Global IoT in Chemical Market Size, Share Analysis Report By Component (Hardware (Sensors, Actuators, Other IoT Devices), Software, Services (Consulting Services, Integration Services, Maintenance and Support Services), By Application (Predictive Maintenance, Asset Tracking, Safety Monitoring, Energy Management, Supply Chain Optimization, Others), By End-Use Industry (Petrochemicals, Polymers & Plastics, Fertilizers & Agrochemicals, Specialty Chemicals, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144674

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- US IoT in Chemical Market

- By Component Analysis

- By Application Analysis

- By End-Use Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

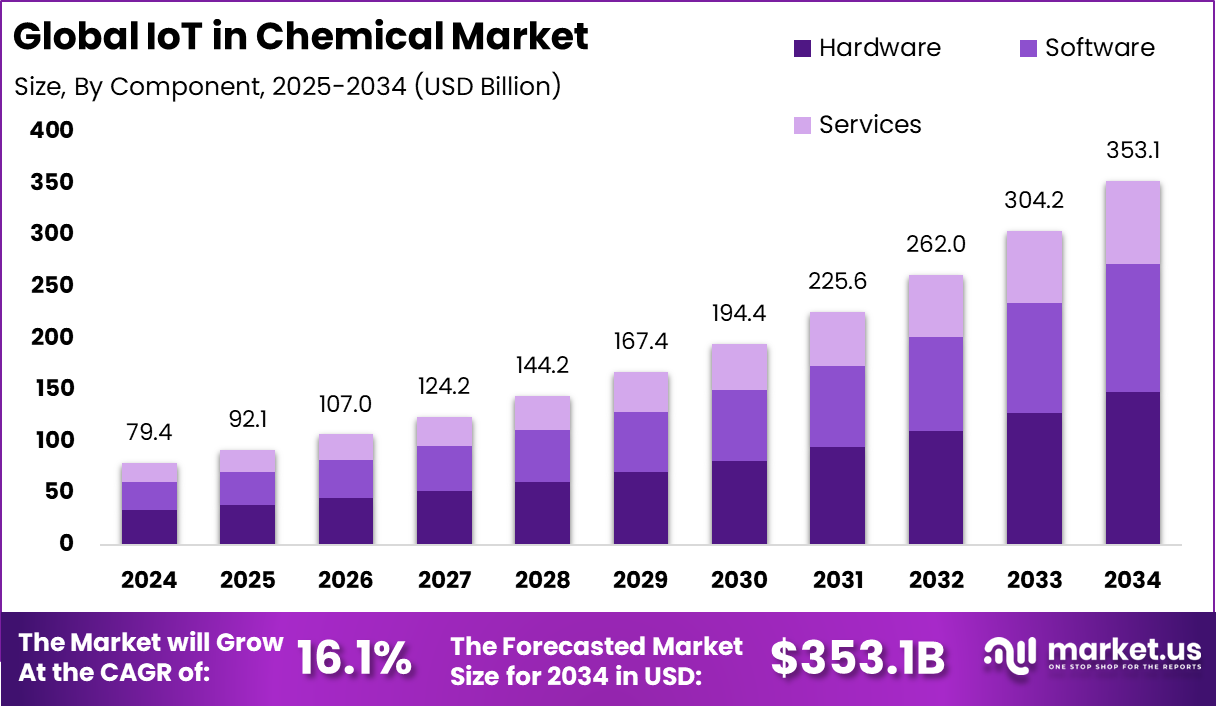

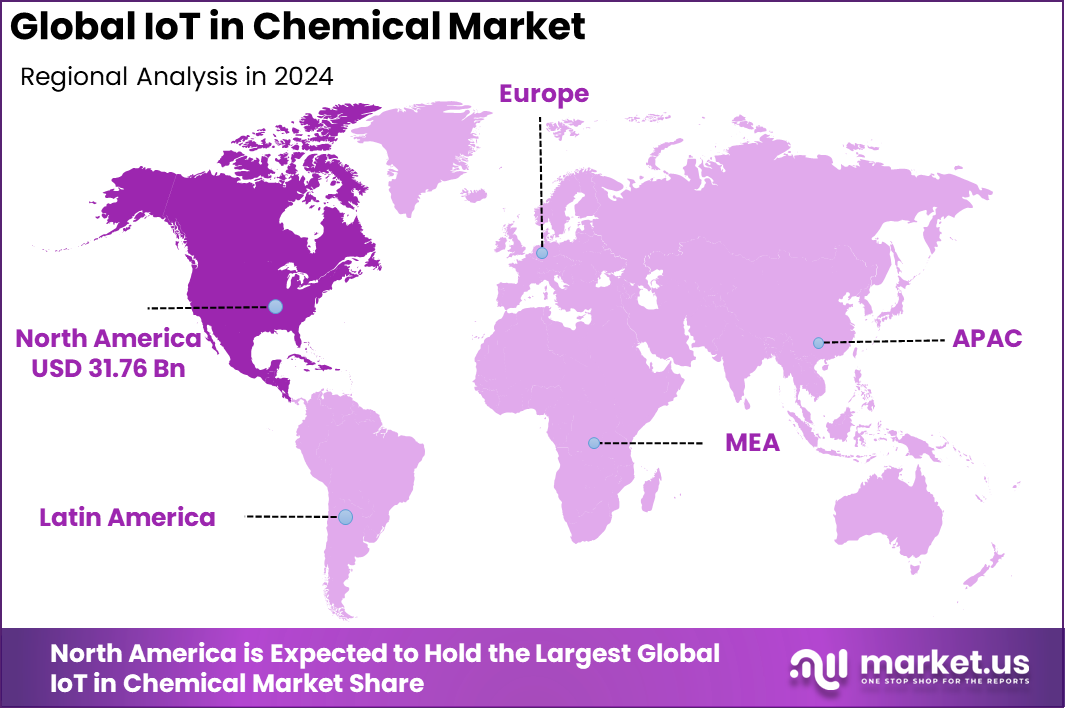

The IoT in Chemical Market size is expected to be worth around USD 353.1 Billion By 2034, from USD 79.4 billion in 2024, growing at a CAGR of 16.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40% share, holding USD 31.76 Billion revenue.

The IoT in the chemical industry refers to the integration of connected devices and systems which facilitate communication and data exchange between machines and humans. This technology revolutionizes how chemical manufacturers operate, offering real-time insights, improving production efficiency, and enhancing safety protocols.

The IoT in Chemical Market is experiencing significant growth driven by the need for innovation and efficiency in chemical manufacturing. This market encompasses the deployment of IoT technologies in chemical plants and throughout the chemical supply chain to enhance production capabilities and safety protocols.

In the chemical industry, the push for sustainability and the need to comply with stringent regulations are driving the adoption of IoT technologies. These technologies enhance the industry’s capabilities by providing real-time monitoring and facilitating data-driven decisions, thus offering a significant strategic advantage.

Key drivers propelling the growth of the IoT in chemical market include the expansion of the global chemical industry and the rising adoption of industrial automation. The chemical industry’s growth, particularly in large markets such as China, contributes significantly to the increasing application of IoT technologies.

The adoption of various technologies such as artificial intelligence (AI), big data analytics, and robotic process automation plays a pivotal role in the IoT in chemical sector. These technologies facilitate predictive maintenance, enhanced safety monitoring, and more efficient data analytics, driving significant improvements in operational workflows and decision-making processes.

According to the research conducted by Market.us, the Global Internet of Things (IoT) Market is anticipated to experience robust growth in the coming years. The market is projected to be valued at approximately USD 3,454.2 billion by 2033, up from USD 492.7 billion in 2023. This growth reflects a remarkable compound annual growth rate (CAGR) of 21.5% between 2024 and 2033.

In parallel, the AI in IoT Market is also gaining substantial traction. The market is forecasted to reach a value of USD 201.3 billion by 2033, rising significantly from USD 33.3 billion in 2023. This represents a strong CAGR of 19.7% during the forecast period from 2024 to 2033.

Companies in the chemical industry are increasingly turning to IoT solutions to address challenges such as the need for better process visibility, improved safety measures, and reduced operational costs. IoT technologies enable real-time monitoring and control, which are essential for maintaining the high standards required in chemical manufacturing.

The demand for IoT solutions in the chemical industry is driven by the need to enhance operational efficiency and regulatory compliance, reduce costs, and improve safety. The continuous technological advancements and the integration of IoT with other digital technologies are expected to further boost market demand.

Key Takeaways

- The IoT in Chemical Market is projected to witness substantial growth over the forecast period. The market size is expected to reach approximately USD 353.1 billion by 2034, rising from an estimated USD 79.4 billion in 2024, reflecting a strong compound annual growth rate (CAGR) of 16.1% from 2025 to 2034.

- In 2024, North America emerged as the leading region in this market, accounting for over 40% of the global revenue, which translates to approximately USD 31.76 billion.

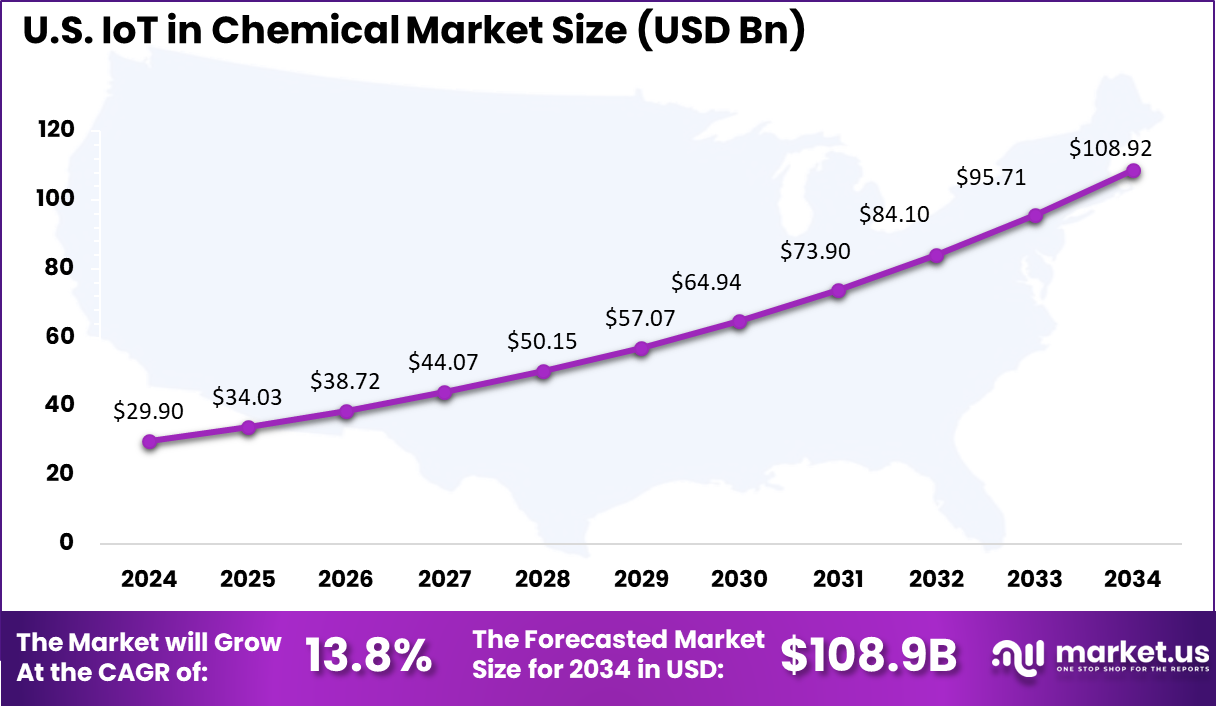

- Within North America, the United States played a critical role, contributing nearly USD 29.9 billion to the IoT in Chemical market in 2024.

- The market in the U.S. is expected to grow steadily, rising from USD 34.03 billion in 2025 to around USD 108.92 billion by 2034, at a projected CAGR of 13.8% during the forecast period.

- By component, the hardware segment held a commanding share of 42% in 2024. This reflects the continued demand for connected devices, sensors, RFID tags, and embedded systems essential for data acquisition and process control in chemical plants.

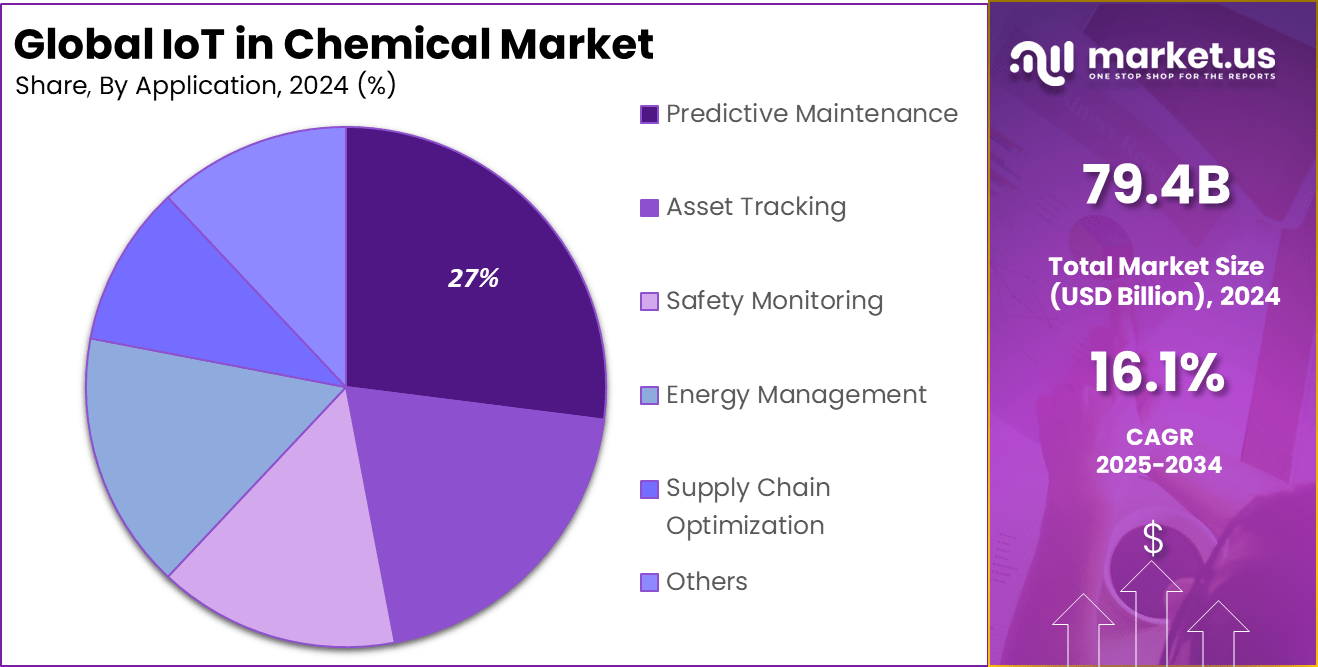

- In terms of application, predictive maintenance accounted for a significant 27% share of the IoT application market in 2024, underscoring its role as a crucial driver of operational efficiency.

- By end-use industry, the petrochemical segment led the market with a share of 35% in 2024. The increasing use of IoT solutions to monitor refining processes, optimize resource utilization, and ensure compliance with environmental regulations has strengthened the demand in this sector.

Analysts’ Viewpoint

Significant investment opportunities exist in developing IoT applications that offer advanced analytics, improved supply chain management, and energy-efficient solutions. Companies are also investing in cybersecurity measures to protect IoT devices from increasing cyber threats, which is becoming a critical part of the IoT investment landscape.

Notable market trends include the use of digital twins for system simulation and the integration of AI for better data analysis. The adoption of 5G technology to enhance connectivity and reduce latency in IoT applications is also gaining traction. These trends are setting the direction for future developments in the IoT in chemical sector.

The primary factors impacting the IoT in chemical market include technological advancements, the regulatory environment, and economic conditions. Innovations in IoT technology such as machine learning and predictive analytics are driving the market forward, while regulatory changes continue to shape the operational landscape.

The regulatory environment for IoT in chemical involves stringent requirements for safety, data security, and environmental protection. Compliance with these regulations is facilitated by IoT technologies, which provide enhanced monitoring and reporting capabilities.

US IoT in Chemical Market

The US IoT in Chemical Market is valued at approximately USD 29.9 Billion in 2024 and is predicted to increase from USD 34.03 Billion in 2025 to approximately USD 108.92 Billion by 2034, projected at a CAGR of 13.8% from 2025 to 2034.

In 2024, North America held a dominant market position within the IoT in Chemical sector, capturing more than a 40% share, which equates to a revenue of USD 31.76 Billion. This leading stance can be attributed to several pivotal factors that distinguish the region in the global landscape.

Primarily, North America’s lead in the IoT in Chemical market is underpinned by its robust technological infrastructure and early adoption of advanced technologies. The region has been at the forefront of integrating IoT solutions across various industries, with a significant emphasis on enhancing chemical manufacturing processes through digital transformation.

Furthermore, the regulatory environment in North America, particularly in the United States and Canada, supports the adoption of IoT technologies by enforcing strict safety and environmental regulations. These regulations compel chemical manufacturers to adopt advanced technologies for better compliance management and operational efficiency.

By Component Analysis

In 2024, the hardware segment in the IoT in Chemical market commanded a significant 42% share. This predominance is largely due to the indispensable role that physical IoT devices – such as sensors, actuators, and gateways – play in the foundational structure of IoT solutions. These components are crucial for collecting and transmitting data, which is vital for real-time monitoring and control of chemical processes.

The strength of the hardware segment is also bolstered by continuous innovations in device technology, improving reliability, accuracy, and durability in harsh chemical manufacturing environments. The leadership of the hardware segment is further justified by the growing need for robust infrastructural bases in the IoT ecosystem.

As chemical plants push towards digitalization, the demand for sophisticated hardware that can withstand the challenging conditions of chemical processing increases. These hardware improvements lead directly to enhanced productivity and safety in operations, making them a central investment point for companies looking to capitalize on IoT capabilities.

By Application Analysis

Predictive maintenance accounted for 27% of the IoT application market share in 2024, distinguishing itself as a critical application within the IoT in Chemical sector. This prominence stems from its capacity to predict equipment failures before they occur, thus avoiding costly downtime and extending equipment lifespan.

The chemical industry, known for its reliance on continuous and efficient production processes, finds immense value in predictive maintenance. This approach uses data analytics and machine learning to analyze data from IoT sensors, identifying patterns that precede equipment issues.

Why this segment leads is clear when considering the economic benefits it offers. By enabling maintenance only when necessary, rather than on a fixed schedule, predictive maintenance reduces unnecessary expenditures and optimizes resource allocation.

By End-Use Industry Analysis

The petrochemical segment led the IoT in Chemical market by end-use industry, holding a 35% share in 2024. This sector’s significant investment in IoT technologies is driven by the complex nature of petrochemical processing, which demands high levels of precision and efficiency.

IoT solutions in this field enhance operational visibility and control, enabling more accurate monitoring of processes and better compliance with environmental and safety regulations. The leadership of the petrochemicals segment in IoT adoption can also be attributed to the high stakes associated with production downtimes and safety incidents in this industry.

IoT technologies help mitigate these risks by providing real-time data that can inform better decision-making and risk management. Furthermore, as global demand for petrochemicals continues to grow, driven by industries such as plastics and fertilizers, the need for technological integration to sustain and enhance production capabilities becomes increasingly critical, cementing the sector’s lead in IoT adoption.

Key Market Segments

By Component

- Hardware

- Sensors

- Actuators

- Other IoT Devices

- Software

- Services

- Consulting Services

- Integration Services

- Maintenance and Support Services

By Application

- Predictive Maintenance

- Asset Tracking

- Safety Monitoring

- Energy Management

- Supply Chain Optimization

- Others

By End-Use Industry

- Petrochemicals

- Polymers & Plastics

- Fertilizers & Agrochemicals

- Specialty Chemicals

- Others

Driver

Adoption of Industrial Robots

The integration of industrial robots in the chemical industry is a significant driver for the adoption of IoT technologies. Industrial robots improve efficiency by automating complex production processes, which is vital in environments that demand precision and consistency.

These robots are equipped with IoT sensors that collect data to optimize operations and predict maintenance needs, thereby reducing downtime and increasing production uptime. The adoption of these technologies is driven by the need to enhance operational efficiency and maintain competitive advantage in a fast-evolving industry landscape.

Restraint

High Initial Investment Costs

A major restraint in the IoT in chemical industry market is the high initial investment required for IoT infrastructure. The cost of deploying sophisticated IoT systems, including sensors, connectivity technologies, and data analytics platforms, can be prohibitively expensive, especially for small to medium-sized enterprises.

This financial barrier can slow down the adoption rate of IoT technologies as companies may be hesitant to invest heavily without clear, short-term financial benefits. Additionally, the integration of these technologies often requires significant changes to existing systems and processes, adding to the overall cost and complexity.

Opportunity

IoT for Enhanced Safety and Compliance

IoT presents substantial opportunities for the chemical industry to enhance safety measures and regulatory compliance. By using IoT technologies, chemical companies can monitor and control the production environment in real-time, detecting any irregularities or hazardous conditions before they become critical issues.

This capability not only helps in preventing accidents but also ensures that the operations are in compliance with stringent environmental and safety regulations. Furthermore, the data collected through IoT devices supports better compliance reporting and more informed decision-making processes.

Challenge

Cybersecurity Risks

As chemical companies increasingly integrate IoT into their operations, they face heightened cybersecurity risks. The interconnected nature of IoT devices means that a single breach can compromise the entire network, leading to potential disruptions in manufacturing processes and even risks to plant safety.

Protecting against cyber threats requires continuous monitoring and updating of cybersecurity measures, which can be resource intensive. The challenge is further compounded by the evolving nature of cyber threats, which requires ongoing investments in cybersecurity technologies and expertise to safeguard sensitive industrial data.

Growth Factors

The growth of the IoT in the chemical industry is significantly influenced by the increasing need for operational efficiency and enhanced safety measures. With IoT technologies, chemical companies can automate complex processes, reduce production costs, and improve resource management, which are crucial in maintaining competitiveness in a rapidly evolving market.

The adoption of IoT enables real-time monitoring and data analytics, leading to optimized operations and proactive maintenance, thereby reducing downtime and increasing overall productivity. Furthermore, the integration of IoT in the chemical industry aligns with the shift towards sustainable practices.

IoT technologies help in monitoring and reducing energy consumption and waste production, contributing to greener manufacturing processes. As regulations around environmental sustainability tighten, IoT offers tools to ensure compliance and facilitate the transition to eco-friendly operations.

Emerging Trends

Emerging trends in the IoT in the chemical industry revolve around the adoption of advanced digital technologies such as big data analytics, artificial intelligence (AI), and the deployment of industrial IoT platforms. These technologies enhance the analysis capabilities of vast amounts of operational data, leading to better decision-making and increased efficiency.

Augmented Reality (AR) and Virtual Reality (VR) are also gaining traction, transforming training and maintenance operations within the industry. These technologies provide immersive, interactive training environments and real-time operational assistance, thereby increasing safety and efficiency in handling complex chemical processes.

Another significant trend is the implementation of IoT platforms that facilitate the integration of various IoT devices and systems, streamlining processes and improving data visibility across the operations. Such platforms are crucial for enhancing connectivity and interoperability among different IoT solutions, which is essential for the scalability and flexibility of IoT implementations in the chemical sector.

Business Benefits

The business benefits of implementing IoT in the chemical industry are manifold. Primarily, IoT enhances operational efficiency by allowing real-time monitoring and control of chemical processes. This real-time capability enables companies to detect and address issues promptly, minimizing risks and downtime, which directly translates to cost savings and increased output.

IoT also plays a critical role in improving product quality and consistency by continuously monitoring production variables. This level of control is vital for maintaining product standards and adhering to strict industry regulations. Additionally, IoT facilitates better resource management, reducing waste and optimizing the use of raw materials.

Lastly, IoT solutions contribute to improved safety in the chemical industry by monitoring environmental conditions and detecting hazardous situations before they lead to accidents. This not only helps in protecting assets and reducing liability but also supports a safer working environment for employees.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The Internet of Things (IoT) is transforming the chemical industry by enhancing operational efficiency and safety. Leading companies are actively engaging in acquisitions, launching new products, and forming mergers to strengthen their positions in this evolving market.

Schneider Electric, a French energy management and automation specialist, acquired AVEVA, a UK-based industrial software company. This acquisition aims to provide comprehensive digital transformation solutions, reducing energy and resource intensity in the chemical industry.

ABB Ltd., a Swiss automation company, launched Margo, an initiative designed to enhance interoperability within the Industrial Internet of Things (IIoT) in April 2024, . Margo facilitates seamless communication between applications, devices, and orchestration software at the edge of industrial ecosystems, transforming plant data into actionable AI-powered insights to improve efficiency and sustainability.

Accenture, a global professional services company, acquired SALT Solutions, a German technology firm, to build cloud-based industrial IoT platforms. This acquisition enables Accenture to optimize clients’ production and logistics, reducing quality issues and waste across the supply chain.

Top Key Players in the Market

The following are the leading companies in the IoT in Chemical market. These companies collectively hold the largest market share and industry trends.

- Siemens AG

- Honeywell

- General Electric Company

- IBM Corporation

- Microsoft Corporation

- Dow Chemical

- ABB Ltd.

- Altizon Inc.

- Atos SE

- Cisco Systems Inc.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Yokogawa Electric Corporation

- Accenture plc

- SAP SE

- Oracle Corporation

- PTC Inc.

- Hitachi Ltd.

- Intel Corporation

- Huawei Technologies Co. Ltd.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Development LP

- Fujitsu Limited

- Other Key Players

Recent Developments

- March 2025: Quaker Houghton announced the acquisition of Dipsol Chemicals, aiming to expand its advanced solutions portfolio in attractive end markets with solid growth characteristics and high barriers to entry.

- February 2025: Bain Capital agreed to acquire Mitsubishi Chemical Group’s pharmaceutical business, Mitsubishi Tanabe Pharma, for approximately $3.37 billion. This divestiture aligns with Mitsubishi Chemical’s strategy to focus on its core chemical businesses.

- October 2024: Honeywell announced plans to spin off its Advanced Materials business into an independent, publicly traded company. This move aims to create a leading provider of sustainability-focused specialty chemicals and materials, with expected revenues of approximately $3.8 billion and an EBITDA margin exceeding 25% in fiscal year 2024.

Report Scope

Report Features Description Market Value (2024) USD 79.4 Bn Forecast Revenue (2034) USD 353.1 Bn CAGR (2025-2034) 16.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware (Sensors, Actuators, Other IoT Devices), Software, Services (Consulting Services, Integration Services, Maintenance and Support Services), By Application (Predictive Maintenance, Asset Tracking, Safety Monitoring, Energy Management, Supply Chain Optimization, Others), By End-Use Industry (Petrochemicals, Polymers & Plastics, Fertilizers & Agrochemicals, Specialty Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens AG, Honeywell, General Electric Company, IBM Corporation, Microsoft Corporation, Dow Chemical, ABB Ltd., Altizon Inc., Atos SE, Cisco Systems Inc., Honeywell International Inc., Mitsubishi Electric Corporation, Robert Bosch GmbH, Rockwell Automation Inc., Schneider Electric SE, Yokogawa Electric Corporation, Accenture plc, SAP SE, Oracle Corporation, PTC Inc., Hitachi Ltd., Intel Corporation, Huawei Technologies Co. Ltd., Dell Technologies Inc., Hewlett Packard Enterprise Development LP, Fujitsu Limited, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens AG

- Honeywell

- General Electric Company

- IBM Corporation

- Microsoft Corporation

- Dow Chemical

- ABB Ltd.

- Altizon Inc.

- Atos SE

- Cisco Systems Inc.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Yokogawa Electric Corporation

- Accenture plc

- SAP SE

- Oracle Corporation

- PTC Inc.

- Hitachi Ltd.

- Intel Corporation

- Huawei Technologies Co. Ltd.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Development LP

- Fujitsu Limited

- Other Key Players