Global Baby Carrier Market By Product (Buckle, Sling, Backpack, and Others), By Distribution Channel (Online, Convenience store, and Supermarket/Hypermarkets), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 17509

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

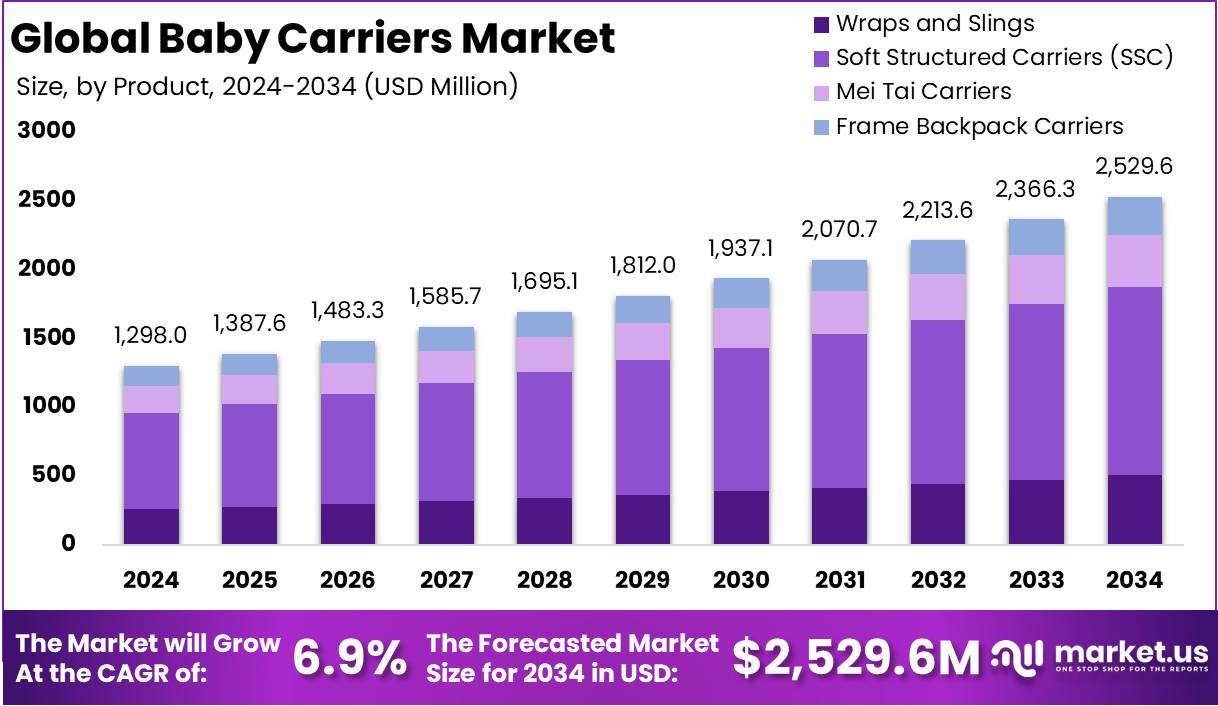

The Global Baby Carriers Market size is expected to be worth around USD 2,529.6 Million by 2034 from USD 1,298.0 Million in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

Baby carriers are ergonomically designed products that allow caregivers to carry infants or toddlers securely against their body, typically using adjustable straps and padded harnesses. These products offer hands-free convenience while ensuring close physical proximity, which supports emotional bonding and comfort for the child.

They come in various formats such as wraps, slings, soft-structured carriers, and backpack-style designs each offering specific benefits based on child age, weight, and caregiver preference. Baby carriers are widely appreciated for promoting mobility and reducing physical strain compared to traditional carrying methods. The baby carriers market refers to the global industry involved in the design, manufacturing, marketing, and sales of products that facilitate infant and toddler carrying solutions. This market spans a wide range of product types, materials, and ergonomic innovations, and it includes both established brands and emerging startups.

It is closely tied to consumer behavior, demographic trends, and lifestyle preferences. The market is segmented by product type, distribution channel, material, age group, and region. With growing parental awareness toward child safety and developmental support, the baby carriers market has seen a significant evolution in recent years, both in product design and consumer expectations.

The expansion of the baby carriers market is driven by increasing birth rates in developing regions, rising urbanization, and greater awareness regarding the developmental benefits of physical closeness between parent and child.

Demand for baby carriers is primarily fueled by the growing need for convenience and mobility in modern parenting. Urban lifestyles and space constraints have made compact, wearable solutions more desirable than bulky alternatives such as strollers. E-commerce platforms have further amplified demand by offering greater product variety, easy comparison, and access to international brands. In addition, demand is increasingly influenced by peer reviews, parenting communities, and social media recommendations, which play a critical role in shaping consumer choice.

Significant opportunity exists for market players to tap into emerging economies where disposable income is rising and urban migration is driving the adoption of modern childcare products. Innovation in smart baby carriers integrated with health tracking sensors or temperature control features also holds considerable promise.

The Baby Carriers Market is witnessing steady growth, driven by consistent global childbirth rates and modern parenting needs. According to MomLovesBest, approximately 367,000 babies are born daily, equating to around 134 million annually. The global birth rate stands at 18 per 1,000 people, while the fertility rate is 2.3 children per woman half the rate observed five decades ago.

Despite this decline, the high volume of annual births continues to support market demand, especially in urbanized regions where babywearing trends are increasing for mobility, convenience, and bonding. As parenting shifts toward ergonomic, safe, and travel-friendly products, the baby carriers segment remains well-positioned for consistent market performance.

Key Takeaways

- The global Baby Carriers Market is projected to reach approximately USD 2,529.6 million by 2034, up from USD 1,298.0 million in 2024, registering a Compound Annual Growth Rate (CAGR) of 6.9% during the forecast period from 2025 to 2034.

- Soft Structured Carriers (SSC) represent the leading product segment in the market, accounting for over 54% of the global market share in 2024, owing to their ergonomic design, comfort, and increasing preference among modern parents.

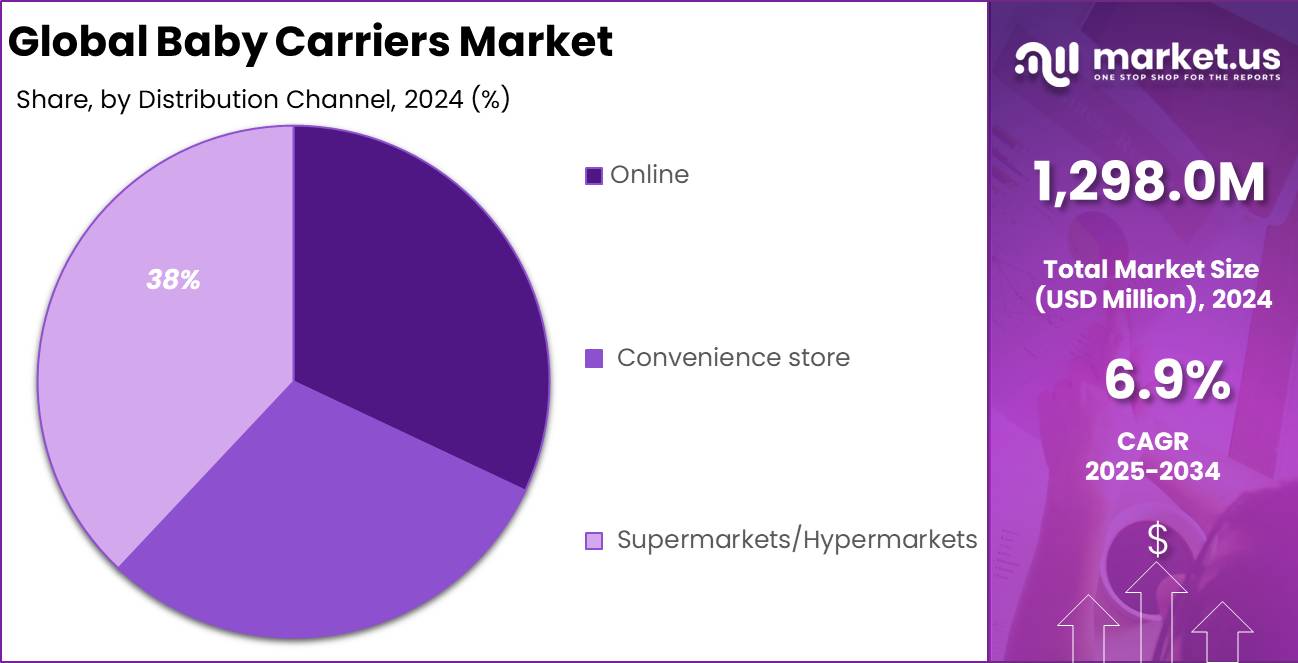

- Supermarkets and Hypermarkets dominate the distribution channel landscape, capturing more than 38% of the market share. This trend is driven by consumer preference for physical inspection of baby products and access to a wide range of choices in one location.

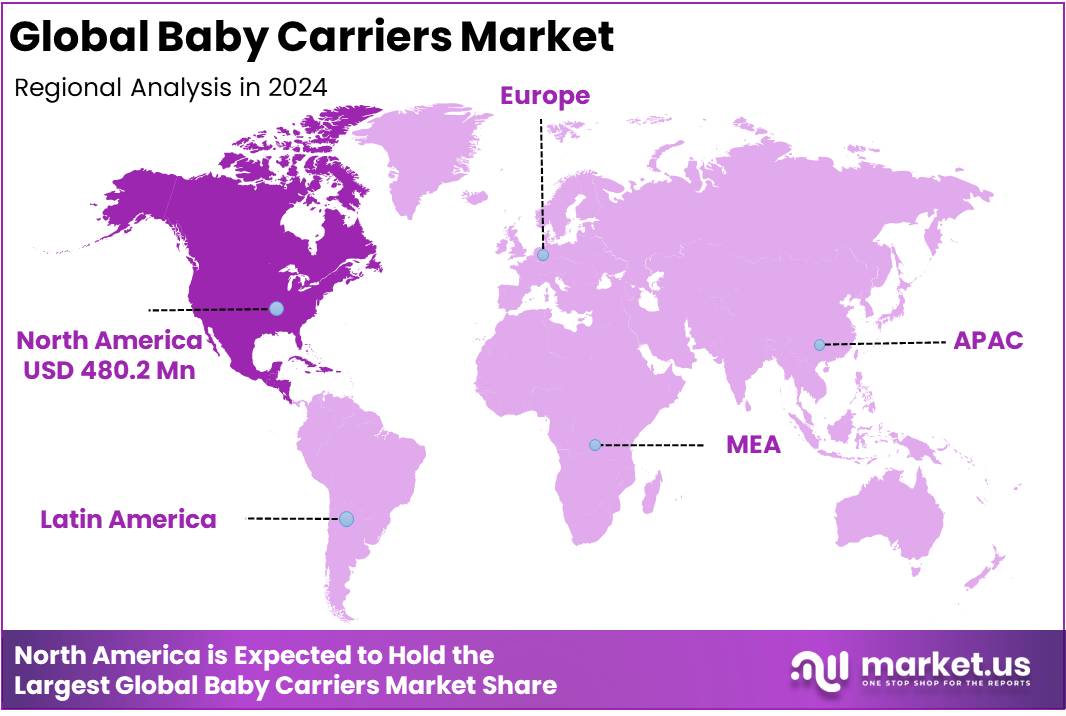

- North America holds the largest regional share in the Baby Carriers Market, contributing to 37% of the global revenue in 2024. The regional market size is valued at approximately USD 480.2 million, supported by high consumer spending, growing awareness regarding child safety, and widespread availability of premium products.

By Product Analysis

Soft Structured Carriers (SSC) Dominates Baby Carriers Market with Over 54% Market Share

In 2024, Soft Structured Carriers (SSC) held a dominant position in the Baby Carriers Market by Product, capturing more than 54% of the market share. This segment’s strong performance can be attributed to its ergonomic design, ease of use, and high safety standards. SSCs often feature padded shoulder straps, adjustable waist belts, and buckled harness systems, providing superior comfort to both infants and caregivers. Their growing popularity among urban parents, who prioritize convenience and mobility, has led to increased demand across both developed and developing economies.

The rising number of dual-income households and the growing awareness of the physical health benefits of ergonomic babywearing further fuel the segment’s growth. Additionally, product innovations with breathable fabrics, versatile carrying positions, and gender-neutral designs have widened the consumer base. As a result, SSCs have become the preferred choice for on-the-go parenting, contributing significantly to market revenue and volume growth.

In 2024, the Wraps and Slings segment demonstrated significant presence in the Baby Carriers Market. These carriers are particularly preferred for their soft fabric construction, traditional aesthetic, and ability to facilitate skin-to-skin contact, which supports infant bonding and breastfeeding. Their affordability, minimalist appeal, and suitability for newborns have contributed to their adoption, especially among environmentally conscious and design-oriented parents.

Although economically accessible and culturally familiar, wraps and slings present certain limitations in terms of ease of use and even weight distribution. Nevertheless, the proliferation of digital tutorials and educational content has helped bridge knowledge gaps and increased user confidence. Furthermore, manufacturers are emphasizing the use of organic and sustainable textiles to align with eco-conscious consumer values, further solidifying demand across both developed and emerging markets.

In 2024, Mei Tai Carriers maintained a modest yet steadily growing presence in the Baby Carriers Market. These carriers combine the structural features of soft structured carriers with the flexibility of wraps, offering adjustable support through tied fabric straps. Their balanced design appeals to caregivers seeking personalized fit, comfort, and a blend of modern and traditional babywearing elements.

While the segment remains smaller in comparison to mainstream alternatives, its growth is supported by increasing interest in culturally inspired parenting practices. As a result, manufacturers are innovating with improved materials and contemporary designs to appeal to a broader audience. With rising global awareness and positive user feedback, Mei Tai Carriers are gradually gaining acceptance, particularly in Western regions and among parents seeking distinctive, adaptable solutions.

In 2024, Frame Backpack Carriers occupied a niche position within the Baby Carriers Market. These carriers are designed for outdoor and recreational use, offering a rigid structure that ensures effective weight distribution, enhanced ventilation, and superior back support. They are particularly well-suited for carrying older infants or toddlers during extended physical activities such as hiking.

Despite their functionality, the segment’s adoption remains limited due to bulkier construction and a comparatively higher price point. Nonetheless, increasing interest in outdoor family experiences and adventure travel is fueling demand in specific consumer segments. In response, manufacturers are integrating features such as weather protection, additional storage, and ergonomic upgrades, positioning these carriers as premium, activity-focused products in the babywearing landscape.

Distribution Channel Analysis

Supermarkets & Hypermarkets Dominates Baby Carriers Market with Over 38% Market Share

In 2024, Supermarkets & Hypermarkets held a dominant market position in the Baby Carriers Market by Distribution Channel, capturing more than 38% of the market share. This significant share can be attributed to the extensive reach and accessibility of these retail outlets. Consumers prefer purchasing baby carriers from supermarkets and hypermarkets due to the convenience of one-stop shopping, which allows them to view and compare various products in person.

These stores also offer a broad selection of brands and styles, which are often accompanied by in-store promotions and discounts. The widespread presence of these retail formats across urban and suburban locations further contributes to their strong market presence.

Additionally, supermarkets and hypermarkets provide the advantage of immediate product availability, enabling consumers to make quick purchasing decisions without waiting for delivery. The physical retail environment also fosters trust and satisfaction, as consumers can directly assess the quality and comfort of the baby carriers. As a result, this segment is expected to continue maintaining a substantial market share in the coming years.

The online distribution channel in the Baby Carriers Market has seen significant growth, driven by the popularity of e-commerce platforms. Online shopping offers consumers the convenience of browsing a wide variety of baby carriers from home, with detailed product descriptions, customer reviews, and comparison tools aiding in decision-making. The ability to access international brands and the added convenience of home delivery further support the segment’s expansion. With increasing digitalization and a shift in consumer buying behavior, online platforms are poised to continue growing as a preferred distribution channel.

Convenience stores are gaining traction in the Baby Carriers Market due to their accessibility and strategic locations in urban and suburban areas. These stores cater to time-sensitive consumers looking for a quick and efficient shopping experience. While the product selection may be more limited than in supermarkets or online platforms, convenience stores offer immediate access to essential products, making them a preferred choice for busy parents. As convenience stores expand, this segment is expected to continue meeting the needs of on-the-go consumers.

Key Market Segments

Product

- Wraps and Slings

- Soft Structured Carriers (SSC)

- Mei Tai Carriers

- Frame Backpack Carriers

Distribution Channel

- Online

- Convenience store

- Supermarkets/Hypermarkets

Driver

Rising Demand for Ergonomic and Multi-Functional Baby Carriers

The growth of the global baby carriers market in 2024 can be attributed to the rising consumer preference for ergonomic and multi-functional designs that ensure comfort for both infants and caregivers. As parenting trends continue to evolve with a strong emphasis on convenience and health, there has been a noticeable surge in demand for baby carriers that provide proper weight distribution, lumbar support, and adaptable configurations. Parents are increasingly inclined towards products that support developmental benefits for babies while reducing physical strain on adults.

This shift in consumer preference is reinforced by heightened awareness around spinal health, posture alignment, and ease of mobility for parents, particularly in urban households where multitasking is common. Additionally, the dual-use capabilities of many new baby carriers such as front and back carrying, adjustable harnesses, and compatibility with growing children have further driven adoption across diverse demographic segments.

Moreover, the increase in working parents and urban dual-income families has significantly influenced market demand for such products that cater to on-the-go lifestyles. Baby carriers are being viewed as essential mobility tools, enabling caregivers to remain productive while ensuring constant physical closeness with infants. The expansion of nuclear families and a growing inclination toward babywearing as a bonding practice have also contributed to sustained product interest.

The market has observed a steady rise in global demand for high-quality, certified ergonomic products, especially in regions where consumers are willing to invest in premium baby care solutions. Consequently, manufacturers are focusing on innovation in materials and structure, launching lightweight, breathable, and flexible designs. As a result, the global baby carriers market continues to experience healthy growth momentum, with the ergonomic and functional design factor emerging as a pivotal driver that shapes purchasing decisions and market dynamics in 2024.

Restraint

Safety Concerns and Regulatory Compliance Challenges

A key restraint impacting the global baby carriers market in 2024 is the persistent concern over product safety and the complexities surrounding regulatory compliance across international markets. Despite the growing popularity of babywearing, apprehensions related to potential health risks, such as suffocation, hip dysplasia, and improper positioning, have deterred a segment of parents from adopting baby carriers. Product recalls due to safety flaws, inadequate instructional labeling, or failure to meet infant safety standards have fueled hesitation among consumers.

As infant care products are subject to stringent oversight by regulatory bodies, failure to comply with evolving standards has affected brand reputation and consumer trust. The diversity in safety regulations across geographies has further complicated market entry and expansion for global manufacturers, necessitating constant updates in product design and quality testing procedures.

In addition to regulatory scrutiny, consumer awareness of these risks amplified by social media, parenting forums, and news coverage—has led to more cautious purchasing behavior. Parents increasingly demand certifications, transparent safety disclosures, and demonstrable compliance with recognized standards. For emerging brands, meeting such expectations often entails significant investment in product development and testing, which can hinder profitability and delay market readiness.

Established players, too, face continuous pressure to innovate without compromising safety, making compliance a costly and ongoing process. These safety-related restraints, while critical for consumer protection, pose a barrier to rapid product rollout and limit the pace of adoption in price sensitive or highly regulated markets. As safety remains a top priority for end-users, any lapse real or perceived—can substantially impact sales volumes, hinder new product acceptance, and slow down market expansion, particularly in developed economies where consumer watchdogs and legal frameworks are more stringent.

Opportunity

Growth of Online Retail and Direct-to-Consumer Channels

The rapid expansion of e-commerce and direct-to-consumer (DTC) channels has presented a significant growth opportunity for the global baby carriers market in 2024. As digital retail ecosystems become more mature and widespread, consumers are increasingly turning to online platforms for baby product purchases due to the convenience, wider assortment, and competitive pricing they offer.

This shift is particularly prominent among tech-savvy millennial and Gen Z parents, who prefer researching, reviewing, and purchasing baby care products from digital marketplaces and brand websites. The proliferation of product reviews, influencer endorsements, and detailed video tutorials has further enhanced consumer confidence in online baby carrier purchases, thereby accelerating conversion rates in the segment.

Furthermore, the DTC approach allows manufacturers to control brand narrative, gather valuable customer feedback, and offer personalized shopping experiences. Customization options, bundled deals, and loyalty programs have been effectively integrated into DTC strategies to drive customer retention and repeat purchases. E-commerce platforms also enable global reach, allowing brands to penetrate new geographic markets without the constraints of traditional retail infrastructure. In emerging markets, rising smartphone penetration and improvements in digital payment systems have significantly widened access to premium baby care products, including baby carriers.

As logistics and delivery systems continue to improve globally, especially in Tier 2 and Tier 3 cities, online retail remains a compelling channel for sustained market growth. The digital transformation of consumer purchasing behavior, combined with the scalability of e-commerce and DTC strategies, positions online retail as a vital opportunity area to capture untapped demand and strengthen brand presence across regional and international markets.

Trends

Preference for Sustainable and Organic Baby Carrier Materials

In 2024, a defining trend shaping the baby carriers market is the increasing consumer preference for sustainable and organic materials in product manufacturing. As environmental awareness gains momentum and parents become more conscious of the materials that come in direct contact with their infants, there has been a significant shift toward baby carriers made from eco-friendly, hypoallergenic, and ethically sourced textiles.

Products that use organic cotton, bamboo fibers, or recycled polyester are gaining traction, as they align with broader consumer values related to sustainability, safety, and social responsibility. This trend is especially notable among environmentally-conscious young parents who actively seek out toxin-free and biodegradable options to reduce their ecological footprint while prioritizing their child’s health.

Manufacturers are responding by integrating sustainability into their value propositions, not only in raw materials but also in packaging, production processes, and supply chain transparency. Certifications such as GOTS (Global Organic Textile Standard) and OEKO-TEX are being leveraged as trust-building mechanisms to communicate product safety and environmental compliance. This trend is also supported by the growing popularity of minimalist parenting, which emphasizes the purchase of fewer but higher-quality, durable items.

As such, eco-friendly baby carriers are not only viewed as a health-conscious choice but also as a long-term investment. Brands adopting sustainable practices are likely to gain competitive advantage and consumer loyalty, particularly in North America and Europe, where green consumerism is more pronounced. This evolving preference for organic and sustainable baby products continues to redefine product innovation, encouraging market players to align with circular economy principles and cater to the rising demand for ethical, safe, and environmentally responsible parenting solutions.

Regional Analysis

North America Baby Carriers Market with Largest Market Share of 37%

The Baby Carriers Market is experiencing substantial growth across various regions, with North America emerging as the dominating market, holding a share of 37% in 2024. The market size for North America is estimated at USD 480.2 million, driven by increasing consumer demand for convenience and comfort in baby care products. The growth of the market in North America can be attributed to rising disposable income, a growing preference for premium baby products, and heightened awareness of the benefits of baby carriers in terms of parent-child bonding and mobility.

In Europe, the Baby Carriers Market is also witnessing significant growth, driven by a strong trend toward high-quality, ergonomically designed baby carriers. The market in Europe benefits from a high standard of living, a focus on child safety, and the increasing adoption of babywearing practices. While the European market is substantial, its share is comparatively lower than North America, as the region is more diverse with varying preferences across countries.

Asia Pacific, though experiencing rapid growth, currently holds a smaller share of the global Baby Carriers Market. However, it is expected to see substantial growth in the coming years due to a rising middle class and urbanization, particularly in countries like China and India. The demand for baby carriers in Asia Pacific is driven by the increasing working population of mothers, who seek products that offer both convenience and comfort. The region’s market is anticipated to expand as babywearing practices become more popular and as the purchasing power of consumers rises.

The Middle East & Africa region is also witnessing a moderate rise in the Baby Carriers Market, albeit at a slower pace. Cultural factors and economic conditions influence the adoption of babywearing products. However, growing awareness of the advantages of baby carriers, particularly in urban areas, is likely to spur demand over the forecast period.

In Latin America, the Baby Carriers Market is smaller compared to other regions but is showing signs of growth, fueled by increasing awareness of child safety and the rise of urbanization. The region’s market share remains limited due to economic constraints, but as disposable income rises, the adoption of baby carriers is expected to gradually increase.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The competitive landscape of the global baby carriers market in 2024 has been shaped by a diverse mix of established international brands and emerging regional players, each contributing to product innovation, ergonomic design, and enhanced functionality. Infantino LLC continues to maintain a strong market presence with its focus on affordability and multi-functionality, appealing especially to budget-conscious consumers.

BabyBjorn AB, a prominent Scandinavian brand, upholds its premium positioning by emphasizing user-friendly designs and high safety standards, supported by continuous product development. Britex Excelsior Ltd and Combi Corp are capitalizing on growing demand across Asia-Pacific markets through lightweight, travel-friendly carrier solutions.

Lillebaby LLC and Snuggy Baby LLC differentiate themselves with advanced lumbar support features and inclusive designs catering to varying caregiver physiques. ERGObaby Carrier Inc remains a global leader by leveraging its extensive distribution network and product versatility, while Tomy Co. Ltd emphasizes playful aesthetics combined with safety, aligning with evolving parental preferences. Tula Baby Carriers and Boba Inc. have cultivated strong customer loyalty through their focus on comfort, breathable fabrics, and stylish prints, making them popular in Western markets.

Beco Baby Carrier and Moby Wrap have gained recognition for their hybrid wrap-structured models that bridge the gap between traditional slings and modern carriers, appealing to health-conscious parents. Onya Baby and LennyLamb, though niche, are gaining traction for eco-conscious materials and ethical manufacturing practices.

Boppy and Stokke enhance product appeal through multifunctional baby gear integration. Infantino’s consistent brand evolution further reinforces its mass-market strength. Other key players continue to influence the market through localized strategies, private-label offerings, and e-commerce expansion, collectively intensifying competition and driving product innovation across all regional segments.

Top Key Players in the Market

- Infantino LLC

- BabyBjorn AB

- Britex Excelsior Ltd

- Combi Corp

- Lillebaby LLC

- Snuggy Baby LLC

- ERGObaby Carrier Inc

- Tomy Co.Ltd

- Tula Baby Carriers

- Boba Inc.

- Beco Baby Carrier

- Moby Wrap

- Onya Baby

- LennyLamb

- Boppy

- Stokke

- Infantino

- Other Key Players

Recent Developments

- In 2023, BabyBjörn introduced new colors to its product line by launching a Dark Purple version of two well-known items. The Baby Carrier Mini and Bouncer Bliss in cotton were released in this soft purple shade starting March 8. This calm and balanced color was chosen to complement the existing range, including gentle pinks and other soft tones already in the collection.

- In 2025, Compass finalized the sale of Ergobaby to Highlander Partners for $104 million. After owning Ergobaby for 15 years, Compass decided to transfer ownership to the Dallas-based private equity group. Compass, known for its investments in consumer and outdoor brands, has held well-known names like CamelBak and Fox Factory in the past and currently holds brands such as BOA and PrimaLoft.

- In 2024, Bc Babycare joined Kind+Jugend in Germany for the first time and gained strong attention. The company, which designs creative baby products, made a powerful first impression at the international trade fair in Cologne. With unique product ideas and modern technology, Bc Babycare stood out to global buyers and baby care professionals during the event.

- In 2024, New research confirmed the NIMBEL baby carrier reduces muscle strain in the back. A study by the Spine & Joint Center observed eleven people using different baby carriers, including NIMBEL. EMG stickers were used to track back muscle movement while standing with and without a baby carrier. The results showed that NIMBEL helped reduce strain compared to other carriers, especially when simulating the weight of a real baby.

Report Scope

Report Features Description Market Value (2024) USD 1,298.0 Million Forecast Revenue (2034) USD 2,529.6 Million CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type(Wraps and Slings, Soft Structured Carriers (SSC), Mei Tai Carriers, Frame Backpack Carriers), Distribution Channel(Supermarkets & Hypermarkets, Convenience Stores, Online) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa. Competitive Landscape Infantino LLC, BabyBjorn AB, Britex Excelsior Ltd, Combi Corp, Lillebaby LLC, Snuggy Baby LLC, ERGObaby Carrier Inc, Tomy Co.Ltd, Tula Baby Carriers, Boba Inc., Beco Baby Carrier, Moby Wrap, Onya Baby, LennyLamb, Boppy, Stokke, Infantino, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User license (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Infantino LLC

- BabyBjorn AB

- Britex Excelsior Ltd

- Combi Corp

- Lillebaby LLC

- Snuggy Baby LLC

- ERGObaby Carrier Inc

- Tomy Co.Ltd

- Tula Baby Carriers

- Boba Inc.

- Beco Baby Carrier

- Moby Wrap

- Onya Baby

- LennyLamb

- Boppy

- Stokke

- Infantino

- Other Key Players