Global Acellular Dermal Matrices Market By Product Type (Freeze-Dried Sheets, Pre-Hydrated Sheets and Others), By Source (Human, Synthetic & Biosynthetic, Animal and Autologous), By Application (Chronic & Acute Wounds, Breast Reconstruction and Others), By End-User (Hospitals, ASCs and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177855

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

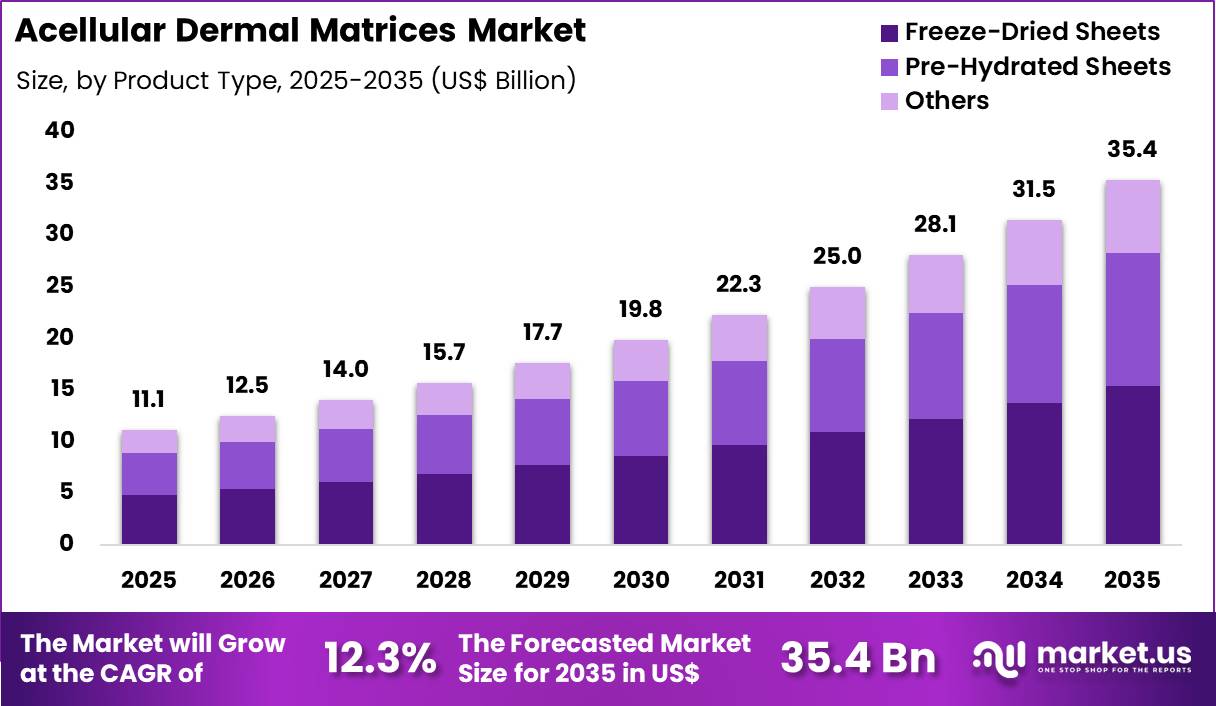

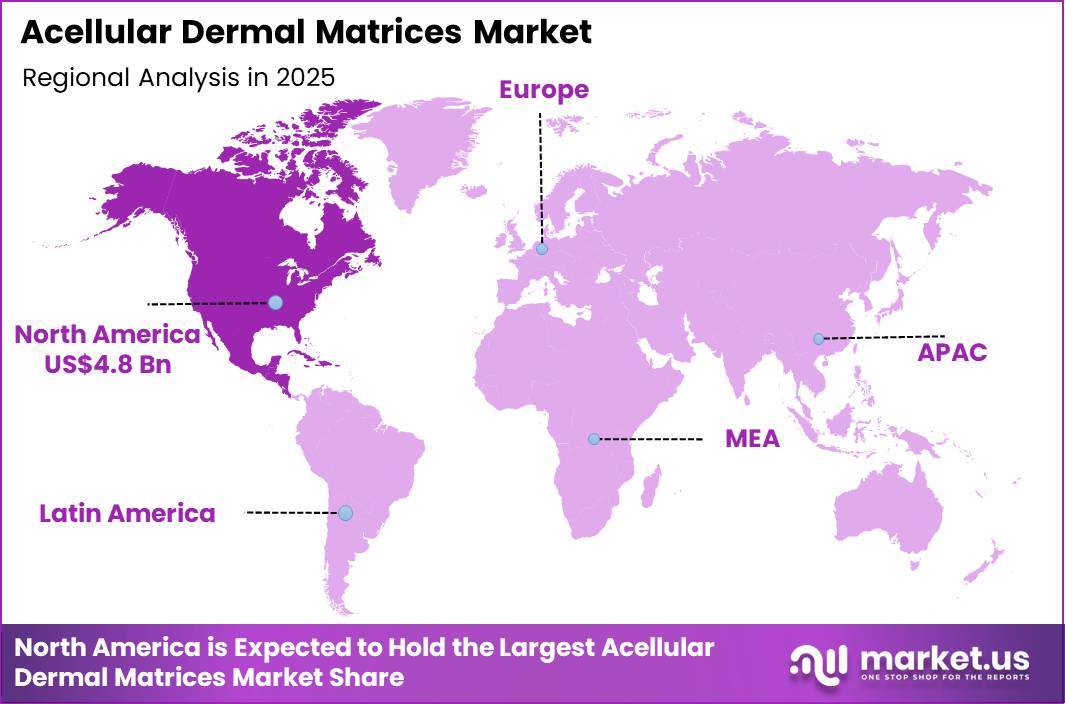

The Global Acellular Dermal Matrices Market size is expected to be worth around US$ 35.4 billion by 2035 from US$ 11.1 billion in 2025, growing at a CAGR of 12.3% during the forecast period 2026-2035. In 2025, North America led the market, achieving over 43.1% share with a revenue of US$ 4.8 Billion.

Increasing prevalence of chronic wounds, burns, and reconstructive needs drives the acellular dermal matrices market as healthcare providers seek biocompatible scaffolds that promote tissue integration and reduce infection risks.

Surgeons increasingly apply human-derived matrices in breast reconstruction following mastectomy, providing structural support that enhances implant stability and aesthetic outcomes while minimizing capsular contracture. These materials support abdominal wall repair in hernia surgeries, where they reinforce weakened tissues and facilitate natural collagen deposition for durable closure.

Clinicians utilize porcine-derived variants for diabetic foot ulcer management, accelerating granulation and epithelialization in non-healing wounds. Acellular dermal matrices also enable complex soft tissue reconstruction in trauma cases, bridging defects and restoring function in extremities or facial areas. Dermatologists incorporate these scaffolds in burn wound coverage, promoting vascularization and scar minimization during healing phases.

Manufacturers pursue opportunities to engineer hybrid matrices infused with growth factors or antimicrobials, expanding applications in orthopedic tendon repairs where enhanced regeneration shortens recovery times. Developers advance cryopreserved options that retain extracellular matrix integrity, broadening utility in vascular graft reinforcements to prevent aneurysm recurrence.

These innovations facilitate personalized matrices via 3D bioprinting, optimizing fit for craniofacial reconstructions. Opportunities emerge in sustainable sourcing from xenogeneic tissues with reduced immunogenicity, appealing to cost-conscious providers.

Companies invest in clinical trials validating long-term efficacy, building evidence for broader adoption. Recent trends emphasize minimally invasive delivery systems and bioresorbable designs, positioning the market for growth in value-based care focused on outcomes and innovation.

Key Takeaways

- In 2025, the market generated a revenue of US$ 11.1 Billion, with a CAGR of 12.3%, and is expected to reach US$ 35.4 Billion by the year 2035.

- The product type segment is divided into freeze-dried sheets, pre-hydrated sheets and others, with freeze-dried sheets taking the lead with a market share of 43.6%.

- Considering source, the market is divided into human, synthetic & biosynthetic, animal and autologous. Among these, human held a significant share of 47.9%.

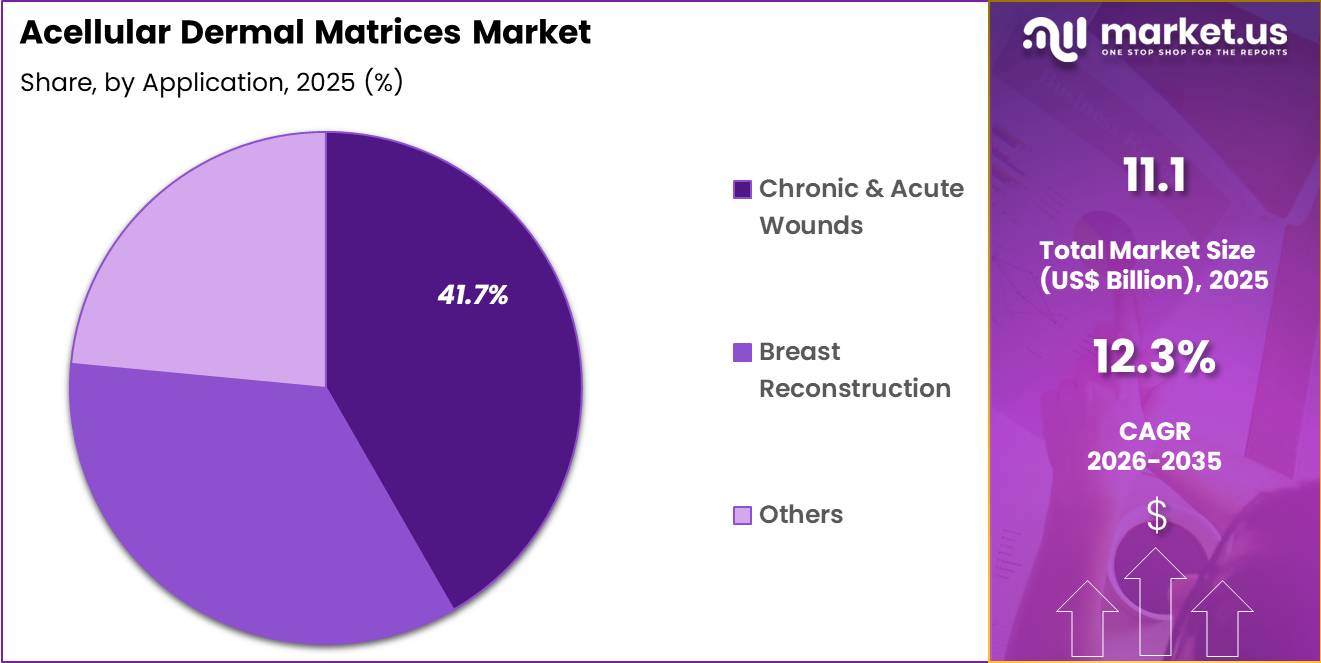

- Furthermore, concerning the application segment, the market is segregated into chronic & acute wounds, breast reconstruction and others. The chronic & acute wounds sector stands out as the dominant player, holding the largest revenue share of 41.7% in the market.

- The end-user segment is segregated into hospitals, ASCs and others, with the hospitals segment leading the market, holding a revenue share of 59.3%.

- North America led the market by securing a market share of 43.1%.

Product Type Analysis

Freeze-dried sheets contributed 43.6% of growth within product type and led the acellular dermal matrices market due to their extended shelf life and ease of storage. Hospitals favor freeze-dried formats because they reduce cold-chain dependency and simplify inventory management. Surgeons rehydrate these sheets intraoperatively, which supports flexible procedural planning. The format aligns well with emergency and elective procedures where preparation timing varies.

Growth strengthens as healthcare facilities prioritize cost-efficient storage solutions and reduced wastage. Freeze-dried matrices maintain structural integrity and biological compatibility after rehydration, which supports consistent clinical outcomes.

Broader adoption in wound care and reconstructive surgery increases utilization frequency. Procurement teams value standardized packaging and handling protocols. The segment is expected to remain dominant as operational efficiency and storage flexibility continue to influence purchasing decisions.

Source Analysis

Human-derived matrices accounted for 47.9% of growth within source and dominated the acellular dermal matrices market due to their strong biocompatibility and lower rejection risk. Surgeons prefer human-derived products because they integrate naturally with host tissue and support vascularization. Clinical familiarity and long-term outcome data reinforce confidence in this source. Human matrices also support a wide range of reconstructive and wound care applications.

Growth accelerates as regenerative medicine advances emphasize biologically compatible scaffolds. Regulatory pathways for human-derived materials remain well established, which supports stable adoption. Increasing donor tissue processing capabilities enhance supply consistency.

Research evidence highlighting improved healing outcomes further strengthens preference. The segment is anticipated to maintain leadership as clinicians prioritize tissue compatibility and predictable integration.

Application Analysis

Chronic and acute wounds generated 41.7% of growth within application and emerged as the leading segment due to the rising prevalence of non-healing ulcers and traumatic injuries. Acellular dermal matrices support tissue regeneration and wound bed preparation, which improves healing timelines. Healthcare providers rely on these matrices to manage diabetic ulcers, pressure injuries, and complex surgical wounds. Increasing aging populations further elevate chronic wound incidence.

Growth strengthens as multidisciplinary wound care programs expand across hospitals and specialty centers. Early intervention strategies emphasize advanced biologic dressings to reduce complications. Reimbursement coverage for complex wound management supports sustained utilization.

Improved clinical protocols highlight the benefits of dermal scaffolds in tissue repair. The segment is projected to remain dominant as chronic wound management continues to demand regenerative solutions.

End-User Analysis

Hospitals contributed 59.3% of growth within end-user and dominated the acellular dermal matrices market due to their concentration of complex surgical and wound care cases. Hospitals manage reconstructive surgeries, trauma cases, and advanced wound treatments that require specialized biomaterials.

Centralized surgical teams and multidisciplinary expertise increase product utilization. Institutional procurement practices further support consistent purchasing volumes. Growth continues as hospitals expand reconstructive and wound care departments.

Accreditation standards and infection control protocols reinforce use of advanced biologic materials. Teaching hospitals further drive adoption through research and training. Referral systems channel complex cases toward hospital settings. The segment is expected to remain the primary growth driver as hospitals continue to anchor regenerative and reconstructive treatment pathways.

Key Market Segments

By Product Type

- Freeze-Dried Sheets

- Pre-Hydrated Sheets

- Others

By Source

- Human

- Synthetic & Biosynthetic

- Animal

- Autologous

By Application

- Chronic & Acute Wounds

- Breast Reconstruction

- Others

By End-User

- Hospitals

- ASCs

- Others

Drivers

Increasing number of breast reconstruction surgeries is driving the market.

The growing volume of breast reconstruction procedures has significantly boosted the demand for acellular dermal matrices, as these products provide essential support for implant-based reconstructions following mastectomies. Enhanced surgical techniques and patient awareness have contributed to higher procedure rates, expanding the application of matrices in reconstructive surgery.

Healthcare providers are increasingly utilizing acellular dermal matrices to improve aesthetic outcomes and reduce complications in breast cancer survivors. The correlation between rising breast cancer diagnoses and the need for reconstruction underscores the market’s expansion for tissue reinforcement solutions.

Government health reports indicate a steady increase in these surgeries, prompting greater investment in matrix technologies. The association between post-mastectomy care and quality of life further amplifies the role of acellular dermal matrices in patient recovery. National plastic surgery associations track procedural trends, highlighting opportunities for matrix integration in standard protocols.

Key developers are refining product designs to meet this escalating clinical requirement. According to the American Society of Plastic Surgeons, breast reconstruction procedures totaled 151,641 in 2022. In 2023, the number rose to 157,740, and in 2024, it reached 162,579.

Restraints

High cost of advanced biomaterials is restraining the market.

The substantial pricing of acellular dermal matrices, derived from complex processing and sourcing of human or animal tissues, restricts their adoption in budget-limited healthcare settings. Manufacturing demands for sterility and biocompatibility elevate overall expenses, which are transferred to end-users through higher product costs.

Smaller facilities often opt for alternative wound care options due to financial constraints, delaying widespread use. Regulatory standards for safety testing add to the

economic burden on suppliers and providers. In public systems, procurement favors cost-effective alternatives, hindering market penetration. Providers must evaluate clinical benefits against fiscal implications when selecting these matrices for procedures. This restraint impacts scalability, particularly in regions with inadequate reimbursement.

Industry initiatives to develop economical variants aim to counteract these challenges progressively. Despite efficacy in tissue regeneration, monetary factors limit universal implementation. Consequently, addressing affordability through subsidies is vital for alleviating this market impediment.

Opportunities

Growth in regenerative medicine applications is creating growth opportunities.

The expanding use of acellular dermal matrices in regenerative medicine opens avenues for their integration in advanced therapies beyond traditional reconstruction. Governmental support for biotechnology fosters the development of matrices for tissue engineering and wound healing innovations.

Increasing focus on personalized medicine amplifies demand for customizable matrix solutions in clinical trials. Partnerships with research institutions facilitate the exploration of matrices in novel indications like soft tissue repair. The large potential in chronic wound management magnifies prospects for matrix utilization in diverse medical fields.

Educational efforts for clinicians promote standardized applications in regenerative protocols. This opportunity allows international firms to diversify into emerging therapeutic areas. Key corporations are establishing collaborations to optimize supply in high-growth sectors.

Overall, regenerative expansions align with efforts to enhance patient outcomes in complex cases. From 2023 to 2024, Materialise’s medical segment revenue increased from 101,376 thousand euros to 116,358 thousand euros, reflecting opportunities in related 3D-printed medical technologies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the acellular dermal matrices market through hospital spending priorities, reimbursement structures, and elective procedure volumes. Inflation and higher interest rates raise operating costs for surgical centers, which increases scrutiny on premium biologic implants used in reconstruction and wound repair.

Geopolitical tensions disrupt global sourcing of processing equipment, sterilization inputs, and packaging materials, adding complexity to manufacturing timelines. Current US tariffs on imported medical components and certain biologic processing materials increase overall production costs, which pressures margins and tightens pricing discussions with providers.

These challenges can slow adoption in budget constrained facilities and affect inventory planning. On the positive side, trade pressure encourages domestic tissue processing, stronger supplier networks, and localized quality control systems.

Rising demand for breast reconstruction, hernia repair, and complex wound management continues to sustain clinical need. With disciplined sourcing, regulatory compliance, and innovation in biologic integration, the market remains positioned for steady and confident growth.

Latest Trends

FDA IDE approvals for clinical investigations is a recent trend in the market.

In 2023, regulatory advancements have propelled clinical studies of acellular dermal matrices for specific indications, enhancing evidence-based applications. These approvals enable rigorous evaluation of matrix performance in implant-based reconstructions. Manufacturers are prioritizing IDE pathways to gather data for pre-market approvals in breast surgery.

Clinical protocols focus on safety and efficacy metrics to support broader commercialization. RTI Surgical received FDA IDE approval in November 2023 for its Cortiva Allograft Dermis in breast reconstruction. This milestone facilitates enrollment in trials to confirm long-term outcomes. The trend emphasizes collaborative research to address FDA concerns on complication rates.

Regulatory adaptations expedite reviews for human-derived matrices in surgical contexts. Industry synergies refine study designs for diverse patient cohorts. These developments aim to establish matrices as standard in reconstructive procedures moving forward.

Regional Analysis

North America is leading the Acellular Dermal Matrices Market

North America held a 43.1% share of the Acellular Dermal Matrices market in 2024, reflecting strong demand across breast reconstruction, hernia repair, and complex wound management. Surgeons increasingly selected biologic scaffolds to reinforce soft tissue and improve aesthetic and functional outcomes.

Growth in post mastectomy reconstruction procedures supported consistent product utilization in leading surgical centers. Rising incidence of breast cancer and higher survival rates encouraged more women to pursue reconstructive options. Hospitals favored advanced biologic materials that integrate with host tissue and reduce complication risks.

Expansion of outpatient surgical facilities also contributed to higher procedural volumes. A relevant supporting indicator comes from the American Cancer Society, which estimated 297,790 new cases of invasive breast cancer in US women for 2023, underscoring sustained clinical need for reconstructive interventions that rely on biologic matrices.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Acellular Dermal Matrices market in Asia Pacific is expected to grow steadily during the forecast period as surgical capacity and reconstructive awareness expand across key countries. Governments invest in oncology care infrastructure, which increases access to mastectomy and subsequent reconstruction procedures. Surgeons adopt biologic grafts to enhance outcomes in trauma, burn, and hernia repair cases.

Growing medical tourism in countries such as South Korea, India, and Thailand strengthens demand for advanced reconstructive solutions. Training programs and international collaborations improve familiarity with biologic scaffold techniques. Rising disposable income also supports elective reconstructive and aesthetic procedures.

A verifiable indicator of demand appears in 2023 data from the World Health Organization, which reported that the Western Pacific Region accounts for a substantial share of global breast cancer cases, highlighting the expanding patient base that supports continued regional growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the acellular dermal matrices market grow by expanding their biologic and synthetic scaffold portfolios to address diverse surgical applications such as breast reconstruction, hernia repair, and wound coverage that improve operative outcomes and patient satisfaction. They also deepen engagement with surgical teams through educational initiatives, clinical evidence generation, and hands-on training that reinforce product familiarity and confidence in complex procedures.

Firms pursue strategic collaborations with hospitals and specialty clinics to secure preferred supplier status and embed their solutions into standardized care pathways. Geographic expansion into Europe, North America, and high-growth Asia Pacific broadens addressable demand as healthcare systems invest in advanced reconstructive techniques and tissue repair technologies.

AlloSource exemplifies a leading biologics provider with a comprehensive suite of human-derived tissue solutions, strong service orientation, and a coordinated commercial strategy focused on quality, surgeon support, and long-term clinical relationships.

The company advances its competitive agenda through disciplined investment in tissue processing innovation, targeted partnerships, and a customer-centric commercialization approach that aligns emerging clinical needs with durable market presence.

Top Key Players

- Allergan

- Integra LifeSciences

- Zimmer Biomet

- Aziyo Biologics

- Baxter International

- Mölnlycke Health Care

- Stryker

- Organogenesis

- Medtronic

- Coloplast

Recent Developments

- In August 2025, AlloSource introduced AlloMend HD, an acellular dermal matrix developed for orthopedic soft-tissue repair. The product launch highlights improved suture retention strength, supporting secure fixation and durability in reconstructive procedures.

- In March 2025, MTF Biologics enrolled the first patient in its Investigational Device Exemption trial assessing FlexHD Pliable for use in pre-pectoral breast reconstruction. The study is designed to evaluate clinical performance and safety outcomes in reconstructive applications.

- Also in March 2025, BD initiated patient treatment within an IDE clinical study evaluating the GalaFLEX LITE scaffold. The trial focuses on its potential to reduce capsular contracture in breast revision surgery, supporting improved long-term reconstructive outcomes.

Report Scope

Report Features Description Market Value (2025) US$ 11.1 Billion Forecast Revenue (2035) US$ 35.4 Billion CAGR (2026-2035) 12.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Freeze-Dried Sheets, Pre-Hydrated Sheets and Others), By Source (Human, Synthetic & Biosynthetic, Animal and Autologous), By Application (Chronic & Acute Wounds, Breast Reconstruction and Others), By End-User (Hospitals, ASCs and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allergan, Integra LifeSciences, Zimmer Biomet, Aziyo Biologics, Baxter International, Mölnlycke Health Care, Stryker, Organogenesis, Medtronic, Coloplast Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Acellular Dermal Matrices MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Acellular Dermal Matrices MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Allergan

- Integra LifeSciences

- Zimmer Biomet

- Aziyo Biologics

- Baxter International

- Mölnlycke Health Care

- Stryker

- Organogenesis

- Medtronic

- Coloplast