Global Digital Twins-as-a-Service (DTaS) Market By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), By Vertical (Manufacturing, Healthcare, Automotive, Aerospace, Energy & Utilities, Retail, Transportation & Logistics, Others), By Application (Predictive Maintenance, Asset Management, Performance Monitoring, Inventory Management, Process Optimization, Others), By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 118912

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

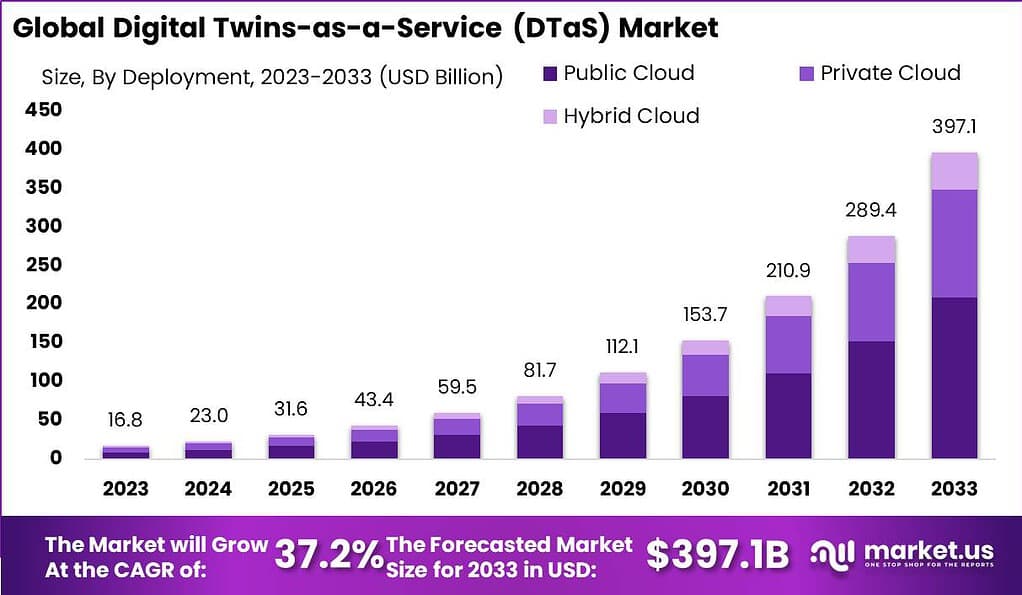

The Global Digital Twins-as-a-Service (DTaS) Market size is expected to be worth around USD 397.1 Billion by 2033, from USD 16.8 Billion in 2023, growing at a CAGR of 37.2% during the forecast period from 2024 to 2033.

Digital Twins-as-a-Service (DTaS) refers to a modern service model where companies use digital replicas of physical assets, systems, or processes to enhance their operations. These digital twins are hosted and managed by a third party, offering clients access to sophisticated simulations without the need for in-house expertise or infrastructure. The DTaS model enables businesses to analyze performance data, optimize operations, and predict maintenance needs in a cost-effective and scalable manner.

The market for DTaS is experiencing significant growth, driven by the increasing adoption of IoT (Internet of Things) technologies and the need for enhanced operational efficiency across various industries. Organizations in sectors such as manufacturing, healthcare, and urban planning are particularly keen on leveraging these services to improve decision-making and strategic planning.

The growth of the DTaS market can be attributed to its ability to provide detailed insights into asset performance and potential system failures before they occur, thereby reducing downtime and maintenance costs. As businesses continue to recognize the benefits of digital twins, the demand for DTaS is expected to rise, positioning it as a crucial component in the future of digital transformation strategies.

According to market research conducted by CPR India, funding for companies specializing in smart city applications, with a particular emphasis on digital twin technology, soared to an impressive ~$500 million in 2023. This significant investment highlights the growing adoption of digital twin solutions by cities worldwide for effective urban planning and efficient infrastructure management.

Moreover, the report reveals that investment in DTaS (Deep Tech as a Service) startups experienced remarkable growth, reaching a record-breaking ~$1.2 billion in 2023. This figure represents a substantial 50% increase compared to the previous year, demonstrating the heightened interest and confidence in DTaS startups.

Key Takeaways

- The Digital Twins-as-a-Service (DTaS) market is estimated to grow substantially, reaching a value of USD 397.1 billion by 2033, representing a remarkable Compound Annual Growth Rate (CAGR) of 37.2% from 2024 to 2033.

- The Public Cloud segment dominated the DTaS market in 2023, holding over 52.8% market share. This segment’s popularity is attributed to its widespread accessibility, cost-effectiveness, scalability, and robust infrastructure supporting extensive data collection and analytics capabilities.

- The Manufacturing segment led the DTaS market in 2023 with over 25.3% market share. Manufacturers leverage digital twins to optimize production processes, supply chains, and perform predictive maintenance, driving operational efficiencies and innovation.

- Predictive Maintenance emerged as the dominant segment in 2023, capturing more than 30.2% market share. This segment’s success is driven by its ability to forecast equipment failures, minimize downtime, and improve productivity across industries like manufacturing, energy, and transportation.

- Large Enterprises dominated the DTaS market in 2023, with over 64.3% market share. Their substantial resources enable comprehensive DTaS solutions deployment, facilitating strategic decision-making, operational efficiencies, and integration with enterprise-level software solutions.

- In 2023, North America held a dominant market position in the Digital Twins-as-a-Service (DTaS) market, capturing more than a 34.8% share.

Deployment Analysis

In 2023, the Public Cloud segment held a dominant position in the Digital Twins-as-a-Service (DTaS) market, capturing more than a 52.8% share. This segment’s leadership can be primarily attributed to its widespread accessibility and cost-effectiveness, making it an attractive option for a broad range of industries.

Public cloud platforms offer a scalable environment where digital twins can be developed and managed without the significant upfront costs associated with physical infrastructure. This flexibility allows businesses to experiment and scale their digital twin initiatives in response to evolving needs and opportunities.

Moreover, the public cloud’s robust infrastructure supports extensive data collection and analytics capabilities, which are essential for the effective operation of digital twins. Companies utilize these features to gain real-time insights into their operations, enhance predictive maintenance, and improve overall decision-making processes. Additionally, the security measures provided by major public cloud providers have increased enterprise trust in deploying digital twins on public platforms, further driving this segment’s growth.

Overall, the Public Cloud segment of the DTaS market benefits significantly from the ongoing shifts towards digitalization and the increasing preference for cost-efficient, flexible technological solutions. As businesses continue to recognize the potential of digital twins to streamline operations and support strategic goals, the prominence of the public cloud is expected to remain strong, reinforcing its market leadership

Vertical Analysis

In 2023, the Manufacturing segment held a dominant market position in the Digital Twins-as-a-Service (DTaS) market, capturing more than a 25.3% share. This leadership is largely due to the segment’s intensive focus on enhancing operational efficiency and reducing production downtime through advanced digital technologies.

Manufacturers are increasingly deploying digital twins to simulate production processes, optimize supply chains, and perform predictive maintenance on equipment, which significantly minimizes unexpected breakdowns and extends the lifespan of machinery. Additionally, the manufacturing industry faces constant pressure to innovate and improve product quality while reducing costs and environmental impact.

Digital twins enable manufacturers to create and test virtual replicas of products and production lines before actual physical deployment. This not only helps in fine-tuning processes but also speeds up the time to market for new products. The ability to monitor systems in real-time and predict failures before they occur can lead to substantial cost savings and enhanced competitive advantage.

The growth of the DTaS market within the manufacturing sector is further propelled by the integration of IoT devices, which collect vast amounts of data from the manufacturing floor. This data is crucial for developing accurate digital twins that can predict outcomes with high precision. As manufacturers continue to strive for innovation and sustainability, the adoption of digital twins is expected to expand, keeping the manufacturing sector at the forefront of the DTaS market.

Application Analysis

In 2023, the Predictive Maintenance segment held a dominant position in the Digital Twins-as-a-Service (DTaS) market, capturing more than a 30.2% share. This leadership can be attributed to the increasing recognition of predictive maintenance as a critical factor in reducing operational costs and enhancing efficiency across various industries.

Predictive maintenance utilizes data analytics and machine learning to forecast equipment failures before they occur, enabling proactive maintenance schedules and minimizing unexpected downtimes. This capability is particularly valued in sectors such as manufacturing, energy, and transportation, where equipment reliability is closely tied to productivity and safety.

The segment’s success is further bolstered by the integration of IoT devices, which continuously collect data on machine performance and health. This data is fed into digital twins, which are virtual replicas of physical assets, to simulate wear and tear and predict future breakdowns.

The accuracy of these predictions has improved with advancements in AI and big data analytics, making predictive maintenance even more essential for operational resilience. For instance, a study by the Aberdeen Group noted that companies using predictive maintenance are able to reduce downtime by up to 50% and increase machine life by 20-40%, underscoring the financial and operational benefits of this technology.

Moreover, as businesses strive for sustainability and efficiency, the demand for predictive maintenance solutions is expected to grow. This trend is evident in the rising investments in digital twin technologies, aimed at enhancing predictive maintenance applications. The market is also seeing a surge in partnerships between DTaS providers and industry leaders to further integrate and innovate in this field, ensuring that the Predictive Maintenance segment remains at the forefront of the DTaS market.

Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the Digital Twins-as-a-Service (DTaS) market, capturing more than a 64.3% share. This substantial market share is primarily due to the significant resources large enterprises can allocate towards advanced technologies and innovation. Large organizations typically have the capital and infrastructure necessary to invest in comprehensive DTaS solutions that provide detailed insights across multiple facets of their operations.

Large enterprises are increasingly utilizing digital twins to enhance their strategic decision-making and operational efficiencies. These companies often operate on a global scale with complex supply chains and asset networks that benefit immensely from the predictive analytics and real-time data monitoring provided by digital twins. This technology enables them to anticipate maintenance needs, optimize production schedules, and reduce downtime, which are critical factors in maintaining competitiveness and profitability in high-stakes markets.

Furthermore, large enterprises are better positioned to leverage the full potential of digital twins due to their ability to integrate these systems with other enterprise-level software solutions, such as ERP and CRM systems. This integration allows for seamless data flow and more comprehensive analytics, enhancing overall business intelligence. As digital transformation continues to be a priority for large enterprises, their dominance in the DTaS market is expected to persist, driven by the ongoing need for innovation and efficiency at scale.

Key Market Segments

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Vertical

- Manufacturing

- Healthcare

- Automotive

- Aerospace

- Energy & Utilities

- Retail

- Transportation & Logistics

- Others

By Application

- Predictive Maintenance

- Asset Management

- Performance Monitoring

- Inventory Management

- Process Optimization

- Others

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Driver

Technological Advancements in IoT and AI

The significant advancements in Internet of Things (IoT) and Artificial Intelligence (AI) technologies serve as a primary driver for the Digital Twins-as-a-Service (DTaS) market. IoT devices provide continuous streams of real-time data critical for the functioning of digital twins, enhancing their accuracy in simulating physical assets.

Concurrently, AI facilitates the sophisticated analysis of vast datasets, enabling digital twins to predict outcomes and optimize processes with unprecedented precision. This synergy between IoT and AI not only improves operational efficiencies but also drives the adoption of DTaS solutions across various sectors including manufacturing, healthcare, and automotive industries, thereby expanding the market’s scope and potential revenue streams.

Restraint

High Implementation Costs

A major restraint for the Digital Twins-as-a-Service (DTaS) market is the high cost associated with its implementation. Setting up digital twins requires substantial initial investments in sensors, data storage solutions, and advanced computing capabilities, as well as ongoing expenses for system maintenance and updates. Small to medium-sized enterprises (SMEs) often find these costs prohibitive, limiting the widespread adoption of DTaS solutions.

Furthermore, the complexity of integrating digital twins with existing systems can add to the financial burden, deterring businesses from embracing this innovative technology. These economic challenges must be addressed to enable broader market penetration and ensure that companies across all tiers can benefit from the advantages of digital twins.

Opportunity

Expansion into Emerging Markets

Emerging markets present a significant opportunity for the expansion of the Digital Twins-as-a-Service (DTaS) market. As these regions experience rapid industrial growth, the demand for advanced technological solutions to enhance operational efficiency and reduce costs is increasing. Digital twins offer a compelling solution by enabling precise asset management and predictive maintenance.

Furthermore, governments in these markets are increasingly supportive of digital transformation initiatives, often providing incentives for the adoption of smart technologies. By capitalizing on these developments, DTaS providers can tap into new customer bases and establish early dominance in these burgeoning markets, thereby driving global market expansion.

Challenge

Data Privacy and Security Concerns

One of the key challenges facing the Digital Twins-as-a-Service (DTaS) market is addressing data privacy and security concerns. Digital twins rely on the continuous acquisition and processing of large amounts of sensitive data, raising significant concerns about data breaches and unauthorized access.

As the technology becomes more integrated into critical infrastructure, the potential ramifications of security failures grow, possibly leading to operational disruptions and loss of public trust. Ensuring robust cybersecurity measures and compliance with international data protection regulations is crucial for maintaining the integrity of digital twin systems and fostering trust among users, which remains a persistent challenge for providers in this space.

Growth Factors

- Increasing Demand for Efficiency and Cost Reduction: Businesses are constantly seeking ways to increase efficiency and reduce costs. Digital Twins-as-a-Service (DTaS) offers a compelling solution by enabling real-time monitoring and predictive maintenance, which minimizes downtime and extends the lifespan of equipment.

- Rapid Industrialization in Developing Countries: As developing countries continue to industrialize, there is a growing need for advanced technological solutions to manage complex industrial operations. DTaS plays a crucial role in facilitating this transition by providing sophisticated tools for simulation and analysis.

- Integration with Extended Reality (XR): The integration of DTaS with technologies like augmented reality (AR) and virtual reality (VR) – collectively known as extended reality (XR) – enhances the user interface for digital twins. This integration provides more intuitive and interactive ways to visualize and interact with digital twins, thus expanding their applicability and attractiveness to various industries.

- Government Initiatives and Regulations: Governments worldwide are increasingly promoting digitalization initiatives, which include the adoption of smart technologies like DTaS in public sectors and critical infrastructure. Additionally, regulations are increasingly mandating the monitoring and reduction of environmental footprints, for which digital twins are ideally suited.

- Advances in Cloud Computing: The evolution and accessibility of cloud computing have made it easier and more cost-effective to implement and scale DTaS solutions. Cloud platforms enable the management of vast amounts of data generated by digital twins and enhance the computational power available for complex simulations.

Emerging Trends

- Sustainability and Green Operations: There is a growing trend towards using digital twins to support sustainability by optimizing energy use and reducing waste. Companies are using DTaS to simulate and tweak processes in virtual environments before implementing changes in the real world, ensuring they are as environmentally friendly as possible.

- Digital Threads and Continuous Learning: The concept of a digital thread, which involves creating a seamless flow of data spanning the lifecycle of an asset, is gaining traction. This approach enhances the learning capabilities of digital twins, allowing them to update and adapt continuously as they receive new data.

- AI-Driven Predictive Analytics: The integration of AI with digital twins to provide predictive analytics is becoming more sophisticated. This trend is leading to more accurate forecasts of potential failures and insights into system performance, thereby preventing issues before they occur.

- Customization and Personalization: As industries vary greatly in their operations, there is an increasing trend toward the customization and personalization of DTaS solutions to meet specific industry needs. This tailored approach increases the relevance and effectiveness of digital twins across diverse sectors.

- Edge Computing: To manage the latency and bandwidth issues associated with large-scale IoT deployments, edge computing is being increasingly integrated with digital twins. This trend involves processing data closer to the source of data generation, which enhances the speed and efficiency of data analysis performed by digital twins.

Regional Analysis

In 2023, North America held a dominant market position in the Digital Twins-as-a-Service (DTaS) market, capturing more than a 34.8% share. This leadership can be attributed to several pivotal factors. Primarily, the region’s robust technological infrastructure and the early adoption of advanced digital technologies in sectors such as manufacturing, healthcare, and automotive drive substantial demand for DTaS solutions. Companies in these industries leverage digital twins to optimize operations, enhance predictive maintenance, and innovate product development processes.

Furthermore, North America benefits from a high concentration of market leaders and technology pioneers, including major cloud service providers and software developers who are integral to the provisioning of DTaS platforms. These companies not only contribute to the service availability but also to the rapid integration of DTaS solutions across various verticals. The presence of a well-established IoT framework and significant investments in R&D activities related to AI and machine learning further reinforce the region’s leading position by enhancing the capabilities of digital twin technologies.

Additionally, regulatory support for digital transformation initiatives across the United States and Canada underpins the expansive deployment of digital twins in critical infrastructure, urban planning, and sustainability projects. Government policies fostering innovation and technology adoption manifest in higher market penetration and scalability of DTaS solutions, thus ensuring sustained growth and technological advancement in the region.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the Digital Twins-as-a-Service (DTaS) market is characterized by the presence of various companies and service providers offering digital twin solutions. These players compete based on factors such as technology offerings, industry expertise, innovation capabilities, partnerships, and customer relationships. The competitive landscape is dynamic, with both established companies and emerging startups vying for market share and differentiation.

Top Market Leaders

- Siemens AG

- IBM Corporation

- General Electric (GE) Company

- PTC Inc.

- Microsoft Corporation

- Oracle Corporation

- Dassault Systèmes

- Bentley Systems Incorporated

- Amazon Web Services (AWS)

- Schneider Electric SE

- AVEVA Group plc

- ANSYS Inc.

- Honeywell International Inc.

- Hitachi, Ltd.

- Altair Engineering Inc.

- Other Key Players

Recent Developments

- General Electric (GE) Company: In January 2024, General Electric (GE) Company announced a strategic partnership with a prominent data analytics firm to enhance its DTaaS offerings. This collaboration aimed to integrate advanced analytics capabilities into GE’s digital twin solutions, enabling predictive maintenance and optimization for industrial assets.

- PTC Inc.: In March 2024, PTC Inc. launched an innovative DTaaS solution tailored for manufacturing companies. This new offering incorporated advanced simulation and modeling capabilities, empowering manufacturers to optimize production processes and improve operational efficiency.

- Siemens AG: In June 2023, Siemens AG announced the acquisition of a leading software company specializing in digital twin technology. This acquisition aimed to enhance Siemens’ portfolio of DTaaS solutions and strengthen its position in the market.

- IBM Corporation: In September 2023, IBM Corporation unveiled a new cloud-based DTaaS platform designed to provide comprehensive digital twin solutions for various industries. This launch marked IBM’s commitment to leveraging advanced technologies like AI and IoT to drive digital transformation.

- Microsoft Corporation: In November 2023, Microsoft Corporation acquired a startup specializing in digital twin technology. This acquisition reinforced Microsoft’s commitment to providing comprehensive DTaaS solutions on its Azure cloud platform, catering to diverse industry verticals.

Report Scope

Report Features Description Market Value (2023) USD 16.8 Bn Forecast Revenue (2033) USD 397.1 Bn CAGR (2024-2033) 37.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), By Vertical (Manufacturing, Healthcare, Automotive, Aerospace, Energy & Utilities, Retail, Transportation & Logistics, Others), By Application (Predictive Maintenance, Asset Management, Performance Monitoring, Inventory Management, Process Optimization, Others), By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Siemens AG, IBM Corporation, General Electric (GE) Company, PTC Inc., Microsoft Corporation, Oracle Corporation, Dassault Systèmes, Bentley Systems Incorporated, Amazon Web Services (AWS), Schneider Electric SE, AVEVA Group plc, ANSYS Inc., Honeywell International Inc., Hitachi, Ltd., Altair Engineering Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Digital Twins-as-a-Service (DTaaS)?DTaaS refers to the provision of digital twin technology as a cloud-based service, allowing organizations to create virtual representations of physical assets, processes, or systems to monitor, analyze, and optimize their performance.

How big is Digital Twins-as-a-Service (DTaS) Market?The Global Digital Twins-as-a-Service (DTaS) Market size is expected to be worth around USD 397.1 Billion by 2033, from USD 16.8 Billion in 2023, growing at a CAGR of 37.2% during the forecast period from 2024 to 2033.

What are the key drivers for the growth of the DTaS market?Advancements in IoT and AI technologies are primary drivers for the DTaS market, enabling real-time data streams and sophisticated analysis for predictive optimization.

What are the main challenges facing the DTaS market?Data privacy and security concerns pose significant challenges, as digital twins rely on sensitive data, requiring robust cybersecurity measures to maintain integrity and trust.

Who are the prominent players operating in the Digital Twins-as-a-Service (DTaS) market?Siemens AG, IBM Corporation, General Electric (GE) Company, PTC Inc., Microsoft Corporation, Oracle Corporation, Dassault Systèmes, Bentley Systems Incorporated, Amazon Web Services (AWS), Schneider Electric SE, AVEVA Group plc, ANSYS Inc., Honeywell International Inc., Hitachi, Ltd., Altair Engineering Inc., Other Key Players

Which region will lead the global Digital Twins-as-a-Service (DTaS) market?In 2023, North America held a dominant market position in the Digital Twins-as-a-Service (DTaS) market, capturing more than a 34.8% share.

Digital Twins-as-a-Service (DTaS) MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Digital Twins-as-a-Service (DTaS) MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens AG

- IBM Corporation

- General Electric (GE) Company

- PTC Inc.

- Microsoft Corporation

- Oracle Corporation

- Dassault Systèmes

- Bentley Systems Incorporated

- Amazon Web Services (AWS)

- Schneider Electric SE

- AVEVA Group plc

- ANSYS Inc.

- Honeywell International Inc.

- Hitachi, Ltd.

- Altair Engineering Inc.

- Other Key Players