Global Zinc Oxide Market Size, Share, And Business Benefits By Source (Primary Zinc, Secondary Zinc), By Form (Powder, Pellet, Liquid), By Grade (Standard, Treated, USP, FCC, Others), By Production Process (Direct, Indirect, Wet Chemical), By Application (Rubber, Ceramics and Glass, Cosmetics and Personal Care, Pharmaceuticals, Agriculture, Paints and Coatings, Chemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 15265

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

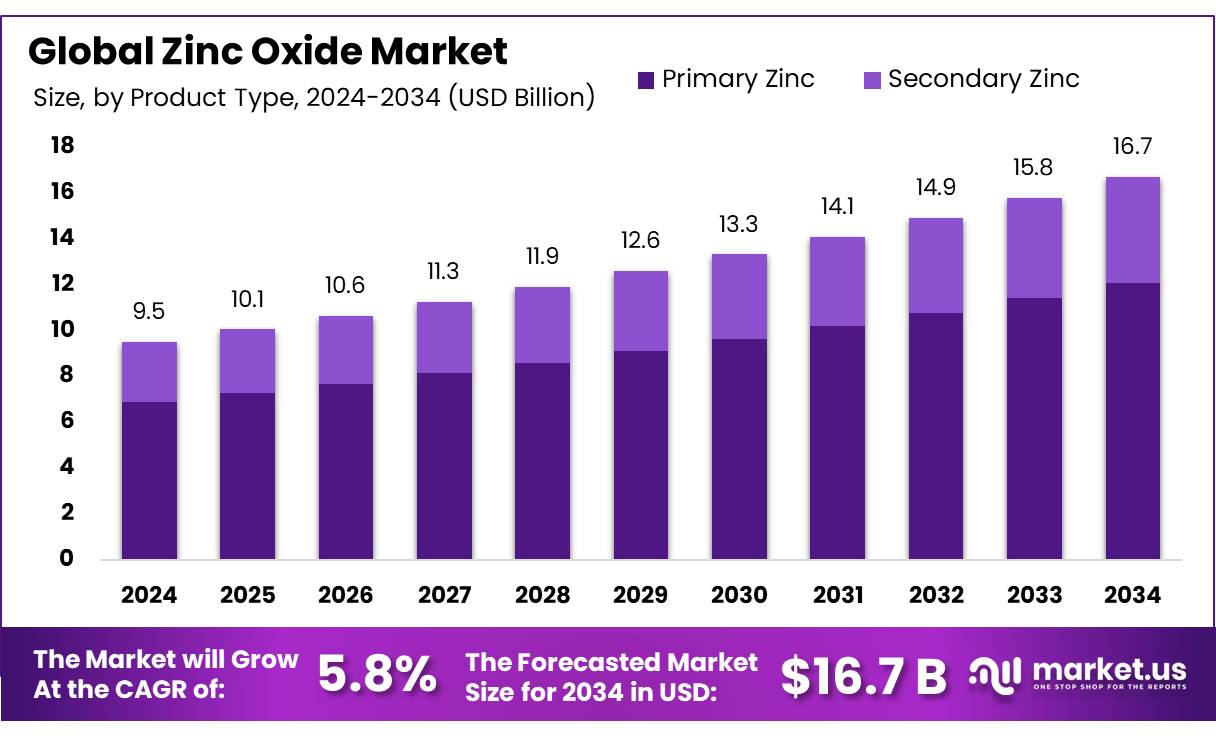

The Global Zinc Oxide Market size is expected to be worth around USD 16.7 billion by 2034, from USD 9.5 billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

Zinc Oxide is a white, powdery mineral with a long history of use as sun protection. It is also used to create other products, such as diaper rash ointments and makeup. Zinc oxide is used in a wide range of cosmetics and personal care products, including makeup, nail products, baby lotions, bath soaps, and foot powders. Zinc oxide is also used in skin protectants, such as diaper rash ointments and sunscreen products.

Zinc oxide is used as a bulking agent and a colorant. The FDA has determined that this white, powdery mineral is safe for use in cosmetic products in concentrations up to 25%. The FDA has approved the use of this mineral in cosmetic products. Absorption of zinc from supplements containing zinc citrate or zinc gluconate is similar, at approximately 61% in young adults; the absorption from supplements containing zinc oxide is 50%.

Taking supplements containing 25 mg elemental iron or more at the same time as zinc supplements can reduce zinc absorption and plasma zinc concentrations. The iron added to enriched or fortified foods does not interfere with zinc absorption. AREDS found that participants who took a supplement each day containing 80 mg zinc in the form of zinc oxide, 15 mg (7,500 mcg retinol activity equivalent) beta-carotene, 180 mg (400 International Units) vitamin E in the form of dl-alpha-tocopheryl acetate, 500 mg vitamin C, and 2 mg copper for 5 years had a 25% lower risk of advanced AMD than those taking a placebo.

Ingestion of large amounts of zinc oxide may cause nausea, cramps, vomiting, and diarrhea. Zinc oxide is often used in ointments along with vitamins A and D, and toxicity usually develops from these added constituents rather than the zinc oxide. It would require an ingestion of greater than 60 g of a typical ointment to result in vitamin A toxicity. Smaller amounts could also cause gastrointestinal disturbances, such as diarrhea, due to the emollient base.

Key Takeaways

- Global zinc oxide market projected to grow from USD 9.5 billion in 2024 to USD 16.7 billion by 2034, at a CAGR of 5.8%.

- Primary zinc dominates with a 72.3% share, driven by its use in high-purity zinc oxide for rubber, ceramics, and paints.

- Powder form holds a 68.6% share, favored for its dispersion and integration in rubber, paints, and personal care industries.

- Standard grade captures a 47.2% share, valued for cost-effective performance in rubber, ceramics, and chemical applications.

- Direct process leads with a 56.1% share, preferred for cost-effective zinc oxide production for rubber, glass, and agriculture.

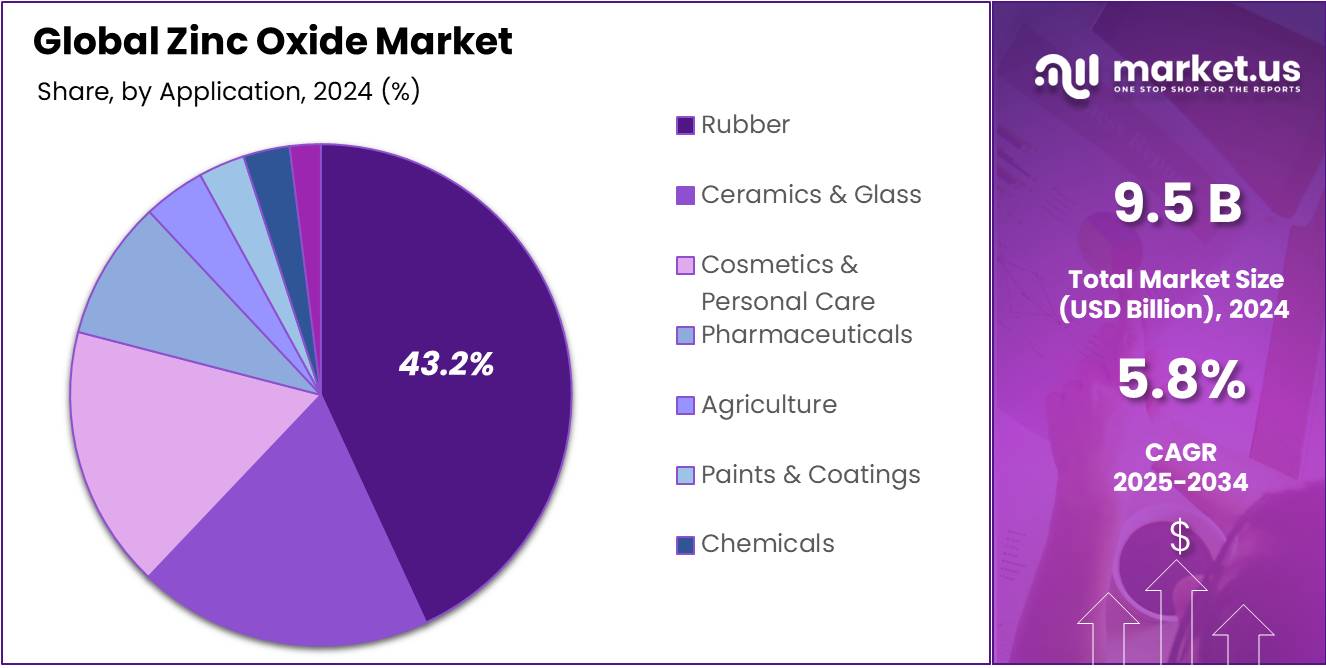

- The rubber industry commands a 43.2% share, relying on zinc oxide for enhanced durability and heat resistance in tires.

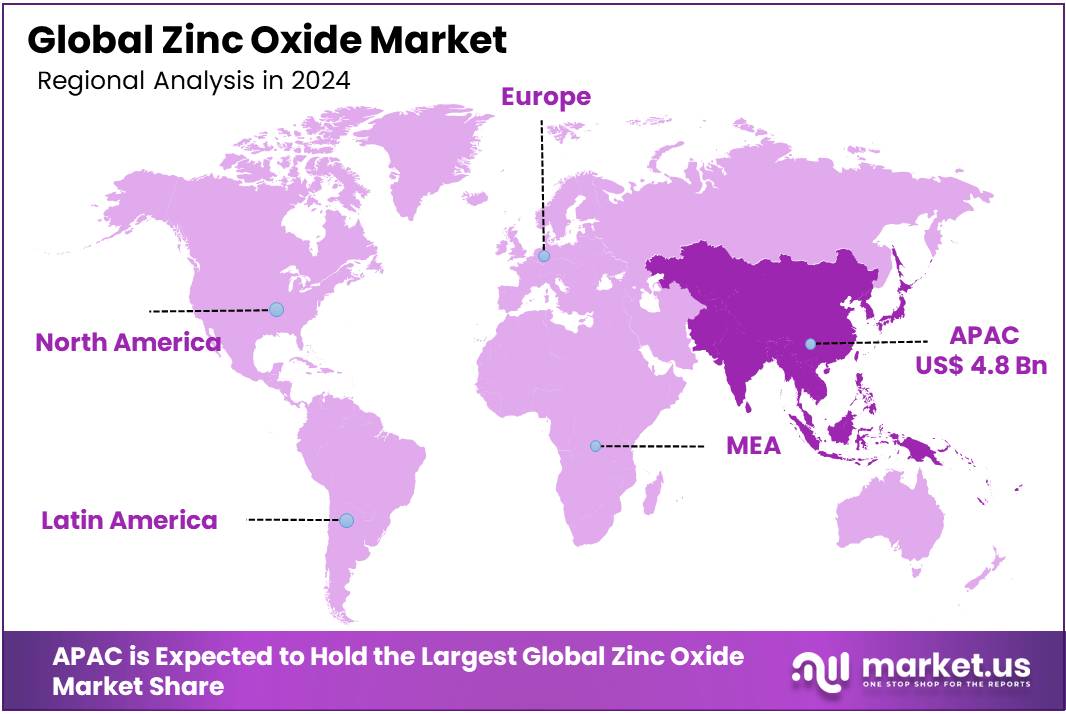

- Asia-Pacific region holds a 51.2% share (USD 4.8 billion), driven by industrial growth and demand in key sectors.

Analyst Viewpoint

The global demand for Zinc Oxide is climbing steadily, fueled by consumer trends favoring natural and sustainable products. For instance, in cosmetics, zinc oxide is a star ingredient in sunscreens due to its UV-blocking prowess, and eco-friendly skincare options based on recent web insights.

Investment opportunities shine in expanding production capacities, particularly in Asia-Pacific, where rapid industrialization in countries like China and India drives demand. Emerging applications, such as zinc oxide nanoparticles in electronics and energy storage, also open new doors for forward-thinking investors. However, risks loom large and shouldn’t be ignored.

Technological advancements, like low-carbon production methods, are a double-edged sword, offering cost savings but demanding hefty upfront R&D investment. Technological impacts, like solar-powered production innovations, are reducing carbon footprints and aligning with sustainability goals, making companies that adopt these methods more attractive to investors.

By Source

Primary Zinc Dominates Zinc Oxide Market with 72.3% Share in 2024

Primary Zinc held a dominant market position, capturing more than a 72.3% share in the global Zinc Oxide market. The widespread use of primary zinc for producing high-purity zinc oxide played a major role in its leadership.

Industries such as rubber, ceramics, and paints prefer primary zinc-based oxide for its consistent quality and strong performance, driving up the demand significantly. Primary zinc provides better control over particle size and purity, making it a top choice for advanced industrial applications.

In 2025, the demand for primary zinc is expected to grow steadily, fueled by rising production needs in automotive tires, pharmaceuticals, and cosmetic formulations. Industries are increasingly prioritizing high-grade materials for product efficiency.

By Form

Powder Form Leads Zinc Oxide Market with 68.6% Share in 2024

In 2024, Powder held a dominant market position, capturing more than a 68.6% share in the global Zinc Oxide market. Powder form remains highly popular because it offers excellent dispersion, easy handling, and better integration into various industrial processes.

Key industries like rubber manufacturing, paints and coatings, and personal care products prefer powder zinc oxide for its fine texture and high reactivity. Its ability to blend seamlessly into mixtures enhances product quality, which continues to drive its preference.

The powder segment is expected to maintain strong demand, especially with the automotive and electronics industries expanding their production. The convenience, versatility, and consistent performance of powder zinc oxide are likely to keep its market share dominant in the coming year.

By Grade

Standard Grade Zinc Oxide Secures 47.2% Market Share in 2024

Standard held a dominant market position, capturing more than a 47.2% share in the global Zinc Oxide market. Standard grade zinc oxide is widely used across industries such as rubber, ceramics, paints, and chemicals due to its balanced quality and cost-effectiveness.

Manufacturers prefer this grade for general-purpose applications where ultra-high purity is not required but consistent performance is essential. Its affordability and reliable properties have made it the go-to choice for mass production sectors.

The demand for standard grade zinc oxide is expected to remain strong as industries continue to focus on value-driven materials. With steady growth in the construction and automotive sectors, Standard grade is likely to retain a solid position and market share moving forward.

By Production Process

Direct Process Zinc Oxide Commands 56.1% Market Share in 2024

Direct held a dominant market position, capturing more than a 56.1% share in the global Zinc Oxide market. The Direct process, also known as the American process, is popular for producing zinc oxide with controlled particle size and reasonable purity, making it suitable for rubber, glass, and agricultural applications.

Industries favor this method because it offers a good balance between cost and performance, which is crucial for large-scale manufacturing needs. As industrial activities continue to expand worldwide, the demand for direct process zinc oxide remains steady.

In 2025, the Direct segment is expected to maintain its strong position, supported by rising demand from tire manufacturing and ceramic production. Its cost advantages and dependable quality output will help the segment stay of its market share in the upcoming year.

By Application

Rubber Industry Drives Zinc Oxide Demand with 43.2% Share in 2024

Rubber held a dominant market position, capturing more than a 43.2% share in the global Zinc Oxide market. Zinc oxide is a key material in rubber production, mainly used to enhance durability, elasticity, and heat resistance. The tire industry, in particular, heavily relies on zinc oxide for improving performance and extending product life.

As global vehicle production and tire replacement needs rise, the demand for zinc oxide from the rubber sector has stayed strong. The rubber application segment is expected to continue leading, supported by growth in automotive, industrial, and consumer goods sectors. The steady rise in transportation activities worldwide is likely to keep the rubber segment of the total market share.

Key Market Segments

By Source

- Primary Zinc

- Secondary Zinc

By Form

- Powder

- Pellet

- Liquid

By Grade

- Standard

- Treated

- USP

- FCC

- Others

By Production Process

- Direct

- Indirect

- Wet Chemical

By Application

- Rubber

- Ceramics and Glass

- Cosmetics and Personal Care

- Pharmaceuticals

- Agriculture

- Paints and Coatings

- Chemicals

- Others

Drivers

Growing Tire Production Boosting Zinc Oxide Demand

One major driving factor for the Zinc Oxide market is the rising global production of tires. Zinc oxide is an essential ingredient in the rubber industry, especially for tire manufacturing, where it improves strength, elasticity, and heat resistance.

This huge number highlights how critical zinc oxide remains to meet the growing needs of the automotive, aviation, and heavy machinery industries. Government initiatives promoting road safety and the replacement of old tires are also fueling demand.

This push toward timely tire replacement is indirectly creating a higher need for zinc oxide. Moreover, the global move toward electric vehicles (EVs) is further driving tire production. Electric cars require specialized tires that are heavier and more heat-resistant, increasing the need for better-quality rubber materials fortified with zinc oxide.

Restraints

Environmental Regulations on Zinc Usage Restricting Market Growth

One major restraint for the Zinc Oxide market is the tightening of global environmental regulations regarding zinc usage and emissions. Zinc oxide production, particularly from the direct (American) process, often involves significant energy consumption and emissions that are harmful to the environment.

To address these concerns, regulatory bodies like the European Chemicals Agency (ECHA) have placed strict controls on zinc compounds under the Registration, Evaluation, Authorisation and Restriction of Chemicals regulation. According to the ECHA, zinc oxide has been classified under specific hazard categories requiring detailed risk assessments and control measures.

The U.S. Environmental Protection Agency (EPA) has also issued guidelines restricting zinc discharge into water bodies, as excess zinc can be toxic to aquatic life. Under the Clean Water Act, industries are required to monitor and limit zinc emissions in wastewater, adding compliance costs and technical burdens to manufacturers.

Opportunity

Expansion of Electronics Industry Accelerating Zinc Oxide Demand

One major growth factor for the Zinc Oxide market is the rapid expansion of the global electronics industry. Zinc oxide is widely used in the production of varistors, surge protectors, light-emitting diodes (LEDs), and thin-film transistors due to its excellent semiconducting and piezoelectric properties.

The growing demand for advanced electronics such as 5G devices, smart wearables, and energy-efficient LED lighting is creating new opportunities. Zinc oxide’s ability to work in transparent and flexible electronics makes it highly valuable for next-generation products. Countries like China, South Korea, and Japan are heavily investing in electronics innovation, further fueling zinc oxide requirements.

Trends

Emerging Role of Zinc Oxide Nanoparticles in Advanced Electronics

Zinc oxide (ZnO) nanoparticles are gaining significant attention in the electronics industry due to their unique properties. These nanoparticles exhibit excellent semiconducting behavior, high thermal conductivity, and transparency, making them ideal for various electronic applications.

One of the key drivers for this growth is the increasing demand for transparent electronics and optoelectronic devices. ZnO nanoparticles are being utilized in the development of transparent thin-film transistors, UV detectors, and light-emitting diodes. Their ability to function as transparent conductive oxides makes them suitable for applications in touchscreens, solar cells, and flat-panel displays.

The integration of ZnO nanoparticles in sensors has opened new avenues in the field of wearable electronics and environmental monitoring. Their sensitivity to various gases and biological molecules enables the fabrication of efficient and compact sensors. The healthcare industry is also exploring ZnO nanoparticles for biosensing applications, given their biocompatibility and antibacterial properties.

Regional Analysis

Asia-Pacific Leads Global Zinc Oxide Market with 51.2% Share in 2024

The Asia-Pacific (APAC) region stands as the preeminent force in the global zinc oxide market, commanding a substantial 51.2% share, which translates to approximately USD 4.8 billion in revenue. This dominance is underpinned by the region’s robust industrial base, rapid urbanization, and burgeoning demand across key sectors.

The automotive industry, particularly in countries like China, India, Japan, and South Korea, significantly contributes to this leadership. Zinc oxide plays a pivotal role in tire manufacturing, serving as an essential additive in the vulcanization process to enhance durability and performance. China, being the world’s largest tire producer, exemplifies this trend.

In the construction sector, the escalating infrastructure development and urbanization efforts have spurred the demand for zinc oxide in paints, coatings, and ceramics. Its properties, such as UV protection and anti-corrosion, make it indispensable in building materials.

The cosmetics and personal care industry in APAC is experiencing a surge, driven by consumer preferences for sun protection and skin-whitening products. Zinc oxide’s efficacy as a UV filter and its anti-inflammatory properties have led to its widespread adoption in sunscreens and skincare formulations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Zochem LLC is a leading North American producer of zinc oxide, known for its high-quality USP and French process grades. The company serves industries like rubber, ceramics, and pharmaceuticals. With advanced manufacturing facilities and a strong distribution network, Zochem emphasizes innovation and sustainability.

- EverZinc, a global leader in zinc oxide production, offers a wide range of products for rubber, cosmetics, and coatings. The company operates multiple plants worldwide, ensuring a reliable supply. EverZinc focuses on eco-friendly production methods and R&D, catering to high-performance applications. Its strong technical support and global presence make it a key player in the zinc oxide industry.

- Silox Holding produces high-purity zinc oxide for rubber, ceramics, and chemicals. The company emphasizes sustainable manufacturing and advanced technology. With a strong presence in Europe and Asia, Silox offers customized solutions to meet diverse industrial needs. Its commitment to innovation and quality makes it a significant player in the zinc oxide sector.

Top Key Players in the Market

- Zochem LLC

- EverZinc

- Weifang Longda Zinc Industry Co., Ltd.

- Silox Holding

- Akrochem Corporation

- Ace Chemie Zynk Energy Limited

- AG CHEMI GROUP s.r.o.

- PT CITRA CAKRALOGAM

- Zinc Nacional

- HAKUSUI TECH

- Lanxess AG

- IEQSA

- Pan-Continental Chemical Co., Ltd.

- Rubamin

- Tata Chemicals Ltd.

- ZM Silesia S.A.

- JG Chemicals Limited

- Upper India

- American Elements

Recent Developments

- In 2024, Zochem launched an advanced, user-focused enhanced customer experience, providing detailed information on its zinc oxide product range, manufacturing technology, and applications. The site is designed to streamline information access and improve user experience across devices.

- In 2024, Ochem’s President & CEO, Mo Sharma, presented at the International Zinc & Zinc Oxide Conference, highlighting the company’s advancements in zinc oxide production and its position as one of North America’s largest and most technologically advanced producers.

Report Scope

Report Features Description Market Value (2024) USD 9.5 Billion Forecast Revenue (2034) USD 16.7 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Primary Zinc, Secondary Zinc), By Form (Powder, Pellet, Liquid), By Grade (Standard, Treated, USP, FCC, Others), By Production Process (Direct, Indirect, Wet Chemical), By Application (Rubber, Ceramics and Glass, Cosmetics and Personal Care, Pharmaceuticals, Agriculture, Paints and Coatings, Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Zochem LLC, EverZinc, Weifang Longda Zinc Industry Co. Ltd., Silox Holding, Akrochem Corporation, Ace Chemie Zynk Energy Limited, AG CHEMI GROUP s.r.o, PT CITRA CAKRALOGAM, Zinc Nacional, HAKUSUI TECH, Lanxess AG, IEQSA, Pan-Continental Chemical Co. Ltd., Rubamin, Tata Chemicals Ltd., ZM Silesia S.A., JG Chemicals Limited, Upper India, American Elements Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Zochem LLC

- EverZinc

- Weifang Longda Zinc Industry Co., Ltd.

- Silox Holding

- Akrochem Corporation

- Ace Chemie Zynk Energy Limited

- AG CHEMI GROUP s.r.o.

- PT CITRA CAKRALOGAM

- Zinc Nacional

- HAKUSUI TECH

- Lanxess AG

- IEQSA

- Pan-Continental Chemical Co. Ltd.

- Rubamin

- Tata Chemicals Ltd.

- ZM Silesia S.A.

- JG Chemicals Limited

- Upper India

- American Elements