Global Business Intelligence Market By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry Vertical (IT & Telecommunications, BFSI, Healthcare, Retail and E-commerce, Manufacturing, Government and Public Sector, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 118253

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

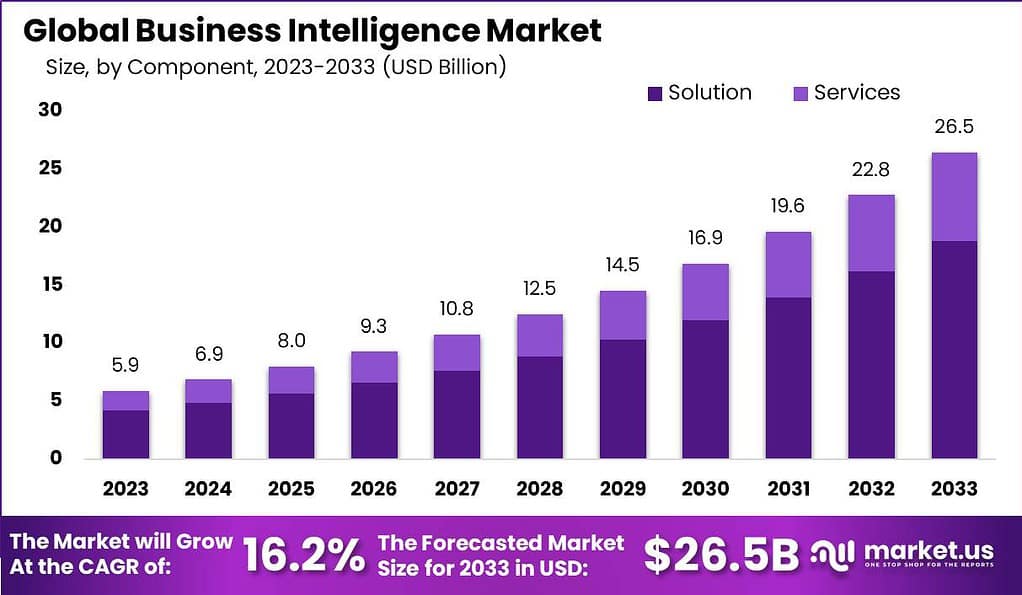

The Global Business Intelligence Market size is expected to be worth around USD 26.5 Billion by 2033, from USD 5.9 Billion in 2023, growing at a CAGR of 16.2% during the forecast period from 2024 to 2033.

Business Intelligence (BI) refers to the process of collecting, analyzing, and presenting data to support decision-making and improve business performance. It involves gathering information from various sources, such as databases, applications, and the web, and transforming it into meaningful insights.

The Business Intelligence Market is the industry that provides tools, technologies, and services to enable businesses to implement BI solutions. This market encompasses a wide range of software vendors, consulting firms, and service providers who offer products and services related to data analysis, reporting, and visualization.

Key growth drivers include the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) into BI solutions, enabling organizations to automate data analysis, uncover hidden insights, and make more informed decisions. The adoption of Internet of Things (IoT) devices is also contributing to the market’s expansion by generating large volumes of data that can be analyzed to gain valuable insights.

In November 2022, Board announced a strategic partnership with Microsoft, marking a significant move to enhance corporate performance outcomes through intelligent planning. This collaboration involves integrating Board’s capabilities with key Microsoft enterprise technologies, including Power BI, Dynamics 365, and Microsoft Azure.

The global adoption rate of BI stands at 26%, indicating that a significant portion of businesses worldwide have recognized the value and importance of leveraging data for decision-making and performance improvement.

One astonishing revelation is that organizations, on average, leave a staggering 97% of the data they gather unused. This underutilization of data highlights the untapped potential and missed opportunities for businesses to extract valuable insights and drive informed decision-making.

The repercussions of poor data quality are evident, as bad data costs the US economy a staggering ~$3.1 trillion annually. This emphasizes the significance of data accuracy, integrity, and quality control for businesses to mitigate the financial impact of erroneous or incomplete information.

BI tools have gained considerable traction among software companies, with 52% of them utilizing these tools. This statistic reflects the growing recognition among businesses of the need for effective data analysis, visualization, and reporting capabilities to unlock the true value of their data assets.

Furthermore, a study conducted by Dresner found that nearly 90% of research and development (R&D) departments consider BI critical for their future endeavors. This underscores the vital role of BI in facilitating innovation, driving strategic decision-making, and enabling R&D teams to harness data-driven insights to fuel their projects and stay competitive in their respective industries.

Key Takeaways

- The Business Intelligence market is projected to reach USD 26.5 billion by 2033, with a strong compound annual growth rate (CAGR) of 16.2% from 2024 to 2033.

- Solution segment dominates with over 71% share in 2023, driven by the need for comprehensive data analytics tools.

- Cloud-Based segment held over 69.8% share in 2023, offering scalable and cost-effective BI solutions.

- Large Enterprises segment maintains over 67.5% share in 2023, driven by extensive datasets and complex operations.

- BFSI segment captures over 30.2% share in 2023, driven by complexity and data-driven nature, requiring robust analytical tools.

- In 2023, North America held a dominant market position in the Business Intelligence (BI) market, capturing more than a 37.5% share

Component Analysis

In 2023, the Solution segment within the Business Intelligence (BI) market held a dominant position, capturing more than a 71% share. This substantial market share underscores the critical role that BI solutions play in enabling organizations to leverage data for strategic decision-making.

The dominance of the Solution segment is primarily attributed to the escalating need for comprehensive data analytics tools and platforms. These solutions provide the backbone for businesses to extract, analyze, and interpret vast volumes of data, transforming them into actionable insights. The increasing complexity and volume of business data, coupled with the growing emphasis on data-driven decision-making across industries, have propelled the demand for robust BI solutions.

BI solutions encompass a wide array of technologies, including data visualization tools, reporting and query interfaces, and advanced analytics platforms. These components work synergistically to allow organizations to navigate and understand their operational landscapes better, identify trends, and predict future patterns. As businesses continue to operate in increasingly competitive and dynamic markets, the ability to rapidly access and analyze data has become a cornerstone of effective strategy formulation and operational efficiency.

The BI Solution segment’s lead signifies its integral role in providing the necessary tools for businesses to remain agile, responsive, and competitive. Furthermore, the evolution of AI and machine learning technologies has significantly enhanced the capabilities of BI solutions, enabling more sophisticated analysis and predictive modeling.

This technological advancement has not only increased the value proposition of BI solutions but also expanded their applicability across different industry verticals, from healthcare and finance to retail and manufacturing. The growing complexity of business operations and the need for scalability in analytics are also factors contributing to the Solution segment’s predominance, highlighting the segment’s vital role in the broader BI market landscape

Deployment Mode Analysis

In 2023, the Cloud-Based segment held a dominant position in the Business Intelligence (BI) market, securing over a 69.8% share. This significant market share can be attributed to the segment’s capacity to offer scalable, cost-effective, and accessible BI solutions to businesses across various sectors. Cloud-based BI platforms have been increasingly favored by organizations for their ability to provide real-time data analysis and insights without the need for substantial upfront investments in IT infrastructure.

Additionally, the flexibility and agility offered by cloud-based solutions, enabling businesses to rapidly adapt to market changes and scale their BI capabilities as needed, have further propelled their adoption. The leading status of the Cloud-Based segment is also reinforced by the growing trend towards digital transformation and remote work environments. With data becoming an invaluable asset for decision-making, cloud-based BI tools have become essential in facilitating access to critical business insights from anywhere, at any time.

This accessibility is particularly crucial in today’s fast-paced business landscape, where timely information can provide a competitive edge. Moreover, the continuous advancements in cloud technology, including enhanced security measures and improved data processing capabilities, have alleviated concerns over data privacy and security, encouraging more businesses to transition to cloud-based BI solutions.

Furthermore, the On-Premise deployment mode, while still relevant, has observed a more restrained growth compared to its cloud-based counterpart. Traditionally preferred by large enterprises with complex data governance requirements and a need for high levels of customization, the on-premise segment has been gradually overshadowed by the cloud-based segment’s advantages. Nevertheless, it remains an important part of the BI market, catering to specific industry needs where control over the physical infrastructure and data is paramount.

Organization Size Analysis

In 2023, the Large Enterprises segment maintained a commanding presence in the Business Intelligence (BI) market, securing a share exceeding 67.5%. This substantial market dominance can be largely attributed to large enterprises’ inherent need to manage extensive datasets and complex business operations across multiple geographic locations.

Such organizations have traditionally been the primary adopters of BI technologies, driven by the necessity to streamline operations, enhance decision-making processes, and maintain a competitive edge in their respective industries. The significant investment capabilities of large enterprises also play a critical role, enabling them to implement comprehensive BI solutions that integrate advanced analytics, machine learning, and data management tools.

The leadership of the Large Enterprises segment is further bolstered by their focus on innovation and continuous improvement. With the rapid pace of digital transformation, large enterprises are increasingly leveraging BI to harness actionable insights from big data, optimize customer experiences, and drive digital marketing strategies.

These organizations’ ability to deploy BI at scale contributes to their enhanced operational efficiency and strategic planning capabilities. Furthermore, the growing emphasis on data-driven decision-making and predictive analytics in large enterprises underscores the segment’s pivotal role in the adoption of BI technologies.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a commanding market position within the Business Intelligence (BI) market, capturing more than a 30.2% share. This leading position is chiefly due to the inherent complexity and data-driven nature of the BFSI sector, which necessitates robust analytical tools for risk management, customer relationship management, fraud detection, and regulatory compliance.

The vast amount of data generated through transactions, customer interactions, and financial operations has driven the BFSI sector to adopt BI solutions aggressively. These tools not only help in managing data effectively but also enable the extraction of meaningful insights that can inform strategic decision-making and operational improvements.

BI solutions in the BFSI sector offer comprehensive analytics capabilities, ranging from real-time transaction monitoring to predictive analytics for assessing loan risks and opportunities for cross-selling. With the increasing competition and evolving regulatory requirements in the BFSI sector, the ability to quickly analyze data and adapt to market changes is vital.

BI tools facilitate this agility, enabling financial institutions to gain a competitive edge by optimizing their operations, enhancing customer experiences, and ensuring compliance with stringent regulatory standards. Moreover, the integration of advanced technologies like AI and machine learning with BI tools has further propelled the BFSI segment’s dominance.

These technologies enhance the predictive capabilities of BI solutions, allowing for more accurate forecasting of market trends and customer behavior. As the BFSI sector continues to navigate through digital transformation, the demand for BI solutions is expected to grow, driven by the need for more sophisticated data analysis and the strategic insights it provides. This trend underscores the critical role of BI in shaping the future of banking and financial services, making the BFSI segment a key driver of the overall BI market growth

Key Market Segments

By Component

- Solution

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- IT & Telecommunications

- BFSI

- Healthcare

- Retail and E-commerce

- Manufacturing

- Government and Public Sector

- Other Industry Verticals

Driver

Increasing Adoption of Data Analytics by Enterprises

The surge in the adoption of data analytics by enterprises stands as a significant driver in the Business Intelligence (BI) market. As organizations generate vast amounts of data, the demand for sophisticated tools to analyze and interpret this data has escalated. Businesses leverage BI tools for insights that guide strategic decisions, optimize operations, and enhance customer experiences.

This driver is underscored by the imperative to stay competitive in a data-driven world, where actionable insights can lead to improved operational efficiency, cost reduction, and enhanced market responsiveness. The growing realization among businesses that data analytics is not just a value-add but a critical component of their operational and strategic toolkit fuels the expansion of the BI market.

Restraint

High Investment Costs for On-Premise Solutions

A significant restraint in the BI market is the high investment costs associated with on-premise BI solutions. These solutions often require substantial upfront investment in infrastructure, software licenses, and ongoing maintenance expenses. For many organizations, especially small and medium-sized enterprises (SMEs), these costs can be prohibitive, limiting their ability to adopt BI solutions.

Moreover, the complexity of integrating on-premise BI tools with existing IT systems and databases can add to the total cost of ownership, deterring businesses from investing in BI technology. This restraint highlights the need for more affordable and flexible BI solutions that can democratize access to business intelligence for a broader range of businesses.

Opportunity

Escalation of Cloud-Based BI Tools

The escalation of cloud-based BI tools presents a significant opportunity in the BI market. Cloud BI solutions offer a cost-effective, scalable, and flexible alternative to traditional on-premise BI systems. With the ability to pay as you go, businesses can avoid large upfront investments and scale their BI capabilities as needed.

Additionally, cloud BI tools facilitate easier access to BI capabilities for remote teams and enable real-time data analysis and reporting. This opportunity is particularly relevant in the context of the increasing remote work trend and the need for businesses to remain agile and responsive in a rapidly changing market environment. The shift towards cloud BI solutions is expected to continue, driven by the benefits of cost savings, scalability, and enhanced collaboration.

Challenge

Skill Gap and Talent Shortage

A critical challenge in the BI market is the skill gap and talent shortage in data analytics and business intelligence. Despite the growing demand for BI tools, there is a significant shortage of professionals with the necessary skills to implement and manage BI solutions effectively. The complexity of BI tools and the specialized knowledge required to derive actionable insights from data mean that businesses often struggle to find and retain qualified personnel.

This talent shortage can hinder the successful adoption and utilization of BI technologies, limiting their potential benefits for businesses. Addressing this skill gap requires investment in training and education, as well as the development of more user-friendly BI tools that require less specialized knowledge to operate.

Emerging Trends

- AI and Machine Learning Integration: The integration of AI and machine learning with BI tools is revolutionizing how data is analyzed and interpreted, enabling more accurate predictions and insights.

- Data Visualization: There is an increasing emphasis on data visualization, with BI tools offering more intuitive and interactive dashboards and reports for better data comprehension.

- Self-Service BI: The rise of self-service BI tools allows business users without technical expertise to generate insights and reports, democratizing access to BI capabilities.

- Real-Time Analytics: The demand for real-time analytics is growing, with businesses seeking BI solutions that can provide instant insights to rapidly respond to market changes.

- Increased Focus on Data Governance: As data privacy concerns grow, there is an increased focus on data governance and security within BI tools to ensure compliance with regulations and protect sensitive information.

Regional Analysis

In 2023, North America held a dominant market position in the Business Intelligence (BI) market, capturing more than a 37.5% share. This substantial market share can be attributed to the region’s robust technological infrastructure, which is conducive to the adoption and implementation of BI solutions.

Moreover, the presence of leading BI software and service providers in this region, particularly in the United States, plays a pivotal role in accelerating the penetration of BI technologies among businesses of all sizes. The strong emphasis on data-driven decision-making in industries such as healthcare, finance, retail, and manufacturing further fuels the demand for advanced analytics and business intelligence solutions.

The advancement in cloud computing and the integration of artificial intelligence and machine learning technologies with BI tools have been key drivers behind the growth of the Business Intelligence market in North America. These technological enhancements have enabled businesses to leverage sophisticated analytics capabilities, enhancing operational efficiency and strategic decision-making.

Additionally, the high level of digital literacy among the workforce and the widespread availability of high-speed internet connectivity have facilitated the seamless adoption of BI solutions. The region’s commitment to embracing digital transformation initiatives across the public and private sectors has also significantly contributed to the expansion of the BI market.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Business Intelligence (BI) market has experienced significant growth, driven by the increasing need for comprehensive data analysis and strategic insights across various sectors. Among the key players that dominate this landscape, several have emerged as pivotal in shaping the industry’s trajectory.

Companies such as IBM, Microsoft, Oracle, and SAP are renowned for their robust BI solutions, offering a wide range of analytics tools and platforms that cater to diverse business needs. These giants invest heavily in research and development, continuously enhancing their offerings to include advanced analytics, machine learning, and data visualization capabilities.

Top Market Leaders

- IBM Corporation

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- Google LLC

- Salesforce, Inc.

- Amazon Web Services Inc.

- SAS Institute

- TIBCO Software Inc.

- MicroStrategy Incorporated

- Sisense Ltd.

- Domo Inc.

- Infor

- Other Key Players

Recent Developments

- In May 2023, Rackspace US Inc introduced Object Storage, allowing organizations to securely store and utilize large amounts of unstructured data. This solution eliminates charges for data egress, retrieval, and transactions, resulting in substantial cost savings. Rackspace Object Storage can often save more than 80% compared to hyper-scale cloud storage options.

- October 2023: IBM (IBM) Announced a partnership with Snowflake to enhance data warehousing capabilities for IBM Cloud

- In May 2023, GoodData launched its Last Mile ETL feature, enabling customers to streamline data management processes and optimize resource utilization. This feature maximizes data velocity and supports changes to the logical data model (LDM) within the GoodData interface without impacting the user’s database structure.

Report Scope

Report Features Description Market Value (2023) USD 5.9 Bn Forecast Revenue (2033) USD 26.5 Bn CAGR (2024-2033) 16.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry Vertical (IT & Telecommunications, BFSI, Healthcare, Retail and E-commerce, Manufacturing, Government and Public Sector, Other Industry Verticals) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, SAP SE, Oracle Corporation, Microsoft Corporation, Google LLC, Salesforce Inc., Amazon Web Services Inc., SAS Institute, TIBCO Software Inc., MicroStrategy Incorporated, Sisense Ltd., Domo, Inc., Infor, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is business intelligence (BI)?Business intelligence refers to the technologies, strategies, and processes used by organizations to analyze data and gain insights for better decision-making. BI encompasses a wide range of activities including data mining, reporting, analytics, data visualization, and predictive modeling.

How big is Business Intelligence Market?The Global Business Intelligence Market size is expected to be worth around USD 26.5 Billion by 2033, from USD 5.9 Billion in 2023, growing at a CAGR of 16.2% during the forecast period from 2024 to 2033.

Who are the prominent players operating in the business intelligence market?The major players operating in the business intelligence market are IBM Corporation, SAP SE, Oracle Corporation, Microsoft Corporation, Google LLC, Salesforce, Inc., Amazon Web Services Inc., SAS Institute, TIBCO Software Inc., MicroStrategy Incorporated, Sisense Ltd., Domo Inc., Infor, Other Key Players

What are the trends driving the growth of the business intelligence market?Trends driving the growth of the BI market include the increasing volume and variety of data generated by organizations (big data), the adoption of cloud-based BI solutions, the integration of AI and machine learning capabilities into BI tools, the rise of self-service BI empowering business users, and the emphasis on real-time analytics.

What are the challenges associated with implementing business intelligence?Challenges may include data integration complexities, ensuring data quality and accuracy, managing and securing large volumes of data, overcoming organizational resistance to change, addressing skills gaps in data analysis and interpretation, and navigating regulatory compliance requirements.

Which region will lead the global business intelligence market?In 2023, North America held a dominant market position in the Business Intelligence (BI) market, capturing more than a 37.5% share.

Business Intelligence MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Business Intelligence MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- Google LLC

- Salesforce, Inc.

- Amazon Web Services Inc.

- SAS Institute

- TIBCO Software Inc.

- MicroStrategy Incorporated

- Sisense Ltd.

- Domo Inc.

- Infor

- Other Key Players