Global Ablation Devices Market By Product Type (Radiofrequency Devices, Ultrasound Devices, Laser/Light Ablation, Cryoablation Devices, and Others), By Application (Cardiology, Oncology, Gynecology, Ophthalmology, and Others), By End-user (Hospitals, Ambulatory Surgery Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145681

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

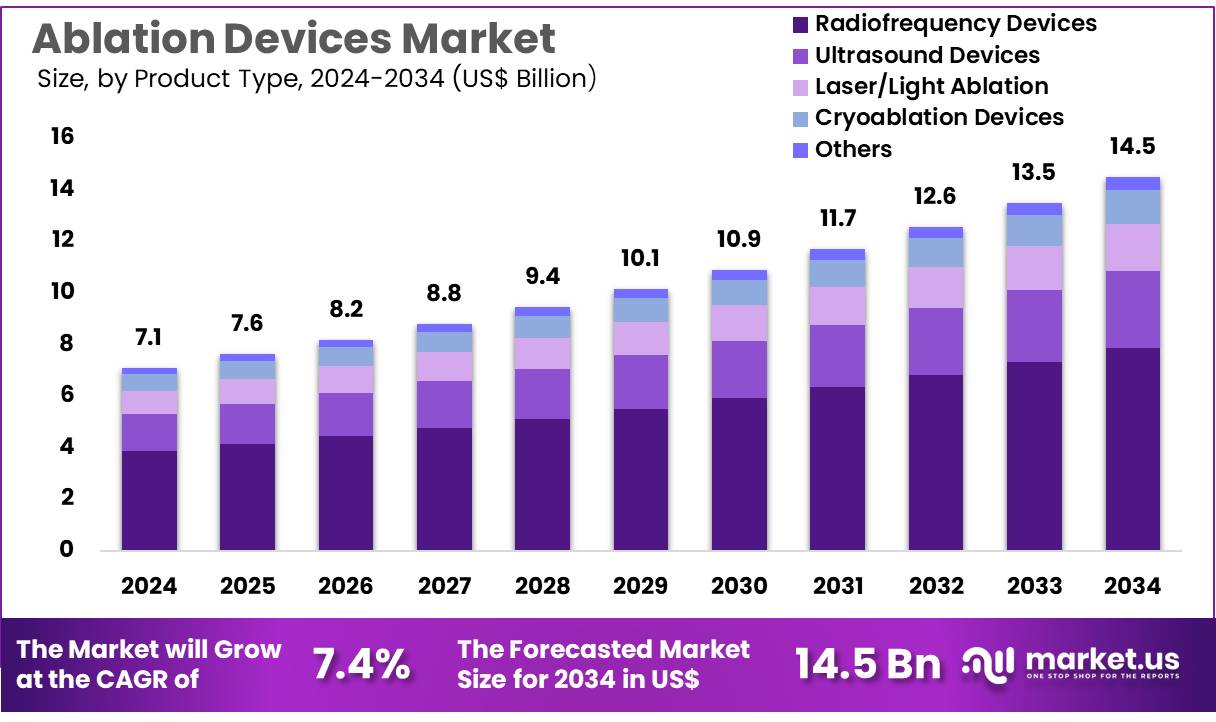

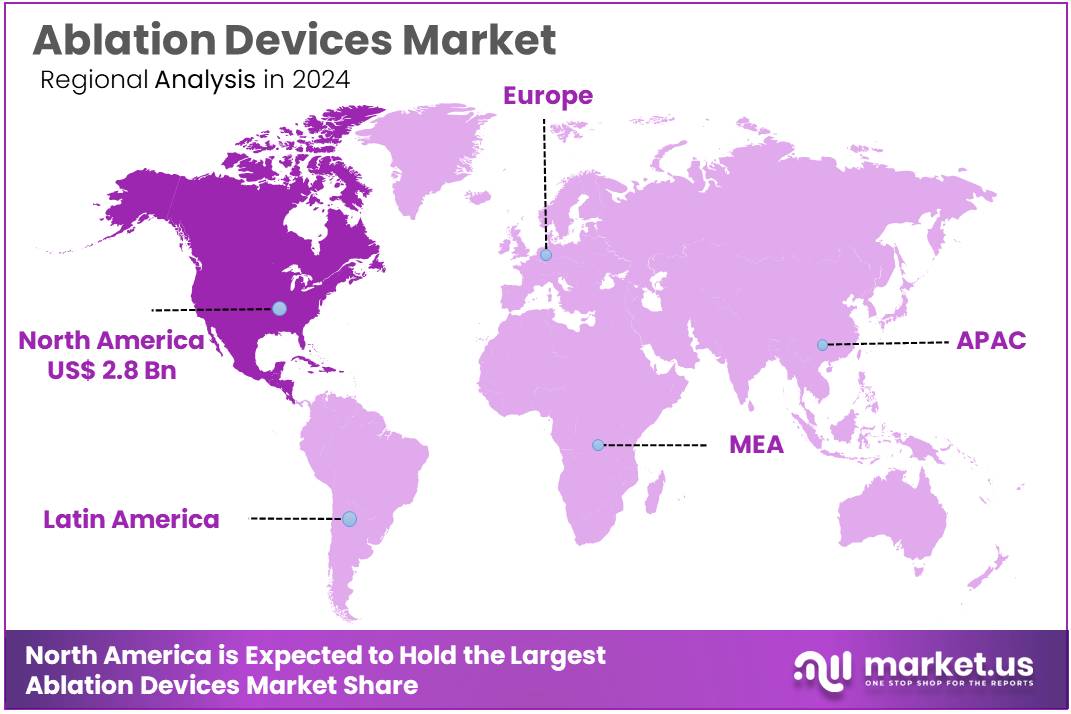

Global Ablation Devices Market size is expected to be worth around US$ 14.5 billion by 2034 from US$ 7.1 billion in 2024, growing at a CAGR of 7.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.2% share with a revenue of US$ 2.8 Billion.

Increasing demand for minimally invasive procedures is driving the growth of the ablation devices market. These devices offer significant advantages in treating various medical conditions, including tumors, cardiac arrhythmias, and chronic pain. Rising incidences of cancer, heart disease, and neurological disorders fuel the demand for innovative treatment solutions that offer precision, safety, and faster recovery times.

Ablation devices are increasingly used in surgical procedures due to their ability to target specific areas of tissue without causing damage to surrounding healthy tissues. Growing advancements in technology, such as robotic systems and high-frequency energy applications, provide opportunities to enhance treatment efficacy and minimize patient discomfort.

In March 2022, Quantum Surgical received 510(k) clearance from the U.S. FDA for its Epione robotic system, designed to provide highly accurate tumor ablation treatments. The system’s advanced features for planning and targeting significantly improve precision in cancer treatments. These innovations contribute to the ongoing trend of developing highly specialized, precise, and efficient ablation devices, boosting the overall market for ablation technology.

Key Takeaways

- In 2024, the market for ablation devices generated a revenue of US$ 7.1 billion, with a CAGR of 7.4%, and is expected to reach US$ 14.5 billion by the year 2033.

- The product type segment is divided into radiofrequency devices, ultrasound devices, laser/light ablation, cryoablation devices, and others, with radiofrequency devices taking the lead in 2024 with a market share of 54.3%.

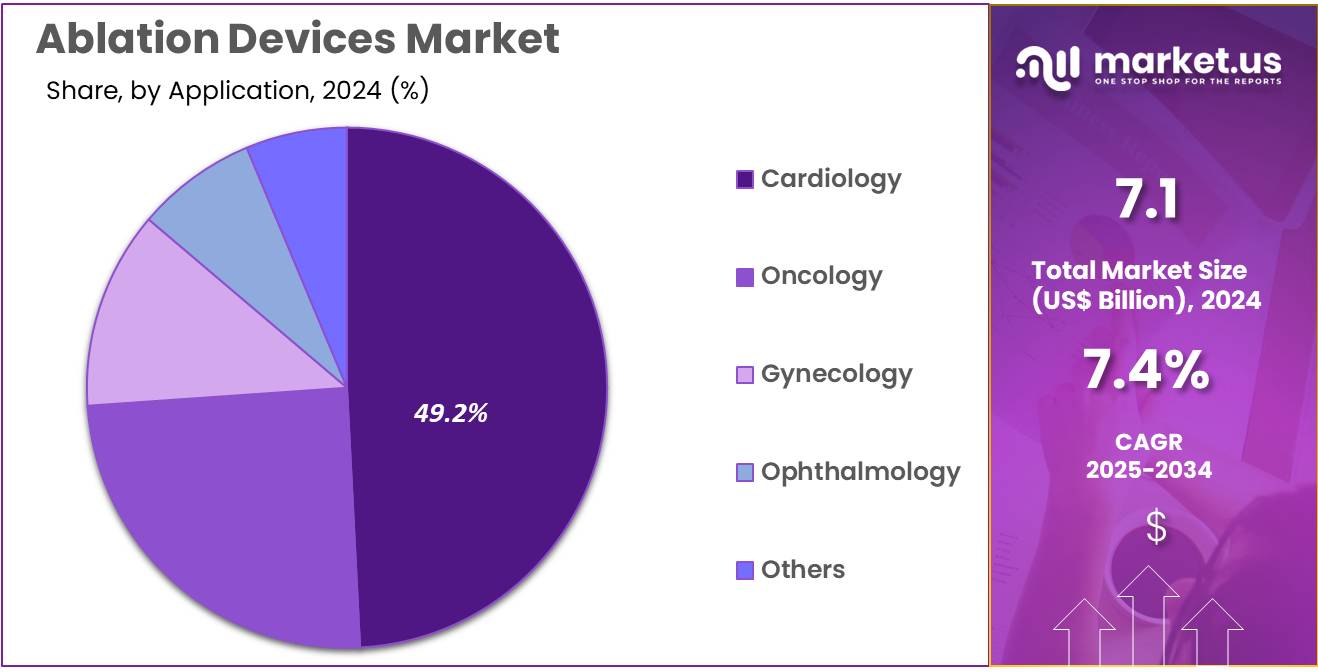

- Considering application, the market is divided into cardiology, oncology, gynecology, ophthalmology, and others. Among these, cardiology held a significant share of 49.2%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, ambulatory surgery centers, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 56.8% in the ablation devices market.

- North America led the market by securing a market share of 39.2% in 2024.

Product Type Analysis

The radiofrequency devices segment led in 2024, claiming a market share of 54.3% owing to the increasing demand for minimally invasive procedures. Radiofrequency ablation (RFA) is widely used for treating a variety of conditions such as cardiac arrhythmias, tumors, and varicose veins. The technology’s ability to precisely target and destroy tissue with minimal damage to surrounding areas is driving its adoption.

As the prevalence of chronic conditions like cancer and heart disease rises, the need for effective, low-risk treatments like radiofrequency ablation is projected to increase. Furthermore, advancements in device technology, such as enhanced electrode designs and improved energy delivery systems, are likely to further fuel the growth of this segment in the coming years.

Application Analysis

The cardiology held a significant share of 49.2% due to the rising prevalence of cardiovascular diseases, particularly arrhythmias. Cardiac arrhythmia treatments, such as radiofrequency ablation, have become standard procedures in modern cardiology, contributing to the demand for ablation devices.

As the global geriatric population increases, so does the number of individuals affected by heart conditions. The shift toward more effective, minimally invasive treatments for conditions like atrial fibrillation is expected to drive further growth. Additionally, technological advancements that improve the precision and safety of procedures are expected to accelerate the adoption of ablation devices in cardiology.

End-User Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 56.8% as hospitals remain the primary centers for advanced medical treatments, including ablation procedures. Hospitals are equipped with the necessary infrastructure and skilled professionals to perform complex ablation procedures for a wide range of conditions, including cancer, heart arrhythmias, and chronic pain.

As the demand for minimally invasive, outpatient-friendly treatments grows, hospitals are expected to increase their adoption of ablation technologies. Moreover, advancements in ablation techniques and growing healthcare investments in medical technologies are anticipated to further drive the uptake of ablation devices in hospital settings, positioning hospitals as a key end-user for the market.

Key Market Segments

By Product Type

- Radiofrequency devices

- Ultrasound devices

- Laser/light ablation

- Cryoablation devices

- Others

By Application

- Cardiology

- Oncology

- Gynecology

- Ophthalmology

- Others

By End-user

- Hospitals

- Ambulatory surgery centers

- Others

Drivers

Increasing Cancer Prevalence is Driving the Market

The growing global cancer burden continues to expand demand for tumor ablation technologies. According to the World Health Organization (WHO), liver and lung cancers, which are common targets for ablation, account for a significant portion of global cancer cases. In the US, the American Cancer Society documented a significant increase in new cancer diagnoses in 2023, driving an uptick in ablation procedures.

Manufacturers such as Medtronic and Boston Scientific have reported growth in their oncology device segments, particularly in radiofrequency ablation systems. The National Cancer Institute’s 2023 budget included a notable allocation for minimally invasive treatment research, which further accelerates technology adoption. With cancer incidence expected to rise significantly by 2040, the clinical need for ablation solutions is poised to continue growing.

Restraints

Stringent Regulatory Requirements are Restraining the Market

Complex approval processes delay market entry for innovative ablation technologies. The FDA’s 2023 medical device report indicated extended average review times for new ablation systems, a trend that is increasing as the regulatory environment tightens. In Europe, the new MDR (Medical Device Regulation) caused a reduction in ablation device certifications in recent years.

Smaller manufacturers face particular challenges with regulatory hurdles, slowing innovation and limiting treatment options, especially for rare conditions that require specialized approaches. These regulatory challenges create barriers to market entry, particularly for novel technologies that could expand the scope of minimally invasive treatments.

Opportunities

Expansion in Emerging Markets is Creating Growth Opportunities

Developing healthcare systems present significant opportunities for the adoption of ablation technologies. In China, the approval of new ablation devices has been increasing steadily, and India’s growth in medical device imports has led to a surge in demand for advanced systems.

Medtronic’s 2023 report highlighted strong sales growth in the Asia-Pacific region, surpassing other markets. Middle-income countries are increasing their hospital equipment budgets, which opens doors for cost-effective ablation solutions tailored to local needs. With a large portion of global cancer cases occurring in developing nations, this shift is generating substantial demand for affordable and effective ablation technology.

Impact of Macroeconomic / Geopolitical Factors

Economic conditions and geopolitical factors significantly influence the ablation technology market. Inflation has led to higher production costs, which prompted manufacturers to raise prices. However, hospitals have maintained procurement budgets for essential systems due to the high clinical demand for ablation technologies.

Trade tensions have caused delays in the supply chain, particularly for semiconductor components critical to ablation systems, although efforts to localize manufacturing in certain regions have helped mitigate some of these risks.

Currency fluctuations in Latin America and other emerging markets have made imported systems more expensive, but regional trade agreements are improving access to these technologies. Despite these economic and geopolitical challenges, continued demand and technological innovations ensure the market’s sustained growth, particularly through the adoption of robotic systems and expansion into emerging markets.

Latest Trends

Robotic-Assisted Ablation is a Recent Trend

Precision robotics are transforming minimally invasive ablation procedures. Robotic-assisted systems have gained traction, with major companies reporting an increase in their adoption rates. This technology is improving the precision of ablation procedures, reducing procedure times, and lowering complication rates when compared to manual methods.

The widespread implementation of robotic platforms in hospitals is changing care standards while driving competition between established medical device firms and robotics startups. As robotic systems evolve and become more widely used, the demand for robotic-assisted ablation solutions continues to rise.

Regional Analysis

North America is leading the Ablation Devices Market

North America dominated the market with the highest revenue share of 39.2% owing to the increasing prevalence of chronic diseases, technological advancements, and expanded insurance coverage. The American Cancer Society reports that cancer cases in the US reached 2 million new diagnoses in 2023, with many requiring tumor ablation procedures.

The Centers for Medicare & Medicaid Services approved 23% more ablation procedure reimbursements in 2023 compared to 2022, making treatments more accessible. The US Food and Drug Administration (FDA) cleared 15 new ablation technologies in 2023, including advanced cardiac and neurological systems.

According to the American Heart Association, cardiac ablation procedures increased by 18% from 2022 to 2023 due to rising atrial fibrillation cases. Major medical centers like Mayo Clinic and Cleveland Clinic reported performing 30% more minimally invasive ablation surgeries in 2023 than previous years. The National Cancer Institute’s US$200 million funding increase for interventional oncology in 2024 has further accelerated market growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR during the forecast period. China’s National Health Commission reports a 25% increase in cancer ablation procedures performed since 2022. Japan’s Ministry of Health, Labour and Welfare approved 12 new ablation devices in 2023, focusing on liver and lung cancer treatments.

India’s Ayushman Bharat program allocated US$150 million for advanced surgical equipment in 2023, including ablation systems for district hospitals. South Korea’s National Cancer Center documented a 40% rise in thyroid ablation cases from 2022 to 2023. Australia’s Therapeutic Goods Administration fast-tracked approval for 8 innovative ablation technologies in 2023.

The Asia Pacific Society of Cardiology estimates cardiac ablation demand will grow 35% by 2025 due to aging populations. These developments indicate strong potential for market growth across the region’s healthcare systems.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the ablation devices market drive growth through technological innovation, strategic partnerships, and expanding global presence. They invest in developing advanced technologies such as pulsed-field ablation and radiofrequency ablation to enhance treatment efficacy.

Collaborations with healthcare providers and research institutions facilitate the integration of new technologies and broaden market reach. Additionally, targeting emerging markets with increasing healthcare infrastructure presents significant growth opportunities.

Boston Scientific Corporation, headquartered in Marlborough, Massachusetts, is a leading developer and manufacturer of medical devices, including ablation systems. The company offers a comprehensive portfolio of ablation products, such as the Farapulse pulsed field ablation system, aimed at treating cardiac arrhythmias. Boston Scientific emphasizes research and development to deliver innovative solutions that improve patient.

Top Key Players

- Thermo Fisher Scientific

- PENTAX Medical

- Olympus Corporation

- CONMED Corporation

- Bausch & Lomb Incorporated

- Angiodynamics

- Alcon Laboratories

- Abbott Laboratories

Recent Developments

- In January 2023, Thermo Fisher Scientific concluded its acquisition of The Binding Site Group, a prominent player in the field of specialty diagnostics. This acquisition is expected to bolster Thermo Fisher’s portfolio and expand its capabilities in immunodiagnostics, enhancing their offerings in critical diagnostic solutions.

- In October 2022, PENTAX Medical launched the C2 CryoBalloon Ablation System in Canada, specifically designed to treat Barrett’s Esophagus. This state-of-the-art system offers a minimally invasive solution, improving treatment options and patient outcomes for individuals with this condition.

Report Scope

Report Features Description Market Value (2024) US$ 7.1 billion Forecast Revenue (2034) US$ 14.5 billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Radiofrequency Devices, Ultrasound Devices, Laser/Light Ablation, Cryoablation Devices, and Others), By Application (Cardiology, Oncology, Gynecology, Ophthalmology, and Others), By End-user (Hospitals, Ambulatory Surgery Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, PENTAX Medical, Olympus Corporation, CONMED Corporation, Bausch & Lomb Incorporated, Angiodynamics, Alcon Laboratories, and Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific

- PENTAX Medical

- Olympus Corporation

- CONMED Corporation

- Bausch & Lomb Incorporated

- Angiodynamics

- Alcon Laboratories

- Abbott Laboratories