Global Internet Of Things In Retail Market Size, Share, Statistics Analysis Report By Offering (Hardware (Beacons, Sensors, Gateways, Radio Frequency Identification), Platform (Connectivity Management, Application Management, Device Management), Services (Professional Services, Managed Services)), By Application (Operations Management (Inventory Management, Supply Chain Automation, Workforce Management, Security & Safety), Customer Management (Smart Vending Machine, Smart Shelves, Queue Management, Automated Checkout), Asset Management (Asset Tracking, Predictive Maintenance), Advertising and Marketing (Smart Digital Signage, Geomarketing), Others)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144361

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

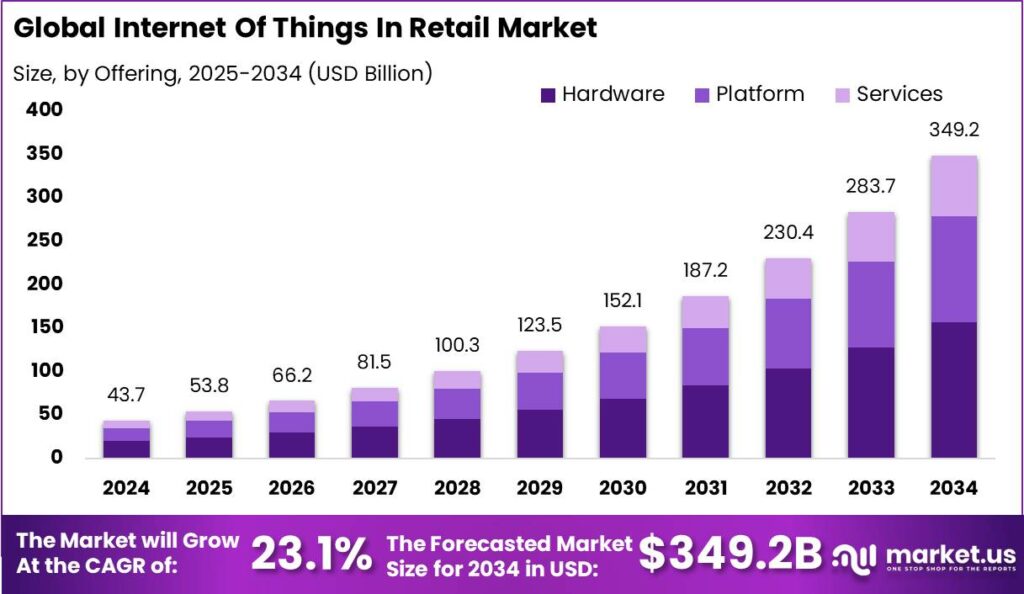

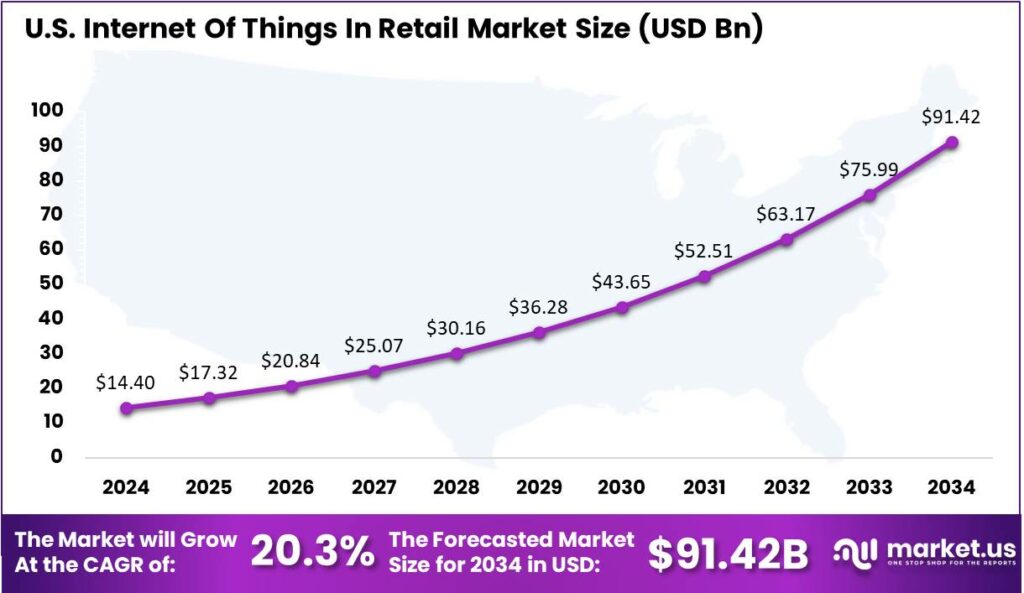

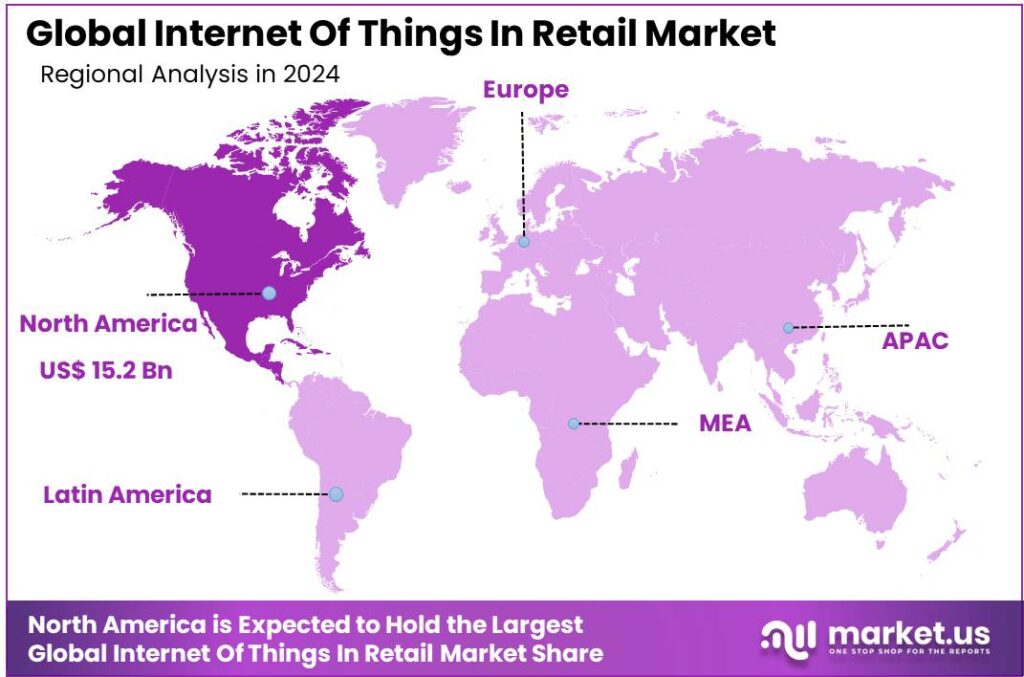

The Global Internet Of Things In Retail Market size is expected to be worth around USD 43.7 Billion By 2034, from USD 349.2 Billion in 2024, growing at a CAGR of 23.10% during the forecast period from 2025 to 2034. In 2024, North America led the IoT in Retail market, holding over 35% of the market share and generating USD 15.2 billion in revenue. The U.S. market was valued at USD 14.4 billion, experiencing strong growth with a CAGR of 20.3%.

The IoT in retail market is experiencing robust growth, driven by the retail industry’s need to innovate and improve operational efficiencies. This market encompasses the deployment of IoT solutions such as smart sensors, advanced analytics, and integrated platforms designed to foster data-driven decision-making in retail settings.

The primary driving force behind the IoT in retail market is the strategic adoption of omnichannel retail strategies, which integrate physical and online shopping platforms to provide a seamless customer experience. This approach not only satisfies the modern consumer’s demand for flexibility and convenience but also enables retailers to gather valuable data for targeted marketing and inventory optimization.

Retailers are increasingly adopting IoT technologies like RFID, near-field communication (NFC), and smart sensors due to their significant benefits in inventory management and customer service enhancement. These technologies allow for real-time tracking of goods, automated checkouts, and personalized customer interactions, which help in reducing operational costs and improving the shopping experience.

According to a recent Microsoft survey, 87% of retailers now consider IoT technology essential for their company’s success. As IoT continues to enhance business operations and elevate customer experiences, retailers who aren’t embracing this innovation risk falling behind in a rapidly evolving market.

As the IoT in retail market grows, investment opportunities are expanding, particularly in developing IoT-based applications for customer engagement and supply chain management. Retailers are investing in IoT to gain insights into consumer behavior, optimize inventory levels, and streamline supply chains, which can lead to enhanced profitability and market share.

The trend towards digitization and automated retail operations continues to shape the IoT in retail market. IoT technologies facilitate enhanced data analysis capabilities, enabling retailers to make informed decisions that improve customer satisfaction and operational efficiency. Benefits include reduced inventory errors, enhanced supply chain management, and improved customer loyalty through tailored marketing strategies.

Key Takeaways

- The Global Internet of Things (IoT) in Retail Market size is expected to reach USD 43.7 billion by 2034, growing from USD 349.2 billion in 2024, at a CAGR of 23.10% during the forecast period from 2025 to 2034.

- In 2024, the Hardware segment held a dominant position in the IoT in Retail market, capturing more than 45% of the market share.

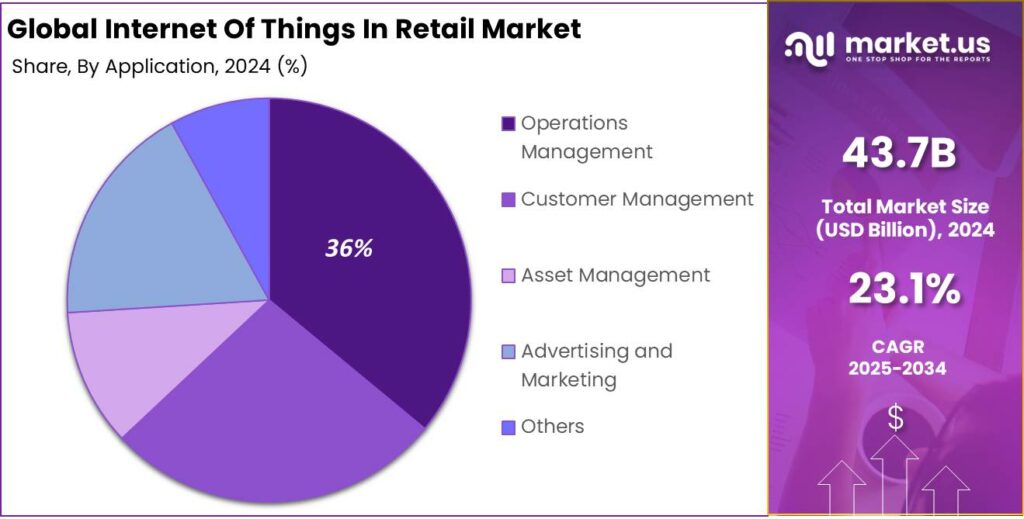

- The Operations Management segment also held a significant market position in 2024, capturing over 36% of the IoT in Retail market share.

- North America was the leading region in the IoT in Retail market in 2024, holding more than 35% of the market share, with revenue amounting to USD 15.2 billion.

- In 2024, the U.S. market for the Internet of Things (IoT) in retail was valued at USD 14.4 billion, experiencing robust growth with a CAGR of 20.3%.

Business Benefits

IoT technology allows retailers to collect data on customer preferences and behaviors. As per i-SCOOP report, around 77% of retailers observe that IoT positively transforms the customer experience, offering personalized services and seamless interactions. This customization boosts engagement and strengthens the retailer-customer connection.

Improved supply chain efficiency is another benefit. According to Smart Tek report, 64% of companies utilize IoT for supply chain optimization, benefiting from real-time tracking and improved logistics. IoT solutions enable real-time tracking of goods, allowing retailers to monitor shipments and anticipate potential delays.

IoT enhances data-driven decision-making. The vast amount of data collected from IoT devices provides retailers with valuable insights into customer behavior, product performance, and operational efficiency. Analyzing this data enables informed decisions that can improve marketing strategies, optimize product placements, and streamline operations, ultimately driving profitability.

Impact of AI

AI and IoT together streamline various retail operations, automating tasks like inventory management, restocking, and checkout processes. Technologies like computer vision and predictive analytics enable real-time inventory tracking and demand forecasting, ensuring optimal stock levels without manual intervention.

AI enables more personalized shopping experiences by analyzing customer data and behavior. This leads to tailored product recommendations and dynamic marketing strategies. AI-powered chatbots offer 24/7 customer service, while sentiment analysis tools enhance interactions by making them more personalized and targeted.

AI’s predictive analytics capabilities enable retailers to understand market trends and adjust their strategies accordingly. Dynamic pricing models can adjust prices in real-time based on factors like market demand, competition, and inventory levels, maximizing profitability while meeting customer expectations.

U.S. Market Dominance

The U.S. market for the Internet of Things (IoT) in retail was valued at USD 14.4 billion in 2024. This sector is experiencing robust growth with a compounded annual growth rate (CAGR) of 20.3%.

The growth in IoT adoption among retailers is driven by the need to improve operational efficiency and customer experience. IoT devices like smart sensors, RFID tags, and connected devices enable real-time data collection, optimizing inventory management, supply chain visibility, and customer interactions. This is fueling the expansion of IoT solutions across various retail formats.

The integration of advanced analytics and machine learning with IoT platforms helps retailers leverage big data for accurate trend forecasting and consumer behavior insights. This enables proactive decision-making and strategic planning, driving market growth. IoT technologies bridge the gap between online and offline channels, enhancing customer satisfaction and supporting seamless omnichannel experiences.

Regulatory support and advancements in connectivity, like 5G, are expected to drive further IoT adoption in retail. As IoT infrastructure becomes more secure and sophisticated, retailers are likely to invest heavily, anticipating improved efficiency and increased sales. This trend signals continued growth and a positive outlook for the U.S. IoT retail market.

In 2024, North America held a dominant market position in the Internet of Things (IoT) in Retail, capturing more than a 35% share with revenue amounting to USD 15.2 billion. This prominent status can be attributed to several key factors that uniquely position North America as a leader in the IoT retail sector.

North America benefits from a highly developed technological infrastructure, essential for the efficient deployment of IoT solutions. The widespread availability of high-speed internet and rapid cloud adoption create a strong foundation for IoT devices. The presence of leading IoT technology providers in the region drives innovation and accessibility in the retail sector.

The North American retail industry is quick to adopt new technologies to improve customer experience and efficiency. Major U.S. and Canadian retailers have embraced IoT to optimize supply chains, manage inventories, and personalize shopping experiences, driving significant growth in the region’s IoT retail market.

Moreover, the consumer base in North America is highly receptive to technology-driven shopping experiences, from online shopping to the use of apps and IoT devices in-store, such as smart carts and interactive kiosks. This receptiveness encourages retailers to further invest in IoT to meet customer expectations and stay competitive in the market.

Offering Analysis

In 2024, the Hardware segment held a dominant position in the IoT in Retail market, capturing more than a 45% share. Gateways are crucial in connecting IoT devices and managing data flow between them and central systems, playing a key role in retail operations and inventory management.

This segment includes devices such as beacons, sensors, gateways, and radio frequency identification (RFID) systems, which are foundational to the deployment of IoT technologies in retail environments. The prominence of the Hardware segment can be attributed to the essential role these devices play in enabling connectivity and data collection across retail operations.

Beacons and sensors are particularly integral to enhancing the consumer shopping experience by facilitating personalized marketing and optimizing store layouts based on real-time data. These devices help retailers capture detailed insights into customer behaviors and preferences, directly impacting sales effectiveness and customer satisfaction.

Radio Frequency Identification (RFID) technology has transformed inventory management by providing automated, error-free tracking of products throughout the supply chain. RFID’s ability to increase operational efficiencies and reduce costs is a major factor driving the adoption of this technology in the retail sector.

Application Analysis

In 2024, the Operations Management segment held a dominant market position within the Internet of Things (IoT) in the retail market, capturing more than a 36% share. This segment’s leadership can be attributed to its critical role in enhancing efficiency and reducing costs across retail operations.

Operations Management leverages IoT technologies such as inventory management systems, supply chain automation tools, and workforce management solutions. These tools enable real-time monitoring and management of resources, which is essential for optimizing operational workflows and minimizing waste.

Inventory Management within Operations Management has been particularly influential. IoT-enabled systems allow for precise tracking of stock levels, reducing instances of overstocking or stockouts, and thus maintaining a smooth supply chain flow. This precision in inventory control not only cuts down on storage costs but also improves the overall customer shopping experience by ensuring product availability.

Supply Chain Automation, powered by IoT technologies, integrates key points from manufacturing to in-store availability, offering transparency and speed. This helps retailers quickly adapt to market changes and consumer demands, boosting responsiveness and agility in the competitive retail environment.

IoT applications in Workforce Management improve labor efficiency through optimized scheduling and task management, while enhancing store security and safety with advanced surveillance and sensors. These benefits make Operations Management a key driver in the IoT retail market, offering a strong return on investment for retailers adopting these technologies.

Key Market Segments

By Offering

- Hardware

- Beacons

- Sensors

- Gateways

- Radio Frequency Identification

- Platform

- Connectivity Management

- Application Management

- Device Management

- Services

- Professional Services

- Managed Services

By Application

- Operations Management

- Inventory Management

- Supply Chain Automation

- Workforce Management

- Security & Safety

- Customer Management

- Smart Vending Machine

- Smart Shelves

- Queue Management

- Automated Checkout

- Asset Management

- Asset Tracking

- Predictive Maintenance

- Advertising and Marketing

- Smart Digital Signage

- Geomarketing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Enhanced Customer Experience

A primary driver for the adoption of IoT in retail is the potential to significantly enhance the customer experience. IoT technologies enable retailers to gather and analyze real-time data on customer behaviors and preferences, facilitating personalized interactions and tailored marketing strategies.

For instance, smart shelves equipped with sensors can detect inventory levels and customer engagement, allowing for timely restocking and targeted promotions. Additionally, IoT-powered mobile applications can guide customers through stores, offering personalized discounts and product recommendations based on their shopping history.

These innovations not only improve customer satisfaction but also foster loyalty and increase sales. By leveraging IoT to create a more responsive and engaging shopping environment, retailers can differentiate themselves in a competitive market.

Restraint

Data Security and Privacy Concerns

Despite its advantages, the implementation of IoT in retail is hindered by significant data security and privacy concerns. IoT devices collect vast amounts of data, including personal customer information and purchasing habits.

This accumulation of sensitive data becomes a target for cyberattacks and unauthorized access, posing risks to both consumers and retailers. Ensuring the confidentiality, integrity, and availability of this data requires robust cybersecurity measures and compliance with privacy regulations.

The complexity increases as IoT ecosystems often involve multiple devices and platforms, each with varying security standards. Retailers must invest in comprehensive security strategies to protect against data breaches, which can lead to financial losses and damage to brand reputation.

Opportunity

Supply Chain Optimization

IoT presents a significant opportunity for retailers to optimize their supply chain operations. By integrating IoT devices such as RFID tags and GPS sensors, retailers can achieve real-time visibility into inventory levels, shipment tracking, and warehouse management.

This enhanced transparency allows for more accurate demand forecasting, reducing instances of overstocking or stockouts. Additionally, IoT-enabled predictive maintenance of equipment can minimize downtime and improve operational efficiency.

The ability to monitor and analyze data across the supply chain enables retailers to make informed decisions, streamline processes, and reduce costs. Embracing IoT in supply chain management not only enhances operational performance but also contributes to a more responsive and customer-centric retail experience.

Challenge

Integration with Existing Systems

A notable challenge in adopting IoT within the retail sector is the integration of new IoT technologies with existing legacy systems. Many retailers operate on established infrastructures that may not be compatible with modern IoT solutions, leading to interoperability issues.

The lack of standardized protocols across different IoT devices and platforms further complicates seamless integration. Addressing these challenges requires significant investment in system upgrades and the development of middleware solutions to bridge the technological gap.

Moreover, retailers must navigate the complexities of data management and ensure that the integration does not disrupt ongoing operations. Overcoming integration hurdles is essential for retailers to fully harness IoT benefits and maintain a competitive edge in the evolving market.

Emerging Trends

The retail industry is transforming with IoT integration, particularly through smart shelves with sensors. These shelves track product levels in real-time, alerting staff to restock and minimizing stockouts, improving inventory management and product availability. Another emerging trend is the use of beacon technology for personalized marketing.

Beacons are small, wireless devices that communicate with customers’ smartphones via Bluetooth. Beacons can send personalized promotions or product details to customers as they approach specific items or sections, enhancing the shopping experience and boosting engagement.

IoT is also revolutionizing supply chain management through real-time tracking of products. By attaching IoT sensors to goods during transit, retailers can monitor the location and condition of products, leading to improved logistics efficiency and reduced losses. This visibility allows for proactive responses to potential issues, ensuring timely deliveries and maintaining product quality.

Key Player Analysis

Key players driving the retail IoT transformation are companies offering innovative solutions and technological advancements, shaping the industry’s future.

Cisco Systems Inc. stands out in the IoT retail market with its robust network infrastructure solutions. Cisco’s IoT technology helps retailers improve operational efficiency, security, and customer engagement through seamless connectivity. Their solutions support real-time data collection from various devices across the retail environment, allowing businesses to make data-driven decisions.

IBM Corporation is a major player in the IoT space, particularly in the retail sector, with its strong focus on artificial intelligence (AI), cloud computing, and data analytics. IBM’s IoT solutions provide retailers with advanced tools for inventory management, supply chain optimization, and personalized customer interactions.

Intel Corporation is a leading force in the IoT retail space due to its cutting-edge hardware technology. Intel provides the necessary processors and microchips that power IoT devices in retail, from smart shelves to in-store sensors. By enabling devices to communicate and process real-time data efficiently, Intel helps retailers improve customer experiences and operational efficiency.

Top Key Players in the Market

- Cisco Systems Inc.

- IBM Corporation

- Intel Corporation

- SAP SE

- Arm Limited

- Google LLC

- Microsoft Corporation

- NXP Semiconductors

- PTC Inc.

- Softweb Solutions Inc.

- Verizon Communications Inc.

- Losant IoT

- RetailNext, Inc.

- Zebra Technologies Corporation

- Other Key Players

Top Opportunities for Players

The Internet of Things (IoT) presents numerous opportunities for retail market players to enhance efficiency, improve customer experiences, and optimize operations.

- Enhanced Customer Experience: IoT can transform customer interactions by enabling personalized shopping experiences through data-driven insights. For example, smart shelves equipped with sensors can provide real-time inventory data, significantly reducing out-of-stock scenarios and ensuring customers find what they need effortlessly.

- Operational Efficiency: IoT devices streamline operations by automating tasks such as inventory management, supply chain monitoring, and predictive maintenance. Sensors on shelves, for instance, can automatically alert staff when items need restocking, and IoT-enabled equipment can predict maintenance needs before breakdowns occur, thus minimizing downtime and maintenance costs.

- In-Store Marketing and Layout Optimization: By analyzing foot traffic data collected through IoT sensors, retailers can optimize store layouts to maximize exposure of high-margin products. This strategic placement directly influences buying behavior and can lead to increased sales.

- Security and Loss Prevention: IoT technologies enhance security within retail environments. Integrated IoT systems using cameras and sensors not only help in monitoring but also in managing store security, reducing theft and ensuring a safe shopping environment for customers.

- Supply Chain and Logistics Transparency: IoT provides real-time visibility into the supply chain, which enhances decision-making and operational efficiency. Sensors can track products from warehouse to shelf, offering insights into inventory levels, delivery times, and logistics operations, thus improving the overall supply chain performance.

Recent Developments

- In January 2024, Advantech, a leader in industrial IoT, acquired Aures Technologies, a French company known for its point-of-sale (POS) and kiosk solutions. This acquisition aims to enhance Advantech’s capabilities in intelligent retail systems and expand its product portfolio in the smart retail sector.

- In March 2024, Amazon enhanced its cashier-less store technology, integrating advanced IoT capabilities that improve the efficiency of checkout processes. This upgrade aims to provide a seamless shopping experience by using AI and sensor technology to track items taken by customers.

Report Scope

Report Features Description Market Value (2024) USD 43.7 Bn Forecast Revenue (2034) USD 349.2 Bn CAGR (2025-2034) 23.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Hardware (Beacons, Sensors, Gateways, Radio Frequency Identification), Platform (Connectivity Management, Application Management, Device Management), Services (Professional Services, Managed Services)), By Application (Operations Management (Inventory Management, Supply Chain Automation, Workforce Management, Security & Safety), Customer Management (Smart Vending Machine, Smart Shelves, Queue Management, Automated Checkout), Asset Management (Asset Tracking, Predictive Maintenance), Advertising and Marketing (Smart Digital Signage, Geomarketing, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems Inc., IBM Corporation, Intel Corporation, SAP SE, Arm Limited, Google LLC, Microsoft Corporation, NXP Semiconductors, PTC Inc., Softweb Solutions Inc., Verizon Communications Inc., Losant IoT, RetailNext, Inc., Zebra Technologies Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Internet of Things In Retail MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Internet of Things In Retail MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems Inc.

- IBM Corporation

- Intel Corporation

- SAP SE

- Arm Limited

- Google LLC

- Microsoft Corporation

- NXP Semiconductors

- PTC Inc.

- Softweb Solutions Inc.

- Verizon Communications Inc.

- Losant IoT

- RetailNext, Inc.

- Zebra Technologies Corporation

- Other Key Players