Global 3D Digital Twin Market Size, Share, Statistics Analysis Report By Type (Product Digital Twin, Process Digital Twin, System Digital Twin, Component Digital Twin), By Application (Design & Development, Simulation, Predictive Maintenance, Monitoring, Other Applications), By Industry Vertical (Manufacturing, Retail, Healthcare, Automotive, Architecture & Construction, Energy and Utilities, Other Industry Verticals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan. 2024

- Report ID: 137176

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

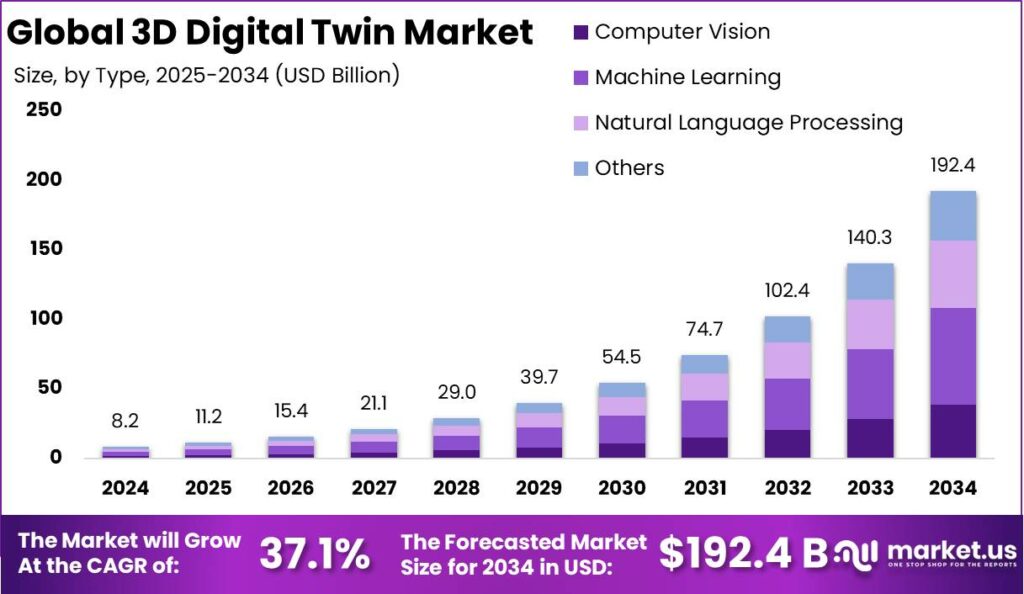

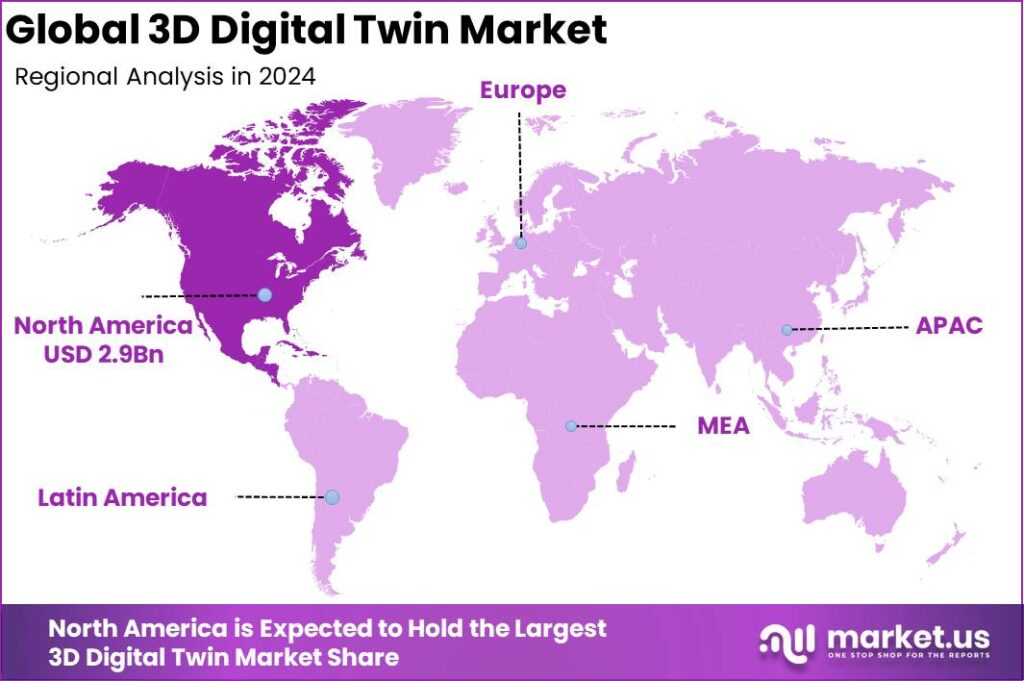

The Global 3D Digital Twin Market size is expected to be worth around USD 192.4 Billion by 2034, from USD 8.2 Billion in 2024, growing at a CAGR of 9.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.50% share, holding USD 2.9 Bn revenue.

A 3D digital twin is a dynamic virtual model of a physical object or system. It integrates real-time data and simulations to mirror and predict the performance and issues of its physical counterpart. This technology enables a comprehensive visual and analytical representation, enhancing decision-making and problem-solving in various industries.

The 3D digital twin market is experiencing significant growth due to its wide applications across various industries, including manufacturing, automotive, construction, and healthcare. This technology helps companies in predicting maintenance needs, enhancing operational efficiency, and reducing time-to-market for new products.

The market’s expansion is driven by increasing digitalization, the rise of the IoT, and greater emphasis on sustainability and efficient resource use. Several key factors drive the adoption of 3D digital twins. First, the need for improved operational efficiency and the ability to predict and mitigate potential issues in complex systems play a crucial role.

Additionally, the demand for this technology is bolstered by its capacity to optimize product performance and enhance decision-making processes. These benefits are particularly valued in sectors where precision and efficiency are paramount, such as in aerospace, automotive, and large-scale manufacturing.

Market demand for 3D digital twins is soaring, especially in industries that manage large-scale projects or complex systems, such as aerospace, automotive, and healthcare. These industries rely on digital twins for comprehensive simulations that offer insights into product performance under various scenarios, thereby enabling more informed decisions and strategic planning.

According to Hexagon, the deployment of digital twins is expected to grow by an average of 36% over the next five years. Approximately 70% of technology leaders in major corporations are actively focusing on and dedicating resources to digital twin initiatives. Furthermore, 42% of executives across industries acknowledge the value of digital twins, with 59% planning to integrate them into their operations by 2028.

Sustainability is emerging as a significant driver for digital twin investments, with 57% of organisations citing it as a key motivator. On average, companies have seen a 16% improvement in sustainability metrics through the use of digital twins. However, despite these promising advancements, nearly 47% of IT decision-makers remain unfamiliar with the concept.

The adoption of digital twins has also proven to be a game-changer in project execution. Companies report a 60% reduction in time required to launch AI-enabled features and a 15% decrease in associated costs. Organisations leveraging digital twins experience an average 15% boost in sales, turnaround time, and operational efficiency, with system performance improvements surpassing 25%.

The continuous advancement in IoT and AI technologies presents new opportunities in the 3D digital twin market. As these technologies evolve, they enhance the capabilities of digital twins, making them more precise and useful across different applications. There is also a growing trend towards integrating digital twins with augmented reality (AR) and virtual reality (VR), which opens up further possibilities for innovation in training, remote operations, and customer experiences.

Technological advancements are continuously shaping the 3D digital twin market. The integration of AI and machine learning algorithms has enabled more sophisticated data analysis and simulation capabilities that can predict wear and tear on physical assets and optimize their operation. Furthermore, improvements in data processing and IoT technology allow for more seamless and scalable implementations of digital twins across various sectors.

Key Takeaways

- In 2024, the Product Digital Twin segment held a dominant market position, capturing more than a 37.8% share of the Global 3D Digital Twin Market.

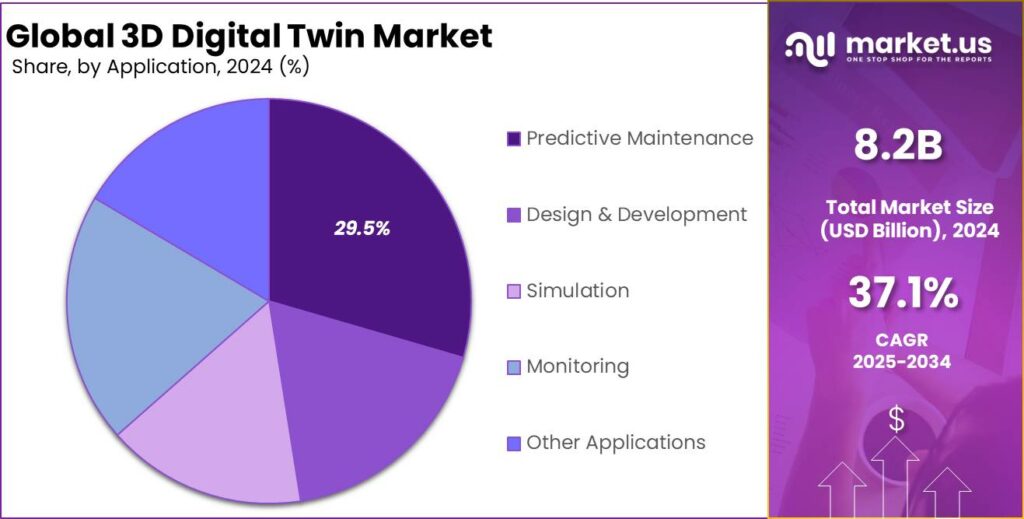

- In 2024, the Predictive Maintenance segment held a dominant market position, capturing more than a 29.5% share of the Global 3D Digital Twin Market.

- In 2024, the Automotive segment held a dominant market position, capturing more than a 19.1% share of the Global 3D Digital Twin Market.

- In 2024, North America held a dominant market position in the global 3D Digital Twin Market, capturing more than a 36.5% share.

- According to the World Economic Forum, the global market for digital twins in the manufacturing industry alone is expected to reach more than $6 billion.

- Based on data from American Hospital Association, around 113 hospitals had centralized 3D facilities for point-of-care manufacturing.

U.S. 3D Digital Twin Market Size

The US 3D Digital Twin market is projected to grow significantly, with its size reaching an impressive USD 273.48 million in 2024. The United States is spearheading this market due to several strategic and technological factors that favor the adoption and development of digital twin technologies.

One of the main drivers behind the US’s dominance in this field is the strong integration of IoT and cloud-based platforms, which enhances the capabilities of digital twins in various industries such as manufacturing, healthcare, and automotive. These technologies facilitate more efficient production processes, asset management, and cost minimization, contributing to the robust growth forecast.

Moreover, the US market benefits from substantial investments in R&D and the presence of leading technology companies like General Electric, Microsoft, and Autodesk. These companies are constantly innovating and expanding their digital twin solutions, which in turn propels the market forward.

In 2024, North America held a dominant market position in the 3D Digital Twin sector, capturing more than a 36.5% share. This translates to a significant revenue of approximately USD 2.9 billion, underlining the region’s leading role in this innovative technology field. Several factors contribute to North America’s prominence in the digital twin market.

Firstly, the region benefits from the presence of a robust technological infrastructure and a concentration of key industry players, including tech giants such as General Electric, IBM, and Microsoft. These companies not only invest heavily in research and development but also drive the adoption of digital twin technologies across various sectors, from manufacturing to healthcare.

Secondly, North America’s market dominance is further supported by its advanced manufacturing and automotive industries, which are increasingly incorporating digital twins for optimizing operations and enhancing production efficiencies. The digital twin technology enables these industries to simulate, predict, and control systems in a virtual environment, which significantly reduces costs and improves operational reliability.

Furthermore, the integration of IoT and big data analytics in the region has propelled the use of digital twins in sectors like energy and utilities, where they help in managing complex systems more effectively and with better predictive capabilities. This has led to improved decision-making processes based on real-time data and simulations, enhancing the operational efficiencies across various industries.

Type segment Analysis

In 2024, the Product Digital Twin segment held a dominant market position, capturing more than a 37.8% share of the Global 3D Digital Twin Market. This is majorly due to the increasing demand for optimizing the product lifecycle, cost saving, and customization.

Product digital twin is highly used for managing and monitoring the product lifecycle from manufacturing to maintenance and disposal as it helps in optimizing each stage, leading to a quality output. For instance, a well-known product digital twin is GE’s Predix that simplifies creating dynamic digital models of physical assets and systems

Additionally, product digital twin enables the manufacturers to customize the products according to the customer feedback in real-time and less cost. This is due to its capability of virtual prototyping and testing, which saves time and requires less resources.

Application Analysis

In 2024, the Predictive Maintenance segment held a dominant market position, capturing more than a 29.5% share of the Global 3D Digital Twin Market. This is due to the increasing need for anomaly predictability, enhanced safety and improved safety.

3D digital twins help in real time monitoring of asset performance and thus allows for prediction of potential failures or maintenance requirements. As a result, it reduces downtime and optimizes maintenance resources.

Therefore, due to its diverse benefits, digital twin in predictive maintenance is used in different industries and sectors including prognostic health monitoring, manufacturing, integration of sustainability initiatives, and refurbishment management.

Industry Vertical Analysis

In 2023, the Automotive segment held a dominant market position, capturing more than a 19.1% share of the Global 3D Digital Twin Market. This could be attributed to the increased need for optimized vehicle designs, supply chain management, quality control, and collaborative working in the automotive industry.

With the increasing demand for personalization and advanced features in vehicles, manufacturers are adopting 3D digital twins which results in a competitive advantage for the firm. For instance, Boeing created an AR-powered aircraft inspection application using a 3D digital twin of one of its planes. The twin enabled this aerospace industry leader to generate over 100,000 synthetic images to better train the machine learning algorithms of the AR application.

Additionally, technologies such as IoT sensors and 3D scanning aids in shaping the 3D digital twin by monitoring the production performance. This further boosts the strategies of manufacturing, innovations and resource management.

Key Market Segments

By Type

- Product Digital Twin

- Process Digital Twin

- System Digital Twin

- Component Digital Twin

By Application

- Predictive Maintenance

- Design & Development

- Simulation

- Monitoring

- Other Applications

By Industry Vertical

- Manufacturing

- Retail

- Healthcare

- Automotive

- Architecture & Construction

- Energy and Utilities

- Other Industry Verticals

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Enhanced Operational Efficiency through Predictive Maintenance

One of the primary drivers propelling the adoption of 3D digital twins across various industries is the significant enhancement of operational efficiency through predictive maintenance. Digital twins enable organizations to create highly accurate simulations of physical assets, which can be used to predict wear and tear and prevent equipment failure. This capability is particularly crucial in sectors like manufacturing, where unplanned downtime can result in significant financial losses.

By leveraging digital twins, companies can reduce maintenance costs and extend the lifespan of their equipment. The ability to anticipate failures and schedule maintenance proactively contributes to smoother operations and improved safety standards. The technology has been embraced notably in sectors such as aerospace and automotive, where its impact on reducing maintenance overhead and increasing asset availability is profound.

Restraint

High Implementation Costs

Despite their potential, the implementation of 3D digital twins is often hindered by high initial costs. Establishing a digital twin requires substantial investment in advanced sensors, software, and the integration of complex systems. This financial barrier can be particularly daunting for small to medium-sized enterprises (SMEs) that may not have the necessary capital to invest in such sophisticated technology.

Furthermore, the ongoing expenses associated with updating and maintaining digital twin systems can also deter companies from adopting this technology. These financial considerations are critical constraints that slow down the market penetration of digital twins, especially in regions with lower industrial automation.

Opportunity

Expansion into Emerging Markets

The global digital twin market is rapidly expanding, with significant growth opportunities in emerging markets. Countries in the Asia-Pacific region, such as China and India, are rapidly industrializing and integrating digital technologies into their industries. This trend is supported by government initiatives and investments in IoT and smart infrastructure, which are conducive to the adoption of digital twins.

The growing industrial base in these countries, coupled with increasing digital literacy, provides a fertile ground for the expansion of digital twin technologies. Market players can leverage these opportunities by offering tailored solutions that meet the specific needs of these emerging markets, potentially gaining a significant foothold and driving global market growth.

Challenge

Data Privacy and Security Concerns

As with many technologies that rely heavily on data, digital twins face significant challenges related to data privacy and security. The extensive data collection required to create and maintain digital twins raises concerns about the security of sensitive information, particularly in industries like healthcare and finance.

Ensuring the integrity and security of this data against cyber threats is a paramount challenge for companies implementing digital twin technology. Additionally, regulatory compliance becomes a critical issue, as firms must adhere to strict data protection laws, which can vary significantly by country and region. Addressing these concerns is crucial for the continued adoption and trust in digital twin technologies

Growth Factors

The increasing demand for sustainability across business and in urban development, facility maintenance and management, and streamlining the business processes has driven the growth of 3D digital twin market.

3D digital twins help in sustainable urban planning by optimizing the resources and reducing wastes. For instance, Singapore’s Virtual Singapore project, uses real-time data to create an interactive digital twin of the city.

This platform allows urban planners to simulate scenarios like traffic flow and environmental impact, testing potential solutions before implementation. Furthermore, 3D digital twins also provide real time monitoring and enhances efficiency of the business processes.

Latest Trends

Ongoing technological revolution and trends are reshaping the 3D digital twin market. These trends include the implementation of 3D digital twin in smart city initiatives, for virtual tours, to monitor the patient’s wellbeing at a remote distance and for personalized and collaborative learning.

These trends have opened new doors for 3D Digital twin market to grow and bring in new innovation. For instance, The Kaohsiung City Government partnered with VIVERSE to create digital twin models of iconic venues like the Kaohsiung Arena. This allows worldwide visitors to explore venues virtually.

Key Players Analysis

One of the leading player in the market is Siemens AG that offers various digital twin solutions including 3D digital twins. These offerings aids in planning, stimulating, predicting and optimizing all the production processes effectively.

Another prominent player operating is Hexagon AB. It offers 3D digital twin solutions that enable virtual models of physical assets, systems, and processes. This transforms industrial operations by stimulating, monitoring and analysing the real world performance in real time.

Top Key Players in the Market

- Siemens AG

- Dassault Systèmes

- Hexagon AB

- Genesys International Corporation Ltd.

- Autodesk, Inc.

- Schneider Electric

- Open Cascade

- GE Vernova

- Bentley Systems, Incorporated

- Rockwell Automation

- Booz Allen Hamilton Inc.

- Virtuscan Ltd.

- Other Key Players

Recent Developments

- In October 2024, Meta launched its new Digital Twin Catalog (DTC), advertised as the world’s “largest and highest quality 3D object model dataset”. The catalog was developed by Reality Labs Research, Meta’s virtual reality (VR) and augmented reality (AR) research unit. It features over 2,400 detailed 3D models of real-life objects or digital twins.

- In August 2024, the Abu Dhabi Housing Authority has introduced a digital twin technology that improves the displaying of housing project. It has partnered with NNTC, a leading digital twin company in the UAE, to offer a 3D digital twin based virtual tour.

- In August 2024, Downtown Phoenix Inc. announced the launch of Downtown Phoenix’s first digital twin. The community-building organization and enhanced municipal services provider has partnered with CyberCity 3D and Orbis Dynamics to produce a replica of Downtown that will use legions of aggregated data to highlight real-time traffic patterns, zoning ordinances, air quality, prime urban heat locations, and other development-related insights.

- In February 2024, Capgemini announced the acquisition of Unity’s Digital Twin Professional Services arm to accelerate enterprises’ digital transformation through real-time 3D technology.

Report Scope

Report Features Description Market Value (2024) USD 8.2 Bn Forecast Revenue (2034) USD 192.4 Bn CAGR (2025-2034) 37.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Product Digital Twin, Process Digital Twin, System Digital Twin, Component Digital Twin), By Application (Design & Development, Simulation, Predictive Maintenance, Monitoring, Other Applications), By Industry Vertical (Manufacturing, Retail, Healthcare, Automotive, Architecture & Construction, Energy and Utilities, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens AG, Dassault Systèmes, Hexagon AB, Genesys International Corporation Ltd., Autodesk, Inc., Schneider Electric, Open Cascade, GE Vernova, Bentley Systems, Incorporated, Rockwell Automation, Booz Allen Hamilton Inc., Virtuscan Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens AG

- Dassault Systèmes

- Hexagon AB

- Genesys International Corporation Ltd.

- Autodesk, Inc.

- Schneider Electric

- Open Cascade

- GE Vernova

- Bentley Systems, Incorporated

- Rockwell Automation

- Booz Allen Hamilton Inc.

- Virtuscan Ltd.

- Other Key Players