Global ZSM-5 Additives Market By Type (Below 5mm, 5mm to 8mm, Above 8mm), By Product Type (Powder, Granules, Others), By Application (FCC Additives, LPG Olefins, Other), By End-User Industry (Oil and Gas, Chemical, Automotive, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 138933

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

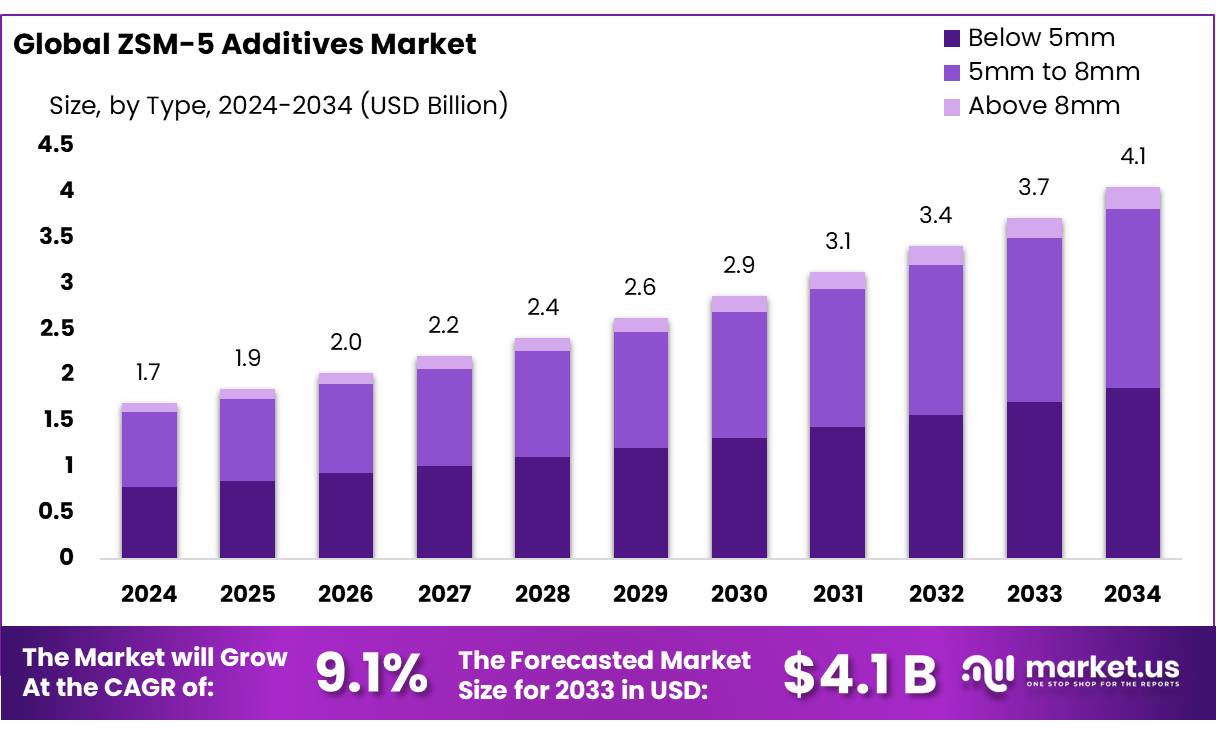

The Global ZSM-5 Additives Market size is expected to be worth around USD 4.1 Bn by 2034, from USD 1.7 Bn in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034.

The global ZSM-5 additives market plays a pivotal role in the petrochemical and refining industries. ZSM-5, a high-silica pentasil zeolite, is a key additive in fluid catalytic cracking (FCC) units, enhancing the selectivity and yields of valuable light olefins like propylene and butenes. As the demand for high-octane gasoline and propylene increases, ZSM-5 additives are essential for improving catalytic cracking processes and maximizing refinery output.

Refining and petrochemical sectors are the main consumers of ZSM-5 additives, as FCC processes convert heavy hydrocarbons into lighter, valuable products. These additives improve gasoline octane ratings and increase propylene yields. With the global demand for propylene expected to grow annually by over 4%, ZSM-5 plays a crucial role in meeting the rising needs for polypropylene, which is used in packaging, automotive components, and consumer goods.

The ZSM-5 additives market is experiencing growth, with key players investing in increasing production capacities and advancing catalyst technologies. Significant investments have been made in research and development, especially in refining hubs like China, India, and the Middle East, as companies aim to optimize catalytic cracking and reduce environmental impacts. This surge in investments is driving demand for high-performance ZSM-5 additives.

One of the key drivers for the ZSM-5 additives market is the global emphasis on fuel quality improvements and emission reduction. Regulatory bodies, including the U.S. EPA and the European Union, have imposed stricter fuel quality standards, which require refiners to reduce sulfur content and improve combustion efficiency. ZSM-5 additives help meet these standards by improving gasoline quality and minimizing by-products like coke formation and aromatics.

Key Takeaways

- ZSM-5 Additives Market size is expected to be worth around USD 4.1 Bn by 2034, from USD 1.7 Bn in 2024, growing at a CAGR of 9.1%.

- 5mm to 8mm held a dominant market position, capturing more than a 48.3% share of the ZSM-5 additives market.

- Powder held a dominant market position, capturing more than a 55.3% share of the ZSM-5 additives market.

- FCC Additives held a dominant market position, capturing more than a 64.2% share of the ZSM-5 additives market.

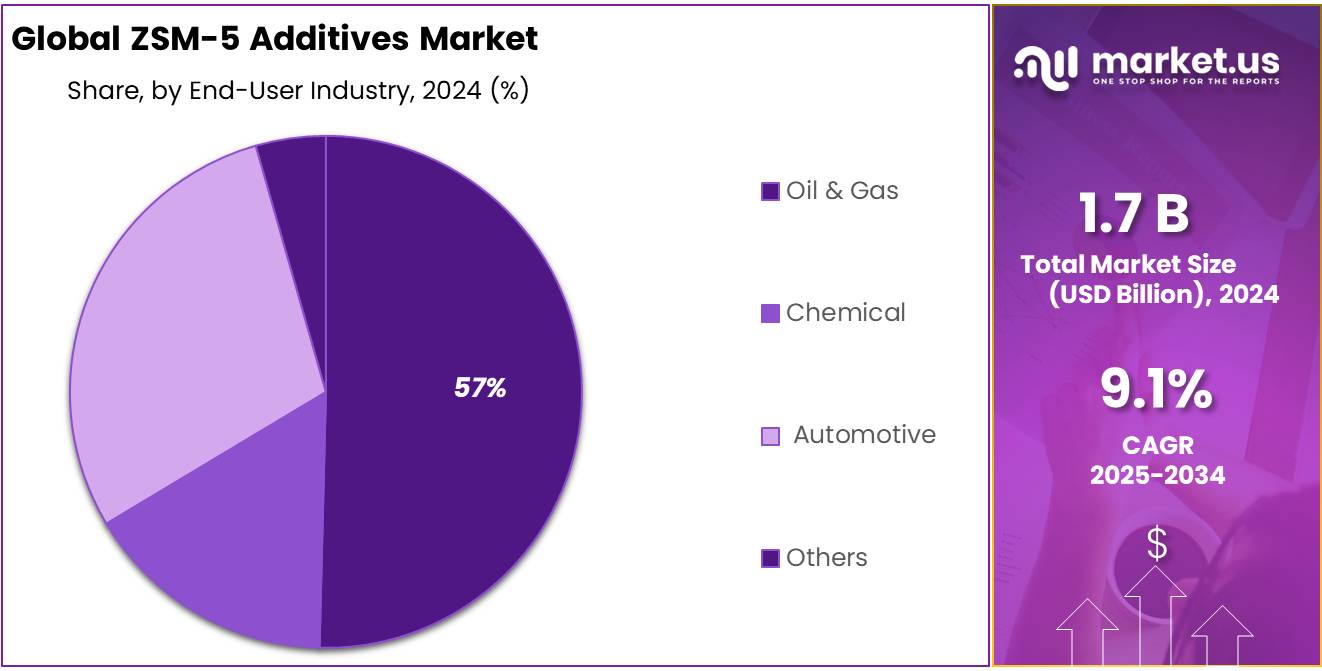

- Oil & Gas held a dominant market position, capturing more than a 57.3% share of the ZSM-5 additives market.

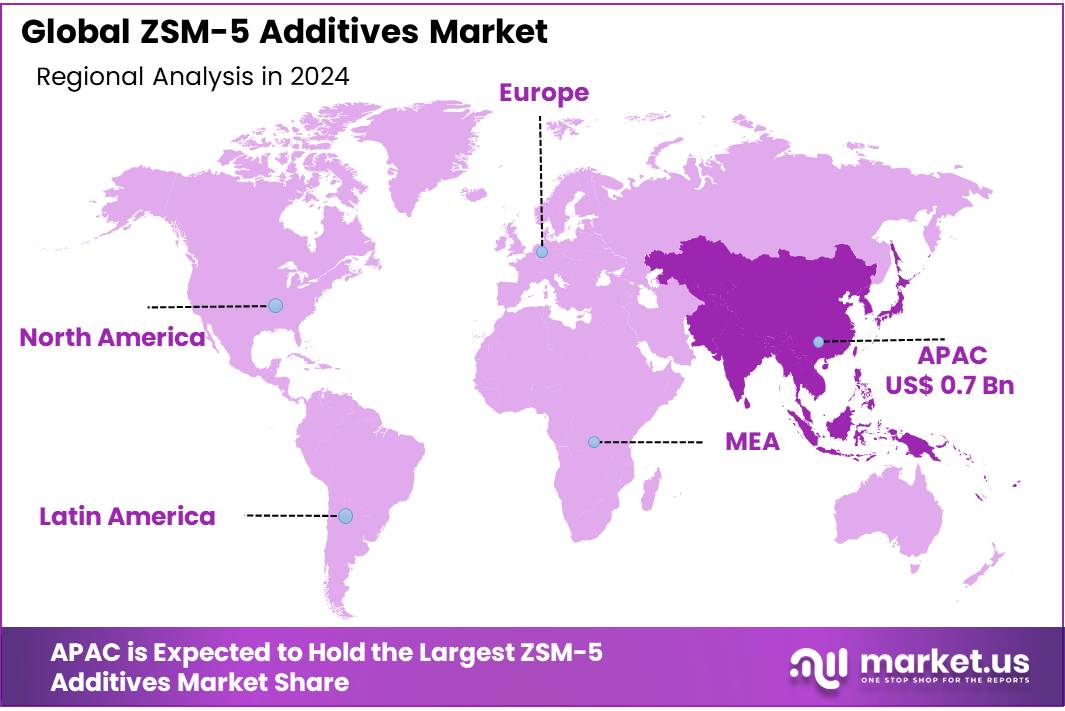

- Asia Pacific (APAC) is the dominant region in the global ZSM-5 additives market, capturing a significant share of 51.2%, valued at $3.8 billion.

By Type

In 2024, 5mm to 8mm held a dominant market position, capturing more than a 48.3% share of the ZSM-5 additives market. This segment continues to lead the market due to its balanced performance and versatility in various industrial applications, including catalysis and adsorption processes. Its size allows it to offer optimal efficiency while maintaining cost-effectiveness, which has made it the preferred choice for many manufacturers.

The Below 5mm segment followed closely behind in 2024, with a significant market presence. While not as dominant as the 5mm to 8mm segment, it still captured a healthy portion of the market. The smaller size of these additives makes them highly suitable for applications where precise control over surface area and pore volume is critical. This segment is particularly favored in industries requiring fine-tuned catalysis and adsorption characteristics.

The Above 8mm segment, although smaller in comparison, accounted for a notable share of the market in 2024. Its larger particle size offers enhanced durability and stability in certain high-temperature processes, making it valuable for specific industrial applications. However, its share in the overall market remained lower due to its more limited suitability across a broad range of applications compared to the 5mm to 8mm and Below 5mm segments.

By Product Type

In 2024, Powder held a dominant market position, capturing more than a 55.3% share of the ZSM-5 additives market. This product type is widely preferred due to its fine texture and ease of integration into various chemical processes. The powder form offers superior surface area, which is particularly valuable for applications in catalysis, where the efficiency of reactions depends on the surface interactions of the material.

Granules, on the other hand, accounted for a considerable portion of the market in 2024, though it lagged behind powder. Granules offer advantages in terms of controlled flow properties and ease of handling in bulk operations. Their size and uniformity make them a popular choice for certain processes that require precise consistency, such as fluidized bed reactors. In 2024, granules made up a substantial share of the market, driven by industries that prioritize ease of use and durability in high-temperature reactions.

By Application

In 2024, FCC Additives held a dominant market position, capturing more than a 64.2% share of the ZSM-5 additives market. This application remains the largest and most important due to its critical role in fluid catalytic cracking (FCC) processes within refineries. FCC additives, especially those based on ZSM-5, are key for enhancing the production of high-value gasoline and optimizing the conversion of heavy hydrocarbons into lighter, more valuable products.

The LPG Olefins segment, while smaller in comparison, has seen steady growth in 2024. ZSM-5 additives are increasingly being used in the production of olefins, such as propylene and ethylene, from liquefied petroleum gas (LPG). These olefins are essential building blocks in the petrochemical industry, and ZSM-5’s high selectivity and activity make it ideal for such processes.

By End-User Industry

In 2024, Oil & Gas held a dominant market position, capturing more than a 57.3% share of the ZSM-5 additives market. This segment continues to lead the market due to the critical role ZSM-5 additives play in refining processes, particularly in fluid catalytic cracking (FCC) and hydrocracking applications. These additives enhance the efficiency of converting heavy crude into valuable products such as gasoline, diesel, and other petrochemicals.

The Chemical industry also represents a significant portion of the market, though it holds a smaller share compared to Oil & Gas. In 2024, this segment is benefiting from the increasing use of ZSM-5 in petrochemical and fine chemical processes, where its catalytic properties help produce essential products like olefins, aromatics, and other key intermediates.

The Automotive sector, while not as large as Oil & Gas or Chemicals, is growing steadily. ZSM-5 additives are increasingly used in the development of cleaner, more efficient automotive fuels and exhaust systems. These additives help reduce emissions and improve the performance of catalytic converters, which are crucial for meeting stringent environmental regulations.

Key Market Segments

By Type

- Below 5mm

- 5mm to 8mm

- Above 8mm

By Product Type

- Powder

- Granules

- Others

By Application

- FCC Additives

- LPG Olefins

- Other

By End-User Industry

- Oil & Gas

- Chemical

- Automotive

- Others

Drivers

Increasing Demand for Cleaner and More Efficient Fuels

One of the major driving factors for the growth of the ZSM-5 additives market is the increasing global demand for cleaner, more efficient fuels. This has been driven by a combination of stricter environmental regulations, technological advancements in catalytic processes, and growing consumer and industry preference for sustainable energy solutions.

ZSM-5 additives, widely used in fluid catalytic cracking (FCC) processes, help refineries produce cleaner, higher-octane gasoline while minimizing harmful emissions. As the world shifts toward more sustainable and environmentally friendly fuels, the ability to produce cleaner gasoline and diesel has become essential. ZSM-5’s high efficiency in catalysis plays a crucial role in this by improving the yield of high-value gasoline and olefins while reducing the production of by-products like coke, which can harm the environment and reduce refinery efficiency.

Stricter Environmental Regulations

A significant driver for this demand is the increasing number of environmental regulations worldwide aimed at reducing emissions and improving air quality. The European Union’s tightening of vehicle emission standards under regulations such as Euro 6 has put pressure on the automotive and refining sectors to adopt cleaner fuels. Similarly, the U.S. Environmental Protection Agency (EPA) has been implementing more stringent standards for gasoline composition to ensure lower sulfur content and higher fuel efficiency.

According to the International Energy Agency (IEA), the transportation sector is responsible for about 23% of global CO2 emissions, with road vehicles being the largest contributor. The move towards cleaner fuels is therefore crucial in meeting climate targets, and catalysts such as ZSM-5 are seen as key enablers in this transition. To achieve these targets, governments have been providing incentives for companies to invest in cleaner technology, including advanced catalytic systems like ZSM-5.

Technological Advancements in Catalysis

Another driving factor is the ongoing advancements in catalyst technology, which have made ZSM-5 additives more efficient and effective in various applications. ZSM-5’s unique pore structure and high stability at high temperatures make it an excellent choice for catalytic processes in oil refining and petrochemical production. The ability to produce high-quality gasoline and chemical products with reduced energy consumption and lower carbon footprints is crucial as industries look for ways to meet sustainability goals.

Government Initiatives and Sustainability Efforts

Governments worldwide are increasingly supporting the adoption of cleaner technologies through policy measures, grants, and financial incentives for businesses that implement green technologies. For instance, in the United States, the Biden administration has prioritized the transition to cleaner energy, with plans to reduce greenhouse gas emissions by 50-52% by 2030, compared to 2005 levels.

In the European Union, the Green Deal and the Fit for 55 package aim to reduce emissions by 55% by 2030 and achieve net-zero emissions by 2050. These ambitious goals are fueling the need for advanced catalytic solutions like ZSM-5, which can help refineries and chemical industries meet these strict environmental goals.

Restraints

High Cost of Production and Limited Availability of Raw Materials

One of the major restraining factors for the growth of the ZSM-5 additives market is the high cost of production and the limited availability of raw materials. ZSM-5, a type of zeolite used in catalytic processes, is synthesized using a combination of silica, alumina, and specific chemical agents under highly controlled conditions. These raw materials, especially the silica-alumina ratio and the purity required for ZSM-5, can be expensive to source and process. Additionally, the synthesis process itself is energy-intensive and requires sophisticated equipment, further increasing production costs.

According to a report by the Food and Agriculture Organization of the United Nations (FAO), the production of high-grade chemicals and catalysts requires substantial energy input, which translates to higher operational costs. For instance, the FAO’s Energy Use Efficiency report shows that chemical manufacturing, including catalyst production, accounts for around 30% of industrial energy consumption globally. This high energy demand for catalyst production can make ZSM-5 additives less cost-effective, especially for smaller enterprises with limited access to affordable energy or advanced technology.

Raw Material Limitations

Beyond the production process itself, the limited availability of key raw materials also poses a challenge to the widespread adoption of ZSM-5 additives. The supply of high-quality silica and alumina needed to create high-performance ZSM-5 is not infinite, and securing these materials can be a logistical challenge. For example, alumina is primarily extracted from bauxite, which is concentrated in specific regions such as Australia, Guinea, and Brazil. However, these regions often face geopolitical and environmental challenges that can impact the availability and cost of alumina.

Impact on Small and Medium-Sized Enterprises (SMEs)

For small and medium-sized enterprises (SMEs) in the chemical and refining industries, the high production costs of ZSM-5 additives are a significant barrier. These companies often operate with smaller margins and less access to economies of scale, making it difficult to absorb the higher costs associated with advanced catalysts. As a result, many SMEs opt for cheaper, less efficient alternatives that do not offer the same catalytic performance as ZSM-5.

Government Initiatives and Sustainability Efforts

Governments worldwide have implemented various initiatives to encourage the development and adoption of green technologies, including catalysts like ZSM-5. However, despite these efforts, the economic feasibility of adopting ZSM-5 additives is often limited by the high production costs. The European Union’s Horizon 2020 program aims to support research and innovation in sustainable technologies, but the funding often focuses on large-scale projects that may not directly benefit smaller companies. Similarly, initiatives in the U.S., such as the Department of Energy’s Advanced Manufacturing Office, offer grants for cleaner technologies, but these are usually directed at larger companies with the infrastructure to scale up.

Opportunity

Advancements in Biofuels and Renewable Energy Production

One major growth opportunity for the ZSM-5 additives market lies in the growing demand for biofuels and renewable energy sources. With the world increasingly shifting towards cleaner energy alternatives, ZSM-5 additives are finding their place in the development of biofuels, bio-based chemicals, and other renewable energy solutions. These catalysts, known for their high stability and selectivity, play a crucial role in enhancing the efficiency and sustainability of biofuel production processes.

Expanding Biofuel Market

The demand for biofuels has seen consistent growth in recent years due to a combination of environmental concerns, government regulations, and advancements in renewable energy technologies. According to the International Energy Agency (IEA), biofuels accounted for about 3.5% of the global transport fuel supply in 2020, and this share is expected to rise as more governments implement stricter emission reduction policies and promote the use of sustainable energy sources.

As countries around the world set ambitious targets to achieve net-zero emissions by mid-century, biofuels are seen as a critical component of the energy transition. For instance, the European Union’s Green Deal and Fit for 55 initiative aim to reduce greenhouse gas emissions by 55% by 2030, and renewable fuels, including biofuels, are expected to play a central role in meeting this target. The U.S. Department of Energy (DOE) has also projected that biofuels, particularly ethanol and biodiesel, will be key to decarbonizing the transportation sector, especially for heavy-duty vehicles and aviation.

Government Policies and Investments

Government initiatives are playing a significant role in driving the biofuels market forward, creating a favorable environment for ZSM-5 additives. In the United States, the Renewable Fuel Standard (RFS) mandates the blending of renewable fuels into the transportation fuel supply, aiming to reach 36 billion gallons of renewable fuels by 2022. This policy has boosted the biofuels industry and increased the need for advanced catalytic solutions to enhance the efficiency of biofuel production processes.

The European Union has also been at the forefront of biofuel promotion, with regulations like the Renewable Energy Directive (RED II), which mandates the use of renewable energy in transport and aims to achieve 14% renewable energy share in transport by 2030. These policies not only encourage the use of biofuels but also call for more efficient technologies to produce them, making ZSM-5 additives a natural fit for this growing market. The European Commission has also allocated significant funds toward research and development in the biofuels sector, supporting projects that explore innovative catalytic solutions for renewable fuel production.

Advancements in Biomass Conversion

Another exciting development for the ZSM-5 additives market is the growing interest in biomass conversion technologies. ZSM-5 is well-suited for catalytic pyrolysis, which converts biomass into bio-oil that can be further refined into fuels and chemicals. This process, known as biomass-to-liquid (BTL) technology, is gaining traction as a sustainable alternative to fossil fuels. The International Renewable Energy Agency (IRENA) estimates that biomass could supply up to 10% of global energy needs by 2050, further increasing the demand for efficient catalysts like ZSM-5.

Trends

Growing Demand for Sustainable Chemistry

Sustainability is becoming a central theme in chemical manufacturing, and catalysts like ZSM-5 are at the heart of this transition. ZSM-5’s unique properties—such as high thermal stability, selectivity, and resistance to deactivation—make it an ideal candidate for promoting more sustainable chemical processes. ZSM-5 additives are being used in a wide range of applications, including fluid catalytic cracking (FCC), biomass conversion, and biofuel production, all of which contribute to reducing the environmental impact of energy and chemical production.

The concept of green chemistry involves using renewable resources, minimizing energy consumption, and reducing waste during chemical production. ZSM-5 additives meet these requirements by enhancing catalytic processes that lead to higher yields and fewer by-products. For example, in biofuel production, ZSM-5 is used to efficiently convert biomass into liquid fuels without excessive energy consumption or the production of harmful emissions. The demand for such sustainable catalysts is expected to grow as industries strive to meet sustainability goals.

Advancements in Green Catalysis

Recent advancements in the development of ZSM-5 additives have made them even more efficient and sustainable. Researchers are working to enhance the catalytic activity and longevity of ZSM-5 while reducing the formation of unwanted by-products like coke, which can deactivate catalysts. These improvements not only make ZSM-5 more cost-effective but also contribute to its appeal as a greener alternative to traditional catalysts.

The U.S. Department of Energy (DOE) has set ambitious goals for reducing the environmental impact of industrial processes. By 2030, the DOE aims to lower energy consumption in manufacturing processes by 20%. This aligns well with the growing demand for energy-efficient catalysts like ZSM-5, which can optimize chemical reactions and reduce energy consumption during production.

ZSM-5 is particularly beneficial in the petroleum and petrochemical industries, where it helps increase the yield of valuable products such as gasoline and olefins while reducing the production of undesirable by-products. These improvements contribute to a more sustainable refining process, which has become crucial as global fuel consumption continues to rise and governments enforce stricter environmental regulations.

Government Initiatives and Support for Green Technologies

Governments are playing a vital role in promoting the adoption of green catalysts like ZSM-5 by offering funding, tax incentives, and policy frameworks that encourage sustainable practices. In the United States, the Biden Administration’s infrastructure plan includes a $7.5 billion investment to accelerate the development of clean energy technologies. This includes funding for more efficient energy production processes, many of which rely on advanced catalysts like ZSM-5.

Similarly, the European Union’s Horizon 2020 research program has allocated substantial funding to support the development of green chemistry technologies. As part of its goal to reduce industrial carbon emissions, the EU has funded various projects focused on sustainable catalyst development. ZSM-5, with its ability to improve energy efficiency and reduce waste, is a prime candidate for such initiatives. The EU’s commitment to reducing carbon emissions by 55% by 2030 underscores the importance of adopting greener manufacturing practices, creating further demand for catalysts like ZSM-5.

Regional Analysis

Asia Pacific (APAC) is the dominant region in the global ZSM-5 additives market, capturing a significant share of 51.2%, valued at $3.8 billion. The region’s dominance is primarily driven by the robust industrial growth in countries such as China, India, and Japan, which are major hubs for the petrochemical, refining, and chemical industries. APAC’s rapid urbanization, coupled with increasing energy demand and manufacturing activities, contributes to the region’s substantial share in the market.

North America holds a considerable market share, benefiting from stringent environmental regulations and a growing emphasis on cleaner energy solutions. The United States, in particular, has made significant investments in sustainable energy practices, driving the demand for high-performance catalysts like ZSM-5 in biofuel production and refining. The region’s commitment to reducing carbon emissions under initiatives like the Clean Power Plan further supports the market for ZSM-5 additives.

Europe follows as a key player, with countries like Germany, France, and the UK leading the way in sustainable chemical production. Europe’s ambitious environmental policies, including the Green Deal and Fit for 55, stimulate the demand for ZSM-5 additives, particularly in biofuel production and green chemistry applications.

Middle East & Africa and Latin America represent smaller but growing markets. In the Middle East, large-scale oil and gas operations push the demand for ZSM-5 additives, while in Latin America, Brazil’s refining sector is an emerging growth driver.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The ZSM-5 additives market is highly competitive, with key players spanning across multiple regions. BASF SE, Honeywell International Inc., Clariant AG, and Albemarle Corporation are some of the leading companies contributing to the growth of the market. These companies leverage advanced research and development (R&D) to improve the efficiency of ZSM-5 catalysts, offering solutions for various applications, including petrochemicals, refining, and biofuels.

Zeolyst International, Tosoh Corporation, and ExxonMobil Chemical Company are key players, contributing to the market’s development by focusing on refining, petrochemical, and green chemistry applications. Sinopec Corporation and JGC Catalysts and Chemicals Ltd. have a strong presence in Asia, benefiting from the region’s industrial growth and increasing adoption of advanced catalytic processes. On the other hand, Axens SA, Haldor Topsoe A/S, and Johnson Matthey Plc are actively involved in the design and manufacturing of high-performance ZSM-5 catalysts, particularly for use in clean energy production and emissions reduction processes.

The INEOS Group Holdings S.A., Royal Dutch Shell Plc, Chevron Phillips Chemical Company, and Evonik Industries AG further strengthen the competitive landscape, offering a diverse range of ZSM-5 additive solutions to a global clientele. These companies are not only focused on the chemical and refining sectors but are also actively exploring opportunities in the biofuels and renewable energy markets, aligning with global trends toward sustainability and lower carbon footprints.

Top Key Players

- BASF SE

- Honeywell International Inc.

- Clariant AG

- Albemarle Corporation

- W.R. Grace & Co.

- Zeolyst International

- Tosoh Corporation

- Arkema Group

- ExxonMobil Chemical Company

- Sinopec Corporation

- JGC Catalysts and Chemicals Ltd.

- PQ Corporation

- Nippon Ketjen Co., Ltd.

- Haldor Topsoe A/S

- Axens SA

- Johnson Matthey Plc

- INEOS Group Holdings S.A.

- Royal Dutch Shell Plc

- Chevron Phillips Chemical Company

- Evonik Industries AG.

Recent Developments

In 2024 BASF SE, the company’s catalyst division saw strong demand for ZSM-5 additives, contributing significantly to its overall €8.2 billion in sales for the Performance Materials segment.

In 2024, Honeywell’s catalyst solutions, including ZSM-5 additives, continued to gain traction in the global market due to their role in improving refining processes and boosting the efficiency of biofuel production.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 4.1 Bn CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Below 5mm, 5mm to 8mm, Above 8mm), By Product Type (Powder, Granules, Others), By Application (FCC Additives, LPG Olefins, Other), By End-User Industry (Oil and Gas, Chemical, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BASF SE, Honeywell International Inc., Clariant AG, Albemarle Corporation, W.R. Grace & Co., Zeolyst International, Tosoh Corporation, Arkema Group, ExxonMobil Chemical Company, Sinopec Corporation, JGC Catalysts and Chemicals Ltd., PQ Corporation, Nippon Ketjen Co., Ltd., Haldor Topsoe A/S, Axens SA, Johnson Matthey Plc, INEOS Group Holdings S.A., Royal Dutch Shell Plc, Chevron Phillips Chemical Company, Evonik Industries AG. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Honeywell International Inc.

- Clariant AG

- Albemarle Corporation

- W.R. Grace & Co.

- Zeolyst International

- Tosoh Corporation

- Arkema Group

- ExxonMobil Chemical Company

- Sinopec Corporation

- JGC Catalysts and Chemicals Ltd.

- PQ Corporation

- Nippon Ketjen Co., Ltd.

- Haldor Topsoe A/S

- Axens SA

- Johnson Matthey Plc

- INEOS Group Holdings S.A.

- Royal Dutch Shell Plc

- Chevron Phillips Chemical Company

- Evonik Industries AG.