Global Automotive Power Liftgate Market Size, Share, Growth Analysis By Type (Passenger Cars (SUVs, Sedans), Commercial Vehicles, Other Cars), By Propulsion (Gasoline, Diesel, Electric), By Material Type (Metal Power Liftgate, Composite Power Liftgate), By System Type (Conventional, Hands-Free Power Liftgate), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 106618

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

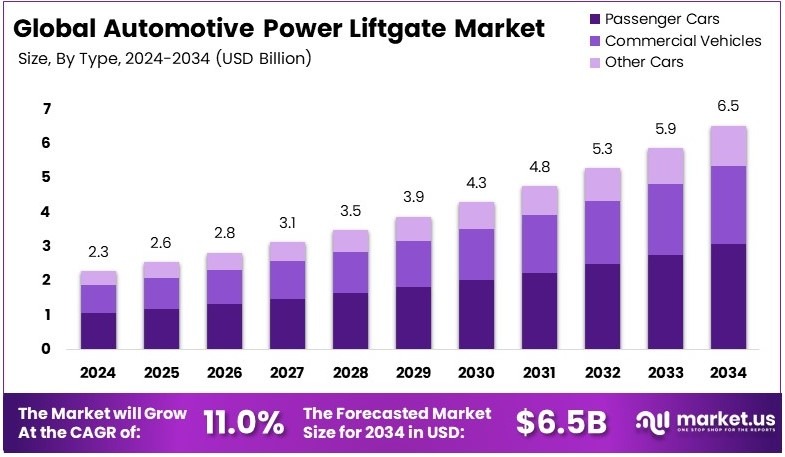

The Global Automotive Power Liftgate Market size is expected to be worth around USD 6.5 Billion by 2034, from USD 2.3 Billion in 2024, growing at a CAGR of 11.0% during the forecast period from 2025 to 2034.

An automotive power liftgate is a motorized rear door that opens and closes automatically. It is usually installed in SUVs, crossovers, and some sedans. Users can control it with a button, key fob, or foot sensor. It offers convenience, especially when loading or unloading items hands-free.

The automotive power liftgate market covers the supply, innovation, and sale of automatic liftgate systems in vehicles. It is driven by rising SUV demand, smart vehicle features, and user comfort trends. Growth also comes from OEM integration and retrofit options in both premium and mid-range car segments.

Automotive power liftgates make loading and unloading easier. These features are popular in larger vehicles like SUVs. According to the IEA, 48% of global car sales in 2023 were SUVs. As cars grow in size and weight, demand for hands-free liftgates that improve convenience continues to rise.

The automotive power liftgate market is growing with smart tech adoption. Many systems now include sensors and automation. As per AlixPartners, 60–82% of consumers trust ADAS features. Since these systems often include hands-free operations, buyers now expect modern cars to have power liftgates as a basic feature.

In addition, people want more comfort and ease in their vehicles. A study by JATO Dynamics shows rising interest in ADAS, which supports smarter and more efficient car features. Therefore, combining ADAS with power liftgates creates a strong value offering in the mid to high-end car segments.

On the other hand, mature markets show rising competition. Brands compete on pricing, speed, and noise levels of the liftgates. Meanwhile, emerging markets offer new demand as more people buy premium vehicles. This shift gives new players an opportunity to grow by offering affordable tech with modern designs.

Locally, liftgates are seen more in SUVs and crossovers in urban areas. These models are common in cities with limited parking space, where hands-free operation is a clear advantage. On a broader scale, more power liftgates mean rising demand for actuators, sensors, and smart controllers in car parts markets.

Key Takeaways

- The Automotive Power Liftgate Market was valued at USD 2.3 billion in 2024 and is expected to reach USD 6.5 billion by 2034, with a CAGR of 11.0%. Increased demand for convenience and luxury vehicles boosts market growth.

- In 2024, Passenger Cars dominated with 47%, as automakers increasingly integrate power liftgates in SUVs and sedans.

- In 2024, Gasoline vehicles led with 49%, as conventional fuel-powered cars remain widely used globally.

- In 2024, Metal power liftgates dominated with 62%, due to their superior strength and durability.

- In 2024, Conventional power liftgates accounted for 64%, as they remain a cost-effective and widely adopted option.

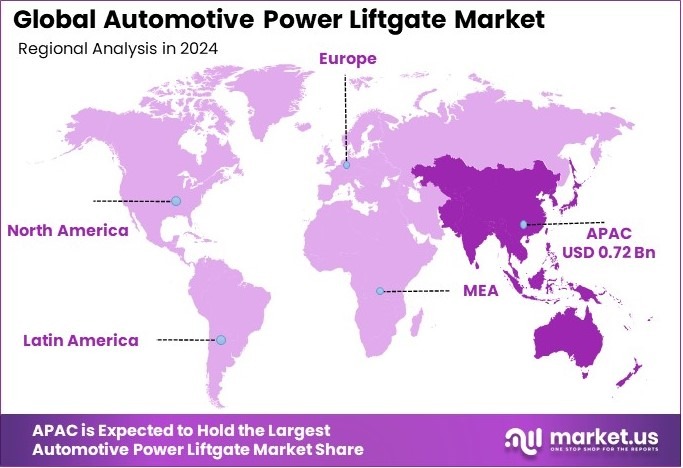

- In 2024, Asia Pacific led with 31.5% with valuation of USD 0.72 billion, driven by growing vehicle production and increasing demand for premium features.

Type Analysis

Passenger Cars dominate with 47% due to their high consumer demand and widespread use.

In the automotive power liftgate market, Passenger Cars emerge as the leading segment, securing a 47% market share. This substantial presence is primarily driven by the high consumer demand for passenger cars globally, coupled with the significant value added by power liftgates in terms of convenience and safety. These features are particularly appealing to families and individuals who prioritize ease of access to their vehicle’s cargo space.

Within the passenger cars category, SUVs stand out due to their larger size and the practical necessity for easy access to extensive cargo areas. Power liftgates in SUVs enhance usability, making them essential for consumers who frequently transport goods or travel with family. Sedans, though typically smaller, benefit from power liftgates in dense urban environments where efficient space utilization and quick access to the trunk are highly valued.

Commercial Vehicles incorporate power liftgates to improve operational efficiency, especially in delivery and utility vehicles where time and ease of access are critical. The functionality of power liftgates in these applications supports quicker loading and unloading processes, which is crucial in commercial operations.

Other Cars, including sports cars and compact vehicles, are also beginning to adopt power liftgates as a standard feature, reflecting broader market trends towards enhancing vehicle functionality and user-friendliness.

Propulsion Analysis

Gasoline vehicles dominate with 49% due to their large market base and established technology.

Gasoline-powered vehicles lead the propulsion segment of the automotive power liftgate market, holding a 49% share. This dominance is underpinned by the extensive global base of gasoline vehicles and the maturity of gasoline propulsion technology, which has traditionally been equipped with more accessories and conveniences, including power liftgates.

Diesel vehicles often feature power liftgates, especially in regions where diesel is favored for its efficiency and durability in larger vehicles such as SUVs and trucks. These vehicles benefit from the robust nature of diesel engines and the added functionality of power liftgates for heavy-duty use.

Electric vehicles (EVs) represent a growing segment where power liftgates are increasingly standard. This trend is aligned with the automotive industry’s shift towards electric mobility, where the integration of advanced, automated features is common. Electric vehicles benefit from the seamless integration of electronic accessories, including power liftgates, enhancing the overall user experience and vehicle appeal.

Material Type Analysis

Metal Power Liftgates dominate with 62% due to their strength and durability.

Metal Power Liftgates occupy a dominant position in the material segment, with a 62% market share, favored for their strength and durability. These characteristics are crucial for components that are frequently used and exposed to various environmental conditions, ensuring longevity and reliability.

Composite Power Liftgates, while currently less common, are gaining popularity due to their advantages in weight reduction and corrosion resistance. These properties are particularly appealing in efforts to improve vehicle efficiency and reduce overall weight, contributing to enhanced fuel economy and reduced emissions.

System Type Analysis

Conventional systems dominate with 64% due to their reliability and lower cost.

Conventional power liftgate systems maintain a leading position in the system type category, claiming a 64% market share. Their widespread adoption is largely due to their reliability and cost-effectiveness, making them a preferred choice among a broad range of consumers.

Hands-Free Power Liftgates are becoming increasingly popular in the premium vehicle segment, where convenience and advanced technology are significant selling points. These systems allow for the liftgate to be operated without physical contact, typically through a simple foot gesture under the rear bumper, which is highly valued by consumers who often have their hands full.

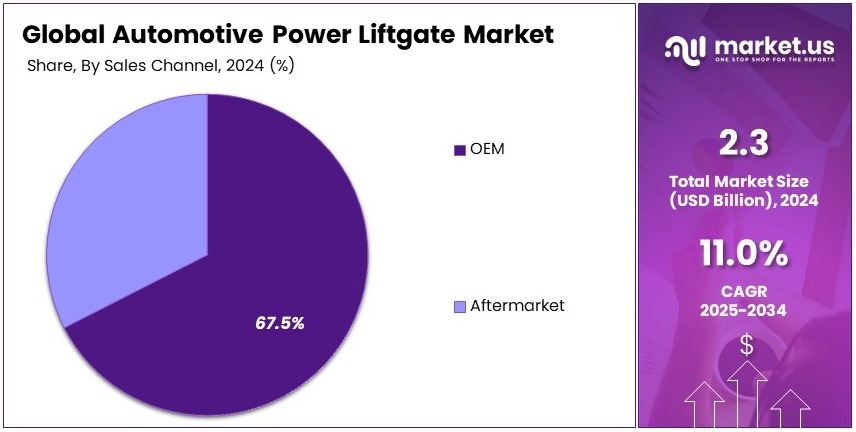

Sales Channel Analysis

OEM dominates with 67.5% due to consumer preference for factory-installed options.

The OEM (Original Equipment Manufacturer) channel is predominant in the automotive power liftgate market, holding a 67.5% share. Consumers generally prefer OEM-installed power liftgates because these systems are designed to integrate seamlessly with the vehicle’s existing aesthetic and electronic systems.

The Aftermarket channel, while smaller, plays a crucial role in providing power liftgate solutions for vehicles that were not equipped with them from the factory. This segment caters to vehicle owners looking to retrofit their cars with modern conveniences, thereby expanding the accessibility of power liftgates to a wider audience.

Key Market Segments

By Type

- Passenger Cars

- SUVs

- Sedans

- Commercial Vehicles

- Other Cars

By Propulsion

- Gasoline

- Diesel

- Electric

By Material Type

- Metal Power Liftgate

- Composite Power Liftgate

By System Type

- Conventional

- Hands-Free Power Liftgate

By Sales Channel

- OEM

- Aftermarket

Driving Factors

Vehicle Comfort and Hands-free Access Drives Market Demand

The automotive power liftgate market is growing due to rising consumer expectations for convenience and advanced vehicle features. One of the major driving forces is the growing demand for comfort and ease in vehicle use. Power liftgates allow users to open and close the vehicle’s rear door electronically, which is especially helpful when carrying heavy items or luggage.

The global rise in SUV and crossover vehicle sales further supports market expansion. These vehicle types are typically larger, making powered liftgates more practical. Their growing popularity among families and urban drivers makes them ideal platforms for such features.

Consumer preference is also shifting toward hands-free access, especially in urban environments. Features like foot-activated liftgates or gesture-based controls enhance user experience and reduce the need for physical contact—an increasingly valued feature post-pandemic.

Additionally, automakers are integrating power liftgates into mid-range vehicle segments, not just high-end models. This broadens the market base and makes the technology accessible to a larger consumer group. As a result, power liftgates are no longer limited to premium vehicles but are becoming a standard expectation.

Restraining Factors

Cost, Reliability, and Fitment Limitations Restraints Market Growth

Although demand for power liftgates is rising, several barriers are slowing down full-scale market penetration. One of the primary challenges is the high cost associated with aftermarket installation and repairs. Consumers may hesitate to upgrade older vehicles due to these added expenses, especially when the benefits are seen as non-essential.

Technical reliability is also a concern. In harsh climates—such as extremely cold or rainy regions—power liftgates can experience malfunctions or reduced performance. Frequent usage in such conditions may lead to premature wear and tear, increasing maintenance frequency.

Compatibility with smaller or budget vehicles poses another issue. Compact hatchbacks or economy cars often lack the structural space or electronic integration to support power liftgate systems. This limits adoption in lower-end segments and emerging markets.

Security concerns are also being raised. As liftgates become smarter and more connected, risks of malfunction or unauthorized access increase. Users may worry about the system failing to lock properly or being bypassed through electronic interference. These concerns highlight the importance of designing systems that are not only convenient but also safe, durable, and adaptable to a variety of vehicle models and usage environments.

Growth Opportunities

Smart Technology and Regional Expansion Provides Opportunities

The automotive power liftgate market offers a wide range of growth opportunities, particularly in smart systems and emerging regions. One major opportunity lies in the development of advanced sensor-based and gesture-controlled systems. These innovations enhance user experience by enabling fully touchless access, which aligns with rising demand for hygiene and automation in vehicle features.

Original equipment manufacturers (OEMs) are also exploring integration of power liftgates into electric and autonomous vehicle platforms. These next-generation vehicles often prioritize user convenience and digital control systems, making them ideal candidates for advanced liftgate functions.

Customization options are gaining popularity in both premium and utility vehicle segments. Buyers increasingly want features tailored to their usage—such as adjustable opening heights, smart lock functions, and integration with vehicle apps. These add value and justify higher price points, particularly in luxury and commercial models.

Expansion into developing regions provides further opportunities. By using localization strategies—such as regional sourcing and simplified product variants—manufacturers can offer cost-effective solutions suited to local market conditions. Countries in Asia, Latin America, and Eastern Europe present strong potential due to growing automotive demand and rising middle-class income.

Emerging Trends

Lightweight Design and Smart Features Are Latest Trending Factor

The automotive power liftgate market is currently shaped by several trending innovations focused on technology, efficiency, and user safety. A leading trend is the development of lightweight and energy-efficient liftgate systems. These use advanced materials and compact motors that reduce vehicle weight and improve battery performance, especially important in electric vehicles.

Smart access technologies are also gaining traction. Wireless key fobs, proximity sensors, and app-based controls allow users to open or close liftgates with minimal effort. These features support seamless vehicle interaction and appeal to tech-savvy consumers seeking convenience and personalization.

Safety is another area of active innovation. Anti-pinch systems and automatic obstacle detection have become standard in newer models. These prevent accidents or damage by halting the liftgate when objects or people are detected in the way. Families with children and elderly passengers especially value these safety functions.

Retrofit solutions with plug-and-play features are rising in popularity. Consumers with older vehicles are showing interest in aftermarket kits that are easy to install without complex rewiring. These solutions help expand the customer base and provide opportunities for accessories brands to tap into existing vehicles. Overall, these trends are driving a smarter, safer, and more accessible liftgate ecosystem.

Regional Analysis

Asia Pacific Dominates with 31.5% Market Share with USD 0.72 Bn in the Automotive Power Liftgate Market

Asia Pacific leads the Automotive Power Liftgate Market, holding a 31.5% share and adding USD 0.72 billion in revenue. This significant market presence is fueled by the region’s rapid automotive industry growth and increasing consumer demand for convenience features in vehicles.

The region’s robust automotive production, coupled with rising consumer expectations for high-tech and luxury vehicle features, drives demand for power liftgates. Additionally, the increasing adoption of SUVs and crossover vehicles, which frequently feature power liftgates, contributes to market growth.

The future impact of Asia Pacific in the Automotive Power Liftgate Market is expected to increase due to ongoing innovations in vehicle technology and rising disposable incomes. The market is poised for further expansion as more manufacturers include power liftgates as standard equipment in new models.

Regional Mentions:

- North America: North America remains a strong market for Automotive Power Liftgates, driven by consumer preferences for SUVs and minivans that often include these features. The market is supported by advanced manufacturing techniques and high consumer spending on vehicle enhancements.

- Europe: Europe’s market for Automotive Power Liftgates is advanced, with a focus on incorporating these systems in premium vehicles. Stringent automotive safety and convenience standards in the region push manufacturers to adopt high-end technologies, including power liftgates.

- Middle East & Africa: In the Middle East and Africa, the Automotive Power Liftgate Market is growing, fueled by the increasing sales of luxury and premium vehicles, which commonly feature these systems as a standard or optional amenity.

- Latin America: The market in Latin America is gradually expanding as the automotive sector modernizes and consumers show greater interest in vehicle convenience features. Economic recovery and increasing vehicle sales are likely to boost the adoption of power liftgates in the region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Automotive Power Liftgate Market is led by key players such as Aisin Corporation, Brose Fahrzeugteile SE & Co. KG, Magna International Inc., and Continental AG. These companies dominate due to strong technical capabilities, long-term partnerships with automakers, and a global manufacturing presence.

Their leadership is driven by the ability to offer reliable, safe, and user-friendly power liftgate systems. These systems are increasingly featured in SUVs, crossovers, and luxury cars. The top players supply both OEM and aftermarket segments, giving them a wide customer base.

Innovation plays a critical role. These companies are investing in smart liftgate solutions with features like gesture control, hands-free opening, and programmable height settings. Brose and Aisin are known for compact and lightweight designs, while Magna and Continental integrate electronics and sensors for smooth and safe operation.

They also benefit from strong collaboration with global automakers. This allows quick adoption of new features into vehicle models. Their expertise in motion control systems and electric actuation technologies supports the development of energy-efficient and high-performance liftgates.

Growing demand for vehicle comfort, safety, and convenience features is driving market growth. The shift toward electric vehicles is also creating new opportunities, as power liftgates align well with the premium features offered in EVs.

With increasing consumer expectations and higher adoption in mid-range vehicles, the top four players are well-positioned to expand their market share. Their focus on innovation, safety, and automation ensures continued leadership in the Automotive Power Liftgate Market.

Major Companies in the Market

- Aisin Corporation

- Autoease Technology

- Brose Fahrzeugteile SE & Co. KG

- Continental AG

- Hi-Lex Corporation

- Huf Hulsbeck & Furst GmbH & Co.

- Johnson Holdings Limited

- Magna International Inc.

- Stabilus GmbH

- Tesla Inc.

- VOXX Electronics Corp.

- Strattec Security Corporation

- Other Key Players

Recent Developments

- Tata Motors: In October 2023, Tata Motors introduced a power liftgate in its facelifted Harrier SUV, enhancing convenience with automatic tailgate functionality.

- Continental AG: Continental AG is developing power liftgate systems with programmable height and hands-free operation, improving vehicle accessibility and user experience.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 6.5 Billion CAGR (2025-2034) 11.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Passenger Cars (SUVs, Sedans), Commercial Vehicles, Other Cars), By Propulsion (Gasoline, Diesel, Electric), By Material Type (Metal Power Liftgate, Composite Power Liftgate), By System Type (Conventional, Hands-Free Power Liftgate), By Sales Channel (OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aisin Corporation, Autoease Technology, Brose Fahrzeugteile SE & Co. KG, Continental AG, Hi-Lex Corporation, Huf Hulsbeck & Furst GmbH & Co., Johnson Holdings Limited, Magna International Inc., Stabilus GmbH, Tesla Inc., VOXX Electronics Corp., Strattec Security Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Power Liftgate MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Power Liftgate MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aisin Corporation

- Autoease Technology

- Brose Fahrzeugteile SE & Co. KG

- Continental AG

- Hi-Lex Corporation

- Huf Hulsbeck & Furst GmbH & Co.

- Johnson Holdings Limited

- Magna International Inc.

- Stabilus GmbH

- Tesla Inc.

- VOXX Electronics corp.

- Strattec Security Corporation

- Other Key Players