecosystem-based natural farming rooted in traditional knowledge. It targets 7.5 lakh hectares through 15,000 clusters and plans to facilitate 1 crore farmers.

Additionally, 10,000 Bio-input Resource Centres are being established, and over 70,000 trained Krishi Sakhis have been deployed to ensure last-mile input delivery and farmer guidance. This initiative underscores the government’s commitment to enhancing soil health and promoting sustainable agricultural practices.

Furthermore, the Indian government has increased its agriculture budget by over 15%, reaching approximately $20 billion, marking the most significant increase in six years. The additional funds are allocated to boosting high-yield seed varieties, enhancing storage and supply infrastructure, and boosting production of pulse crops, oilseeds, vegetables, and dairy products. This substantial investment reflects the government’s focus on improving rural incomes and controlling inflation, thereby fostering a favorable environment for the growth of agricultural biologicals.

These policy initiatives not only provide financial support but also facilitate the dissemination of knowledge and resources to farmers, encouraging the adoption of biological solutions. By aligning with the government’s vision for sustainable agriculture, the agricultural biologicals sector is poised for continued growth and development.

Regional Insights

North America leads with 37.3% share worth USD 4.8 Bn

In 2024, North America emerged as the leading region in the agricultural biologicals market, capturing 37.3% of the global share, valued at approximately USD 4.8 billion. The region’s dominance is built on a combination of strong regulatory support, advanced farming practices, and increasing awareness among growers about the long-term benefits of biological inputs.

The U.S. Environmental Protection Agency (EPA) has streamlined the registration process for biopesticides under its reduced-risk program, allowing quicker approvals and encouraging innovation in microbial and botanical solutions. This policy clarity has enabled biopesticides and biofertilizers to secure significant acreage in crops such as corn, soybeans, and wheat, which together account for the majority of farmland in the U.S. and Canada.

Government-backed programs are reinforcing this adoption trend. In 2024, the U.S. Department of Agriculture (USDA) allocated $300 million under the Organic Transition Initiative, along with $75 million for Organic Market Development Grants, directly benefiting biological input manufacturers and farmers transitioning toward sustainable practices.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE has built a strong footprint in agricultural biologicals with a wide portfolio of biopesticides, biofertilizers, and biostimulants. The company invests heavily in R&D to integrate microbial solutions into crop protection systems, targeting both yield improvement and residue reduction. BASF collaborates with growers across North America and Europe, aligning with EU’s Farm-to-Fork sustainability goals. With global expertise in chemicals and life sciences, BASF leverages advanced formulation technologies to scale concentrated biologicals and strengthen its leadership in sustainable agriculture.

Bayer AG is a global leader integrating biologicals with traditional crop protection, advancing a “Better Life Farming” model that supports smallholder and large-scale farmers. Its portfolio includes microbial seed treatments, biocontrol products, and biostimulants aimed at enhancing soil health and improving resilience against climate stress. Bayer’s strategic partnerships, including open-innovation platforms, accelerate biological innovations. Supported by sustainability commitments to cut environmental impact by 30% by 2030, the company is investing in next-generation biological solutions to complement its dominant chemical crop protection business.

Syngenta Group has scaled its biologicals business globally through acquisitions and partnerships, notably with Valagro, a leader in biostimulants. Its biologicals division develops microbial solutions for crop protection and nutrient efficiency, complementing Syngenta’s strong seeds and crop protection portfolio. The company leverages digital agriculture platforms to integrate biologicals into precision farming systems, offering growers data-driven choices for sustainable inputs. With its sustainability pledge to support regenerative agriculture on 300 million hectares by 2030, Syngenta continues expanding investments in biological innovation and commercialization worldwide.

Top Key Players Outlook

- BASF SE

- Bayer AG

- FMC Corporation

- Syngenta Group

- Corteva

- UPL

- Nufarm

- Sumitomo Chemical Co., Ltd.

- Lallemand Inc

- Mosaic

Recent Industry Developments

In 2024, BASF SE’s Agricultural Solutions arm brought in €9,798 million in sales, a modest decline of 2.9% from the previous year, reflecting currency impacts and slightly lower prices in key areas like herbicides.

In 2024, Bayer AG’s Crop Science business—the division that includes both conventional crop protection and biological solutions—generated €22.3 billion in revenue, a modest 2.0 % decline from the year before, while its EBITDA before special items slipped around 14.2 % to €4.3 billion, with a margin of 19.4 %.

Report Scope

Report Features Description Market Value (2024) USD 13.1 Bn Forecast Revenue (2034) USD 40.7 Bn CAGR (2025-2034) 12.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Crop-Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others), By Product (Biopesticides, Biostimulants, Biofertilizers, Others), By Application (Biofertilizers, Seed Treatment, Soil Treatment, Post-Harvest) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Bayer AG, FMC Corporation, Syngenta Group, Corteva, UPL, Nufarm, Sumitomo Chemical Co., Ltd., Lallemand Inc, Mosaic Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agricultural Biologicals MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Agricultural Biologicals MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Bayer AG

- FMC Corporation

- Syngenta Group

- Corteva

- UPL

- Nufarm

- Sumitomo Chemical Co., Ltd.

- Lallemand Inc

- Mosaic