Quick Navigation

Overview

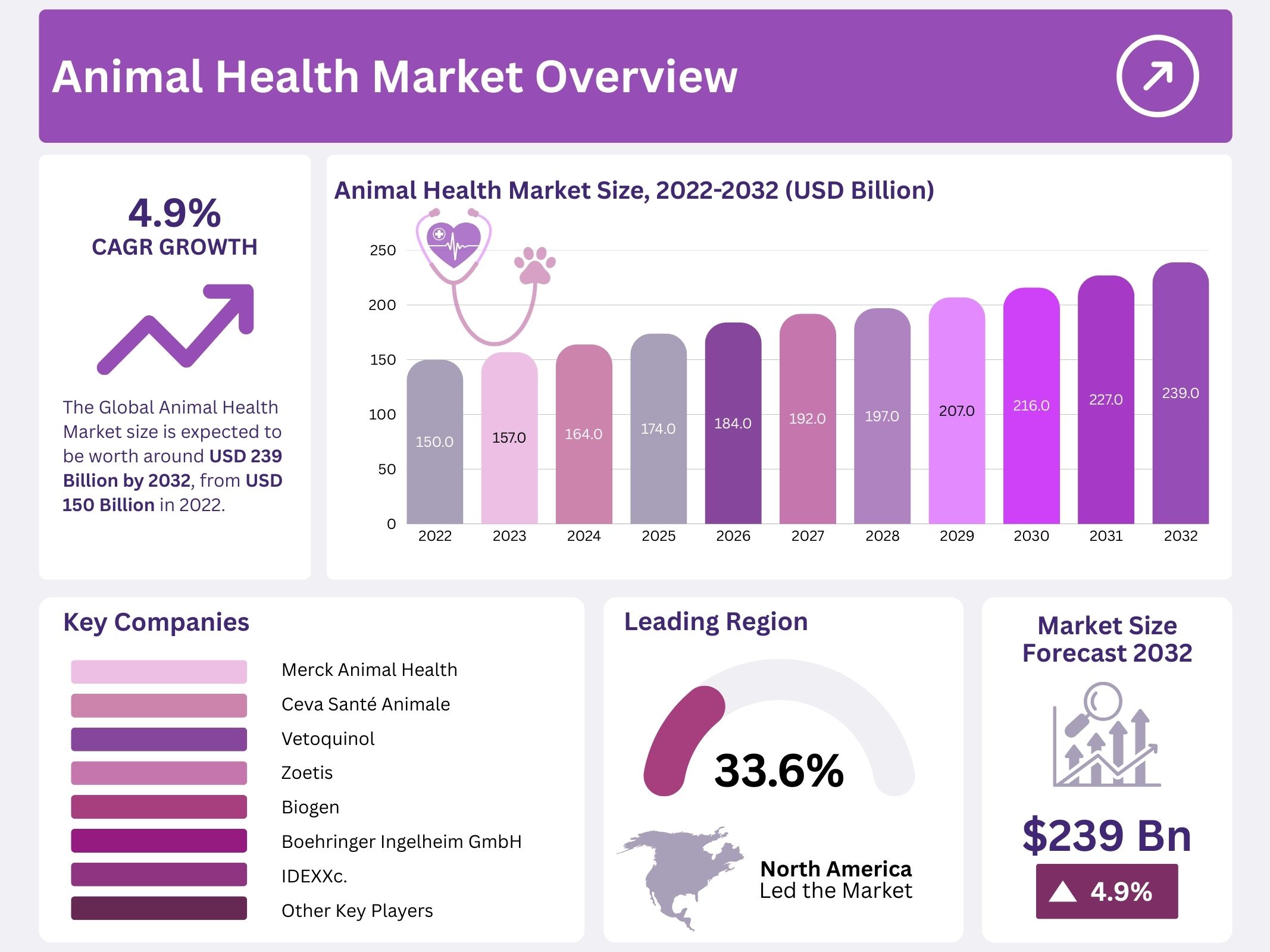

The Global Animal Health Market is experiencing substantial growth, with an expected increase in market size from USD 150 billion in 2022 to USD 239 billion by 2032, growing at a CAGR of 4.9%. This growth is driven by several key factors. The primary driver is the increasing global demand for animal-derived food products, particularly meat, dairy, and eggs. Population growth, urbanization, and rising incomes in emerging markets have led to higher consumption of these products. As a result, there is a growing need for healthier and more productive livestock, leading to a surge in demand for animal health products like vaccines, therapeutics, and diagnostics.

Another significant factor contributing to the market growth is the continuous advancements in veterinary medicine. Innovations in diagnostic tools, biologics, and biotechnology have made it easier to manage and prevent animal diseases. New vaccines, parasite control treatments, and antimicrobial products have improved disease management, benefiting both animal productivity and health. Additionally, the development of precision medicine, tailored to specific conditions or breeds, further supports this growth trend by offering more effective solutions for disease prevention.

Government regulations and policy support also play a crucial role in driving the animal health market. Policies aimed at improving animal welfare and ensuring food safety are creating demand for high-quality products. For instance, regulations on the use of antibiotics and controlling zoonotic diseases have prompted the development of products that meet these standards. Government subsidies and funding for veterinary research have further fueled innovation within the sector, providing a favorable environment for market growth.

The rising awareness of animal health and welfare is another vital factor propelling the market forward. Consumers are increasingly concerned about the ethical treatment of animals and the connection between animal health and food safety. This has led to higher investments in veterinary care, preventive health measures, and the development of products that promote animal well-being. The growing concern about issues such as antibiotic resistance and zoonotic diseases has amplified the demand for responsible and sustainable practices in animal health.

Additional Growth Drivers in the Animal Health Market

The growth of the animal health market is also being fueled by technological advancements. The integration of digital technologies, such as telemedicine, wearable devices, and data analytics, is improving the management of animal health. These technologies allow for remote monitoring of animals, early detection of diseases, and better tracking of health data. Additionally, the incorporation of artificial intelligence (AI) in diagnostics and treatment protocols is expected to further enhance health outcomes and reduce costs, benefiting veterinarians and farmers alike.

The expansion of companion animal care is another key driver in the animal health sector. While the market has traditionally focused on livestock, the growing pet ownership rates, particularly in developed countries, are shifting the focus to companion animals. Pet owners are increasingly proactive about their pets’ health, which has led to higher spending on preventive care, treatments, and wellness products. Innovations in pet healthcare, including insurance and advanced diagnostics, are further contributing to the market’s expansion in this segment.

Economic growth in emerging markets is also contributing significantly to the rise in demand for animal health products. Regions such as Asia Pacific, Africa, and Latin America are witnessing an improvement in living standards and disposable incomes. This, combined with greater awareness of animal health, is driving the consumption of veterinary products. Furthermore, the expansion of commercial farming practices in these regions requires sophisticated animal health management solutions, further propelling market growth.

Finally, there is an increasing investment in research and development (R&D) activities within the animal health sector. Both public and private sectors are heavily investing in R&D to develop new drugs, vaccines, and diagnostic tools. Pharmaceutical companies, biotech firms, and academic institutions are working together to advance solutions that improve animal health. These innovations contribute to better health outcomes and present new opportunities for growth in the animal health market. Additionally, the growing awareness of zoonotic diseases, particularly after the COVID-19 pandemic, has led to heightened efforts in disease prevention, further increasing the demand for animal health products.

Key Takeaways

- Market Growth Projection: The global animal health market is set to expand from USD 150 billion in 2022 to USD 239 billion by 2032, with a CAGR of 4.9%.

- Production Animal Segment: In 2022, the production animal segment led the market, accounting for over 60% of revenue, driven by food security and sustainable livestock practices.

- Pharmaceuticals Segment: Pharmaceuticals dominated the market in 2022, propelled by advances in veterinary drugs and a surge in pet ownership worldwide.

- Distribution Channel: Hospital pharmacies were the primary distribution channel in 2022, holding more than 52% of the market share, due to frequent pet treatments.

- End-Users: Veterinary hospitals and clinics were the largest end-users in 2022, offering a broad array of treatments and diagnostic services to animals.

- Regional Market Leadership: North America led the animal health market in 2022, securing a 33.6% revenue share, influenced by stringent animal welfare regulations and technological innovations.

- Asia Pacific Growth: The Asia Pacific region is projected to grow at a 12.7% CAGR, driven by rising disposable incomes and growing awareness of pet nutrition.

- Market Growth Drivers: The rise in pet adoption, increasing foodborne disease cases, and growing demand for natural product transparency are key drivers of market growth.

- Challenges: The increasing cost of veterinary services presents a challenge, potentially hindering market growth as financial burdens on pet owners rise.

- Opportunities: The growing life expectancy of pets opens opportunities for advancements in early wellness and elder care treatments in veterinary services.

Regional Analysis

In 2022, North America dominated the global animal health market, holding the largest revenue share of 33.6%. This market leadership can be attributed to numerous actions taken by governmental animal welfare groups. These organizations continuously work to improve overall animal health standards. As a result, North America has seen significant growth in the animal health sector, contributing to its dominant position in the market.

The demand for animal health products in North America is expected to continue growing. Technological advancements, an increase in zoonotic diseases, and a rise in pet ownership are driving this growth. Additionally, numerous cooperative initiatives by major corporations to boost their research and development (R&D) capabilities are expected to further enhance the market in this region. These factors collectively contribute to North America’s dominance in the animal health market.

The Asia Pacific region is forecast to experience significant growth in the coming years. The market is expected to grow at a compound annual growth rate (CAGR) of 12.7%. A key factor driving this growth is the region’s ongoing investments in R&D. These investments have enabled companies to commercialize both branded and generic treatments at affordable prices. This trend is expected to continue, supporting the region’s expansion in the animal health market.

Additionally, the rise in pet ownership and growing awareness of pet nutrition and supplies are driving the market growth in Asia Pacific. Increasing disposable income in this region is further fueling demand for high-quality animal health products. As a result, the Asia Pacific market is anticipated to see rapid expansion, making it a key player in the global animal health industry.

Segmentation Analysis

In 2022, the production animal segment led the global animal health market, capturing over 60% of the revenue share. This dominance is attributed to growing concerns about food safety and sustainability, with national health organizations focusing on increasing livestock productivity. Policies supporting large-scale food production and livestock health have driven this trend. Furthermore, the Food and Agriculture Organization reports that animal foods provide a significant portion of protein in developing nations, emphasizing the importance of improving livestock productivity for food security.

The companion animal segment is expected to experience significant growth due to increasing demand for animal care and rising pet ownership. Pet-to-human ratios are growing, leading to an increased focus on pet health. Pets are known to offer psychological benefits, such as reducing anxiety and lowering blood pressure. The rise in animal-assisted therapy has further propelled the market for companion animals. This trend is likely to continue as people increasingly prioritize their pets’ well-being, driving demand for related health services and products.

The pharmaceuticals segment was the largest revenue contributor in the global animal health market in 2022. This is due to continuous advancements in veterinary medicines, including parasiticides, antibiotics, and anti-inflammatory drugs. The increasing pet ownership trend has further fueled the adoption of longevity-enhancing drugs. Mergers and acquisitions, like Bayer’s purchase of Elanco, have expanded the availability and distribution of veterinary pharmaceuticals. Additionally, the diagnostics segment is expected to grow significantly, driven by rising healthcare costs, increased zoonotic cases, and growing demand for diagnostic tools for pets.

In 2022, hospital pharmacies accounted for over 52% of the market share in the animal health industry. This growth is largely driven by the increasing number of hospital pharmacies and frequent pet admissions for treatment. The e-commerce segment is also expected to expand rapidly, offering greater convenience for customers and reducing costs by streamlining the supply chain. Retail pharmacy growth is projected to be moderate. In the end-user segment, veterinary hospitals and clinics dominated the market, providing a range of diagnostic and treatment options, and benefiting from rising demand for preventive pet care and specialized diagnostics.

Key Players Analysis

The animal health market experienced growth even amid the challenges posed by the epidemic, particularly within diagnostics. IDEXX’s Companion Animal Group (CAG) diagnostics business was a key driver, contributing to a 12% year-over-year revenue increase. This growth highlights the market’s resilience and the increasing demand for advanced diagnostic tools. As a result, major players in the industry have focused on expanding their capabilities and strengthening their market position through various strategic initiatives.

To adapt to shifting market dynamics, leading players have turned to collaborations, partnerships, and mergers & acquisitions. These actions aim to enhance their product portfolios and tap into emerging market opportunities. Through such strategic moves, companies look to gain a competitive edge. This trend reflects the growing importance of innovation and agility in a highly competitive and consolidating market environment.

The consolidation trend within the animal health market is expected to continue in the coming years. Larger players are acquiring smaller companies to expand their market share and diversify offerings. This ongoing consolidation is reshaping the competitive landscape, driving industry growth. As a result, the market will likely witness further strategic alliances, mergers, and acquisitions. Companies are focusing on achieving economies of scale, enhancing operational efficiency, and broadening their geographic reach to stay competitive.

Market Key Players

- Merck Animal Health

- Ceva Santé Animale

- Vetoquinol

- Zoetis

- Boehringer Ingelheim GmbH

- IDEXX

- Elanco

- Heska Corporation

- Virbac

- B.Braun Vet Care

- Covetrus

- DRE Veterinary

- Televet

- Mars Inc.

- Phibro Animal Health Corporation

- Dechra Pharmaceuticals PLC

- Bimeda, Inc.

- Midmark Corporation

- Thermo Fisher Scientific, Inc.

- IDVet

- Intas Pharmaceuticals Ltd.

- Other Key Players

Conclusion

In conclusion, the global animal health market is poised for continued growth, driven by rising demand for animal-derived food products, advancements in veterinary medicine, and increasing awareness of animal welfare. Technological innovations, such as telemedicine and AI, are enhancing disease management and improving overall animal health. The expansion of companion animal care, coupled with rising disposable incomes in emerging markets, is further fueling market growth. With increasing investments in research and development, the market is likely to see ongoing innovations in veterinary products and services, creating ample opportunities for stakeholders in the industry. The future of animal health remains promising, with continuous advancements shaping the sector.

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]

View More

AI In Animal Health Market || Animal Genetics Market || Animal Hormones Market || Companion Animal Diagnostics Market || Companion Animal Drugs Market || Animal Model Market || Animal Antibiotics Market || Animal Diagnostics Market || Animal Drugs Market || Animal Nutrition Market || Animal Sedatives Market || Animal Wound Care Market || Animal Digital Health Market || Animal Vaccines Market