Global Adult Diapers Market Report By Type (Underwear and Brief, Pads and Guards, Drip Collector and Bed Protectors), By Distribution Channel (Institutional Sales, Retail Stores, Online Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 18277

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

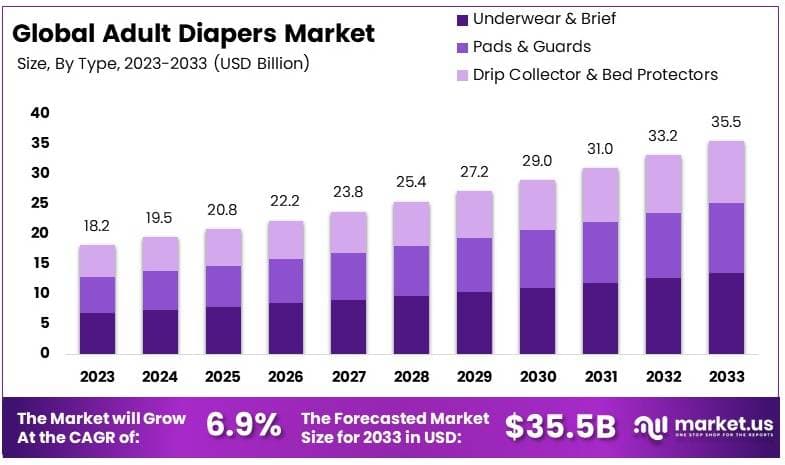

The Global Adult Diapers Market size is expected to be worth around USD 35.5 Billion by 2033, from USD 18.2 Billion in 2023, growing at a CAGR of 6.9% during the forecast period from 2024 to 2033.

Adult diapers are absorbent garments designed for adults who face issues like incontinence, mobility impairments, or severe diarrhea. They provide comfort, convenience, and hygiene, helping individuals manage bladder or bowel conditions. These products are used by older adults, people with disabilities, or patients recovering from surgeries.

The adult diapers market covers the production, distribution, and sale of adult incontinence products. It includes various types like pull-ups, disposable briefs, and pad-style diapers. This market is growing due to an aging population and increasing awareness about hygiene products for elderly care. Companies are also investing in new technologies to make products more comfortable and discreet, meeting the demand for better quality solutions.

The adult diapers market is expanding rapidly, driven by the growing elderly population and the increasing prevalence of conditions like urinary incontinence (UI). According to the United Nations, the number of individuals aged 60 and above will rise from 1 billion in 2020 to 1.4 billion by 2030, reaching 2.1 billion by 2050.

This demographic shift will primarily occur in low- and middle-income countries, where 80% of the elderly population will reside by mid-century. This trend suggests a significant increase in demand for adult diapers and other incontinence products, as these markets prepare for rapid population aging.

Urinary incontinence (UI) is a key growth factor for the adult diapers market. A study by the National Library of Medicine shows that 423 million people worldwide are affected by UI as of 2023. In the U.S. alone, 13 million individuals suffer from this condition, with a particularly high rate among nursing home residents, where 50% experience UI.

Among older adults, the prevalence reaches around 42% for men aged 75 and older. This data indicates a rising need for reliable and comfortable incontinence products, creating a strong growth opportunity for manufacturers and distributors.

In addition, companies like SeniorCare in Singapore have shown the effectiveness of tapping into the elderly care segment. By distributing over 1 million parcels of eldercare products, including incontinence supplies, SeniorCare has established a significant presence, showcasing the market’s potential for businesses offering a diverse range of eldercare solutions.

The adult diapers market is moderately competitive, with both large multinational companies like Kimberly-Clark and Procter & Gamble and smaller, specialized brands actively competing. Market saturation is still relatively low, especially in emerging markets, where the elderly population is growing faster. Companies that can localize their products and marketing strategies to address cultural sensitivities and preferences stand to gain a competitive advantage.

On a global scale, the aging population is reshaping healthcare and product demands, including disposable hygiene products. The increase in elderly populations, particularly in Asia and Africa, indicates a growing need for such products and associated healthcare services. This trend affects local markets differently. For instance, in Asia, where cultural preferences influence product usage, brands offering discreet and comfortable solutions gain market acceptance.

Government involvement and regulations impact the adult diapers market, especially regarding environmental concerns. The Environmental Protection Agency (EPA) highlights that 20 billion disposable diapers are added to U.S. landfills annually, generating around 3.5 million tons of waste. These diapers can take up to 500 years to decompose due to their plastic content and super-absorbent polymers.

As environmental regulations become stricter, companies are under pressure to develop sustainable alternatives. Some manufacturers are investing in biodegradable plastics and innovative designs to reduce landfill waste and align with regulatory standards. This shift not only supports environmental goals but also appeals to consumers who prioritize sustainability.

Key Takeaways

- The Adult Diapers Market was valued at USD 18.2 billion in 2023 and is expected to reach USD 35.5 billion by 2033, with a CAGR of 6.9%.

- In 2023, Underwear and Brief segment dominated with over 38% of revenue, driven by its comfort and discreet design.

- In 2023, Pads and Guards recorded the fastest growth with a CAGR of 13.4%, attributed to increased preference for flexibility.

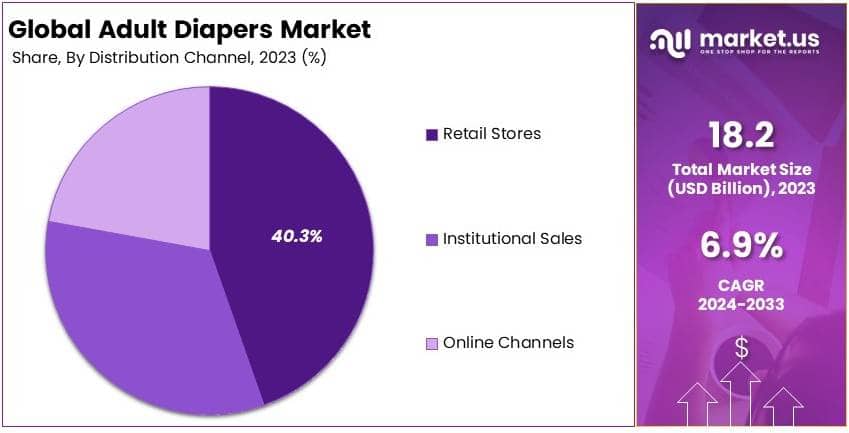

- In 2023, Retail Stores held a 40.3% share, benefiting from customer preference for direct product inspection and purchase.

- In 2023, Online Channels emerged as the most profitable, leveraging convenience and wide product availability.

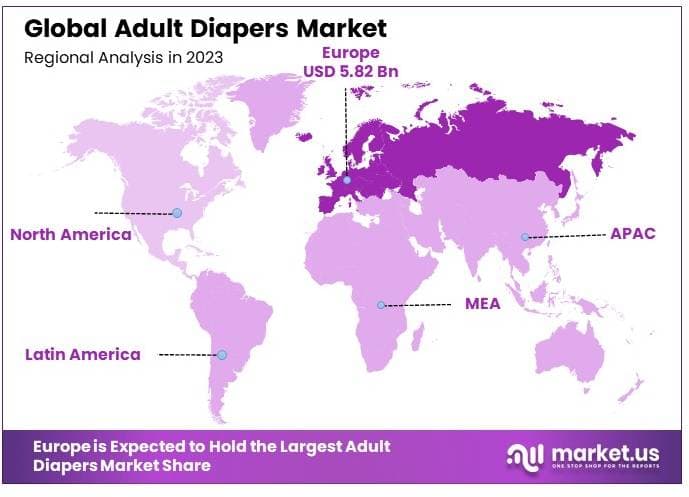

- In 2023, Europe led with 32.0% share, contributing USD 5.82 billion, owing to high aging population and advanced healthcare infrastructure.

Type Analysis

Underwear and Brief dominate with over 38% of revenue in 2022 due to their convenience and comfort.

In the adult diapers market, the type segment is crucial for understanding consumer preferences and industry dynamics. Underwear and brief-style adult diapers lead the market, capturing over 38% of the revenue in 2022. This dominance is largely due to the product’s ability to offer users a combination of convenience, comfort, and discretion. These factors are essential for consumers seeking solutions that do not disrupt their everyday lives.

The design innovations in this segment focus on enhancing the fit and absorbency of the products, which are key attributes that drive consumer satisfaction. Manufacturers have invested in developing materials that are not only highly absorbent but also soft, breathable, and skin-friendly, thus preventing irritation and ensuring comfort over long periods of wear.

Pads and guards, which are primarily designed for lighter incontinence levels, represent a fast-growing segment within the market, experiencing the fastest compound annual growth rate (CAGR) of 13.4%. These products are favored for specific situations where less absorbency is sufficient and discretion is paramount. They are easy to use and replace, making them a convenient option for many individuals.

Drip collectors and bed protectors are also significant, serving needs that extend beyond personal wear to include bedding protection. This segment caters to a more specific market, including individuals with severe incontinence and healthcare institutions, where robust solutions are necessary to manage patient care effectively.

Distribution Channel Analysis

Retail stores hold a 40.3% share over the forecast period due to wide availability and consumer trust.

Distribution channels in the adult diapers market play a pivotal role in reaching the end consumer. Retail stores currently hold the largest share, accounting for 40.3% of the market over the forecast period.

This segment benefits from widespread availability and consumer trust in purchasing from established retail outlets. Consumers appreciate the ability to physically inspect products before purchase, which is particularly important for first-time buyers or those looking to switch brands.

Retail environments also offer the advantage of immediate purchase without the wait associated with online ordering, which can be crucial for consumers in need of immediate solutions. Additionally, many consumers value the discretion and anonymity of buying incontinence products in person, where they can also seek advice from pharmacy staff or sales associates.

Online channels are identified as the most profitable segment over the forecast period, demonstrating significant growth due to the convenience of home delivery and often lower prices compared to brick-and-mortar stores. The privacy of purchasing adult diapers online is a compelling factor for many consumers, coupled with the increasing comfort of the older population with using digital platforms for their shopping needs.

Institutional sales also form a crucial part of the market, providing bulk products to healthcare facilities and assisted living centers. This channel is driven by the needs of organizations providing care to individuals who may require frequent and reliable access to adult diapers.

Key Market Segments

By Type

- Underwear and Brief

- Pads and Guards

- Drip Collector and Bed Protectors

By Distribution Channel

- Institutional Sales

- Retail Stores

- Online Channels

Drivers

Increasing Aging Population Drives Market Growth

The growth of the adult diapers market is significantly driven by the increasing aging population, rising awareness of incontinence issues, growth in healthcare expenditure, and the expansion of home care services.

The aging population globally is expanding rapidly, leading to a higher demand for incontinence products such as adult diapers. As people live longer, there is a greater need for these products to maintain quality of life. This demographic shift naturally drives market demand, creating sustained growth opportunities.

Rising awareness of incontinence issues has also played a role in expanding the market. Through medical campaigns and social initiatives, more individuals are informed about managing incontinence, encouraging them to seek reliable products like adult diapers. This shift in awareness not only increases market penetration but also promotes acceptance and openness toward using these products.

Healthcare expenditure is on the rise, allowing more individuals and institutions to invest in adult diapers as part of comprehensive patient care. Hospitals, clinics, and home healthcare services increasingly incorporate these products, expanding their adoption beyond individual consumers. This institutional uptake further supports the growth of the market.

Restraints

High Product Pricing and Stigma Restraints Market Growth

High product pricing is a significant barrier, particularly for lower-income and elderly individuals who may rely on fixed pensions. Premium adult diapers, which offer advanced features, are often expensive, making it difficult for these consumers to access them.

Stigma remains a prominent issue. Despite growing awareness, many individuals are reluctant to purchase or use adult diapers due to the social embarrassment associated with incontinence. This reluctance prevents the market from reaching its full potential as many consumers opt not to address their needs openly.

In rural areas, limited product availability is another challenge. Distribution networks often prioritize urban centers, resulting in insufficient access to adult diapers for those living in less developed regions. This gap in the supply chain restricts market growth and limits the reach of manufacturers in expanding their customer base.

Environmental concerns related to the disposal of adult diapers also restrain the market. With increasing attention on sustainability, the disposal of non-biodegradable products has drawn criticism, pushing some consumers to seek alternatives. Addressing these environmental issues is crucial for mitigating this restraint and ensuring future market growth.

Opportunity

Innovations in Biodegradable Products Provides Opportunities

The development of biodegradable products is a key opportunity. With rising environmental awareness, manufacturers can capitalize on this trend by creating eco-friendly options. These sustainable products appeal to environmentally conscious consumers and healthcare providers, opening new market segments and driving growth.

Emerging markets offer significant potential. As these regions experience economic growth and improvements in healthcare infrastructure, the demand for adult diapers is rising. Manufacturers entering these markets early can capture a large share, leveraging the increasing affordability and accessibility of these products to expand their reach.

Partnerships with healthcare institutions also create opportunities for growth. By collaborating with hospitals, clinics, and caregiving facilities, companies can integrate adult diapers into patient care plans, ensuring consistent demand. These partnerships establish long-term relationships and enhance the visibility and credibility of products within the healthcare sector.

Additionally, the growth of online sales channels provides a scalable opportunity. E-commerce platforms enable convenient and discreet purchasing options, making adult diapers more accessible. Companies that optimize their online presence and offer subscription-based models can tap into a wider audience, increasing sales and market penetration.

Challenges

High Competition and Regulatory Compliance Challenges Market Growth

High competition among established brands makes it difficult for new entrants and smaller companies to capture significant market share. This competitive environment pressures manufacturers to invest in continuous product innovation and aggressive marketing strategies, which can be costly.

Fluctuating raw material costs add another layer of complexity. The adult diapers market relies on materials such as cotton and polymers, which are subject to price volatility. These fluctuations affect manufacturing costs and profitability, making it challenging for companies to maintain stable pricing.

Regulatory compliance is another significant challenge. Adult diapers must adhere to stringent safety and hygiene standards to ensure user safety. Meeting these regulations involves extensive testing and certification processes, which require time and financial investment.

Lastly, the market’s dependency on supply chain efficiency poses challenges. Any disruption in the supply chain, such as delays in raw material procurement or transportation, can impact production timelines and availability of products. Ensuring a resilient supply chain is crucial for maintaining consistent market growth and meeting consumer demand.

Growth Factors

Increasing Demand for Premium Products Is Growth Factors

Consumers are increasingly willing to invest in premium products that offer advanced features, such as superior absorbency and skin-friendly materials. This trend allows manufacturers to introduce high-margin products and cater to customers who prioritize quality, boosting overall market revenue.

The surge in e-commerce platforms is also propelling growth. Online retail channels provide convenience and anonymity, which are crucial for adult diaper consumers. The availability of subscription models and discounts online has expanded market reach, especially in urban regions.

Improvements in product quality and features continue to enhance market growth. Innovations that focus on skin health, leak prevention, and comfort attract more consumers, encouraging repeat purchases. These improvements increase customer satisfaction and contribute to expanding the market base.

The integration of advanced absorbent technologies is another growth factor. New materials that offer better absorption and moisture management ensure comfort and protection, attracting a diverse range of consumers, from elderly users to those with temporary incontinence issues.

Emerging Trends

Adoption of Gender-Specific Products Is Latest Trending Factor

Gender-specific products are gaining traction as manufacturers develop adult diapers tailored for men and women separately. These products offer better fit and comfort, addressing specific needs and preferences. This trend attracts a broader audience, enhancing product differentiation and expanding market segments.

The focus on discreet and comfortable designs is another trend. Consumers seek adult diapers that are thin and invisible under clothing while providing maximum comfort. Manufacturers are responding with innovative designs that ensure both functionality and discretion, appealing to active individuals and boosting market adoption.

Subscription-based models are becoming increasingly popular, providing consumers with convenient, recurring deliveries. This trend allows companies to maintain customer loyalty while ensuring a steady revenue stream. It also makes adult diapers more accessible, as consumers can receive products directly at their doorstep without stigma.

Emphasis on biodegradable packaging is also trending. As environmental concerns grow, manufacturers are exploring recyclable and eco-friendly packaging options. Companies investing in sustainable practices not only appeal to eco-conscious customers but also align with broader industry shifts toward sustainability, creating a positive impact on brand image and sales.

Regional Analysis

Europe Dominates with 32.0% Market Share

Europe leads the global adult diapers market with a 32.0% share, valued at USD 5.82 billion. This dominance is driven by the region’s aging population, high healthcare standards, and strong awareness of incontinence management. Government support and healthcare programs also boost the adoption of adult diapers, ensuring the market remains well-established and stable.

The region benefits from an advanced healthcare infrastructure and widespread insurance coverage, making adult diapers accessible to those in need. European consumers also prioritize hygiene and quality, leading to strong demand for premium and eco-friendly products. This preference influences manufacturers to focus on high-quality, sustainable options, which further strengthens Europe’s market position.

Europe’s market presence is expected to grow steadily as the aging population continues to increase and the focus on sustainable, high-quality products remains strong. As healthcare programs expand and insurance policies continue to support the accessibility of adult diapers, the region’s market share is likely to stay robust, with opportunities for premium product growth.

Regional Mentions:

- North America: North America has a significant share in the adult diapers market, driven by a strong focus on healthcare and aging population support. High spending on premium products and healthcare services boosts its market presence.

- Asia Pacific: Asia Pacific shows rapid growth in the adult diapers market, mainly due to increasing elderly populations and rising awareness of incontinence care. Economic development in the region enhances accessibility and product variety.

- Middle East & Africa: The Middle East & Africa region is gradually developing its adult diapers market, with increasing healthcare initiatives and expanding retail networks. The focus remains on affordable solutions to cater to diverse populations.

- Latin America: Latin America’s adult diapers market is growing, supported by rising awareness and improved healthcare infrastructure. The market expansion is influenced by the focus on affordable, high-quality options accessible to a broad consumer base.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The adult diapers market is competitive, with leading companies like PAUL HARTMANN AG, Kimberly-Clark Corporation, Procter & Gamble, and Unicharm Corporation. These companies dominate due to strong brands, diverse products, and global reach.

Top players offer a wide range of adult diapers, including disposable, reusable, and overnight options. They focus on comfort, absorbency, and skin-friendly materials to meet the needs of elderly and medically dependent customers. Additional products like incontinence pads and skin care solutions are also offered.

Companies such as Kimberly-Clark and Procter & Gamble focus on premium quality, using well-known brands like Depend and Always. PAUL HARTMANN AG and Ontex target both premium and mid-range segments, balancing quality with affordability. They invest in direct-to-consumer online platforms and partner with healthcare facilities to increase market reach.

These companies operate globally, with strong markets in North America, Europe, and Asia-Pacific. They utilize extensive distribution channels, including pharmacies, retail stores, and e-commerce platforms, to reach diverse regions.

Innovation is key, with emphasis on enhancing product comfort, fit, and absorbency. Sustainable materials and eco-friendly production processes are also gaining attention to meet consumer demand for green products.

The competitive edge of these companies lies in their strong brand presence, diverse product ranges, and focus on innovation. By leveraging global distribution networks and investing in quality, they maintain leadership in the market.

Top Key Players in the Market

- PAUL HARTMANN AG

- Kimberly-Clark Corporation

- Procter & Gamble

- Ontex

- Domtar Corporation

- Unicharm Corporation

- Wellspect HealthCare (Dentsply Sirona)

- Hollister Incorporated

- TZMO SA

- Other Key Players

Recent Developments

- Friends UltraThinz Launch Summary: On May 2023, Nobel Hygiene’s Friends brand launched UltraThinz, India’s first slim disposable absorbent underpant designed for younger individuals experiencing mild incontinence due to obesity, prostate issues, or postpartum conditions. The product offers a discreet, “bulge-free” fit and comes in gender-specific variants, aiming to cater to a diverse demographic with an emphasis on functionality and comfort.

- Indorama India’s Super Comfort Spandex Launch: On June 2022, Indorama India introduced the SnugFit spandex at the 5th ‘Right Hygiene’ Conference in New Delhi. This new hygiene-grade spandex, designed for baby and adult diapers, emphasizes comfort, skin safety, and compatibility with leading adhesive brands to support local manufacturers in reducing reliance on imports.

- First Quality and Cradles to Crayons Partnership: On June 2024, First Quality and Cradles to Crayons celebrated three years of collaboration aimed at addressing diaper needs in the U.S. The partnership has distributed over 20 million diapers and raised more than $2 million through sales of First Quality’s Cuties brand, supporting families facing clothing insecurity.

Report Scope

Report Features Description Market Value (2023) USD 18.2 Billion Forecast Revenue (2033) USD 35.5 Billion CAGR (2024-2033) 6.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Underwear and Brief, Pads and Guards, Drip Collector and Bed Protectors), By Distribution Channel (Institutional Sales, Retail Stores, Online Channels) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PAUL HARTMANN AG, Kimberly-Clark Corporation, Procter & Gamble, Ontex, Domtar Corporation, Unicharm Corporation, Wellspect HealthCare (Dentsply Sirona), Hollister Incorporated, TZMO SA, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- PAUL HARTMANN AG

- Kimberly-Clark Corporation

- Procter & Gamble

- Ontex

- Domtar Corporation

- Unicharm Corporation

- Wellspect HealthCare (Dentsply Sirona)

- Hollister Incorporated

- TZMO SA

- Other Key Players